Professional Documents

Culture Documents

TN33 California Pizza Kitchen

Uploaded by

TodayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TN33 California Pizza Kitchen

Uploaded by

TodayCopyright:

Available Formats

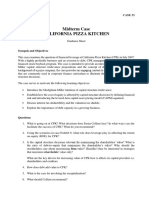

Case 33 California Pizza Kitchen

163

CALIFORNIAPIZZAKITCHEN

Teaching Note

Synopsis and Objectives

This case examines the question of financial leverage at California Pizza Kitchen (CPK) in

July 2007. With a highly profitable business and an aversion to debt, CPK management is

considering a debt-financed stock buyback program. The case is intended to provide an introduction

to the Modigliani-Miller capital structure irrelevance propositions and the concept of debt tax

shields. With the background of a pizza company, the case provides an engaging context to discuss

the pizza graphs that are commonly used in corporate finance curriculum to illustrate the wealth

effects of capital structure decisions.

The case serves to motivate the following teaching objectives:

Introduce the Modigliani-Miller intuition of capital structure irrelevance;

Establish how the cost of equity is affected by capital structure decisions by defining

financial risk and introducing the levered-beta capital asset pricing model (CAPM) equation;

Discuss interest tax deductibility and the valuation tax shields;

Explore the importance of debt capacity in a growing business.

Suggestion for Advance Assignment to Students

Students may consider the following study questions:

1. In what ways can Susan Collyns facilitate the success of CPK?

2. Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return

on equity (ROE) for CPK? What about the cost of capital? In assessing the effect of

leverage on the cost of capital, you may assume that a firms CAPM beta can be modeled

in the following manner: L = U[1 + (1 T)D/E], where U is the firms beta without

leverage, T is the corporate income tax rate, D is the market value of debt, and E is the

market value of equity.

3. Based on the analysis in case Exhibit 9, what is the anticipated CPK share price under

each scenario? How many shares will CPK be likely to repurchase under each scenario?

164

Case 33 California Pizza Kitchen

What role does the tax deductibility of interest play in encouraging debt financing at

CPK?

4. What capital structure policy would you recommend for CPK?

Supplementary Material

A spreadsheet (Case_33.xls) is available for students. The technical

note, The Effects of Debt Equity Policy on Shareholder Return Requirements

and Beta, (UVA-F-1168) is available as a review of the theory and

application of the issues surrounding financial risk. A spreadsheet (TN_33.xls)

is also available for instructors.

Teaching Plan

1. What is going on at CPK? What decisions does Susan Collyns face? What do you

recommend?

This question affords an outline of the issues regarding the capital structure decision at CPK.

End with a class vote on the alternatives.

2. Maybe we can all be right. Is there a case for that?

This question is designed to introduce a discussion of the Modigliani-Miller value

irrelevance of capital structure decisions.

3. How does debt add value to CPK?

This question allows the class to go through the concepts and mechanics of leverage and

debt tax shields. Using case Exhibit 9, the class can discuss ROE, levered betas, and the

concept of risk-sharing.

4. What is the case for not doing the recapitalization?

This question affords a discussion of the counterpoint that completing the recapitalization

diverts the current borrowing capacity away from funding CPKs growth trajectory.

5. What should Collyns recommend?

This question invites a wrap-up of the case discussion.

Case 33 California Pizza Kitchen

165

Case Analysis

1. What is going on at CPK? What decisions does Susan Collyns face? What do you

recommend?

The instructor should allow the students to develop the lay of the land for the case. Of

particular importance are the following points.

CPK has shown strong operating performance recently despite industry challenges of

increasing labor, food input, and energy costs.

Its management has an agenda of expanding the company with 2007 growth requiring $85

million in capital expenditures. Staying power requires a strong balance sheet.

CPKs stock price is down 10% to $22.10. Management is considering the benefits of

borrowing to repurchase shares

The four alternatives considered explicitly in the case are

1.

Maintain existing financial policy with no debt;

2.

Borrow $23 million (10% debt to total book capital);

3.

Borrow $45 million (20% debt to total book capital);

4.

Borrow $68 million (30% debt to total book capital).

This discussion can end with the instructor inviting each student to vote on the alternatives

at hand. Representative student champions can be recorded to facilitate subsequent discussion.

2. Maybe we can all be right, is there a case for that?

This question is designed to introduce a discussion of the Modigliani-Miller value

irrelevance of capital structure decisions. Since this is a pizza case, an engaging way to stimulate

this discussion is with the traditional pizza example of capital structure theory. In this case, I like to

do this example with a couple of real pizzas.1 The instructor can alternatively draw two pizzas on

the board. The pizzas should be identical except that one pizza might be cut into four slices and the

other cut into eight slices. The instructor can ask if anyone is willing to pay $5 for the four-slice

pizza. Then the instructor can ask if the person would rather pay $10 for the eight-slice pizza. The

instructor can use this discussion to solicit the observation that the value of the pizza depends more

on the size of the pizzanot on how it is sliced.

Once the class is convinced, the instructor can ask the class to draw comparisons with CPK.

The students will quickly recognize that the value of CPK depends on the total size of the profits

1

A particularly memorable way to introduce this discussion is to orchestrate a pizza delivery to the classroom at

a particular appointed time, say 20 minutes into the class session.

166

Case 33 California Pizza Kitchen

and not on how the profits are divided up. One can also discuss homemade leverage in the same

spirit as the low cost of self-cutting the pizza and creating an eight-slice pizza. The pizza experience

becomes a striking example that can easily be hearkened back to in subsequent class sessions.

3. How does debt add value to CPK?

Conceptually, the instructor can proceed from the previous discussion by highlighting the

large piece of pizza consumed by the government in the form of corporate income taxes. A tax

policy that allows for interest payments to be tax deductible allows firms to create wealth for

investors by reducing the governments share of the pie.

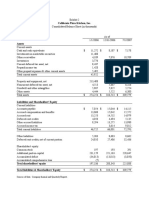

The mechanics of debt tax shields can be facilitated through a discussion of case Exhibit 9.

This exhibit provides a simple pro forma estimate of the value of debt tax shields for three

recapitalization scenarios (10%, 20%, and 30%). In the suggested study questions, students are

invited to complete a variety of different tasks with respect to case Exhibit 9. These tasks include

calculating the implied ROE, costs of capital, stock price, and number of shares outstanding for

each scenario. Exhibit TN1 provides instructor solutions to that exercise. The instructor can invite

students to explain the exhibit and then present their analyses regarding each of those tasks. The

exercise provides two main learning points:

Comprehending the effect of financial leverage and financial risk on firm returns;

Understanding the effect of tax shields on value and the cost of capital.

Financial leverage and financial risk

The instructor can draw attention to the apparent appeal of leverage in increasing the

expected ROE of CPK. When pushed, students will appreciate that leverage comes with additional

risk. To illustrate the point, the instructor can ask students to adjust the earnings before interest and

taxes (EBIT) line of case Exhibit 9 by a certain amount both up and down. In the first round, the

EBIT line can be multiplied by a factor of 1. In this case, the no-leverage ROE drops to 18%,

while the high-leverage ROE drops even more to 29%. Alternatively, if the EBIT line is multiplied

by a factor of 2, the no-leverage ROE rises to +22%, while the high-leverage ROE increases even

more to +30%. The students should quickly see the magnifying effect of leverage on the risk of

equity returns.

The instructor can ask whether equity investors should be happy with the same level of

return for a much higher risk. The instructor can use this discussion to motivate and discuss the

levered-beta formula provided in the study questions and how it captures the effect of financial risk

in concentrating the business risk within a smaller amount of equity capital. The instructor can refer

back to the pizza argument with respect to risk. Leverage is simply a way of slicing up the business

risk. Since the weighted average cost of capital (WACC) reflects the total risk, the WACC should

not change with simply slicing up the risk across various types of contracts. The total risk is

unadjusted. To demonstrate this point with the case example, the instructor must alter the beta

Case 33 California Pizza Kitchen

167

formula in the study questions to remove the portion of risk that the government bears in the tax

shield. This revised formula is L = U[1 + D/E]. The instructor can review the students cost of

capital estimates and discuss how the tax shield allows leverage to reduce the WACC.

The effects of tax shields on value and the cost of capital

The suggested study questions have the students estimating the cost of capital and implied

stock price effects of the tax shield. Exhibit TN1 provides the analysis for that exercise. The

instructor can have the students present and discuss their analyses. The instructor can encourage

consensus on the motivation and mechanics for how the tax shield enters into the weighted-average

costs of capital. An illustration of each component of the cost of capital at each scenario may be

helpful.

Students frequently struggle with estimating the effect of the tax shield on the stock-price

effect and estimating the number of repurchased shares. To help students understand the mechanics,

it is helpful to break the task down by event time. At the time of the announcement of the

recapitalization, the stock price will change to reflect the anticipated tax shield but the number of

shares remains constant. The stock price rises by the value of the tax shield:

Present value of tax shield using perpetuity formula = (kd D t)/kd = D t.

Post-announcement share price = PN = $22.10 + D t/29.129 million shares outstanding.

Later, at the recapitalization, shares are repurchased in the amount of the debt raised. In

expectations, the repurchase occurs at the new share price, PN.

Number of shares repurchased = D/PN.

The new shares-outstanding number is equal to the original number of shares outstanding less the

number of shares repurchased.

4. What is the case for not doing the recapitalization?

CPK has a tradition of conservative financial policy based on its concern for maintaining

staying power. Senior management may be leery of the benefits of leverage and tax-shield gains

when contrasted with the cost of using up borrowing capacity for the future.

Since CPK management has an important growth trajectory for the business, one might

question whether the growth path exceeds the firms ability to sustain such growth. One way to

explore that issue is through an analysis of the sustainable growth rate. To motivate the sustainable

growth rate, the instructor can start with the sources and uses of cash. The definition below excludes

the possibility of new equity financing.

168

Case 33 California Pizza Kitchen

Sources of cash = NOPAT + Net new debt.

Uses of cash = NWC + PPE + Dividends and repurchases + Interest payments.

Setting those equations equal to each other and rearranging terms, we get:

NWC + PPE = NOPAT + Net new debt Dividends and repurchases Interest payments.

Dividing both sides of the equation by total capital (TC) gives the following equation:

Growth in total capital = ROC + D/TC Payments/TC,

where growth in total capital is equal to TC/TC, ROC is equal to NOPAT/TC, and payments are

equal to dividends plus repurchases plus interest payments.

By using debt capacity to repurchase shares, management restricts the funding of business

growth to the level generated by the operations of the business, ROC. With ROC for CPK running

at approximately 10%, CPKs growth rate should be at about that level. The growth in new stores

for 2007 was estimated at 16 to 18 on a base of 213 stores, representing a 7.5% to 8.5% expected

growth rate. The 2007 capital expenditure was expected to be $85 million; depreciation was likely

to be $35 million based on historical values and the first six months of 2007. A $50 million increase

($85 million $35 million) in net property and equipment (NPE) on a book capital base of $226

million represents a 22% growth rate in total capital, not including any increases in new working

capital (NWC). The internally generated funding for growth will be adversely affected if the

industrys economics deteriorate further and reduce businesss ROC.

5. What should Collyns recommend?

The class can close with a discussion on the recommendation. An epilogue for the case is

included in Exhibit TN2.

Case 33 California Pizza Kitchen

Exhibit TN1

CALIFORNIA PIZZA KITCHEN

Pro Forma Tax Shield Effect of Recapitalization Scenarios

(dollars in thousands, except share data; figures based on end of June 2007)

_____________________

Notes:

(1)

Interest rate of CPKs credit facility with Bank of America: LIBOR + 0.80%.

(2)

EBIT includes interest income.

(3)

No earnings per share calculated on treasury stock.

(4)

Market values of debt equal book values.

169

170

Case 33 California Pizza Kitchen

Source: Case writer analysis based on CPK financial data.

Exhibit TN2

CALIFORNIA PIZZA KITCHEN

Epilogue

Over the month of July, CPK repurchased $16.8 million of company shares. The

repurchase was funded with the companys line of credit such that the companys outstanding

borrowings stood at $17 million by the end of the summer. In early 2008, the company

announced its intention to repurchase an additional $46.3 million shares. The company planned

to fund the new program with borrowings under an expanded credit line and available cash

balances. Co-CEOs Rosenfield and Flax remarked,

Management and our Board are confident about the strength and long-term

prospects of our Company. The [share repurchase agreement], in conjunction with

our expanded credit facility, is an effective way for us to return capital to

stockholders, leverage our balance sheet, and reduce our overall cost of capital.

You might also like

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Knoll Furniture CaseDocument5 pagesKnoll Furniture CaseIni EjideleNo ratings yet

- 2018 CFA Level 2 Mock Exam MorningDocument40 pages2018 CFA Level 2 Mock Exam MorningElsiiieNo ratings yet

- Hill Country Snack Foods Capital Structure DebateDocument8 pagesHill Country Snack Foods Capital Structure DebateANKIT AGARWALNo ratings yet

- TN33 California Pizza KitchenDocument8 pagesTN33 California Pizza KitchenChittisa CharoenpanichNo ratings yet

- Sampa Video Group 5Document6 pagesSampa Video Group 5Ankit MittalNo ratings yet

- DuPont Corporation Sale of Performance CoatingsDocument1 pageDuPont Corporation Sale of Performance Coatingsj2203950% (2)

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet

- CPK CaseDocument12 pagesCPK Casejohncaleb100% (5)

- California Kitchen Case StudyDocument9 pagesCalifornia Kitchen Case StudyBYQNo ratings yet

- Kohler Case Leo Final DraftDocument16 pagesKohler Case Leo Final DraftLeo Ng Shee Zher67% (3)

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Word Note California Pizza KitchenDocument7 pagesWord Note California Pizza Kitchenalka murarka100% (16)

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- DuPont QuestionsDocument1 pageDuPont QuestionssandykakaNo ratings yet

- Summery of California Pizza Kitchen CaseDocument1 pageSummery of California Pizza Kitchen CaseAbid Ullah67% (3)

- California Pizza Kitchen Financial ReportsDocument12 pagesCalifornia Pizza Kitchen Financial Reportsxinz1313No ratings yet

- Sampa Video Inc.: Case 3 Corporate Finance December 3, 2015Document5 pagesSampa Video Inc.: Case 3 Corporate Finance December 3, 2015Morsal SarwarzadehNo ratings yet

- CPK Case Study AnalysisDocument4 pagesCPK Case Study AnalysisAbhishek BharteNo ratings yet

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Teuer Furniture CaseDocument5 pagesTeuer Furniture CaseArindam Malakar0% (3)

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Midterm Case California Pizza KitchenDocument2 pagesMidterm Case California Pizza KitchenAhmed El Khateeb100% (1)

- Flinder Valves and Controls Inc.: Case 50Document29 pagesFlinder Valves and Controls Inc.: Case 50SzilviaNo ratings yet

- Case 33 California Pizza Kitchen ExhibitsDocument10 pagesCase 33 California Pizza Kitchen ExhibitsmhogomanNo ratings yet

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- Case 51 - SolDocument20 pagesCase 51 - SolArdian Syah75% (4)

- California PizzaDocument4 pagesCalifornia PizzaMaria Fe Callejas0% (1)

- California Pizza KitchenDocument13 pagesCalifornia Pizza KitchenKhaled Al-Bousairi100% (3)

- California Pizza Kitchen-Rev2Document7 pagesCalifornia Pizza Kitchen-Rev2amit ashish100% (2)

- T3-Sample Answers-Consideration PDFDocument10 pagesT3-Sample Answers-Consideration PDF--bolabolaNo ratings yet

- Blaine Kitchenware CaseDocument4 pagesBlaine Kitchenware Caseskyhannan80% (5)

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyNo ratings yet

- Annual ReportDocument15 pagesAnnual ReportDibakar DasNo ratings yet

- Teuer Furniture (A) Case Group 5 AnalysisDocument5 pagesTeuer Furniture (A) Case Group 5 AnalysisRajesh PatidarNo ratings yet

- Boeing's New 7E7 AircraftDocument10 pagesBoeing's New 7E7 AircraftTommy Suryo100% (1)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Teuer Furniture Case AnalysisDocument3 pagesTeuer Furniture Case AnalysisPankaj KumarNo ratings yet

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- California Pizza Kitchen Case SolnDocument8 pagesCalifornia Pizza Kitchen Case Solnkiller dramaNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Lecture Note 6 (Case Ocean Carrier)Document25 pagesLecture Note 6 (Case Ocean Carrier)Jing Zhou100% (1)

- Case Study - Hill Country Snack Foods Co.Document2 pagesCase Study - Hill Country Snack Foods Co.Spencer123455678967% (3)

- TN40 MoGen IncDocument29 pagesTN40 MoGen Inc__myself50% (4)

- VC, PE, Angel investors and startup ecosystem parties in IndonesiaDocument82 pagesVC, PE, Angel investors and startup ecosystem parties in IndonesiaGita SwastiNo ratings yet

- California Pizza KitchenDocument4 pagesCalifornia Pizza KitchenMarvi Ahmad100% (2)

- California Pizza KitchenDocument3 pagesCalifornia Pizza KitchenTommy HaleyNo ratings yet

- California Pizza Chicken Share Repurchase AnalysisDocument13 pagesCalifornia Pizza Chicken Share Repurchase AnalysisBerni RahmanNo ratings yet

- Caso TeuerDocument46 pagesCaso Teuerjoaquin bullNo ratings yet

- DCF valuation of video delivery business expansionDocument24 pagesDCF valuation of video delivery business expansionHenny ZahranyNo ratings yet

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncUmair ahmedNo ratings yet

- Calculation of Blain Kitchenware CaseDocument2 pagesCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Teuer Furniture SecB Grp9Document18 pagesTeuer Furniture SecB Grp9devilcaeser201033% (3)

- Case 51 Palamon Capital Partners Team System SPADocument10 pagesCase 51 Palamon Capital Partners Team System SPAcrs50% (2)

- BKI's Capital Structure and Payout PoliciesDocument4 pagesBKI's Capital Structure and Payout Policieschintan MehtaNo ratings yet

- TN33 California Pizza KitchenDocument8 pagesTN33 California Pizza KitchenJoel PerezNo ratings yet

- Teachings Note California Pizza Kitchen - Term PaperDocument8 pagesTeachings Note California Pizza Kitchen - Term PaperDharm Veer RathoreNo ratings yet

- 20181021211002case 33 California Pizza Kitchen Guidance Sheet April 2018Document2 pages20181021211002case 33 California Pizza Kitchen Guidance Sheet April 2018ahmed mahmoudNo ratings yet

- Case 32 - Analysis GuidanceDocument1 pageCase 32 - Analysis GuidanceVoramon PolkertNo ratings yet

- Case33notes 000Document2 pagesCase33notes 000Amit GuptaNo ratings yet

- Suggested Quey4uujjrstions For Advance Assignment To StudentsDocument3 pagesSuggested Quey4uujjrstions For Advance Assignment To StudentsDendy FebrianNo ratings yet

- TN14 4eDocument21 pagesTN14 4eAarti J50% (2)

- LatAm Fintech Landscape - 2023Document3 pagesLatAm Fintech Landscape - 2023Bruno Gonçalves MirandaNo ratings yet

- Extinguishment of Obligations by Confusion and CompensationDocument38 pagesExtinguishment of Obligations by Confusion and CompensationMaicah Marie AlegadoNo ratings yet

- Invoice #100 for Project or Service DescriptionDocument1 pageInvoice #100 for Project or Service DescriptionsonetNo ratings yet

- Simple Annuity Activity (Math of Investment)Document1 pageSimple Annuity Activity (Math of Investment)RCNo ratings yet

- Xisaab XidhDocument1 pageXisaab XidhAbdiNo ratings yet

- Ch.3 Size of BusinessDocument5 pagesCh.3 Size of BusinessRosina KaneNo ratings yet

- Central Surety and Lnsurance Company, Inc. vs. UbayDocument5 pagesCentral Surety and Lnsurance Company, Inc. vs. UbayMarianne RegaladoNo ratings yet

- Role of Derivatives in Economic Growth and DevelopmentDocument22 pagesRole of Derivatives in Economic Growth and DevelopmentKanika AnejaNo ratings yet

- Taurian Curriculum Framework Grade 11 BSTDocument6 pagesTaurian Curriculum Framework Grade 11 BSTDeepak SharmaNo ratings yet

- 1.25 Suku Bunga, Diskonto, Imbalan (Persen Per Tahun)Document2 pages1.25 Suku Bunga, Diskonto, Imbalan (Persen Per Tahun)Izzuddin AbdurrahmanNo ratings yet

- Itc Balance SheetDocument2 pagesItc Balance SheetRGNNishant BhatiXIIENo ratings yet

- Revenue Recognition Guide for Telecom OperatorsDocument27 pagesRevenue Recognition Guide for Telecom OperatorsSaurabh MohanNo ratings yet

- s6 Econ (Public Finance and Fiscal Policy)Document50 pagess6 Econ (Public Finance and Fiscal Policy)juniormugarura5No ratings yet

- Dambisa Moyo (2010) : Dead Aid - Why Aid Is Not Working and How There Is Another Way For AfricaDocument7 pagesDambisa Moyo (2010) : Dead Aid - Why Aid Is Not Working and How There Is Another Way For AfricaseidNo ratings yet

- How To Apply For A Rental Property - Rent - Ray White AscotDocument2 pagesHow To Apply For A Rental Property - Rent - Ray White AscotRRWERERRNo ratings yet

- Comparison of Equity Mutual FundsDocument29 pagesComparison of Equity Mutual Fundsabhishekbehal5012No ratings yet

- Salient Features of The Companies Act, 2013Document6 pagesSalient Features of The Companies Act, 2013SuduNo ratings yet

- Croissance Economique Taux Change Donnees Panel RegimesDocument326 pagesCroissance Economique Taux Change Donnees Panel RegimesSalah OuyabaNo ratings yet

- Principle of Halal PurchasingDocument13 pagesPrinciple of Halal Purchasing680105100% (1)

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- What is Operations ResearchDocument10 pagesWhat is Operations ResearchSHILPA GOPINATHANNo ratings yet

- Zambia Housing Policy ImpactDocument54 pagesZambia Housing Policy ImpactMukuka KowaNo ratings yet

- Region I - TIP DAR ProgramDocument761 pagesRegion I - TIP DAR ProgramDavid ThomasNo ratings yet

- Maximizing Advantages of China JV for HCFDocument10 pagesMaximizing Advantages of China JV for HCFLing PeNnyNo ratings yet

- Termination of Sub-Broker AgreementDocument3 pagesTermination of Sub-Broker AgreementJnanesh S DevrajNo ratings yet