Professional Documents

Culture Documents

Econ U - Bill

Uploaded by

jesuschristissaviorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Econ U - Bill

Uploaded by

jesuschristissaviorCopyright:

Available Formats

U.

S Economy Good

ENDI 4-Week

EMORY

Snyder

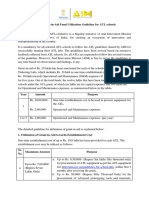

U.S Economy Good

U.S Econ Key to Global Econ.....................................................................................................................................................................2

U.S Econ Key to Global Econ.....................................................................................................................................................................3

U.S Econ Key to Global Econ.....................................................................................................................................................................4

U.S Econ key to Global Econ......................................................................................................................................................................5

U.S Econ key to Hegemony.........................................................................................................................................................................6

U.S Econ key to Hegemony.........................................................................................................................................................................7

U.S Econ key to Hegemony.........................................................................................................................................................................8

U.S Econ Key to Hegemony-Impact...........................................................................................................................................................9

U.S Econ helps Environment.....................................................................................................................................................................10

U.S Econ helps Environment-Impact........................................................................................................................................................11

ANSWERS

AT: U.S Econ key to Global Econ.............................................................................................................................................................12

AT: U.S Econ key to Hegemony................................................................................................................................................................13

AT: U.S Econ helps Environment..............................................................................................................................................................14

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ Key to Global Econ

The U.S is linked to the global economy

Federal Reserve 04, the Federal Reserve System on the implementation of Monetary Policy

[http://www.federalreserve.gov/pf/pdf/pf_4.pdf]

The U.S. economy and the world economy are linked in many ways. Economic developments in this country have a major

influence on production, employment, and prices beyond our borders; at the same time, developments abroad significantly affect

our economy. The U.S. dollar, which is the currency most used in international transactions, constitutes more than half of other

countries official foreign exchange reserves. U.S. banks abroad and foreign banks in the United States are important actors in

international financial markets.

Conversely, economic developments in the United States, including U.S. monetary policy actions, have significant effects on

growth and inflation in foreign economies. Although the Federal Reserves policy objectives are limited to economic outcomes in

the United States, it is mutually beneficial for macroeconomic and financial policy makers in the United States and other countries

to maintain a continuous dialogue. This dialogue enables the Federal Reserve to better understand and anticipate influences on the

U.S. economy that emanate from abroad.

The U.S economy is key to the global economy

Dr Estrada, 08, PhD in Economics and Econometrics

[Dr Mario Arturo Ruiz Estrada, The Economic Waves Effect of the U.S. Economy on the World Economy

http://www.scitopics.com/The_Economic_Waves_Effect_of_the_U_S_Economy_on_the_World_Economy.html]

Initially, we would like to give a short explanation about economic waves. The Economic waves are based on the construction of a

large surface plotted in the same graphical space. The large surface is formed by different parts, in our case these different parts

represent markets (countries or regions), at the same time, all these markets are connected directly to a single epicenter. This

epicenter is fixed by the GDP growth rate of the U.S.

In fact, the GDP growth rate of U.S. can experience anytime a dramatic, uncontrolled and non-logical change such as expansion,

contraction or stagnation. An abrupt negative fall of the GDP growth rate in the U.S. economy can generate strong damage in

different levels at different markets simultaneously. It is originated by the large international trade exchange and investment

mobility relationship that different countries or regions keep with U.S. economy.

We find that the economic waves willing to evaluate the negative impact on different markets in different levels from a possible

deep economic recession from the largest economy of the world such as U.S. To observe the negative effect of a possible deep

economic recession and the generation of economic waves, we suggest the application of multi-dimensional graphical modeling is

available to simulate the movement of economic waves on live or real time movement under the application of graphical computer

animation

We can observe that between 2007/2008, the constant generation of economic waves that strikes different markets around the

world. It can be originated from the poor performance of the GDP growth rate of U.S. economy. The generation of economic

waves is originated from the strong relationship that exists between the rest of the world and U.S. economy through international

trade exchange, FDI mobility and Stock markets integration. The economic waves effect can show clearly how integrated is the

world economy under the umbrella of the globalization. Moreover, The negative impact of the slowdown of U.S. economy rests on

the last phase of the economic waves, the last phase of the economic waves are identified as the level of unemployment in different

markets: Japan, China, ASEAN, EU and Latin America.

This paper conclude that day to day the world economy became more vulnerable and sensible to suffer global recession and global

inflation, it can be originated by the strong and rapid integration of markets, especially markets are attached to the U.S. economy

through international trade exchange by the promotion of free trade areas (FTA), easy and fast mobility of foreign direct

investment (FDI) by transnational companies and stock markets integration through sophisticate information communication

technologies (ICT). In fact, the high possibility to be affected by Strength economic waves a several number of markets is real and

latent anytime. It can be observed when the economic waves arrive to its final phase or last window refraction in the same market

(country or region). The last window refraction is located the unemployment growth rate of all markets.

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ Key to Global Econ

The U.S is key to the global economy because economic outputnot GDP

Amadeo, 08, Kimberly publishes WorldMoneyWatch.com. She has 25 years experience in senior-level economic research and

business planning

[Kimberly Amadeo, The Power of the U.S. Economy http://useconomy.about.com/od/supply/p/Economic_power.htm]

The economic power of the United States is matched by no other countries around the world. Total output for the U.S. economy in

2007 was $13.86 trillion, one fifth of the world's total output. It is also the largest single country economy in the world, although

the EU is larger at $14.44 trillion. China is the second largest, at $7.04 trillion and Japan at $4.3 trillion. Please note: these

comparisons are made using purchasing power parity. (Source: CIA World Factbook, Rank Order GDP)

In fact, the GDP of most countries are the same as many U.S. states. To put these numbers in perspective, check out this map,

which shows which country has the same GDP as each state.

The power of the U.S. economy is seen in its GDP per capita, which was $46,000 in 2007. Although it is the world's largest

economy, the EU's GDP per capita was only $32,900, while Japan's was $33,800. China's GDP per capita was only $5,300 because

they have four times the number of people as does the U.S. (Source: CIA World Factbook, Rank Order GDP per Capita)

Think of the incredible economic power it takes to both be the largest economy in the world while producing one of the highest

standards of living per person. While other countries, such as Norway and Bermuda, have higher GDP per capita, they aren't also a

driver of the global economic engine that the U.S. is.

The U.S economy affects all countries around the globe

Gumbel, 08, NYT Europe editor

[Peter Gumbel, Global breakdown: Winners and losers CNN Money,

http://money.cnn.com/2008/09/29/news/economy/gumbel_world_economy.fortune/index.htm?postversion=2008093005]

So much for the theory of "decoupling," the hopeful notion held just a few weeks ago that the rest of the world was robust enough

to ride out a U.S. domestic crisis.

If the world has learned anything from the American banking meltdown, it is that chaos on Wall Street hits every part of

the globe: Witness would-be oligarchs in Russia scrambling to cover margin calls, policyholders in Singapore queued up at offices

of American International Assurance (as AIG (AIG, Fortune 500) is known in Asia) to close investment accounts, and - mon Dieu!

- a new poll showing three-quarters of the French public, usually unmoved by events on Wall Street, worried that the financial

shakeout will hurt them too.

Of course, the crisis isn't affecting all countries or even all economic sectors equally, and it isn't clear how this latest case of

financial contagion will play out. But here are some early takeaways from around the globe.

Financial services are great, until they cause catastrophe. London, long locked in a contest with Manhattan for the title of world

financial capital, risks being hit as hard as New York because its economy is just as dependent on financial services. "We're in for a

difficult time," says British real estate mogul Vincent Tchenguiz, who predicts a five- to seven-year pullback in his business.

A roaring economy isn't a perfect defense, but it sure helps. The stock and bond markets of some of the world's fastest-growing

economies have been hit especially hard by the crisis: China's Shanghai Stock Exchange is down 50% this year. The Brazilian

bond market has taken a pounding, and, as we've already noted, Russia shuttered its stock exchange altogether.

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ Key to Global Econ

Other nations affected by U.S economyour recession proves

NASDAQ, 08 an American stock exchange

[NASDAQ, http://www.nasdaq.com/newscontent/20090102/U.S.-recession-impacting-global-economy.aspx?storyid=18953475]

Various overseas economies are still struggling in the global recession, largely due to less demand for their products in the U.S.

and other western nations.

This week, Reuters reported that factory production in China, Russia and India has fallen dramatically in recent months. In China,

manufacturing has reportedly fallen for five straight months, although last month's pace was somewhat slowed.

Factories in India are also said to be cutting jobs, while Russia's manufacturing drop is worse than it experienced during its 1998

financial crisis. Also, South Korea is expecting its weakest growth since the beginning of the decade, while Singapore's economy

could shrink up to two percent in 2009.

Still, the news isn't completely dismal. The wire service also noted that global stocks were 0.6 percent recently on the MSCI world

index, raising the prospect that the economy may have finally turned a corner.

"That's not to say there isn't another storm on the horizon, but for the moment the intense pessimism of October and November

seems to have eased," Robert Rennie of Westpac was quoted as saying.

CNNMoney.com also quoted Tim Crimmin of Lord Abbett as suggesting that "optimism for '09" had helped breathe life into

futures markets. Later Friday, observers were expected to get a better glimpse at the state of the U.S. economy with the release of

the latest manufacturing numbers.

The world economy is dependent on the U.S economy

Sesit, 07 Sesit is a Bloomberg News columnist

[Michael R. Sesit, Europe, Asia Won't Weather a U.S. Slowdown http://www.bloomberg.com/apps/news?

pid=20601039&refer=columnist_sesit&sid=alXkzT5rSN30]

The ability of other countries to emerge from the U.S. economy's long shadow may reflect more wishful thinking than logic. No

doubt, it will eventually happen, especially as some of the bigger emerging countries mature. Right now, the world still needs the

U.S. consumer.

The global economy is too dependent on exports to the U.S., whose trade deficit was $765.3 billion in 2006, while Asia and

Europe lack sufficient domestic demand to offset reduced U.S. spending on overseas goods, says Stephen Roach, chief economist

at Morgan Stanley in New York.

The U.S. accounts for 24 percent of Japan's total exports, 84 percent of Canada's, 86 percent of Mexico's and about 40 percent of

China's, he says.

Just as China is dependent on the U.S., other countries rely on Asia's second-largest economy. So a U.S. slowdown that hurts

China will reverberate in Japan, Taiwan, South Korea and commodity producers such as Russia, Australia, New Zealand, Canada

and Brazil.

From 2001 through 2006, the U.S. and China combined contributed an average of 43 percent to global growth, measured on the

basis of purchasing-power parity, according to Roach. And there may be more fallout from a U.S. decline.

``Allowing for trade linkages, the total effects could be larger than 60 percent,'' he says. ``Globalization makes decoupling from

such a concentrated growth dynamic especially difficult.''

As the U.S. economy faltered in early 2001, many Wall Street gurus predicted that Europe would outpace the U.S.

European Vulnerability

``It didn't happen -- a lesson investors should bear in mind today,'' says Joseph Quinlan, chief market strategist at Bank of America

Capital Management in New York. Even though only about 8 percent of European exports go to the U.S., Europe is vulnerable to a

U.S. slowdown through its businesses abroad.

The earnings of European companies' U.S. units plunged 64 percent in 2001, according to Quinlan. Those declines in the biggest

and most-profitable market for many German, U.K., French and Dutch enterprises resulted in reduced orders, lower profit, slower

job growth and weak business confidence. After expanding 3.9 percent in 2000, euro-area growth shrank to 1.9 percent in 2001,

0.9 percent in 2002 and 0.8 percent in 2003.

``As the U.S. economy decelerates and as the dollar continues its slide, Europe will sink or swim with the U.S. in 2007,'' Quinlan

says. Affiliates of European Union companies generate 42 percent of their non-EU earnings in the U.S., he says.

If the naysayers are wrong about decoupling and Goldman Sachs is right, the world may even help the U.S. economy through its

slowdown, O'Neill says.

``If the U.S. has a massive housing correction, what better time to do it than when the rest of the world can help pick up the slack.''

``Happy Slowdown'' is his motto.

The U.S. will be hoping O'Neill is right.

4

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ key to Global Econ

The U.S is important in the global economy

Tabb 06 , William K., taught economics at Queens College for many years, and economics, political science, and sociology at the

Graduate Center of the City University of New York,

[William K Tabb Trouble, Trouble, Debt, and Bubble, May 11, http://www.monthlyreview.org/0506tabb.htm]

Importantly, on a global scale, saving and investment rates have both gone down, trends mainly reflecting developments in the

industrial countries where both saving and investment have been trending downward since the 1970s even as saving has been

increasing in the oil-producing countries and in Asia. The industrial countries still account for 70 percent of world saving, but this

is down from 85 percent in 1970. Together, global savings and investment are near historic lows, having fallen markedly since the

late 1990s. The even more telling figure is for the rate of growth of the global economy, which has been falling since the 1960s,

when it was 5.4 percent to 4.1 percent in the 1970s, to 3.0 percent in the 1980s, to 2.3 percent in the 1990s. While mainstream

economists dismiss any idea of a race to the bottom, there is an unquestionable slowing of growth and an emergent

underconsumptionist, or rather overaccumulationist, trend. While global growth has slowed, the reach of transnational capital has

dramatically increased, and its power to seek out lower costs and play workers in one place against workers elsewhere has grown.

What we are seeing is a process of redistributional growth, in which over the ups and downs of the business cycle, capitals share

of the social product is increasing and labors share is diminishing.

There is a clear thread that connects domestic developments in the U.S. income distribution, debt-funded growth, the increased

dominance of the rentier capitalists who profit from these developments, and global ambitions and the projection of imperial

dominance. A century ago John A. Hobson argued that as the power of rentiers grows and taxation becomes more dramatically

regressive, a hegemonic power (then Great Britain) is tempted to engage in imperialism. Hobson urged higher taxation of incomes

generated as a result of financial speculation and government favoritism to produce a more equal distribution of income and higher

working-class and middle-income spending, which would encourage domestic investment and make imperialism less attractive. He

wrote,

The issue in a word, is between external expansion of markets and of territory on the one hand, and internal social and industrial

reforms upon the other; between a militant imperialism animated by the lust for quantitative growth as a means by which the

governing and possessing classes may retain their monopoly of political power and industrial supremacy, and a peaceful

democracy engaged upon the development of its national resources in order to secure for all members the conditions of improved

comfort, security, and leisure essential for a worthy national life. (John A. Hobson, Free Trade and Foreign Policy,

Contemporary Review 64 [1898]: 179, quoted in Leonard Seabrooke, The Economic Taproot of US Imperialism: The Bush

Rentier Shift, International Politics 41, no. 3 (September 2004): 293318.

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ key to Hegemony

The U.S economy is key to hegemony- countries dependent on U.S

Hensman and Correggia, 05 Hensman is researcher and writer active in the women's liberation, trade union, and human rights

and Correggia is author and reporter in social and environmental issues

[Rohini Hensman and Marinella Correggia, US DOLLAR HEGEMONY: THE SOFT UNDERBELLY OF EMPIRE (AND WHAT CAN BE DONE TO

USE IT! http://www.sacw.net/free/rohini_marinella30012005.html]

What we intend to argue below is that if the US's ability to undertake imperial conquests like that of Iraq depends on its obvious

military supremacy, this in turn is ultimately based on the use of the US dollar as the world's reserve currency. It is the dominance

of the dollar that underpins US financial dominance as a whole as well as the apparently limitless spending power that allows it to

keep hundreds of thousands of troops stationed all over the world. Destroy US dollar hegemony, and "Empire" will collapse.

The core advantage of the US economy, the source of its financial dominance, is the peculiar role of the US currency. It is because

the dollar is the world's reserve currency that the US is able to maintain its twin deficits (fiscal and trade) and depend on the

world's generosity. It needs a subsidy of at least 1.2 billion dollars per day to keep up its level of spending. Its military superiority

is one reason why it it is unlikely ever to face an embargo, but more importantly, it can continue to live beyond its means because

of US dollar hegemony. But for long?

The dollar mechanism has been described extensively elsewhere,(3) so we will merely summarize here. The strength of the US

economy after World War II enabled the US dollar, backed by gold, to become the world's reserve currency. When the US

abandoned the gold standard in 1971, the dollar remained supreme, and its position was further boosted in 1974 when the US came

to an agreement with Saudi Arabia that the oil trade would be denominated in dollars.(4) Most countries in the world import oil,

and it made sense for them to accumulate dollars in order to guard against oil shocks. Third World countries had even more reason

to hoard dollars so as to protect their fragile economies and currencies from sudden collapse. With everyone clamouring for

dollars, all the US had to do was print fiat dollars and other countries would accept them in payment for their exports. These

dollars then flowed back into the US to be invested in Treasury Bonds and similar instruments, offsetting the outflow.

As a reserve currency fulfills world needs in addition to the functions of a domestic currency, the favoured country can build up

debt for a protracted period on a scale that would wreck any other country's currency. But this advantage is a double-edged sword.

(5) It allowed the US economy to decline unnoticed, its fiscal and trade deficits to climb steeply: by 2004 the US trade deficit had

reached $503 billion, the current account deficit $413 billion, the gross national debt around $7 trillion. Globalization destroyed

the US as a manufacturing nation; the outsourcing of services means that even this sector is gradually being shifted out of the US.

(6) Only its pre-eminence in the global financial services industry remains intact.(7) And this is underpinned by US dollar

hegemony.

As Pierre Lecomte, a French financial analyst and supporter of the Campaign "Dette et dollar" (to reject the dollar as world

currency) says, "While the rest of the world must toil hard to earn dollars which are needed to buy goods internationally, or to pay

off foreign debt, the USA just needs to print dollars".(8) And as Frdric Clairmont wrote in Le Monde Diplomatique (April 2003):

"Living on credit is the credo of the foremost power in the world".

Various campaigns around the world have asked people to boycott Brand America,'(9) but most products with American brandnames are not made in the USA. Therefore refusing to buy such things may reduce royalties to America, but will not seriously

undermine US economic power. On the other hand, the longest-lived and most widely seen American "brand" in the rest of the

world is almost certainly not Coca-Cola nor McDonalds, but rather the US dollar.'(10) Taking this into account, the secretariat of

the international Boycott Bush campaign,' based at the Mother Earth association in Belgium, recently asked members if they were

ready to open another front, to boycott the dollar'. Most of them have responded yes'.

Dollar hegemony is what concealed the costs of Empire, which were effectively being paid for by the rest of the world, from US

citizens. Other countries were compelled to accept fiat dollars because they had no choice. It was the world's only reserve.

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ key to Hegemony

U.S economy and innovation is key to global hegemony

Dunn & Reifer, 02 professors at University of California, Riverside

[Christopher Chase-Dunn, Thomas Reifer, US Hegemony and Biotechnology: The geopolitics of new lead technology

http://www.irows.ucr.edu/papers/irows9/irows9.htm]

New lead industries are important as the bases of hegemonic rises because they have huge spin-offs for the national economies in

which they first emerge, spurring growth far beyond the original sectors in which they appear, and because they generate

technological rents. Technological rents are the large profits that return to innovators because they enjoy a monopoly over their

inventions. The first firm to invent a calculator that calculated a square root at the press of a key was able to sell that calculator for

several hundreds of dollars. Patents, legal protections of monopolies justified by the idea that technological innovation needs to be

rewarded, can extend the period in which technological rents may be garnered. But nearly all products eventually follow the

product cycle in which technological rents are reduced because competing producers enter the market, and profits become

reduced to a small percentage of the immediate cost of production. Inputs such as labor costs, raw materials, and transport costs

become the major determinants of profitability as a production becomes more standardize and routine (Vernon 1966, 1971).

The ability to innovate new products and to stay at the profitable end of the product cycle is one of the most important bases of

successful core production in the modern world-system. Products typically move to the semiperiphery or the periphery as

production becomes routinized. So the cotton textile industry was a new lead industry in the early nineteenth century, but it spread

from the English midlands to other core states and to semiperipheral locations (such as New England), and eventually it moved on

to the periphery.Thus the product cycle is important in the reproduction of the core/periphery hierarchy, but it is also important in

determining relative competitive advantages within the core. Some core countries are better than others at innovation and

implementation of new lead technologies, and it is the ability to concentrate these by means of strategic development of research

and development activities, usually including important public investments and coordination of educational institutions and

industry, that allows some core countries to do better than others.

The United States has had huge advantages over competing core countries since World War II. Because the United States is a

continental-sized country with a huge home market that is a substantial share of the world economy, it has been rather difficult

for contenders to outcompete the U.S. because of reasons of mere size. This said, the U.S. share of world GDP decreased from

1950 to 1992 (see Figure 3). Some of this was due to the increasing share of Japan, and some due to increasing shares of certain

countries in the semiperiphery.[1]

In about 1992 the U.S. share began again to increase, while the East Asian crisis led the Japanese share to decline. Some observers

have attributed this to a reemergence of U.S. economic hegemony based on successes in information technology. Rennstich

contends that the United States has cultural and social advantages over Europe and Japan that enable its workers to adapt quickly

to technological changes and that these, combined with the huge size of the U.S. domestic market, will serve as the basis for a new

power cycle of U.S. concentration of economic comparative advantage based on information and biotechnology.

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ key to Hegemony

U.S economy has been key global hegemony

Dymski, 02 a Professor of Economics at the University of California

[Gary A. Dymski, Post-Hegemonic U.S. Economic Hegemony: Minskian and Kaleckian Dynamics in the Neoliberal Era

http://economics.ucr.edu/papers/papers02/02-13.pdf]

Until 1971, the U.S. enjoyed global economic hegemony because it underwrote the Bretton Woods system of fixed exchange rates.

It was hegemonic in the sense defined by Kindleberger (1973, 1974)it underwrote the system of fixed exchange rates, and

operated as a lender of last resort within that system. After 1971, the U.S. has been a global economic hegemon in the sense

defined above, though not in Kindlebergers sense: it has been a posthegemonic hegemon. This hegemony has rested on the U.S.

economys importance in global trade, the U.S. dollars role as a reserve currency and unit of global exchange, and the dominance

of U.S. markets and institutions in global finance. This recent period, an era of great instability and recurrent crashes, has seen a

step-by-step global deregulation of financial markets and a relaxation of controls on cross-border capital movements. In this

period, global growth has been slower and more unstable; but U.S. military hegemony has, if anything, become stronger. With

fewer restrictions on cross-border capital movements, a slower pace of global economic growth, and continued U.S. military

power, the U.S. has increasingly been a safe harbor magnet for globally mobile wealth. These changes in the character of U.S.

global economic hegemony are root cause of changes in the character and timing of U.S. cyclical fluctuations. Today, the U.S.

economy has unassailable global power. As noted above, this global power emanates both from the military/political sphere and

from the economic sphere, especially due to the preeminence of Wall Street and the New Economy. U.S. global dominance is

paralleled by weaknesses elsewhere: Latin America had its Lost Decade in the 1980s, while Japans economy has been mired in its

own Lost Decade of the 1990s; and Europe has stagnated due to the transition in Eastern Europe and the policies implemented to

meet European Monetary Union criteria. The two economic bases of U.S. strength have been badly shaken in the recent past. Wall

Street has not recovered momentum since the 1998 Russia/Brazil crisis; and in early 2000 the New Economy began a long period

of retrenchment. Other problems of the U.S. economy during the 2001 recessionmanufacturing slowdown, low household

savings, and huge trade deficitare all linked to the strong dollar. The overvaluation of the dollar thus appears to be the obstacle

to correcting this situation (Godley and Izurieta 2001, Krugman2001)..

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ Key to Hegemony-Impact

Leadership stops multiple global nuclear wars & a new Dark Age

LIEBER 05 Prof. Gov and Intl. Affairs @ Georgetown U.

(Robert, The American Era: Power and Strategy for the 21st Century, p. 53-54)

Withdrawal from foreign commitments might seem to be a means of evading hostility toward the United States, but the consequences would almost certainly be harmful both

to regional stability and to U.S. national interests. Although Europe would almost certainly not see the return to competitive balancing among regional powers (i.e., competition and

even military rivalry between France and Germany) of the kind that some realist scholars of international relations have predicted," elsewhere the dangers could increase. In Asia,

Japan, South Korea, and Taiwan would have strong motivation to acquire nuclear weapons which they have the technological capacity to do quite

quickly. Instability and regional competition could also escalate, not only between India and Pakistan, but also in Southeast Asia

involving Vietnam, Thailand, Indonesia, and possibly the Philippines. Risks in the Middle East would be likely to increase , with regional competition among the

major countries of the Gulf region (Iran, Saudi Arabia, and Iraq) as well as Egypt, Syria, and Israel. Major regional wars, eventually involving the use of weapons of

mass destruction plus human suffering on a vast scale, floods of refugees, economic disruption, and risks to oil supplies are all readily conceivable .

Based on past experience, the United States would almost certainly be drawn back into these areas , whether to defend friendly states, to cope with a

humanitarian catastrophe, or to prevent a hostile power from dominating an entire region. Steven Peter Rosen has thus fit-tingly observed, "If the logic of American empire is unappealing,

it is not at all clear that the alternatives are that much more attractive."2z Similarly, Niall Ferguson has added that those who dislike American predominance ought to bear in mind that the

alternative may not be a world of competing great powers, but one with no hegemon at all. Ferguson's warning may be hyperbolic, but it hints at the perils that the

absence of a

dominant power, "apolarity," could bring "an anarchic new Dark Age of waning empires and religious fanaticism; of endemic

plunder and pillage in the world's forgotten regions; of economic stagnation and civilization's retreat into a few fortified enclaves .

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ helps Environment

A strong U.S economy helps the environment

Pacific Research Institute 02, San Francisco-based non-profit advocating for personal responsibility and individual liberty in

national and state issues

[Pacific Research Institute, US environment continues to improve, annual Earth Day report finds http://www.sdearthtimes.com/et0502/et0502s4.html]

Environmental quality continues to improve dramatically in the United States, according to the Index of Leading Environmental

Indicators 2002, released today by the San Francisco-based Pacific Research Institute (PRI). Authors Steven Hayward and Julie

Majeres show that environmental quality has been improving since the first Earth Day 32 years ago, despite the public perception

that it is getting worse.

Air quality is improving and is going to continue to improve. Many news stories give the impression that air quality is

worsening, and that health problems from air pollution are on the rise. However, since 1970, aggregate emissions of the six

criteria pollutants regulated under the Clean Air Acts have declined 29 percent, at the same time that the US economy grew 150

percent, auto travel increased by 143 percent, and total US energy consumption (the primary source of air pollution emissions)

increased 45 percent. Air quality will continue to improve because of technology, turnover of the auto fleet to lower-polluting

engines, and new regulations of public utilities. Economic growth is good for the environment. In the 1970s, many leading

environmentalists argued that economic growth was incompatible with a healthy environment. But international data show that the

nations with the most robust economies have the best record of environmental protection. Today, a growing number of

environmentalists are acknowledging that economic growth is the main prerequisite for an improving environment.

Strong U.S economy is needed for the environment

Carmichael, 4-14-09, reporter for the Huntington Post

[Ben Carmichael, A Bad Economy Makes for a Bad Environment http://www.huffingtonpost.com/ben-carmichael/a-bad-economy-makes-fora_b_186309.html]

As the markets have gone down, long-held assumptions have been thrown up into the air. Economic theories, and not just the value

of our homes and our retirement accounts, are coming undone. In some cases, that may just be a good thing.

Consider the argument that climate change solutions, no matter what you may think about the science, are simply too costly. This

has long been a stock argument of the political right. Indeed, it was one of the publicly stated reasons President George W. Bush

chose not to ratify the Kyoto Protocol.

The logic is fairly simple. Because greenhouse gas emissions are so deeply embedded in our purchases and productivity, people

have argued that a strong climate response will require a weakening of our economy. It's been presented as a choice: you can have

either a stable climate, or you can have economic growth. Now choose.

It is true that carbon is deeply embedded in our processes of production and consumption. For this reason, steps towards decarbonizing any of the G-20 countries will be expensive. And yet, the declining economy has proven two things about the

argument that one must choose between either a robust economy or a vital ecology: it is both politically persistent and

demonstrably false. This is not a good sign, for our environment or our politicians

The lesson, it seems, is that as the economy goes, so goes the environment.

This only goes so far, of course. People consume, travel and eat less meat as their affluence declines. By this logic, the recession

has actually reduced our impact on the environment. And yet, with fuel cheap and the prospect of climate regulation far away and

uncertain, there has been little substantive action of late. Whatever reductions people have made in their habits due to the

recession, they remain only part of the much-larger need for a transition to a low-carbon energy infrastructure.

Across the landscape of leading, if declining economies, and their climate policies and investments in renewable energy, much the

opposite can be said to be true; a stable environment requires a strong economy. As much as the current recession threatens our

livelihoods, so too does it threaten our environment.

As we talk about a stimulus package, we talk mostly about restoring stability to our homes, our careers and our bank accounts. But

let us remember that we're talking about our environment, too. We need a strong economy to make the right investments in

renewable energy technologies to make them affordable, scalable and publicly acceptable.

Contrary to conventional wisdom, the environment and our economy form one of few potentially positive policy relationships. Let

us hope our politicians realize this before its too late.

10

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

U.S Econ helps Environment-Impact

Environmental Collapse causes Extinction

CAIRNS 04 Department of Biology, Virginia Polytechnic Institute and State University

John Cairns Future of Life on Earth, Ethics in Science and Environmental Politics, www.int-res.com/esepbooks/EB2Pt2.pdf.

One lesson from the five great global extinctions is that species and ecosystems come and go, but the evolutionary process

continues. In short, life forms have a future on Earth, but humankinds future depends on its stewardship of ecosystems that favor Homo

sapiens. By practicing sustain- ability ethics, humankind can protect and preserve ecosystems that have services favorable to it. Earth has

reached its present state through an estimated 4550 million years and may last for 15000 million more years . The sixth mass extinction, now underway,

is unique because humankind is a major contributor to the process. Excessive damage to the ecological life support system will

markedly alter civilization, as it is presently known, and might even result in human extinction. However, if humankind learns to live

sustainably, the likelihood of leaving a habitable planet for posterity will dramatically increas e. The 21st century represents a defining

moment for humankindwill present generations become good ancestors for their descendants by living sustainably or will they leave a less habitable planet for

posterity by continuing to live unsustainably?

11

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

AT: U.S Econ key to Global Econ

Global Economy is at its strongest period-the U.S economy doesnt have an global impact

McQuillen and Swann 4-05-07, Mcquillen is the Legal Affairs Reporer at Bloomberg News, and Swann is the International

economics correspondent at Bloomberg

[William McQuillen and Christopher Swann, IMF Says Global Economy to Withstand U.S. Slowdown http://www.bloomberg.com/apps/news?

pid=20601087&sid=arhhIMIyFPeA&refer=home]

By contrast to slowed U.S. growth, the global economy as a whole is in the midst of its strongest period in more than a quarter

century, as China logs growth rates above 10 percent and expansions in Japan and Europe pick up steam. The euro region grew the

fastest in six years in 2006 and Japan's gross domestic product increased 5.5 percent in the fourth quarter.

The fund will release its updated economic forecasts in the first chapter of the World Economic Outlook on April 11, ahead of the

spring gathering of the IMF and World Bank in Washington. IMF Managing Director Rodrigo de Rato said in the Hague last week

that the fund would probably cut its 2007 U.S. growth estimate from 2.9 percent.

The IMF in September predicted world GDP would increase 4.9 percent this year, the fourth straight year above 4.5 percent. That's

the best performance since IMF records dating from 1980.

In the U.S., the outlook is marred by rising defaults on subprime mortgages, loans made to the riskiest borrowers. Delinquencies

rose to a 3 1/2-year high in the fourth quarter as home values fell, according to the Mortgage Bankers Association. Foreclosures in

February jumped 12 percent from a year ago.

``So far, the impact on the rest of the world has been mild,'' Johnson said. At the same time, he warned ``it would be wise to keep

in mind we should not dismiss the potential wider impact from specific problems in the U.S. economy.''

About three-quarters of industrial countries suffered the effects of the past five U.S. recessions, according to the analysis by the

report's authors -- Thomas Helbling, Peter Berezin, Ayhan Kose, Michael Kumhof, Doug Laxton and Nikola Spatafora. The impact

was about half the amount of U.S. deceleration, they said.

Unlike past U.S. downturns, the current slowdown wasn't caused by global factors such as rising energy prices, which would have

a greater impact on other economies, the IMF said.

US economic downturn will not devastate world economy.

Summers 06, Treasury secretary for Obama

[Larry Summers, Testing all engines, the economist]

Alongside stronger domestic demand in Europe and Japan, emerging economies are also tipped to remain robust. These economies

are popularly perceived as excessively export-dependent, flooding the world with cheap goods, but doing little to boost demand.

Yet calculations by Goldman Sachs show that Brazil, Russia, India and China combined have in recent years contributed more to

the worlds domestic demand than to its GDP growth. They have chipped in almost as much to global domestic demand as

America has. If this picture endures, a moderate slowdown in America need not halt the expansion in the rest of the world. Europe

and Japan together account for a bigger slice of global GDP than the United States, so faster growth there will help to keep the

global economy flying. A rebalancing of demand away from America to the rest of the world would also help to shrink its huge

current account deficit. This all assumes that Americas economy slows, rather than sinks into recession. The world is undoubtedly

better placed to cope with a slowdown in the United States than it was a few years ago. That said, in those same few years

Americas imbalances have become larger, with the risk that the eventual correction will be more painful. A deep downturn in

America would be felt all around the globe.

12

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

AT: U.S Econ key to Hegemony

U.S hegemony will inevitably collapse China proves

Watson, 08, reporter for International Relations

[Jake Watson, China: The Greatest Threat to US Hegemony http://newsflavor.com/politics/international-relations/china-the-greatest-threat-to-ushegemony/]

In the next twenty-five years, the United States will see China become its biggest threat to hegemony. The US currently dominates

the worlds political, military, and cultural scene. This dominance is known as hegemony. The economic relationship between the

US and China, the global energy crisis, and the increase in Chinese soft power will lead to the decline of US hegemony.

China has become one of the globes largest economic powers. Economic growth has depended on Chinese exports to the US.

Without American consumers, the Chinese economy would not be as powerful, and the economic relationship between the two

countries would not be interdependent. Eventually, the Chinese middle-class will grow large enough to end their reliance on

exports to the US. When this happens, Chinese ownership of American debt could be used as political leverage. Now, China

needs American markets and the US needs Chinese capital. The US will lose power as soon as the economic balance inevitably

tips in Chinas favor.

The global energy crisis creates competition between the US and China. Competition for fossil fuels will decrease American

influence in the world. China will soon pass the US for the lead consumer of fossil fuels. As China needs and gains more energy

resources, their technological and military prowess will approach that of the US. Chinese influence will expand as fuel imports

increase. Any expansion of Chinese influence negatively affects the US. As the competition between the US and China grows,

US hegemony is decreased.

An increase in exports, global political participation, and culture projection will help China gain influence in the international

community. Trade agreements between China and other countries increase Chinas legitimacy and reputation in the capitalist

world. China continues to increase its participation in international organizations and multi-lateral agreements. As Chinese culture

is projected to the rest of the world, influence abroad is gained. Influence across the globe will give China soft power. Soft power

is non-military influence exerted on foreign nations. As China gains soft power, American influence and power is decreased.

Any power the Chinese gain is power lost by the US. The US will undoubtedly remain powerful in the international community

for many more years. However, Chinese economic growth, acquisition of energy resources, and soft power projection will give

China more influence and take away from US global dominance. Unless the situation changes or the US takes action to hinder

Chinese expansion, Americans may soon see a world controlled by more than one great power.

13

U.S Economy Good

ENDI 4-Week

EMORY

Snyder

AT: U.S Econ helps Environment

A poor U.S economy helps the environment

Johnson, 4-06-09 a reporter for the Wall Street Journal

[Keith Johnson Bad Economy, Good Environment: Slump Helps U.S. Cut Emissions http://blogs.wsj.com/environmentalcapital/2009/04/06/bad-economygood-environment-slump-helps-us-cut-emissions/]

The economic downturn may be complicating President Obamas hopes of passing climate change legislation, but it appears to be

doing wonders for efforts to cut U.S. greenhouse-gas emissions.

A report issued Monday by the Washington-based Environmental Integrity Project says that because of the recent economic

slowdown and milder-than-usual weather, carbon dioxide emissions from U.S. power plants dropped 3.1 percent in 2008, a

departure from the recent trends in power plant carbon dioxide emissions, which have risen 0.9 percent since 2003, and 4.5 percent

since 1998, according to data from the Environmental Protection Agency.

This obviously isnt the kind of news that the Obama administration probably wants to tout. It also echoes arguments that

emissions-reductions and economic lethargy are synonymous. Thats been the case in Europe, for instance, and in individual

industries such as commercial aviation.

But it does raise a substantive question: Should the U.S. should seek even more aggressive reductions in greenhouse gas emissions

than previously called for?

After all, some environmental groups say, the economic downturn and the recently passed economic stimulus packagewhich

includes provisions to boost low-carbon technologiesshould make it easier to meet emission-reduction targets.

Mr. Obamas emission-reduction targets call for reducing U.S. emissions about 14% below 2005 levels by 2020. The draft energy

and climate bill in the House goes further, mandating a 20% reduction by 2020.

For now, those arguments dont appear to be swaying many minds within the administration, although Mr. Obamas Special Envoy

for Climate Change, Todd Stern, told The Wall Street Journal in an interview last week that its a very good question.

One would assume that with economic activity lower in the world, that has probably had a temporary downward effect on

emissions, but Id underscore the word temporary, Mr. Stern said. The economy is going to get going again. We dont know

exactly when, but its not going to be years and years of a slowdown.

Bad economy helps the environment Cuts CO2 emissions

Watson, 4/8/2009, reporter for USA Today

[Traci Watson, Bad economy helps cut CO2 emissions http://www.usatoday.com/weather/climate/globalwarming/2009-04-08-climate_N.htm]

The worldwide economic slowdown is having an unexpected positive impact in the fight against global warming: Emissions of

carbon dioxide are falling, records collected by governments show.

From the United States to Europe to China, the global economic crisis has forced offices to close and factories to cut back. That

means less use of fossil fuels such as coal to make energy. Fossil-fuel burning, which creates carbon dioxide, is the primary human

contributor to global warming.

A recession-driven drop in emissions "is good for the environment," says Emilie Mazzacurati of Point Carbon, an energy research

company. "In the long term, that's not how we want to reduce emissions."

As carbon dioxide builds in the atmosphere, it traps heat and warms the Earth. The result: melting glaciers, rising seas and fiercer

droughts.

The lower emissions are caused partly by milder weather which means less energy is needed for cooling and heating and by

policies that promote energy efficiency, but experts agree that economic problems play a role.

The emission decreases are unusual and in some cases unprecedented:

Carbon dioxide from U.S. power plants fell roughly 3% from 2007 to 2008, according to preliminary data from the Environmental

Protection Agency analyzed by the Environmental Integrity Project. That's the biggest drop since 1995-1996, the first two

consecutive years for which data are publicly available.

Carbon dioxide from industrial facilities in 27 European nations in 2008 plummeted 6%, according to Point Carbon's analysis of

data published last week by the European Commission.

Electricity production by Chinese power plants has been lower every month since September compared with the same months a

year earlier, says Richard Morse, a Stanford University energy researcher. A drop in power generation translates to a drop in

carbon-dioxide output. These are the first such drops in Chinese power production since the Chinese economic boom in the 1990s.

European nations face a 2012 deadline to cut their emissions under the Kyoto Protocol, a global-warming treaty written in 1997

and renounced by President George W. Bush in 2001. The recession could make it easier for countries to meet their goals, says

David Doniger of the Natural Resources Defense Council, an environmental group, but "I wouldn't recommend recession as a way

to deal with this problem." Some experts fear lower emissions may make companies and governments less likely to spend money

to cut carbon output. "There's a risk that it will push back needed investment into cleaner production," Mazzacurati says.

14

You might also like

- Chap 1 ReadingsDocument16 pagesChap 1 Readingseya KhamassiNo ratings yet

- 423 1916 1 PBDocument20 pages423 1916 1 PBDevi GNo ratings yet

- The Leaderless Economy: Why the World Economic System Fell Apart and How to Fix ItFrom EverandThe Leaderless Economy: Why the World Economic System Fell Apart and How to Fix ItRating: 4 out of 5 stars4/5 (1)

- Global Economic RecoveryDocument13 pagesGlobal Economic RecoveryvilasshenoyNo ratings yet

- Sterling College of Arts, Commerce and Science: Topic: Global Recession and Its Contagious EffectsDocument34 pagesSterling College of Arts, Commerce and Science: Topic: Global Recession and Its Contagious EffectsAniket KhotNo ratings yet

- USA Financial Crisis Impact on IndiaDocument13 pagesUSA Financial Crisis Impact on IndiaElahee ShaikhNo ratings yet

- Global Financial CrisisDocument7 pagesGlobal Financial CrisisYasir AyazNo ratings yet

- Martin Wolf examines threats to global recovery from lingering financial fault linesDocument6 pagesMartin Wolf examines threats to global recovery from lingering financial fault linespriyam_22No ratings yet

- Outline of The U S EconomyDocument76 pagesOutline of The U S EconomyUmar JameelNo ratings yet

- A Study On Subprime Crisis and Its Effects On India Mba ProjectDocument75 pagesA Study On Subprime Crisis and Its Effects On India Mba ProjectSagar ChitrodaNo ratings yet

- Analyzing Recessions in the US and EuropeDocument16 pagesAnalyzing Recessions in the US and EuropeNasim JanNo ratings yet

- Literature Review On Global Economic CrisisDocument7 pagesLiterature Review On Global Economic Crisisafmzsawcpkjfzj100% (1)

- Macro Chpter 1Document15 pagesMacro Chpter 1Taha SabirNo ratings yet

- Bankrupt: Global Lawmaking and Systemic Financial CrisisFrom EverandBankrupt: Global Lawmaking and Systemic Financial CrisisNo ratings yet

- Rethinking Globalization - NotesDocument13 pagesRethinking Globalization - NotesLana HNo ratings yet

- Navigating A World of Turmoil: A Deloitte Research Publication - 2nd Quarter 2011Document60 pagesNavigating A World of Turmoil: A Deloitte Research Publication - 2nd Quarter 2011Timothy KohNo ratings yet

- Hy Have Some Countries Experienced Rapid Growth in Incomes Over The Past Century While Others Stay Mired in PovertyDocument4 pagesHy Have Some Countries Experienced Rapid Growth in Incomes Over The Past Century While Others Stay Mired in PovertysittoolwinNo ratings yet

- Research Paper Global EconomyDocument4 pagesResearch Paper Global Economynnactlvkg100% (1)

- Indian Economy GrowthDocument26 pagesIndian Economy GrowthMakrana MarbleNo ratings yet

- Spending Da: Economy DA UTNIF 2k8Document16 pagesSpending Da: Economy DA UTNIF 2k8AffNeg.ComNo ratings yet

- Actualrseminaepg 3 Rdsem RepairedDocument16 pagesActualrseminaepg 3 Rdsem RepairedanabNo ratings yet

- OPVL QuizDocument6 pagesOPVL QuizMARIA CATROGA AGUIAR-AlumnoNo ratings yet

- Book Review: Globalization and Its Discontents by Joseph Stiglitz: The dark side of globalizationFrom EverandBook Review: Globalization and Its Discontents by Joseph Stiglitz: The dark side of globalizationNo ratings yet

- Summary: Stephen Roach on the Next Asia: Review and Analysis of Stephen S. Roach's BookFrom EverandSummary: Stephen Roach on the Next Asia: Review and Analysis of Stephen S. Roach's BookNo ratings yet

- Financial Crisis - KGPDocument17 pagesFinancial Crisis - KGPKIRAN GOPALNo ratings yet

- Chapter 4: Industry Analysis: FMCG Sector in IndiaDocument146 pagesChapter 4: Industry Analysis: FMCG Sector in IndiaKaviya KaviNo ratings yet

- 14 - Chapter 4Document146 pages14 - Chapter 4Preetika SainiNo ratings yet

- Asia's Post-Global Financial Crisis Adjustment: A Model-Based DynamicDocument33 pagesAsia's Post-Global Financial Crisis Adjustment: A Model-Based DynamicADBI PublicationsNo ratings yet

- The Stiglitz Report: Reforming the International Monetary and Financial Systems in the Wake of the Global CrisisFrom EverandThe Stiglitz Report: Reforming the International Monetary and Financial Systems in the Wake of the Global CrisisNo ratings yet

- Journal of Asian Economics: Peter A. Petri, Michael G. PlummerDocument14 pagesJournal of Asian Economics: Peter A. Petri, Michael G. Plummersami03210No ratings yet

- Sample Lecture: Giving You All The Answers Up FrontDocument3 pagesSample Lecture: Giving You All The Answers Up FrontMipsNo ratings yet

- Global Financial Crisis and International Institutions: Challenges, Opportunities and ChangeDocument15 pagesGlobal Financial Crisis and International Institutions: Challenges, Opportunities and ChangeShahab UdinNo ratings yet

- Recession in IndiaDocument17 pagesRecession in Indiakapilkg8100% (5)

- The Contemporary World Module 2Document27 pagesThe Contemporary World Module 2Dan Christian VillacoNo ratings yet

- Bankruptcy and Survival in Times of Economic Uncertainty: Practical Tips for Surviving the Economic Downturn/RecessionFrom EverandBankruptcy and Survival in Times of Economic Uncertainty: Practical Tips for Surviving the Economic Downturn/RecessionNo ratings yet

- Chapter 1 MacroeconomicsDocument22 pagesChapter 1 MacroeconomicsTeesha AggrawalNo ratings yet

- Financial Crisis Impact on Developing NationsDocument11 pagesFinancial Crisis Impact on Developing Nationsmanak7No ratings yet

- May Allah S.W.T Guide Us Through This Financial Crisis.: Universiti Kebangsaan Malaysia Fakulti Undang-UndangDocument21 pagesMay Allah S.W.T Guide Us Through This Financial Crisis.: Universiti Kebangsaan Malaysia Fakulti Undang-Undangmusbri mohamedNo ratings yet

- Economic Systems and Their Impact on International BusinessDocument8 pagesEconomic Systems and Their Impact on International BusinessKhalid AminNo ratings yet

- Why The Global Economic Crisis Is Not Going Away 120510Document4 pagesWhy The Global Economic Crisis Is Not Going Away 120510LCNo ratings yet

- Krisis Finansial Amerika Serikat Dan Perekonomian IndonesiaDocument22 pagesKrisis Finansial Amerika Serikat Dan Perekonomian IndonesiaYasid Zaenal ArifinNo ratings yet

- What Needs To Be DoneDocument9 pagesWhat Needs To Be DonebowssenNo ratings yet

- Impact of US Recession on Indian Stock MarketDocument24 pagesImpact of US Recession on Indian Stock Marketrathore31No ratings yet

- Socscie Module 3Document9 pagesSocscie Module 3rodalyn malanaNo ratings yet

- (John Bellamy Foster and Robert W. W. McChesney) TDocument264 pages(John Bellamy Foster and Robert W. W. McChesney) Tana eNo ratings yet

- Introduction to Macroeconomics: Key Concepts and IndicatorsDocument13 pagesIntroduction to Macroeconomics: Key Concepts and IndicatorsteamhackerNo ratings yet

- A First Look at Macroeconomic Trends and IssuesDocument51 pagesA First Look at Macroeconomic Trends and IssuesDianitha VentNo ratings yet

- 2015 Origins of InequalityDocument24 pages2015 Origins of Inequalitybhavyaroda08No ratings yet

- Learning From the Global Financial Crisis: Creatively, Reliably, and SustainablyFrom EverandLearning From the Global Financial Crisis: Creatively, Reliably, and SustainablyNo ratings yet

- Nvestment Ompass: Quarterly CommentaryDocument4 pagesNvestment Ompass: Quarterly CommentaryPacifica Partners Capital ManagementNo ratings yet

- May 7Document28 pagesMay 7Amal NathNo ratings yet

- Great Global Shift WhitepaperDocument20 pagesGreat Global Shift WhitepapermcampuzaNo ratings yet

- Causes, Consequences and Policy Responses of the 2008-2009 RecessionDocument12 pagesCauses, Consequences and Policy Responses of the 2008-2009 Recessiontim kimNo ratings yet

- My Work1Document14 pagesMy Work1lyndaumoruNo ratings yet

- Surfing The Waves of Globalization: Asia and Financial Globalization in The Context of The TrilemmaDocument57 pagesSurfing The Waves of Globalization: Asia and Financial Globalization in The Context of The TrilemmaAsian Development BankNo ratings yet

- The Current Economic Crisis: Causes, Cures and Consequences: Karl AigingerDocument33 pagesThe Current Economic Crisis: Causes, Cures and Consequences: Karl Aigingerfarnaz_2647334No ratings yet

- America vs. Europe - Which Is The Bigger Threat To The World EconomyDocument8 pagesAmerica vs. Europe - Which Is The Bigger Threat To The World EconomyBrendan ChuaNo ratings yet

- Michigan Donovan MeyersLevy Neg Texas Round2Document31 pagesMichigan Donovan MeyersLevy Neg Texas Round2jesuschristissaviorNo ratings yet

- Indiana Aaronson K Neg Texas Round4Document41 pagesIndiana Aaronson K Neg Texas Round4jesuschristissaviorNo ratings yet

- Dartmouth Belhachmi Ahmad Neg Texaskinkyvii Round4Document38 pagesDartmouth Belhachmi Ahmad Neg Texaskinkyvii Round4jesuschristissaviorNo ratings yet

- Dartmouth Kreus Cramer Neg Gsu Round5Document8 pagesDartmouth Kreus Cramer Neg Gsu Round5jesuschristissaviorNo ratings yet

- Fellows - OCO NFU NegDocument74 pagesFellows - OCO NFU NegjesuschristissaviorNo ratings yet

- NYU Moity Song Aff Rochesterbsdt Round3Document9 pagesNYU Moity Song Aff Rochesterbsdt Round3jesuschristissaviorNo ratings yet

- Georgetown Louvis Knez Neg Kentuckycollege Round3Document47 pagesGeorgetown Louvis Knez Neg Kentuckycollege Round3jesuschristissaviorNo ratings yet

- Georgia Boyce Rice Neg Vanderbilt Round2Document37 pagesGeorgia Boyce Rice Neg Vanderbilt Round2jesuschristissaviorNo ratings yet

- Wake Forest Cronin Lopez Aff CEDA Round1Document12 pagesWake Forest Cronin Lopez Aff CEDA Round1jesuschristissaviorNo ratings yet

- Declaratory policy solves secrecy issues with new military technologiesDocument33 pagesDeclaratory policy solves secrecy issues with new military technologiesjesuschristissaviorNo ratings yet

- Edgemont Kohli Xu Aff Harvard Round2Document18 pagesEdgemont Kohli Xu Aff Harvard Round2jesuschristissaviorNo ratings yet

- Kentucky Vargason Geldof Neg NDT Round3Document50 pagesKentucky Vargason Geldof Neg NDT Round3jesuschristissaviorNo ratings yet

- Domestic Detention Negative - JDI 2015Document54 pagesDomestic Detention Negative - JDI 2015jesuschristissaviorNo ratings yet

- Harvard Herman Sanjeev Neg GSU Round7Document44 pagesHarvard Herman Sanjeev Neg GSU Round7jesuschristissaviorNo ratings yet

- Michigan Pasquinelli Walzzrath Neg Kentucky Round6Document31 pagesMichigan Pasquinelli Walzzrath Neg Kentucky Round6jesuschristissaviorNo ratings yet

- Speech 1NC RD2 7-2Document34 pagesSpeech 1NC RD2 7-2jesuschristissaviorNo ratings yet

- TSDC Psychoanalysis AffDocument70 pagesTSDC Psychoanalysis AffjesuschristissaviorNo ratings yet

- Offsets CP - Michigan7 2015Document49 pagesOffsets CP - Michigan7 2015jesuschristissaviorNo ratings yet

- Agamben Aff +neg - Beffjr 2015Document78 pagesAgamben Aff +neg - Beffjr 2015jesuschristissaviorNo ratings yet

- Rufus King KellyMiller Shaw Neg State Round4Document13 pagesRufus King KellyMiller Shaw Neg State Round4jesuschristissaviorNo ratings yet

- Energy CrisesDocument17 pagesEnergy CrisesMuhammad MuzammalNo ratings yet

- Lecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDocument5 pagesLecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDaryl VenturaNo ratings yet

- Accounting Standard As 1 PresentationDocument11 pagesAccounting Standard As 1 Presentationcooldude690No ratings yet

- IBT - Lesson 1Document18 pagesIBT - Lesson 1Melvin Ray M. MarisgaNo ratings yet

- Itc PPT 1Document10 pagesItc PPT 1nikhil18202125No ratings yet

- ResourceResourceADocument322 pagesResourceResourceASergey PostnykhNo ratings yet

- ACC 304 Financial Reporting III Group Assignment 1 SolutionsDocument3 pagesACC 304 Financial Reporting III Group Assignment 1 SolutionsGeorge AdjeiNo ratings yet

- Assets MCDocument19 pagesAssets MCpahuyobea cutiepatootieNo ratings yet

- Assessment of Customer Satisfaction On Home Based Catering Business in Cabadbaran CityDocument7 pagesAssessment of Customer Satisfaction On Home Based Catering Business in Cabadbaran CityIOER International Multidisciplinary Research Journal ( IIMRJ)No ratings yet

- CH IndiaPost - Final Project ReportDocument14 pagesCH IndiaPost - Final Project ReportKANIKA GORAYANo ratings yet

- Customer Experience Department: Daily Incentive Program "Mcrewards"Document4 pagesCustomer Experience Department: Daily Incentive Program "Mcrewards"Cedie Gonzaga AlbaNo ratings yet

- CSR Practices of Indian Public Sector BanksDocument6 pagesCSR Practices of Indian Public Sector BankssharadiitianNo ratings yet

- Midterm EcommerceDocument6 pagesMidterm EcommerceUSMAN NAVEEDNo ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- Multi Modal Logistics HubDocument33 pagesMulti Modal Logistics HubsinghranjanNo ratings yet

- Basics of AppraisalsDocument20 pagesBasics of AppraisalssymenNo ratings yet

- St. Saviour's ULURP LetterDocument3 pagesSt. Saviour's ULURP LetterChristina WilkinsonNo ratings yet

- Palm Heights Tower Web BrochureDocument19 pagesPalm Heights Tower Web BrochureGaurav RaghuvanshiNo ratings yet

- Grant-In-Aid Fund Utilization GuidelineDocument5 pagesGrant-In-Aid Fund Utilization GuidelineBiswambharLayekNo ratings yet

- Review LeapFrogDocument2 pagesReview LeapFrogDhil HutomoNo ratings yet

- Ds 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PDocument1 pageDs 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PprabindraNo ratings yet

- Acounting For Business CombinationsDocument20 pagesAcounting For Business CombinationsMathew EstradaNo ratings yet

- ABE Level 6 Corporate Finance Examiner Report Dec 2016Document10 pagesABE Level 6 Corporate Finance Examiner Report Dec 2016Immanuel LashleyNo ratings yet

- Solution Manual For Essentials of Corporate Finance by ParrinoDocument21 pagesSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)

- Senario Case StudyDocument19 pagesSenario Case Studymaya100% (1)

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaNo ratings yet

- Business Plan Step by StepDocument147 pagesBusiness Plan Step by StepJason MartinNo ratings yet

- TUTDocument2 pagesTUTNadia NatasyaNo ratings yet

- The Scope and Method of EconomicsDocument23 pagesThe Scope and Method of EconomicsSyifa034No ratings yet

- General Information SheetDocument6 pagesGeneral Information SheetInnoKal100% (2)