Professional Documents

Culture Documents

W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding

Uploaded by

RISACAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding

Uploaded by

RISACACopyright:

Available Formats

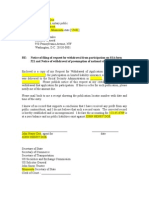

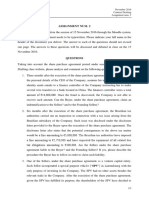

Form

W-8BEN

Certificate of Foreign Status of Beneficial Owner

for United States Tax Withholding

(Rev. February 2006)

Department of the Treasury

Internal Revenue Service

OMB No. 1545-1621

Section references are to the Internal Revenue Code. See separate instructions.

Give this form to the withholding agent or payer. Do not send to the IRS.

Do not use this form for:

A U.S. citizen or other U.S. person, including a resident alien individual

A person claiming that income is effectively connected with the conduct

of a trade or business in the United States

A foreign partnership, a foreign simple trust, or a foreign grantor trust (see instructions for exceptions)

A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization,

foreign private foundation, or government of a U.S. possession that received effectively connected income or that is

claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b) (see instructions)

Note: These entities should use Form W-8BEN if they are claiming treaty benefits or are providing the form only to

claim they are a foreign person exempt from backup withholding.

A person acting as an intermediary

Note: See instructions for additional exceptions.

Name of individual or organization that is the beneficial owner

Arturo Sayegh

3

W-8ECI or W-8EXP

W-8IMY

Country of incorporation or organization

Venezuela

Type of beneficial owner:

Grantor trust

Central bank of issue

W-8ECI

W-8ECI or W-8IMY

Identification of Beneficial Owner (See instructions.)

Part I

1

Instead, use Form:

W-9

Individual

Corporation

Complex trust

Estate

Tax-exempt organization

Private foundation

Disregarded entity

Partnership

Government

International organization

Simple trust

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.

Av Principal los Robles, Qta Everest, Urb Altos del Halcon, Sector Oripoto - La Union

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

Caracas Miranda 1083

5

Venezuela

Mailing address (if different from above)

CCS-3999, 2250 NW 114th Ave Unit 1C

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

Miami, Florida 33172-3652

6

United States

SSN or ITIN

Foreign tax identifying number, if any (optional)

EIN

Reference number(s) (see instructions)

Claim of Tax Treaty Benefits (if applicable)

Part II

9

10

U.S. taxpayer identification number, if required (see instructions)

I certify that (check all that apply):

a

The beneficial owner is a resident of

If required, the U.S. taxpayer identification number is stated on line 6 (see instructions).

within the meaning of the income tax treaty between the United States and that country.

The beneficial owner is not an individual, derives the item (or items) of income for which the treaty benefits are claimed, and, if

applicable, meets the requirements of the treaty provision dealing with limitation on benefits (see instructions).

The beneficial owner is not an individual, is claiming treaty benefits for dividends received from a foreign corporation or interest from a

U.S. trade or business of a foreign corporation, and meets qualified resident status (see instructions).

The beneficial owner is related to the person obligated to pay the income within the meaning of section 267(b) or 707(b), and will file

Form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000.

Special rates and conditions (if applicablesee instructions): The beneficial owner is claiming the provisions of Article

% rate of withholding on (specify type of income):

treaty identified on line 9a above to claim a

Explain the reasons the beneficial owner meets the terms of the treaty article:

Notional Principal Contracts

Part III

11

of the

.

I have provided or will provide a statement that identifies those notional principal contracts from which the income is not effectively

connected with the conduct of a trade or business in the United States. I agree to update this statement as required.

Part IV

Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I

further certify under penalties of perjury that:

1 I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates,

2 The beneficial owner is not a U.S. person,

3 The income to which this form relates is (a) not effectively connected with the conduct of a trade or business in the United States, (b) effectively connected but is

not subject to tax under an income tax treaty, or (c) the partners share of a partnerships effectively connected income, and

4 For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or

any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.

Sign Here

SELF

Signature of beneficial owner (or individual authorized to sign for beneficial owner)

For Paperwork Reduction Act Notice, see separate instructions.

Date (MM-DD-YYYY)

Cat. No. 25047Z

Printed on Recycled Paper

Capacity in which acting

Form

W-8BEN

(Rev. 2-2006)

You might also like

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesFrom EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNo ratings yet

- How to Complete a W-8BEN FormDocument2 pagesHow to Complete a W-8BEN FormrichblackNo ratings yet

- W8-BEN PaypalDocument3 pagesW8-BEN PaypalKarol Machajewski67% (6)

- Foreign Status Certificate for Tax WithholdingDocument1 pageForeign Status Certificate for Tax WithholdinghectorNo ratings yet

- W 8ben TdaDocument1 pageW 8ben TdaAnamaria Suciu100% (1)

- IRS Form W-8BEN With Affidavit of Unchanged Status Instructions Feb 2006Document1 pageIRS Form W-8BEN With Affidavit of Unchanged Status Instructions Feb 2006Jennipher Lin100% (4)

- W8Ben With US Mailing (FILLABLE)Document2 pagesW8Ben With US Mailing (FILLABLE)Veronica Mtz100% (1)

- Affidavit of TaxexpDocument5 pagesAffidavit of Taxexpdemon100% (7)

- Social Security Form 521 AttachmentsDocument7 pagesSocial Security Form 521 AttachmentsFreeman Lawyer100% (2)

- HHIADocument4 pagesHHIAKeith Alden100% (6)

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)HACKER XNNo ratings yet

- Form 1041-V Payment InstructionsDocument2 pagesForm 1041-V Payment InstructionsPnut Hallman100% (1)

- Corporate Dissolution or Liquidation: InstructionsDocument2 pagesCorporate Dissolution or Liquidation: InstructionsFab Management100% (1)

- F2848 - Power of Attorney and Declaration of Representative - InstructionsDocument6 pagesF2848 - Power of Attorney and Declaration of Representative - InstructionsAutochthon Gazette100% (3)

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Sav 5188Document3 pagesSav 5188Michael100% (1)

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Form - 1040 - ES PDFDocument12 pagesForm - 1040 - ES PDFAnonymous JqimV1ENo ratings yet

- FS Form 5188Document3 pagesFS Form 51882Plus100% (4)

- ChargeBack Order ABH-122009-CO101 PDFDocument2 pagesChargeBack Order ABH-122009-CO101 PDFAllen-nelson of the Boisjoli familyNo ratings yet

- Ss 5Document1 pageSs 5elhorseboxo100% (1)

- UCC3 Assign BondDocument2 pagesUCC3 Assign BondMichael Kovach86% (7)

- 2-Assign Interest in InstrumentDocument2 pages2-Assign Interest in InstrumentMichael Kovach100% (1)

- IRS Form 1040es 2016Document12 pagesIRS Form 1040es 2016Freeman Lawyer100% (1)

- 2848 - Arnold Part 2Document2 pages2848 - Arnold Part 2Arnissia Dior100% (5)

- Notice Concerning Fiduciary RelationshipDocument4 pagesNotice Concerning Fiduciary Relationshipjoe100% (3)

- FW 8 BeneDocument8 pagesFW 8 BenecaptkcNo ratings yet

- Conditional Acceptance and Request for Authentic StatementDocument4 pagesConditional Acceptance and Request for Authentic StatementamenelbeyNo ratings yet

- 1040-V Template 10-03-08Document1 page1040-V Template 10-03-08Justin Vance100% (5)

- Notice of International Commercial ClaimDocument9 pagesNotice of International Commercial Claimjoe100% (3)

- Sample Fraud Private Bond PDFDocument1 pageSample Fraud Private Bond PDFBrien JeffersonNo ratings yet

- Corporate Dissolution FormDocument2 pagesCorporate Dissolution FormDUTCH55140089% (9)

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationAnonymous puqCYDnQNo ratings yet

- 2 Letter To Secretary Paulson BC BondDocument2 pages2 Letter To Secretary Paulson BC BondKonan Snowden100% (8)

- SIKANU Form 56Document4 pagesSIKANU Form 56sikanubeyel100% (3)

- 1040VDocument1 page1040VJack Canterbury100% (3)

- Form 56 PDFDocument2 pagesForm 56 PDFdee donnarumma75% (8)

- H H I A: OLD Armless AND Ndemnity Greement No. 05091989QNWHHIA Non Negotiable Between The PartiesDocument4 pagesH H I A: OLD Armless AND Ndemnity Greement No. 05091989QNWHHIA Non Negotiable Between The PartiesQueenNicole WilliamsNo ratings yet

- Foreign Status Certificate for Tax BenefitsDocument1 pageForeign Status Certificate for Tax BenefitsFaisal Khan100% (1)

- IRS Publication Form 706Document4 pagesIRS Publication Form 706Francis Wolfgang UrbanNo ratings yet

- Ucc 3Document2 pagesUcc 3fh14101995100% (2)

- FW 8 BenDocument1 pageFW 8 BenAbhinav Anand SinghNo ratings yet

- Form W-8BEN Certificate of Foreign StatusDocument1 pageForm W-8BEN Certificate of Foreign StatusImran BashaNo ratings yet

- Form W-8BEN Guide for Foreign StatusDocument8 pagesForm W-8BEN Guide for Foreign StatusneuzatyNo ratings yet

- Foreign Status Certificate Individual Tax FormDocument1 pageForeign Status Certificate Individual Tax FormAndrew Christopher CaseNo ratings yet

- Phisher's W8-BEN FormDocument2 pagesPhisher's W8-BEN FormJames BallNo ratings yet

- Taxform 2Document1 pageTaxform 2perfectmhnNo ratings yet

- W-8ben For CDN Beachbody Coaches SampleDocument1 pageW-8ben For CDN Beachbody Coaches Sampleapi-295933330No ratings yet

- Form W-9 and Instructions Request For Taxpayer Identification Number andDocument20 pagesForm W-9 and Instructions Request For Taxpayer Identification Number andnormlegerNo ratings yet

- IRS Form W-9Document8 pagesIRS Form W-9SAHASec8No ratings yet

- Tax W8 BENsDocument3 pagesTax W8 BENsroman tamayo Jr.No ratings yet

- Merijn 2013 W8-BEN Form - SignedDocument2 pagesMerijn 2013 W8-BEN Form - SignedMerijn Fredriks0% (1)

- FW 9Document4 pagesFW 9api-268381837No ratings yet

- W9Document4 pagesW9James-heatha GowersNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationJeffery OsbunNo ratings yet

- Request W-9 Tax Form IdentificationDocument4 pagesRequest W-9 Tax Form IdentificationLogan BairdNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationChristiney Spencer100% (1)

- W-8BEN Form and InstructionsDocument9 pagesW-8BEN Form and InstructionsgdrsysNo ratings yet

- Print 1stDocument1 pagePrint 1stChristine Marie RamirezNo ratings yet

- PCSO Vigilant Enterprise Service Agreement For "COVERT LPR TRAILERS"Document13 pagesPCSO Vigilant Enterprise Service Agreement For "COVERT LPR TRAILERS"James McLynasNo ratings yet

- LT 2023 Oct-Nov p2 MsDocument13 pagesLT 2023 Oct-Nov p2 Msrqb7704No ratings yet

- Foundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFDocument140 pagesFoundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFjulianbreNo ratings yet

- Contract Drafting - Assignment 2Document2 pagesContract Drafting - Assignment 2verna_goh_shileiNo ratings yet

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Document10 pagesModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoNo ratings yet

- Extra Book - June 2015 FinalDocument84 pagesExtra Book - June 2015 Finaldanishzafar100% (1)

- Amazon Order Details for Sunglasses and Bike AccessoriesDocument1 pageAmazon Order Details for Sunglasses and Bike AccessoriesJuanse CeballosNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Notice: Health Insurance Portability and Accountability Act of 1996 Implementation: Taxpayer Advocacy PanelsDocument1 pageNotice: Health Insurance Portability and Accountability Act of 1996 Implementation: Taxpayer Advocacy PanelsJustia.comNo ratings yet

- Revenue Receipts and Capital ReceiptsDocument17 pagesRevenue Receipts and Capital Receiptsvivek mishra100% (2)

- Taxation DigestsDocument87 pagesTaxation DigestsMeng Goblas67% (3)

- Flange PricesDocument96 pagesFlange PricesSalik ShabbirNo ratings yet

- Direct Selling Report PDFDocument3 pagesDirect Selling Report PDFDHIRAJ KUMARNo ratings yet

- 160-Central Azucarera de Don Pedro v. CTA, Et. Al., May 3, 1967Document6 pages160-Central Azucarera de Don Pedro v. CTA, Et. Al., May 3, 1967Jopan SJNo ratings yet

- Spring2022 Paper Berrychristopher 2-24-22Document58 pagesSpring2022 Paper Berrychristopher 2-24-22Cristiana NobileNo ratings yet

- Unemployment: Unemployment Rate (Unemployed Persons / Labour Force) X 100Document9 pagesUnemployment: Unemployment Rate (Unemployed Persons / Labour Force) X 100slimhippolyte91% (22)

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Document2 pagesForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyNo ratings yet

- Gaudreau v. R. Tax Residency CaseDocument13 pagesGaudreau v. R. Tax Residency CaseCiera BriancaNo ratings yet

- BIR Form No GuidlineDocument11 pagesBIR Form No GuidlineFernando OrganoNo ratings yet

- The Expat Dilemma: Balancing Corporate Goals and Family NeedsDocument16 pagesThe Expat Dilemma: Balancing Corporate Goals and Family NeedsAatif Sumar100% (1)

- Analisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiDocument23 pagesAnalisis Perpajakan Terhadap Bentuk Usaha Tetap Berbasis Layanan AplikasiNidha NianNo ratings yet

- Monthly Current Affairs and GK Capsule July 2018 - Download in PDFDocument47 pagesMonthly Current Affairs and GK Capsule July 2018 - Download in PDFsagrvNo ratings yet

- Pas 12 Income TaxesDocument15 pagesPas 12 Income TaxesrandyNo ratings yet

- BIR Ruling 097-11Document4 pagesBIR Ruling 097-11Jobi BryantNo ratings yet

- Invoice: Invoice Number Invoice Date Payment TypeDocument1 pageInvoice: Invoice Number Invoice Date Payment TypeRishabhGupta 2k20umba32No ratings yet

- IncomeTax Chapter 8Document17 pagesIncomeTax Chapter 8Marie Frances Sayson50% (2)

- Settlement Commissionb Tax FDDocument15 pagesSettlement Commissionb Tax FDhani diptiNo ratings yet

- Factsheet Supply Chain S Ge en 2018Document4 pagesFactsheet Supply Chain S Ge en 2018voumeregistrarNo ratings yet