Professional Documents

Culture Documents

Analyst Presentation (Company Update)

Uploaded by

Shyam Sunder0 ratings0% found this document useful (0 votes)

10 views17 pagesContent Aggregation content Creation - the core competence of content owners ie. Publishers The last mile is Content Delivery to the customer (e-books and p-books), on any media - book, computer, tablet or mobile publishers strive to increase revenues by maximising the reach of their content in the required time At the required price To Students to Readers All over the world, physically or digitally!

Original Description:

Original Title

Analyst Presentation [Company Update]

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentContent Aggregation content Creation - the core competence of content owners ie. Publishers The last mile is Content Delivery to the customer (e-books and p-books), on any media - book, computer, tablet or mobile publishers strive to increase revenues by maximising the reach of their content in the required time At the required price To Students to Readers All over the world, physically or digitally!

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views17 pagesAnalyst Presentation (Company Update)

Uploaded by

Shyam SunderContent Aggregation content Creation - the core competence of content owners ie. Publishers The last mile is Content Delivery to the customer (e-books and p-books), on any media - book, computer, tablet or mobile publishers strive to increase revenues by maximising the reach of their content in the required time At the required price To Students to Readers All over the world, physically or digitally!

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

Repro India - Strategic Results : FY 2014-15

27 May 2015

www.reproindialtd.com

Strategic Results : Annual 2014-15

The Annual Strategic Direction

1.

Content Aggregation

2.

New Initiatives : Rapples, enhancing digital education

3.

New Initiatives : The exciting e-tailing opportunity

4.

Exports : Strategy of Large Volume Fulfillment and Cross-selling

5.

Domestic Market : Strategy of Value Addition and Margin Growth

Strategic Results : Annual 2014-15

1. Content Aggregation

Content Creation

the core competence of content owners ie. Publishers

The last mile is Content Delivery to the customer ie. students or readers (e-books and p-books),

on any media book, computer, tablet or mobile

Publishers strive to increase revenues by maximising the reach of their content

In the required time

At the required price

To Students

to Readers

All over the world, physically or digitally!

Strategic Results : Annual 2014-15

1. Content Aggregation (cont.)

Repro: Bridging the in-between miles between the publisher and his reader

From Content Designing to Digital Warehousing..

From Content Adaptation to Multimedia Enhancements

From producing millions of books for students

To Just One Book on Demand for the e-Commerce /e-Tailers customer

To pioneer Digital and Bagless Educational opportunity

(multimedia textbooks on tablets)

To participate and enhance the burgeoning e-retail markets India and Global

Leveraging Repros strong relationships with publishers over last 2 decades to become

the largest aggregator of content, which gives Repro significant competitive advantage

Strategic Results : Annual 2014-15

1. Content Aggregation (cont.)

Repro : The In-Between Miles

Strategic Results : Annual 2014-15

1. Content Aggregation (cont.)

Repro : Offering multiple opportunities for revenue multiplication

to the Publishers with the same content

Strategic Results : Annual 2014-15

2. New Initiatives : Rapples, enhancing digital education

Rapples : changing the course of educational experience

and outcome in India

State of Digital Education : A Digital revolution is

underway and this is changing the way Education is

imparted

Customised Educational solutions are possible

Increased penetration of Mobile devices in

schools

Digital Content and Personalised Learning is

increasing

The Future Classroom : Blended Technology to

augment Teacher capability

Strategic Results : Annual 2014-15

2. New Initiatives : Rapples, enhancing digital education (cont.)

Repro has created a customised solution RAPPLES : The 360 degree multi-sensory

learning experience with pre-loaded textbooks delivered on tablet

Repro enables Publishers to create, store digitally, produce and reach their books to

millions of children

For students, the solution promotes bagless learning with the benefits of

multimedia and interactive learning

Repro has already invested Rs. 22 crores over the last 2 years in Rapples, all of which

has been written off as expenses.

Strategic Results : Annual 2014-15

3. New Initiatives : The exciting e-tailing opportunity

e-Fulfillment Services: The Critical component

Strategic Results : Annual 2014-15

3. New Initiatives : The exciting e-tailing opportunity (cont.)

e-Fulfillment : E-Tail The carts.deals etc.

Repro has tie-ups with international and

Indian e-tailers enabling the listing of

publishers titles on the e-tail site, giving the

customers access to global titles with

significantly reduced lead times and price

Repro enables publishers to increase their

revenues and reach their e-tail customer

by providing a complete solution thereby

improving efficiencies of the supply chain

and reducing costs

The solution includes offering the publisher

a state of the art technology content

repository, to printing on Demand even a

single book for the end customer to

disbursing the royalties back to the

publisher

Strategic Results : Annual 2014-15

4. Exports : Strategy of Large Volume Fulfillment and Cross-selling

Repro has strong relationships with the key

publishers in over 22 countries and a first

mover advantage

Deep understanding of the business

environment, the model and the deliverables

Repro complements the Publishers by

planning and mass producing the right

product, at the right price, in the required

time reaching it anywhere in Africa

With the experience and the relationships,

Repro opens additional revenue

opportunities to Indian and African publishers

By offering them access to each other markets

thus capitalising on their respective IPRs

Strategic Results : Annual 2014-15

5. Domestic Market : Strategy of Value Addition and Margin Growth

Providing integrated services and end to end

solution to content owners like educational

publishers in India and globally

Offering full services has improved the margins

that Repro realises from the domestic market

Repro complements the Publishers by planning

and mass producing the right product, at the right

price, in the required time reaching it anywhere

in India

Repro has customised offerings based on Clients

requirements and also the experience and

expertise to fulfill demand effectively whether it is

for

1 million books (web based production)

Or 1 book (POD based production)

Strategic Results : Annual 2014-15

The Financial Highlights

Year 14-15 over Year 13-14 - Consolidated

6% reduction in Revenue : 421.09 crs 395.65crs

Exports reduced from 197 crores to 114 crores

Exports to West Africa reduced by 50% due to Ebola, Elections and

Import duty scare

26% Growth in Domestic (223 crores to 282 crores)

PBT reduction from 34.31crs 25.67crs

PBT before Rapples & E-TAIL expense : 44.43crs 40.17crs

Additional expense of 4.38 crores in New Initiatives (14.50 crores vs 10.12 crores)

Reduction in margins due to reduced exports

Exports: Domestic Ratio = 29%:71% (CY) vs. 47%:53% (PY)

Reduction in margins partially offset by growth in EBIDTA margins for domestic

Domestic EBIDTA improved from 9.14% to14.2%

Export EBIDTA reduced from 31.2% to 17.2% (Reduction due to more government

tenders, and allocation of fixed costs on lower volumes)

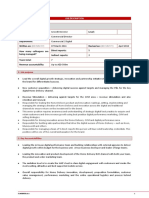

2014 15 Key Business Parameters

Debtors:

SEGMENT

SALES

DEBTORS

Domestic

Print

Export

Digital

Total

260.31

95.00

NO OF DAYS No of days

after ECGC

133

133

113.61

21.15

395.07

72.59

4.32

171.91

233

75

158

120

75

126

Opening Order Book:

SEGMENT

ORDER BOOK 1.4.2015

DOMESTIC

EXPORT

TOTAL

33.52

26.22

59.74

ORDER BOOK

1.4.2014

33.18

1.24

34.42

Capex:

Rs 19.3 crores (12.29 crores- Maintenance Capex and Balance New Equipment)

Thank You

You might also like

- Reaping the Benefits of Industry 4.0 through Skills Development in High-Growth Industries in Southeast Asia: Insights from Cambodia, Indonesia, the Philippines, and Viet NamFrom EverandReaping the Benefits of Industry 4.0 through Skills Development in High-Growth Industries in Southeast Asia: Insights from Cambodia, Indonesia, the Philippines, and Viet NamNo ratings yet

- Presentation Made at Analyst Meet On May 30 2012Document20 pagesPresentation Made at Analyst Meet On May 30 2012Repro India LimitedNo ratings yet

- Inzpira Case StudyDocument5 pagesInzpira Case Studyalikenth8206No ratings yet

- P MDC MCuvcnq A1687123036495Document8 pagesP MDC MCuvcnq A1687123036495Jatin KhatriNo ratings yet

- CV1 Kushal Agarwal 62110014 PDFDocument1 pageCV1 Kushal Agarwal 62110014 PDFBhawika ChhawchhariaNo ratings yet

- CV PDFDocument2 pagesCV PDFRishabh MagoNo ratings yet

- Rocking The Daisies - 2011 & 2012 - Case StudyDocument6 pagesRocking The Daisies - 2011 & 2012 - Case StudyPooja ShettyNo ratings yet

- IIT Kharagpur '21 - CFA L1 Product Manager: About Me Education BackgroundDocument1 pageIIT Kharagpur '21 - CFA L1 Product Manager: About Me Education Backgroundnishant.mishraNo ratings yet

- Aat PDFDocument47 pagesAat PDFPankajRoeNo ratings yet

- L.E.K. Consulting Application InsightsDocument2 pagesL.E.K. Consulting Application Insightsrishav098No ratings yet

- CV - 2022-10-11T183806.377Document1 pageCV - 2022-10-11T183806.377Ayush MagowNo ratings yet

- LM Publications Catalogue Jan-June 2015 4Document41 pagesLM Publications Catalogue Jan-June 2015 4Piyal HossainNo ratings yet

- Controlling 1Document11 pagesControlling 1IGNACIO, Nemiel (3B)No ratings yet

- Ingram Micro Inc. HCL Technologies Ltd. CMC Ltd. Compuage Infocom. JK Software SolutionDocument9 pagesIngram Micro Inc. HCL Technologies Ltd. CMC Ltd. Compuage Infocom. JK Software SolutionsunnyNo ratings yet

- Wipro's Global Effectiveness Case StudyDocument3 pagesWipro's Global Effectiveness Case StudyashishbatraNo ratings yet

- A A Scoring SheetDocument1 pageA A Scoring SheetAmbITionNo ratings yet

- CV PDFDocument1 pageCV PDFAnyone SomeoneNo ratings yet

- MKT 6080 Final Project Milestone 2 WorksheetDocument7 pagesMKT 6080 Final Project Milestone 2 WorksheetafamefunaonyimaduNo ratings yet

- P&GDocument11 pagesP&GSabir RahimNo ratings yet

- CGPA 3.23/4, ISB PGPM Marketing & Strategy, 6+ Years Banking & Fintech Analytics LeadershipDocument1 pageCGPA 3.23/4, ISB PGPM Marketing & Strategy, 6+ Years Banking & Fintech Analytics LeadershipHarmandeep singhNo ratings yet

- Upgrad Industry Project Part 1 - Competitor AnalysisDocument22 pagesUpgrad Industry Project Part 1 - Competitor AnalysisPrithvirajNo ratings yet

- Digital Marketing Award MGIDocument9 pagesDigital Marketing Award MGIazmanstarNo ratings yet

- Peer-Graded AssignmentDocument2 pagesPeer-Graded AssignmentAAA NNNNo ratings yet

- BSBSTR601 Simulation PackDocument13 pagesBSBSTR601 Simulation PackAmra Ali AliNo ratings yet

- Indian School of Business (ISB) - : Client Success Manager (Delhi NCR)Document1 pageIndian School of Business (ISB) - : Client Success Manager (Delhi NCR)Dushyant ChaturvediNo ratings yet

- Case Study - Worlducation: © 2021 RTO WorksDocument11 pagesCase Study - Worlducation: © 2021 RTO WorksNoreen GounderNo ratings yet

- DBP Assignment Brief A2 - FinalDocument6 pagesDBP Assignment Brief A2 - Finalnguyen phuongNo ratings yet

- CV1 Akhila Kambhampati 61920133Document1 pageCV1 Akhila Kambhampati 61920133Harmandeep singhNo ratings yet

- FIFA 2018 Be A King New Magnum This Is Living Naturally DifferentDocument1 pageFIFA 2018 Be A King New Magnum This Is Living Naturally DifferentHarmandeep singhNo ratings yet

- Programme Brochure CMO0312Document4 pagesProgramme Brochure CMO0312edupreneursindiaNo ratings yet

- Resume Arnold SimanjuntakDocument3 pagesResume Arnold SimanjuntakHalimah FirmansyahNo ratings yet

- Nilabh SharmaDocument3 pagesNilabh SharmaNilabh SharmaNo ratings yet

- CV2 Hardik Parekh 61920705Document1 pageCV2 Hardik Parekh 61920705Harmandeep singhNo ratings yet

- CV3 Surabhi Agarwal 61920586Document1 pageCV3 Surabhi Agarwal 61920586Harmandeep singhNo ratings yet

- Digital Agency Scope of Work TemplateDocument7 pagesDigital Agency Scope of Work TemplatepfchiaNo ratings yet

- Shiraz Hasan Marketing Manager ResumeDocument2 pagesShiraz Hasan Marketing Manager ResumeAshimaSinghNo ratings yet

- Hamza Ata: ProfileDocument2 pagesHamza Ata: ProfileXspark StudioNo ratings yet

- FDnl9b0jaw - Key Account Manager - Repro IndiaDocument2 pagesFDnl9b0jaw - Key Account Manager - Repro Indiaradhika kumarfNo ratings yet

- Anirudh Ravichandran's Impressive Career Journey and AccomplishmentsDocument1 pageAnirudh Ravichandran's Impressive Career Journey and AccomplishmentsMridul GuptaNo ratings yet

- DBP Assignment Brief A2Document7 pagesDBP Assignment Brief A2ldan240505No ratings yet

- 3.5 Years - Data Science & Analytics Consulting: Sales and Customer ManagementDocument1 page3.5 Years - Data Science & Analytics Consulting: Sales and Customer ManagementPrahlad ModiNo ratings yet

- Launch Apen DriveDocument47 pagesLaunch Apen DriveJsmBhanotNo ratings yet

- Ayush Kalra: Profile Summary WORK EXPERIENCE (Total 4.5 Years)Document2 pagesAyush Kalra: Profile Summary WORK EXPERIENCE (Total 4.5 Years)Rajeev misraNo ratings yet

- Final - DBP A2 Briefing NEWDocument3 pagesFinal - DBP A2 Briefing NEWMinh TâmNo ratings yet

- Dissertation Report On Green MarketingDocument6 pagesDissertation Report On Green MarketingFinishedCustomWritingPaperCanada100% (1)

- VMUAE - Growth DirectorDocument4 pagesVMUAE - Growth Directorsimon templarNo ratings yet

- Core CompetencyDocument5 pagesCore Competencykrishnan MishraNo ratings yet

- Universal LastDocument30 pagesUniversal LastHMAN OROMONo ratings yet

- Operation and supply chain strategiesDocument7 pagesOperation and supply chain strategieswatchbasant.bkNo ratings yet

- GCPL boosts digital investments and teams to drive growthDocument5 pagesGCPL boosts digital investments and teams to drive growthManjula RNo ratings yet

- Roxana Nastase CVDocument6 pagesRoxana Nastase CVRoxana NastaseNo ratings yet

- BCS L3 Digital Marketer IfATE V1.1 Project H OverviewDocument6 pagesBCS L3 Digital Marketer IfATE V1.1 Project H OverviewIT AssessorNo ratings yet

- Project of Rahul 2191111#1Document48 pagesProject of Rahul 2191111#1ATUL ABNo ratings yet

- Senior Marketing Expert with 9+ Years ExperienceDocument2 pagesSenior Marketing Expert with 9+ Years ExperienceThe Cultural CommitteeNo ratings yet

- CamlinDocument158 pagesCamlinTeja MulagalaNo ratings yet

- L&D JDDocument2 pagesL&D JDbuildingblocks.remedialNo ratings yet

- Director of Product, FinTechDocument3 pagesDirector of Product, FinTechAnkita RajputNo ratings yet

- Assessment Task Two Power PointDocument14 pagesAssessment Task Two Power PointRaí SilveiraNo ratings yet

- DIDI PDS Client Briefs 2021-22Document19 pagesDIDI PDS Client Briefs 2021-22Malak SalemNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SubjectivityinArtHistoryandArt CriticismDocument12 pagesSubjectivityinArtHistoryandArt CriticismMohammad SalauddinNo ratings yet

- Ecomix RevolutionDocument4 pagesEcomix RevolutionkrissNo ratings yet

- Marcos & Sumulong Highway, Rizal Applicant'S Information Sheet (Non-Academic)Document2 pagesMarcos & Sumulong Highway, Rizal Applicant'S Information Sheet (Non-Academic)dummy testerNo ratings yet

- Week 4 CasesDocument181 pagesWeek 4 CasesMary Ann AmbitaNo ratings yet

- 5E Lesson PlanDocument3 pages5E Lesson PlanSangteablacky 09100% (8)

- A Comparative Look at Jamaican Creole and Guyanese CreoleDocument18 pagesA Comparative Look at Jamaican Creole and Guyanese CreoleShivana Allen100% (3)

- KINGS OF TURKS - TURKISH ROYALTY Descent-LinesDocument8 pagesKINGS OF TURKS - TURKISH ROYALTY Descent-Linesaykutovski100% (1)

- Epitalon, An Anti-Aging Serum Proven To WorkDocument39 pagesEpitalon, An Anti-Aging Serum Proven To Workonæss100% (1)

- The Alkazi Collection of Photography Vis PDFDocument68 pagesThe Alkazi Collection of Photography Vis PDFMochamadRizkyNoorNo ratings yet

- KAMAGONGDocument2 pagesKAMAGONGjeric plumosNo ratings yet

- Rebekah Hoeger ResumeDocument1 pageRebekah Hoeger ResumerebekahhoegerNo ratings yet

- The Avengers (2012 Film)Document4 pagesThe Avengers (2012 Film)Matthew SusetioNo ratings yet

- C4 - Learning Theories and Program DesignDocument43 pagesC4 - Learning Theories and Program DesignNeach GaoilNo ratings yet

- TOTAL Income: POSSTORE JERTEH - Account For 2021 Start Date 8/1/2021 End Date 8/31/2021Document9 pagesTOTAL Income: POSSTORE JERTEH - Account For 2021 Start Date 8/1/2021 End Date 8/31/2021Alice NguNo ratings yet

- HiaceDocument1 pageHiaceburjmalabarautoNo ratings yet

- StoreFront 3.11Document162 pagesStoreFront 3.11AnonimovNo ratings yet

- Q3 Week 7 Day 2Document23 pagesQ3 Week 7 Day 2Ran MarNo ratings yet

- Grade 4 Science Quiz Bee QuestionsDocument3 pagesGrade 4 Science Quiz Bee QuestionsCecille Guillermo78% (9)

- Midterm Exam ADM3350 Summer 2022 PDFDocument7 pagesMidterm Exam ADM3350 Summer 2022 PDFHan ZhongNo ratings yet

- Tele Phone Directory 2023-24Document10 pagesTele Phone Directory 2023-24vinoth5028No ratings yet

- RPP Microteaching TaruliDocument9 pagesRPP Microteaching TaruliTaruli Sianipar 165No ratings yet

- Bracketing MethodsDocument13 pagesBracketing Methodsasd dsa100% (1)

- Bioassay Techniques For Drug Development by Atta-Ur RahmanDocument214 pagesBioassay Techniques For Drug Development by Atta-Ur RahmanEmpress_MaripossaNo ratings yet

- Practice Questionnaire For New Omani QAQC Staff - DLQ DeptDocument7 pagesPractice Questionnaire For New Omani QAQC Staff - DLQ DeptSuliman Al RuheiliNo ratings yet

- Meesho FDocument75 pagesMeesho FAyan khanNo ratings yet

- B767 WikipediaDocument18 pagesB767 WikipediaxXxJaspiexXx100% (1)

- Prof 7 - Capital Market SyllabusDocument10 pagesProf 7 - Capital Market SyllabusGo Ivanizerrckc100% (1)

- Extra Grammar Exercises (Unit 6, Page 64) : Top Notch 3, Third EditionDocument4 pagesExtra Grammar Exercises (Unit 6, Page 64) : Top Notch 3, Third EditionA2020No ratings yet

- Real Vs Nominal Values (Blank)Document4 pagesReal Vs Nominal Values (Blank)Prineet AnandNo ratings yet

- Instafin LogbookDocument4 pagesInstafin LogbookAnonymous gV9BmXXHNo ratings yet