Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2012 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2012 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

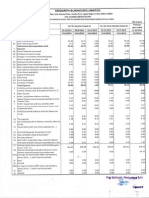

VISHVPRABHA TRADING LIMITED

Regd. Office: Warden House, 340, J.J. Road, Byculla, Mumbai 400 008.

Unaudited Financial Results for Three/Nine Months

ended 31st December, 2012

(R upees In Th ousan d s )

s-.

Particulars

1 (a)Net Sales/Income from Operation

(b)ather Operating Income

Three Months Ended

Accounting

31.12.12

30,09,12

31.12.11

31.12.12

31.12,11

31.03.2012

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

Total Income

Nine Months Ended

81

'12

83

81

12

83

136

136

148

4

152

Expenditure

(a) (rncrease)fDecrease in Stock-in-Trade

(b) Other Expenditure

(e Total

25

25

18

23

91

18

23

91

86

86

(23)

63

(11)

(8)

50

(23)

63

158

158

(Any Item exceeding 10% of the total

expendltureto be shown seperately)

3 Profit from Operations before Other Income,

Interest & Exceptional Items (1-2)

4 Other Income

5 Profit before Interest & Exceptional Items (3+4)

6 Interest

7 Profit after Interest but before Exceptional

(23)

(6)

(11)

(8)

60

(6)

(11)

(8)

50

(6)

(8)

50

(6)

(8)

44

(12)

63

Items (56)

8 Exceptional Items

9 Profit (+)fLoS5 [-] from Ordinary Activities

(23)

63

(11)

63

(17)

before tax (7+8)

10 Tax Expenses

11 Net Profit (+)/Loss

from Ordlnery Activities

after tax (910)

12 Extra Ordinery Items (Net of Tax Expenses)

13 Net Profit (+) / Loss (-) for the period (11~12)

14 Paid-up equity share capital

(Face Value Rs.10/ per share)

15 Reserves excluding Revaluation Reserves

as per Balance Sheet of previous Ale year

(23)

(23)

63

(17)

2,450

2,450

2,450

16 Earning Per Share (EPS)

(a) Basic and diluted EPS before Extraordinary

(8)

44

(12)

2,450

2,450

2,450

2,557

0,26

0.18

items for the period for the year to date & for

the previous year (not to be annualized)

(b) Basic and diluted EPS after Extraordinary

0.18

0.26

items for the period for the year to date & for

the previous year (not to be annualized)

17 Public Share Holding

Number of Shares

Percentage of Shareholding

163,150

163,150

163,150

163,150

163,150

66.59

66.59

66.59

66.59

66.59

163,150

66.59

18 Promoters and promoter group Shareholding

a) Pledged/Encumbered

Number of shares

Percentage of shares (as a % of the total

shareholding of promoter and promoter

group)

Percentage of shares (as a % of the total

share capltat of the company)

b) Non-encumbered

Number of shares

81,850

81,850

81,850

81,850

Percentage of shares (as a % of the total

100.00

100.00

100.00

100.00

81,850

100.00

81,850

100.00

33.41

33.41

33.41

33.41

33.41

33.41

shareholding of promoter and promoter

group)

- Percentage of shares (as a % of the total

share capital of the company)

Notes.

The above results were taken on record by the Board of Directors of the Company

atlts meeting held on 30.01.2013.

2 Previous period's figures have been regrouped/rearranged wherever necessary.

3 The company is a single segment company in accordance with AS-17 (Segment ReportIng)

issued by the ICAI.

4 There is no material tax effect of timing difference based on the estimated computation

for a reasonable period, hence there is no provision for deferred tax in terms of AS 22.

5 No Investor complaints were received during the quarter ended 31.12.2012.

6 Provtston tor tax if any will be considered at the end of the year.

For VISHVPRABHA TRAOING LIMITED

rr r

~J

~

Place: Mumbai

nil

Dated: 30.01.2013

Oi ector

.Burve

I. G. Naik & CO.

Chartered Accountants

M.COM., LLB., rCA.

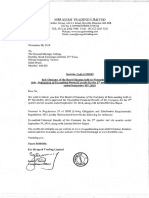

REVIEW REPORT

We have reviewed the accompanying Statement of Unaudited Financial Results of

Vishvprabha Trading Limited for the quarter ended 31s t December, 2012.This Statement

is the responsibility of the Company's management and has been approved by the Board of

Directors.

A review of interim financial information consists principally of applying analytical procedures

for financial data and making inquiries of persons responsible for financial and accounting

matters. It is substantially less in scope than an audit conducted in accordance with the

generally accepted auditing standards, the objective of which is the expression of an opinion

regarding the financial statements taken as a whole. Accordingly, we do not express such an

opinion.

Based on our review conducted as above, nothing has come to our notice that causes us to

believe that the accompanying statement of unaudited financial results prepared in

accordance with Accounting Standards and other recognized accounting practices and

policies has not disclosed the information required to be disclosed in terms of clause 41 of

the Listing Agreement including the manner in which it is to be disclosed, or that it contains

any material mis-statement.

For I.G. NAIK & CO.

Chartered Accountants

Firm Registration No. t 0681 OW

I. .

Proprietor.

M.No.034504

Date: 30.01.2013

Place: Mumbai

Chandrama, 2nd Floor, 21, Kalanaqar. Sandra (E).. Mumbai 400 051.

Tel. : +91 2226591851 Fax; +91 222640 889B MnhilP. +9198201 49972

Email: ign1953@gmail.com

You might also like

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For March 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For March 31, 2016 (Result)Document10 pagesRevised Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- International Marketing Channels: Mcgraw-Hill/IrwinDocument35 pagesInternational Marketing Channels: Mcgraw-Hill/IrwinIzatti AyuniNo ratings yet

- Module 6 SDMDocument34 pagesModule 6 SDMdharm287No ratings yet

- Punjab Spatial Planning StrategyDocument12 pagesPunjab Spatial Planning Strategybaloch47No ratings yet

- The Feasibility of Merging Naga, Camaligan and GainzaDocument5 pagesThe Feasibility of Merging Naga, Camaligan and Gainzaapi-3709906100% (1)

- E1.developments in The Indian Money MarketDocument16 pagesE1.developments in The Indian Money Marketrjkrn230% (1)

- Using Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test BankDocument13 pagesUsing Sage 50 Accounting 2017 Canadian 1st Edition Purbhoo Test Bankmungoosemodus1qrzsk100% (25)

- Aditya Pandey - Summer Internship Report PDFDocument52 pagesAditya Pandey - Summer Internship Report PDFHustle TvNo ratings yet

- CH 14Document8 pagesCH 14Lemon VeinNo ratings yet

- Explain The Purpose and The Functions of HRMDocument3 pagesExplain The Purpose and The Functions of HRMSujit DuwalNo ratings yet

- Content/Elements of Business Plan: Mary Mildred P. de Jesus SHS TeacherDocument28 pagesContent/Elements of Business Plan: Mary Mildred P. de Jesus SHS TeacherMary De JesusNo ratings yet

- Online Shopping Hesitation: Chang-Hoan Cho, PH.D., Jaewon Kang, PH.D., and Hongsik John Cheon, PH.DDocument14 pagesOnline Shopping Hesitation: Chang-Hoan Cho, PH.D., Jaewon Kang, PH.D., and Hongsik John Cheon, PH.DAmber ZahraNo ratings yet

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Document3 pagesICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)

- Operations Management Essay Operations Management EssayDocument4 pagesOperations Management Essay Operations Management EssayShirley Soriano-QuintoNo ratings yet

- BBB EXAM REVIEW 2023Document12 pagesBBB EXAM REVIEW 2023osbros10No ratings yet

- MAC CH 12 Money Supply CC PDFDocument20 pagesMAC CH 12 Money Supply CC PDFBerkshire Hathway coldNo ratings yet

- Zuellig V Sibal PDFDocument25 pagesZuellig V Sibal PDFCarlo AfNo ratings yet

- International BusinessDocument3 pagesInternational Businesskarthi320No ratings yet

- Swiss NCP Initial Assessment UBS STP ForpublicationDocument8 pagesSwiss NCP Initial Assessment UBS STP ForpublicationComunicarSe-ArchivoNo ratings yet

- Gilaninia and MousavianDocument9 pagesGilaninia and Mousavianpradeep110No ratings yet

- Preface PDFDocument2 pagesPreface PDFOscar Espinosa BonillaNo ratings yet

- Time Value of Money: Present and Future ValueDocument29 pagesTime Value of Money: Present and Future ValuekateNo ratings yet

- Full Download Global Business Today Canadian 4th Edition Hill Solutions Manual PDF Full ChapterDocument36 pagesFull Download Global Business Today Canadian 4th Edition Hill Solutions Manual PDF Full Chapterowch.lactamduwqu100% (15)

- COBECON - Math ProblemsDocument16 pagesCOBECON - Math ProblemsdocumentsNo ratings yet

- Access To Finance For Women Entrepreneurs in South Africa (November 2006)Document98 pagesAccess To Finance For Women Entrepreneurs in South Africa (November 2006)IFC SustainabilityNo ratings yet

- To DoDocument3 pagesTo DoSolomon AttaNo ratings yet

- Oman - Corporate SummaryDocument12 pagesOman - Corporate SummarymujeebmuscatNo ratings yet

- Developing Marketing Strategies and PlansDocument43 pagesDeveloping Marketing Strategies and PlansThaer Abu Odeh100% (1)

- The Bkash Banking Company and Summary of It'S Marketing StrategyDocument19 pagesThe Bkash Banking Company and Summary of It'S Marketing StrategyRita AhmedNo ratings yet

- AAO Promotion Exam NewSyllabus ItDocument35 pagesAAO Promotion Exam NewSyllabus ItSRanizaiNo ratings yet

- Aluminum Building and Construction Usage Study: April 2021Document25 pagesAluminum Building and Construction Usage Study: April 2021Anver AkperovNo ratings yet