Professional Documents

Culture Documents

Section 80CCD (1) & 80CCD (2) - Deduction For Contribution To NPS

Uploaded by

Parth UpadhyayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Section 80CCD (1) & 80CCD (2) - Deduction For Contribution To NPS

Uploaded by

Parth UpadhyayCopyright:

Available Formats

3/11/2014

Section 80CCD(1) & 80CCD(2): Deduction for Contribution to NPS

These Deductions are available under Section 80C, Section 80CCC & Section 80CCD and can be claimed at

the time of filing of the income tax return. This article mainly focuses on Deductions allowed under Section

80CCD. For deductions under Section 80C & Section 80CCC, refer the following links:Section 80CCC: Deduction for Contribution for Pension Plan of Insurance Company

Section 80C: Deduction for Contribution Pension Plan of UTI/Mutual Fund

Deduction under Section 80CCD

Section 80CCD provides for Income Tax deductions for contributions made to the notified Insurance

Scheme of the Central Govt i.e. for contribution to the National Pension Scheme (NPS). Deduction under this

Section is only available to Individuals and not to HUFs. The Individual claiming deduction under this Section

may be Resident or Non-Resident.

Section 80CCD(1): Deduction to NPS Scheme for Contribution by the Individual

Deduction under Section 80CCD(1) is not only available to Salaried Individuals but non-salaried individuals can

also contribute to the NPS Scheme and avail deduction for the same.

The maximum amount allowed as a deduction under Section 80CCD(1) is:In case of an employees: 10% of his salary for the financial year (Salary includes Dearness Allowance but

excludes all other Allowances and Perquisites)

In case of non-employees: 10% of the Gross Total Income in the Financial Year

As per Section 80CCE, the total maximum deduction allowed under Section 80C, Section 80CCC & Section

80CCD(1) is limit to Rs. 1 Lakh. This is a combined aggregate deduction of Rs. 1 Lakh and no separate

deduction has been prescribed for each of these sections. The Individual can choose to invest under any of these

sections subject to an aggregate total deduction limit of Rs. 1 Lakh.

Section 80CCD(2): Deduction to NPS Scheme for Contribution by the Employer

http://www.charteredclub.com/section-80ccd/

2/6

3/11/2014

Section 80CCD(1) & 80CCD(2): Deduction for Contribution to NPS

In case any employer contributes to the NPS Scheme on behalf of the employee and the benefit of the same

would be availed by the employee, the employee would also be allowed a deduction under Section 80CCD(2)

for the amount of contribution made by the employer.

The contribution made by the employee himself to the NPS Scheme would be allowed as a deduction under

section 80CCD(1) and the contribution made by the employer to the NPS Scheme would be allowed as a

deduction under Section 80CCD(2).

There is a maximum limit for deduction for contribution made by the Individual himself under Section 80CCD(1)

as mentioned above. But for contribution made by the employer to the NPS Scheme for benefit of employee,

there is no maximum limit for deduction allowed under Section 80CCD(2). The Deduction under Section

80CCD(2) is over and above the deduction of Rs. 1 Lakh under Section 80C + Section 80CCC + Section 80

CCD(1)

Tax on Amount received back from the National Pension Scheme

The contribution made to the NPS Scheme would be received back by the employee as Pension after retirement

or on surrender of the policy (as the case may be). The amount so received as Pension or on closure of the NPS

Account either by the individual himself or by the nominee which has earlier been claimed as a deduction under

Section 80CCD, would be regarded as Income in the hands of the recipient and would be taxed as per the

Income Tax Slabs in the year of receipt.

Recommended Read: Computation of Tax on Pension Income

If the amount received by a taxpayer has been used for purchasing an annuity plan in the same year in the year of

receipt, the taxpayer would be deemed to have not received any amount from the NPS Scheme and therefore no

tax would be levied on the same.

Similar Articles

Section 80CCC: Tax Deduction for Contribution to Pension Funds

Tax on Pension Income: Computation of Amount Exempted

http://www.charteredclub.com/section-80ccd/

3/6

You might also like

- Form 11 Revised FormatDocument3 pagesForm 11 Revised FormatParth UpadhyayNo ratings yet

- Form 11 Revised FormatDocument3 pagesForm 11 Revised FormatParth UpadhyayNo ratings yet

- Credit Risk Estimation TechniquesDocument31 pagesCredit Risk Estimation TechniquesHanumantha Rao Turlapati0% (1)

- Week 10 Current Affairs 2016 PDFDocument16 pagesWeek 10 Current Affairs 2016 PDFParth UpadhyayNo ratings yet

- Rina Mocha Kam NG Alas To TramDocument2 pagesRina Mocha Kam NG Alas To TramParth UpadhyayNo ratings yet

- 2016 Books AuthorsDocument2 pages2016 Books AuthorsParth UpadhyayNo ratings yet

- Bhairava Homam Sanskrit PDFDocument36 pagesBhairava Homam Sanskrit PDFshalumutha3No ratings yet

- Chapter 5 Depreciation Accounting PDFDocument42 pagesChapter 5 Depreciation Accounting PDFravibhartia197888% (8)

- NewjobDocument35 pagesNewjobParth UpadhyayNo ratings yet

- Tarpana SanskritDocument9 pagesTarpana SanskritnavinnaithaniNo ratings yet

- Current Affairs of Feb16Document12 pagesCurrent Affairs of Feb16Parth UpadhyayNo ratings yet

- 12thFYP ObjectivesDocument3 pages12thFYP ObjectivesParth UpadhyayNo ratings yet

- Appointments 2016Document4 pagesAppointments 2016Parth UpadhyayNo ratings yet

- Basic Uses of The English Tenses PDFDocument4 pagesBasic Uses of The English Tenses PDFSreeNo ratings yet

- Current Affairs FebruaryDocument29 pagesCurrent Affairs FebruaryParth UpadhyayNo ratings yet

- Current Affairs Pocket PDF - December 2015 by AffairsCloudDocument22 pagesCurrent Affairs Pocket PDF - December 2015 by AffairsCloudRakesh RanjanNo ratings yet

- Week 41 - 4 Oct-10 OctDocument15 pagesWeek 41 - 4 Oct-10 OctParth UpadhyayNo ratings yet

- Current Affairs Pocket PDF - January 2016 by AffairsCloud - FinalDocument25 pagesCurrent Affairs Pocket PDF - January 2016 by AffairsCloud - FinalRAGHUBALAN DURAIRAJUNo ratings yet

- Fab Current Affair 2016Document25 pagesFab Current Affair 2016Parth UpadhyayNo ratings yet

- Fiscal Policy 2015Document11 pagesFiscal Policy 2015Parth UpadhyayNo ratings yet

- Current Affairs - Week 35 Banking: Bandhan BankDocument12 pagesCurrent Affairs - Week 35 Banking: Bandhan BankParth UpadhyayNo ratings yet

- RBI designates SBI, ICICI Bank as D-SIBsDocument10 pagesRBI designates SBI, ICICI Bank as D-SIBsParth UpadhyayNo ratings yet

- Week 43-11 Oct - 25 Oct Weekly PDFDocument46 pagesWeek 43-11 Oct - 25 Oct Weekly PDFParth UpadhyayNo ratings yet

- Current Affairs - 5 WeekDocument16 pagesCurrent Affairs - 5 WeekParth UpadhyayNo ratings yet

- Week 40 - 27 Sep - 3 OctDocument12 pagesWeek 40 - 27 Sep - 3 OctParth UpadhyayNo ratings yet

- Week 4 GKDocument9 pagesWeek 4 GKParth UpadhyayNo ratings yet

- Week SeptDocument16 pagesWeek SeptParth UpadhyayNo ratings yet

- Week 41 - 4 Oct-10 OctDocument15 pagesWeek 41 - 4 Oct-10 OctParth UpadhyayNo ratings yet

- Nov GKDocument16 pagesNov GKParth UpadhyayNo ratings yet

- Current Affairs - Week 51Document22 pagesCurrent Affairs - Week 51Parth UpadhyayNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business Taxation Module 1&2Document13 pagesBusiness Taxation Module 1&2Khushboo Parikh100% (1)

- Piramal Vaikunth TDS TutorialDocument8 pagesPiramal Vaikunth TDS TutorialRanjit DalviNo ratings yet

- Statement of Income and Tax Calculation for FY 2014-15Document10 pagesStatement of Income and Tax Calculation for FY 2014-15B GANAPATHY100% (1)

- SRB 25022019 CW 108462016Document16 pagesSRB 25022019 CW 108462016vsprajanNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNo ratings yet

- Executive SummaryDocument50 pagesExecutive SummaryGanesh ShetNo ratings yet

- Income Tax Guide 2011-12: Residential Status, Rates, Salary, DeductionsDocument156 pagesIncome Tax Guide 2011-12: Residential Status, Rates, Salary, DeductionsSalman Ansari100% (1)

- Income Slabs Income Tax RateDocument4 pagesIncome Slabs Income Tax RateSavoir PenNo ratings yet

- Agriculture Income 14Document4 pagesAgriculture Income 14insathiNo ratings yet

- Penalty Under Section 271 (1) (C) of Income Tax Act 1961Document17 pagesPenalty Under Section 271 (1) (C) of Income Tax Act 1961Manu GuptaNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Private Placement of 80Ccf Tax Saving Ifci Long Term Infrastructure Bond - Series - Ii Information MemorandumDocument39 pagesPrivate Placement of 80Ccf Tax Saving Ifci Long Term Infrastructure Bond - Series - Ii Information MemorandumAnkit MadanNo ratings yet

- LNT Bond FormDocument8 pagesLNT Bond FormsunajbaniNo ratings yet

- Homeloan DetailsDocument3 pagesHomeloan Detailsgurudev001No ratings yet

- PRO 104 2016-17 Nedumchalil Charitable Trust HospitalDocument8 pagesPRO 104 2016-17 Nedumchalil Charitable Trust HospitaldpfsopfopsfhopNo ratings yet

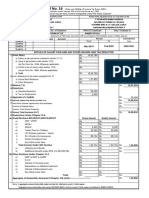

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Assinment 2Document24 pagesAssinment 2Hardik SabbarwalNo ratings yet

- Form 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorDocument2 pagesForm 26QB: Complete Address of The Property Transferee Complete Address of The Property TransferorRabindra SinghNo ratings yet

- Income Tax Rates in Nepal For 2076 - 2077 (Individual and Couple)Document1 pageIncome Tax Rates in Nepal For 2076 - 2077 (Individual and Couple)BasantaBhattarai100% (1)

- File PDFDocument197 pagesFile PDFarunnair2468No ratings yet

- CORPORATE TAX CALCULATORDocument11 pagesCORPORATE TAX CALCULATORmohanraokp2279No ratings yet

- 10-Practical Questions of Individuals (78-113)Document38 pages10-Practical Questions of Individuals (78-113)Sajid Saith0% (1)

- Set Off & Carry Forward of LossesDocument4 pagesSet Off & Carry Forward of LossesdamspraveenNo ratings yet

- Tax Rebate 80ccf Ifci Long Term Infra BondDocument62 pagesTax Rebate 80ccf Ifci Long Term Infra BondInvestmentstartegy TipsNo ratings yet

- Taxation policies' effect on employee investment practicesDocument64 pagesTaxation policies' effect on employee investment practicesprashanthNo ratings yet

- Eligibility and Limitations For Acquiring Agricultural Land in KarnatakaDocument40 pagesEligibility and Limitations For Acquiring Agricultural Land in KarnatakaSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (6)

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementMadan ChaturvediNo ratings yet

- Malaysia Amendments To Income Tax Act 1967Document52 pagesMalaysia Amendments To Income Tax Act 1967Abd MuisNo ratings yet