Professional Documents

Culture Documents

Differences between private and public companies

Uploaded by

Ubai M-pireOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Differences between private and public companies

Uploaded by

Ubai M-pireCopyright:

Available Formats

Difference between private and public company

structure under the Corporations Act

Governance Foundations

(1) Types of companies

Public vs private

Type of company

Differences in regulation

Regulated by

Percentage of registrations

- Limited by shares

Sub-classified as small or large

ASIC

- Unlimited with share capital

Small =

Can be any size; some are very

large

- consolidated gross operating

revenue < $25m - consolidated

gross asset value < $12.5m

The majority of registered

companies are proprietary. As at

March 2012, ASIC reports that

there were 1,871,004 proprietary

companies, representing 98.87% of

all registered companies.

Unlisted

The majority of registered

companies are proprietary. As at

March 2012, ASIC reports that

there were 1,871,004 proprietary

companies, representing 98.87% of

all registered companies.

Proprietary = private

Must have at least one member

and up to a maximum of 50 nonemployee shareholders

By definition UNLISTED, as they

are not allowed to raise capital that

would require lodging a prospectus

or offer information statement

Compliance requirements less

stringent than for public companies

Can hold shares in listed

companies

- fewer than 50 f/t employees

Large = revenue, assets and

employees greater than small

companies

Can offer shares to existing

shareholders of the company or

employees of the company or a

subsidiary of the company

Proprietary companies must have

at least one director and need not

have a company secretary

Public = Ltd

Minimum of one member, but there

is no maximum

- Limited by shares, eg commercial

businesses

Can be LISTED or UNLISTED

- Limited by guarantee e.g.

charities, not-for-profits, clubs

The use of Ltd does not distinguish

Limited by both shares and

between them

guarantee, eg private schools,

Can own Pty Ltd companies

friendly societies

Public Unlisted and Listed

- Unlimited, eg professional

Companies can raise capital by

practices

offering a prospectus reporting

- No liability (NL) only for mining

to ASIC

companies

A public company must have at

least three directors and at least

one company secretary.

ASIC

APRA, if an authorised deposittaking institution, life insurance or

general insurance company

Listed

ASIC

ASX

APRA, if an authorised deposittaking institution, life insurance or

general insurance company

Difference between private and public company

structure under the Corporations Act

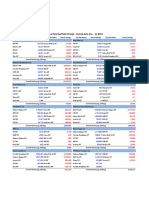

(2) Differences in disclosure requirements

Small proprietary companies

Large proprietary companies

Public companies

Listed public companies

Audit and financial reports

Not required to be audited or file

financial statements or a directors

report. Members holding five

per cent or more of the votes, or

ASIC, can require a financial and

directors report for a financial year

(and direct them to be audited) and

send them to all shareholders

Required to have an external audit

and will have to lodge financial

statements and a directors report

Required to have an external audit

and will have to lodge financial

statements and a directors report

Required to have an external audit

and will have to lodge financial

statements, a directors report and

a remuneration report

Reporting to members

No requirement to report to

members

Required to lodge accounts with

Required to provide reports to

Required to provide reports to

members four months after the end members 21 days prior to the AGM ASIC three months after the end of

of the companys financial year

or four months after the end of the the companys financial year

companys financial year, whichever

is earlier

Holding an AGM

No obligation to hold an AGM

unless the constitution requires it

No obligation to hold an AGM

unless the constitution requires it

Must hold an AGM once a year no

later than five months after the end

of the companys financial year

Must hold an AGM once a year no

later than five months after the end

of the companys financial year. A

minimum of 28 days notice of the

AGM must be provided.

Disclosure of constitution

No requirement to lodge a copy of

the constitution

No requirement to lodge a copy of

the constitution

Required to lodge a copy of the

special resolution adopting,

modifying or repealing its

constitution, and if adopted, a copy

of the constitution, and if modified,

a copy of that modification.

Required to lodge a copy of the

special resolution adopting,

modifying or repealing its

constitution, and if adopted, a copy

of the constitution, and if modified,

a copy of that modification.

Can vote

Must not be present while the

matter is being considered at the

meeting or vote on the matter,

unless the other directors are

satisfied that the interest should not

disqualify the director from voting.

Must not be present while the

matter is being considered at the

meeting or vote on the matter,

unless the other directors are

satisfied that the interest should not

disqualify the director from voting.

Can vote

Directors voting on matters

where there is a personal material

interest being considered at a

directors meeting

Difference between private and public company

structure under the Corporations Act

Removal of directors

Liability of directors for insolvent

trading

Cannot be removed by other

Cannot be removed by other

directors but are subject to removal directors but are subject to removal

by the members.

by the members.

Face personal liability if the

company should carry on trading

while insolvent if they cannot

establish adequate defences

Face personal liability if the

company should carry on trading

while insolvent if they cannot

establish adequate defences

Face personal liability if the

company should carry on trading

while insolvent if they cannot

establish adequate defences

Face personal liability if the

company should carry on trading

while insolvent if they cannot

establish adequate defences

Directors to notify market

operator of interests

Required to notify their interest in

the securities of the company of

which they are a director and any

changes to those interests.

Questions to the auditor

Members are entitled to submit

questions to the auditor prior to the

AGM and the auditor is obliged to

attend or be represented at the AGM.

You might also like

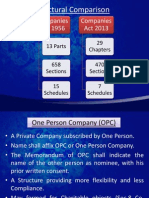

- Key Changes to Indian Company LawDocument52 pagesKey Changes to Indian Company LawSudhaker PandeyNo ratings yet

- Types of Business Entities in India and Requirements for a Private Limited CompanyDocument5 pagesTypes of Business Entities in India and Requirements for a Private Limited CompanyAnshul GuptaNo ratings yet

- Members and Shareholders: A Quick GuideDocument12 pagesMembers and Shareholders: A Quick GuideChristieNo ratings yet

- Far 250Document18 pagesFar 250Aisyah SaaraniNo ratings yet

- Company AccountsDocument24 pagesCompany Accountsdeo omachNo ratings yet

- Legal Requirement For Formation and Operation of CompanyDocument5 pagesLegal Requirement For Formation and Operation of CompanyHusnainShahidNo ratings yet

- Faq - PacraDocument8 pagesFaq - PacraJohn BandaNo ratings yet

- ACBP6222 - LU 10 - Companies ActDocument32 pagesACBP6222 - LU 10 - Companies Actnishania pillayNo ratings yet

- Companies Act 2013 IndiaDocument15 pagesCompanies Act 2013 IndiaBhagirath Ashiya100% (2)

- 5 Company AccountsDocument11 pages5 Company Accountsdeo omachNo ratings yet

- Accounting for Corporations under the Revised Corporation CodeDocument77 pagesAccounting for Corporations under the Revised Corporation CodeRosethel Grace Gallardo100% (1)

- Incorporating A CompanyDocument35 pagesIncorporating A CompanyXiuling Grace ZhangNo ratings yet

- DreptDocument17 pagesDreptMaria-Diana URSUNo ratings yet

- 2nd Generation Economic Reforms in IndiaDocument42 pages2nd Generation Economic Reforms in IndiaReema Dawra100% (2)

- Company LawDocument8 pagesCompany LawNickyNo ratings yet

- Corporate Formation and The Stockholders - EquityDocument39 pagesCorporate Formation and The Stockholders - EquityChocochipNo ratings yet

- CompCompanies Bill, 2012 Presentation From Sympro Consulting Pvt. LTD - Anies Bill, 2012 Presentation From Sympro Consulting Pvt. Ltd.Document33 pagesCompCompanies Bill, 2012 Presentation From Sympro Consulting Pvt. LTD - Anies Bill, 2012 Presentation From Sympro Consulting Pvt. Ltd.pasupathy_vnNo ratings yet

- Directors Qualifications & Corporate Officers RolesDocument5 pagesDirectors Qualifications & Corporate Officers RolesDenmark CabadduNo ratings yet

- Tutor's Answer (W2)Document6 pagesTutor's Answer (W2)chikaNo ratings yet

- Companies Bill 2012: Presented by Ca Pratik AroraDocument40 pagesCompanies Bill 2012: Presented by Ca Pratik Arorababy0310No ratings yet

- Study Material-Overview of The Companies Act, 2013-AM-IX-CL-IDocument6 pagesStudy Material-Overview of The Companies Act, 2013-AM-IX-CL-IannnooonnyyyymmousssNo ratings yet

- Chapter 2 - Corporate GovernanceDocument34 pagesChapter 2 - Corporate GovernancebkamithNo ratings yet

- (A) Prospectus: Definition of Prospectus (S-2 (29) )Document9 pages(A) Prospectus: Definition of Prospectus (S-2 (29) )akashabuttNo ratings yet

- Comparing Trusts, Societies, Section 25 Companies and Private Limited CompaniesDocument4 pagesComparing Trusts, Societies, Section 25 Companies and Private Limited CompaniesManohar G ShankarNo ratings yet

- Corporate AdministrationDocument7 pagesCorporate AdministrationaliyahnicoleeeeNo ratings yet

- Duties Rights Liabilities of DirectorsDocument59 pagesDuties Rights Liabilities of DirectorsJeevitha RamanNo ratings yet

- The Companies Act 1956Document77 pagesThe Companies Act 1956Varun JainNo ratings yet

- Business Legislation Study Notes ComplawDocument29 pagesBusiness Legislation Study Notes ComplawNitesh KumarNo ratings yet

- South Africa Companies Act ComparisonsDocument7 pagesSouth Africa Companies Act ComparisonsBheki TshimedziNo ratings yet

- Business Legal Structures PPT 1Document45 pagesBusiness Legal Structures PPT 1api-316477395No ratings yet

- Difference Between Public Company and Private CompanyDocument3 pagesDifference Between Public Company and Private CompanyMurali KrishnaNo ratings yet

- COMPANIESDocument12 pagesCOMPANIESSeth MophanNo ratings yet

- The Companies Act 1956 PPT at Bec DomsDocument55 pagesThe Companies Act 1956 PPT at Bec DomsBabasab Patil (Karrisatte)100% (1)

- Corporate Governance: Submitted To: Submitted byDocument12 pagesCorporate Governance: Submitted To: Submitted byAnkisha BansalNo ratings yet

- Company Types ExplainedDocument8 pagesCompany Types ExplainedRizwan AhmedNo ratings yet

- Companies Act 2017Document4 pagesCompanies Act 2017Ahmad Ali AmjadNo ratings yet

- Clause 49 - Listing AgreementDocument36 pagesClause 49 - Listing AgreementMadhuram Sharma100% (1)

- Business Forms in UgandaDocument33 pagesBusiness Forms in UgandaRichard Wejuli Wabwire89% (9)

- Companies NotesDocument40 pagesCompanies NotesPetrinaNo ratings yet

- Module 2 - Xid-133513 - 1Document17 pagesModule 2 - Xid-133513 - 1Erika BernardinoNo ratings yet

- Unit - 5 (Coi)Document21 pagesUnit - 5 (Coi)sachinyadavv13No ratings yet

- Meetings of A Company: University Businees School, Panjab University ChandigarhDocument24 pagesMeetings of A Company: University Businees School, Panjab University ChandigarhRamneet ParmarNo ratings yet

- Shareholders Right in GMDocument13 pagesShareholders Right in GMWan M Luqman FauziNo ratings yet

- All About Powers and Duties of Shareholders Under Companies Act by Jyotsana UplavdiyaDocument6 pagesAll About Powers and Duties of Shareholders Under Companies Act by Jyotsana UplavdiyaNandita GogoiNo ratings yet

- BE Week 4Document42 pagesBE Week 4nikhilkhemka123No ratings yet

- Types of Companies ExplainedDocument12 pagesTypes of Companies Explainedshrikant_22No ratings yet

- Module - 4 Company Management and AdministrationDocument59 pagesModule - 4 Company Management and Administrationkavitagothe100% (1)

- Companies Act 2013Document6 pagesCompanies Act 2013brightlight1989No ratings yet

- Denmark P. Cabaddu 2BDocument4 pagesDenmark P. Cabaddu 2BDenmark CabadduNo ratings yet

- The Company Law in India: Urvi Shah Assistant Professor of Law Unitedworld School of LawDocument48 pagesThe Company Law in India: Urvi Shah Assistant Professor of Law Unitedworld School of LawSunil ShawNo ratings yet

- Types of Companies PDFDocument8 pagesTypes of Companies PDFHadiBies100% (3)

- MRL2601-notes 2015 RELIABLEDocument38 pagesMRL2601-notes 2015 RELIABLEKhanyisani ZitumaneNo ratings yet

- Chapter 1Document10 pagesChapter 1Fatimah ArshNo ratings yet

- FEDERAL UNIVERS-WPS OfficeDocument11 pagesFEDERAL UNIVERS-WPS Officetersoobenard150No ratings yet

- Forms of Business EntityDocument20 pagesForms of Business EntityMain Daiictian HuNo ratings yet

- 1.introduction, Features & Formation of CopaniesDocument35 pages1.introduction, Features & Formation of CopaniesIshan GuptaNo ratings yet

- Differences between private and public companiesDocument3 pagesDifferences between private and public companiesUbai M-pireNo ratings yet

- LawDocument4 pagesLawUbai M-pireNo ratings yet

- Garfield The MovieDocument6 pagesGarfield The MovieUbai M-pireNo ratings yet

- Just in Time (Autosaved) BaruDocument9 pagesJust in Time (Autosaved) BaruUbai M-pireNo ratings yet

- Ogos 2010.fiqh MuamalatDocument10 pagesOgos 2010.fiqh MuamalatUbai M-pireNo ratings yet

- Apa2 AjaDocument2 pagesApa2 AjaUbai M-pireNo ratings yet

- Hari Raya Aidilfitri Is A Common Thing Now For Me Because The Enjoyment of This Raya Only Feels When I Was A Little BoyDocument1 pageHari Raya Aidilfitri Is A Common Thing Now For Me Because The Enjoyment of This Raya Only Feels When I Was A Little BoyUbai M-pireNo ratings yet

- Cadbury Report SummaryDocument16 pagesCadbury Report Summaryप्रदीप बागलNo ratings yet

- General Information Sheet for Global Link Technology Industrial Supplies & Services IncDocument11 pagesGeneral Information Sheet for Global Link Technology Industrial Supplies & Services Incmaricel TandangNo ratings yet

- Merger of HDFC Bank and Centurion Bank of PunjabDocument9 pagesMerger of HDFC Bank and Centurion Bank of PunjabJacob BrewerNo ratings yet

- 2003 December Corporate & Business LawDocument4 pages2003 December Corporate & Business LawDEAN TENDEKAI CHIKOWONo ratings yet

- Insurance Law Case List Atty Moera Joy Galing-LunaDocument2 pagesInsurance Law Case List Atty Moera Joy Galing-LunaMarilyn Padua AnnangNo ratings yet

- 1 Pengajuan Shipment PT. Mulia Investama Sejahtera QQ PT. The Master Steel ManufactoryDocument3 pages1 Pengajuan Shipment PT. Mulia Investama Sejahtera QQ PT. The Master Steel ManufactorygamaputrabNo ratings yet

- Ethical Financial Reporting ArticleDocument5 pagesEthical Financial Reporting ArticleCarl BurchNo ratings yet

- Private and Public Banks DatabaseDocument37 pagesPrivate and Public Banks DatabasesagartikaitNo ratings yet

- Salient Changes Under The Revised Corporation CodeDocument3 pagesSalient Changes Under The Revised Corporation CodeOwen BuenaventuraNo ratings yet

- Chapter 1 - Partnerships (Part 1)Document12 pagesChapter 1 - Partnerships (Part 1)bassmastahNo ratings yet

- Hints LawDocument10 pagesHints LawCloudSpireNo ratings yet

- Castillo Vs Balinghasay (Section 6 7 8 9)Document5 pagesCastillo Vs Balinghasay (Section 6 7 8 9)NikkieLEXNo ratings yet

- PR - Order in The Matter of M/s Adarsh Wealth Ventures LTDDocument1 pagePR - Order in The Matter of M/s Adarsh Wealth Ventures LTDShyam SunderNo ratings yet

- Credit Suisse - 10K Checklist - Accounting Tells A StoryDocument13 pagesCredit Suisse - 10K Checklist - Accounting Tells A StoryPhil WeissNo ratings yet

- Converting Swap To FuturesDocument6 pagesConverting Swap To FuturesJasvinder JosenNo ratings yet

- Mediclaim Details 2019-20 PDFDocument5 pagesMediclaim Details 2019-20 PDFBIDHANNo ratings yet

- ULOa Answer KeyDocument2 pagesULOa Answer KeyAyah Layson100% (3)

- Permohonan Pendaftaran Majikan: Employer Registration Application FormDocument1 pagePermohonan Pendaftaran Majikan: Employer Registration Application FormMohammad Rafiq IzzatNo ratings yet

- Candon Ilocos Sur Check Disbursement DetailsDocument28 pagesCandon Ilocos Sur Check Disbursement DetailsJen AlvaradeNo ratings yet

- AnDocument7 pagesAnapi-371619450% (6)

- Law103 L9Document36 pagesLaw103 L9jumanNo ratings yet

- Comparative Accounting: EuropeDocument20 pagesComparative Accounting: EuropeSylvia Al-a'maNo ratings yet

- Option GreeksDocument7 pagesOption GreeksNIDHI ANN FRANCIS 20121024No ratings yet

- A Project Report On ULIP Unit Linked Insurance Plan PDFDocument45 pagesA Project Report On ULIP Unit Linked Insurance Plan PDFRima. SapkalNo ratings yet

- IFCBDocument108 pagesIFCBchunnilal_munnilalNo ratings yet

- PartnershipDocument2 pagesPartnershipAbdul Samad ShaikhNo ratings yet

- New Companies Act, 2017: Key Changes & ConceptsDocument26 pagesNew Companies Act, 2017: Key Changes & ConceptsAbdul Muneem100% (1)

- Sectorwise MF Top Share Changes Jul 2019Document45 pagesSectorwise MF Top Share Changes Jul 2019stockengageNo ratings yet

- Why Good Accountants Do Bad AuditsDocument32 pagesWhy Good Accountants Do Bad AuditsPedro SamissoneNo ratings yet

- Understanding System AuditsDocument23 pagesUnderstanding System AuditsAckie ValderramaNo ratings yet