Professional Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

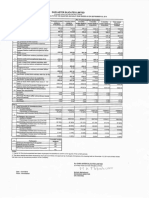

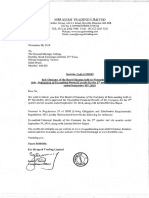

MRUGI:::;H l'HADING UMlr!

CIN: l74999MH1984PLC034746

Rsgd. Office: Warden HOU$o$. 340, J.J. RQAd, Byculla. Mumhfll aM ODS.

Unaudited Ffnan(;lal Results for the Quartet

ended 30th Soptembet, 2(l14

Rupees In Thousands!

Sr.

No.

Particulars

Corresp.

Year to

Year to

Accounting

Months

Months

ondlng 3

Oats figures

Date figures

Year ended

ended

ended

months

for Curfflnt

for Pravlous

30.09,2014

30,00,2013

'UnaUdited)

(Unaudited)

3.

01

300

73

335

35

91

373

(bl Other E)(pencfltul'O

,4$

'45

(e Total

143

(HO)

17

17

'88

288

,..

(110)

74

102

liio

74

I{SiNet Sales/Income from operatIon

300

"

Stock..jn~Trlldo

270 '

270

81

16.

,.5

47

85

81

{Any Item exceeding 10% of the total

expanditureto be shown separately;

Profit from Oporatlons before Other Income,

4

5

Other Income

Interest

192

'Profit after Interest but befOrn Exceptional

Itoms (u.s)

Exeeptlonalltems

Profit (+)ILoss (-I from Ordinary Act!vltles

192

'0

11

Tax Expanses

Net Proflt (+}/Loss H from Ordlnery Activities

12

Extra Ordlnery Items {Net ~~.Tal( Ex~n$(I$l

,.,

(110)

,.

1110)

_.

102

2,450 '

Reserves excludIng Revaluation Reserves

as per Salance Shoot of pravlolls Ak year

74

7.

74

(110

7.

2,450

2,450

13 Net Proflt(+}J L()$s H for the perIod i11.12}

14 : Pald~up equIty share eaplllilll

(Face Valu8 Rs, 101 persharel

(110)

after tax (910J

15

Profit before: Interest & Exc.eptionalltems (3+4.

before tax j7+8)

12.

12.

Interest & Except!Qnalltems (1.2)

31.03.2014

(Audited)

c>lpendltutu

(al {lnr:rnMln)fr'll'lr;reMe In

ended

Wnaudltedl

(Unaudited!

:(blOttierOperatfng Incomn

Totallncornu

Perfod

ended

Year

30.09.2013

Period

Previous

30.06,2014

{Unaudited)

30,09,2014

end&djn

as

.

.5

s.

2,450

47

47

47

10

7.

.7

2.

47

.,

2,450

.7

2,450

earning Per Share (EPS)

(a) Basle and diluted EPS b&klr& Extraordinary

0.73

(0.45)

0,30

f).35

0,19

0.19

0.78

(0.4.)

0,30

0.35

0.19

0.19

1,46:,100 ,

1.4&,150

1,46.750

59.90

1,116,750

59.90'

1,46,150

$9,90 :

5~.90

69.90

Items for the petlod for the year to dam 8. for

the prevIous year (not to be annuallitedj

(b) Basic and diluted EPS after Extraordinary

Items for the period for the year to date & fo(

the previous 'Plar \Ilot to be annualized)

17 Public Sharo HOlding

1.46:.750

59.90'

Number of Shl:u'e$

Percentage Of Sharsholding

16

ProMoters and promoter group Shareholdlng

a) Pledged/Encumbered

Number of stlares

Perc6n~6 of sharee (as a % (If the total

sbarehoJding of promoter and promoter

group}

Pe/'entage of shares (a$ a % of the totsl

share capital of Ihe company)

b) Non-encumbered

~

98,250

Number of shares

98,250

98,250

98,250

98,250

100

"'"

100

100

100

98,250

100

4{).10

40'.10

Mi,10

40,10

M).10 :

40.10

Percentage of shares {as a % Qf Ihe total

shareholdlng ot prol'l1oter and promoter

group;

PorcontslJe of ,hares {n a % of tM total

ehara Cllpltal of the company}

M'fITt~

::::J '

"\ .;>

~ \.MUt48Ai,I'"

"2!.

,~

',-".~./<,~,

~,..,......."'-.;..,.

{, r

--~.d

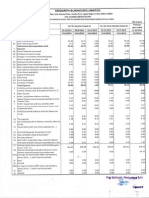

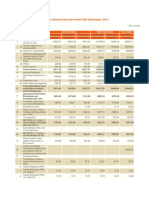

STATEMENT OF ASSETS AND LIABILITIES AS AT 30TH SEPTEMBER, 2014

(Rupees in Thousands)

PARTICULARS

SR.

NO.

AS AT

AS AT

30/09/2014

31/0312014

(Unaudited)

(Audited)

EQUITY AND LIABILITIES

1 Share Holders' Fund

(a) Share Capital

(b) Reserves & Surplus

Sub Total Share Holders' Fund

2 Current LiabiUties

(a> Tl'lld. Payable

(b) Other Current Liabilities

Sub Total ~ Current Liabilities

TOTAL EQLJITY AND LIABILITIES

~.

,-_

..

2.450 :

(667)

1,783

2,450

(752)

1,698

4

1,662

1,666

3.449

60 :

1,562

1,622

3,320

218

1,116

1,334

218

1,225

1,443

189

10

1,849

67

2,115

3,449

186

10

1,549

132

1,877

3,320

ASSETS

1 Non-Current Assets

(a) Non-Current Investment

(b) Long Term Loans & Advances

Sub Total- Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(0) Cash and Bank Balance

(d) Short Term Loans & Advances

Sub Total- Current Assets

TOTAL ASSETS

Notes,

The above results were taken on record by the Board of Oirectors of the Company

at Its meeting held on 30.10.2014

Previous period's figures have been regrouped/rearranged wherever necessary.

The company is a single segment company in accordance with

There is no material tax effect of timing difference based on the estimated computation

for a reasonable period, hence there is no provision for deferred tax in terms of AS

No Investor complaints were received during the quarter ended 30.09.2014

Provision for tax if any will be considered at the end of the year.

AS~17

(Segment Reporting)

Issued by the ICAI.

~22.

For MRLJGESH TRADING LIMITED

Place: Mumbai

Dated: 30.10.2014

~1~

. u:~ /~'1

u: Dlrecto~

I. G. Naik & Co.

Chartered

M,COM" LLB" ECA

Accountants

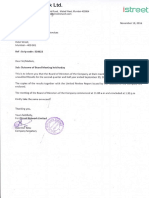

Independent Auditor's Report on Limited Review of the Unaudited FiDlludal Results of the

company for the Quarter ended 30 th September, Z014.

To

The Board of Directors

Mrugesh Trading Limited

Warden House, 340, J.J. Road,

Byculla, Mumbai -400 008

We have reviewed the accompanying statement of unaudited financial results of Mrugesh Trading

Limited for the three-months period ended 30th September, 2014, except for the disclosures regarding

"Public Shareholding" and "Promoter and Promoter Group shareholding" which have been traced from

disclosures made by the management and have not been audited by us. This Statement is the

responsibility of the Company's Management and has been approved by the Board of

Directors/Committee of the Board of Directors. Our responsibility is to issue a report on these financial

statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the mstitute of Chartered Accountants of India.

This Standard requires that we plan and perform the review to obtain moderate assurance as to whether

the financial statements are free of material misstatemel1t. A review is limited primarily to inquiries of

Company personnel and analytical procedures applied to financial data and thus provide less assurance

than an audit. We have not permrmed an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe that

the accompanying Statement of unaudited financial results prepared in accordance with the applicable

accounting standards and other recognized accounting practices and policies has not disclosed the

information required to be disclosed in terms of Clause 41 of the Listing Agreements including the

manner in which it is to be disclosed, or that it contains any material misstatement.

Place: Mumbai

Date:30u October, 2014

For I.G. Naik & Co.

Chartered Accountants

1'~106BI0HV

I.G. Naik

Proprietor

Membership No. 034504

Chandrama, 2nd Floor, 21, Kalanagar, Bandra (El" Mumbai 400 051.

Tel. : +91 222659 1851 Fax: +91 2226408898 Mobile: .91 98201 49972

Email: ign1953@gmaiLcom

You might also like

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Nov 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Nov 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Unaudited Financial Results Q2 2014Document4 pagesUnaudited Financial Results Q2 2014Dhruba DebnathNo ratings yet

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Mughal Iron Annual Report 2014Document38 pagesMughal Iron Annual Report 2014sana ahmadNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Divisible Profits Factors and PrinciplesDocument14 pagesDivisible Profits Factors and PrinciplesVeeresh SharmaNo ratings yet

- SOCARDocument113 pagesSOCAREl ShanNo ratings yet

- AT.1807 Preliminary Engagement Activities 1 PDFDocument7 pagesAT.1807 Preliminary Engagement Activities 1 PDFPia DumigpiNo ratings yet

- AUD Quizmaster'sDocument22 pagesAUD Quizmaster'sjessa marie virayNo ratings yet

- Report On TVS Srichakra Ltd.Document48 pagesReport On TVS Srichakra Ltd.Nilesh Sorde100% (1)

- Decommissionin Provision NotesDocument41 pagesDecommissionin Provision NotesWilliam PyneNo ratings yet

- Audit Reports Chapter 3Document18 pagesAudit Reports Chapter 3Iwan Putra60% (5)

- British Land 2015Document202 pagesBritish Land 2015lizNo ratings yet

- Thompson Et Al.2022Document20 pagesThompson Et Al.2022hanieyraNo ratings yet

- BSBFIN601 Project Portfolio 1Document21 pagesBSBFIN601 Project Portfolio 1Zumer FatimaNo ratings yet

- Procesian Comsostas 7832461584dwdDocument15 pagesProcesian Comsostas 7832461584dwdNikunjNo ratings yet

- Audit of Cash and Cash Equivalents QuizDocument16 pagesAudit of Cash and Cash Equivalents QuizBienvenido JmNo ratings yet

- 2018 - 12 - 11 - SandO - Agenda - Attachment - 1 - To - Item - 16 - Road - Infrastructure - Asset - Management - Plan 2018Document55 pages2018 - 12 - 11 - SandO - Agenda - Attachment - 1 - To - Item - 16 - Road - Infrastructure - Asset - Management - Plan 2018Wenny SY KalaloNo ratings yet

- Streamlining Accounts Payable With Doc-LinkDocument2 pagesStreamlining Accounts Payable With Doc-LinkeepabaluNo ratings yet

- Conceptual Framework and Accounting Standards: OutlineDocument6 pagesConceptual Framework and Accounting Standards: OutlineMichael TorresNo ratings yet

- PU 4 YEARS BBA V Semester SyllabusDocument12 pagesPU 4 YEARS BBA V Semester Syllabushimalayaban50% (2)

- PPM 2019 02 Ibrahim PDFDocument11 pagesPPM 2019 02 Ibrahim PDFasfand yar aliNo ratings yet

- Accounting Professional: Corporate - Insolvency - CharteredDocument2 pagesAccounting Professional: Corporate - Insolvency - Charteredsamwilson0501No ratings yet

- Relationship Managenment in Internal AuditingDocument37 pagesRelationship Managenment in Internal AuditingPatrick MasarirambiNo ratings yet

- C0302131 Sharrock BRC Report 2016 PDFDocument28 pagesC0302131 Sharrock BRC Report 2016 PDFpushpamaliNo ratings yet

- Fsi9 GN SampleDocument6 pagesFsi9 GN SampleMusa GürsoyNo ratings yet

- Thesis Topics Corporate FinanceDocument8 pagesThesis Topics Corporate FinanceGina Rizzo100% (2)

- PROJECT MANAGEMENT PLAN or PROPOSAL SAMPLE GUIDE-1Document20 pagesPROJECT MANAGEMENT PLAN or PROPOSAL SAMPLE GUIDE-1Joereinz YsonNo ratings yet

- Chapter23 Audit of Cash BalancesDocument37 pagesChapter23 Audit of Cash BalancesJesssel Marian AbrahamNo ratings yet

- Accepting An Engagement AuditingDocument7 pagesAccepting An Engagement AuditingCarlo FrioNo ratings yet

- Accounting Reforms Determinants of Local Governments' ChoicesDocument23 pagesAccounting Reforms Determinants of Local Governments' ChoicesMade Candra SwadayaNo ratings yet

- Financial Modeling GuideDocument59 pagesFinancial Modeling GuideGhislaine TohouegnonNo ratings yet

- International Transfer Pricing Advance ArrangementsDocument30 pagesInternational Transfer Pricing Advance ArrangementsSen JanNo ratings yet

- CSR - Case Johnson and JohnsonDocument13 pagesCSR - Case Johnson and JohnsonPhilippe André Schwyn100% (1)