Professional Documents

Culture Documents

Boeing - Recommendation

Uploaded by

Nguyen HieuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boeing - Recommendation

Uploaded by

Nguyen HieuCopyright:

Available Formats

Recommendation

Boeing should go forward with the Boeing 7E7 Project. There are uncertain risks in

this project regarding the new materials used (composite carbon) and design with

wingtip extenders. These risks are relevant because Boeing 7E7 is the first type of

airplane applying these new elements. However, with the harsh competition from

Airbus, which is designing its new large commercial airplanes to be launched in

2005, Boeing will fall behind in innovation, fuel efficiency, and customer capacity if

the 7E7 is not developed. Boeing needs to take these risks and develop the 7E7 to

provide the cost-saving and large capacity airplanes, which are the expectations of

airline companies in the current fluctuating economy.

In terms of shareholders wealth, the 7E7 project has the IRR of 15.66% while

Boeings WACC is at 13.72%. The IRR is about 1.5% better than the WACC, which

signifies that the 7E7 will more likely create value to Boeing and its shareholders.

The 7E7 project will be a driver for Boeing to keep the company competitive and

successful in the market; and to regain shareholders trust regarding the companys

capability of innovation after two cancelled projects in the early 90s.

Alternative Perspective

The 7E7 Project has a very large initial cost at about $8 billion. Even though its

success rate and potential outcome are attractive, it has too much of a risk if it fails.

Additionally, the current market is somewhat dimmed for the commercial aviation

industry with many negative world events such as the 9-11 terrorist attack, the

outbreak of SARS, etc. Therefore, Boeings board could instead focus on its

integrated defense system business. Boeing is currently the second largest provider

of military aircraft in the US and 46% of Boeings revenue is from this line of

business. With the US governments combat plan in Iraq and the rising level of

worldwide terrorist attacks, Boeing could expect to get more orders for its

integrated defense system, which would contribute considerably to its bottom line.

Financially, according to table below, if Boeing continues its 7E7 project, its military

lines WACC would be 13.72%. Meanwhile, the WACC of the military line without the

7E7 project would be 5.09%. Therefore, Boeing would be a much safer investment

to the investors, but the returns they can earn from Boeing would also shrink.

Focusing on military line seems to be a better choice for Boeing; however, Boeing

will lose its market share in the commercial aviation market, which it still is a giant

participant and contributes 54% of its revenue. The revenue from the commercial

aviation market is considerably large and will dominate the revenue from its

integrated defense system business.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Excel Exam 01Document4 pagesExcel Exam 01redouane50% (2)

- Role of QA&QC in Manufacturing - PresentationDocument32 pagesRole of QA&QC in Manufacturing - Presentationimran jamilNo ratings yet

- PM-case Study - AaronSide Goes To TeamsDocument2 pagesPM-case Study - AaronSide Goes To TeamsHassan Akbar SharifzadaNo ratings yet

- Market Penetration of Maggie NoodelsDocument10 pagesMarket Penetration of Maggie Noodelsapi-3765623100% (1)

- Financial Accounting Reviewer - Chapter 60Document15 pagesFinancial Accounting Reviewer - Chapter 60Coursehero Premium100% (1)

- Vested Outsourcing: A Exible Framework For Collaborative OutsourcingDocument12 pagesVested Outsourcing: A Exible Framework For Collaborative OutsourcingJosé Emilio Ricaurte SolísNo ratings yet

- Top 10 Forex Trading RulesDocument3 pagesTop 10 Forex Trading Rulescool_cyrusNo ratings yet

- ITIL Test PaperDocument9 pagesITIL Test PaperNitinNo ratings yet

- Quality ImprovementDocument5 pagesQuality Improvementzul0867No ratings yet

- Stanley Material and Metallurgical Pipe and Tube Industry at CoimbatoreDocument41 pagesStanley Material and Metallurgical Pipe and Tube Industry at CoimbatoreAnusuya kannanNo ratings yet

- SEB - ISO - XML Message For Payment InitiationDocument75 pagesSEB - ISO - XML Message For Payment InitiationbpvsvNo ratings yet

- Discounted Cash Flow Analysis Input Parameters and SensitivityDocument13 pagesDiscounted Cash Flow Analysis Input Parameters and Sensitivityfr5649No ratings yet

- Investment BankingDocument62 pagesInvestment Bankingकपिल देव यादवNo ratings yet

- Sip Zudus PerformanceDocument104 pagesSip Zudus PerformanceAkshay Jiremali100% (1)

- Financial Accounting Chapter 9Document66 pagesFinancial Accounting Chapter 9Jihen SmariNo ratings yet

- Module 6 - Operating SegmentsDocument3 pagesModule 6 - Operating SegmentsChristine Joyce BascoNo ratings yet

- Abm 115 TRMDocument329 pagesAbm 115 TRMgurubabNo ratings yet

- Legal Notice in The Matter of The International Cotton Association LimitedDocument3 pagesLegal Notice in The Matter of The International Cotton Association LimitedMahfuz Law RuNo ratings yet

- Data Mexico EdcDocument12 pagesData Mexico EdcDaniel Eduardo Arriaga JiménezNo ratings yet

- Rosenflex BrochureDocument32 pagesRosenflex Brochuresealion72No ratings yet

- Revaluation ModelDocument7 pagesRevaluation ModelkyramaeNo ratings yet

- The Effectiveness of Sales Promotion On Buying BehaviourDocument116 pagesThe Effectiveness of Sales Promotion On Buying BehaviourMohammed Jamiu100% (2)

- Contacts DetailsDocument33 pagesContacts DetailsviswaNo ratings yet

- Airarabia FundamentalsDocument11 pagesAirarabia FundamentalsallenNo ratings yet

- 1.supply Chain MistakesDocument6 pages1.supply Chain MistakesSantosh DevaNo ratings yet

- PCT CountriesDocument1 pagePCT CountriesshamimNo ratings yet

- LSCDocument6 pagesLSCGautamNo ratings yet

- Lincoln Automatic Lubrication SystemsDocument8 pagesLincoln Automatic Lubrication Systemsromaoj671No ratings yet

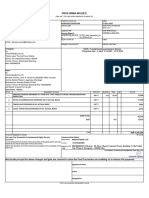

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Document1 pageService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajNo ratings yet

- Francisco Vs Chemical Bulk CarriersDocument2 pagesFrancisco Vs Chemical Bulk CarriersJerahmeel Cuevas0% (1)