Professional Documents

Culture Documents

Bir Form 1901

Uploaded by

jaciemCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Form 1901

Uploaded by

jaciemCopyright:

Available Formats

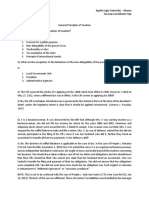

(To be filled-up by the BIR)

DLN:

BIR Form No.

1901

Application for

Registration

Republika ng Pilipi nas

Kag awaran ng Pananalapi

Kawanihan ng Rentas Internas

January 2000 (ENCS)

For Self-Employed and Mixed Income

Individuals, Estates and Trusts

New TIN to be issued, if applicable

(To be fille d up by BIR)

Text

Fill in all appropriate white spaces. Mark all appropriate boxes with an X.

Part I

1 Taxpayer Type

Single Proprietorship

Professional

Taxpayer Information

Estate 2 Registering Office

Head Office

Trust

Branch Office

4 Taxpayer Identification No.

(For taxpayers with existing TIN

or applying for a branch)

Date of Registration

(MM/ DD/ YYYY)

(To be filled up by BIR)

RDO Code

Male

Female

Sex

(To be filled up by BIR)

7 Taxpayer's Name

Last Name

First Name

10 Residence Address (Please indicate complete address)

Citizenship

Date of Birth/ Organization Date

(Estates/ Trusts) ( MM / DD / YYYY )

Middle Name

11 Zip Code

12 Telephone Number

13 Business Address (Please indicate complete address)

15 Municipality Code

14 Zip Code

16 Telephone Number

(To be filled up by the BIR)

18 Address of

Administrator/Trustee

17 Name of Administrator/Trustee

(In case of Estate/Trust)

19 Primary/ Secondary Industries (Attach Additional Sheets, If Necessary) Facility Types : PP - Place of Production; SP - Storage Place; WH - Warehouse

CODE

Number

Facility Type

(To be filled up by BIR)

Industry

Primary

Primary

Secondary

Secondary

Business / Trade Names

PSIC

with no independent tax types

PSOC

Line of Business/ Occupation

PP

SP

WH

of

Facilities

21 Telephone Number

20 Contact Person/ Accredited Tax Agent (if different from taxpayer)

Last Name, First Name, Middle Name (if individual) / Registered Name (if non-individual)

22

Tax Types (choose only the tax types that are applicable to you)

FORM TYPE

ATC

(To be filled up by the BIR)

(To be filled up by the BIR)

Income Tax

Value-added Tax

Percentage Tax - Stocks

Percentage Tax - Stocks (IPO)

Other Percentage Taxes Under the National Internal Revenue Code

(Specify)

Percentage Tax Payable Under Special Laws

Withholding Tax - Compensation

Withholding Tax - Expanded

Withholding Tax - Final

Withholding Tax - Fringe Benefits

Withholding Tax - Banks and Other Financial Institutions

Withholding Tax - Others (One-time Transaction not

subject to Capital Gains Tax)

Withholding Tax - VAT and Other Percentage Taxes

Withholding Tax - Percentage Tax on Winnings and Prizes Paid by

Excise Tax - Ad Valorem Racetrack Operators

Excise Tax - Specific

Tobacco Inspection and Monitoring Fees

Documentary Stamps Tax

Capital Gains Tax - Real Property

Capital Gains Tax - Stocks

Estate Tax

Donor's Tax

Registration Fees

Miscellaneous Tax (Specify)

Others (Specify)

23 Registration of Books of Accounts

PSIC

TYPE OF BOOKS TO BE REGISTERED

PSOC

(To be filled up by BIR) (To be filled up by BIR)

VOLUME

QNTY.

FROM

TO

NO. OF

PAGES

BIR Form No. 1901 (ENCS)-PAGE 2

Part II

Personal Exemptions

24

Civil Status

25

Employment Status of Spouse:

Single/Widow/Widower/Legally Separated (No dependents)

Unemployed

Head of the Family

Employed Locally

Single with qualified dependent

Legally separated with qualified dependent

Employed Abroad

Widow/Widower with qualified dependent

Benefactor of a qualified senior citizen (RA No. 7432)

Engaged in Business/Practice

Married

of Profession

26 Claims for Additional Exemptions/ Premium Deductions for husband and wife whose aggregate family income does not exceed P250,000.00 per annum.

Husband claims additional exemption and any premium deductions

Wife claims additional exemption and any premium deductions

(Attach Waiver of the Husband)

27 Spouse Information

Spouse Taxpayer Identification Number

Spouse Name

27A

27B

Last Name

First Name

Spouse Employer's Name

Spouse Employer's Taxpayer Identification Number

27C

Middle Name

27D

Part III

Section A

28 Number of Qualified Dependent Children

29 Names of Qualified Dependent Children

Last Name

Additional Exemptions

Number and Names of Qualified Dependent Children

First Name

Middle Name

Date of Birth

Mark if Mentally

/ Physically

Incapacitated

( MM / DD / YYYY )

29A

29B

29C

29D

29E

30A

30B

30C

30D

30E

31A

31B

31C

31D

31E

32A

32B

32C

32D

32E

Section B

Name of Qualified Dependent Other than Children

Last Name

33A

First Name

33B

Middle Name

33C

Mark if Mentally

/ Physically

Incapacitated

Date of Birth

( MM / DD / YYYY )

33D

33E

33F

Relationship

Parent

Brother

Sister

Qualified Senior Citizen

Part IV

For Employee With Two or More Employers (Multiple Employments) Within the Calendar Year

34

Type of multiple employments

Successive employments (With previous employer(s) within the calendar year), for late registrants if applicable

Concurrent employments (With two or more employers at the same time within the calendar year)

[If successive, enter previous employer(s); if concurrent, enter secondary employer(s)]

Previous and Concurrent Employments During the Calendar Year

TIN

Name of Employer/s

35 Declaration

I declare, under the penalties of perjury, that this form has been made in good faith, verified by me and to the best of my knowledge

and belief is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued

under authority thereof.

TAXPAYER / AUTHORIZED AGENT

(Signature over printed name)

Part V

36 Taxpayer Identification Number

Current Main Employer Information

37 RDO Code

(To be filled up by BIR)

38 Employer's Name (Last Name, First Name, Middle Name, if Individual/ Registered Name, if non-Individuals)

39 Employer's Business

Address

40 Zip Code

41 Municipality Code

42 Effectivity Date

(To be filled

(Date when Exemption Information is applied)

up by the BIR)

43 Date of Certification

(Date of certification of the accuracy of the

exemption information)

44 Telephone Number

(MM/ DD/ YYYY)

45 Declaration

I declare, under the penalties of perjury, that this form has been made in good faith, verified by

me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the

National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

(MM/ DD/ YYYY)

Stamp of BIR Receiving Office

and Date of Receipt

Attachments Complete?

(To be filled up by BIR)

EMPLOYER / AUTHORIZED AGENT

Title / Position of Signatory

Yes

(Signature over printed Name)

ATTACHMENTS: (Photocopy only)

A. For Self-employed/ Professionals/ Mixed Income Individuals

1- Birth Certificate or any document showing name, address

and birth date of the applicant

No

2- Mayor's Permit - if applicable,

3- DTI Certificate of Registration of Business Name

to be submitted prior to the issuance of

to be submitted prior to the issuance of

Certificate of Registration

Certificate of Registration

C. For Estate - Death Certificate of the deceased

B. For Trust -Trust Agreement

NOTE:

1. Update trade name upon receipt of DTI Certificate of Registration of Business Name.

2. Taxpayer should attend the required taxpayers briefing before the release of the BIR Certificate of Registration

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER(TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE

PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

You might also like

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- AIA Philam Life Policy Fund Withdrawal FormDocument2 pagesAIA Philam Life Policy Fund Withdrawal Formippon_osotoNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Notarized CertificationDocument3 pagesNotarized CertificationRheneir MoraNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- TaxxxxDocument3 pagesTaxxxxfaye gNo ratings yet

- Affidavit of Loss - ForMDocument1 pageAffidavit of Loss - ForMLiDdy Cebrero BelenNo ratings yet

- Ibp Lawyers Id Form: Integrated Bar of The PhilippinesDocument1 pageIbp Lawyers Id Form: Integrated Bar of The PhilippinesVoltaire Delos ReyesNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- Request For BI Clearance CertificateDocument1 pageRequest For BI Clearance CertificateNith08No ratings yet

- Deed of DonationDocument3 pagesDeed of DonationMenard Dasing KilitoNo ratings yet

- Letter To PhilhealthDocument5 pagesLetter To PhilhealthCCC DocsNo ratings yet

- Affidavit of Loss of ID Cards and DocumentsDocument1 pageAffidavit of Loss of ID Cards and DocumentsSusan PascualNo ratings yet

- Prescription, Waiver and Closure - Jamie Lyn HernandezDocument23 pagesPrescription, Waiver and Closure - Jamie Lyn HernandezJamie LynNo ratings yet

- Annual Income Tax Return: (DonotentercentavosDocument2 pagesAnnual Income Tax Return: (DonotentercentavosKuhramaNo ratings yet

- Business PermitDocument1 pageBusiness PermitVELOX MABUHAYNo ratings yet

- Special Power of Attorney FormDocument2 pagesSpecial Power of Attorney FormFrance De LunaNo ratings yet

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsDocument1 pageSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston BullionNo ratings yet

- Application-for-Business-Retirement in MuntinlupaDocument1 pageApplication-for-Business-Retirement in MuntinlupajoycegNo ratings yet

- Receipts InvoicesDocument9 pagesReceipts InvoicesDu Baladad Andrew MichaelNo ratings yet

- Bir TaxDocument1 pageBir TaxLester JayNo ratings yet

- Terms and Conditions Capital Contribution PDFDocument4 pagesTerms and Conditions Capital Contribution PDFI-golot AkNo ratings yet

- CDR Voluntary Application For ACR I-CardDocument1 pageCDR Voluntary Application For ACR I-CardFrodina Mafoxci RafananNo ratings yet

- BIR Tax Return Payment RequestDocument1 pageBIR Tax Return Payment Requestjoy buedoNo ratings yet

- (2018) New BIR Income Tax Rates andDocument31 pages(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- Credit Application Form Motorcycle LoanDocument2 pagesCredit Application Form Motorcycle Loanmark_ortencio50% (2)

- Demand Letter To PayVacateDocument1 pageDemand Letter To PayVacateIan Jala CalmaresNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- Annex C.2: Sworn Application For Tax ClearanceDocument1 pageAnnex C.2: Sworn Application For Tax ClearanceIan Bernales OrigNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- Ian-Gio Olaso Papa: Attorney-at-LawDocument8 pagesIan-Gio Olaso Papa: Attorney-at-LawRenzo JamerNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocument2 pagesRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake Mitsuki100% (1)

- Efps Letter 009Document1 pageEfps Letter 009ElsieJhadeWandasAmandoNo ratings yet

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- Request For Reimbursement Form: Claim No.Document1 pageRequest For Reimbursement Form: Claim No.Bohol FSEO AnnexNo ratings yet

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Document2 pagesShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- License To Operate FDADocument2 pagesLicense To Operate FDAx9hhzc28kb100% (1)

- Electronic Business Permit - Renewal: Subject To InspectionDocument3 pagesElectronic Business Permit - Renewal: Subject To InspectionRose Salminao100% (1)

- Account Closing Letter To BankDocument1 pageAccount Closing Letter To BankCostea FlorinNo ratings yet

- Pag-IBIG Employer Enrollment FormDocument2 pagesPag-IBIG Employer Enrollment FormJhonna Magtoto100% (2)

- Certificate of Death 1Document2 pagesCertificate of Death 1Charley Labicani BurigsayNo ratings yet

- SPADocument1 pageSPAPaul CasajeNo ratings yet

- Revenue Memorandum Order No. 35-1990Document2 pagesRevenue Memorandum Order No. 35-1990Kaye MendozaNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument4 pagesCover Sheet: For Audited Financial StatementsAlea Mae Therese BermejoNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsMacLaw MacOfficeNo ratings yet

- HDMF Contributions and Loan PaymentDocument29 pagesHDMF Contributions and Loan PaymentRocelle IndicoNo ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document5 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Jennylyn TagubaNo ratings yet

- GFFS General Form Rev 20061Document14 pagesGFFS General Form Rev 20061Genesis Manalili100% (1)

- Bpathlete Entry FormDocument1 pageBpathlete Entry FormJone del PinoNo ratings yet

- Electronic Official Receipt: City Government of Manila City Treasurer'S OfficeDocument2 pagesElectronic Official Receipt: City Government of Manila City Treasurer'S OfficeBarangay 708 Zone 78 District VNo ratings yet

- Trade LicenceDocument1 pageTrade Licencekellymtuku25No ratings yet

- Filamer Christian University: Roxas Avenue, Roxas City, Philippines 5800 Tel. No. (036) 6212-317Document2 pagesFilamer Christian University: Roxas Avenue, Roxas City, Philippines 5800 Tel. No. (036) 6212-317Alejandre BrotarloNo ratings yet

- COA guidelines for preventing irregular expendituresDocument71 pagesCOA guidelines for preventing irregular expendituresleah santosNo ratings yet

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- BIR Form 1901 ApplicationDocument4 pagesBIR Form 1901 ApplicationAlvin John Benavidez Salvador50% (2)

- Alphabet Vocabulary Mini Cards Set 1 Lowercase PDFDocument5 pagesAlphabet Vocabulary Mini Cards Set 1 Lowercase PDFjaciemNo ratings yet

- Renewal Application Adult01Document2 pagesRenewal Application Adult01scribideeNo ratings yet

- Affidavit of Loss: Republic of The Philippines) - , - ) S.SDocument1 pageAffidavit of Loss: Republic of The Philippines) - , - ) S.SDeiz PilaNo ratings yet

- Step Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)Document1 pageStep Applicant/Client Service Provider Person in Charge Fees Form Duration of Activity (Under Normal Circumstances)jaciemNo ratings yet

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- Perfect Mind PDFDocument67 pagesPerfect Mind PDFjaciemNo ratings yet

- PFF108 LoyaltyCardApplicationForm V04 PDFDocument2 pagesPFF108 LoyaltyCardApplicationForm V04 PDFCircuit CulzNo ratings yet

- Work Experience Sheet for Supervising PositionsDocument2 pagesWork Experience Sheet for Supervising PositionsCes Camello100% (1)

- 2017 Pds GuidelinesDocument4 pages2017 Pds GuidelinesManuel J. Degyan75% (4)

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- Apply for Professional ID CardDocument1 pageApply for Professional ID CardVeraNataaNo ratings yet

- PROPOSED AMENDMENTS TO PHILIPPINE CORPORATION CODEDocument95 pagesPROPOSED AMENDMENTS TO PHILIPPINE CORPORATION CODEjaciemNo ratings yet

- Sample of Employment Contact PT EngDocument3 pagesSample of Employment Contact PT EngjaciemNo ratings yet

- Certificate of Employment - Graphic ArtistDocument2 pagesCertificate of Employment - Graphic ArtistjaciemNo ratings yet

- Early Childhoon in Calamba and BiñanDocument2 pagesEarly Childhoon in Calamba and BiñanjaciemNo ratings yet

- Suspension Letter SampleDocument1 pageSuspension Letter Samplechikkieting50% (2)

- Dissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - LguDocument2 pagesDissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - Lgujaciem100% (1)

- Midwifery ExamDocument1 pageMidwifery ExamjaciemNo ratings yet

- Business Law and Taxation ReviewerDocument5 pagesBusiness Law and Taxation ReviewerJeLo ReaNdelar100% (2)

- Business Organization ReviewerDocument7 pagesBusiness Organization ReviewerRozel L Reyes100% (2)

- Oman Business GuideDocument17 pagesOman Business GuideZadok Adeleye50% (2)

- Income Tax Study PackDocument68 pagesIncome Tax Study PackKempton MurimiNo ratings yet

- Fit Chap011Document59 pagesFit Chap011goodfella00975% (4)

- Aquila Legis Fraternity – Ateneo Tax Law Last Minute TipsDocument17 pagesAquila Legis Fraternity – Ateneo Tax Law Last Minute TipsWilbert ChongNo ratings yet

- January 2023 Advisory Section 1202 Small Business Stock Capital Gains ExclusionDocument4 pagesJanuary 2023 Advisory Section 1202 Small Business Stock Capital Gains Exclusionvincent nolanNo ratings yet

- TAX BAR Qs With AnswersDocument10 pagesTAX BAR Qs With AnswersJanila BajuyoNo ratings yet

- Mutual Funds: Project Report OnDocument40 pagesMutual Funds: Project Report OnShilpi_Mathur_7616No ratings yet

- Taxguru - In-Taxation of CharitableReligious Trust 4Document6 pagesTaxguru - In-Taxation of CharitableReligious Trust 4Ishita FarsaiyaNo ratings yet

- Taxation Law Review Notes: I. Basic Principles of Taxation A. Taxation As An Inherent Power of The StateDocument47 pagesTaxation Law Review Notes: I. Basic Principles of Taxation A. Taxation As An Inherent Power of The Stategilbert marimon chattoNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- DT NotesDocument95 pagesDT NotesDharshini AravamudhanNo ratings yet

- Income Tax Procedure PracticeU 12345 RB PDFDocument41 pagesIncome Tax Procedure PracticeU 12345 RB PDFBrindha BabuNo ratings yet

- CCG Honduras 2013 - Latest - Eg - HN - 069624Document111 pagesCCG Honduras 2013 - Latest - Eg - HN - 069624Yeny PazNo ratings yet

- Capital Gains Section ParticularsDocument15 pagesCapital Gains Section ParticularsNiyati DholakiaNo ratings yet

- 7tax Administration LectureDocument48 pages7tax Administration LectureHawa MudalaNo ratings yet

- Income Taxation Preliminary Examination Income Tax On Individuals Multiple ChoicesDocument3 pagesIncome Taxation Preliminary Examination Income Tax On Individuals Multiple ChoicesJoel RagosNo ratings yet

- Foreign Institutional Investment (Fii) Impact On Indian Stock Market and Its Investment Behavior (Fin)Document79 pagesForeign Institutional Investment (Fii) Impact On Indian Stock Market and Its Investment Behavior (Fin)khareanurag49100% (4)

- Tax Return 2012 Guide EnclosedDocument16 pagesTax Return 2012 Guide EnclosedNatalia Ciocirlan100% (1)

- Bcom 402Document220 pagesBcom 402Prabhu SahuNo ratings yet

- 8 Ways To Minimize Taxes When Selling A Business: Adam TkaczukDocument16 pages8 Ways To Minimize Taxes When Selling A Business: Adam TkaczukBerchadesNo ratings yet

- 2016 NAIC Instructions - IMRDocument13 pages2016 NAIC Instructions - IMRtiogang1256No ratings yet

- CIR vs. Estate of Benigno P. Toda, JRDocument13 pagesCIR vs. Estate of Benigno P. Toda, JRMrln VloriaNo ratings yet

- Working From Home Policy: 1. Aims and ObjectivesDocument14 pagesWorking From Home Policy: 1. Aims and ObjectivesPraween Anselm LakraNo ratings yet

- Banco de Oro vs RCBC dispute over tax treatment of PEACe BondsDocument64 pagesBanco de Oro vs RCBC dispute over tax treatment of PEACe BondsJesse Myl MarciaNo ratings yet

- BCH 501 Lesson PlanDocument17 pagesBCH 501 Lesson PlansdddNo ratings yet

- một số câu hỏi bài tập tiếng anhDocument21 pagesmột số câu hỏi bài tập tiếng anhNam chính Chị củaNo ratings yet

- Set of Carry ForwardDocument4 pagesSet of Carry ForwardShobhit ShuklaNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- Donor's TaxDocument17 pagesDonor's TaxTessie CuaNo ratings yet

- 6481 CorporateTaxPlanninarticleDocument24 pages6481 CorporateTaxPlanninarticleRaghav SharmaNo ratings yet