Professional Documents

Culture Documents

ACCT 221-Corporate Financial Reporting-Bila Zia

Uploaded by

muhammadmusakhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 221-Corporate Financial Reporting-Bila Zia

Uploaded by

muhammadmusakhanCopyright:

Available Formats

Lahore University of Management Sciences

Instructor

Room No.

Office Hours

Email

Telephone

Secretary/TA

TA Office Hours

Course URL (if any)

COURSE BASICS

Credit Hours

Lecture(s)

Recitation/Lab (per week)

Tutorial (per week)

ACCT 221 Corporate Financial Reporting

Fall Semester 2014

Bilal Zia

416 SDSB Building

To be announced

bilal.zia@lums.edu.pk

042-3560-8364

Kashif

TBA

Suraj.lums.edu.pk

3

Nbr of Lec(s) Per Week

Nbr of Lec(s) Per Week

Nbr of Lec(s) Per Week

Duration

Duration

Duration

1 hour 15 minutes

COURSE DISTRIBUTION

Core

Elective

Open for Student Category

Close for Student Category

ACF Core

COURSE DESCRIPTION

The course builds on your knowledge of corporate theory and techniques as used to record, process, and report financial information.

While some emphasis is placed on analysis, interpretation, and use of accounting data for investing, credit, and management decisions,

the reporting function of accounting to external users (investors and creditors) will be stressed. Current financial reporting and

disclosure requirements, plus controversial and emerging practices, will be discussed in class. The course will examine asset and income

determination, preparation and interpretation of financial statements, and related disclosure requirements. Please note that this course

is a building block for the financial reporting issues encountered in the daily professional life.

COURSE PREREQUISITE(S)

Principles of financial accounting

Principles of management accounting

COURSE LEARNING OUTCOMES (CLO)

Upon successful completion of the course, students should be able to:

1. Demonstrate understanding of the fundamental concepts, mainstream theories, international accounting

standards and practices in financial reporting;

2. Identify financial reporting issues faced by investors in analyzing different companies based on financial

reporting standards;

3. Apply financial reporting requirements to ascertain financial position, financial performance and cash flows of

companies of diverse nature.

4. Discuss and debate a variety of topics in emerging areas of accounting and their relevance to business financial

decisions including the ethical and global perspectives;

5. Present and defend their analysis and recommendations effectively, both in oral and written forms. (General

Learning Goal)

Lahore University of Management Sciences

UNDERGRADUATE PROGRAM LEARNING GOALS & OBJECTIVES

General Learning Goals & Objectives

Goal 1 Effective Written and Oral Communication

Objective: Students will demonstrate effective writing and oral communication skills

Goal 2 Ethical Understanding and Reasoning

Objective: Students will demonstrate that they are able to identify and address ethical issues in an organizational

context.

Goal 3 Analytical Thinking and Problem Solving Skills

Objective: Students will demonstrate that they are able to identify key problems and generate viable solutions.

Goal 4 Application of Information Technology

Objective: Students will demonstrate that they are able to use current technologies in business and management

context.

Goal 5 Teamwork in Diverse and Multicultural Environments

Objective: Students will demonstrate that they are able to work effectively in diverse environments.

Goal 6 Understanding Organizational Ecosystems

Objective: Students will demonstrate that they have an understanding of Economic, Political, Regulatory, Legal,

Technological, and Social environment of organizations.

Major Specific Learning Goals & Objectives

Goal 7 (a) Discipline Specific Knowledge and Understanding

Objective: Students will demonstrate knowledge of key business disciplines and how they interact including

application to real world situations. (including subject knowledge)

Goal 7 (b) Understanding the science behind the decision-making process

Objective: Students will demonstrate ability to analyze a business problem, design and apply appropriate

decision-support tools, interpret results and make meaningful recommendations to support the decision-maker

Indicate below how the course learning objectives/outcomes specifically relate to any program learning goals and objectives.

PROGRAM LEARNING GOALS AND

OBJECTIVES

Goal 1 Effective Written and Oral

Communication

Goal 2 Ethical Understanding and

Reasoning

Goal 3 Analytical Thinking and Problem

Solving Skills

Goal 4 Application of Information

Technology

Goal 5 Teamwork in Diverse and

Multicultural Environments

Goal 6 Understanding Organizational

Ecosystems

Goal 7 (a) Discipline Specific Knowledge

and Understanding (Subject Knowledge)

Goal 7 (b) Understanding the science

behind the decision-making process

COURSE LEARNING OBJECTIVES

COURSE ASSESSMENT ITEM

Students get a number of opportunities to

demonstrate their ability to communicate

effectively (CLO #5)

Ethical perspectives in some of the case

studies are highlighted (CLO #4)

Major Goal: Analytical thinking and

problem solving skills are essential for

success in this course (CLO #1-3)

Introduction and Use of e learning

software,

Discussion and debate thereon of diverse

topics in classroom will allow this

objective to be met.

Develop students understanding of the

interaction of firm specific variables with

the securities markets, industry, and the

economy (CLO #4)

Major Goal: Comprehensive coverage of

topics in Applied Corporate Finance (CLO

#1-5)

NA

CP, Quiz and Exam

CP, Quiz and Exam

CP, Quiz, and Exam

Assignments, Cases

CP

CP, Quiz and Exam

CP, Quiz and Exam

NA

Lahore University of Management Sciences

GRADING BREAKUP AND POLICY

Quiz(s):

30%

Class Participation:

7%

Attendance:

3%

Midterm Examination: 30%

30%

Final Examination:

100%

There will be no makeup quizzes.

If you miss more than 5 classes you will automatically get an F grade in the course.

Develop critical thinking skills by completing research tasks, group learning and interaction tasks, and written and oral

communication tasks. Critical thinking is a rational response to questions that cannot be answered definitively and for which all the

relevant information may not be available.

There will be a combination of announced and unannounced quizzes and the lowest scoring quiz will be dropped. There will be no

makeup quizzes.

If you miss more than 5 classes you will automatically get an F grade in the course. I expect you to be punctual and be in your seat

before the class starts. Walk-in after 5 minutes will be counted as a nonattendance and will lower your attendance grade. It is

important to note that the course structure is integrated and one missed class may result in relatively pervasive impact on

understanding of concepts.

Examinations are demanding of both your efficiency and effectiveness in addressing accounting measurement, reporting, and

analysis issues.

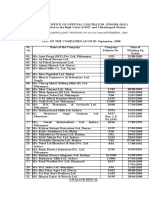

EXAMINATION DETAIL

Midterm

Exam

Final Exam

Yes/No: Yes

Combine Separate: Combine

Duration: 3 hours

Preferred Date:

Exam Specifications: Open IFRS text/ closed notes

Yes/No: Yes

Combine Separate: Combine

Duration: 3 hours

Exam Specifications: Open IFRS text/ closed notes

Lahore University of Management Sciences

COURSE OVERVIEW

WEEK/

TOPICS

LECTURE/

MODULE

RECOMMENDED

READINGS

1-2

Framework and IAS 1

IFFRS Text

3-4

IAS 7

IFFRS Text

IAS 2

IFFRS Text

6-7

IAS 16 plus Quiz

IFFRS Text

8-9

IAS 38

IFFRS Text

10-11

IAS 36

IFFRS Text

SESSION OBJECTIVES

Describe what is meant by a conceptual framework of

accounting.

Discuss whether a conceptual framework is necessary and

what an alternative system might be.

Moreover

a) Discuss what is meant by understandability in relation to

the provision of financial information.

b) Discuss what is meant by relevance and reliability and

describe the qualities that enhance these characteristics.

c) Discuss the importance of comparability to users of

financial statements.

(CLO 1-5)

Prepare, compare and interpret statement of cash flows

(CLO 1-5)

Describe and apply the principles of inventory valuation.

(CLO 1-5)

a) Define and compute the initial measurement of a noncurrent (including self-constructed and borrowing costs)

asset.

b) Identify subsequent expenditure that may be capitalized,

distinguishing between capital and revenue items.

c) Discuss the requirements of relevant accounting

standards in relation to the revaluation of non-current

assets.

d) Account for revaluation and disposal gains and losses for

non-current assets.

(CLO 1-5)

a) Discuss the nature and accounting treatment of internally

generated and purchased intangibles.

b) Distinguish between goodwill and other intangible assets.

c) Describe the criteria for the initial recognition and

measurement of intangible assets.

d) Describe the subsequent accounting treatment, including

the principle of impairment tests in relation to goodwill.

e) Indicate why the value of purchase consideration for an

investment may be less than the value of the acquired

identifiable net assets and how the difference should be

accounted for.

f) Describe and apply the requirements of relevant

accounting standards to research and development

expenditure.

(CLO 1-5)

a) Define an impairment loss.

b) Identify the circumstances that may indicate impairments

to assets.

c) Describe what is meant by a cash generating unit.

d) State the basis on which impairment losses

Lahore University of Management Sciences

12-13

IAS 18 and 11 plus Quiz

IFFRS Text

Discuss revenue recognition issues; indicate when income

and expense recognition should occur.

(CLO 1-5)

14

15

Mid Terms

IAS 40

IFFRS Text

16

IAS 23

IFFRS Text

17

IFRS 5

IFFRS Text

18

IAS 10

IFFRS Text

19 - 20

IAS 37

IFFRS Text

IAS 24 plus Quiz

IFFRS Text

21

should be allocated, and allocate an impairment loss to the

assets of a cash generating unit.

(CLO 1-5)

a) Define a construction contract and discuss the role of

accounting concepts in the recognition of profit.

c) Describe the acceptable methods of determining the

stage (percentage) of completion of a contract.

d) Prepare financial statement extracts for construction

contracts.

a) Discuss why the treatment of investment properties

should differ from other properties.

b) Apply the requirements of relevant accounting standards

for investment property.

(CLO 1-5)

Application of principles of capitalization of financial costs

and debate on other alternatives

(CLO 1-5)

a) Discuss the importance of identifying and reporting the

results of discontinued operations.

b) Define and account for non-current assets held for sale

and discontinued operations.

c) Indicate the circumstances where separate disclosure of

material items of income and expense is required.

(CLO 1)

Events after the reporting date

i) distinguish between and account for adjusting and nonadjusting events after the reporting date

ii) Identify items requiring separate disclosure, including

their accounting treatment and required disclosures

(CLO 1-5)

a) Explain why an accounting standard on provisions is

necessary.

b) Distinguish between legal and constructive obligations.

c) State when provisions may and may not be made and

demonstrate how they should be accounted for.

d) Explain how provisions should be measured.

e) Define contingent assets and liabilities and describe their

accounting treatment.

f) Identify and account for:

i) warranties/guarantees

ii) onerous contracts

iii) environmental and similar provisions

iv) Provisions for future repairs or refurbishments.

(CLO 1-5)

Indicate the effect that the related party relationship may

have on the separate and the consolidated financial

Lahore University of Management Sciences

22

IAS 32, IFRS 9

IFFRS Text

23

IAS 41

IFFRS Text

24

IAS 34

IFFRS Text

25-26

Consolidation (IFRS

3,10,11,12) plus Quiz

Handouts will be provided

27 - 28

Advance Areas (IAS

12,17,19,21)

IFFRS Text

statements.

(CLO 1-5)

a) Explain the need for an accounting standard on financial

instruments.

b) Define financial instruments in terms of financial assets

and financial liabilities.

c) Indicate for the following categories of financial

instruments how they should be measured and how any

gains and losses from subsequent measurement should be

treated in the financial statements:

i) amortized cost

ii) fair value ( including option to classify equity instruments

through other comprehensive income)

d) Distinguish between debt and equity capital.

e) Apply the requirements of relevant accounting standards

to the issue and finance costs of:

i) equity

ii) redeemable preference shares and debt instruments with

no conversion rights (principle of amortized cost)

iii) convertible debt

(CLO 1-5)

Initial recognition, measurement and disposal of agricultural

assets and their reporting

(CLO 1)

The understanding of the need of interim financial

statements and its specific implementation issues

(CLO 1)

a) Describe the concept of a group as a single economic

unit.

b) Explain and apply the definition of a subsidiary within

relevant accounting standards.

c) Identify and outline using accounting standards and other

applicable regulation the circumstances in which a group is

required to prepare consolidated financial statements.

d) Describe the circumstances when a group may claim

exemption from the preparation of consolidated financial

statements. .

e) Explain why directors may not wish to consolidate a

subsidiary and outline using accounting standards and other

applicable regulation the circumstances where this is

permitted.

f) Explain the need for using coterminous year

ends and uniform accounting polices when preparing

consolidated financial statements.

g) Explain why it is necessary to eliminate intragroup

transactions.

(CLO 1-5)

Basic concepts of these topics will be discussed to expedite

the learning curve when these topics are to be read at

advance stage.

(CLO 4)

Lahore University of Management Sciences

TEXTBOOK(S)/SUPPLEMENTARY READINGS

PWC Manual of Accounting; Delloite E Learning

You might also like

- Calendar 2020 - 2021 - 2-2Document1 pageCalendar 2020 - 2021 - 2-2muhammadmusakhanNo ratings yet

- Calendar 2020 - 2021 - 1-1Document1 pageCalendar 2020 - 2021 - 1-1muhammadmusakhanNo ratings yet

- STP RSTPDocument21 pagesSTP RSTPmuhammadmusakhanNo ratings yet

- Spanning Tree Protocols 1108Document76 pagesSpanning Tree Protocols 1108muhammadmusakhanNo ratings yet

- OSPF Paper 1 PDFDocument4 pagesOSPF Paper 1 PDFmuhammadmusakhanNo ratings yet

- Paper ProjectDocument37 pagesPaper Projectakhtar khanNo ratings yet

- 2014 Quiz1 With SolutionDocument1 page2014 Quiz1 With SolutionmuhammadmusakhanNo ratings yet

- Spanning Tree MSTDocument6 pagesSpanning Tree MSTmuhammadmusakhanNo ratings yet

- Turkish Airlines November Flights From-To Saudi ArabiaDocument1 pageTurkish Airlines November Flights From-To Saudi ArabiamuhammadmusakhanNo ratings yet

- Paper ProjectDocument37 pagesPaper Projectakhtar khanNo ratings yet

- Spanning TreeDocument6 pagesSpanning TreemuhammadmusakhanNo ratings yet

- OSPF Paper 1 PDFDocument4 pagesOSPF Paper 1 PDFmuhammadmusakhanNo ratings yet

- PD Analysis by NattrassDocument14 pagesPD Analysis by NattrassmuhammadmusakhanNo ratings yet

- OSPF Paper 1 PDFDocument4 pagesOSPF Paper 1 PDFmuhammadmusakhanNo ratings yet

- Cisco Live OSPF LessonsDocument72 pagesCisco Live OSPF LessonsmuhammadmusakhanNo ratings yet

- PEO Power Systems AnalysisDocument1 pagePEO Power Systems AnalysismuhammadmusakhanNo ratings yet

- Extensive Reviews of OSPF and EIGRP Routing Protocols Based On Route Summarization and Route RedistributionDocument4 pagesExtensive Reviews of OSPF and EIGRP Routing Protocols Based On Route Summarization and Route RedistributionLee HeaverNo ratings yet

- MATLAB Tutorial PDFDocument101 pagesMATLAB Tutorial PDFmuhammadmusakhanNo ratings yet

- Power SystemsDocument1 pagePower SystemsmuhammadmusakhanNo ratings yet

- ESP - Grass ECE 665Document8 pagesESP - Grass ECE 665muhammadmusakhanNo ratings yet

- Stress Controlled High VoltageDocument84 pagesStress Controlled High Voltagecnmengineering100% (1)

- MATLAB Tutorial PDFDocument101 pagesMATLAB Tutorial PDFmuhammadmusakhanNo ratings yet

- 1171 Math 647Document16 pages1171 Math 647muhammadmusakhanNo ratings yet

- 10Document2 pages10muhammadmusakhanNo ratings yet

- Post-Text PDFDocument33 pagesPost-Text PDFscribdvindNo ratings yet

- Course Outline Electrical EngineeringDocument1 pageCourse Outline Electrical EngineeringmuhammadmusakhanNo ratings yet

- Grade Iv-Science & Health Grade Iv - Science & Health: How Self Pollination Differs From Cross PollinationDocument27 pagesGrade Iv-Science & Health Grade Iv - Science & Health: How Self Pollination Differs From Cross PollinationmuhammadmusakhanNo ratings yet

- Course Outline Electrical EngineeringDocument1 pageCourse Outline Electrical EngineeringmuhammadmusakhanNo ratings yet

- Lecture Notes 1Document25 pagesLecture Notes 1muhammadmusakhanNo ratings yet

- Ee Graduate HandbookDocument50 pagesEe Graduate HandbookmuhammadmusakhanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TransistorDocument1 pageTransistorXhaNo ratings yet

- Amana PLE8317W2 Service ManualDocument113 pagesAmana PLE8317W2 Service ManualSchneksNo ratings yet

- Investigatory Project Pesticide From RadishDocument4 pagesInvestigatory Project Pesticide From Radishmax314100% (1)

- Irctc Tour May 2023Document6 pagesIrctc Tour May 2023Mysa ChakrapaniNo ratings yet

- Report Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIDocument26 pagesReport Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIHafizh ZuhdaNo ratings yet

- Tygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingDocument4 pagesTygon S3 E-3603: The Only Choice For Phthalate-Free Flexible TubingAluizioNo ratings yet

- Tatoo Java Themes PDFDocument5 pagesTatoo Java Themes PDFMk DirNo ratings yet

- PW CDocument4 pagesPW CAnonymous DduElf20ONo ratings yet

- Cianura Pentru Un Suras de Rodica OjogDocument1 pageCianura Pentru Un Suras de Rodica OjogMaier MariaNo ratings yet

- 5 Dec2021-AWS Command Line Interface - User GuideDocument215 pages5 Dec2021-AWS Command Line Interface - User GuideshikhaxohebkhanNo ratings yet

- April 2017 Jacksonville ReviewDocument40 pagesApril 2017 Jacksonville ReviewThe Jacksonville ReviewNo ratings yet

- Feasibility StudyDocument47 pagesFeasibility StudyCyril Fragata100% (1)

- TLE8 Q4 Week 8 As Food ProcessingDocument4 pagesTLE8 Q4 Week 8 As Food ProcessingROSELLE CASELANo ratings yet

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Document4 pagesStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20No ratings yet

- Spsi RDocument2 pagesSpsi RBrandy ANo ratings yet

- Cisco CMTS Feature GuideDocument756 pagesCisco CMTS Feature GuideEzequiel Mariano DaoudNo ratings yet

- GIS Arrester PDFDocument0 pagesGIS Arrester PDFMrC03No ratings yet

- Lesson 2 Mathematics Curriculum in The Intermediate GradesDocument15 pagesLesson 2 Mathematics Curriculum in The Intermediate GradesRose Angel Manaog100% (1)

- EnerSys Global Leader in Industrial BatteriesDocument32 pagesEnerSys Global Leader in Industrial BatteriesAshredNo ratings yet

- 2007 Bomet District Paper 2Document16 pages2007 Bomet District Paper 2Ednah WambuiNo ratings yet

- BMS Technical ManualDocument266 pagesBMS Technical Manualiago manziNo ratings yet

- General Separator 1636422026Document55 pagesGeneral Separator 1636422026mohamed abdelazizNo ratings yet

- BoQ East Park Apartment Buaran For ContractorDocument36 pagesBoQ East Park Apartment Buaran For ContractorDhiangga JauharyNo ratings yet

- Chapter 2Document22 pagesChapter 2Okorie Chinedu PNo ratings yet

- Self Team Assessment Form - Revised 5-2-20Document6 pagesSelf Team Assessment Form - Revised 5-2-20api-630312626No ratings yet

- Failure Analysis Case Study PDFDocument2 pagesFailure Analysis Case Study PDFScott50% (2)

- Guidelines Tax Related DeclarationsDocument16 pagesGuidelines Tax Related DeclarationsRaghul MuthuNo ratings yet

- Operation Manual: Auto Lensmeter Plm-8000Document39 pagesOperation Manual: Auto Lensmeter Plm-8000Wilson CepedaNo ratings yet

- Living Nonliving DeadDocument11 pagesLiving Nonliving DeadArun AcharyaNo ratings yet

- Overview of Quality Gurus Deming, Juran, Crosby, Imai, Feigenbaum & Their ContributionsDocument11 pagesOverview of Quality Gurus Deming, Juran, Crosby, Imai, Feigenbaum & Their ContributionsVenkatesh RadhakrishnanNo ratings yet