Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2012 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2012 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

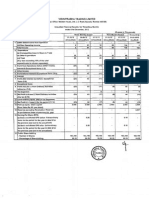

MRUGESH TRADING LIMITED

Regd. Office; Warden House, 340, J.J. Road. Byculla, Mumbai 400 008.

Unaudited Financial Results for Three/Nine Months

ended 31st December, 2012

(Rupees in Thousands)

Sr.

Particulars

Three Months Ended

Nine Months Ended

Accounting

31.12.12

30.09.12

31.12.11

31.12.12

31.12.11

31.03.2012

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

(a}Net Salesllncome from Operation

(b)Other Operating Income

258

34

326

180

130

Total Income

258

34

326

180

208

78

Expenditure

(b) Other Expenditure

24

17

23

104

114

203

(c)) Total

24

17

23

104

114

203

234

17

(19)

222

66

(a) (Increase)/Decrease in Stock-in-Trade

(Any Item exceeding 10% of the total

expenditureto be shown separately)

3

Profit from Operations before Other Income,

Interest & Exceptional Items (1-2)

Other Income

Profit before Interest & Exceptional Items (3+4)

234

Interest

Profit after Interest but before Exceptional

234

17

17

(19)

222

(19)

222

66

66

Items (5-6)

8

Exceptional Items

Profit (+)/Loss H from Ordinary Activities

234

17

(19)

222

66

before tax (7+8)

10

Tax Expenses

11

Net Profit (+)fLoss

t-l from

Ordinery Activities

234

17

(19)

222

66

after tax (9-10)

12

Extra Ordinery Items (Net of Tax Expenses)

13

Net Profit (+) I Loss

14

Paid-up equity share capital

H for the

period (11-12)

234

17

(19)

222

66

2.450

2,450

2,450

2,450

2,450

2,450

(Face Value Rs. 101- per share)

15

Reserves excluding Revaluation Reserves

as per Balance Sheet of previous Alc year

16

Earning Per Share (EPS)

(a) Basic and diluted EPS before Extraordinary

0.96

0.07

0.91

0.27

0.96

0.07

0.91

0.27

146,750

146.750

59.90

146,750

146,750

146,750

146,750

59.90

59.90

59.90

59.90

items for the period for the year to date & for

the previous year (not to be annualized)

(b) Basic and diluted EPS after Extraordinary

items for the period for the year to date & for

the previous year (not to be annualized)

17

Public Share Holding

. Number of Shares

- Percentage of Shareholding

59.90

18

Promoters and promoter group Shareholding

a) Pledged/Encumbered

- Number of shares

- Percentage of shares (as a % of the total

share holding of promoter and promoter

group)

- Percentage of shares (as a % of the total

share capital of the company)

b} Non-encumbered

- Number of shares

~

Percentage of shares (as a % of the total

98,250

100

98,250

100

98,250

100

98,250

100

98,250

100

98,250

100

40.10

40.10

40.10

40.10

40.10

40.10

share holding of promoter and promoter

group)

Percentage of shares (as a % of the total

share capital of the company)

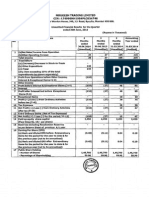

Notes:

The above results were taken on record by the Board of Directors of the Company

2

at its meeting held on 30.01.2013.

Previous period's figures have been regrouped/rearranged wherever necessary.

The company Is a single segment company in accordance with AS-17 (Segment Reporting)

issued by the ICAI.

There is no material tax effect of timing difference based on the estimated computation

for a reasonable period, hence there is no provision for deferred tax in terms of AS -22.

No Investor complaints were received during the quarter ended 31.12.2012.

Provision for tax if any will be considered at the end of the year.

'"

J

For MRUGESH TRADING LIMITED

Place: Mumbai

Dated: 30.01.2013

iI

. Surve

Dir ctor

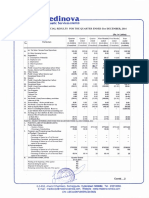

I. G. Naik & CO.

Chartered Accountants

M.COM" Ll.B., rCA.

REVIEW REPORT

We have reviewed the accompanying Statement of Unaudited Financial Results of Mrugesh

Trading Limited for the quarter ended 31s t December, 2012.This Statement is the

responsibility of the Company's management and has been approved by the Board of

Directors.

A review of interim financial information consists principally of applying analytical procedures

for financial data and making inquiries of persons responsible for financial and accounting

matters. It is substantially less in scope than an audit conducted in accordance with the

generally accepted auditing standards, the objective of which is the expression of an opinion

regarding the financial statements taken as a whole. Accordingly, we do not express such an

opinion.

Based on our review conducted as above, nothing has come to our notice that causes us to

believe that the accompanying statement of unaudited financial results prepared in

accordance with Accounting Standards and other recognized accounting practices and

policies has not disclosed the information required to be disclosed in terms of clause 41 of

the Listing Agreement including the manner in which it is to be disclosed, or that it contains

any material mis-statement.

For I.G. NAIK & CO.

Chartered Accountants

nm'~_g

I.G.NAIK

Proprietor.

M.No.034504

Date: 30.01.2013

Place: Mumbai

Chandrama, 2nd Floor, 21, Kalanagar, Sandra (E)., Mumbai - 400 051.

Fax: +91 22 2640 8898 Mobile: +91 98201 49972

Email: ign1953@gmail.com

T01. : +91 22 2659 1851

You might also like

- English 7 WorkbookDocument87 pagesEnglish 7 WorkbookEiman Mounir100% (1)

- The Bilderberg GroupDocument35 pagesThe Bilderberg GroupTimothy100% (2)

- The Objectivist Ethics - Ayn RandDocument159 pagesThe Objectivist Ethics - Ayn Randlizz lzNo ratings yet

- Financial Results 201920Document26 pagesFinancial Results 201920Ankush AgrawalNo ratings yet

- The Life of St. John of KronstadtDocument47 pagesThe Life of St. John of Kronstadtfxa88No ratings yet

- Juvenile Deliquency and Juvenile Justice SystemDocument32 pagesJuvenile Deliquency and Juvenile Justice SystemDrew FigueroaNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- RavsolovetichikyomhaatzmautDocument61 pagesRavsolovetichikyomhaatzmautHirshel TzigNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document3 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- RGPV Enrollment FormDocument2 pagesRGPV Enrollment Formg mokalpurNo ratings yet

- 19 Preposition of PersonalityDocument47 pages19 Preposition of Personalityshoaibmirza1No ratings yet

- PATHFINDER On Aquaculture and FisheriesDocument114 pagesPATHFINDER On Aquaculture and FisheriesLIRMD-Information Service DevelopmentNo ratings yet

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- Bio New KMJDocument11 pagesBio New KMJapi-19758547No ratings yet

- Directory-Of-Doctors UNEPDocument34 pagesDirectory-Of-Doctors UNEPPerera KusalNo ratings yet

- Late Birth Registration Form for KenyaDocument2 pagesLate Birth Registration Form for KenyaSarati80% (5)

- 8 deadly sins of investing: Overlooking fundamentals, myopic vision, ignoring portfolioDocument4 pages8 deadly sins of investing: Overlooking fundamentals, myopic vision, ignoring portfolionvin4yNo ratings yet

- Eastern PhilosophyDocument70 pagesEastern PhilosophyRedimto RoseteNo ratings yet

- Axis Priority SalaryDocument5 pagesAxis Priority SalarymanojNo ratings yet

- Group 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDocument5 pagesGroup 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDominador RomuloNo ratings yet

- MPRC - OGSE100 FY2020 Report - 0Document48 pagesMPRC - OGSE100 FY2020 Report - 0adamNo ratings yet

- ASAP Current Approved Therapists MDocument10 pagesASAP Current Approved Therapists MdelygomNo ratings yet

- Heaven and Hell in The ScripturesDocument3 pagesHeaven and Hell in The ScripturesOvidiu PopescuNo ratings yet

- Penrock Seeds Catalogue Closing Down SaleDocument26 pagesPenrock Seeds Catalogue Closing Down SalePaoloNo ratings yet

- NAAC GRADE A+ ACCREDITED COLLEGE PRESIDENT'S MESSAGEDocument66 pagesNAAC GRADE A+ ACCREDITED COLLEGE PRESIDENT'S MESSAGEhargun singhNo ratings yet

- Boltanski Thevenot Los Usos Sociales Del CuerpoDocument52 pagesBoltanski Thevenot Los Usos Sociales Del CuerpoAngélica VeraNo ratings yet

- Intercultural Presentation FinalDocument15 pagesIntercultural Presentation Finalapi-302652884No ratings yet

- Debate Motions SparringDocument45 pagesDebate Motions SparringJayden Christian BudimanNo ratings yet

- Annotated Bibliography Wet Nurse SlaveryDocument7 pagesAnnotated Bibliography Wet Nurse SlaveryNicholas MusauNo ratings yet

- AFL Cheque ScanDocument2 pagesAFL Cheque ScanMantha DevisuryanarayanaNo ratings yet

- Receivable Financing Pledge Assignment ADocument34 pagesReceivable Financing Pledge Assignment AJoy UyNo ratings yet

- Chapter 1 Imc 407Document14 pagesChapter 1 Imc 407Mayson Chua ShangNo ratings yet

- Tiket Kemahasiswaan Makasar1Document4 pagesTiket Kemahasiswaan Makasar1BLU UnramNo ratings yet