Professional Documents

Culture Documents

2015-17 Biennium Allocations Oil and Gas Tax Collections - Reflecting House Bill Nos. 1176, 1377, and 1476

Uploaded by

Rob PortOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2015-17 Biennium Allocations Oil and Gas Tax Collections - Reflecting House Bill Nos. 1176, 1377, and 1476

Uploaded by

Rob PortCopyright:

Available Formats

15.9519.

09000

Prepared by the Legislative Council staff

2015-17 BIENNIUM ALLOCATIONS OIL AND GAS TAX COLLECTIONS REFLECTING HOUSE BILL NOS. 1176, 1377, AND 1476

The schedules below provide information on 2015-17 biennium estimated oil and gas tax allocations based on

the Conference Committee version of Engrossed House Bill No. 1176 [15.0329.05019], the Conference

Committee version of Engrossed House Bill No. 1377 [15.0400.05009] reflecting the March 2015 revised revenue

forecast and reflecting the provisions of Engrossed House Bill No. 1476 [15.1024.05022]. The Conference

Committee version of Engrossed House Bill No. 1176 increases the allocation of oil and gas gross production tax

revenue to counties from 25 percent to 30 percent of all revenue over $5 million. The proposed changes to

Engrossed House Bill No. 1377 include changing the name of the property tax relief sustainability fund and

decreasing the allocation to the fund from $341.79 million to $300 million, removing the transfer of 25 percent of

the revenue from the strategic investment and improvements fund to the legacy fund, providing that the state

disaster relief fund does not receive oil and gas tax allocations if the unobligated balance in the fund exceeds a

certain amount, and providing an allocation of 30 percent of the remaining revenue to a newly created political

subdivision allocation fund. Engrossed House Bill No. 1476 changes the oil extraction tax rate to 5 percent.

2015-17 Biennium Forecast Estimates - House Bill Nos. 1176 and 1377

March 2015

Proposed Changes Forecast

HB 1476

Increase (Decrease)

Legacy fund

$940,730,000

$950,600,000

$9,870,000

Three Affiliated Tribes

262,640,000

265,080,000

2,440,000

Oil and gas research fund

10,000,000

10,000,000

0

Oil and gas impact grant fund

140,000,000

140,000,000

0

630,790,000

630,790,000

0

Political subdivisions

Abandoned well reclamation fund

10,000,000

10,000,000

0

North Dakota outdoor heritage fund

27,500,000

27,500,000

0

Foundation aid stabilization fund

131,180,000

134,230,000

3,050,000

Common schools trust fund

131,180,000

134,230,000

3,050,000

Resources trust fund

262,370,000

268,460,000

6,090,000

General fund

300,000,000

300,000,000

0

Tax relief fund

300,000,000

300,000,000

0

Strategic investment and improvements fund

194,910,000

202,490,000

7,580,000

Political subdivision allocation fund

40,670,000

43,930,000

3,260,000

State disaster relief fund

16,420,000

16,420,000

0

Total oil and gas tax revenue allocations

$3,398,390,000

$3,433,730,000

$35,340,000

March 2015 Revised Revenue Forecast

Proposed Changes - House Bill No. 1476

State's share $852 million

State's share $862 million

Distributed by formula

Distributed by formula

General fund - First $200 million

General fund - First $200 million

Tax relief fund - Next $300 million

Tax relief fund - Next $300 million

General fund - Next $100 million

General fund - Next $100 million

Strategic investment and improvements fund - Next $100 million

Strategic investment and improvements fund - Next $100 million

State disaster relief fund - Next $22 million if disaster fund balance

does not exceed a certain level - $16 million

State disaster relief fund - Next $22 million if disaster fund balance

does not exceed a certain level - $16 million

Strategic investment and improvements fund 70 percent of any additional revenues - $95 million

Strategic investment and improvements fund 70 percent of any additional revenues - $102 million

Political subdivision allocation fund 30 percent of any additional revenues - $41 million

Political subdivision allocation fund 30 percent of any additional revenues - $44 million

NOTE: The amounts reflected in these schedules are preliminary estimates. The actual amounts allocated

for the 2015-17 biennium may differ significantly from these amounts based on actual oil price and oil

production.

North Dakota Legislative Council

April 2015

You might also like

- Tribal Oil Revenue ForecastDocument5 pagesTribal Oil Revenue ForecastRob PortNo ratings yet

- Revised ForecastDocument4 pagesRevised Forecastjennifer_brooks3458No ratings yet

- House Proposed Budget ANER Money Report.2015.05.14Document35 pagesHouse Proposed Budget ANER Money Report.2015.05.14CarolinaMercuryNo ratings yet

- Draft: 2015 Minnesota House of Representatives - HF 848, Omnibus Tax Bill General Fund Tax RevenuesDocument14 pagesDraft: 2015 Minnesota House of Representatives - HF 848, Omnibus Tax Bill General Fund Tax Revenuescrichert30No ratings yet

- Legislature Revenue ForecastDocument4 pagesLegislature Revenue ForecastRob PortNo ratings yet

- FY2015 Budget Amendment #2Document1 pageFY2015 Budget Amendment #2cafwexmiNo ratings yet

- FSBR Financial Statement and Budget Report SummaryDocument32 pagesFSBR Financial Statement and Budget Report SummaryIan KrebsNo ratings yet

- IFS (2009) Public Finances PaperDocument22 pagesIFS (2009) Public Finances PaperJoeNo ratings yet

- Amending The Adopted Budget 09-01-15Document3 pagesAmending The Adopted Budget 09-01-15L. A. PatersonNo ratings yet

- City of Rayne 2015 Budget Final Amend and Approved 2015 2016Document39 pagesCity of Rayne 2015 Budget Final Amend and Approved 2015 2016Theresa RichardNo ratings yet

- 2015 Brookhaven Budget Final VersionDocument17 pages2015 Brookhaven Budget Final VersionThe Brookhaven PostNo ratings yet

- Sept BudgetDocument3 pagesSept BudgetRob PortNo ratings yet

- Non-General RevenueDocument36 pagesNon-General RevenueMNCOOhioNo ratings yet

- Summary of 2014-15 Taylor Budget ChangesDocument2 pagesSummary of 2014-15 Taylor Budget ChangesDavid KomerNo ratings yet

- Fy 2020 CBJ PDFDocument177 pagesFy 2020 CBJ PDFGabriel PenaNo ratings yet

- ENCSD, NCSD Closing in HOUSE BILL 200 RATIFIED BILL Section 7.25. (A)Document343 pagesENCSD, NCSD Closing in HOUSE BILL 200 RATIFIED BILL Section 7.25. (A)Brance-Rhonda LongNo ratings yet

- Council Tax LeafletDocument2 pagesCouncil Tax LeafletabaragbcNo ratings yet

- 67 101 06 As Amemded Budget Ord 2007 FinalDocument3 pages67 101 06 As Amemded Budget Ord 2007 FinaltulocalpoliticsNo ratings yet

- Shakopee Quarterly Financial Update Q1-2016Document6 pagesShakopee Quarterly Financial Update Q1-2016Brad TabkeNo ratings yet

- Money Report House HHS Subcommittee Report - 05!14!2015Document20 pagesMoney Report House HHS Subcommittee Report - 05!14!2015CarolinaMercuryNo ratings yet

- Bill H4242Document466 pagesBill H4242MassLiveNo ratings yet

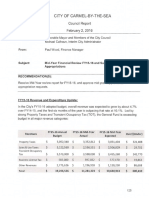

- City of Carmel-By-The-Sea: Council Report February 2, 2016Document6 pagesCity of Carmel-By-The-Sea: Council Report February 2, 2016L. A. PatersonNo ratings yet

- Start of Budget 11-12Document2 pagesStart of Budget 11-12api-130911854No ratings yet

- Solutionchapter 15Document36 pagesSolutionchapter 15Ken Jomel PeñadaNo ratings yet

- Best BudgetDocument31 pagesBest BudgetSyed Muhammad Ali SadiqNo ratings yet

- A Bill: For An Act To Be EntitledDocument5 pagesA Bill: For An Act To Be EntitledFactBasedNo ratings yet

- Pa Environment Digest Feb. 13, 2017Document64 pagesPa Environment Digest Feb. 13, 2017www.PaEnvironmentDigest.comNo ratings yet

- HB-SB76 Presentation To Senate Finance 10-15-2013Document29 pagesHB-SB76 Presentation To Senate Finance 10-15-2013shadowchbNo ratings yet

- Appropriation (Amendment) : EntitledDocument7 pagesAppropriation (Amendment) : EntitledMwawiNo ratings yet

- Government Accounting Chapter 3: Government Accounting ProcessDocument5 pagesGovernment Accounting Chapter 3: Government Accounting Process뿅아리No ratings yet

- NWFP-WhitePaper 2009-10Document173 pagesNWFP-WhitePaper 2009-10Wajiha SaeedNo ratings yet

- Santo Nino Executive Summary 2015Document6 pagesSanto Nino Executive Summary 2015mocsNo ratings yet

- Report On The Amended Executive Budget FINALtDocument51 pagesReport On The Amended Executive Budget FINALtcara12345No ratings yet

- Office For The AgingDocument6 pagesOffice For The AgingKelsey O'ConnorNo ratings yet

- Sullivan County Enacts Cuts, Including Staff ReductionsDocument11 pagesSullivan County Enacts Cuts, Including Staff ReductionsLissa HarrisNo ratings yet

- IV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods CorpDocument9 pagesIV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods Corpjennie martNo ratings yet

- House Bill 2004: 96Th General AssemblyDocument17 pagesHouse Bill 2004: 96Th General AssemblyKOMU NewsNo ratings yet

- Report On The Amended State Fiscal Year 2011-12 Executive BudgetDocument51 pagesReport On The Amended State Fiscal Year 2011-12 Executive BudgetRick KarlinNo ratings yet

- 2013 14 d156 Budget State Form 091013Document29 pages2013 14 d156 Budget State Form 091013api-233183949No ratings yet

- Expenses and Appropriations of The Mississippi LegislatureDocument71 pagesExpenses and Appropriations of The Mississippi LegislatureRuss LatinoNo ratings yet

- 2013 Proposed Program Budget: Village of Grafton, WisconsinDocument42 pages2013 Proposed Program Budget: Village of Grafton, Wisconsinsschuster4182No ratings yet

- Journal entries for city general fundDocument3 pagesJournal entries for city general fundEkta Saraswat VigNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- F6uk 2011 Dec QDocument12 pagesF6uk 2011 Dec Qmosherif2011No ratings yet

- Sample Past Exam Questions RevisedDocument23 pagesSample Past Exam Questions RevisedAngie100% (2)

- Arkansas Bill HB1145Document11 pagesArkansas Bill HB1145Karl HillsNo ratings yet

- Fourth Quarter FY 2012-13 Performance Reportt 09-10-13Document10 pagesFourth Quarter FY 2012-13 Performance Reportt 09-10-13L. A. PatersonNo ratings yet

- Tax Restructuring Revision 120619Document199 pagesTax Restructuring Revision 120619Alyssa RobertsNo ratings yet

- The Appropriation Act, 2012Document8 pagesThe Appropriation Act, 2012markfachristNo ratings yet

- Review questions on government accounting transactions and financial statementsDocument8 pagesReview questions on government accounting transactions and financial statementsRALLISONNo ratings yet

- Solution Chapter 15Document33 pagesSolution Chapter 15Sy Him82% (11)

- Hr4348conference Cbo ReportDocument8 pagesHr4348conference Cbo ReportPeggy W SatterfieldNo ratings yet

- Report On The Amended Executive Budget FINALtDocument51 pagesReport On The Amended Executive Budget FINALtAzi PaybarahNo ratings yet

- Taxation Answers 2Document9 pagesTaxation Answers 2Kiều Thảo AnhNo ratings yet

- Special Town Meeting Warrant May 9, 2016Document22 pagesSpecial Town Meeting Warrant May 9, 2016The Republican/MassLive.comNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Legalize Cannabis PetitionDocument25 pagesLegalize Cannabis PetitionRob PortNo ratings yet

- Katrina ChristiansenDocument566 pagesKatrina ChristiansenRob PortNo ratings yet

- Mohr Candidate FilingDocument32 pagesMohr Candidate FilingRob PortNo ratings yet

- 7 - Resolution on CO2 Private Property and Eminent DomainDocument1 page7 - Resolution on CO2 Private Property and Eminent DomainRob PortNo ratings yet

- Presidential Caucuses Media Advisory 29feb24Document1 pagePresidential Caucuses Media Advisory 29feb24Rob PortNo ratings yet

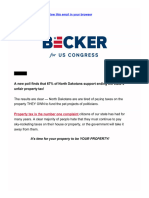

- Becker Property Tax Fundraising PitchDocument5 pagesBecker Property Tax Fundraising PitchRob PortNo ratings yet

- Retire CongressDocument1 pageRetire CongressRob PortNo ratings yet

- Simons Pre-Trial BriefDocument5 pagesSimons Pre-Trial BriefRob PortNo ratings yet

- Vote No on 7 - Full Page - Complete (1)Document2 pagesVote No on 7 - Full Page - Complete (1)Rob PortNo ratings yet

- Protect District 37s Rights LetterDocument1 pageProtect District 37s Rights LetterRob PortNo ratings yet

- Burleigh County Conflict Case Stenehjem Email No Prosecution LetterDocument28 pagesBurleigh County Conflict Case Stenehjem Email No Prosecution LetterRob PortNo ratings yet

- Legendary PacDocument1 pageLegendary PacRob PortNo ratings yet

- UND Reporton Conflict InvestigationDocument34 pagesUND Reporton Conflict InvestigationRob PortNo ratings yet

- 2011 o 12Document3 pages2011 o 12Rob PortNo ratings yet

- Becker Property Tax Fundraising PitchDocument5 pagesBecker Property Tax Fundraising PitchRob PortNo ratings yet

- BSPI Media Release 2-2-2023Document1 pageBSPI Media Release 2-2-2023Rob PortNo ratings yet

- Cramer For SenateDocument1,359 pagesCramer For SenateRob PortNo ratings yet

- Miller AnnouncementDocument1 pageMiller AnnouncementRob PortNo ratings yet

- Cramer For SenateDocument1,359 pagesCramer For SenateRob PortNo ratings yet

- Brocker EmailDocument1 pageBrocker EmailJeremy TurleyNo ratings yet

- PD Ir2314849Document6 pagesPD Ir2314849Rob PortNo ratings yet

- Approved Property Tax Petition 29june23Document8 pagesApproved Property Tax Petition 29june23Rob PortNo ratings yet

- 25 5061 02000 Meeting AgendaDocument3 pages25 5061 02000 Meeting AgendaRob PortNo ratings yet

- Matt Entz Contract AmendmentsDocument4 pagesMatt Entz Contract AmendmentsMike McFeelyNo ratings yet

- Best of America PAC FEC ReportsDocument9 pagesBest of America PAC FEC ReportsRob PortNo ratings yet

- Election Integrity Ballot MeasureDocument13 pagesElection Integrity Ballot MeasureRob PortNo ratings yet

- Combined ReportsDocument131 pagesCombined ReportsRob PortNo ratings yet

- Combined ReportsDocument131 pagesCombined ReportsRob PortNo ratings yet

- Pierce PieceDocument2 pagesPierce PieceRob PortNo ratings yet

- NDGOP August MonthlyDocument22 pagesNDGOP August MonthlyRob PortNo ratings yet

- Career Option After Std. 12th (India) - LAWDocument6 pagesCareer Option After Std. 12th (India) - LAWMoumita MurmuNo ratings yet

- Professor Paula Giliker Vicarious Liability in The UK Supreme Court 2016 7 The UK Supreme Court Yearbook 152Document16 pagesProfessor Paula Giliker Vicarious Liability in The UK Supreme Court 2016 7 The UK Supreme Court Yearbook 152LouisChinNo ratings yet

- GR. No. People Vs JumawanDocument6 pagesGR. No. People Vs JumawanWinston YutaNo ratings yet

- Arigo v. Swift (G.R. No. 206510, September 16, 2014)Document5 pagesArigo v. Swift (G.R. No. 206510, September 16, 2014)Ma. Regine Joyce AgdonNo ratings yet

- Age Discrimination 2Document2 pagesAge Discrimination 2Raphael Seke OkokoNo ratings yet

- Chapter 12 - International Transfer Pricing: Multiple Choice QuestionsDocument11 pagesChapter 12 - International Transfer Pricing: Multiple Choice QuestionsLoretta SuryadiNo ratings yet

- Montano V Verceles Case DigestDocument5 pagesMontano V Verceles Case DigestRho Hanee XaNo ratings yet

- Buckley V UkDocument12 pagesBuckley V UkShriya ChandankarNo ratings yet

- CELF Final ProspectusDocument265 pagesCELF Final ProspectusDealBookNo ratings yet

- Chapter 21 - Section 1Document21 pagesChapter 21 - Section 1api-206809924No ratings yet

- G.R. No. 195534 June 13, 2012 People of The Philippines, Appellee, EDUARDO GONZALES, AppellantDocument6 pagesG.R. No. 195534 June 13, 2012 People of The Philippines, Appellee, EDUARDO GONZALES, AppellantExistentialist5aldayNo ratings yet

- Custom Search: Today Is Friday, January 26, 2018Document2 pagesCustom Search: Today Is Friday, January 26, 2018Iya AnonasNo ratings yet

- Polymer Rubber Corporation Vs SalamudingDocument3 pagesPolymer Rubber Corporation Vs SalamudingRenz Aimeriza AlonzoNo ratings yet

- Re Letter of Tony Valenciano DISSENTDocument2 pagesRe Letter of Tony Valenciano DISSENTEric Karl Nicholas AguilarNo ratings yet

- Partition AgreementDocument2 pagesPartition AgreementMelford LapnawanNo ratings yet

- The American Pageant - Chapter 23 Review SheetDocument3 pagesThe American Pageant - Chapter 23 Review SheetJoesterNo ratings yet

- City of Spokane Use of Force Commission, Final ReportDocument29 pagesCity of Spokane Use of Force Commission, Final ReportinlanderwebNo ratings yet

- Hancock v. Watson Full TextDocument5 pagesHancock v. Watson Full TextJennilyn TugelidaNo ratings yet

- The Quadrilateral Security DialogueDocument16 pagesThe Quadrilateral Security Dialogueram manogarNo ratings yet

- Pa113 Public Accountability - LectureDocument43 pagesPa113 Public Accountability - LectureDennisGomez100% (1)

- Bolalin V OccianoDocument2 pagesBolalin V OccianoMary Louise R. Concepcion100% (1)

- GR No. L-40789, February 27, 1987 Intestate Estate of Petra Rosales Vs Fortunato RosalesDocument2 pagesGR No. L-40789, February 27, 1987 Intestate Estate of Petra Rosales Vs Fortunato RosalesDiane DistritoNo ratings yet

- Tañada vs. Tuvera 136 Scra27 Grno. 63915 Dec. 29, 1986: FactsDocument71 pagesTañada vs. Tuvera 136 Scra27 Grno. 63915 Dec. 29, 1986: FactsKhristine Ericke De Mesa100% (1)

- Bachrach vs. La ProtectoraDocument6 pagesBachrach vs. La ProtectoraXtine CampuPotNo ratings yet

- United States Court of Appeals, Third CircuitDocument33 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Atty. Crisostomo A. Uribe: Persons and Family RelationsDocument66 pagesAtty. Crisostomo A. Uribe: Persons and Family RelationsCars CarandangNo ratings yet

- Thayer Vietnam: Prime Minister's Bag Man' Implicated in Bribery ScandalDocument2 pagesThayer Vietnam: Prime Minister's Bag Man' Implicated in Bribery ScandalCarlyle Alan ThayerNo ratings yet

- Supreme Court Rules in Favor of Daughters' Equal Rights to Coparcenary PropertyDocument3 pagesSupreme Court Rules in Favor of Daughters' Equal Rights to Coparcenary Propertyayush kumarNo ratings yet

- Labor Standards Law 1 Semester, 2020-2021 Atty. Raidah M. Mangantulao Assignments For September 21, 2020 5:30-8:30PMDocument3 pagesLabor Standards Law 1 Semester, 2020-2021 Atty. Raidah M. Mangantulao Assignments For September 21, 2020 5:30-8:30PMEsmeralda De GuzmanNo ratings yet

- SPECIAL POWER O-WPS OfficeDocument4 pagesSPECIAL POWER O-WPS OfficeKaori SakiNo ratings yet