Professional Documents

Culture Documents

How Much Do Oil Prices Affect Inflation?

Uploaded by

AdminAliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Much Do Oil Prices Affect Inflation?

Uploaded by

AdminAliCopyright:

Available Formats

Economic SYNOPSES

short essays and reports on the economic issues of the day

2015 Number 10

How Much Do Oil Prices Affect Inflation?

Christopher J. Neely, Assistant Vice President and Economist

eople tend to think that oil prices drive inflation. The

high inflation rates of the 1970s, which occurred

after large increases in oil prices, probably contribute

to this perception.

Indeed, it seems to make sense that oil prices explain a

lot of the variation in inflation because many industries

consume oil, often for transportationit is used to make

gasoline for automobiles and jet fuel for air transportor

as heating fuel for many homes in the Northeast. In 2014,

the United States used about 6.95 billion barrels of oil.1 At

a price of $93 per barrel, the average for 2014, the United

States used about $648 billion dollars worth of oil, which

was about 3.8 percent of U.S. GDP.

It is puzzling why large monthly

or quarterly oil price changes predict

very small changes in the CPI but daily

oil prices predict large changes

in breakeven inflation.

Economists generally agree that oil prices can drive

some variation in inflation, at least over the short and

medium runs. The fact that international inflation rates

move together (Neely and Rapach, 2011) suggests that

international factors, such as commodity prices like oil,

might drive a substantial part of inflation. Over the long

run, economists think that central banks can use monetary policy to offset such shocks and choose an average

inflation rate.

Financial market inflation forecasts do react strongly to

changes in oil prices, however, which indicates that financial market participants think that oil prices do substantially predict inflation. One can obtain a market inflation

forecast by comparing the yields of bonds with inflationadjusted payouts (Treasury inflation-protected securities

[TIPS]) with yields of bonds whose payouts do not depend

on inflation. Such measures of inflation are called break-

even inflation. Over the 2004-15 sample period, the correlation between the daily changes in breakeven inflation

and West Texas Intermediate (WTI) spot oil prices is positive and substantial, ranging from 0.34 to 0.41, depending

on the forecast horizon of breakeven inflation. These correlations dont change much over the sample or with the

use of 2-day or 5-day correlations rather than 1-day correlations. Similarly, if one uses WTI spot oil prices to predict

contemporaneous changes in breakeven consumer price

index (CPI) inflation, then a 50 percent reduction in oil

prices would cumulatively reduce expected inflation by

27 basis points per year, or about 2.7 percentage points,

over a horizon of 10 years.

Inflation is notoriously difficult to predict, however.

The best forecast for inflation over medium horizons is

probably a gradual return to the central banks target from

the current rate of inflation (Faust and Wright, 2013). And

specific studies of the effect of oil prices on inflation suggest that there is very little pass-through of oil prices to

inflation. For example, Chens (2009) estimates with quarterly data predict that a 50 percent decrease in oil prices

would reduce the overall price level by less than 0.19 percent, which is far less than the change implied by financial

markets.2

It is puzzling why large monthly or quarterly oil price

changes predict very small changes in the CPI but daily

oil prices predict large changes in breakeven inflation. Perhaps financial market participants systematically overestimate the importance of oil prices, or perhaps the econometric studies fail to accurately measure pass-through and

oil prices do heavily influence inflation. Or perhaps there

is another explanation, such as breakeven inflation causing

changes in oil prices. But it is a mystery.

NOTES

1 Data are from the U.S. Energy Information Administration

(http://www.eia.gov/tools/faqs/faq.cfm?id=33&t=6).

2 Chen lists the short-run pass-through for the United States in his Table 3 as

0.00372, so 0.5 0.00372 = 0.186%.

Economic SYNOPSES

Federal Reserve Bank of St. Louis 2

REFERENCES

Chen, Shiu-Sheng. Oil Price Pass-Through into Inflation. Energy Economics,

January 2009, 31(1), pp. 126-33.

Faust, Jon and Wright, Jonathan H. Forecasting Inflation, in Graham Elliott

and Allan Timmermann, eds., Handbook of Economic Forecasting. Volume 2,

Part A. Chap. 1. Amsterdam: North Holland, 2013, pp. 3-56.

Neely, Christopher J. and Rapach, David E. International Comovements in

Inflation Rates and Country Characteristics. Journal of International Money

and Finance, November 2011, 30(7), pp. 1471-90.

Posted on May 11, 2015

2015, The Federal Reserve Bank of St. Louis. Views expressed do not necessarily reflect official positions of the Federal Reserve System.

research.stlouisfed.org

You might also like

- Ali Montag Resume-2016Document2 pagesAli Montag Resume-2016AdminAliNo ratings yet

- Ali Montag Resume-2016Document1 pageAli Montag Resume-2016AdminAliNo ratings yet

- Ali Montag Resume-2016Document2 pagesAli Montag Resume-2016AdminAliNo ratings yet

- Forecasting Unemployment in Real Time During Great Recession PDFDocument6 pagesForecasting Unemployment in Real Time During Great Recession PDFAdminAliNo ratings yet

- Blog Post On FeminismDocument3 pagesBlog Post On FeminismAdminAliNo ratings yet

- Unprecedented Actions: The Federal Reserve's Response To The Global Financial Crisis in Historical PerspectiveDocument42 pagesUnprecedented Actions: The Federal Reserve's Response To The Global Financial Crisis in Historical PerspectiveAdminAliNo ratings yet

- Long Run Natural Rate of InterestDocument3 pagesLong Run Natural Rate of InterestAdminAliNo ratings yet

- An Offer You Can't Refuse? Incentives Change How We ThinkDocument71 pagesAn Offer You Can't Refuse? Incentives Change How We ThinkAdminAliNo ratings yet

- Redacted Police ReportDocument1 pageRedacted Police ReportAdminAliNo ratings yet

- Star Wars and FinanceDocument10 pagesStar Wars and FinanceAdminAliNo ratings yet

- The Informational Content of Market-Based Measures of Inflation Expectations Derived From Government Bonds and Inflation Swaps in The United KingdomDocument38 pagesThe Informational Content of Market-Based Measures of Inflation Expectations Derived From Government Bonds and Inflation Swaps in The United KingdomAdminAliNo ratings yet

- 2013 Wage TrendsDocument47 pages2013 Wage TrendsAdminAliNo ratings yet

- Mortgage Risk and The Yield CurveDocument53 pagesMortgage Risk and The Yield CurveAdminAliNo ratings yet

- Labor Market During After Great Recession PDFDocument5 pagesLabor Market During After Great Recession PDFAdminAliNo ratings yet

- Who Is Holding All The Excess ReservesDocument3 pagesWho Is Holding All The Excess ReservesAdminAliNo ratings yet

- Fed: Effects of US Quantitative Easing On Emerging Market EconomiesDocument68 pagesFed: Effects of US Quantitative Easing On Emerging Market EconomiesAdminAliNo ratings yet

- Fed (Atlanta) : Foreign Exchange Predictability During The Financial Crisis: Implications For Carry Trade ProfitabilityDocument30 pagesFed (Atlanta) : Foreign Exchange Predictability During The Financial Crisis: Implications For Carry Trade ProfitabilityAdminAliNo ratings yet

- The Corporate Saving Glut in The Aftermath of The Global Financial CrisisDocument62 pagesThe Corporate Saving Glut in The Aftermath of The Global Financial CrisisAdminAliNo ratings yet

- Global Shadow Banking Monitoring Report 2015Document62 pagesGlobal Shadow Banking Monitoring Report 2015AdminAliNo ratings yet

- FDIC: Payday Lending in AmericaDocument21 pagesFDIC: Payday Lending in AmericaAdminAliNo ratings yet

- Calculating The Natural Rate of Interest: A Comparison of Two Alternative ApproachesDocument6 pagesCalculating The Natural Rate of Interest: A Comparison of Two Alternative ApproachesAdminAliNo ratings yet

- Aging and The Economy: The Japanese ExperienceDocument2 pagesAging and The Economy: The Japanese ExperienceAdminAliNo ratings yet

- The Price of Climate Change Global Warming's Impact On PortfoliosDocument12 pagesThe Price of Climate Change Global Warming's Impact On PortfoliosAdminAliNo ratings yet

- BIS: Monetary Policy and Financial Spillovers: Losing Traction?Document44 pagesBIS: Monetary Policy and Financial Spillovers: Losing Traction?AdminAliNo ratings yet

- China SlowdownDocument2 pagesChina SlowdownTBP_Think_TankNo ratings yet

- Payday Lending Abuses and Predatory PracticesDocument33 pagesPayday Lending Abuses and Predatory PracticesAdminAliNo ratings yet

- CFPB Payday Dap WhitepaperDocument45 pagesCFPB Payday Dap WhitepaperJames BrentNo ratings yet

- InterestDocument31 pagesInterestTBP_Think_TankNo ratings yet

- Imperfect Forward SecrecyDocument13 pagesImperfect Forward SecrecyAdminAliNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CH 15Document45 pagesCH 15Mohamed AdelNo ratings yet

- What Is An ATM: Automated Teller MachineDocument6 pagesWhat Is An ATM: Automated Teller MachineTilahun GirmaNo ratings yet

- Financial Planning ToolsDocument50 pagesFinancial Planning ToolsPhill SamonteNo ratings yet

- Endowment Fund Scholarship FormDocument2 pagesEndowment Fund Scholarship FormPäťhäň ŘājāNo ratings yet

- B.A. (Hons.) Eco - Sem-II - Finance (GE) - WorkingCapital - RuchikaChoudharyDocument10 pagesB.A. (Hons.) Eco - Sem-II - Finance (GE) - WorkingCapital - RuchikaChoudharymanjusri lalNo ratings yet

- The Wall Street Journal March 17 TH 2023Document42 pagesThe Wall Street Journal March 17 TH 2023Jorge Antonio PichardoNo ratings yet

- BANK MUSCAT-Tariff Eng BookDocument14 pagesBANK MUSCAT-Tariff Eng BookmujeebmuscatNo ratings yet

- 20MW SPV Project Report NagalandDocument2 pages20MW SPV Project Report NagalandHimanshu Bhatia100% (1)

- 4BSA2 GROUP2 GroupActivityNo.1Document4 pages4BSA2 GROUP2 GroupActivityNo.1Lizerie Joy Kristine CristobalNo ratings yet

- Resource Mobilization Workshop: Enhanced Project DesignDocument32 pagesResource Mobilization Workshop: Enhanced Project DesignJoseph Raymund Autor SumabalNo ratings yet

- ACCT 101 Chapter 1 HandoutDocument3 pagesACCT 101 Chapter 1 HandoutLlana RoxanneNo ratings yet

- Manufacturing Account-Ref - Material: SyllabusDocument5 pagesManufacturing Account-Ref - Material: SyllabusMohamed MuizNo ratings yet

- Sonali JoshiDocument71 pagesSonali JoshiSonali Joshi100% (1)

- S6-10 Digital Lending - Lending Club and AffirmDocument22 pagesS6-10 Digital Lending - Lending Club and AffirmVivek SinghNo ratings yet

- Alert Company S Shareholders Equity Prior To Any of The Following PDFDocument1 pageAlert Company S Shareholders Equity Prior To Any of The Following PDFHassan JanNo ratings yet

- The Global Capitalist Crisis:: Its Origins, Nature and ImpactDocument45 pagesThe Global Capitalist Crisis:: Its Origins, Nature and Impactanmol149No ratings yet

- Sample Practice Exam 29 March 2019 Answers - CompressDocument7 pagesSample Practice Exam 29 March 2019 Answers - CompressShevina Maghari shsnohsNo ratings yet

- Imperia Racing FormDocument2 pagesImperia Racing FormAbhinandan KumarNo ratings yet

- FAR 4309 Investment in Debt Securities 2Document6 pagesFAR 4309 Investment in Debt Securities 2ATHALIAH LUNA MERCADEJASNo ratings yet

- Topic 03 Balance of PaymentsDocument42 pagesTopic 03 Balance of PaymentsAnisha SapraNo ratings yet

- Genmath 1 20Document144 pagesGenmath 1 20Oriel Dave100% (4)

- RFM Corp Annual ReportDocument169 pagesRFM Corp Annual ReportGab RielNo ratings yet

- Creating Powerful BrandDocument511 pagesCreating Powerful BrandMiau Miau100% (19)

- Application of Option Greeks - Z-Connect by Zerodha Z-Connect by ZerodhaDocument1 pageApplication of Option Greeks - Z-Connect by Zerodha Z-Connect by Zerodhayashu yashNo ratings yet

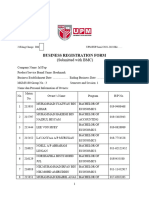

- 03 - Business Registration Form With BMC - 5%Document7 pages03 - Business Registration Form With BMC - 5%Linda LiongNo ratings yet

- Fin Common Tables For ReportingDocument9 pagesFin Common Tables For ReportingJuan Pablo GasparriniNo ratings yet

- Shareholder'S Equity Multiple Choice QuestionsDocument7 pagesShareholder'S Equity Multiple Choice QuestionsRachel Rivera50% (2)

- Te040 R12 Cash Management Test ScriptsDocument62 pagesTe040 R12 Cash Management Test ScriptsGrace Ohh100% (2)

- Block 2Document90 pagesBlock 2G RAVIKISHORENo ratings yet

- CHAPTER 2 The IS LM ModelDocument73 pagesCHAPTER 2 The IS LM ModelDương ThùyNo ratings yet