Professional Documents

Culture Documents

Ent On Proposed Private Placement Dated 28.11.2014

Uploaded by

nickong53Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ent On Proposed Private Placement Dated 28.11.2014

Uploaded by

nickong53Copyright:

Available Formats

MALTON BERHAD (MALTON OR COMPANY)

PROPOSED PRIVATE PLACEMENT OF UP TO 40,000,000 NEW ORDINARY SHARES OF

RM1.00 EACH IN MALTON (PROPOSED PRIVATE PLACEMENT)

1.

INTRODUCTION

On behalf of the Board of Directors of Malton (Board), KAF Investment Bank Berhad (KAF)

wishes to announce that the Company proposes to undertake the Proposed Private Placement.

2.

PROPOSED PRIVATE PLACEMENT

2.1

Details of the Proposed Private Placement

The Proposed Private Placement would involve the issuance of up to 40,000,000 new

ordinary shares of RM1.00 each in Malton (Malton Shares or Shares) (Placement

Shares), representing approximately 9.3% of the issued and paid-up share capital of the

Company, to be issued at an issue price to be determined and announced later.

2.2

Placement arrangement

The Placement Shares are intended to be placed out to third party investor(s) to be

identified at a later date and who qualify under Schedules 6 and 7 of the Capital Markets

& Services Act 2007.

In addition, the Placement Shares are not intended to be placed out to any director,

major shareholder or chief executive of Malton or any interested person connected with

such director, major shareholder or chief executive.

The Proposed Private Placement may be implemented in one or more tranches within a

period of six (6) months from the date of the approval from Bursa Malaysia Securities

Berhad (Bursa Securities) for the Proposed Private Placement or any extended period

as may be approved by Bursa Securities, subject to the then prevailing market

conditions.

2.3

Basis of determining the issue price of the Placement Shares

The issue price of the Placement Shares will be determined and fixed by the Board at a

later date after receipt of all relevant approvals for the Proposed Private Placement. The

final issue price for each tranche of the Placement Shares shall be determined

separately in accordance with market-based principles.

The Placement Shares may be issued at a discount of not more than 10% to the five (5)day weighted average market price of Malton Shares immediately preceding the pricefixing date. In any event, the issue price of the Placement Shares shall not be lower than

the par value of Malton Shares of RM1.00 each.

2.4

Ranking of the Placement Shares

The Placement Shares shall, upon allotment and issue, rank pari passu in all respects

with the existing Malton Shares, except that they shall not be entitled to any dividends,

rights, allotments and/or any other forms of distribution, the entitlement date of which is,

prior to the date of allotment of the Placement Shares.

The Placement Shares are not expected to be entitled to the first and final single-tier

dividend of 3% for every one Share, the entitlement date of which has been fixed on 31

December 2014.

2.5

Listing of and quotation for the Placement Shares

An application will be made to Bursa Securities for the listing of and quotation for the

Placement Shares on the Main Market of Bursa Securities.

2.6

Utilisation of proceeds

The quantum of proceeds to be received by the Company pursuant to the Proposed

Private Placement would depend on the actual number of Placement Shares issued and

the final issue price. For illustration purpose only, assuming that the entire 40,000,000

Placement Shares are fully issued at an indicative issue price of RM1.00 each, the

Company would raise gross proceeds amounting to RM40,000,000 from the Proposed

Private Placement. The gross proceeds are proposed to be utilised as follows:

Gross

Proceeds

RM000

Proposed utilisation of proceeds

Repayment of bank borrowings

(1)

Expected

utilisation time

frame from date of

completion of the

Proposed Private

Placement

20,000

Within

12 months

Working capital for Malton and its subsidiaries

(2)

(Malton Group or the Group)

19,800

Within

12 months

Estimated expenses relating to the Proposed

200

(3)

Private Placement

Total

Within 1

month

40,000

Notes:

(1)

As at 30 September 2014, the Groups bank borrowings was approximately RM256.18

million as per the unaudited interim financial report for the financial period ended 30

September 2014. The estimated annual interest savings arising from the part repayment of

the Groups borrowings based on an average interest rate of 8% per annum would be

approximately RM1.60 million. Any proceeds not utilised by the Company to repay bank

borrowings shall be utilised as working capital of the Group.

(2)

Approximately RM19.80 million is proposed to be utilised to finance the Groups working

capital requirements for existing and up-coming property development projects and

construction jobs over the next 12 months. Such working capital may include project

development related costs, including payment to contractors/sub-contractors/suppliers, staff

related costs, promotional and marketing expenses, general overheads and other

administrative expenses.

(3)

The estimated expenses consist of professional fees, fees payable to authorities and other

miscellaneous expenses to be incurred in relation to the Proposed Private Placement. Any

variation in the actual amount of expenses will be adjusted to/from the amount allocated for

working capital purposes.

Any difference between the illustrated proceeds above and the actual proceeds raised

from the Proposed Private Placement (which is dependent on the issue price and the

final number of Placement Shares issued) as well as any differences in the actual

expenses relating to the Proposed Private Placement shall be adjusted to the allocation

for working capital of the Malton Group.

3.

RATIONALE FOR THE PROPOSED PRIVATE PLACEMENT

The purpose of the Proposed Private Placement is to enable the Company to raise additional

funds in an expeditious manner to reduce its bank borrowings.

The Board also intends to utilise the placement proceeds to partly finance the working capital

requirements of the Group for the existing and up-coming new property development projects

and construction jobs of the Group over the next 12 months.

The Proposed Private Placement enables the Company to raise equity capital without having

any interest cost burden which would otherwise arise if the Group takes up more bank

borrowings. In this respect, the Board expects the Proposed Private Placement to contribute

positively to the future earnings and continuing growth of the Malton Group.

After due consideration of the various methods of fund raising, the Board is of the opinion that

the Proposed Private Placement is an appropriate avenue of fund raising at this juncture as it

enables the Company to raise funds expeditiously. Upon completion of the Proposed Private

Placement, the enlarged capital base and shareholders funds are also expected to further

strengthen the financial position of the Group. In addition, the Proposed Private Placement may

potentially increase the liquidity of the Malton Shares in the market.

4.

EFFECTS OF THE PROPOSED PRIVATE PLACEMENT

The proforma effects of the Proposed Private Placement are set out below in the ensuing

sections:

4.1

Issued and paid-up share capital

The proforma effects of the Proposed Private Placement on the issued and paid-up

share capital of the Company are as set out below.

Issued and paid-up share capital as at

the date of this announcement

Add: Placement Shares to be issued

pursuant to the Proposed

Private Placement

Enlarged issued and paid-up share

capital

No. of Malton Shares

RM

428,415,812

428,415,812

40,000,000

40,000,000

468,415,812

468,415,812

[The rest of this page is intentionally left blank]

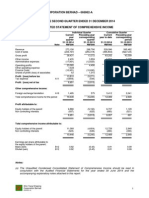

4.2

Net assets (NA) per share and gearing

The proforma effects of the Proposed Private Placement on the NA per share and

gearing of the Group, based on the audited consolidated financial statements of the

Company as at 30 June 2014, are as set out below.

Share capital

Audited as at

30 June 2014

After the Proposed

Private Placement

RM000

RM000

422,550

462,550

(1)(2)

Reserves

236,776

Shareholders funds / NA

659,326

699,126

No. of Malton shares (000)

422,550

462,550

NA per Malton share (RM)

236,576

1.56

Interest bearing borrowings (RM000)

390,170

Gearing (times)

0.59

1.51

(3)

370,170

0.53

Notes:

4.3

(1)

After deducting the estimated expenses in relation to the Proposed Private Placement from

the share premium and retained earnings accounts amounting to about RM200,000.

(2)

Assuming the issue price for the Placement Shares is RM1.00 each.

(3)

Based on the utilisation of approximately RM20 million of the total gross proceeds to repay

part of the Groups bank borrowings as disclosed in Section 2.6 of this announcement.

Earnings and earnings per share (EPS)

The Proposed Private Placement is not expected to have any material effects on the

consolidated earnings of the Group for the financial year ending 30 June 2015 except for

the corresponding dilution in the consolidated EPS of Malton as a result of the increase

in the number of Malton Shares pursuant to the Proposed Private Placement.

Nevertheless, the Group would be in the position to repay part of its bank borrowings,

which would therefore result in some interest savings to the Group. Based on an average

interest cost of 8% per annum, the placement proceeds of approximately RM20 million

which are allocated to repay a part of the bank borrowings are expected to result in an

annual interest savings of about RM1.60 million.

[The rest of this page is intentionally left blank]

4.4

Substantial shareholders shareholdings

The proforma effects of the Proposed Private Placement on the substantial shareholders

shareholdings of Malton based on the Register of Substantial Shareholders are as set

out below.

Substantial

shareholders

As at the date of this announcement

Direct

After the Proposed Private Placement

Indirect

Direct

Indirect

No. of

Shares

No. of

Shares

No. of

Shares

No. of

Shares

Malton

Corporation

Sdn Bhd

158,477,313

36.99

158,477,313

33.83

Tan Sri Lim

Siew Choon

(1)

158,477,313

36.99

(1)

158,477,313

33.83

Puan Sri Tan

Kewi Yong

(1)

158,477,313

36.99

(1)

158,477,313

33.83

Note:

(1)

4.5

Deemed interested by virtue of his/her substantial shareholdings in Malton Corporation Sdn

Bhd.

Convertible securities

The Proposed Private Placement is not expected to have any effects on the Companys

existing warrants 2011/2018 (Warrants), 7-year 6% redeemable convertible secured

loan stocks (RCSLS) and the options granted under the employees share option

scheme (ESOS). Save for the Warrants, RCSLS and ESOS options, the Company

does not have any other existing convertible securities as at the date of this

announcement.

5.

APPROVALS REQUIRED

The Proposed Private Placement is subject to and conditional upon approvals being obtained

from the following:

(i)

Bursa Securities, for the listing of and quotation for the Placement Shares to be issued

pursuant to the Proposed Private Placement on the Main Market of Bursa Securities.

(ii)

any other relevant authorities, if required.

The Company had earlier obtained a general mandate from its shareholders at the last Annual

General Meeting which was convened on 20 November 2014 pursuant to Section 132D of the

Companies Act, 1965 that empowers the Board to issue new ordinary shares in Malton from

time to time upon such terms and conditions and for such purposes as the Board may deem fit

provided that the aggregate number of new Malton Shares to be issued does not exceed ten

percent (10%) of the issued and paid-up share capital of the Company. The said mandate is

valid until the next annual general meeting to be convened.

The Proposed Private Placement is not conditional upon any other proposals undertaken or to

be undertaken by the Company.

6.

INTEREST OF DIRECTORS, MAJOR SHAREHOLDERS AND/OR PERSONS CONNECTED

WITH THEM

None of the Directors and/or major shareholders of the Company and/or persons connected to

them as defined in the Main Market Listing Requirements has any interest, whether direct or

indirect, in the Proposed Private Placement.

7.

DIRECTORS RECOMMENDATION

The Board, after having considered all aspects of the Proposed Private Placement, is of the

opinion that the Proposed Private Placement is in the best interest of the Group.

8.

ADVISER AND PLACEMENT AGENT

The Board has appointed KAF as the Adviser and Placement Agent for the Proposed Private

Placement.

9.

ESTIMATED TIMEFRAME FOR SUBMISSION TO THE AUTHORITIES

Barring unforeseen circumstances, all the relevant applications to the authorities in relation to

the Proposed Private Placement will be made within one (1) month from the date of this

announcement.

10.

ESTIMATED TIMEFRAME FOR COMPLETION

Barring unforeseen circumstances, the Proposed Private Placement is expected to be

st

completed by the end of first (1 ) quarter of 2015.

This announcement is dated 28 November 2014.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Abrupt FPSO Cancellation A Major Setback For Bumi Armada, Says Maybank IB - Business News - The Star OnlineDocument9 pagesAbrupt FPSO Cancellation A Major Setback For Bumi Armada, Says Maybank IB - Business News - The Star Onlinenickong53No ratings yet

- Interim Financial Result For 3rd Quarter Ended 31.01.2013Document23 pagesInterim Financial Result For 3rd Quarter Ended 31.01.2013nickong53No ratings yet

- Q12 ResultsReport (5 Mar 2013)Document4 pagesQ12 ResultsReport (5 Mar 2013)nickong53No ratings yet

- t31 12 14Document17 pagest31 12 14nickong53No ratings yet

- AcquisiShares - Sinar MekarDocument3 pagesAcquisiShares - Sinar Mekarnickong53No ratings yet

- Purchase oDocument4 pagesPurchase onickong53No ratings yet

- N Q1fye2015Document18 pagesN Q1fye2015nickong53No ratings yet

- 4 Fy 2014Document17 pages4 Fy 2014nickong53No ratings yet

- YTB 062015 AccountsDocument4 pagesYTB 062015 Accountsnickong53No ratings yet

- Sample Official ReceiptDocument1 pageSample Official Receiptnickong53No ratings yet

- YTB 062015 NotesDocument13 pagesYTB 062015 Notesnickong53No ratings yet

- Avoir (To Have) - The French TutorialDocument1 pageAvoir (To Have) - The French Tutorialnickong53No ratings yet

- Almond CroissantDocument3 pagesAlmond Croissantnickong53No ratings yet

- 0620 s07 Ms 1Document2 pages0620 s07 Ms 1Varun PanickerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Finance Reading List PHDDocument8 pagesFinance Reading List PHDAnonymous P1xUTHstHTNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Case Study 1 Case Study 2Document3 pagesCase Study 1 Case Study 2MoatasemMadianNo ratings yet

- Luckscout Ultimate Wealth System: The Ultimate Guide Toward Wealth and Financial FreedomDocument36 pagesLuckscout Ultimate Wealth System: The Ultimate Guide Toward Wealth and Financial FreedomSamuel AnemeNo ratings yet

- High Yield Bonds Market Structure, Valuation, and Portfolio StrategiesDocument689 pagesHigh Yield Bonds Market Structure, Valuation, and Portfolio StrategiesFurqaan Syah100% (1)

- Priority Pass LoungesDocument2 pagesPriority Pass LoungesAayush ChelawatNo ratings yet

- Philippine Stocks Index Fund CorpDocument1 pagePhilippine Stocks Index Fund CorptimothymaderazoNo ratings yet

- Bond Portfolio Management StrategiesDocument23 pagesBond Portfolio Management Strategiesashudadhich100% (2)

- Application Form - Vuka (Form 1 A)Document7 pagesApplication Form - Vuka (Form 1 A)Derrick KimaniNo ratings yet

- Chapte 1Document27 pagesChapte 1Mary Ann Alegria MorenoNo ratings yet

- Money PadDocument15 pagesMoney PadSubhash PbsNo ratings yet

- CAASA 2023 WMF ProgramDocument33 pagesCAASA 2023 WMF ProgramAlexander YorochenkoNo ratings yet

- United States v. Amjad Awan, Akbar A. Bilgrami, Sibte Hassan, Syed Aftab Hussain, Ian Howard, 966 F.2d 1415, 11th Cir. (1992)Document32 pagesUnited States v. Amjad Awan, Akbar A. Bilgrami, Sibte Hassan, Syed Aftab Hussain, Ian Howard, 966 F.2d 1415, 11th Cir. (1992)Scribd Government DocsNo ratings yet

- Unit 6 Foreign Exchange Exposure: Sanjay Ghimire Tu-SomDocument68 pagesUnit 6 Foreign Exchange Exposure: Sanjay Ghimire Tu-SomMotiram paudelNo ratings yet

- AC4001 Solutions Template Tutorial Week 3 2020Document5 pagesAC4001 Solutions Template Tutorial Week 3 2020hannah nolanNo ratings yet

- Challan Form No.32-A: State Bank of PakistanDocument1 pageChallan Form No.32-A: State Bank of PakistanZubair KhanNo ratings yet

- Subunit 3.6 Efficiency Ratio AnalysisDocument30 pagesSubunit 3.6 Efficiency Ratio AnalysisSteam MainNo ratings yet

- 39 1 Vijay KelkarDocument14 pages39 1 Vijay Kelkargrooveit_adiNo ratings yet

- Annual Report 2 PDFDocument156 pagesAnnual Report 2 PDFSassy TanNo ratings yet

- CHEQUEmaster ClassDocument10 pagesCHEQUEmaster ClassMohanarajNo ratings yet

- Banking and Insurance (Bbh461) - 1515423225879Document8 pagesBanking and Insurance (Bbh461) - 1515423225879SamarthGoelNo ratings yet

- Bank Reconciliation Statement:: Unit - 6Document4 pagesBank Reconciliation Statement:: Unit - 6deepshrmNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- Titan Business AnalysisDocument9 pagesTitan Business AnalysisbcyberhubNo ratings yet

- Bitcoin RoughDocument19 pagesBitcoin RoughSaloni Jain 1820343No ratings yet

- 1551881771258PfLpwrL9IDegaTlV PDFDocument5 pages1551881771258PfLpwrL9IDegaTlV PDFNishant PatelNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement AnalysisAbdul RehmanNo ratings yet

- ATM CARD Pin RegenerationDocument7 pagesATM CARD Pin RegenerationAnnamore MushakavanhuNo ratings yet

- Accounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueDocument50 pagesAccounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueTAWANDA CHIZARIRANo ratings yet

- FM102 Financial ManagementDocument2 pagesFM102 Financial ManagementmusuotaNo ratings yet