Professional Documents

Culture Documents

ACC 359 - Cost and Management Accounting - Atiase PDF

Uploaded by

tuonghoangvanhpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC 359 - Cost and Management Accounting - Atiase PDF

Uploaded by

tuonghoangvanhpCopyright:

Available Formats

University of Texas at Austin

McCombs School of Business

Department of Accounting

Course Outline

Fall 2012

ACC 359/387.1

Cost and Management Accounting

Professor K. Rowland Atiase

Office:

Office Phone:

Office Hours:

E-Mail:

CBA 4M.248

471-5841

TuTh 12:15 1:15 p.m., and by appointment

ratiase@mail.utexas.edu

TAs:

Office:

Hours:

E-Mail:

Siming Yang

CBA 4.304A

W 12:30 2:00 p.m. and by appt.

Siming.Yang@utexas.edu

TAs:

Office:

Hours:

E-Mail:

Adibfar Itrat

CBA 4.304A

MW 11:00 12:30 p.m. and by appt.

aitrat@hotmail.com

Carolyn Syer

CBA 4.304A

MW 2:00 3:30 p.m. and by appt.

Carolyn.syer@bba08.mccombs.utexas.edu

Required Texts:

Horngren, Datar, & Rajan, Cost Accounting: A Managerial Emphasis (14th Ed.)

Ajinkya, Atiase & Bamber (AAB), Issues in Accounting Education, Fall 1986, pp. 268-281.*

The Ernst & Young Guide To Total Cost Management (E&Y Guide), Wiley & Sons, 1992, Chapters 7, 8

& 9.*

ACC 359/387.1, Cost and Management Accounting Readings, Handouts (HOs), Cases and Solutions

Package. Available at Speedway Copy and Printing, Dobie Mall (478-3334).

* Included in the ACC 359/387.1 Course Package.

Course Objectives:

This course will cover cost accumulation concepts and techniques for Product and Service Costing,

Planning and Control, as well as Non-routine Managerial Decisions. Modern management accountants are

not only concerned with how cost data are transformed into cost accounting information but more

importantly how to use cost accounting information to aid managerial goals. It is the case, however, that

one cannot effectively use cost information without a good understanding of how various cost accounting

Page 2, ACC 359/387.1, Fall 2012, Course Outline

information are generated. Topics introduced in Introductory Managerial Accounting Course will be covered

much more rigorously in this course. In addition the course will provide students with a good exposure to

topics on current and emerging concepts, practices and developments in Total Cost Management (TCM)

including Activity-Based Costing (ABC), Benchmarking and Best Practices (BBP), Customer Costing (CC),

Business Process Analysis (BPA), Business Process Improvement (BPI), Cost-Volume-Profit Analysis

under Absorption and Direct Costing, Relevant Costing, Strategic Cost Management (SCM), and Transfer

Pricing in Perfect and Imperfect Intermediate Product Markets.

The course should develop the student's understanding, skill, and analytic ability in management

accounting to the level where he or she can function effectively (and efficiently) as a professional

management accountant in industry, in public accounting, in management consulting, in government, or in

personal business management.

Reading/Written (Home) Assignments & Outline of Class Notes:

This course, though not difficult conceptually, will undoubtedly be demanding in time and effort.

Thus students may be well-advised to plan to allocate adequate time to the study of the material. The only

path to success in this course is for the student to complete (or at least attempt) the reading and written

home assignments regularly and on time (i.e., before each class meeting.) Note: Basic algebraic and

quantitative skills are assumed.

Written homework (in pencil) is due at the beginning of each class session for which it is assigned.

Homework need not be perfect; if a reasonable attempt is made towards solving all problems, you will

receive perfect scores. Assigned problems are meant to guide class participation; time constraints will

determine whether they will (all) be solved in class. Active class participation is required. Homework will

be collected at random.

The outline of class notes for each class will be posted on Blackboard a few days before each

class. Each student should print and bring the outline of class notes for each class to class.

Group Case Write-up and Presentation:

You and your group will be responsible for a detailed analysis of a primary case. You should

generally plan to submit three copies of a maximum of a five-page double-spaced typed solution, along with

any exhibits and presentation slides you deem appropriate. Your solution to the case must explain what

you believe the company's problems and challenges are, and then explain how your suggested course of

action addresses those problems. Your target audience is fellow managers who are familiar with basic

business concepts, but not with the details of a particular problem or solution techniques. Obviously, a set

of computations or schedules would not by themselves be sufficient to define the problem and explain a

solution.

Secondary Case Write-ups:

You and your group should also turn in three copies of a maximum of two-page double-spaced

executive summary (along with any exhibits you deem appropriate) of the other cases on the designated

dates. The executive summaries should discuss (1) the major issues, (2) your solution, (3) operational

and/or strategic questions you might pose to specific managers or to the firm.

Page 3, ACC 359/387.1, Fall 2012, Course Outline

Group Review Synthesis Write-up and Presentation:

You and your group will present and submit three copies of two-page double-spaced typed review

and synthesis (along with exhibits and presentation slides) of one of the major areas of cost and

managerial accounting covered during the semester. I expect each student to contribute equally to every

case and synthesis write-up and presentation.

Attire for Group Project Presentations: Business Casual

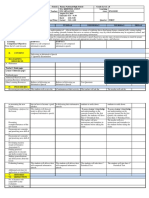

Examinations, Group Case Write-up and Presentations, Synthesis and Grading:

There will be two mid-term exams and a comprehensive final exam. In addition, there may be unannounced

pop quizzes. A requirement of the course is that the Exam I, Exam II & the Final Exam will be given in the evening.

Do note the exam dates and times now and arrange to keep yourself free at those times.

Individual grades will depend on the student's performance according to the following criteria:

Grading Item

Mid-term Exam I (Oct. 10, 8:00-10:00 p.m.)

Mid-term Exam II (Nov. 19, 8:00-10:00 p.m.)

Final Exam

(Dec. 13, 7:00-10:00 p.m.)

Cases:

Primary Case

Secondary Case

Synthesis

TOTAL POINTS

Quizzes, Homework & Class Participation

Points

125

125

150

50

25

25

500

Soft Points*

*Soft points are typically used to upgrade students whose overall performance on hard points

(examinations, etc.) falls on a borderline (e.g., A/A-/B+/B). However, each student must earn at least 70 percent of

the points assigned to homework collected or risk an automatic reduction of his or her final course grade by half a

letter grade!

In accordance with the Accounting Department Grade Policy/Guideline for the integrated MPA Core

courses, Final Course Grades (A, A-, B+, B, B-, C+, C, etc.) will be assigned to achieve a final class average GPA

between 3.2 and 3.4, inclusive.

Students with Disabilities:

The University of Texas at Austin provides upon request appropriate academic accommodations for qualified

students with disabilities. For more information, contact the Office of the Dean of Students at 471-6259, 471-4641

TTY.

Page 4, ACC 359/387.1, Fall 2012, Course Outline

Policy Statement on Scholastic Dishonesty:

Students who violate University rules on scholastic dishonesty are subject to disciplinary penalties, including

the possibility of failure in the course and/or dismissal from the University. Since dishonesty harms the individual, all

students, and the integrity of the University, policies on scholastic dishonesty will be strictly enforced.

The Department of Accounting has no tolerance for acts of scholastic dishonesty. The responsibilities

of both students and faculty with regard to scholastic dishonesty are described in detail in the

departments Policy Statement on Scholastic Dishonesty in the MPA Program and the Professional Program

in Accounting. By teaching this course, I have agreed to observe all of the faculty responsibilities

described in that document. If you are an MPA student 1 , by enrolling in this class, you have

agreed to observe all of the student responsibilities described in the policy statement. If you are an MBA student,

you have signed a MBA Honor Pledge that is fully consistent with the Policy Statement. If the application

of that Policy Statement or the MBA Honor Pledge to this class and its assignments is unclear in any

way, it is your responsibility to ask me for clarification. A copy of the Policy Statement is available from me

or in CBA 4M.202 and is online at http://www.mccombs.utexas.edu/dept/accounting/honesty.asp. The MBA Honor

Pledge is online at http://mba.mccombs.utexas.edu/students/academics/honor/hnrpldg.asp.

Including integrated MPAs, traditional MPAs, and Eco-MPAs.

Page 5, ACC 359/387.1, Fall 2012, Course Outline

ACC 359/387.1, Assignment Schedule, Fall 2012

Mont

h

Date

Day

Reading Assignment

Written Assignment

Aug.

30

Th

1-1, 2, 3, 12, 13

Sept.

3

4

M

T

Introduction, Course Policies, Ch. 1- Objectives

of Cost & Management Accounting

Labor Day Holiday

Ch. 2 -- Cost Terms & Purposes, Actual Costing

6

11

13

18

20

Th

T

Th

T

Th

25

27

2

4

Th

T

Th

9

10

11

16

T

W

Th

T

18

Th

23

25

30

Th

T

1

6

Th

T

Oct.

Nov.

Ch. 4 Normal Costing

Ch. 4 Normal Costing

Ch. 3 -- Cost Volume Profit (CVP) Analysis

Ch. 3 Profit Volume (PV) Line

Ch. 9; HOs #3a, 3b, 4a;

AAB paper -- Absorption versus Direct Costing

Ch. 9; AAB paper Difference in Net Income AC

vs. DC; Cost Volume Profit Analysis under

Absorption Costing

Ch. 11 -- Relevant Costing

Ch. 11 Non-Routine Decisions

Chs. 6 & 7 -- Static & Flexible Budgets I

Responsibility Accounting, Direct Materials &

Direct Labor Standard Costs & Variances

Catch-up & Review

Exam I (8:00-10:00 p.m.); No Make-ups

No Class

Chs. 6 & 7 -- Static & Flexible Budgets I

Responsibility Accounting, Direct Materials &

Direct Labor Standard Costs & Variances

Chs. 7 & 10 -- Flexible Budgets & Cost Behavior

/ Berkshire Threaded Fasteners Case (wait

for additional guidelines to start!)

Ch. 8 -- Flexible Budgets II Variable & Fixed

Overhead Budgets & Vaviances

Bridgeton Industries Case

Ch. 8; Ch. 5 and E&Y Guide-Chs. 7 & 8; Business Process Analysis, Business Profit

Improvement, Activity Based Costing, &

Customer Costing

Ch. 14 -- Sale and Production Variances

Ch. 22 -- Transfer PricingGeneral Rule for

Optimal Transfer Price

2-1, 2, 7, 8, 9, 10, 11, 12, 14, 32, 33,

34, 35

4-1, 2, 9, 12, 13, 18, 20, 26, 32

4- 19, Handouts (HO) #1 & HO #2

3-35, 38, 44, 47; HO #3

9-1, 4, HO #4

HO #5 & HO #6

11-1, 2, 3, 4, 8, 21, 23, 29; HO #7

HO # 8, HO #9, HO #10

6-2, 7, 8,11; HO #11;7- 35

7-36

7-1, 3, 4, 24, 26, 27, 28; 10-25 (req. 1

only)

8-26

HO #12 & HO #13

5- 35, 38, 39;

E&Y Guide Ch. 9; HO #14 & HO #15

HOs # 16 & HO #17

22-2, 6, 11, 25, 26

Page 6, ACC 359/387.1, Fall 2012, Course Outline

Dec.

Th

13

15

19

20

22

T

Th

M

T

Th

Ch. 22 -- Transfer PricingImperfectly

Competitive Intermediate Product Markets

Destin Brass Case

Catch-up and Review

Exam II (8:00-10:00 p.m.); No Make-ups

No class

Thanksgiving Holiday

27

29

4

6

Tu

Th

T

Th

Total & Strategic Cost Management.

Review & Synthesis Presentations

Catch up and Review

TBA

HO#18 &HO #19

Final Exam: Common Final Exam Thursday Dec 13, 2012; 7:00-10:00 p.m.

Make-Up Final Exam Friday Dec 14, 2012; 7:00-10:00 p.m.

GUIDELINES FOR CASE & SYNTHESIS WRITE-UPS

Attach a cover page including the following items: case name; group

members names; course and class time or unique number.

10, 11 or 12 point font with 1 inch margins.

double-spaced (1.5 line spacing does not constitute double-spacing).

The first paragraph should include a brief overview of the case facts as

well as introduction to the issues you are to address, i.e. the questions

that you intend to answer throughout the case. This will provide a nice

transition to your first paragraph.

Do not enumerate your answers, but instead include answers in a

coherent sequence of paragraphs.

All pages following the cover page should have a page number (beginning

with page 1) on the lower right-hand corner (right footer for the Word

users).

For each paragraph, include a concise topic sentence that answers the

question. Support in the form of analysis and explanations should follow

your topic sentence.

Provide adequate support for conclusionsdo not simply conclude

something without supporting it somehow (this applies even to the

secondary cases although there is less breadth expected in the

explanations). A good heuristic is to ask yourself, if you were the CEO of

this firm would this conclusion make sense to you.

Headings are ok, but you should be able to lead the reader to the next

paragraph easily with a segue.

All table and exhibits should be attached at the end of the case discussion

and be noted upon first reference in the case discussion, e.g. Blah blah blah

(see exhibit 1).

PROOFREADmany mistakes could be detected and subsequently

corrected with a cursory proofread.

Suggested Questions and Issues on the

Berkshire Threaded Fasteners Co. Case

1. How do the individual product line and total companys Direct

Costing Income Statements and Incomes compare with the

Absorption Costing Income Statements and Incomes for the year

ended December 31, 1973 and the six months ended June 30,

1974?

2. If the company had dropped the 300 series as of January 1, 1974,

what effect would that action have had on the profit for the first six

months of 1974?

3. In July 1974, should the company have reduced the price of the

100 series from $2.45 to $2.25?

4. Which is Berkshires most profitable product line?

5. What strategic suggestions do you have for Mr. Magers and

Berkshire as a result of your overall analysis?

These questions and issues are things you may wish to consider.

You may emphasize other issues you think are important or adopt a

different perspective that you think may be appropriate to the case.

Group write-ups for primary and secondary cases are described in

the course outline. Each primary (secondary) case group should plan

to submit three copies of a maximum of five(two)-page doublespaced typed solution, along with any exhibits and presentation slides

that they deem appropriate. Each primary case group should also

plan on a maximum 15 minute overall presentation (including set-up

time).

Suggested Questions and Issues on the

Bridgeton Industries Case

1. Explain the trend in the overhead allocation rates over the 1987 to

1990 period.

2. Are the product costs reported by the cost system appropriate for

strategic non-routine decision making?

3. Assuming 1991 prices, sales volumes and materials costs are

unchanged from 1990, what is the likely 1991 budget (Hint: Use

Direct costing )

(a) with no changes in the product line

(b) if the manifold product line is dropped?

How does the overhead allocation rate differ under the two

alternatives?

4. Would you outsource manifolds in 1991?

5. What other strategic suggestions do you have for Bridgeton

Industries?

These questions and issues are things you may wish to consider.

You may emphasize other issues you think are important or adopt a

different perceptive that you think may be more appropriate to the

case.

Group write-ups for primary and secondary cases are described in

the course outline. Each primary (secondary) case group should plan

to submit three copies of a maximum of five(two)-page doublespaced typed solution, along with any exhibits and presentation slides

that they deem appropriate. Each primary case group should also

plan on a maximum 15 minute overall presentation (including set-up

time).

Suggested Questions and Issues on the

Destin Brass Product Co. Case

1. What are the problems/issues facing Destin Brass?

2. How might the standard cost estimates being used be improved

upon using activity based costing?

3. What are the implications of the differences between your

improved cost estimate and the companys standard cost?

4. Suppose that production and sales levels as well as other

activities and costs are at the current standard level. How would

net income differ under currently used standard costing system

and the activity based costing system?

5. What strategic suggestions would you make to Destin Brass Co.

as a result of your overall analysis?

These questions and issues are things you may wish to consider.

You may emphasize other issues you think are important or adopt a

different perceptive that you think may be more appropriate to the

case.

Group write-ups for primary and secondary cases are described in

the course outline. Each primary (secondary) case group should plan

to submit three copies of a maximum of five(two)-page doublespaced typed solution, along with any exhibits and presentation slides

that they deem appropriate. Each primary case group should also

plan on a maximum 15 minute overall presentation (including set-up

time).

Suggested Questions and Issues on the

Group Synthesis Write-up and Presentation

Managerial/Cost Accounting has three major objectives namely:

1. Product (Service) Costing

2. Planning and Control, and

3. Non-Routine Managerial Decisions

Virtually all topics covered in this course fall under at least one of these three major

areas. You and your group will be responsible for the review and synthesis of one of

the above major areas of managerial accounting (i.e., your Primary Synthesis Topic)

covered during the semester. Your review and synthesis may address the following

suggested questions and issues:

1. What are the learning objectives of your (primary) synthesis topic?

2. How have we achieved them?

3. How is your primary synthesis topic related to the other major areas of

managerial accounting?

4. What Knowledge have we gained in this course beyond ALL previous courses

taken (Value Added)?

5. How do you expect the knowledge you gained in this course on (i) your

primary synthesis topic and (ii) your secondary synthesis topics to help you in

your potential future careers?

6. Any other comments you want to share.

These questions and issues are things you may wish to consider. You may

emphasize other issues you think are important or adopt a different perceptive that

you think may be more appropriate for your review and synthesis. Each group

should plan to submit three copies of two-page, double-spaced typed review and

synthesis (along with any exhibits and presentation slides that they deem

appropriate) and also plan on a 5 minute overall presentation.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Eganala CVDocument2 pagesEganala CVAisyah SukarmaNo ratings yet

- Report - Convening On Refugee and Migrant YouthDocument7 pagesReport - Convening On Refugee and Migrant YouthJosh BrownNo ratings yet

- Social Group InteractionDocument2 pagesSocial Group Interactionapi-263411724No ratings yet

- Susie Wong CaseDocument18 pagesSusie Wong CaseJashley NicoleNo ratings yet

- Interpret Electrical Signs & SymbolsDocument2 pagesInterpret Electrical Signs & Symbolsnoy83% (6)

- Empowerment Technology Lesson 1 DLLDocument3 pagesEmpowerment Technology Lesson 1 DLLGian Carlos Bolaños100% (1)

- Bocconi Orientation Guide for Double Degree StudentsDocument23 pagesBocconi Orientation Guide for Double Degree StudentssubashnehruNo ratings yet

- Schema Theory NarrativeDocument5 pagesSchema Theory Narrativeapi-188978784100% (1)

- Teacher's Resources p4Document97 pagesTeacher's Resources p4navicanivela50% (2)

- Front Page of Marketing StartegyDocument4 pagesFront Page of Marketing StartegyAshish MotghareNo ratings yet

- Ntercultural Ommunication Enter: Understanding "Fossilized" Grammar: When Fluency Is Stronger Than GrammarDocument2 pagesNtercultural Ommunication Enter: Understanding "Fossilized" Grammar: When Fluency Is Stronger Than GrammarGunnie PandherNo ratings yet

- High Stakes Testing Meets Multiple IntelligencesDocument23 pagesHigh Stakes Testing Meets Multiple Intelligencesleetolbean0% (1)

- Institute of Graduate Studies: Reference: English Powerplus 2Document4 pagesInstitute of Graduate Studies: Reference: English Powerplus 2Angelica OrbizoNo ratings yet

- Multinomial Logistic Regression With SPSS: Neo-Ffi ND - LocDocument8 pagesMultinomial Logistic Regression With SPSS: Neo-Ffi ND - LocNur Cahyani SetiawatiNo ratings yet

- Week 9Document3 pagesWeek 9Kristell PungtilanNo ratings yet

- School Handbook 13-14 in PDFDocument43 pagesSchool Handbook 13-14 in PDFElla ToonNo ratings yet

- Recent Perspectives On The Role of Previously Known (PPT Yati)Document16 pagesRecent Perspectives On The Role of Previously Known (PPT Yati)Siti Nurhayati100% (1)

- Dartmouth Rassias MethodDocument24 pagesDartmouth Rassias MethodZaira GonzalezNo ratings yet

- Annex 13 SRC TemplateDocument4 pagesAnnex 13 SRC TemplateSheena Maye PortaNo ratings yet

- Dr. Graham Spanier: and Training in Higher EducationDocument35 pagesDr. Graham Spanier: and Training in Higher EducationJudith Reisman, Ph.D.No ratings yet

- Scienceclub in Schools:Scope and Organization: Features ObjectivesDocument4 pagesScienceclub in Schools:Scope and Organization: Features Objectivesfathima AnazNo ratings yet

- Naeyc Statement of Commitment 123Document3 pagesNaeyc Statement of Commitment 123api-311435461No ratings yet

- Research Action PlanDocument6 pagesResearch Action PlanMa. Rosanna OlinoNo ratings yet

- HtgamitDocument384 pagesHtgamitLochie FerrierNo ratings yet

- 7362 02 Rms 20110309Document7 pages7362 02 Rms 20110309Taqsim RajonNo ratings yet

- Mapeh Calendar of Activities 2019Document4 pagesMapeh Calendar of Activities 2019Violet DV Balino100% (2)

- Description: Tags: WWC Wilson Reading 070207Document5 pagesDescription: Tags: WWC Wilson Reading 070207anon-697598No ratings yet

- Lesson Plan Template: Essential QuestionsDocument4 pagesLesson Plan Template: Essential Questionsapi-352684188No ratings yet

- Dietz HenryDocument14 pagesDietz HenryyauliyacuNo ratings yet

- ART Grade 1 Teaching GuideDocument3 pagesART Grade 1 Teaching GuideLary BagsNo ratings yet