Professional Documents

Culture Documents

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

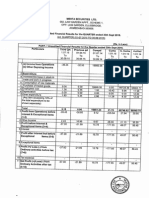

Unisys Softwares & Holding Indutries Ltd.

Regd. Office : 75-C, Park Street (Basement), Kolkata - 700 016 .

CIN - L51909WB1992PLC056742, Email : unisys.softwares@gmail.com, Wesbite : www.unisyssoftwares.com

Statement of Unaudited Financial Results for the Quarter Ended 30th June 2015

Rs. in Lacs

Sr.

No.

1

3 Months ended

30.06.2015

Un-Audited

Particulars

Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

Total Income from Operations (Net)

Expenses

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

3

Total Expenses

Profit/(Loss) from Operations before other Income, finance cost and exceptional

Expenses (1-2)

Corresponding 3

Months ended

30.06.2014

Un-Audited

7,851.95

21,250.43

14,188.04

85.00

100.69

45.25

7,936.95

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

(c) Changes in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade

Preceding 3

Months ended

31.03.2015

Audited*

7,871.89

-

21,351.12

-

21,324.84

-

14,233.29

-

14,155.23

-

Year to date

figures as on

31.03.2015

Audited

47,314.58

330.69

47,645.27

-

47,317.81

-

4.60

4.44

4.75

18.69

7.52

11.27

11.28

45.11

5.48

17.85

5.55

35.02

7,889.49

21,358.40

14,176.81

47,416.63

47.46

(7.28)

56.48

228.64

4

5

Other Income/(Loss)

Profit/(Loss) from ordinary activities before finance costs and exceptional items (3+4)

47.46

(7.28)

56.48

228.64

6

7

Finance Costs

33.75

72.05

158.40

13.71

(79.33)

56.48

70.24

8

9

10

11

12

13

14

15

Profit/(Loss) from ordinary activities after finance cost but before exceptional items

(3+4)

Exceptional Items

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

13.71

Tax Expense

Net Profit (+)/Loss(-) from ordinary activites after tax (9-10)

Extra Ordinary Items (Net of Tax Expense of Rs.

Net Profit (+)/Loss(-) for the period (11-12)

13.71

13.71

-

Lac)

Share of Profit/(Loss) of Associates*

Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share of Profit / (Loss) of

Associates (13-14-15)

16

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

18 Reserves excluding revaluation Reserves as per last Balance Sheet

13.71

2,300.02

-

Earning Per Share (before extra-ordinary items) of Rs. 10/- each (not annualized)

(79.33)

32.95

(112.28)

(112.28)

(112.28)

2,300.02

-

56.48

-

56.48

56.48

-

70.24

32.95

37.29

37.29

-

56.48

37.29

2,300.02

2,300.02

3,609.22

19

(i) a) Basic

b) Diluted

0.06

(0.49)

0.25

0.16

0.06

(0.49)

0.25

0.16

19

(ii) a) Basic

b) Diluted

0.06

(0.49)

0.25

0.16

0.06

(0.49)

0.25

0.16

Earning Per Share (after extra-ordinary items) of Rs. 10/- each (not annualized)

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

- Percentage of Shares (as a % of the total Share Capital

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

- Percentage of Shares (as a % of the total Share Capital

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

17,440,800

17,440,800

17,440,800

17,440,800

75.83

75.83

75.83

75.83

50,000

50,000

50,000

50,000

0.90

0.90

0.90

0.90

0.22

0.22

0.22

0.22

5,509,400

5,509,400

5,509,400

5,509,400

99.10

99.10

99.10

99.10

23.95

23.95

23.95

23.95

of Promoter & Promoter Group

of the Company

of Promoter & Promoter Group

of the Company

Nil

Nil

Nil

Nil

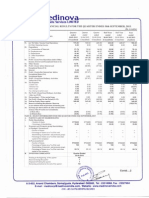

Unisys Softwares & Holding Indutries Ltd.

Regd. Office : 75-C, Park Street (Basement), Kolkata - 700 016 .

CIN - L51909WB1992PLC056742, Email : unisys.softwares@gmail.com, Wesbite : www.unisyssoftwares.com

Un-Audited Segment Results for the Quarter ended 30th June 2015

Rs. in Lacs

Sr.

No.

Particulars

1 Segment Revenue

a) Sale of Software & Hardware / Mobile

b) Investment Activities

c) Other Operational Activities

Total Income from Operations

2 Segment Profit/(Loss) before Interest & Tax

a) Sale of Software & Hardware / Mobile

b) Investment Activities

c) Other Unallocable Activities

Profit before Tax

3 Capital Employed

a) Software & Hardware / Mobile

b) Investment Activities

c) Other Unallocable Activities

Total

Notes :

3 Months ended

30.06.2015

Un-Audited

Preceding 3

Months ended

31.03.2015

Audited*

Corresponding 3

Months ended

30.06.2014

Un-Audited

Year to date

figures as on

31.03.2015

Audited

7,851.95

21,250.43

14,188.04

47,314.58

85.00

100.69

45.25

313.38

7,936.95

21,351.12

14,233.29

47,627.96

3.00

(36.89)

25.80

14.09

10.71

(42.44)

30.68

56.15

13.71

(79.33)

56.48

70.24

5,281.00

5,794.74

3,869.00

5,794.74

33,514.00

30,886.11

28,530.00

30,886.11

82.72

90.24

38,877.72

36,771.09

124.07

32,523.07

90.24

36,771.09

1. Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 14th August, 2015.

2. Provision for taxation will be made end of the Financial Year.

*3. The figures of preceding Quarter ended 31st March 2015 are the balancing figures between Audited figures in respect of full financial year and the

published year to date figures upto the 3rd Quarter of the Previous Financial Year.

4. The Auditors of the Company have carried out "Limited Review" of the above financial Results.

For

Place : Kolkata

Date : 14th August, 2015

Unisys Softwares & Holding Industries Ltd.

Sd/-

Jagdish Prasad Purohit

Managing Director

B. S. Kedia & Co.

Chartered Accountants

Limited Review Report by Auditors

To

The Board of Directors

M/s. Unisys Softwares & Holding Industries Limited

75C, Park Street

Kolkata-700 016

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s. Unisys

Softwares & Holding Industries Limited for the Quarter ended 30th June 2015 except for the

disclosures regarding Public Shareholding and Promoter and Promoter Group Shareholding

which have been traced from disclosures made by the management and have not been audited by

us. This statement is the responsibility of the Companys Management and has been approved by

the Board of Directors/ Committee of Board of Directors. Our responsibility is to issue a report

on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards 1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For M/s. B. S. Kedia & Co.

Chartered Accountants

Firm Reg. No. : 317159E

Place : Kolkata

Date : August 14, 2015

Vikash Kedia

Partner

Membership Number 066852

You might also like

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Statement of Assets & Liabilties As On September 30, 2016 (Result)Document2 pagesStatement of Assets & Liabilties As On September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document1 pageFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results & Limited Review Report For December 31, 2015 (Result)Document3 pagesStandalone Financial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- MACD Histo TEMA Strat Price ActionDocument2 pagesMACD Histo TEMA Strat Price ActionCl IsaNo ratings yet

- McGahan Porter PDFDocument30 pagesMcGahan Porter PDFGerónimo SchlieperNo ratings yet

- Open Banking API FrameworkDocument4 pagesOpen Banking API FrameworkChandra SNo ratings yet

- Supply and Demand Basic - Alfonso Moreno PDFDocument73 pagesSupply and Demand Basic - Alfonso Moreno PDFCiprian Vatamanu60% (5)

- Abhi Project PDFDocument63 pagesAbhi Project PDFAnoop K PNo ratings yet

- Surviving The Economic CollapseDocument3 pagesSurviving The Economic CollapseEden BakerNo ratings yet

- Middlesex v. QuestDocument12 pagesMiddlesex v. QuestJustin OkunNo ratings yet

- Construction Planning and ManagementDocument12 pagesConstruction Planning and ManagementDivyanshu ShekharNo ratings yet

- 09 Financial Reporting and Analysis - Financial Reporting Quality and Financial Statement Analysis PDFDocument15 pages09 Financial Reporting and Analysis - Financial Reporting Quality and Financial Statement Analysis PDFSUMMERSnlNo ratings yet

- JAIIB-PPB-Free Mock Test - JAN 2022Document3 pagesJAIIB-PPB-Free Mock Test - JAN 2022kanarendranNo ratings yet

- Group 4 - SeaMarkDocument17 pagesGroup 4 - SeaMarkRyan Omar Vallega ReyesNo ratings yet

- Introduction To Finance: According To HOWARD AND UPTON, " Financial ManagementDocument11 pagesIntroduction To Finance: According To HOWARD AND UPTON, " Financial ManagementJagadish Kumar BobbiliNo ratings yet

- Quiz 2Document10 pagesQuiz 2simcity23No ratings yet

- AlShaheer Quarterly Report 2016Document35 pagesAlShaheer Quarterly Report 2016faiqsattar1637No ratings yet

- Cost of Capital: Dr. A.N. SAHDocument41 pagesCost of Capital: Dr. A.N. SAHHARMANDEEP SINGHNo ratings yet

- GIC Report 2009Document54 pagesGIC Report 2009Devin KarterNo ratings yet

- S&P ERMethodologyDocument1 pageS&P ERMethodologyapi-3715003No ratings yet

- Cir vs. Suter FactsDocument12 pagesCir vs. Suter FactsEzi AngelesNo ratings yet

- Explanatory StatementDocument3 pagesExplanatory Statementrockyrr100% (1)

- INTERMEDIATE ACCOUNTING INTERIM PERIOD EXERCISES_Borrowing CostsDocument4 pagesINTERMEDIATE ACCOUNTING INTERIM PERIOD EXERCISES_Borrowing CostsAngelica Danuco0% (1)

- NISM Equity Derivatives Free Mock TestDocument18 pagesNISM Equity Derivatives Free Mock TestCharu AgarwalNo ratings yet

- Maximizing Corporate Profits Under RiskDocument21 pagesMaximizing Corporate Profits Under RiskrcouchNo ratings yet

- 2010-03-18 FCIC Memo of Staff Interview With Ellen (Bebe) Duke, CitigroupDocument3 pages2010-03-18 FCIC Memo of Staff Interview With Ellen (Bebe) Duke, CitigroupCarrieonicNo ratings yet

- HKFRS for Private Entities: Nelson Lam Nelson Lam 林智遠 林智遠Document77 pagesHKFRS for Private Entities: Nelson Lam Nelson Lam 林智遠 林智遠ChanNo ratings yet

- PCGG Landmark CasesDocument23 pagesPCGG Landmark CasesJazztine ArtizuelaNo ratings yet

- CB Insights Global Fintech Report Q1 2017Document64 pagesCB Insights Global Fintech Report Q1 2017prsntNo ratings yet

- Financial Attest Audit Guidelines PDFDocument149 pagesFinancial Attest Audit Guidelines PDFsrinivas_54No ratings yet

- FedEx UPS Case StudyDocument31 pagesFedEx UPS Case Studysyahiirah.ariffin0% (1)

- Dandy Horse Ranch ProposalDocument28 pagesDandy Horse Ranch ProposalBoulder City Review100% (1)

- Kuwait - Mohamed IqbalDocument18 pagesKuwait - Mohamed IqbalAsian Development Bank50% (2)