Professional Documents

Culture Documents

BIRForm 1905 e TIS1

Uploaded by

Anonymous NAlWIFIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIRForm 1905 e TIS1

Uploaded by

Anonymous NAlWIFICopyright:

Available Formats

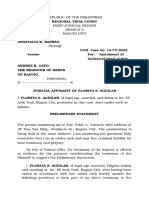

(To be filled up by BIR)

[NOTE: This form shall be used in RDOs with eTIS-1 only]

DLN:

Republic of the Philippines

Department of Finance

Bureau of Internal Revenue

BIR Form No.

Application for

1905

Registration Information

Update/Correction/Cancellation

November 2014 (ENCS)

Fill in applicable spaces. Mark all appropriate boxes with an "X".

TAXPAYER INFORMATION

Part I

1 Taxpayer Identification

Number (TIN)

4 Taxpayer's Name (If Individual ) (Last Name)

2 RDO

Code

(First Name)

3 Contact

Number

(Middle Name)

(Suffix)

(Nickname)

(If Non-Individual , Registered Name)

REASON/DETAILS OF REGISTRATION INFORMATION UPDATE/CORRECTION

PART II

5 Replacement/Cancellation of:

FORM/S

REASON/DETAILS

Lost/Damaged

Correction/Change/Update of

A Certificate of Registration (COR)

B Authority to Print (ATP) Receipts/Invoices

Closure of a business

Registration Information

(please proceed to number 6 for

C Tax Clearance Certificate for Tax Liabilities (TCL1)

Change of accredited printer as

applicable change in registration

requested by the taxpayer

D Taxpayer Identification Number (TIN) Card

information)

E Tax Clearance Certificate for Transfer of Property/ies

Others (please specify)

(TCL2)/Certificate Authorizing Registration (CAR)

F Others (please specify)

6 Correction/Change/Update of Registration Information

A. CHANGE IN REGISTERED NAME/TRADE NAME

Registered Name

New Registered

Name/Trade Name

Trade Name

(Old RDO)

B. CHANGE IN REGISTERED ADDRESS

Transfer within same RDO

Transfer to another RDO

Lot#/Blk#/Phase/House#/Unit/Room/Floor/Bldg.#/Sub Street

(New RDO)

From

To

Building Name/Street Name/Subdivision/Village Zone

Municipality/City/District

Province

Barangay

C. CHANGE IN ACCOUNTING PERIOD (Applicable to Non-Individual)

From Calendar Period to Fiscal Period

From Fiscal Period to Calendar Period

From One Fiscal Period to Another Fiscal Period

ZIP Code

(MM/DD/YYYY)

Start Date of New Period

Start Date of Old Period

D. CHANGE/ADD REGISTERED ACTIVITY/LINE OF BUSINESS

New Registered Activity/

Effective Date of Change

Line of Business

(MM/DD/YYYY)

E. CHANGE/ADD FACILITY TYPE/DETAILS (attach additional sheet, if necessary)

Additional/New Facility

Facility Type*

(pls check applicable facility type)

Facility Code

Others (specify)

PP SP WH SR GG BT RP

F

F

PP

SP

WH

SR

GG

Facility Type*

Place of Production

BT

Storage Place

RP

Warehouse

Showroom

Garage

Bus Terminal

Real Property for

Lease with No

Sales Activity

Address of Facility

Lot#/Blk#/Phase/House#/Unit/Room/Floor/Bldg.#/Sub Street

Building Name/Street Name/Subdivision/Village Zone

Municipality/City/District

Barangay

F. CHANGE/ADD INCENTIVE DETAILS/REGISTRATION

Investment Promotion Agency

ZIP Code

Number of Years

Legal Basis

Start Date (MM/DD/YYYY)

Incentives Granted

End Date (MM/DD/YYYY)

Registration/Accreditation No.

From

Effectivity Date

Province

Registered Activity

To

Tax Regime

(MM/DD/YYYY)

Activity Start Date (MM/DD/YYYY)

Date Issued (MM/DD/YYYY)

Activity End Date (MM/DD/YYYY)

G. CHANGE/ADD TAX TYPE DETAILS/SUSPEND TAX TYPE/RE-REGISTER TAX TYPE

Suspend/Cancelled Form Type

ATC

Effective Date of

Re-register/Added/

(to be filled-up by BIR) Change (MM/DD/YYYY)

Tax Type/s

New Tax Type/s

Form Type

ATC

(to be filled-up by BIR)

Effective Date

(MM/DD/YYYY)

H. CHANGE/UPDATE OF CONTACT TYPE

Phone Number

Mobile Number

Fax Number

Email Address (required)

I. CHANGE/UPDATE OF CONTACT PERSON/AUTHORIZED REPRESENTATIVE

(Last Name)

Position

(First Name)

(Middle Name)

TIN

(Suffix)

page 2 - BIR Form No. 1905

J. CHANGE/UPDATE OF STOCKHOLDERS/MEMBERS/PARTNERS

TIN

(Last Name, First Name, Middle Name, Suffix, if Individual/Registered Name, if non-individual)

7 Closure of Business/Cancellation of Registration

A. CANCELLATION OF TIN

Death

Multiple/Identical TIN

Failure to start/commence business (For Non-Individual)

Permanent closure of a branch

Dissolution of corporation/partnership

As a result of merger/consolidation

Others (please specify)

Effective Date of Cancellation

(MM/DD/YYYY)

B. DE-REGISTER/CESSATION OF REGISTRATION

Permanent closure of business (head office) of an individual

Others (please specify)

8 Update of Books of Accounts

Type

(Manual or Loose)

Books Registered

9 Other Update/Correction (please specify details)

Quantity

Effective Date of Cessation

(MM/DD/YYYY)

Volume

From

To

Date Registered

(MM/DD/YYYY)

For Taxpayer

Permit Number

Date Issued

(MM/DD/YYYY)

For BIR Use

Effective Date of Change

(MM/DD/YYYY)

Approved by:

REVENUE DISTRICT OFFICER

(Signature over Printed Name)

10 Declaration

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me,

and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal

Revenue Code, as amended, and the regulations issued under authority thereof.

Taxpayer/Authorized Representative

(Signature over Printed Name)

Date

Stamp of Receiving Office

and Date of Receipt

Title/Position of Signatory

Documentary Requirements:

REPLACEMENT/CANCELLATION

A. Certificate of Registration

1. Original Copy of Old Certificate of Registration, for replacement

2. Affidavit of Loss, if lost

3. Proof of payment of Certification Fee and Documentary Stamp Tax - to be

submitted before the issuance of the new Certificate of Registration

B. Authority to Print (ATP) Receipts and Invoices

1. Original Authority to Print Primary and Secondary Receipts/Invoices

2. New Application Form (BIR Form No. 1906), if applicable

C. Tax Clearance Certificate For Tax Liabilities (TCL1)

1. Affidavit of Loss, if lost

2. Proof of payment of Certification Fee and Documentary Stamp Tax - to be

submitted before the issuance of the new Tax Clearance Certificate

D. TIN Card

1. Affidavit of Loss, if lost

2. Old TIN Card (if replacement is due to damaged card)

3. Marriage Certificate (for change of family name)

4. SEC Certificate (for change of Corporate Name)

CORRECTION/CHANGE/UPDATE OF REGISTRATION INFORMATION

A. Change in Registered Name/Trade Name

1. Amended SEC Registration/ DTI Certificate

2. Original Certificate of Registration

B. Change in Registered Address

1. Original Certificate of Registration

2. Inventory list of unused principal and supplementary receipts/invoices

3. Unused primary and supplementary receipts/invoices for stamping

4. Latest DTI Certificate/ SEC Registration

5. Sketch of place of production (if taxpayer is subject to Excise Tax)

6. Duly signed Transfer Commitment Form (unnotarized)

See Annexes C & F, RMO No. 40-2004

C. Change in Accounting Period

1. BIR written approval of the change

2. Photocopy of short period return filed

D. Change/Add Registered Activity/Line of Business

- Original Certificate of Registration

E. Change/Add Facility Type/Details

- Appropriate Application for Registration and requirements therein

F. Change/Add Incentive Details/Registration

- Certificate of Accreditation/Registration from Investment Promotion Agency

G. Change/Add Tax Type Details

- Original Certificate of Registration

I. Change/Update of Contact Person/Authorized Representative

- Authorization or Certification issued by Officer enumerated under Section 52 (A)

of the Tax Code (President or representative and Treasurer or Assistant

Treasurer of the Corporation)

J. Change/Update of Stockholders/Members/Partners

- Amended Articles of Incorporation/Cooperation/Partnership

CLOSURE OF BUSINESS/CANCELLATION OF REGISTRATION

A. Cancellation of TIN

INDIVIDUAL

1. Death Certificate

2. Estate Tax Return

3. Proof of payment of existing liabilities, if any

Additional requirements for taxpayers engaged in trade or

business or exercise of Profession

4. Existing BIR Certificate of Registration (for surrender)

5. Inventory list of unused primary and secondary receipts/invoices

6. Unused primary and secondary receipts/invoices for cancellation

NON-INDIVIDUAL

1. Notice of Dissolution of Business

2. Dissolution Papers (board resolution, bankruptcy declaration)

3. Inventory list of unused primary and secondary receipts/invoices

4. Unused primary and secondary receipts/invoices for cancellation

5. Existing BIR Certificate of Registration

6. Proof of payment of existing liabilities

7. SEC issued Certificate of the Filing of the Articles of Merger/Consolidation,

if applicable

8. Affidavit of "No Operation" together w/ returns filed, "No Operation"

duly indicated (for failure to commence business)

B. Cessation of Registration (for Individual & Non-individual with business)

1. Letter request for cessation of registration

2. Existing BIR Certificate of Registration (for surrender)

3. Inventory list of unused primary and secondary receipts/invoices

4. Unused primary and secondary receipts/invoices for cancellation

5. Same requirements as in Cancellation of TIN, if applicable

Update of Books of Accounts

- Photocopy of the first page of the previously approved books

You might also like

- Reyes v. CADocument14 pagesReyes v. CAAiyla AnonasNo ratings yet

- That He Enters The Dwelling of AnotherDocument7 pagesThat He Enters The Dwelling of AnotheryoungkimNo ratings yet

- Batch 3Document7 pagesBatch 3Michael ArgabiosoNo ratings yet

- CertiorariDocument3 pagesCertiorariHazel MascarinasNo ratings yet

- Colorado v. AgapitoDocument12 pagesColorado v. AgapitoCla BANo ratings yet

- Motion For Extension of Time To File Position Paper: Bureau of Fisheries and Aquatic ResourcesDocument1 pageMotion For Extension of Time To File Position Paper: Bureau of Fisheries and Aquatic ResourcesDerick RevillozaNo ratings yet

- Conspiracy CasesDocument69 pagesConspiracy CasesRah-rah Tabotabo ÜNo ratings yet

- Investigation of Removal and Sale of PropertyDocument1 pageInvestigation of Removal and Sale of PropertyJohn Karlo P. FernandezNo ratings yet

- Affid Loss Licenses FirearmDocument3 pagesAffid Loss Licenses FirearmAnonymous VgZb91pLNo ratings yet

- GR 101083 Oposa V Factoran Jr. July 30, 1993Document11 pagesGR 101083 Oposa V Factoran Jr. July 30, 1993Naro Venna VeledroNo ratings yet

- 7 G.R. No. 190710 - Lucas v. LucasDocument3 pages7 G.R. No. 190710 - Lucas v. LucasAndelueaNo ratings yet

- Four Promises of Allah That You Should Never ForgetDocument2 pagesFour Promises of Allah That You Should Never Forgetlawswood claimsNo ratings yet

- Garcia vs. Recio - GR No. 138322Document9 pagesGarcia vs. Recio - GR No. 138322Vincent OngNo ratings yet

- CASE DIGEST: Cynthia S. Bolos Vs Danilo T. BolosDocument1 pageCASE DIGEST: Cynthia S. Bolos Vs Danilo T. BolosDi KoyNo ratings yet

- Case Digests 090619Document224 pagesCase Digests 090619NMNGNo ratings yet

- Supreme Court Decision on Land Registration and Back TaxesDocument8 pagesSupreme Court Decision on Land Registration and Back TaxesRocky CadizNo ratings yet

- Senate v. Ermita G.R. No. 169777Document27 pagesSenate v. Ermita G.R. No. 169777JinyoungPNo ratings yet

- ManifestationDocument3 pagesManifestationMarc Christian H. TangpuzNo ratings yet

- 013-Damasco v. NLRC, G.R. No. 115755, 4 Dec 2000Document6 pages013-Damasco v. NLRC, G.R. No. 115755, 4 Dec 2000Jopan SJNo ratings yet

- Advance Legal Writing Assignment 4Document5 pagesAdvance Legal Writing Assignment 4Anathema Device100% (1)

- Facts: Nora Fe Sagun Is The Legitimate Child of Albert S. Chan, A Chinese National, andDocument3 pagesFacts: Nora Fe Sagun Is The Legitimate Child of Albert S. Chan, A Chinese National, andAlexis CatuNo ratings yet

- Warning Letter To Tenant For Late PaymentDocument1 pageWarning Letter To Tenant For Late Paymentemerald100% (1)

- Cadavedo vs. Atty. Lacaya, A.C. No. 173188, Jan. 15, 2014Document15 pagesCadavedo vs. Atty. Lacaya, A.C. No. 173188, Jan. 15, 2014Tim SangalangNo ratings yet

- Court Convicts Man of Estafa and Attempted Estafa for Falsifying Bank ChecksDocument204 pagesCourt Convicts Man of Estafa and Attempted Estafa for Falsifying Bank ChecksDanielleNo ratings yet

- Carmencita o Reyes Vs SandiganbayanDocument9 pagesCarmencita o Reyes Vs Sandiganbayankristel jane caldozaNo ratings yet

- Deed of Sale FinalDocument3 pagesDeed of Sale FinalChrise TalensNo ratings yet

- Natelco Vs CADocument10 pagesNatelco Vs CAcharmdelmoNo ratings yet

- Authorization Letter: Tel # (044) 9585018 Cell # 09399209458Document1 pageAuthorization Letter: Tel # (044) 9585018 Cell # 09399209458elmerdlpNo ratings yet

- PALE DigestDocument4 pagesPALE DigestClarence Octaviano-Salanga100% (1)

- Certificate - As Fully To All Intents and Purposes As I Might or Could Lawfully Do IfDocument1 pageCertificate - As Fully To All Intents and Purposes As I Might or Could Lawfully Do IfMarky CieloNo ratings yet

- Serna V CADocument2 pagesSerna V CAJunsi AgasNo ratings yet

- SUMMONSDocument6 pagesSUMMONSMarion JossetteNo ratings yet

- Third Division: The Lawphil Project - Arellano Law FoundationDocument14 pagesThird Division: The Lawphil Project - Arellano Law FoundationDennisOlayresNocomoraNo ratings yet

- RTC Civil Case Annulment Unilateral Deed SaleDocument5 pagesRTC Civil Case Annulment Unilateral Deed SaleTrem GallenteNo ratings yet

- Litton Wins Against Santos' Non-Profit ShieldDocument9 pagesLitton Wins Against Santos' Non-Profit ShieldJP De La PeñaNo ratings yet

- Republic V Corazon NaguitDocument9 pagesRepublic V Corazon NaguitJoe RealNo ratings yet

- Ablang v. Fernandez, 25 Phil. 33Document2 pagesAblang v. Fernandez, 25 Phil. 33Dah Rin Cavan100% (1)

- UntitledDocument17 pagesUntitledanatheacadagatNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor Vehiclesandy vincentNo ratings yet

- Orencia vs. Enrile, G.R. No. L-28997 February 22, 1974, 55 SCRA 580Document4 pagesOrencia vs. Enrile, G.R. No. L-28997 February 22, 1974, 55 SCRA 580RJCenitaNo ratings yet

- Affidavit of Loss of PassportDocument1 pageAffidavit of Loss of PassportGladys SerranoNo ratings yet

- Get Homework/Assignment DoneDocument21 pagesGet Homework/Assignment DoneDustin FormalejoNo ratings yet

- A.M. OCA IPI No. 08-2854-RTJ, JosonDocument9 pagesA.M. OCA IPI No. 08-2854-RTJ, JosonJudge Florentino FloroNo ratings yet

- Vda de Cailles Vs MayugaDocument1 pageVda de Cailles Vs MayugaGillian Caye Geniza BrionesNo ratings yet

- Morana v. Republic (2019)Document13 pagesMorana v. Republic (2019)Vox Populi Too100% (1)

- Deed of Conditional Sal1Document2 pagesDeed of Conditional Sal1Julian HemedezNo ratings yet

- Affidavit of Loss-Sss-Ritchel Cerbo CastilloDocument1 pageAffidavit of Loss-Sss-Ritchel Cerbo CastilloAidalyn MendozaNo ratings yet

- Lawyer's OathDocument7 pagesLawyer's OathBest KuroroNo ratings yet

- In Re Atty. Jose AvancenaDocument4 pagesIn Re Atty. Jose AvancenaRocky MagcamitNo ratings yet

- People vs. Cabral bail application dutiesDocument1 pagePeople vs. Cabral bail application dutiesDan Alden ContrerasNo ratings yet

- Benedicto vs. Board of Administrators of Television Stations RPN BBC and IBCDocument12 pagesBenedicto vs. Board of Administrators of Television Stations RPN BBC and IBCral cbNo ratings yet

- Affidavit Correcting Name DiscrepancyDocument2 pagesAffidavit Correcting Name DiscrepancyAntonio J. David IINo ratings yet

- 6 Purefoods Vs NLRC G.R. No. 122653Document5 pages6 Purefoods Vs NLRC G.R. No. 122653Lonalyn Avila Acebedo100% (1)

- In Re Petition For Liquidation of Intercity Savings and Loan BankDocument8 pagesIn Re Petition For Liquidation of Intercity Savings and Loan BankBeatriz VillafuerteNo ratings yet

- Charges Upon and Obligations of The Conjugal PartnershipDocument13 pagesCharges Upon and Obligations of The Conjugal PartnershipSheie WiseNo ratings yet

- Sykiong V Sarmiento 90 PHIL 434Document2 pagesSykiong V Sarmiento 90 PHIL 434JA BedrioNo ratings yet

- Bir 1905Document2 pagesBir 1905mastanistaNo ratings yet

- 1905 (Encs) 2000Document4 pages1905 (Encs) 2000Loss Pokla100% (1)

- Form - BIR Form 1905Document4 pagesForm - BIR Form 1905ibangpassword50% (2)

- Bir 1905Document2 pagesBir 1905Allan Paul Mariano100% (1)

- 18 Ufe V NestleDocument11 pages18 Ufe V NestleLegaspiCabatchaNo ratings yet

- Caltex Refinery Employees Association v. BrillantesDocument3 pagesCaltex Refinery Employees Association v. BrillantesJackie CanlasNo ratings yet

- Caltex Refinery Employees Association v. BrillantesDocument3 pagesCaltex Refinery Employees Association v. BrillantesJackie CanlasNo ratings yet

- Supreme Court Upholds Conviction of Recruiters for Illegal Recruitment and EstafaDocument4 pagesSupreme Court Upholds Conviction of Recruiters for Illegal Recruitment and EstafaAnonymous NAlWIFINo ratings yet

- EBIR Forms GuidelinesDocument103 pagesEBIR Forms Guidelinescutiejen2167% (3)

- Import of Vehicles Taxpayer GuideDocument9 pagesImport of Vehicles Taxpayer GuideOmer WaheedNo ratings yet

- NTPC Revises TA Rules to Rationalize RatesDocument41 pagesNTPC Revises TA Rules to Rationalize RatesHemant ChaurasiaNo ratings yet

- BOB Foreign Inward Remittance Application FormDocument4 pagesBOB Foreign Inward Remittance Application FormFinance Logan MineralsNo ratings yet

- Agitator - 2 PDFDocument11 pagesAgitator - 2 PDFParth ThakarNo ratings yet

- F.19 Vs F.13Document2 pagesF.19 Vs F.13Nandu AdapaNo ratings yet

- PapaDocument2 pagesPapaSimranpreet KaurNo ratings yet

- Unit 4 Activity Worksheet Revenue and Collection Cycle IDocument2 pagesUnit 4 Activity Worksheet Revenue and Collection Cycle IFinneth AchasNo ratings yet

- Lockbox - User GuideDocument68 pagesLockbox - User Guidekrishan0432No ratings yet

- Umma University Prequalification of Suppliers for 2020-2021Document21 pagesUmma University Prequalification of Suppliers for 2020-2021Stellah IreriNo ratings yet

- Guide Technique 2.0Document247 pagesGuide Technique 2.0Yannick TchatoNo ratings yet

- Silicon Philippines v. CIR: DOCTRINE/S: All Told, The NonDocument3 pagesSilicon Philippines v. CIR: DOCTRINE/S: All Told, The NonDaLe AparejadoNo ratings yet

- Bir Form 1901Document4 pagesBir Form 1901Jayvee CayabyabNo ratings yet

- TP Orthodontics, Inc.: Product CatalogDocument246 pagesTP Orthodontics, Inc.: Product CatalogNeil Wilfredo GonzalesNo ratings yet

- Hilti AnchoringDocument15 pagesHilti Anchoringwdavid81No ratings yet

- MODULE 8 - Test of ControlsDocument16 pagesMODULE 8 - Test of ControlsRufina B VerdeNo ratings yet

- Tech Functional Requmt A6e19aDocument136 pagesTech Functional Requmt A6e19aAnkit SinghNo ratings yet

- Practice Questions and Answers in AccounDocument100 pagesPractice Questions and Answers in Accounwalidabdo274No ratings yet

- Physical Inventory Observation ChecklistDocument10 pagesPhysical Inventory Observation ChecklistIke FinchNo ratings yet

- Export ProcedureDocument3 pagesExport Procedurethyvivek91% (11)

- Flow Chart Red Lane Sea ImportDocument2 pagesFlow Chart Red Lane Sea Importannisa nurr100% (1)

- Coa Circulars 2020-2021Document5 pagesCoa Circulars 2020-2021Jireh RiveraNo ratings yet

- Supplier Portal OracleDocument4 pagesSupplier Portal OracleJaved KhanNo ratings yet

- API DocsDocument73 pagesAPI DocsIslamic IndiaNo ratings yet

- Procurement Process in SAP MM Chap.4Document26 pagesProcurement Process in SAP MM Chap.4Priyanka BarotNo ratings yet

- Contract Accounts Receivables & Payables - SAP Expertise ConsultingDocument33 pagesContract Accounts Receivables & Payables - SAP Expertise ConsultingRahulNo ratings yet

- Payment Receipt: Online Receipt Is Valid Subject To Realization of Amount From BankDocument1 pagePayment Receipt: Online Receipt Is Valid Subject To Realization of Amount From BankSoumya MohapatraNo ratings yet

- A Survey On Delving The Hizon Laboratories' Internal Cash Control & Management Part I. ProfileDocument9 pagesA Survey On Delving The Hizon Laboratories' Internal Cash Control & Management Part I. ProfileimperialmichelleNo ratings yet

- Xstore 150 UserGuideDocument489 pagesXstore 150 UserGuidetejashreekadamNo ratings yet

- AaaDocument45 pagesAaaPriya NairNo ratings yet

- Bharatmala Pariyojna - Haryana - 14.84 KMDocument254 pagesBharatmala Pariyojna - Haryana - 14.84 KMSayantani Mitra100% (2)