Professional Documents

Culture Documents

Accounting Week 2

Uploaded by

Erryn M. ParamythaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Week 2

Uploaded by

Erryn M. ParamythaCopyright:

Available Formats

44

Part 1

Financial

Accounting

Concluding Comment

A t this point, readers should not be alarmed i f they do not yet fully understand some of

the topics in this chapter. In subsequent chapters, we shall expand considerably on the

concepts, categories, and terms introduced here. We shall describe modifications

and qualifications to some o f the basic concepts, and we shall introduce many additional terms that are used on balance sheets. We shall not, however, discard the basic

structure that was introduced in this chapter; it was based on the equation Assets =

Liabilities + Owners' equity. Furthermore, it is important to remember that every accounting transaction can be recorded in terms o f its effect on the balance sheet. The

reader should be able to relate all the new material to this basic structure.

Summary

The basic concepts discussed in this chapter may be briefly summarized as follows:

1. Money measurement. Accounting records only those facts that can be expressed in monetary terms.

2. Entity. Accounts are kept for entities as distinguished from the persons associated with

those entities.

3. Going concern. Accounting assumes that an entity will continue to exist indefinitely and

that it is not about to be liquidated.

4. Cost. Nonmonetary and monetary assets are ordinarily entered in the accounts at the

amount paid to acquire them. This cost, rather than current fair value, is the basis for

subsequent accounting for nonmonetary assets. Most monetary assets are accounted for

at fair value following their acquisition.

5. Dual aspect. Every transaction affects at least two items and preserves the fundamental

equation: Assets = Liabilities + Owners' equity.

The balance sheet shows the financial condition of an entity as of a specified moment in

time. It consists o f two sides. The assets side shows the economic resources controlled

by the entity that are expected to provide future benefits to it and that were acquired at objectively measurable amounts. The equities side shows the liabilities, which are obligations

of the entity, and the owners' equity, which is the amount invested by the owners. In a corporation, owners' equity is subdivided into paid-in capital and retained earnings.

__

Problems

Problem 2 - 1 .

'

WStM^-a. I f assets equal $95,000 and liabilities equal $40,000, then owners'equity equals

b. I f assets equal $65,000 and owners' equity equajs $40,000, then liabilities equal

c. I f current assets equal $25,000, liabilities equal $40,000, and owners' equity equals

. $55,000, the noncurrent assets equal

.

-i

d. I f the current ratio is 2.2:1, current assets are $33,000, and noncurrent assets equal

$55,000, then owners' equity is

. (Assume that all liabilities are current.)

e. What is the current ratio i f noncurrent assets equal $60,000, total assets equal $95,000,

and owners'equity equals $70,000? (Assume that all liabilities are current.)

Chapter 2

Basic Accounting Concepts: The Balance Sheet

45

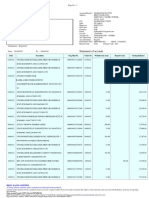

Problem 2-2.

Prepare a balance sheet as of June 30, for the J. L. Gregory Company, using the following

data:

Accounts payable

Accounts receivable

Accrued expenses

Accumulated depreciation

on buildings

Accumulated depreciation

on equipment

Bonds payable

Buildings (at cost)

Capital stock

$ 241,000

505,000

107,000

538,000

386,000

700,000

1,120,000

1,000,000

Cash

Equipment (at cost)

Estimated tax liability

Inventories

Investment in the Peerless

Company

Land (at cost)

Marketable securities

Notes payable

Retained earnings

$ 89,000

761,000

125,000

51 3,000

320,000

230,000

379,000

200,000

?

Problem 2-3.

Indicate the net effect on assets, liabilities, and owners' equity resulting from each of the

following transactions:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Capital stock was issued for $100,000 cash.

Bonds payable of $25,000 were refunded with capital stock.

Depreciation on plant and equipment equaled $8,500 for the year.

Inventory was purchased for $ 15,900 cash.

$9,400 worth of inventory was purchased on credit.

Inventory costing $4,500 was sold for $7,200 on credit.

$3,500 in cash was received for merchandise sold on credit.

Dividends of $3,000 were declared.

The declared dividends of $3,000 were paid.

The company declared a stock split, and replaced each outstanding share with two new

shares.

Problem 2-4.

D. Carson and F. Leggatt formed a partnership on June 1 to operate a shoe store. Carson

contributed $50,000 cash and Leggatt contributed $50,000 worth of shoe inventory. During

the month of June, the following transactions took place:

1. Additional shoe inventory was purchased at a cost of $24,000 cash.

2. Total cash sales for the month were $31,000. The inventory that was sold had a cost of

$15,500.

3. Carson withdrew $6,200 of cash drawings. Leggatt withdrew only $3,700 o f cash

drawings.

4. The partnership borrowed $50,000 from the Third National Bank.

5. Land and a building were purchased at a cash cost o f $25,000 and $50,000,

respectively.

Required:

a. Prepare a balance sheet as of June 1.

b. Prepare a reconciliation of the beginning and ending balances for each owner's capital account.

c. Prepare a balance sheet as of June 30.

46

Part 1

Financial

Accounting

Problem 2-5.

The January 1 balance sheet of the Marvin Company, an unincorporated business, is as

follows:

MARVIN COMPANY

Balance Sheet

As of January 1

Liabilities and Owners' Equity

Assets

Cash

Inventory

Total

$25,000

50,000

$75,000

Notes payable

Capital

Total

$20,000

55,000

$75,000

The following transactions took place in January:

Merchandise was sold for $12,000 cash that had cost $7,000.

To increase inventory, Marvin placed an order with Star Company for merchandise that would cost $7,000.

Marvin received the merchandise ordered from Star and agreed to pay the

$7,000 in 30 days.

Merchandise costing $1,500 was sold for $2,500 in cash.

Merchandise costing $2,000 was sold for $3,400 on 30-day open

account.

Marvin paid employees for the month $4,200 in cash.

Purchased land for $20,000 in cash.

Marvin purchased a two-year insurance policy for $2,800 in cash.

Jan.

11

16

26

29

31

Required:

Describe the impact of each transaction on the balance sheet, and prepare a new balance

sheet as of January 31.

Problem 2-6.

As of December 31, Brian Company had the following account balances:

Accounts payable

Accounts receivable

Bonds payable

Cash

$5,000

7,000

8,000

2,000

bonds payable

2,000

Current portion of

Required:

a. What was the current ratio?

b. Explain what the current ratio measures.

Long-term investments

Marketable securities

Plant and equipment

Wages payable

$1,500

3,500

8,500

1,500

You might also like

- 9/11: Twenty Years Later (2001-2021)Document46 pages9/11: Twenty Years Later (2001-2021)Timothy80% (5)

- Practice Exam 1 - With SolutionsDocument36 pagesPractice Exam 1 - With SolutionsMd Shamsul Arif KhanNo ratings yet

- PS Form 6387 Rural Money Order TransactionDocument1 pagePS Form 6387 Rural Money Order TransactionRoberto MonterrosaNo ratings yet

- ACCT 284 AD Clem Fionaguo Old Exam PacketDocument25 pagesACCT 284 AD Clem Fionaguo Old Exam PacketHemu JainNo ratings yet

- Corporate Liquidation: Accounting For Special Transactions (Module 1) PageDocument9 pagesCorporate Liquidation: Accounting For Special Transactions (Module 1) PagePrincess SagreNo ratings yet

- Week 3Document46 pagesWeek 3BookAddict721No ratings yet

- Despiece Upgrade PDFDocument5 pagesDespiece Upgrade PDFjonbilbaoNo ratings yet

- Balance Sheet QuestionsDocument9 pagesBalance Sheet Questionskmillat0% (1)

- PIP RFEG1000 Guidelines For Use of Refractory PracticesDocument5 pagesPIP RFEG1000 Guidelines For Use of Refractory PracticesNicolasMontoreRosNo ratings yet

- Quiz No 1Document8 pagesQuiz No 1LJ ValdezNo ratings yet

- 031 Barrameda Vs MoirDocument2 pages031 Barrameda Vs MoirTaz Tanggol Tabao-Sumpingan100% (2)

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- G1 6.4 Partnership - Amalgamation and Business PurchaseDocument15 pagesG1 6.4 Partnership - Amalgamation and Business Purchasesridhartks100% (2)

- Accounting Test 1Document8 pagesAccounting Test 1Nanya BisnestNo ratings yet

- Acct 200 MidtermDocument9 pagesAcct 200 MidtermLương Thế CườngNo ratings yet

- Topic Two: Recording Business Transactions: Case One: Owner Supplying All The ResourcesDocument15 pagesTopic Two: Recording Business Transactions: Case One: Owner Supplying All The ResourcesZAKAYO NJONYNo ratings yet

- FSA-Tutorial 1-Fall 2022Document4 pagesFSA-Tutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument111 pagesChapter 02 - Basic Financial Statementsyujia ZhaiNo ratings yet

- Multiple Choices and Exercises - AccountingDocument33 pagesMultiple Choices and Exercises - Accountinghuong phạmNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- Study Guide Chap 10Document33 pagesStudy Guide Chap 10taimoormalikNo ratings yet

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Lec. 3 - Transactions Recording - PRMG 030Document9 pagesLec. 3 - Transactions Recording - PRMG 030Ahmad SharaawyNo ratings yet

- INTERMEDIATE ACCOUNTING 1 - MidtermDocument6 pagesINTERMEDIATE ACCOUNTING 1 - Midtermailel isagaNo ratings yet

- Module 3. Activity Sheet The Accounting EquationDocument4 pagesModule 3. Activity Sheet The Accounting Equationmarejoymanabat3No ratings yet

- Chapter 1 and 2Document18 pagesChapter 1 and 2Hoèn HoènNo ratings yet

- CH 01 2 SolDocument29 pagesCH 01 2 Solюрий локтионовNo ratings yet

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHNo ratings yet

- Accounting Principles 1Document27 pagesAccounting Principles 1shaza jocarlos100% (1)

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- For CDEEDocument7 pagesFor CDEEmikiyas zeyedeNo ratings yet

- Basic AccountingDocument46 pagesBasic AccountingMD LeeNo ratings yet

- Chapter 2Document21 pagesChapter 2Kibrom EmbzaNo ratings yet

- Financial AccountingDocument72 pagesFinancial AccountingChitta LeeNo ratings yet

- ch01 Introduction Acounting & BusinessDocument37 pagesch01 Introduction Acounting & Businesskuncoroooo100% (1)

- SFP WK 1Document6 pagesSFP WK 1Alma Dimaranan-AcuñaNo ratings yet

- HOMEWORK1: Introduction To Accounts: Financial Markets Education: Accounting FundamentalsDocument15 pagesHOMEWORK1: Introduction To Accounts: Financial Markets Education: Accounting FundamentalsRavi KumarNo ratings yet

- Statement of Financial Position (SFP) : Lesson 1Document29 pagesStatement of Financial Position (SFP) : Lesson 1Dianne Saragena100% (1)

- Problems Inter Acc1Document10 pagesProblems Inter Acc1Chau NguyenNo ratings yet

- EQuestionsDocument11 pagesEQuestionsLala BoraNo ratings yet

- Financial Accounting Libby Short 7th Edition Test BankDocument122 pagesFinancial Accounting Libby Short 7th Edition Test BankJennifer Winslow100% (28)

- Accounting - Chapter 2 OutlineDocument17 pagesAccounting - Chapter 2 Outlinesxzhou23No ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- Ch11 - Current Liabilities and Payroll AccountingDocument52 pagesCh11 - Current Liabilities and Payroll AccountingPrincess Trisha Joy Uy100% (1)

- Module No 1 Corporate LiquidationDocument10 pagesModule No 1 Corporate LiquidationKrishtelle Anndrhei SalazarNo ratings yet

- Chapter 5 AfspDocument41 pagesChapter 5 AfspFrances AgustinNo ratings yet

- Balance Sheet Dimasaka & JaranillaDocument56 pagesBalance Sheet Dimasaka & JaranillaShaneBattierNo ratings yet

- Review Sessiokkbk 1 TEXTDocument6 pagesReview Sessiokkbk 1 TEXTMelissa WhiteNo ratings yet

- 1Document21 pages1DrGeorge Saad AbdallaNo ratings yet

- Effects of Business TransactionsDocument4 pagesEffects of Business TransactionsP leeNo ratings yet

- ACC300 Principles of AccountingDocument11 pagesACC300 Principles of AccountingG JhaNo ratings yet

- Accountancy TestDocument9 pagesAccountancy TestGaurav PitaliyaNo ratings yet

- Conta FinancieraDocument21 pagesConta FinancieraAdrian TajmaniNo ratings yet

- Basic Financial StatementsDocument50 pagesBasic Financial StatementsK KNo ratings yet

- Corporate LiquidationDocument7 pagesCorporate LiquidationpajarillamicNo ratings yet

- Tutotial 1 - Financial Statement and Cash FlowDocument2 pagesTutotial 1 - Financial Statement and Cash FlowAmy LimnaNo ratings yet

- Acc101 Mini Exam Review For StudentsDocument10 pagesAcc101 Mini Exam Review For StudentsHundaol KumaaNo ratings yet

- ACTG 240 - Solutions 01Document4 pagesACTG 240 - Solutions 01xxmbetaNo ratings yet

- HW01 2014S AccountingBasics BSvaluationDocument5 pagesHW01 2014S AccountingBasics BSvaluationBethany Wong0% (1)

- Suspense QuestionsDocument15 pagesSuspense QuestionsChaiz MineNo ratings yet

- Accounting 1 Review QuizDocument6 pagesAccounting 1 Review QuizAikalyn MangubatNo ratings yet

- Intermidate AssignmentDocument6 pagesIntermidate AssignmentTahir DestaNo ratings yet

- Acct 2600 Exam 1 Study SheetDocument8 pagesAcct 2600 Exam 1 Study Sheetapi-236442317No ratings yet

- SFP WK 1Document6 pagesSFP WK 1Alma Dimaranan-Acuña0% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirNo ratings yet

- LGF V5 1 0 enDocument311 pagesLGF V5 1 0 enJahidul IslamNo ratings yet

- Applied PhysicsDocument5 pagesApplied Physicsahmad irtisamNo ratings yet

- Solvency PPTDocument1 pageSolvency PPTRITU SINHA MBA 2019-21 (Kolkata)No ratings yet

- 11i Implement Daily Business Intelligence: D17008GC30 Edition 3.0 April 2005 D 41605Document14 pages11i Implement Daily Business Intelligence: D17008GC30 Edition 3.0 April 2005 D 41605Bala KulandaiNo ratings yet

- Chapter 5 AmponganDocument31 pagesChapter 5 AmponganMelchorCandelaria100% (1)

- SMB105 5 PDFDocument65 pagesSMB105 5 PDFmech430No ratings yet

- Application Form For Business Permit 2016Document1 pageApplication Form For Business Permit 2016Monster EngNo ratings yet

- Thermal Physics Assignment 2013Document10 pagesThermal Physics Assignment 2013asdsadNo ratings yet

- Trellick Tower PresentationDocument2 pagesTrellick Tower PresentationCheryl Ng100% (1)

- Aetna V WolfDocument2 pagesAetna V WolfJakob EmersonNo ratings yet

- CESSWI BROCHURE (September 2020)Document2 pagesCESSWI BROCHURE (September 2020)Ahmad MensaNo ratings yet

- 101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041Document8 pages101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041mrcopy xeroxNo ratings yet

- 96boards Iot Edition: Low Cost Hardware Platform SpecificationDocument15 pages96boards Iot Edition: Low Cost Hardware Platform SpecificationSapta AjieNo ratings yet

- Sinif Matemati̇k Eşli̇k Ve Benzerli̇k Test PDF 2Document1 pageSinif Matemati̇k Eşli̇k Ve Benzerli̇k Test PDF 2zboroglu07No ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Employee Grievance Settlement Procedure: A Case Study of Two Corporation SDocument12 pagesEmployee Grievance Settlement Procedure: A Case Study of Two Corporation SSandunika DevasingheNo ratings yet

- Part IV Civil ProcedureDocument3 pagesPart IV Civil Procedurexeileen08No ratings yet

- What Is Cybercrime?Document3 pagesWhat Is Cybercrime?JoshuaFrom YTNo ratings yet

- SEC Cryptocurrency Enforcement Q3 2013 Q4 2020Document30 pagesSEC Cryptocurrency Enforcement Q3 2013 Q4 2020ForkLogNo ratings yet

- Fmea Aiag Vda First Edition 2019Document254 pagesFmea Aiag Vda First Edition 2019Sabah LoumitiNo ratings yet

- Credcases Atty. BananaDocument12 pagesCredcases Atty. BananaKobe BullmastiffNo ratings yet

- APHYD00136810000170072 NewDocument3 pagesAPHYD00136810000170072 NewNithin Sunny ChackoNo ratings yet

- Water Quality Categorization Using WQI in Rural Areas of Haridwar, IndiaDocument16 pagesWater Quality Categorization Using WQI in Rural Areas of Haridwar, IndiaESSENCE - International Journal for Environmental Rehabilitation and ConservaionNo ratings yet