Professional Documents

Culture Documents

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

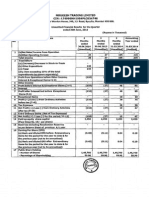

PRIME CAPITAL MARKET LIMITED

Regd. Office : Office No. 18A, BJB Nagar, Bhubaneswar 751014

Corparate Office: P-27, Princep Street, 3rd Floor, Kolkata 700072

CIN - L67120OR1994PLC003649, Email : primecapital.kolkata@gmail.com, Wesbite : www.primecapitalmarket.com

Statement of Unaudited Financial Results for the Quarter ended 30th June 2015

Rs. in Lacs

Corresponding 3 Year to date

3 Months ended 3 Months ended Months ended figures as on

30.06.2015

31.03.2015

31.03.2015

30.06.2014

Un-Audited

Audited*

Un-Audited

Audited

Particulars

Sr.

No.

1

Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

78.00

16.27

Total Income from Operations (Net)

Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

(c) Changes in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

3

Total Expenses

Profit/(Loss) from Operations before other Income, finance cost and exceptional Expenses

(1-2)

4

5

Other Income/(Loss)

6

7

Finance Costs

8

9

10

11

12

13

14

15

44.00

42.00

1.18

2.75

1.15

3.41

1.17

2.17

4.68

8.81

89.93

4.56

3.34

13.49

4.34

21.71

11.76

55.61

21.71

11.76

55.61

21.71

11.76

55.61

4.34

Tax Expense

Net Profit (+)/Loss(-) from ordinary activites after tax (9-10)

Net Profit (+)/Loss(-) for the period (11-12)

69.10

4.34

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

Extra Ordinary Items (Net of Tax Expense of Rs.

15.10

Profit/(Loss) from ordinary activities after finance cost but before exceptional items (3+4)

21.71

11.76

10.42

55.61

10.42

4.34

4.34

11.29

11.29

11.76

11.76

45.19

45.19

1,000.01

-

1,000.01

-

1,000.01

-

1,000.01

328.51

0.04

0.04

0.11

0.11

0.12

0.12

0.45

0.45

0.04

0.04

0.11

0.11

0.12

0.12

0.45

0.45

9,509,749

9,509,749

9,509,749

9,509,749

95.10

95.10

95.10

95.10

Lac)

Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance Sheet

69.10

26.27

4.34

Exceptional Items

15.10

94.27

Profit/(Loss) from ordinary activities before finance costs and exceptional items (3+4)

26.27

Earning Per Share (before extra-ordinary items) of Rs. 10/- each (not annualized)

16

(i) a) Basic

b) Diluted

Earning Per Share (after extra-ordinary items) of Rs. 10/- each (not annualized)

17

(ii) a) Basic

b) Diluted

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

- Percentage of Shares (as a % of the total Share Capital

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

- Percentage of Shares (as a % of the total Share Capital

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

of Promoter and Promoter Group

of the Company

of Promoter and Promoter Group

of the Company

490,351

100.00

490,351

100.00

490,351

100.00

490,351

100.00

4.90

4.90

4.90

4.90

Nil

Nil

Nil

Nil

Notes :

1. Segmental Report for the Quarter as per AS-17 is not applicable for the Quarter.

2. Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 14th August, 2015.

3. Provision for Taxation will be made at the end of Financial Year.

*4. The figures of preceding Quarter ended 31st March 2015 are the balancing figures between Audited figures in respect of full financial year and the

published year to date figures upto the 3rd Quarter of the Previous Financial Year.

5. The Auditors of the Company have carried out "Limited Review" of the above financial Results.

Place : Kolkata

Date : 14th August 2015

For

Prime Capital Market Limited

Sd/-

Sushil Kr. Purohit

Managing Director

B. S. Kedia & Co.

Chartered Accountants

Limited Review Report by Auditors

To

The Board of Directors

M/s. Prime Capital Market Limited

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s. Prime

Capital Market Limited for the Quarter ended 30th June 2015 except for the disclosures

regarding Public Shareholding and Promoter and Promoter Group Shareholding which have

been traced from disclosures made by the management and have not been audited by us. This

statement is the responsibility of the Companys Management and has been approved by the

Board of Directors/ Committee of Board of Directors. Our responsibility is to issue a report on

these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For M/s. B. S. Kedia & Co.

Chartered Accountants

Firm Reg. No. : 317159E

Place : Kolkata

Date : August 14, 2015

Vikash Kedia

Partner

Membership Number 066852

You might also like

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document3 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document4 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- Form Purchase RequisitionDocument1 pageForm Purchase RequisitionAwan SetiawanNo ratings yet

- PHD in Economics, Lecturer Professor, "Dimitrie Cantemir" Christian University BraşovDocument6 pagesPHD in Economics, Lecturer Professor, "Dimitrie Cantemir" Christian University BraşovellennaNo ratings yet

- Monitor Financial TransactionsDocument27 pagesMonitor Financial TransactionsCherrielyn LawasNo ratings yet

- Mercer Salary SurveyDocument31 pagesMercer Salary Surveyjim agustianNo ratings yet

- Ethical Dilemma 3Document2 pagesEthical Dilemma 3Santosh KCNo ratings yet

- Cost AccountingDocument1 pageCost AccountingKathleenNo ratings yet

- What is an Accrued ExpenseDocument3 pagesWhat is an Accrued ExpenseNiño Rey LopezNo ratings yet

- Accounting Information Systems Global 14th Edition Romney Solutions ManualDocument15 pagesAccounting Information Systems Global 14th Edition Romney Solutions Manualkris mNo ratings yet

- Session 5Document2 pagesSession 5Angelia SimbolonNo ratings yet

- CH 1 Managerial Accounting BasicsDocument53 pagesCH 1 Managerial Accounting BasicsIra AdraNo ratings yet

- 6 Funciones Basicas Con CebesDocument35 pages6 Funciones Basicas Con CebesalexanderNo ratings yet

- Apd 6 NotesDocument4 pagesApd 6 NotesHelios HexNo ratings yet

- AndersenDocument26 pagesAndersenJojo Josepha MariaNo ratings yet

- Nama: Nurahma Amalia NIM: 20200070042 Kelas: AK20ADocument4 pagesNama: Nurahma Amalia NIM: 20200070042 Kelas: AK20Aedit andraeNo ratings yet

- Laporan Keuangan 31 Desember 2016Document78 pagesLaporan Keuangan 31 Desember 2016Nova Dwi LestariNo ratings yet

- Final Project Acc406Document18 pagesFinal Project Acc406tintoNo ratings yet

- Template Excel Pengantar AkuntansiiDocument15 pagesTemplate Excel Pengantar AkuntansiiKim SeokjinNo ratings yet

- Central Government Annual General Report For 2015-2016Document637 pagesCentral Government Annual General Report For 2015-2016Anonymous IThkqkNo ratings yet

- Institute of Accountancy ArushaDocument15 pagesInstitute of Accountancy ArushaaureliaNo ratings yet

- Evidence Plan: Bookkeeping NC IiiDocument2 pagesEvidence Plan: Bookkeeping NC IiiJeremy Ortega67% (3)

- 75% RuleDocument2 pages75% RuleKAM JIA LINGNo ratings yet

- Cambridge Ordinary LevelDocument20 pagesCambridge Ordinary LevelShoaib AslamNo ratings yet

- SC upholds validity of CPA certificate issued to British nationalDocument1 pageSC upholds validity of CPA certificate issued to British nationalpja_14No ratings yet

- Accounting Basics Flashcards DsDocument10 pagesAccounting Basics Flashcards DsCorina PaiereleNo ratings yet

- Financial Management & Planning MCQ'sDocument28 pagesFinancial Management & Planning MCQ'sFaizan Ch100% (4)

- CH 10 Revision 2Document14 pagesCH 10 Revision 2Deeb. DeebNo ratings yet

- Accounting and FinanceDocument15 pagesAccounting and FinanceSujal BedekarNo ratings yet

- Store ledger card analysisDocument3 pagesStore ledger card analysisShafiq AbdullahNo ratings yet

- Jit and Backflush CostingDocument10 pagesJit and Backflush CostingMercine Rose SabandalNo ratings yet