Professional Documents

Culture Documents

Fast Food Industry Overview in Russia and Ukraine

Uploaded by

geopan88Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fast Food Industry Overview in Russia and Ukraine

Uploaded by

geopan88Copyright:

Available Formats

522 SW 5th Ave.

, Suite 708

Portland, OR, 97205, USA

Toll Free: 877-WITH-ACG

Direct Line: 503-419-6431

info@aginskyconsulting.com

www.aginskyconsulting.com

Overview of the Fast Food Industry in Russia and Ukraine

Summary of contents

I. Ukrainian Market Overview

A. Macroeconomic Conditions in Ukraine

B. Ukrainian Retail Industry

C. Ukrainian Restaurant Industry

D. Ukrainian Fast Food Market

II. Russian Market Overview

A. Macroeconomic Conditions in Russia

B. Russian Retail Industry

C. Russian Restaurant Industry

D. Russian Fast Food Market

III. Conclusion and Opportunities

Ukrainian Economic Overview

Market growth and a relative lack of market saturation make

Ukraine the third most attractive consumer market in the

world. A.T. Kearney

After Russia, Ukraine is by far the most important economy in the Commonwealth of Independent

States (CIS), producing four times the output of the next ranking country. Its population is nearly

50 million people and its GDP (at Purchasing Power Parity) is more than $350 billion.1 With rich

farmlands, a well-developed industrial base, highly trained labor force, and a good education

system, Ukraine has become a major Eastern European power. Ukraine has experienced rapid

growth since the turn of the century and these trends are expected to continue into the future.

The annual economic growth has averaged 7.4 percent per year since 2000, reaching 12.1 percent

in 2004 and 7.0 percent in 2006.2 GDP grew by more than 50 percent from 1999 to 2004, which,

in combination with significant improvement in the countrys fiscal position, led to a dramatic

decrease in its debt-to-GDP ratio. Personal incomes are also rising rapidly and total disposable

income grew to $49.9 billion dollars in 2005, a 23 percent increase over 2000. 3 Consumer

spending in Ukraine has increased by 25 percent YOY to $50.7 billion in 2004, and expanded by an

estimated 35 percent to $68.5 billion in 2005.4

Ukraine actively encourages foreign trade and investment. Their foreign investment laws allow

Westerners to purchase businesses and property, to repatriate revenue and profits, and to receive

compensation in the event that property is to be nationalized by a future government. Ukraine

1 Country Report: Ukraine, The World Bank. November 1, 2007. Available online at: www.worldbank.org

2 U.S. Department of State: Bureau of European and Eurasian Affairs. March 2007. Available online at:

http://www.state.gov/r/pa/ei/bgn/3211.htm

3 Overview of Ukrainian Retail, Dragon Capital Corporate Finance. Available online at:

http://www.horizoncapital.com.ua/files/Ukrainian%20Retail%20Overview%20(Eng).pdf

4 Ibid.

www.aginskyconsulting.com

Page 1 of 8

AGINSKY CONSULTING GROUP

passed more than 20 laws in 2006 to bring its trading regime into consistency with the World

Trade Organization standards. These changes are validated by positive indicators such as

dramatically heightened investor interest, a surge in foreign direct investment (FDI), sales by

financial and industrial groups of subsidiaries and banks, continued growth of services, increases

in light industrial production, and continuous entry of small and medium enterprises. In 2005 and

2006, Ukraine received a record amount of FDI, bringing total foreign investment in Ukraine to

$19.9 billion. 5 This figure is expected to grow to more than $21 billion in 2007.6 Russian and

European exporters dominate the Ukrainian market, while US exports are steadily climbing,

reaching over $500 million in 2006.7

Ukrainian Retail Market

Retail trade is one of Ukraines fastest growing sectors and the most rapidly growing retail market

in Central and Eastern Europe. Retail turnover has grown to $45 billion, rising by $4.6 billion or

24.8 percent in 2006.8 More than half (51.6 percent) of retail goods are sold through large retail

chains, while 31.3 percent are sold at markets, and 18.1 percent sold by sole proprietors.9 The

structure of turnover is stable, with wholesale trade representing 70 percent and retail 30

percent. Nearly 70 percent of enterprises engaged in the retail trade are profitable. The retail

market expanded by more than 26 percent from 2000-2005, outpacing nominal economic growth

by nearly five percentage points.10

Growth Rates of Real GDP and Retail Revenue

5 Ukrainian Commercial Guide, US Commercial Service. March 2007. Available online at:

http://www.buyusainfo.net/docs/x_2557634.pdf

6 U.S. Department of State: Bureau of European and Eurasian Affairs. March 2007. Available online at:

http://www.state.gov/r/pa/ei/bgn/3211.htm

7 U.S. Department of State: Bureau of European and Eurasian Affairs. March 2007. Available online at:

http://www.state.gov/r/pa/ei/bgn/3211.htm

8 Consumer Market Retail Chains, foodstuffs, FMCG, Accessed: November 9, 2007. Available online at: http://www.ukrainearabia.ae/economy/market/

9 Consumer Market Retail Chains, foodstuffs, FMCG, Accessed: November 9, 2007. Available online at: http://www.ukrainearabia.ae/economy/market/

10 Overview of Ukrainian Retail, Dragon Capital Corporate Finance. Available online at:

http://www.horizoncapital.com.ua/files/Ukrainian%20Retail%20Overview%20(Eng).pdf

www.aginskyconsulting.com

Page 2 of 8

AGINSKY CONSULTING GROUP

Kiev is the largest regional retail market in Ukraine. It is the largest and wealthiest city and is at

the cutting edge of the new changes taking place in the sector. In 2004, Kiev had 550,000 square

meters of modern retail space and in 2005, an additional 220,000 were commissioned. This kind

of growth is expected to continue for years to come.

The Ukrainian retail sector is represented in various formats ranging from hypermarkets to street

vendors and kiosks, which are still predominant. However, these venues, which symbolize the

past, gradually surrender to large multi-functional shopping centers. Rapid development of

contemporary retail outlets in large Ukrainian cities is evidence of the countrys economic

progress. In the past several years the retail space in the Ukrainian capital has been growing by

50-70 percent annually. As of January 2005, over 40 percent of all retail space (600,000 square

meters) in Kiev was offered in large outlets. There is an average of 100 square meters of new

retail space per 1,000 Kiev residents. In spite of this incredible growth Kiev is still far behind

western European capital cities in terms of retail space per capita.

According to the Ukrainian Government statistics authority, Derzhcomstat, private spending is

growing on the tide of rising wages. Per capita nominal income was up 16 percent and real

income was up 7 percent on average in 2004. 11 Consumer confidence is also on the rise as

economic recovery continues and wages increase.

Food represents a majority of retail spending.

Ukrainian Restaurant Industry

Good access to cheap raw materials and increased levels of tourism are

driving strong growth in the Ukrainian food service sector. United

States Department of Agriculture

The restaurant industry is enormous in Ukraine and is growing much faster than the economy as a

whole. The restaurant business has grown to $1.8 billion, rising $140 million or 8.5 percent in

2006.12 The restaurant sector in Ukraine is comprised of over 56,600 eateries, including 34,100

11 Retail Sector in Ukraine, US Commercial Service. 2006. Available online at: http://www.buyusainfo.net/docs/x_2251875.pdf

12 Consumer Market Retail Chains, foodstuffs, FMCG, Accessed: November 9, 2007. Available online at: http://www.ukrainearabia.ae/economy/market/

www.aginskyconsulting.com

Page 3 of 8

AGINSKY CONSULTING GROUP

cafs, 11,500 cafeterias, 9000 bars, 1900 restaurants, and more than 100 caterers. 13 The key

factors promoting the development of consumer food service are improving consumer wellbeing

through rising disposable incomes, mushrooming of Western style outlets, and busier lifestyles.

City centers are the most attractive locations for food service establishments due to significantly

higher turnover and greater foot traffic. Higher-income Ukrainians, who can afford to visit

consumer food service outlets on a permanent basis, usually live and work in downtown areas.

Tourism is a key driver for the restaurant market as tourists have higher disposable incomes. As

tourism grows in Ukraine, so too will the restaurant industry. Ukraine saw an estimated 18.8

million visitors14 in 2006, which was up 7 percent from 2005.15 This trend is expected to continue

as infrastructure in Ukraine continues to improve.

As Ukrainians get wealthier, their restaurant-going habits change too. Nowadays, the most

frequently cited reasons for eating out are to meet with friends, spend time with family, and get

a quick meal. Ukraines burgeoning middle class is the local restaurant markets main driving

force, which explains why fast-food, with an average check of up to $10, is the fastest growing

segment.

Ukrainian Fast Food Market

Characteristics of the fast food market in Ukraine include, reasonable prices, quick service, and

versatile menus, offering dishes of American, Russian, and traditional Ukrainian cuisines. The

numerous fast food chains in Kiev welcome everybody who is short of time and wants to have a

snack.

The domestic fast food industry operates in three formats:

Traditional fast food (McDonalds, MakSmak, Mister Snack, Shvydko), characterized by

high client turnover, limited food selection, and visited by low-to-middle class customers,

paying $2-4 per meal on average.

Bistro/Counter (Domashnya Kuhnya, Puzata Hata, Chinese bistros), featuring an extensive

menu (up to 150 items) served at long counters; customers pay $2-4 per meal on average.

Quick & Casual (Pizza Chelentano, Dva Gusya, Potato House, Pan Pizza), offering a mix of

traditional and fast food meals and visited by customers with higher disposable income,

who pay $7-10 on average; this is the fastest growing of the three formats.

There are 11 major competitors in the fast food industry: Domashnyaya Kukhnya, Dva Gusya, Il

Patio, McDonalds, MacSmack, Pan-Pizza, Pechiona, Potato House, Puzata Khata, Rostiks, and

Shyydko.16

13 Consumer Market Retail Chains, foodstuffs, FMCG, Accessed: November 9, 2007. Available online at: http://www.ukrainearabia.ae/economy/market/

14 Trends in the Ukraine Hotel Industry, Hotel Business Review. Accessed: November 9, 2007. Available online at:

http://www.hotelexecutive.com/bus_rev/pub/003/130.asp

15 Ukrainian Food Processing Sees Rapid Growth, Neil Merritt. June 10, 2006. Available online at: http://www.ceefoodindustry.com/news/

16 Kiev Information Guide. Fast Food Restaurants of Kiev, Kiev Tourist Bureau. Accessed: November 9, 2007. Available online at:

http://www.kiev.info/fastfood.htm

www.aginskyconsulting.com

Page 4 of 8

AGINSKY CONSULTING GROUP

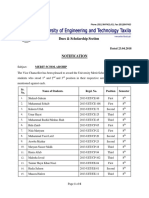

The six biggest players are listed below by number and type of locations:

Russian Economic Overview

Since 1999, Russia has experienced outstanding growth rates, constantly improving

macroeconomic conditions, and a growing involvement in the global economy.

These

achievements, together with high world oil prices, political and economic stability, and

skyrocketing foreign direct investment have all contributed to the growth of the countrys

economy.

Russias growth: Russia is the fastest growing economy in the G8 group of industrialized nations.

Over the last seven years, Russias economy has grown by an average rate of 6.8 percent each

year and is projected to grow at an average rate of at least 7 percent YOY through 2010. In 2006

and 2007 Russias growth exceeded all expectations (7.9 percent GDP growth), accelerating in

several key economic sectors such as retail, real estate, tourism, and communications.

Russias stability: Russia has a very stable macroeconomic situation. Inflation runs below 10

percent, foreign currency and gold reserves have increased to around $400 billion and are now

the worlds third largest after China and Japan.17 The strength and stability of the economy was

noted by the major credit rating agencies (S&P, Moodys and Fitch), all of which awarded Russia

an upgraded investment rating in 2006. 18 In addition, the stable political environment has

contributed to make the country one of the favorite destinations in the region for foreign

investors.

Investment: The excellent macroeconomic conditions make Russia a thriving capital market

that foreign investors are increasingly finding more attractive. Foreign investment for the

first half of 2007 totaled $67 billion, 19 compared, for instance, to $14 billion in Poland in

the entire 2006.20 Economists say that, unlike in China, there are no signs of overheating of

the economy detectible. Modern Russia has never before seen such a growth rate and

economists expect the tendency to continue. 21 Given the most favorable conditions offered

by the Russian market, the size of domestic investment is soaring as well, with local

entrepreneurs reinvesting their capital in the countrys economy.

Consumer demand: In the past years, Russias model of economic growth has notably

changed, with retail, telecommunication, and construction, among others, becoming key

17 RIA Novosti, May 21, 2007. Available online at: http://www.cdi.org/russia/johnson/2007-115-4.cfm

18 Russian IT quarterly. Available on-line at: http://www.reksoft.com/misc/reksoft_co/files/137/Russian_Economy_Outlook.pdf

19 Kommersant July 23, 2007. The Russian Investment Boom Continues

20 Polish information and Foreign investment Agency. Available on-line at: http://www.paiz.gov.pl/nowosci/?id_news=1350&lang_id=1

21 Kommersant July 23, 2007. The Russian Investment Boom Continues

www.aginskyconsulting.com

Page 5 of 8

AGINSKY CONSULTING GROUP

drivers of the countrys booming economy.22 Citizens real incomes have doubled over the

past six years and consumer demand is thriving. The flourishing Russian economy has given

rise to a growing middle and upper class that has caused an explosion in all types of

consumption.23 Not only is Russias per-capita income, at purchasing power parity (PPP),

well above that of Mexico, Brazil, Turkey, China, and even EU members Romania and

Bulgaria, 24 but also 70% of Russians' income is disposable, vs. around 40% for a typical

Western consumer, 25 making it a very attractive market for FMCG, food and beverage

products, apparel, and luxury goods.

Russian Retail Industry

According to AT Kearneys 2007 Growth opportunities for global retailers market study,

Global retail is experiencing an explosive modernization as investment

rushes into developing markets. As the wealthiest markets mature, more

retailers are pursuing new growth opportunities. Retailers that can identify

the most promising markets will become fierce global competitors able to

saturate the obvious markets and gain first-mover advantage in new ones.26

Rising consumer demand for new and better products and increasing incomes have significantly

enhanced the growth of emerging markets retail sector. In Russia, consumer spending has risen

rapidly for the past few years, fueled by an income growth rate of 10 percent last year (2006) and

11 percent the year before. The flourishing economy has given rise to an expanding middle and

upper class that has caused an explosion in all types of consumption.27

According to AT Kearneys study, for the third year in a row Russia is ranked the second best

market in the world for retail ahead of China and Mexico, and the first in Europe. In terms of

volume, within Europe, Russias retail is more than three times higher than that of the secondplaced Poland.28

More spending by Russian consumers translated into an overall retail sales growth rate of 25.5

percent in 2006 and there is no sign of slowing down.29 Growth is expected to increase at an

average rate of 11.29 percent YOY through 2011, with the top retail chains expecting to register

22 Where until 2004 and largely 2005 the growth model was based on an accelerated extraction of natural resources, primarily

hydrocarbons, in recent years the structure and sources of growth have absolutely changed. Exports, including the exports of

hydrocarbons, have ceased to be the main motive force of economic development, being supplanted by investment demand and the end

household demand. Interfax News Agency , Source: The Financial Times Limited. Available on-line at:

http://www.tmcnet.com/usubmit/2007/05/21/2641275.htm

23 Business Week, Russia: Shoppers Gone Wild, February 20, 2006 Available on-line at:

http://www.businessweek.com/magazine/content/06_08/b3972071.htm

24 International Monetary Fund, World Economic Outlook Database, April 2007, for the year 2006.

25 Business Week, Russia: Shoppers Gone Wild, February 20, 2006. Available on-line at:

http://www.businessweek.com/magazine/content/06_08/b3972071.htm

26 Growth opportunities for global retailers. A.T.Kearney, 2007.

27 Business Week, Russia: Shoppers Gone Wild, February 20, 2006. Available online at:

http://www.businessweek.com/magazine/content/06_08/b3972071.htm

28 Russia Tops Europe's Retail Ranking. Available on-line at: http://www.themoscowtimes.com/stories/2007/10/30/058.html

29 Growth opportunities for global retailers. A.T.Kearney, 2007.

www.aginskyconsulting.com

Page 6 of 8

AGINSKY CONSULTING GROUP

42 percent average revenue growth. 30 According to the RNCOS report Russian Retail Sector

Analysis (2007-2011),

Russian retail sales reached approximately $318 billion last year (2006).

This has made Russia the second most lucrative and twelfth largest retail

market throughout the globe.31

According to the World Banks June 2007 report, the ongoing strengthening of the currency

(Ruble) and stable growth in personal incomes are expected to help expand the retail markets

size to $744.92 billion by the year 2011.32 As economic development boosts income throughout

the country, retailers will expand beyond the main cities.33 Retail chains are moving steadily

outside of Moscow and St. Petersburg into Russias other major cities, where demand for Western

products is burgeoning. 34 According to international experts, "Russia is the market of the

future.35

Russian Restaurant Industry

The Russian restaurant industry accounts for 46 percent of all retail sales in Russia.36 The Russian

food-retail market also offers excellent growth opportunities. The retail food sector has grown 24

percent during 2001-2006 and has reached $144.62 billion in revenue.37 The steady growth in

personal incomes and ongoing real Ruble appreciation will help food retail reach sales of more

than $350 billion by 2011.

30 Russian Food Market Projected to Touch US$ 227 Billion Level. Available on-line at: http://www.rncos.com/Blog/2007/03/russian-foodmarket-projected-to-touch.html

31 Russian Retail Market to Hit US$ 744.92 Billion Mark by 2011. Available on-line at: http://www.newswiretoday.com/news/18038/

32 Available on-line at www.worldbank.com.

33 RNCOS Food industry Research, Russian Food Market Projected to Touch US$ 227 Billion Level, March 20, 2007. Available online at:

http://www.rncos.com/Blog/2007/03/russian-food-market-projected-to-touch.html

34 The Russian market place, A farewell to Russia, US agricultural trade office-Moscow, 3.

35 Go for Russia, not China, wine experts say. June 21, 2007. Available online at:

http://www.breitbart.com/article.php?id=070621045143.mp9e76kt&show_article=1&cat=0

36 Russian Food and Non Food Retail Forecast (2007-2011), September 2007. Available online at

http://www.researchandmarkets.com/reortinfo.asp?report_id=556427

37 Ibid.

www.aginskyconsulting.com

Page 7 of 8

AGINSKY CONSULTING GROUP

Moscow and St. Petersburg have the largest share of restaurants in the country, with

approximately 38 percent of the total market.38 However, because Russia is more developed than

Ukraine, there is a bigger opportunity for expansion into the more remote regions of Russia.

The Russian restaurant market consists of several market niches:

Boutique restaurants higher priced outlets

Democratic restaurants moderately priced outlets

Coffee shops combination of coffee and food, counter-style service

Fast food which has two separate sub-segments

1. Street/Mobile fast food - kiosks, stalls, and carts

2. Walk-in/Sit-down fast food outlets with counter service

Russian Fast Food Market

The development of the Russian retail market and rising disposable incomes is precipitating a

major change in the way Russians buy their food. The countrys emerging middle class consumers

are looking for better comfort, quality, and safety when shopping, all of which is good news for

chain operated fast food restaurants. People are moving away from shopping in outdoor venues

and moving toward more modern establishments. The market share for organized food chains has

risen from 9.5 percent in 2005 to an estimated 15.6 percent in 2007.39

There are many competitors in the Russian fast food market including McDonalds, Rosticks,

Russkoye Bistro, Sbarro, Mobile Stop-top units, Kroshka-Kartoshka, Teremok Russian Bliny, and

KFC, which are amongst the biggest players. McDonalds is by far the biggest fast food operator

in Russia, and one of the oldest, entering the market back in 1990. They now operate more than

175 outlets across the country, with more than 100 in Moscow. According to Michael Roberts,

president and senior director of McDonalds corporation, Russia was the fifth most profitable

market in Europe, and by far the most profitable in Eastern Europe.

There are 13 cities in Russia with populations of more than one million, which are optimal

locations for fast food expansion within Russia, especially for those who already have a foothold

in Moscow and St. Petersburg.

Opportunities in Eastern Europe

Ukraine and Russia have experienced fantastic growth in the retail and restaurant industries since

2000. This growth is expected to continue into the next decade as tourism continues to rise and

the stable macroeconomic conditions produce rapid growth of infrastructure and rising personal

incomes. As consumer spending continues to grow people will opt for consumer food services,

finding them convenient and time- and effort-saving. Cities will be the areas where consumer

foodservice grows most dynamically, both in value and volume terms.

The opportunities for fast food establishments do not stop with Russia and Ukraine. There are

opportunities for expansion throughout Eastern Europe. Countries in this region are experiencing

very similar growth rates. Other optimal targets for expansion within Eastern Europe include, but

are not limited to, Poland, Czech Republic, Hungary, and Romania. These markets are

experiencing similar trends and overall development throughout the region is booming.

38 Food Buying Patterns Change as Russian Retail Market Booms, March 1, 2007. PMR Consulting Group.

Available online at:

http://www.just-food.com/article.aspx?id=97679&d=1

39 Ibid.

www.aginskyconsulting.com

Page 8 of 8

You might also like

- Glo-Stick, Inc.: Financial Statement Investigation A02-04-2015Document6 pagesGlo-Stick, Inc.: Financial Statement Investigation A02-04-2015碧莹成No ratings yet

- DSA Interview QuestionsDocument1 pageDSA Interview QuestionsPennNo ratings yet

- Chap 009Document51 pagesChap 009kmillatNo ratings yet

- Spiritual Warfare - Mystery Babylon The GreatDocument275 pagesSpiritual Warfare - Mystery Babylon The GreatBornAgainChristian100% (7)

- Volvo FM/FH with Volvo Compact Retarder VR 3250 Technical DataDocument2 pagesVolvo FM/FH with Volvo Compact Retarder VR 3250 Technical Dataaquilescachoyo50% (2)

- Written Report - 6.419x Module 1Document8 pagesWritten Report - 6.419x Module 1聂宝鹏No ratings yet

- Uli-Final Report Savannah Civic CTR RedevelopmentDocument43 pagesUli-Final Report Savannah Civic CTR RedevelopmentWanda PeedeeNo ratings yet

- Pestle Analysis of Ukraine: BY Avinash Chethan Darshan Arif AnsariDocument15 pagesPestle Analysis of Ukraine: BY Avinash Chethan Darshan Arif AnsariChetan BharadwajNo ratings yet

- POWER School of Technology The Contemporary WorldDocument15 pagesPOWER School of Technology The Contemporary WorldAllan Ometer100% (8)

- The Butterfly Effect movie review and favorite scenesDocument3 pagesThe Butterfly Effect movie review and favorite scenesMax Craiven Rulz LeonNo ratings yet

- Dyson Case StudyDocument4 pagesDyson Case Studyolga100% (3)

- C15.0021 Money, Banking, and Financial Markets: Professor A. Sinan Cebenoyan NYU-Stern-FinanceDocument6 pagesC15.0021 Money, Banking, and Financial Markets: Professor A. Sinan Cebenoyan NYU-Stern-FinanceSunil SunitaNo ratings yet

- ACG Russian Cosmetics Market OverviewDocument8 pagesACG Russian Cosmetics Market OverviewSheikh Majid AleemNo ratings yet

- Political FactorsDocument4 pagesPolitical FactorsThùyy DunggNo ratings yet

- Transition to Agricultural Market Economies: The Future of Kazakhstan, Russia and UkraineFrom EverandTransition to Agricultural Market Economies: The Future of Kazakhstan, Russia and UkraineNo ratings yet

- Pharmaceutical Industry in UkraineDocument20 pagesPharmaceutical Industry in UkraineMariana GnaskoNo ratings yet

- Takeover Ukraine Agricultural LandDocument33 pagesTakeover Ukraine Agricultural LanddulescuxNo ratings yet

- Food Processing in UkraineDocument20 pagesFood Processing in UkraineponsinbautierNo ratings yet

- Klaus Pichler 'One Third'Document9 pagesKlaus Pichler 'One Third'Claire SmithNo ratings yet

- Russian Economy ThesisDocument5 pagesRussian Economy Thesisdanabooindianapolis100% (2)

- Global Impact of Russia-Ukraine Conflict PDFDocument7 pagesGlobal Impact of Russia-Ukraine Conflict PDFBipul RahulNo ratings yet

- North China Market Profile - Beijing ATO - China - Peoples Republic of - 3!29!2011Document13 pagesNorth China Market Profile - Beijing ATO - China - Peoples Republic of - 3!29!2011Chitranjan SoodNo ratings yet

- Ukraine: Analysis of The Economy ofDocument4 pagesUkraine: Analysis of The Economy ofDhritiraj MisraNo ratings yet

- Croatia Pesal AnalysisDocument16 pagesCroatia Pesal AnalysisPriya JagtapNo ratings yet

- The Future of Ukrainian OligarchsDocument88 pagesThe Future of Ukrainian OligarchspaintoisandraNo ratings yet

- C. Market Audit and Competitive Market Analysis: I. The ProductDocument16 pagesC. Market Audit and Competitive Market Analysis: I. The ProductXuân BìnhNo ratings yet

- Progression of Regression or Who Is To Be Blamed For Ukrainian CrisisDocument2 pagesProgression of Regression or Who Is To Be Blamed For Ukrainian CrisisЮлія ПриймакNo ratings yet

- Ukraine's Economy: From Soviet Collapse to RecoveryDocument11 pagesUkraine's Economy: From Soviet Collapse to RecoveryAlok SanghviNo ratings yet

- Vietnam Packaged Food enDocument16 pagesVietnam Packaged Food enZack Anh VuNo ratings yet

- Poland HRI Sector Offers Growth for U.S. Food ExportersDocument13 pagesPoland HRI Sector Offers Growth for U.S. Food ExportersCrueLargoNo ratings yet

- Successful Application of International Marketing PrezentacjaDocument23 pagesSuccessful Application of International Marketing PrezentacjaPiotr KosynNo ratings yet

- Poorest Country of EuropeDocument2 pagesPoorest Country of Europereagan blaireNo ratings yet

- Case Study On Croatian EconomyDocument19 pagesCase Study On Croatian EconomyLeyla BelleNo ratings yet

- McDonald's Strategic Management in RussiaDocument51 pagesMcDonald's Strategic Management in RussiaSagar GajjarNo ratings yet

- PDF Copy of Module 1Document25 pagesPDF Copy of Module 1Sanika YadavNo ratings yet

- The Retail Food Sector - 2011 - Islamabad - Pakistan - 6!23!2011Document14 pagesThe Retail Food Sector - 2011 - Islamabad - Pakistan - 6!23!2011sab2010No ratings yet

- Problems and Prospects of Tourism Development in Ukraine: Homework #2 Done by Pavliukova ValeriiaDocument2 pagesProblems and Prospects of Tourism Development in Ukraine: Homework #2 Done by Pavliukova ValeriiaELizabeth LastovkaNo ratings yet

- Ukraine: Century of SurvivalDocument3 pagesUkraine: Century of SurvivalsusangeibNo ratings yet

- DUO Russia PrivateHealthDocument74 pagesDUO Russia PrivateHealthnoeljeNo ratings yet

- The Hindu Synoptic Notes, 16 March 2024Document8 pagesThe Hindu Synoptic Notes, 16 March 2024Sam NaikNo ratings yet

- An Overview of Chinas Fruit and Vegetables IndustryDocument50 pagesAn Overview of Chinas Fruit and Vegetables IndustryAnonymous 45z6m4eE7pNo ratings yet

- Culinary (Or Gastronomic) TourismDocument4 pagesCulinary (Or Gastronomic) Tourismbang beckNo ratings yet

- (Marat Terterov) Ukraine Since The Orange RevolutiDocument55 pages(Marat Terterov) Ukraine Since The Orange Revoluti13SNicholasNo ratings yet

- PP P P: Source: The Library of Congress Country StudiesDocument5 pagesPP P P: Source: The Library of Congress Country StudiesUmme RubabNo ratings yet

- Ukraine Cereal SituationDocument94 pagesUkraine Cereal SituationmickelllaaNo ratings yet

- Russian Fruit OppDocument80 pagesRussian Fruit Oppjutt1No ratings yet

- Arzadon, Moira Nicole N. - Reflective Essay TCWDocument1 pageArzadon, Moira Nicole N. - Reflective Essay TCWMoira Nicole ArzadonNo ratings yet

- Exposing Myths of GlobalisationDocument8 pagesExposing Myths of GlobalisationAbu AbdullahNo ratings yet

- Looting Ukraine - How East and West Teamed Up To Steal A CountryDocument24 pagesLooting Ukraine - How East and West Teamed Up To Steal A Countryvidovdan9852No ratings yet

- Food Processing Ingredients Poland 2019Document9 pagesFood Processing Ingredients Poland 2019Mera Samir100% (1)

- W3 & W4 the Global Economy - PresentationDocument18 pagesW3 & W4 the Global Economy - PresentationKyla MedinaNo ratings yet

- Market Opportunities For Key U.S. Products in Russia - Moscow - Russian Federation - 3!20!2012Document48 pagesMarket Opportunities For Key U.S. Products in Russia - Moscow - Russian Federation - 3!20!2012ayakimova_1No ratings yet

- Uk Economic Blueprint For Pakistan - English - 1Document4 pagesUk Economic Blueprint For Pakistan - English - 1JawwadNo ratings yet

- Name of student: Lại Thị Huyền Trà Class: BAK9 ID: DTQ1953401010107Document3 pagesName of student: Lại Thị Huyền Trà Class: BAK9 ID: DTQ1953401010107Huyền TràNo ratings yet

- Nikolai OstapenkoDocument21 pagesNikolai OstapenkodanielNo ratings yet

- HandicraftDocument10 pagesHandicraftromanaNo ratings yet

- Kazakhstan Seizes Apple Market Opportunity in RussiaDocument8 pagesKazakhstan Seizes Apple Market Opportunity in RussiakzsuemNo ratings yet

- Economy Overview of PakistanDocument4 pagesEconomy Overview of PakistanIbrahim MehkriNo ratings yet

- Trade Americas JulyDocument4 pagesTrade Americas JulydharisaroyaNo ratings yet

- Pakistan Economy OverviewDocument11 pagesPakistan Economy OverviewMuhammad YousifNo ratings yet

- Economics Essay CIGEDocument8 pagesEconomics Essay CIGERidhan RiyalNo ratings yet

- Islam and Economic GrowthDocument6 pagesIslam and Economic GrowthpathanthegeniusNo ratings yet

- Why Ukraine in Turmoil After Deadly WeekDocument5 pagesWhy Ukraine in Turmoil After Deadly WeekPaavni SharmaNo ratings yet

- UkraineDocument2 pagesUkraineNgoc VoNo ratings yet

- UK Population Sees Biggest Increase in Half A CenturyDocument10 pagesUK Population Sees Biggest Increase in Half A CenturyNgan LamNo ratings yet

- Silvano Group 2017Document64 pagesSilvano Group 2017geopan88No ratings yet

- Ukraine Pharmaceutical Market Overview 2010Document40 pagesUkraine Pharmaceutical Market Overview 2010geopan88No ratings yet

- Kodikas Deontologias Bank of GreeceDocument48 pagesKodikas Deontologias Bank of Greecegeopan88No ratings yet

- Agricultures Connected Future How Technology Can Yield New Growth FDocument10 pagesAgricultures Connected Future How Technology Can Yield New Growth Fgeopan88100% (1)

- Basic Finance For Marketers Vol 1 FAODocument128 pagesBasic Finance For Marketers Vol 1 FAOKhushboo MamtaniNo ratings yet

- Strategy Formulation GuideDocument10 pagesStrategy Formulation Guidegeopan88No ratings yet

- Business Planning Tools-Industry Analysis and PurposeDocument20 pagesBusiness Planning Tools-Industry Analysis and Purposegeopan88No ratings yet

- Global Crisis 2008 (Feb 28th 09)Document49 pagesGlobal Crisis 2008 (Feb 28th 09)ziadiqbal19100% (2)

- Valve Handbook LowResDocument37 pagesValve Handbook LowResgeopan88No ratings yet

- Business Planning Tools - Firm AnalysisDocument17 pagesBusiness Planning Tools - Firm Analysisgeopan88No ratings yet

- Analyze Intellectual CapitalDocument19 pagesAnalyze Intellectual Capitalgeopan88No ratings yet

- Agricultural and Food Marketing ManagementDocument344 pagesAgricultural and Food Marketing ManagementRoberto GarciaNo ratings yet

- Tool 1Document17 pagesTool 1Katerina EvdokiaNo ratings yet

- Contents Tool 6: Your Business EnvironmentDocument14 pagesContents Tool 6: Your Business Environmentgeopan88No ratings yet

- Business Planning Tools - Customer AnalysisDocument16 pagesBusiness Planning Tools - Customer Analysisgeopan88No ratings yet

- Business Planning Tools - CompetitorsDocument12 pagesBusiness Planning Tools - Competitorsgeopan88No ratings yet

- Tool 1Document17 pagesTool 1Katerina EvdokiaNo ratings yet

- Analyze Intellectual CapitalDocument19 pagesAnalyze Intellectual Capitalgeopan88No ratings yet

- Contents Tool 6: Your Business EnvironmentDocument14 pagesContents Tool 6: Your Business Environmentgeopan88No ratings yet

- Biz Planning For Success 2005Document124 pagesBiz Planning For Success 2005geopan88No ratings yet

- PharmaI Investment Opportunities in UkraineDocument31 pagesPharmaI Investment Opportunities in Ukrainegeopan88No ratings yet

- Strategy Formulation GuideDocument10 pagesStrategy Formulation Guidegeopan88No ratings yet

- Biz Planning For Success 2005Document124 pagesBiz Planning For Success 2005geopan88No ratings yet

- Grow Sme GuideDocument24 pagesGrow Sme Guidegeopan88No ratings yet

- Smart Learning PublishingDocument31 pagesSmart Learning Publishinggeopan88No ratings yet

- Biscuits Market in EuropeDocument5 pagesBiscuits Market in Europegeopan88No ratings yet

- Investment in GermanyDocument228 pagesInvestment in Germanygeopan88No ratings yet

- A Window of Opportunity For Europe Full ReportDocument64 pagesA Window of Opportunity For Europe Full ReportmunshikdNo ratings yet

- Russia Outlook Best Practice During and After CrisisDocument19 pagesRussia Outlook Best Practice During and After Crisisgeopan88No ratings yet

- Villadolid, Thea Marie J - 1st CENTURY SKILLS CATEGORIESDocument4 pagesVilladolid, Thea Marie J - 1st CENTURY SKILLS CATEGORIESThea Marie Villadolid100% (1)

- Adverbs of Frequency Board GameDocument1 pageAdverbs of Frequency Board GameIsmi PurnamaNo ratings yet

- Zeng 2020Document11 pagesZeng 2020Inácio RibeiroNo ratings yet

- Project Management-New Product DevelopmentDocument13 pagesProject Management-New Product DevelopmentRahul SinghNo ratings yet

- Full Download Ebook Ebook PDF Nanomaterials Based Coatings Fundamentals and Applications PDFDocument51 pagesFull Download Ebook Ebook PDF Nanomaterials Based Coatings Fundamentals and Applications PDFcarolyn.hutchins983100% (43)

- 3 People v. Caritativo 256 SCRA 1 PDFDocument6 pages3 People v. Caritativo 256 SCRA 1 PDFChescaSeñeresNo ratings yet

- Algebra Extra Credit Worksheet - Rotations and TransformationsDocument8 pagesAlgebra Extra Credit Worksheet - Rotations and TransformationsGambit KingNo ratings yet

- Emergency Order Ratification With AmendmentsDocument4 pagesEmergency Order Ratification With AmendmentsWestSeattleBlogNo ratings yet

- Plo Slide Chapter 16 Organizational Change and DevelopmentDocument22 pagesPlo Slide Chapter 16 Organizational Change and DevelopmentkrystelNo ratings yet

- Electric Vehicles PresentationDocument10 pagesElectric Vehicles PresentationKhagesh JoshNo ratings yet

- Negotiating For SuccessDocument11 pagesNegotiating For SuccessRoqaia AlwanNo ratings yet

- REMEDIOS NUGUID vs. FELIX NUGUIDDocument1 pageREMEDIOS NUGUID vs. FELIX NUGUIDDanyNo ratings yet

- Government of Telangana Office of The Director of Public Health and Family WelfareDocument14 pagesGovernment of Telangana Office of The Director of Public Health and Family WelfareSidhu SidhNo ratings yet

- Derivatives 17 Session1to4Document209 pagesDerivatives 17 Session1to4anon_297958811No ratings yet

- Ten Lessons (Not?) Learnt: Asset AllocationDocument30 pagesTen Lessons (Not?) Learnt: Asset AllocationkollingmNo ratings yet

- Dues & Scholarship Section: NotificationDocument6 pagesDues & Scholarship Section: NotificationMUNEEB WAHEEDNo ratings yet

- Other Project Content-1 To 8Document8 pagesOther Project Content-1 To 8Amit PasiNo ratings yet

- Critiquing a Short Story About an Aged MotherDocument2 pagesCritiquing a Short Story About an Aged MotherJohn Rey PacubasNo ratings yet

- San Mateo Daily Journal 05-06-19 EditionDocument28 pagesSan Mateo Daily Journal 05-06-19 EditionSan Mateo Daily JournalNo ratings yet

- Decision Support System for Online ScholarshipDocument3 pagesDecision Support System for Online ScholarshipRONALD RIVERANo ratings yet

- Term2 WS7 Revision2 PDFDocument5 pagesTerm2 WS7 Revision2 PDFrekhaNo ratings yet

- Summer 2011 Redwood Coast Land Conservancy NewsletterDocument6 pagesSummer 2011 Redwood Coast Land Conservancy NewsletterRedwood Coast Land ConservancyNo ratings yet

- Chess Handbook For Parents and Coaches: Ronn MunstermanDocument29 pagesChess Handbook For Parents and Coaches: Ronn MunstermanZull Ise HishamNo ratings yet

- Cell Types: Plant and Animal TissuesDocument40 pagesCell Types: Plant and Animal TissuesMARY ANN PANGANNo ratings yet

- Office of The Court Administrator v. de GuzmanDocument7 pagesOffice of The Court Administrator v. de GuzmanJon Joshua FalconeNo ratings yet