Professional Documents

Culture Documents

IRDA Incurred Claim Ratio-How To Choose The Best Health Insurance

Uploaded by

Pamela BradleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRDA Incurred Claim Ratio-How To Choose The Best Health Insurance

Uploaded by

Pamela BradleyCopyright:

Available Formats

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Hom e

I nsurance Planning

Q & A Forum

I nv estm ent Planning

About BasuNiv esh

Mutual Fund

EPF and PPF

O ld-Articles

Tax Planning

Contact us

Banking

Real Estate

You are here: Home / Insurance Planning / IRDA Incurred Claim Ratio-How to choose the best health Insurance?

IRDA Incurred Claim Ratio-How to choose

the best health Insurance?

January 12, 2015 by Basavaraj Tonagatti 201 Comments

4

Share

34

Share

11

Tweet

Pin0

0

Share

0

Share

When it comes to purchasing health insurance either for you or to family, then you will come across many more

doubts, like how much insurance is suffice for you, whether you can afford it or not, which one to buy and much

more. The answer to this is a simple tool developed by POLICYADVISOR. Let us look how it works and help

you.

Before proceeding further, let us look at recent annual report of IRDA Annual Report 2013-14. This will also

give you some inputs about whom to believe and how they are doing business.

What is the Incurred Claims Ratio?

It is the ratio of claim incurred by the insurance company to actual premium collected for that period. You may

also say it as a net claim settlement cost incurred to the net premium collected for a given accounting period.

Formula for calculating is as below.

Incurred Claim Ratio=Net claims incurred/Net earned premium.

For example, let us say an insurance companys incurred claim ratio is 90%. Then what it indicates is, for

every Rs.100 earned as premium, Rs.90 spent on the claims settled by the insurer. Therefore, Rs.10 is the

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

1/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

profit to the company. If this incurred claim ratio is over and above 100%, then it indicates that they suffered a

loss in their business.

What this ratio indicates?

This indicates how much you can believe in insurance companies, when it comes to claim. Usually higher the

incurred claim ratio then it is good for you. This is how the health insurance companys performance is gauged.

However, when it comes to insurance company point of view, then if higher the incurred claim ratio means the

company is in loss. That is the reason usually insurance companies load your premium when they incur a

higher loss in particular age group segment (even though you do not have any claims in previous years).

What this ratio doesnt indicate?

When company A and company B have a same incurred claim ratio then it is hard for you to judge who settled

claims quickly. So even though it may give a clear picture about an insurance company, but still hard to find

who is efficient in claim settlement.

What is the difference between incurred claim ratios to claim settlement ratio?

You can confuse yourself between incurred claim ratios to claim settlement ratio. The claim settlement ratio is

the ratio of settled claims to the total claims filed in a given accounting period. Therefore, if claim settlement

ratio indicates 90%, then it means that out of 100 claims filed 90 claims are settled. Remaining 10% claims are

either rejected or pending with the insurance company.

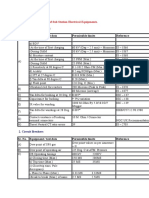

Below is the latest IRDA Annual Report for 2013-14 for individual Health Insurance Companies Incurred

Claim Ratio for 2013-14.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

2/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

As I said above, this CIR will give you an indication of believing on these insurance companies. You may notice

that none of the private health insurance companies (including standalone health insurance companies) has

CIR of more than their collected premium.

Now let us move to the next step of selecting the health insurance product by using the tool of

POLICYADVISOR. Here in the first place you need to enter your date of birth and city you currently live. The

name of the city is important to identify the cost of health in these cities. They did some research on this to

arrive at the final figures on this.

Next, you need to enter your marital status, your monthly income, whether you want to add family members

or not. If yes, then add the number of members you want to cover in this policy.

Last step is to specify whether you have any existing health insurance or not. This is required to arrive at the

required Sum Insurance. Along with that, you need to enter information about any health issues. Finally share

the information, whether you have any major hospital expenses in last 1 year or so.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

3/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

That is all what you need to do. The result will show you whether you require any health insurance or not

(based on your current health insurance), ideal cover required for you (based on current requirement, the city

you stay, family members you want to cover and your health status.) and the required cover which excludes

the existing insurance coverage.

If you need quotes for this insurance, then you can fill up your personal data like name, email id and mobile

number. This will give you the list of products.

Few assumptions that were made to arrive at required quote are as below.

You are the eldest member of the family.

You have an annual surplus of 3% to 4% to pay towards your health insurance premium.

You have not exhausted the Sec.80D limit.

Your premium affordability may vary to actual calculation. However, it is considered based on industry

average.

This is not a final recommendation. Before buying a product, consult insurance adviser or financial

planner.

I know that buying health insurance involves too many data like apart from said information you may require

information like co-payment clause, pre-existing diseases or many more. But by going through IRDA ICR and

using the POLICYADVISOR tool at least you may come to nearer of your selection.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

4/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

4

Share

34

Share

11

Tweet

Pin0

0

Share

0

Share

Similar Stories...

LICs Jeevan Vaibhav-Review

Online Term Insurance in India-Beware before buying !!!

Video Tutor on how to buy online term plan of LICs e-Term

Mis-Selling in Insurance industry with example

LICs Bonus rates for 2013-14 and Comparison

Anonymous

Basavaraj Tonagatti

I am a Certified Financial Planner by qualification and currently living in Bangalore. I am using

this platform to spread knowledge about Personal Financial Planning. Hope you too join me in

spreading this awareness :)

Connect With Me :

Google+

Comments

siddharth says

August 5, 2015 at 8:57 PM

Could you suggest a good Health Insurance provider for myself ( 32 ) and my Brother ( 26) .Thanks

Sir.

Reply

Basavaraj Tonagatti says

August 6, 2015 at 10:01 AM

Siddharth-The list with data already available in above post.

Reply

Sandeep Singh says

August 3, 2015 at 11:43 AM

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

5/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Dear Sir

I want to buy health insurance for me & my wife. pl suggest which is best for for me keeping in mind

service, Claim settlement ratio, support & premium.

I want following things to be covered :

1. Minor operations like herina, cattract eye sight issues etc. ( immediately after 30 to 90 days after i

buy policy)

In most of polices , this benefits they give after 24 months.

2. Maternity benefits

3. Critical illness coverage

4. Pre diseases cover

5. Reimbursement if i use non-network hospital like Fortis, PGI chandigarh etc.

i have gone through Max Bhupa (family first plan )- for 15 lakh premium is 18222/- , it is too high.

Apollo is also there but i do not know much about their service, performance. CIR etc.

Pl give me ur valuable advice.

regards

Sandeep Singh

Reply

Basavaraj Tonagatti says

August 3, 2015 at 12:20 PM

Sandeep-It seems you are going for surgery or hospitalization soon and that is the reason looking

for a health insurance. No one can protect you in such situations.

Reply

Gaurav Malik says

August 2, 2015 at 1:26 PM

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

6/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Sir,

I have Max Bupa Gold Heartbeat Gold 10 Lakhs for 2 Adults ( 36 and 32) and one Child 2 Years. My

this years premium is 27,500. I have checked our Religare the same is 16359 for Super No Claim

Bonus. What would you advice? Max Bupa claims that within my policy they also cover Critical Illness

to the SA but I do not see it written anywhere within the policy. Please advice.

Best Regards

Gaurav Malik

Reply

Basavaraj Tonagatti says

August 2, 2015 at 4:12 PM

Gaurav-Dont combine critical illness with health insurance. Just buy it separately.

Reply

Gaurav Malik says

August 2, 2015 at 10:14 PM

But do you advice that I discontinue the Max Bupa and go in for the Religare Policy. I feel a

premium for 27,000 is unjustified almost for a similar policy.

Regards

Reply

Basavaraj Tonagatti says

August 3, 2015 at 12:42 PM

Gaurav-I am not suggesting either to discontinue or continue. I just said separate the

health insurance with critical. If the Religare is matching your features requirement

and also within budget then you can go with Religare. You are the right person to judge

it.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

7/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Srivatsav says

August 1, 2015 at 12:16 AM

Dear Basu,

Thank you for this wonderful blog !

Basu, Just need your advice

I am planning to take a family floater with Sum Assured of Rs 10 Lacs where the NCB could go upto

20 Lacs if there is no claim ( 2 Adults + 1 Child )

I have found Max Bupa Companion and Royal Sundaram Lifeline Supreme quite attractive. However

I am not quite sure of their services in the long run and I have also found their premium low

compared to others.

Whats your take on this ? Which one do you suggest or is there any alternative ?

Regards,

Srivatsav

Reply

Basavaraj Tonagatti says

August 1, 2015 at 10:06 AM

Srivatsav-I am not sure about Royal Sundaram but I feel MaxBupa provides good service.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

8/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Malhari salunkhe says

July 30, 2015 at 10:20 AM

I want to buy Health Insurance for my Parents. Father Age 52 & Mother Age 49.

Mother is having joint pain .is this considered in preexisting disease ?

Please suggest which Insurance Provider is best for SI 4-5 lacks ?

Shall i go with Religare or ICICI lomard ?

Reply

Basavaraj Tonagatti says

July 30, 2015 at 12:31 PM

Malhari-Joint pain is considered as existing disease. For me both are fine. Also, suggest to check

for Apollo or some public sectors like National and New India.

Reply

Nitin says

July 28, 2015 at 3:06 PM

Mr Basavaraj,

First, thank you for such informative post.

I noticed, mostly youre suggesting buying health insurance from standalone companies e.g. Star,

Apollo, Max or Religare even though their CIR is much less than other private sector companies e.g.

ICICI, HDFC etc. I undersntad that public insurers can sustain on loss (with high CIR) but what are

the advantage you see going with standalone insurers compared to private insurers? I feel ICICI with

93% CIR is very good compared to Apollos 65%.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

9/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

July 29, 2015 at 12:32 PM

Nitin-First of all, I am not sticking my recommendations to any particular company. Second

thing is, CIR is not a sole criteria to select a company. There are millions of reasons for getting

hospitalized. Hence, we cant generalize and say that based on CIR we must buy an insurance.

We have to look for efficiency in claim settlement (adopting fast approach), features we are

looking forward, premium affordability and comfort with company.

Reply

Nitin says

July 31, 2015 at 12:15 PM

No particular to a company but to group of standalone insurerstwo of your replies here

prove it

Basavaraj Tonagatti says

June 29, 2015 at 11:56 AM

Sujit-You can check with Star, Apollo, Max or Religare.

Basavaraj TonagattiBasavaraj Tonagatti says

May 6, 2015 at 10:14 AM

Sunny-Go with Apollo, Max or Religare (I am not aware about TTK). There is no

advantage. But in case of settlement they may be bit generous.

Reply

Basavaraj Tonagatti says

July 31, 2015 at 1:51 PM

Nitin-I consider service as a major issue when it comes to health insurance. Hence, I

am fan of standalone companies. You may think of I am biased and you are free to

interpret it. Because I have any profit from recommending public, private or

standalone companies

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

10/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Nitin says

July 31, 2015 at 2:38 PM

Yes, youre not sticking a particular company but to group of standalone insurers. This is

evident from your replies below. CIR is not only criteria but most important because delay

in claim (public company) is better than denying claim (private standalone company). Will

you prefer efficiency in claim settlement than increasing probability of claim denial ?

Reply

Basavaraj Tonagatti says

July 31, 2015 at 2:46 PM

Nitin-There are million reasons to be sick and at the same time insurance companies

have million reasons to reject. Hence, depending solely on CIR is not best. Also, for

companies point of view, approving is easy than rejecting. Because rejecting leads to

proper answer to client or in some cases either court or IRDA. Hence, they must take

into notice of that point. The data which IRDA publishes itself not indicate what are the

major reasons for rejection. Then it is wrong to generalize and say that if a company

rejection ratio is more than it rejects your claim too. You are saying PROBABILITY.

Hence, I will not indulge in predictions. For me what matters more is complete

disclosure from my end, understand the plan features and exclusions.

Reply

Amit Mo says

July 27, 2015 at 6:10 PM

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

11/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Hi, Do you have latest updated table of ICR published in current year?

Thanks

Reply

Basavaraj Tonagatti says

July 27, 2015 at 7:08 PM

Amit-This is the updated one.

Reply

Ravi says

July 26, 2015 at 1:51 AM

Dear Mr. Basavaraj,

Thank you for the detailed guide on how to choose the best health insurance, which is of great value

to all of us.

I have a question: I have a Religare Care floater policy for Rs.5 lakhs, which is one year old, and a

Religare Enhance I floater policy for Rs. 5 lakhs which I have taken on 18 July 2015. Both these

policies are for me and my wife. The Enhance I policy has Deductible: Rs.5 lakhs.

Now suppose that I or my wife incurs a medical expense of say Rs.8 lakhs , does Deductible mean

that I can claim Rs.5 lakhs from the Care policy, and the balance Rs.3 lakhs from the Enhance I

policy? This way can I claim the full Rs.8 lakhs from the two policies?

Secondly, if say the other person in these policies have any medical expenses in the same year, how

much will be left to claim for the other person in the same year?

Your reply shall be highly appreciated. Just want to be clear about how these policies will operate.

Thanks

Ravi Kumar

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

12/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

July 26, 2015 at 12:43 PM

Ravi-Care policy is treated as separate than the Enhance. Please read the definition provided by

Religare about Deductible as Deductible Plan works on the simple principle of Policy Deductible,

which is the pre-defined amount that you will bear, through your own finances or any other

source, during a medical event Any amount over and above policy deductible will be borne by us.

The pre-specified deductible can be reduced/exhausted using the principle of aggregation.

Simply put, if you opt for a 6 lac Sum Insured with deductible of 2 lac, then 2 lac will be borne by

you and 6 lac over and above the deductible of 2 lac will be borne by us..

Reply

ravi says

July 26, 2015 at 3:11 PM

As you said, Care policy is treated as separate from Enhance policy, but suppose that I or

my wife incurs a medical expense of say Rs.8 lakhs for hospitalisation, can I can claim Rs.5

lakhs from the Care policy, and the balance Rs.3 lakhs from the Enhance policy? This is the

idea of the Enhance policy, is it not, as a top-up policy?

Ravi

Reply

Basavaraj Tonagatti says

July 26, 2015 at 5:54 PM

Ravi-In case the claim amount is less than sum insured then there will not be any

problem. You can approach any insurance company (in your case policy) and settle the

claim. However, if the claim amount is more than sum insured then insurance

companies may raise the Contribution Clause will come into picture and insurance

companies settle the claim based on the sum insured to % of cliam amount.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

13/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

ravi says

July 26, 2015 at 6:40 PM

thanks, but in the situation that I have mentioned, the claim of Rs.8 lakhs will

exceed the Rs.5 lakhs of our Care policy, so can the balance of Rs.3 lakhs be

claimed against the Enhance policy, since Deductible in Enhance policy is Rs.5

lakhs, and this Rs.5 lakhs I will claim against my Care policy.

This is basically what I would like to know.

Ravi

Reply

Basavaraj Tonagatti says

July 26, 2015 at 7:09 PM

Ravi-Yes, you are right. But I still suggest you to confirm this example with

Religare. Because whether Enhance deductible of Rs.5 lakh is treated on

whole claim amount of Rs.8 lakh or the left out claim amount (post claim

settlement from Care i.e Rs.3 lakh). If they consider on whole claim amount

then you can get it from Care and rest Rs.3 lakh from Enhance. However, if

enhance policy considered only Rs.3 lakh as claim amount which they need to

settle then they may turn up the claim stating that Rs.3 lakh will come under

deductable amount.

Reply

Sudhakar says

July 18, 2015 at 2:24 PM

Hello Sir,

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

14/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Please suggest me a best Health insurance plan & company for coverage of my entire family??

Me-27 years

Spouse-23year

My Son-8 months

My father-55 years

My mother-46 years old,

Sir pls Can you help me guide on which policy can be benificial?

Reply

Basavaraj Tonagatti says

July 18, 2015 at 7:16 PM

Sudhakar-In my view, better to separate your parents from you three. Let them have separate

insurance. One more insurance for you, wife and a kid. For this, I suggest to check out with Star,

Apollo, Religare, National, New India.

Reply

Sudhakar says

July 20, 2015 at 5:08 PM

Sir,

Please suggest me a best Health insurance plan & company for coverage of my parents??

Reply

Basavaraj Tonagatti says

July 20, 2015 at 8:44 PM

Sudhakar-First understand the requirement based on my earlier post Best Senior

Citizen Health Insurance in India-Product Comparison and then decide which is

BEST.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

15/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

anindya ghosh says

July 17, 2015 at 11:25 PM

Basavaraj jee, I am continuing my mother health insuarance poliicy for last 6 yrs, with star healh red

carpet, she is 73 yrs old. Can the policy claim still be rejected saying p.e.d and suppression of material

fact?

Reply

Basavaraj Tonagatti says

July 18, 2015 at 7:25 PM

Anindya-It hard for me to say that they not reject. But at the same time, if you are with them

since 6 years, I feel they not reject (again it depends on case to case).

Reply

Kp says

July 11, 2015 at 6:17 PM

Hi,

I want to buy a health insurance for my family(me,wife and 1 child). My and my wifes is age 31 and

child is 3 year old.

I have already a corporate health plan of 3 Lac SA which is provided by Employer. But I want to take

a personal one which i want to continue with whole life. I am living in Ghaziabad UP.

I have lot of confusions for choosing a Health Insurance company

1. Which Company i need to choose? like Public or Private

2. If answer is Private comp, which is best one?

3. What should be sufficient Sum Assured?

4. If i will take a plan from private comp and after some years comp shutdown their health insurance

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

16/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

unit.

in this case can i continue my plan with other company OR I need to buy a fresh plan.

Thanks in Advance.

Reply

Basavaraj Tonagatti says

July 12, 2015 at 12:45 PM

KP-1) In my view both are same. 2) NA 3) Ideal sum insured in case of health insurance must be

around 50% of your yearly income. 4) Yes, you can move to public sector companies using

portability option.

Reply

siva says

July 11, 2015 at 10:37 AM

hello bro,

Im 37yrs old and my wife 32 yrs we have 2 kids 3months old. pls suggest a best insurance plan for

my whole family. I want 2 to 3 lahks cover. with critical illness rider and policy should be renewable

to life long or maximum age. thanks. pls reply.

Reply

Basavaraj Tonagatti says

July 11, 2015 at 1:02 PM

Siva-Insurance is required on you but not on your wife (is she is not working) and in kids name.

Ideal insurance coverage must be around 15-20 times of yearly income. Now think how much

you need.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

17/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Jai says

July 11, 2015 at 9:07 AM

Hi basu

I had national family floater 5 lac for last 5 yrs. I want portability to Apollo munikh optima restore 10

lac as I cannot increase my sum insured with national policy. But 1 yr back I got some ear surgery

and my son had some kidney disease 3 yr back which is now cured. These diseases were not there

when I had purchased national policy and I got claim for these two.

My question is that if do portability to Apollo ..these two will be preexisting disease.if I need any

claim for these two disease in future..will Apollo give claim..their customer care say Apollo will cover

these after portability as I am having previous running policy for 5 yrs..

Will it be ok or Apollo will look any excuse to cancel claim

Should I make it portable or keep these 2 policies for 3 years so that I take claim form national for

these 2 diseases

and then leave national ..after 3 yrs Apollo will in any case cover these

Kindly suggest

Thanks

Reply

Basavaraj Tonagatti says

July 11, 2015 at 1:09 PM

Jai-Yes, apollo give claim and what they are saying is correct.

Reply

Deepak says

July 3, 2015 at 5:15 PM

Hi,

Please suggest me a best Health insurance plan & company for coverage of my entire family me, my

wife and my parents?? Thanks.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

18/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Basavaraj Tonagatti says

July 3, 2015 at 6:24 PM

Deepak-What are your requirements?

Reply

Subhasish says

July 2, 2015 at 10:33 PM

Hello sir

I have purchased the heath insurance from religare i.e. Care for a sum insured of 5 lakhs. My age and

my spouse age are 25 each. My question is when shall i consider increasing the sum insured ?

Both health condition are absolutely fine.

Also whether my decision is right to go with religare?

Reply

Basavaraj Tonagatti says

July 3, 2015 at 11:02 AM

Subhasish-You can consider increasing sum insured at the time of next premium payment.

Reply

Subhasish says

July 6, 2015 at 3:51 PM

Actually i am covered under corporate insurance, so i decided to go for a lesser sum insured

plan.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

19/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Basavaraj Tonagatti says

July 6, 2015 at 6:44 PM

Subhasish-Ideal insurance cover must be around 50% of your yearly income. If both

the corporate and Religare combining cover is that much then no need to increase.

Reply

Sri says

July 1, 2015 at 2:00 PM

Hello Basavaraj

I follow your blogs actively. For health insurance, it is important to also share with the readers that

the premium increases over time. This is based on my analysis of the Apollo Munich and the ICICI

Lombard proposals. The premium table (as stated by the agent) is fixed when you take it for the first

year for the insured amount and so the consumer has to pay higher premium when they move into

the next bracket as they age. This is unlike a term insurance where the premium remains fixed over

the period of coverage.

It is likely that people end up paying an annual premium of Rs. 1 lakh for a coverage of Rs. 5 Lkahs.

Thanks

Sri

Reply

Basavaraj Tonagatti says

July 1, 2015 at 3:36 PM

Sri-Yes, it is known fact. Because loading will be based on age bracket the proposer or insured

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

20/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

fall.

Reply

Sujit Roy says

June 28, 2015 at 4:59 PM

Hello,

I need your help for choosing a good health policy for me and my wife. I am 32 and my wife is 26. We

dont have any critical illness and any hospitalization before. Can you suggest me a good health policy

in terms their easy claim settlement and less premium. I need 4 lacs sum assured policy.

Thank you in advance

Reply

Basavaraj Tonagatti says

June 29, 2015 at 11:56 AM

Sujit-You can check with Star, Apollo, Max or Religare.

Reply

sambhu n jha says

July 2, 2015 at 5:21 PM

Sujit, for you couple you can try best in terms of maternity claim settlment and ped coverage

you cna try national teller made plan

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

21/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Ashraf says

June 26, 2015 at 12:39 PM

Hello,

I want to buy Health Insurance for my Parents. Father Age 65 & Mother Age 60.

Please suggest which Insurance Provider is best like: Star or Religare or any other option?

Reply

Basavaraj Tonagatti says

June 26, 2015 at 3:26 PM

Ashraf-Check first with public sector companies.

Reply

sambhu n jha says

July 2, 2015 at 5:25 PM

you must go with govt companies i.e oriental, national

Reply

Ravi Aswani says

June 25, 2015 at 4:51 PM

Great, thanks a lot Basavaraj for speedy reply on my earlier query!

Could you also suggest for below:

1. Is critical illness better from Apollo, as it covers more no. of deseases? Or do you suggest some

other company?

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

22/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

2. I have plan to take a total LI term cover of 2 Crores, out of which I have already taken 1 Cr. term

cover of Aegon Religare and am planning to take 2 more insurers policies of 50 Lacs each to

diversify. Could you please suggest which are better ones, considering low premium and better claim

settlement ratio?

3. I have taken a personal health cover of 5 Lacs (Family Floater) from Religare (Care, Super NCB)

policy due to its good features, especially Super No Claim Bonus (Super NCB) and recharge feature

wherein SI is doubled if base cover exhausted. Hopefully this is good?

Thanks.

Br, Ravi

Reply

Basavaraj Tonagatti says

June 25, 2015 at 6:07 PM

RAvi-If you feel it covers more illness then go with Apollo. Why not the further insurance from

Aegon? I feel no logic in splitting your sum assured. I too have my health insurance with Religare

Reply

Ravi Aswani says

June 25, 2015 at 3:04 PM

Hi Basavaraj,

Thanks for sharing this valuable information. Could you please suggest which personal accident policy

is better out of Apollo and Bajaj. Else, would you like to suggest any other better than these two?

Is personal accident cover included in the health policies itself for companies (from statistics

perspective) as I could not find Personal Accidental policy statistics from IRDA site? Thanks in

advance.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

23/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Best Regards,

Ravi Aswani

Reply

Basavaraj Tonagatti says

June 25, 2015 at 3:14 PM

RAvi-I prefer Bajaj.

Reply

Raj Mehra says

June 25, 2015 at 1:50 PM

i want to take health insu. plan for my parents in which OPD should be cover.

my father is 54 yrs. and mother is 49 yrs old. There is no nay pre-existing condition.

i want to take 5 lacs cover for both. within 15-20 thousand,but not should be expensive more than

20k.

Please suggest me from which company i shoud take.

Thanks

Reply

Basavaraj Tonagatti says

June 25, 2015 at 2:03 PM

Raj-No insurer will offer you and cover the pre-existing diseases.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

24/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

sambhu n jha says

July 2, 2015 at 5:15 PM

Dear Raj, there is no any company whcih can wave you off ped waiting periodfo 4yrs and 3yrs .

but if you talk about opd you can try with icici lombard,star health ,cigna .

but i would suggest you also try for medhealth opd cards basically of opd only

Reply

Ashish m says

June 24, 2015 at 6:59 PM

Can you tell me which is the best between RD & FD

Reply

Basavaraj Tonagatti says

June 25, 2015 at 1:49 PM

Ashish-Both are meant for different usage. RD can used for monthly or quarterly investment.

Whereas, FD for one-time investment. Therefore, it is hard for me to say which suites to you.

Reply

Akshay says

June 22, 2015 at 2:17 PM

hi ,

I am 60 years old , planning to buy health insurance plan for me and spouse from any of nationalized

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

25/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

banks health insurance products.

Can you please suggest is Andhra banks AB HEALTH Insurance product good to buy?

Reply

Basavaraj Tonagatti says

June 22, 2015 at 3:24 PM

Akshay-Andhra Bank is not a General Insurance company.

Reply

Ashish m says

June 24, 2015 at 6:40 PM

Which is the best health insurance,

Private Or Public Sector.

Reply

Basavaraj Tonagatti says

June 25, 2015 at 1:49 PM

Ashish-Both.

Reply

SHAMBHBU says

June 23, 2015 at 4:07 PM

yOU CAN BUY NATIONL TELLER MADE POLICY WHERE PED WHOULD BE COVERED

AND PREMIUM WOULD BE VERY LESS IN COPMPARISON OF OTHER HEALTH

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

26/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

INSURANCE COMPANIES

Reply

Vaibhav says

June 21, 2015 at 6:38 PM

Hi

My retired parents have taken OBC mediclaim or 5 lacs in 7k. But i think limit is less ,especially 1%

sublimits

Please advise another policy of 5-10 lacs. We are most worried about claim settlement

Reply

Basavaraj Tonagatti says

June 22, 2015 at 4:00 PM

Vaibhav-You can check first with public sector companies.

Reply

SHAMBHU JHA says

June 23, 2015 at 4:12 PM

iF WORRIED ABOUT CLAIM SETTLEMENT PLEASE YOU CAN CONSIDER l&t,cIGNA,mAX

AND ICICI,AND IN PUBLIC SECTOR NATIONAL AND ORIENTAL

Reply

RAJESH SHETH says

July 18, 2015 at 4:26 PM

I want no which company is best in health policy ICICI Lombard or Religar .

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

27/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Basavaraj Tonagatti says

July 18, 2015 at 7:15 PM

Rajesh-I personally feel Religare offers more features than ICICI.

Reply

meena says

June 18, 2015 at 12:12 PM

Hello Sir,

I want to take policy for me and my husband.We both are diabetic and below 30 yrs.

pls suggest we want to take health cover.We both diagnosed this disease bcoz of some financial

problems in family.can u pls suggest best for us.

Companies cover pre existing disease after 3 yrs thats no problem for us but they need to take

medical of us if we mentioned diabetes in this age medical they take ???

if any company covers after 36 mnths & 48 mnths we are ok with that but the claims we get

afterwards if any complications arise

As u know diabetes are not having complications in early ages if we hide and we need claim after 10

years then how company willa ble to diagnose etc..

but we want to be honest but good claim settlement.Pls suggest your approach in our case.

waiting your valuable feedback.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

28/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

June 18, 2015 at 12:23 PM

Meena-I suggest you to check with first through public sector companies. In private sector, my

recommendations are Apollo, Religare or MaxBupa. I personally have insurance with Religare.

Reply

Pal says

June 22, 2015 at 3:17 PM

Dear Basavaraj Tonagatti,

you must check the claim settlement ratio of religare, I am not commenting you, please

check it, it have lowest claim settlement ratio. also never recommend apollo munich to any

customer its a fraud company, Apollo Munich can increase premium any time according to

there policy wording in addition to age group. recently they have increased the premium to

40% and at your age of 50yrs the premium of customer will be rs 2.7lakhs for sum insured

of Rs 3Lakhs, Always ask your customer to buy health insurance from public sector

insurance companies like oriental, new india, united and national if you are really a good

financial planner.

Reply

Basavaraj Tonagatti says

June 22, 2015 at 3:20 PM

Pal-How efficient are these PUBLIC SECTOR biggies when it comes to responding to

emergencies? I know how they behave. Regarding Apollo, if the feature of plan

matching you and the claim is within purview of the insurance contract then even GOD

cant stop. Please note that, claim incurred ratio is not a single criteria to select a

product.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

29/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

SHAMBHBU says

June 23, 2015 at 4:08 PM

yOU CAN CAN TRY FOR CIGNA AND ROYAL SUNDARAM .IF THEY WILL REJECT THEN

LAST OPTION NATIONAL TELLERMADE

Reply

SHAMBHU JHA says

June 23, 2015 at 4:15 PM

mEENA U CAN TRY WITH CIGNA ,l&t ,rOYAL sUNDRAM,AND NATIONAL TELLER MADE

Reply

Gaurav Gupta says

June 12, 2015 at 2:33 PM

Hi,

Thanks for nice blog.

Want to confirm if executive of any company make a false commitment and make us to buy policy. Is

he doing the violation of IRDA rules and do we have any chance to challenge the company based on

this fact.

Notable thing is, every time conversation is on Recorded line but that is for company only. consumer

dont have any access to that.

Reply

Basavaraj Tonagatti says

June 12, 2015 at 7:06 PM

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

30/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Gaurav-If you have valid proof then you can go ahead and compalin. But the problem is, in most

cases you fail to produce the proof.

Reply

Jai says

June 3, 2015 at 11:18 AM

Dear basu. I have corporate medical insurance of. 5 lac from new india insurance and a family floater

policy from national insurance for 5 lac ( one member can use only 2.5 lac ) .i want to add topup to

these. I have shortlisted apollo Munich but then all policies will be from different cowill it be

problematic at time of claim if I need claim from two co. Will it be more useful to take topup from new

india co itself ..

In top up policy if claim is rejected by first company ( like new india, national ) then the company

which is supposed to pay the topup ( like Apollo munikh ) above certain sum will reject rest of sum of

topup or will always pay the topup irrespective of first company

Thanks

Reply

Basavaraj Tonagatti says

June 3, 2015 at 1:36 PM

Jai-For comfort and ease better to use the same insurer. However, it is not mandatory to hold

both under one insurance company. Because what if you change job and new company not

offering the insurance with New India? It is your comfort with a company that matters.

Regarding rejection, they may or they may not. Because it is purely a decision based on case to

case.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

31/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Pal says

June 13, 2015 at 12:55 PM

Dear basu and jai,

never buy insurance from any private company specially from Appollo Munich, these companies

always hide required information from customer, Appollo Munich have increased the premium

recently upto 40% by taking permission from IRDA, and according financial planners for a sum

assured of Rs 3 lakhs at age of 60yrs the premium will be as below

according to company after every 3 yrs (may be every years according to policy terms) apollo

munich will increase premium to 40 % and let us make calculations for sum assured of 3 lakhs at

age of 33 yrs premium is 10000/- approx, if ur aspect-ed age is 80 years

total number of yrs for premium 80-33= 47 years

total number of times premium increases 47/3= 16 times

premium increases 1st time 40%> 10000@40%= 4000/- total premium of next 3 yrs=

4000+10000=14000/and 2nd time increase in premium 14000*40% =5600/- total premium of next 3 yrs=

5600+14000=19600/and soon upto 16 or 17 times in ur life

in addition to this regular premium increase according to age group 36 to 45=5000/46 to 50=7000/50 to 55=23000-/56 to 60=32000/61 t0 65=70000/Now gross premium paid by you at age of 36=4000+10000+5000=19000/after 3 year with 40% increase in premium to 39 5600+14000+7000=26600/and so on.

at age of 60 years ur gross premium will be= 2.7 lakh for a sum assured of Rs 3lakh and at age of

75yrs premium will be 6 lakhs for sum insured of rs 3 lakhs

this is how apollo munich optima restore plan lot the Indian people by a other country company

and also optima restore option will not act effectively at that age and no other company will give

u an option to by any other plan.. its premium increases exponentially after age of 45 years

Reply

Basavaraj Tonagatti says

June 13, 2015 at 1:30 PM

Pal-Premium will increase based on the age slab (irrespective of companies). Apollo may

have some different slab. But fixing the premium is entirely the company decision.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

32/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

SHAMBHU JHA says

June 23, 2015 at 4:22 PM

Dear BAsu What i would suggest you can try Super toup of L&T ,cigna or i.e. royal which is

unique in industry.

And one thing if your base company rejects any claim then also you can not claim from topup

also

Reply

sudhadar says

June 1, 2015 at 11:26 PM

sir

i want to purchase a health insurance policy for 5-6 lakhs. which company should i prefer public

sector or private sector. name some good companies and policies

Reply

Basavaraj Tonagatti says

June 2, 2015 at 10:28 AM

Sudhadar-To me all are good companies. Hence, first understand your requirement like apart

from sum insured what other features you are looking, premium budget and comfort with a

company.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

33/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

SHAMBHU JHA says

June 23, 2015 at 4:25 PM

You can go for ICICI Lombard health smart,max health companion,cigna plus,royal supreme

Reply

sakshi says

June 1, 2015 at 12:08 AM

Mr basu I would like To tell you that max bupa company has permanently excluded ulcerative colitis

and crohns disease.Im really shocked that max bupa has permanently excluded ulcers in large

intestine. I have read this thing in their policy wordings and they are saying that these are genetic

disease.but when I visited mayo clinic website there it is written ulcerative colitis often occurs to

those who do not have this disease in their families.max bupa is clearly violating the terms and

conditions of irda

Reply

Basavaraj Tonagatti says

June 1, 2015 at 10:48 AM

Sakshi-May I know which terms and conditions of IRDA is MaxBupa violating?

Reply

pradipta says

May 31, 2015 at 10:31 PM

Hi Basu,

I am a IT professional and have 3 lakh mediclaim policy from employer.I want to take another super

top up policy(family floter 2+2) 3 lakh deductible with more than 7 lakh sum insured.I know how

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

34/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

topup and super topup policy works. I choosen United India(SUPER TOP UP MEDICARE POLICY)

and L&T (Medisure SuperTopUp policy). L&T offering little less premium than United India.Also

offering pre and post hospitalization.But pre and post hospitalization is not covered in United indias

case.Even in L&T case, 12 lakh sum insured possible with low premium.

But as per your chart, United india has better claim and revenue than L&T. Is govt company is better

than private? L&T has coomited to give better response at the time of claim settlement.But I doubt

about Gove case.

Could you please review these two policies and guide me which one is better. I am looking for only

super top up plan.

Thanks,

Pradipta

Reply

Basavaraj Tonagatti says

June 1, 2015 at 10:49 AM

Pradipa-When it comes to service, then private players always respond lately. Hence, if that is

your core concern, then I suggest to go for L&T.

Reply

pradipta says

June 30, 2015 at 11:21 PM

Dear Basu,

I want to share one incident with all the readers.

Recently I wanted to take super top hearth policy, so I approached many companies and

finally decided to take from L&T health insurance for 3 lakh deductible to 12 lakh sum

insured. They approached many times.

When I declared that my wife has preHypertension for last 1 year and no issue as of now,

they told to take medical test. After that when I agreed and asked them to schedule the

test, I did not get any answer from them, even they didnot replyed my mail. So they want

only healthy person to take insurance.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

35/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

So in this case what we can do.?So Im thinnking, i will not declare anything now, and declare

after 3/4 years of continuous renewal that i am suffering from that disease since last 1 year.

As there is no alternative.

Thanks,

Pradipta

Reply

Basavaraj Tonagatti says

July 1, 2015 at 10:27 AM

Pradipta-Is it right from you to hide only because they avoided the business of risky?

Let them not approach you, but you can approach and submit the proposal. If they

reject the proposal then let them provide valid reasons for that. If they are doing

wrong then why you too doing wrong by hiding the medical conditions? It may cost you

in different way. Please dont do.

Reply

ramreddy says

May 23, 2015 at 2:48 PM

hi,

i would like to take a health insurance policy for my family. myself, wife and my baby of 1 year old. i

would likr to inform that my baby was born with one kidney and he is fine . will i be able to add him in

the health insurance policy, will it be considered PED.kindly clarify

regards

Ramreddy

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

36/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

May 23, 2015 at 8:57 PM

Ramreddy-This is unique case, I suggest you to discuss the same with insurance company.

Reply

SHAMBHU JHA says

June 23, 2015 at 4:27 PM

You can try with cigna and Royal

Reply

Aakash says

May 22, 2015 at 8:25 PM

A very good article. I was looking precisely for claim settlement ratio but incurred claim ratio is an

added bonus. Im personally looking to migrate from New India Insurance health policy.

Looking at this , i believe one should take into consideration is incurred claim ratio. It should ideally

be between 80-90%, anything more than that and there would be chances of premium being

increased in the future years.

Reply

Rajeev says

May 18, 2015 at 5:40 PM

Hello Sir,

I am at the age of 36 going to have family floater (2A + 2C )from Max.

I am having slightly hypothyroidism which is under controlled due to medicine and did not have any

issue because of it at present.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

37/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

I used to take tobacco 2 years back but quitted since 2012.

Please suggest me should I disclose Under Active Thyroid and Tobacco consumption to insurer

before taking health insurance or this will automatically treated in PED?

Should I avoid to disclose?

Does premium will increase if tell them?

Kindly suggest me

Reply

Basavaraj Tonagatti says

May 18, 2015 at 5:45 PM

Rajeev-Better disclose it. However, I am not sure whether they increase the premium or not.

Reply

Rajeev says

May 18, 2015 at 6:20 PM

Thanks for getting back to me.

Just one clarification sir.If someone hide it and disease occur due to hidden fact but after 5

years, ( after PED waiting time) then also insurer can raise issue?

Reply

Basavaraj Tonagatti says

May 18, 2015 at 6:49 PM

Rajeev-In theory no, but in practical insurers look for reasons to reject the claim

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

38/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Sanchita Ganguly says

May 15, 2015 at 10:56 PM

I have medical insurance from New India Assurance. I have a coverage of 2 lakhs. I am 43years now,

and want to buy a super top up plan for myself. for 10 15 lakhs. Please advice which one I should go

for.Thank You.

Reply

Basavaraj Tonagatti says

May 16, 2015 at 11:43 AM

Sanchita-New India Assurance offers this plan. You can buy from them.

Reply

RamaKrishna says

May 15, 2015 at 1:01 PM

Hello Sir,

I am 32 , married and i have a kid. I already (since 2009 Mar) have a term policy of tata aia for 20L

and a ULIP of 18 lakhs. Also, i have a health insurance policy of 3L from Apollo Munich since 2012

Nov.

I am diagnosied with Asthama 2 years back. Now, i want to close the existing policies and take fresh

policies of term plan to 1 cr and health insurance to 10L. I want to disclose my health condition but i

am not sure if insurance companies are going to decline the policy. Please suggest. Thank you very

much for your suggestion !

Thanks,

Rama

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

39/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

sakshi says

May 14, 2015 at 6:46 PM

Mr basu u r a promoter of religare health insurance company

Reply

Basavaraj Tonagatti says

May 14, 2015 at 6:51 PM

Sakshi-Not at all. Because if I promote or not, I will not receive any benefit from that.

Reply

Jai says

May 7, 2015 at 2:01 PM

Hi

In continuation with previous question If I add some other policy to national family floater and keep

both..if at any time my hospital bill cross limits of one policy.. Can I get rest of billing from other

company

How bills are divided if there r two policies and bill crosses limit of policies individually.

Thank you in anticipation

Appreciate urs help

Reply

Basavaraj Tonagatti says

May 8, 2015 at 8:50 AM

Jai-You can claim. Initially, you approach one company for the claim. Once they approve the

claim then take the photocopies of bills and settlement summary and submit it to another

insurer for approval of remaining cost. Otherwise, you can inform to the hospital about your

multiple insurance companies. Hospital will send the request for approval to all insurers and

accordingly it will be settled directly with the hospital.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

40/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Jai says

May 7, 2015 at 1:40 PM

Hi

I have parihar mediclaim family policy from national insurance for myself 41 yr wife 35 yrs two

sons 8 and 5 yr for sum of 5 lac. I find it inadequate. I have this policy for 5 yrs. if I want to shift to

some private insurance co or some other govt insurance co ( who give more sum assured like oriental

for 10 lacs )will the benefits accrued after 3 yrs of policy will be granted to me in new policy or not.

If I take policy from national itself for all members individually ..will the same benefits be granted to

us.

How many companies offer 1 adult + 1 child type policies..will these better if I need higher insurance

cover

Thanx

Jai

Reply

Basavaraj Tonagatti says

May 8, 2015 at 8:53 AM

Jai-First check for moving to the different plan in National only. In that case your existing

benefits will get transferred to the new plan. Otherwise, you can use portability option to move

from National to the different insurer.

Reply

Sunny Jain says

May 5, 2015 at 7:03 PM

Hi,

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

41/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

I was looking at Religare, TTK, Max and Apollo.. and all of them looks good to me Can you please

suggest me one..

Is there any advantage of public sector companies like national.

I have only one requirement.. Company which settle claims and the process is simple

Reply

Basavaraj Tonagatti says

May 6, 2015 at 10:14 AM

Sunny-Go with Apollo, Max or Religare (I am not aware about TTK). There is no advantage. But

in case of settlement they may be bit generous.

Reply

T janakiraman says

April 29, 2015 at 3:42 PM

We are having health insurance at new india assurance myselfage31 father64mother55for 3 lake each

with accumulated bons 30000 each now I feel new India peri mum is high I want to change company

for the fast 10 years with new India so tell me which one best in public sector pls mail me thank u

Reply

Basavaraj Tonagatti says

April 29, 2015 at 5:39 PM

Janakiraman-I suggest to continue with same insurer.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

42/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Sunendra says

April 27, 2015 at 12:29 PM

Hello,

I need health insurance coverage of my parents (father age 65 yrs & mother age 59 yrs). please

advise options of good and best health plans and scheme.

Regards,

Sunendra

Reply

Basavaraj Tonagatti says

April 27, 2015 at 6:37 PM

Surendra-I request to go through my earlier post Best Senior Citizen Health Insurance in

India-Product Comparison.

Reply

Sreenivasulu says

April 24, 2015 at 12:53 PM

Dear sir as per claim ratio and services and future of policy which is better please send reply from

these below companies Apollo, Cignattk, Marbury, Star health and Riligare

Reply

Sreenivasulu says

April 24, 2015 at 12:54 PM

Apollo, Cignattk, Maxbupa, Star health and Riligare

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

43/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

April 24, 2015 at 5:11 PM

Sreenivasulu-I prefer Apollo, Star and Religare. I am not aware about Cigntattk.

Reply

Sreenivasulu says

April 25, 2015 at 6:56 AM

Dear sir, please send reply immediately I want term insurance policy which is better for claim

ratio and services and low cost premium my age 37 and I want term maximum how much is

there that requires and give priority 1to 6 Companies sequence give names and please send

reply THANQ Sreenivasulu

Reply

Basavaraj Tonagatti says

April 25, 2015 at 8:52 AM

Sreenivasulu-You can go with LIC, HDFC, LIC, SBI, Max, Bajaj enough?

Reply

Suresh says

April 10, 2015 at 5:21 PM

Hi

My father age is 72 Years old kindly advise for if any medical policy available either for his. or

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

44/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

attached with my family flotter plans.

Regards

Suresh

Reply

Basavaraj Tonagatti says

April 10, 2015 at 6:02 PM

Suresh-You can opt National Insurance.

Reply

Kaushik says

April 6, 2015 at 3:31 PM

Hi,

Great article.

Can you also help me with my query: I need to buy health insurance for my father (age 69 years) and

mother (age 58). Which policy would you recommend for a SI of Rs 3 lacs each.

Thanks,

Kaushik

Reply

Basavaraj Tonagatti says

April 6, 2015 at 6:05 PM

Kaushik-You can check with Star and Apollo senior citizen plans. If you need lesser sum

insurance then go for National Insurance.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

45/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Bappaditya Mondal says

April 7, 2015 at 6:20 PM

HI Basavaraj,

First of all thanks for sharing such useful article.

I have gone through your other comments based on people queries.

I am a bit confused here. As you said in your article higher the incurred claim ratio then it

is good for you. From the above table Apollo Munich is having 65.59% of ICR where as

Oriental is having 115.23 %. But for few people you suggested to go for Apollo Munich. Can

you please elaborate the reason behind it. And If I want to take a new health policy, which

one should I go for. I dont have any issue with a higher premium, but I need the best claim

settlement and service.

The second part is , My wife is a Cancer survivor. Four year back She got diagnosed with

breast Cancer. Its god grace that it was in very initial stage. We did the complete treatment

in Tata Memorial and now she completely cured. Last three years there is no re-occurrence

of cancer and she is not going under any medication. Is any Health policy available for her .

(I asked almost all insurance company, but everyone denied tough even I am fine with the

waiting period)

Waiting for your earliest response

Thanks

Bappaditya

Reply

Basavaraj Tonagatti says

April 7, 2015 at 7:47 PM

Bappaditya-I recommended Apollo based on the requirment and looking at the

features of plans. Do remember that, considering incurred claim ratio for plan selection

is one creteria but not the sole creteria. Hence dont look too much on this data. There

may be many reasons for hospitalization and there may be many reasons for

rejections, which not known to us. Hence if the plan suites to you and premium within a

budget then go ahead. Regarding your wifes insurance, check with public sector

insurers than private insurers. I am not sure who issues. Because it is purely a decision

of insurers.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

46/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Mohan says

April 21, 2015 at 9:42 AM

Hi Basavaraj,

I want to a family floater health policy pls. suggest any best policy,how is HDFC

Ergo based on service and claim?

Reply

Basavaraj Tonagatti says

April 21, 2015 at 11:00 AM

Mohan-You can go ahead with HDFC. No issues.

Reply

Anil lohia says

April 25, 2015 at 7:42 PM

Dear ,

In Health Insurance Sector claim ratio means the profit and loss of the company.

the higher it is, the higher the loss.

it is just opposite of the Life Insurance Companies.

please buy a policy from the company which has lower claim ratio.

Regards

Anil Lohia

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

47/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

April 26, 2015 at 1:13 PM

Anil-You mean to say the company the company which settles higher claims and

be under loss is not good? In that case all Public Sector companies are totally BAD

for you right?

Reply

Abhishek says

April 3, 2015 at 9:55 AM

Hi Basu,

Thanks for sharing such a valuable article.

Looking for a health insurance plan for my Father(63) and mother (57). I have selected floater

Religare Health insurance Pan due to some of its unique features like no sub limit on Room and ICU

charges, Auto recharge of the policy Sum Insured if exhausted,No Claim based loading ever & Get

Lifetime renewability,Get health check-ups for insured members every year.

I am concerened with its low Incurred Claim ratio as compared with PSU and some private

companies having TPA.Also have seen lot of negative reviews abouth Religare during claim

settlement.Whats your take on this?

Looking for Company having hassle free cashless treatment and smooth claim settlement when its

required.

Which is better option to buy a Policy ,to buy policy through company itself of through financial

website like PolicyBazar,etc.

Please guide me.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

48/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Basavaraj Tonagatti says

April 3, 2015 at 11:39 AM

Abhishek-I have policy with Religare. Better to go directly to Insurance Companies. I dont

believe neither financial websites nor policybazaar.

Reply

NKP says

April 3, 2015 at 6:20 PM

Dear Abhishek

I had also almost finalised a religare policy for parents (aged 57 & 54) . All other features are

good compared to other companies. Only shortcoming is Religare doesnt cover the cost incurred

towards prosthesis. I dropped religare at that point of time. These days after 50 years, knee/hip

joint replacement are not uncommon. Cost of prosthesis is very high.

Take a decision based on family history.

Reply

NKP says

April 3, 2015 at 6:36 PM

Dear Abhishek

You please download the policy wording from Religare website and go through it word-byword. It make take some time but its worth doing.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

49/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Raghavendra says

March 31, 2015 at 4:36 PM

Dear Basavaraj,

I am a 30 year old software engineer working in bangalore. I dont have any pre-existing illness.

Below are my existing policies:

Oriental Family Floater Silver Plan (Myself, Spouse and My Mother) : Sum assured of 6 Lakhs

HDFC CLick to Protect Plus Term Insurance (Myself) : Sum assured of 1 crore

I am thinking of going for a critical illness plan for myself and policy bazaar recommend me Religare

Assure and after reading the product brochure it sounds good.

Could you please suggest me can i rely upon Religare Assure or should i go for Max Bupa or Bharti

Axa?

What sum assured should i go for or how do i know how much sum assured i should go for?

Should i go for Individual/Family when it comes to critical illness?

And finally am i insured sufficiently with my existing insurance portfolio or do you recommend any

other extra add on to my insurance portfolio?

Many thanks for your assisstance in advance

Thanks and Best Regards,

Raghavendra P

Reply

Basavaraj Tonagatti says

March 31, 2015 at 5:56 PM

Raghavendra-If Religare plan features attractive to you then go ahead. How much you need and

whether the current life and health insurance are suffice or not depends on many things. So I

cant say in one word. Better you buy family floater critical illness cover.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

50/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

prasanna says

March 30, 2015 at 10:18 AM

Hello Basavaraj,

In 2014 article (http://www.basunivesh.com/2014/05/12/best-health-insurance-companies-inindia-based-on-irda-data/) you tabulated the health insurance based on Individual/Family/Group.

My question is what does the above table ICR specify for Individual/Family/Group?

Because i see Religare ICR is 67.8%, 70.23% & 108.61% respectively for Individual/Family/Group.

This variation is huge for HDFC ergo.

~Cheers

Prasanna

Reply

Basawaraj says

March 28, 2015 at 10:30 AM

Dear Mr.Basavaraj,

I , Am 37 Years Old , Looking For A New Medical Insurance For Me And My Family. Wife Is 33 Yrs

And Son 5 Yrs. Looking For A Cover Of Around 10 Lakh Rupees. I Have Zeroed In On Religare- Care

, Star- Optima , ICICI Complete , And Max Bupa Heart Beat( Its Expensive). Could U Please

Suggest Which One is Better. Many Thanks In Advance.

Basawaraj Tegnoor.

Reply

Basavaraj Tonagatti says

March 28, 2015 at 2:12 PM

Basawaraj-I prefers Religare and Apollo.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

51/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

shweta aggarwal says

March 23, 2015 at 2:20 PM

i have checked the claim settlement ratio and claim incurred ratio of new india assurance. both the

percentages are very good.

Reply

pradeep says

March 22, 2015 at 12:20 AM

Mr basu you will yourself know that religare never replies for customer queries .totally inefficient

staff

Reply

Basavaraj Tonagatti says

March 23, 2015 at 1:25 PM

Pradeep-But in my case it is not like that

Reply

pradeep says

March 22, 2015 at 12:16 AM

Mr basu u have purchased your health policy from religare .if u go for hospitalization they will never

pay u

Believe my words

I wish u get your claim when u are in most need of money

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

52/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

March 23, 2015 at 1:26 PM

Pradeep-In my case no such bad experience.

Reply

vishal says

March 28, 2015 at 10:18 PM

brother you are very rite chor hai sale kutte. mera 73000 ka claim reject kr dia or no reply

Reply

Basavaraj Tonagatti says

March 29, 2015 at 8:46 AM

Vishal-Please use a proper language. I will not allow such harsh words.

Reply

Mahi says

March 19, 2015 at 1:31 AM

Hi Basu,

Very Interesting blog.

I have a 6 Lakhs cover from Reliance General Insurance and I liked their services so far.

In none of your blogs, I could read Reliance. Do you suggest to change from my existing insurer to

some other company.

Reply

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

53/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Basavaraj Tonagatti says

March 19, 2015 at 10:12 AM

Mahi-If you satisfied with their service then why to change?

Reply

Anirban says

March 14, 2015 at 6:16 PM

First of all thanks for such valuable information.

I am looking for a health insurance, Comparing with these three: Apollo Munich, Max Bupa and

Religare? Which One you recommend although i know you have Religare for yourself. But i am little

bit confuse about these threes claim settlement. My Age: 27, Wife:26. Lived in Gurgaon, Looking for

2lac Yearly Packages for two member. No pre existing diseases to both.

Regards

Anirban

Reply

Basavaraj Tonagatti says

March 15, 2015 at 8:35 AM

Anirban-But look at current year data at IRDA Incurred Claim Ratio-How to choose the best

health Insurance? and then decide

Reply

Kss says

March 27, 2015 at 9:57 PM

dont go for apollo munich,it cheats customers

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

54/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

Rahul says

March 3, 2015 at 5:36 PM

Dear Basavaraj,

Need a suggestion. I am 36yrs, planning to get a health insurance for myself for a cover of 5 Lakhs. I

am thinking to split the sum insured in half and go with 2 different company. One with Private player,

other with Govt firm. Reason being that govt players settlement/claim ratio is always higher than

private players, but at the same time private players have more better coverage for cashless

hospitalization. So basically putting money in 2 basket approach. Is this planning correct or better go

with one firm? In that case which one will be better govt or private.

Secondly Which private players you would suggest I have shortlisted ICICI Lombard But

premium too high; Religare dont know if its reliable + claim ratio very avg/low ; Apollo Munich

Claim Ratio again very very low.

Public player United Insurance ; Oriental.

Please help in the following matter.

Reply

Basavaraj Tonagatti says

March 3, 2015 at 7:28 PM

Rahul-I dont think it is wise to split. You can check with ICICI, HDFC, Bajaja, and the

companies you mentioned.

Reply

Rahul says

March 4, 2015 at 11:57 AM

So you are suggesting me to better go with a Private player. Any specific reason for that

(since this suggestion will really help me in purchasing, as I am about to buy a health

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

55/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

insurance today).

Secondly Religare settlement ratio is on the lesser side and thats a stand alone firm, will it

adviseable to purchase it.

Reply

Basavaraj Tonagatti says

March 4, 2015 at 3:17 PM

Rahul-I have not specified any particular company. First you must understand your

requirement, premium budget, company existence and service part. Then go ahead

with buying. I prefer standalone companies mainly because of expecting claims settled

at earliest.

Reply

Rahul says

March 4, 2015 at 10:29 PM

So this is where my problem of selection is coming. Premium is fine with me, but

service is a major aspect, where I am not getting that comfort with Public firm,

but then their claim settlement ratio is probably the best.

Now for example In private player, Religare is giving a product which is value

for money; but their sustainability in the insurance business is a question mark.

Whereas ICICI is a stable company, but their product has lot of loop holes.

So what should I do, please help.

Reply

Basavaraj Tonagatti says

March 5, 2015 at 8:16 AM

Rahul-A hint to go ahead

I personally have my insurance with Religare.

Because of its features, affordability and service they provided.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

56/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

Reply

atul dhumal says

February 23, 2015 at 8:14 PM

Hello ,

I want to take General Insurance agency ,with whom i can go New India Assurance or Religare.

Regards,

Atul

9595452646

Reply

Basavaraj Tonagatti says

February 25, 2015 at 3:37 PM

Atul-It is hard for me to suggest.

Reply

sunil says

February 21, 2015 at 6:58 PM

i would like to know your views on the following with regard to health insurance.

1. for a family of 4 (2adults and2 children), instead of taking a single family floater policy, would it be

wiser to go for 2 floater policies each for 1A+1C. logic is the chances of adults getting ill is more with

age.

www.basunivesh.com/2015/01/12/irda-incurred-claim-ratio-how-to-choose-the-best-health-insurance/

57/73

8/10/15

IRDA Incurred Claim Ratio-How to choose the best health Insurance?

2. your opinion about top up/super topup plans.

3. which of the 3 is bettera) single plan with large sum insured say 10 to 15lakh coverage or b) one

plan for 10L and a top up of another 5 to 10lakhs or c) one small plan, family floater of 2 to 3 lakhs to

cover small illness and a top up orseperate policy for a larger sum.

4. there are conflicting opinion regarding need of critical illness plan. your take on that.

i am presuming a small healthy middle aged family of 35 to 40 yrs with no history or predisposition to

any major illness for self or in family

Reply

Basavaraj Tonagatti says

February 21, 2015 at 11:01 PM

Sunil- 1) What about the cost? 2) Its good option. 3) It depends on your requirement and

affordability. 4) Yesbecause it is complicated product. Also I suggest to you have if you have

any family history of such critical deceases.

Reply

Sumi says

February 20, 2015 at 3:36 PM

Dear Sir,

I am 35 years of age and I want to go for the Happy Family Floater of Oriental Health Insurance. I