Professional Documents

Culture Documents

Business Vocabulary Related To ACCOUNTING

Uploaded by

DanielGonzálezZambranoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Vocabulary Related To ACCOUNTING

Uploaded by

DanielGonzálezZambranoCopyright:

Available Formats

Universidad de Santiago de Chile

Facultad de Humanidades

Lic. en educacin en ingls

Introduction to ESP

Business vocabulary related to ACCOUNTING

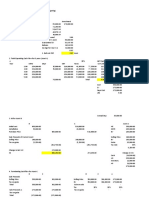

Balance Sheet

Its a summary of a companys financial position at a specific point in time, usually the

end of its financial year. It indicates the value of everything the company owes (or its

assets) as well as everything that it owes (or its liabilities).

As an example: Our balance sheet is not as strong as last year, since weve taken some

heavy losses on investments.

Asset

Its anything owned by a company that can be used to generate money or an income. It

can be tangible, meaning that it has a physical existence, as can be cash, or any

equipment and property; or can also be intangible, meaning that it doesnt have a

physical existence, as can be a patent or copyright.

For example: Most oh the companys assets consists of accounts receivables from very

risky customers and, until theyre paid, its hard to be sure of their actual value.

Consulting firms usually have few tangible assets, and their main intangible asset is the

reputation theyve established.

Liability

Is a financial obligation or debt held by a company, normally liabilities can be accounts

payable, bank loans and outstanding taxes.

For example: Managing liabilities effectively is critical to good financial planning.

There are two types of liability: Short-term liabilities, and long-term liabilities.

Short-term liabilities are the ones paid within one year, while long-term ones are

repayable after more than a year.

For example: Our short-term liabilities have grown very quickly this year, as we

expanded into new territories.

Profit

It is the amount of money earned in a given period, normally a year, after deducting all

its expenses.

As an example: Profits for many firms have declined due to a slowdown in consumer

spending.

Profit Margin

It is the percentage of income a company retains after all costs are deducted. If the cost

of a product is as high as its selling price, then the profit margin would be very low.

Example: The profit margin on luxury automobiles is much higher than on economy

vehicles.

Loss

It is like a profit but in negative terms, companies make a loss (or take a loss) if a single

transaction costs more than it earns.

Example: Weve always taken a loss on our equipment sales, but we make it up by

generating revenue through after-sales service.

Companies run at a loss if their profit is negative for an entire year.

Example: Companies that run at a loss for several years may be forced to stop trading

on the Stock Exchange.

Universidad de Santiago de Chile

Facultad de Humanidades

Lic. en educacin en ingls

Introduction to ESP

Profit/Loss Statement

Its a type of accounting report that companies publish on a regular basis.

Debt

It is money owed by a company to another company or an individual. Most corporate

debt is in the form of loans from banks, or bonds that have been sold to investors.

Example: This years balance sheet shows that the companys bank debts have been

fully repaid.

Gross

A gross figure is a sum that does not include any deductions. We describe the total

amount of money earned by selling a companys products as gross income, or revenue.

Example: The Companys gross sales have risen 20% in the last quarter alone.

To gross could be a verb as well, meaning to earn gross income.

Example: The film was a great success, and grossed more than $50 million on its first

weekend.

Net

A net figure is a sum that includes all deductions. We describe the amount of money

earned through a companys sales after subtracting all costs as net income, or profit.

Example: We netted more than $100000 from a single day of direct-marketing sales.

To net is also a verb, which means to earn net income.

Pretax

It is an adjective which means before payment of tax. Accountants normally show

pretax profit or pretax income on one line of a companys financial statement, and show

profit after tax on a separate line.

Example: Our overseas results look better on a pretax basis, because we operate in

several countries where corporate taxes are very high.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Navy Leave ChitDocument2 pagesNavy Leave ChitBrandon FischerNo ratings yet

- ABCs of SME financial management: assets, liabilities, equityDocument2 pagesABCs of SME financial management: assets, liabilities, equityPabloNo ratings yet

- The Happy Club (Abridged)Document7 pagesThe Happy Club (Abridged)DanielGonzálezZambranoNo ratings yet

- Abstract Chapter 2 How Languages Are LearnedDocument4 pagesAbstract Chapter 2 How Languages Are LearnedDanielGonzálezZambranoNo ratings yet

- What is revenue and expenseDocument5 pagesWhat is revenue and expenseJohn MilnerNo ratings yet

- UNIT 4_REVISIONDocument19 pagesUNIT 4_REVISIONhalam29051997No ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsJonabed PobadoraNo ratings yet

- English For Accounting VocabularyDocument7 pagesEnglish For Accounting VocabularyMarcia OhtaNo ratings yet

- Does The Balance Sheet Always BalanceDocument3 pagesDoes The Balance Sheet Always BalanceJacqueline Anne MalonzoNo ratings yet

- Essential accounting terms explainedDocument6 pagesEssential accounting terms explainedGERMANo ratings yet

- 30 Easy To Learn English TermsDocument6 pages30 Easy To Learn English TermsNat100% (1)

- Glossary of FA and FSA - RPDocument13 pagesGlossary of FA and FSA - RPPooja GuptaNo ratings yet

- What Does Receivables Turnover Ratio Mean?Document9 pagesWhat Does Receivables Turnover Ratio Mean?azyNo ratings yet

- Professional Practices Lecture 18Document40 pagesProfessional Practices Lecture 18Talha Chaudhary100% (1)

- Finance Management Notes MbaDocument12 pagesFinance Management Notes MbaSandeep Kumar SahaNo ratings yet

- Financial Terms and Ratios DefinitionsDocument25 pagesFinancial Terms and Ratios DefinitionsKtn Patil100% (1)

- 30 Easy-To-Learn English Terms For Accounting: 1. AssetsDocument6 pages30 Easy-To-Learn English Terms For Accounting: 1. Assetsatena golmohammadiNo ratings yet

- Assets, Liabilities, Equity, RevenueDocument17 pagesAssets, Liabilities, Equity, RevenueAlfred MphandeNo ratings yet

- 30 Ways To Learn English For AccountingDocument7 pages30 Ways To Learn English For AccountingkanahiraNo ratings yet

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingDocument6 pagesAccounting Vocabulary: Easy-To-Learn English Terms For AccountingRed WaneNo ratings yet

- Beginners' Guide To Financi...Document8 pagesBeginners' Guide To Financi...Nadia KhanNo ratings yet

- Engineering EconomicsDocument12 pagesEngineering EconomicsAwais SiddiqueNo ratings yet

- Financial Health: What Is 'Working Capital'Document11 pagesFinancial Health: What Is 'Working Capital'arhijaziNo ratings yet

- Commonly Used Financial TermsDocument2 pagesCommonly Used Financial TermsMihai GeambasuNo ratings yet

- Business Finance FundamentalsDocument51 pagesBusiness Finance Fundamentalsroselyn espinosaNo ratings yet

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingDocument6 pagesAccounting Vocabulary: Easy-To-Learn English Terms For AccountingHamza El MissouabNo ratings yet

- Accounting Terms for Business OwnersDocument4 pagesAccounting Terms for Business OwnersInneu VeweNo ratings yet

- Terms For AccountingDocument7 pagesTerms For AccountingJaime Choque CopajaNo ratings yet

- How Do Companies Calculate RevenueDocument11 pagesHow Do Companies Calculate RevenuesebascianNo ratings yet

- Understanding Key Finance TermsDocument5 pagesUnderstanding Key Finance TermsP KarthikeyaNo ratings yet

- Gross Profit Operating Revenue CogsDocument11 pagesGross Profit Operating Revenue CogskyoNo ratings yet

- Balance SheetDocument9 pagesBalance SheetMARL VINCENT L LABITADNo ratings yet

- The Essentials of Cash FlowDocument5 pagesThe Essentials of Cash FlowDaniel GarciaNo ratings yet

- Financial Term GlossaryDocument17 pagesFinancial Term GlossaryharshitberiwalNo ratings yet

- English Terms For AccountingDocument3 pagesEnglish Terms For Accountingtriariningsih62No ratings yet

- Beginners' Guide To Financial StatementsDocument7 pagesBeginners' Guide To Financial StatementsIbrahim El-nagarNo ratings yet

- Personal Assets: AssetDocument6 pagesPersonal Assets: AssetDipak NandeshwarNo ratings yet

- Questions DuresDocument25 pagesQuestions DuresAnna-Maria Müller-SchmidtNo ratings yet

- Ratio Analysis TabularDocument4 pagesRatio Analysis TabularKhondaker RiyadhNo ratings yet

- 2012 '000 2011 '000 Long-Term Liabilities Capital Employed Gearing RatioDocument5 pages2012 '000 2011 '000 Long-Term Liabilities Capital Employed Gearing Ratioolivia66wardNo ratings yet

- Accounting Common TermsDocument4 pagesAccounting Common TermsMa. Catherine PaternoNo ratings yet

- Fundamental Analysis-Income StatementDocument2 pagesFundamental Analysis-Income Statementsuperman11212No ratings yet

- Common Terms Used in FinanceDocument22 pagesCommon Terms Used in FinanceAli Riaz KhanNo ratings yet

- Business Financial Terms - Definitions: Acid TestDocument11 pagesBusiness Financial Terms - Definitions: Acid Testaishwary rana100% (1)

- English Terms For AccountingDocument5 pagesEnglish Terms For Accountingyayita2010No ratings yet

- Accounting RelationshipDocument2 pagesAccounting RelationshipJoem'z Burlasa-Amoto Esler-DionaldoNo ratings yet

- Definition of Elements of Financial StatementsDocument1 pageDefinition of Elements of Financial StatementsKc B.No ratings yet

- Chapter2 0Document56 pagesChapter2 0Eaindray OoNo ratings yet

- Analyzing Financial Ratios to Assess a Company's PerformanceDocument56 pagesAnalyzing Financial Ratios to Assess a Company's PerformanceAugusto Teixeira ModestoNo ratings yet

- Stock ResearchDocument50 pagesStock Researchvikas yadavNo ratings yet

- What Is Capitalization?Document4 pagesWhat Is Capitalization?Jared EnriquezNo ratings yet

- Industrial OdtDocument10 pagesIndustrial OdtBICHAKA MELKAMUNo ratings yet

- Industrial OdtDocument10 pagesIndustrial OdtBICHAKA MELKAMUNo ratings yet

- Accounting Basics - Assets, Liabilities, Equity, Revenue, and ExpensesDocument4 pagesAccounting Basics - Assets, Liabilities, Equity, Revenue, and ExpensesShah JehanNo ratings yet

- Chart of AccountsDocument7 pagesChart of Accountsdilip_ajjuNo ratings yet

- Acid Test: Hariapankti@yahoo - Co.inDocument14 pagesAcid Test: Hariapankti@yahoo - Co.inAbhijeet Bhaskar100% (1)

- Accounting GlossaryDocument105 pagesAccounting Glossarykumaravelphd5030No ratings yet

- Accounting PositionDocument4 pagesAccounting PositionMarcoNo ratings yet

- Glossary - 257 258 - Entrepreneurship DevelopmentDocument4 pagesGlossary - 257 258 - Entrepreneurship DevelopmentrajendrakumarNo ratings yet

- AssignmentDocument4 pagesAssignmentRithik TiwariNo ratings yet

- Introduction To Financial StatementsDocument21 pagesIntroduction To Financial StatementsmanjushreeNo ratings yet

- Careers involving people, objects, concepts and responsibilitiesDocument2 pagesCareers involving people, objects, concepts and responsibilitiesDanielGonzálezZambranoNo ratings yet

- Sociolinguistics Spider MapDocument2 pagesSociolinguistics Spider MapDanielGonzálezZambranoNo ratings yet

- At The Hairdresser: A Play For Eigth Grade'S Time For EnglishDocument5 pagesAt The Hairdresser: A Play For Eigth Grade'S Time For EnglishDanielGonzálezZambranoNo ratings yet

- Types of Allophones and Their UsesDocument9 pagesTypes of Allophones and Their UsesDanielGonzálezZambrano83% (6)

- Linguistic AnalysisDocument18 pagesLinguistic AnalysisDanielGonzálezZambranoNo ratings yet

- Selection of Quotes About Prosody and Action ResearchDocument5 pagesSelection of Quotes About Prosody and Action ResearchDanielGonzálezZambranoNo ratings yet

- Quechua PossessivesDocument8 pagesQuechua PossessivesDanielGonzálezZambranoNo ratings yet

- Curry Action ResearchDocument4 pagesCurry Action ResearchDanielGonzálezZambranoNo ratings yet

- 10 1 1 128Document9 pages10 1 1 128Eva Yolanda Hernandez RomeroNo ratings yet

- Carroll, Lewis - Alice's Adventures in WonderlandDocument202 pagesCarroll, Lewis - Alice's Adventures in WonderlandDanielGonzálezZambranoNo ratings yet

- Edgar Allan Poe - The Fall of The House of UsherDocument10 pagesEdgar Allan Poe - The Fall of The House of UsherDanielGonzálezZambranoNo ratings yet

- Inventory Accounting and ValuationDocument13 pagesInventory Accounting and Valuationkiema katsutoNo ratings yet

- Active and Passive VoiceDocument8 pagesActive and Passive Voicejerubaal kaukumangera100% (1)

- Achievements of Fatima JinnahDocument5 pagesAchievements of Fatima JinnahmuhammadrafayNo ratings yet

- COC 2021 - ROY - Finance OfficerDocument2 pagesCOC 2021 - ROY - Finance OfficerJillian V. RoyNo ratings yet

- Nirma University Institute of Technology M.Tech. in Electrical Engineering (Electrical Power Systems) Semester - II LTPC 2 0 0 2Document2 pagesNirma University Institute of Technology M.Tech. in Electrical Engineering (Electrical Power Systems) Semester - II LTPC 2 0 0 2Aditya TiwariNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- MC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Document10 pagesMC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Allysa Nicole OrdonezNo ratings yet

- Biological Science - September 2013 Licensure Examination For Teachers (LET) - TuguegaraoDocument8 pagesBiological Science - September 2013 Licensure Examination For Teachers (LET) - TuguegaraoScoopBoyNo ratings yet

- A Message To The Glorious ChurchDocument109 pagesA Message To The Glorious ChurchhungrynicetiesNo ratings yet

- Guimba, Nueva EcijaDocument2 pagesGuimba, Nueva EcijaSunStar Philippine NewsNo ratings yet

- Tax Invoice: State Name Delhi, Code 07Document1 pageTax Invoice: State Name Delhi, Code 07Ritesh pandeyNo ratings yet

- (47318) CARLOS EDUARDO ENCARNACION FABIAN Job Offer 1488575986Document1 page(47318) CARLOS EDUARDO ENCARNACION FABIAN Job Offer 1488575986Carlos FabianNo ratings yet

- Lect. 3 Mens ReaDocument15 pagesLect. 3 Mens ReaNicole BoyceNo ratings yet

- Coca-Cola VS CaDocument6 pagesCoca-Cola VS CaporeoticsarmyNo ratings yet

- Occupational Health Safety Quiz 1Document2 pagesOccupational Health Safety Quiz 1Al-juffrey Luis AmilhamjaNo ratings yet

- Department of Education: Sto. Niño National High SchoolDocument3 pagesDepartment of Education: Sto. Niño National High SchoolMackie BarcebalNo ratings yet

- GAISANO INC. v. INSURANCE CO. OF NORTH AMERICADocument2 pagesGAISANO INC. v. INSURANCE CO. OF NORTH AMERICADum DumNo ratings yet

- A&M Plastics v. OPSol - ComplaintDocument35 pagesA&M Plastics v. OPSol - ComplaintSarah BursteinNo ratings yet

- Euro MedDocument3 pagesEuro MedAndrolf CaparasNo ratings yet

- TranscriptDocument10 pagesTranscriptAnonymous 4pbJ6NtNo ratings yet

- ZTE WF833F/WF833 CDMA Fixed Wireless Terminal User ManualDocument22 pagesZTE WF833F/WF833 CDMA Fixed Wireless Terminal User ManualYawe Kizito Brian PaulNo ratings yet

- 4 2 Pure BendingDocument13 pages4 2 Pure BendingRubayet AlamNo ratings yet

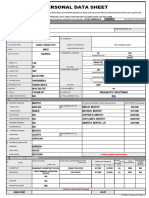

- Abner PDSDocument7 pagesAbner PDSKEICHIE QUIMCONo ratings yet

- CIE Registration Form SummaryDocument3 pagesCIE Registration Form SummaryOrdeisNo ratings yet

- 7221-7225 Beverly BLVDDocument10 pages7221-7225 Beverly BLVDJu PoNo ratings yet

- Diplomacy settings and interactionsDocument31 pagesDiplomacy settings and interactionscaerani429No ratings yet

- BC t?ng tr??ng User Internet Banking có g?n TK TGTT- Xu?t chi ti?tDocument12 pagesBC t?ng tr??ng User Internet Banking có g?n TK TGTT- Xu?t chi ti?tMy TruongNo ratings yet

- Law CV Template 3Document2 pagesLaw CV Template 3jaslinNo ratings yet

- ELECTION LAW Case Doctrines PDFDocument24 pagesELECTION LAW Case Doctrines PDFRio SanchezNo ratings yet