Professional Documents

Culture Documents

CFPB Letter To Google Re Student Debt Relief

Uploaded by

Barmak NassirianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFPB Letter To Google Re Student Debt Relief

Uploaded by

Barmak NassirianCopyright:

Available Formats

1700 G Street, N.W.

, Washington, DC 20552

June 22, 2015

Susan Molinari

Vice President, Americas Public Policy and Government Relations

25 Massachusetts Ave NW, Suite 900

Washington, DC 20001

Dear Ms. Molinari:

I am writing to alert Google that student debt relief scammers may be targeting student loan

borrowers through the companys search products.

There are over 40 million Americans who collectively owe over $1.2 trillion in student debt, with a

substantial portion in distress. The Consumer Financial Protection Bureau estimates that there are

more than 8 million Americans in default on a federal or private student loan. While federal

student loan borrowers are able to avoid or get out of default through various income-driven

repayment and rehabilitation plans, we are concerned that student loan servicers have left many

borrowers in the dark about these options.

The CFPB has seen an increase in the number of companies and websites requiring large upfront

fees to help borrowers enroll in a plan that can be done for free. While we have warned consumers

about these scams, we are concerned that unscrupulous companies may be using aggressive

advertising through search products to lure distressed borrowers.

We understand that Google has policies in place to protect consumers against misrepresentations

in advertisements. 1 We would like to alert you to the fact that there may be companies within this

sector who do not meet these requirements.

Federal and state law enforcement agencies have taken a number of actions to stop the illegal and

harmful practices of these companies. For example, the CFPB and the Florida Attorney General

worked to shut down College Education Services, which operated websites such as

For example, policies restrict advertisements that make misrepresentation of self, product, or service.

https://support.google.com/adwordspolicy/answer/6020955

consumerfinance.gov

CollegeDefaultedStudentLoan.com and HelpStudentLoanDefault.com. 2 The Illinois Attorney

General has additionally taken a number of actions, including suing Broadsword Student

Advantage, the operator of GetForgiven.org.

The CFPBs analysis of Google Trends data suggests that struggling borrowers are indeed

searching for help using keywords such as student loan default, student loan forgiveness, and

Obama student loan relief. This bears a close resemblance to the foreclosure crisis, where

borrowers were given conflicting information about their options and found scammers who made

false promises on loan modifications in exchange for upfront fees. In 2011, through its cooperation

with the Office of the Special Inspector General for the Troubled Asset Relief Program, Google

helped to stop these scammers from preying on homeowners in trouble. 3

We urge you to work closely with federal and state agencies to ensure your search products are not

being used by individuals and companies seeking to prey on the most vulnerable student loan

borrowers by implying an affiliation with the federal government. By more closely monitoring

advertising on key search terms and helping to drive traffic toward unbiased sources of

information, your users will gain greater value from your search products and scammers will be

less likely to flourish.

If you wish to discuss this issue in more detail, please do not hesitate to contact Aryn Bussey at

students@cfpb.gov.

Sincerely,

Rohit Chopra

Assistant Director & Student Loan Ombudsman

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau. CFPB Takes Action to End Student Debt Relief Scams.

http://www.consumerfinance.gov/newsroom/cfpb-takes-action-to-end-student-debt-relief-scams/

3 Office of the Special Inspector General for the Troubled Asset Relief Program: SIGTARP Shuts Down 85

Online Mortgage Modification Scams Advertised on Google.

http://www.sigtarp.gov/Press%20Releases/Google_Web_Ad_Press_Release.pdf

2

consumerfinance.gov

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Stock Market Forecasting Through Charting: An IntroductionDocument18 pagesStock Market Forecasting Through Charting: An IntroductionOm Prakash100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Procure To PayDocument2 pagesProcure To PaySanjeewa PrasadNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

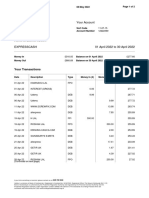

- 2022 April StatementDocument2 pages2022 April StatementAvishekNo ratings yet

- Affidavit BIRDocument1 pageAffidavit BIREnp Gus AgostoNo ratings yet

- CA Certificate For VisaDocument4 pagesCA Certificate For VisaVamshi Krishna Reddy Pathi0% (1)

- Simple & Compound Interest With SolutionsDocument26 pagesSimple & Compound Interest With Solutionssecret studentNo ratings yet

- Entrepreneurship and Small Business Management: Hamza SheikhDocument24 pagesEntrepreneurship and Small Business Management: Hamza SheikhSahibzada Abu Bakar GhayyurNo ratings yet

- Financial Distress: Mcgraw-Hill/Irwin Corporate Finance, 7/EDocument26 pagesFinancial Distress: Mcgraw-Hill/Irwin Corporate Finance, 7/EMutiara Inas SariNo ratings yet

- 5rd Sessiom - Audit of LeaseDocument21 pages5rd Sessiom - Audit of LeaseRyan Victor Morales100% (1)

- Project Financials with Prospective AnalysisDocument34 pagesProject Financials with Prospective AnalysisAzhar SeptariNo ratings yet

- Pell Bonus MemoDocument3 pagesPell Bonus MemoBarmak NassirianNo ratings yet

- Rokita Kline Scott FERPADocument42 pagesRokita Kline Scott FERPABarmak NassirianNo ratings yet

- Campus Litigation Privacy Act SummaryDocument1 pageCampus Litigation Privacy Act SummaryBarmak NassirianNo ratings yet

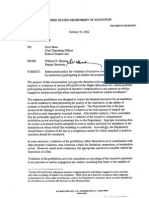

- Hansen Memo On EnforcementDocument2 pagesHansen Memo On EnforcementBarmak NassirianNo ratings yet

- Mitchell Memo To Jim RuncieDocument2 pagesMitchell Memo To Jim RuncieBarmak NassirianNo ratings yet

- Campus Litigation Privacy ActDocument4 pagesCampus Litigation Privacy ActBarmak NassirianNo ratings yet

- OMB Labor-H TablesDocument10 pagesOMB Labor-H TablesBarmak NassirianNo ratings yet

- AASCU Statement On Student Bill of RightsDocument1 pageAASCU Statement On Student Bill of RightsBarmak NassirianNo ratings yet

- Kaine Et Al CTE TQP Bill FinalDocument16 pagesKaine Et Al CTE TQP Bill FinalBarmak NassirianNo ratings yet

- HR 970Document6 pagesHR 970Barmak NassirianNo ratings yet

- Corinthian Bankruptcy FilingDocument19 pagesCorinthian Bankruptcy FilingBarmak NassirianNo ratings yet

- As Delisle Cover Letter For State Plans To Ensure Equitable Access To ExDocument3 pagesAs Delisle Cover Letter For State Plans To Ensure Equitable Access To ExBarmak NassirianNo ratings yet

- DRAFT - Community OMB Comments On TP Cost Estimates 1-2-15Document3 pagesDRAFT - Community OMB Comments On TP Cost Estimates 1-2-15Barmak NassirianNo ratings yet

- Letter From Massachusetts AG Healey To Sec. Duncan Feb4 2015Document3 pagesLetter From Massachusetts AG Healey To Sec. Duncan Feb4 2015Barmak NassirianNo ratings yet

- ED GE Notice of Information CollectionDocument3 pagesED GE Notice of Information CollectionBarmak NassirianNo ratings yet

- Labor-H Approps Report Language Re Marketing BanDocument2 pagesLabor-H Approps Report Language Re Marketing BanBarmak NassirianNo ratings yet

- Equitable Access FAQs FinalDocument28 pagesEquitable Access FAQs FinalBarmak NassirianNo ratings yet

- Notice Pay As You Earn Reg NegDocument9 pagesNotice Pay As You Earn Reg NegBarmak NassirianNo ratings yet

- Senator Harkin AASCU LetterDocument1 pageSenator Harkin AASCU LetterBarmak NassirianNo ratings yet

- Quick Review of New Markey-Hatch FERPA AmendmentDocument2 pagesQuick Review of New Markey-Hatch FERPA AmendmentBarmak NassirianNo ratings yet

- Relief For Underwater Student Borrowers One PagerDocument1 pageRelief For Underwater Student Borrowers One PagerBarmak NassirianNo ratings yet

- CoalitionCommentLetteronGEReg May27 2014 SubmittedDocument3 pagesCoalitionCommentLetteronGEReg May27 2014 SubmittedBarmak NassirianNo ratings yet

- Library, HigherEd Net Neutrality Comments July 2014 - FinalDocument42 pagesLibrary, HigherEd Net Neutrality Comments July 2014 - FinalBarmak NassirianNo ratings yet

- DoD Approps Report LanguageDocument2 pagesDoD Approps Report LanguageBarmak NassirianNo ratings yet

- DoD Approps Marketing Ban Leg. LanguageDocument6 pagesDoD Approps Marketing Ban Leg. LanguageBarmak NassirianNo ratings yet

- WI PIRS Cover and LetterDocument5 pagesWI PIRS Cover and LetterBarmak NassirianNo ratings yet

- Higher Ed / Libraries Net Neutrality Press Release and PrinciplesDocument10 pagesHigher Ed / Libraries Net Neutrality Press Release and PrinciplesBarmak NassirianNo ratings yet

- UC President Napolitano To Duncan Et AlDocument3 pagesUC President Napolitano To Duncan Et AlBarmak Nassirian100% (1)

- HEAA Discussion Draft Language 6.25.14Document785 pagesHEAA Discussion Draft Language 6.25.14Barmak NassirianNo ratings yet

- Accounting Voucher 60Document1 pageAccounting Voucher 60Pavan BhandareNo ratings yet

- Risk AnalysisDocument7 pagesRisk AnalysisAlin Veronika50% (2)

- Exam 3 Review and Sample ProblemsDocument14 pagesExam 3 Review and Sample ProblemsCindy MaNo ratings yet

- 4252 SRO 351 Finance 06 - December - 2022 (18789 18790)Document2 pages4252 SRO 351 Finance 06 - December - 2022 (18789 18790)Satyajit NathNo ratings yet

- Credit RiskDocument30 pagesCredit RiskVineeta HNo ratings yet

- CFAS Module 8Document42 pagesCFAS Module 8Eu NiceNo ratings yet

- Applying the Importance Performance Matrix to analyze Singapore's financial clusterDocument29 pagesApplying the Importance Performance Matrix to analyze Singapore's financial clusterAlexNo ratings yet

- Final Project MbaDocument91 pagesFinal Project MbaYadnyesh PatilNo ratings yet

- Gerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonDocument6 pagesGerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonGerry DayananNo ratings yet

- Mansa-X KES Fact Sheet Q1 2023Document1 pageMansa-X KES Fact Sheet Q1 2023KevinNo ratings yet

- PT Edelweiss MelvinoDocument69 pagesPT Edelweiss MelvinoTrainingDigital Marketing BandungNo ratings yet

- Chen 2020Document20 pagesChen 2020KANA BITTAQIYYANo ratings yet

- What Is IrdaDocument14 pagesWhat Is IrdaSandeep GalipelliNo ratings yet

- Multi Sports FacilityDocument7 pagesMulti Sports FacilityDivyanshu ShekharNo ratings yet

- Long Quiz Fund. of AcctngDocument5 pagesLong Quiz Fund. of AcctngLorraine DomantayNo ratings yet

- Fundamental Analysis of Public Sector Banks in India (SBI)Document81 pagesFundamental Analysis of Public Sector Banks in India (SBI)Meraj Ansari60% (5)

- Time Value of Money CalculatorDocument22 pagesTime Value of Money CalculatorSuganyaNo ratings yet

- Accounting Past PaperDocument10 pagesAccounting Past PaperNoha SobhyNo ratings yet

- Flirting With Risk: Get Custom PaperDocument2 pagesFlirting With Risk: Get Custom PaperAkash PandeyNo ratings yet

- List of Bonded Accountable Public OfficersDocument1 pageList of Bonded Accountable Public Officersuixisminee14No ratings yet