Professional Documents

Culture Documents

Evasion of Stamp Duty Offences Under Penal Code Are Not Attracted Bombay HC

Uploaded by

Live LawOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evasion of Stamp Duty Offences Under Penal Code Are Not Attracted Bombay HC

Uploaded by

Live LawCopyright:

Available Formats

1

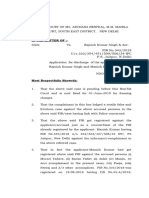

CRI.APPLICATION NO.4614/2012

BENCHATAURANGABAD

C

ou

CRIMINALAPPLICATIONNO.4614OF2012

RavindraBabulalJain,

Age45yrs.,Occ.Business,

VardhamanResidency,Ulkanagari,

Auragabad.

2.

AshishTejmalMugdiya,

Age36yrs.,Occ:Business,

r/o.N3,CIDCO,Aurangabad.

...PETITIONERS

VERSUS

TheStateofMaharashtra,

ThroughtheSecretary,

HomeDepartment,

Mantralaya,Mumbai32

TheDy.SuperintendentofPolice,

AntiCorruptionBureau,Aurangabad,

Tq.&Dist.Aurangabad.

...RESPONDENTS

...

Mr.R.R.Mantri,Advocatefortheapplicants.

Mrs.A.V.Gondhalekar,APPforrespondentState.

...

CORAM:R.M.BORDE

AND

P.R.BORA,JJ.

***

Dateofreserving

thejudgment:September8th,2015

Dateofpronouncing

thejudgment:October1st,2015.

***

om

ba

y

2.

ig

h

1.

1.

rt

INTHEHIGHCOURTOFJUDICATUREOFBOMBAY

JUDGMENT (Per P.R.Bora, J.):

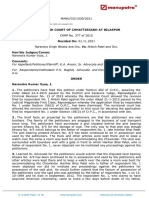

1.

Rule. Rule made returnable and heard forthwith

with the consent of learned Counsel for the parties.

The applicants have filed the present application for

quashment of the FIR lodged against them and Crime

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

CRI.APPLICATION NO.4614/2012

rt

No.I-141/2012 registered against them on the basis of the

said FIR at City Chowk Police Station, Aurangabad, for the

C

ou

offenses punishable under Sections 119, 167, 418, 468,

471 read with Section 34 of the Indian Penal Code, Section

13(1)(d) read with Section (2) of Prevention of Corruption

Act and Sections 59 and 62 of the Bombay Stamps Act,

2.

ig

h

1958.

On

30.8.2012,

Shri

Bramhadeo

Vasudeo

Gawade, the then Deputy Superintendent of Police, Anti

Corruption

Bureau,

Aurangabad,

filed

written

report

against the present applicants at City Chowk Police

Station, Aurangabad, alleging that the present applicants,

in connivance with Shri V.M.Made, the then in-charge Sub

ba

y

Registrar-II, Aurangabad, and Mrs. Kavita Pradip Kadam,

the then Junior Clerk working in the office of Sub

Registrar-II, Aurangabad, got registered the sale deed

om

No.4228 in respect of land admeasuring 8 acres 4 gunthas

out of Gat No.72 situate at Mouje Satara, taluka and

district Aurangabad, showing market value of the said

property as Rs.3500/- per square meter when the market

value of the said property at the relevant time was

Rs.4100/- per square meter and thus caused revenue loss

to the tune of Rs.12,76,000/- to the Government. It was

also alleged that the applicant completed the aforesaid

transaction by preparing false documents, false record and

fraudulently and dishonestly used the said record as

genuine one.

On the basis of the report so lodged by Shri

Gawade, the offence was registered against the present

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

applicants

and

Sau.Kavita

two

Kadam

others,

on

CRI.APPLICATION NO.4614/2012

namely,

30.8.2012

Shri

for

Made

the

and

rt

offenses

C

ou

punishable under Sections 119, 167, 418, 468, 471 read

with Section 34 of the Indian Penal Code, Section 13(1)(d)

read with Section 13 (2) of Prevention of Corruption Act

and Sections 59 and 62 of the Bombay Stamps Act, 1958,

and the investigation was set in motion.

The record shows that

ig

h

were arrested on the same day.

The applicants

police custody of the applicants / accused was obtained

upto

3rd

November,

2012,

and

thereafter,

on

3rd

November, 2012 itself, both the applicants were released

3.

on bail.

The prosecution case, as is revealing from the

ba

y

contents of the FIR, is that the applicants purchased the

land Gat No.72 admeasuring 8 acres, 4 gunthas for

consideration of Rs. three crores, sixty lacs.

The sale

om

deed in that regard was presented for registration on 2nd

of

December,

Aurangabad.

2008

before

the

Sub

Registrar-II,

While presenting the deed of sale for its

registration, the applicants i.e. the purchasers of the

subject land did not disclose the true market value of the

aforesaid land which, according to the prosecution, was

Rs.4100/- per square meter as per the Ready Reckoner

rates declared by the Government in the year 2008.

alleged that the applicants showed

It is

the market value of

the said property as Rs.3500/- per square meter which

was the Ready Reckoner rate of the earlier year i.e. of

2007.

According to the prosecution, as per Ready

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

CRI.APPLICATION NO.4614/2012

rt

Reckoner rates of the year 2008, the market value of the

subject property was Rs.seven crores, five lacs, twenty

C

ou

thousand and the stamp duty payable on the same was

Rs.thirty five lacs, twenty six thousand.

The present

applicants, as alleged by the prosecution, declared the

market value of the subject property to the tune of Rs.

four crores, fifty lacs on the strength of the Ready

tune

of

ig

h

reckoner rates of 2007 and paid the stamp duty to the

Rs.22,50,000/-

only.

According

to

the

prosecution, the applicants thus paid less stamp duty to

the extent of Rs.12,76,000/- and caused loss to the

the

Government revenue to that extent.It is also the case of

prosecution

that

while

registering

the

subject

instrument, the present applicants used false and forged

ba

y

documents as genuine one and conniving with the then in

charge Assistant Sub Registrar, namely, Shri Made and the

then Junior Clerk in the Office of the Sub Registrar-II,

om

Aurangabad, namely, Sau. Kavita Kadam, cheated the

Government by causing loss of Rs.12,76,000/- to the

Government.

4.

Prosecution

case

also

reveals

that

Shri

K.N.Tandale and two others have made complaint alleging

that the racket was in existence in the office of the Sub

Registrar which was helping the private builders to evade

the stamp duty.

On the basis of the said complaint, it is

the contention of the prosecution that the transaction

entered into by the present applicants pertaining to the

sale deed executed and registered on 2nd December,

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

CRI.APPLICATION NO.4614/2012

rt

2008, at Sr.No. 4228 of 2008, was also examined and the

5.

Shri

R.R.Mantri,

C

ou

same was found objectionable.

learned

counsel

for

the

petitioners, vehemently argued that initiation of the

alleged criminal prosecution against the applicants was a

vindictive action at the instance of the persons who were

interested in the subject land.

Learned Counsel further

ig

h

submitted that though the entire transaction was clean,

transparent and in accordance with the provisions of law,

on some false pretext and with colourable exercise of the

powers, a total false case came to be registered against

the applicants.

Learned Counsel further submitted that

the subject property was purchased by the applicants in a

ba

y

public auction for consideration of Rs. 3,00,60,000/- (Rs.

three Crores, sixty lacs), however, the market value of the

said property was shown to be Rs.4,50,00,000/- and,

om

accordingly, stamp duty of Rs.22,50,000/- ( Rs. twenty

two lacs, fifty thousand) was paid by the applicants.

Learned Counsel further submitted that since the then incharge Sub Registrar was satisfied with the market value,

as

was

document

shown

for

by

the

applicants,

registration

and

he

accepted

registered

the

the

same.

Learned Counsel further submitted that the allegations

against the applicants that they prepared false and forged

document, and used them to be genuine one, is absolutely

false and unfounded.

Learned Counsel further submitted

that the FIR, even if read as it is, and accepted to be true,

no offence can be said to have been made out against the

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

Learned Counsel further submitted

rt

present applicants.

CRI.APPLICATION NO.4614/2012

that in view of the specific provisions of the Bombay

C

ou

Stamp Act pertaining to evasion of stamp duty and

providing punishment for the same, general provisions of

the Indian Penal Code cannot be pressed into service.

Learned Counsel further argued

from the facts that the

FIR was registered at wee hours i.e. at 6 a.m. on 30th

were

made

in

ig

h

August, 2012, and the arrests of the present applicants

the

early

registration of the FIR,

morning

and

it is writ large

action was with mala fide intention.

even

before

that the entire

Learned Counsel

submitted that initiation of the criminal prosecution against

the applicants is abuse of process of the Court and he,

therefore, prayed for quashment of the FIR and the crime

ba

y

registered against the applicants on the basis of the said

FIR.

Learned Counsel added that some of the offenses

alleged against the applicants under the Indian Penal

om

Code, can be invoked only against the Government

servants and not against the private individuals.

Learned

Counsel further submitted that Sections 13(1)(d) and

13(2) of the Prevention of Corruption Act also cannot be

invoked against the present applicants.

6.

Mrs. A.V.Gondhalekar, learned Assistant Public

Prosecutor, opposed the submissions advanced on behalf

of the applicants.

criminal

Learned A.P.P. strongly supported the

prosecution

applicants.

initiated

against

the

present

Learned A.P.P. submitted that showing the

market value of the property in question, according to the

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

CRI.APPLICATION NO.4614/2012

rt

Ready Reckoner rates prevailing in the year 2007, though

the sale deed was presented for registration on 2nd of

the

Government

Government.

and

causing

C

ou

December, 2008, was with the only intention of cheating

revenue

loss

to

the

Learned A.P.P. further submitted that non

mentioning of zone number within which the subject

property falls, also clearly indicates the ill intention of the

Learned A.P.P. further submitted that even in

ig

h

applicants.

the past, the applicants had adopted the same modus

operandi and had caused revenue loss to the Government

in lacs of rupees.

Learned A.P.P. submitted that

the

offensea alleged against the applicants are prima facie

made out through the contents of FIR.

Learned A.P.P.

therefore prayed that in such circumstances, this Court

ba

y

shall refrain from exercising its powers under Section 482

of the Code of Criminal Procedure.

om

7.

We have carefully considered the submissions

advanced by the learned Counsel for

well as on behalf of learned A.P.P.

the applicants as

We have perused the

FIR, the written submissions filed on behalf of the State

and the documents filed on record by the applicants as

well as by the State.

On the basis of the FIR lodged by

Shri Bramhadeo V. Gawade on 30.8.2012, a crime has

been registered against the applicants for the offenses

punishable under Sections 59 and 62 of the Bombay

Stamp Act, 1958,

Section 13(1)(d) read with Section

13(2) of the Prevention of Corruption Act, 1988, and

Sections 119, 167, 418, 468, 471 and 34 of the Indian

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

The offenses under Sections 119 and 167 of

rt

Penal Code.

CRI.APPLICATION NO.4614/2012

the Indian Penal Code; so also the offenses under Section

C

ou

13(1)(d) and 13(2) of the Prevention of Corruption Act,

1988, are attracted only against the public servants.

As

such, now it will have to be seen whether, on the basis of

the FIR lodged against the applicants and the material

placed on record by the prosecution in support thereof ,

ig

h

any case under Sections 418, 471, 468 and 34 of the

Indian Penal Code can be said to be made out.

8.

Considering the contents of the FIR and the

material on record, it is apparent that Section 418 of the

Indian Penal Code may not apply to the present case.

This

Section

talks

of

cheating

with

knowledge

that

ba

y

wrongful loss may ensue to the person whose interest the

offender is bound to protect. No such case is made out in

om

the FIR or through the other material on record.

9.

The offences of (i) forgery for the purpose of

cheating (Section 468) and (ii) using as genuine a forged

document

(Section

471)

are

alleged

to

have

been

committed by the applicants sharing common intention

(Section 34) with the other two accused namely; Shri

Made, the then Assistant Sub Registrar and Sau Kavita

Kadam, the then Junior Clerk working in the office of Sub

Registrar-2, Aurangabad, on the following grounds.

(I)

The applicants submitted the in-put form which was

not correctly filled.

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

The applicants intentionally did not mention the zone

rt

(II)

CRI.APPLICATION NO.4614/2012

C

ou

number within which the subject property is situated.

(III) The ready recknoer rate and zone number are not

mentioned at the top of the document of sale deed.

(IV) The

market

value

of

the

subject

property

is

(V)

ig

h

deliberately shown less.

The market value of the property is fraudulently

assessed as per the ready recknoer rates prevailing

in the year 2007 i.e. Rs.3,500/- per Sq. Mtr. When

the same ought to have been assessed at the ready

recknoer rates of the year 2008 i.e. Rs.4,100/- per

ba

y

Sq. Mtr., with a view to confer pecuniary advantage

to the applicants which resulted in causing wrongful

loss

to

the

Government

to

the

tune

of

om

Rs.12,76,000/-.

(VI) The applicants and the other two accused had

common intention to cheat the Government.

10.

After having considered the aforementioned

grounds in light of the pleadings and documents placed on

record, it does not appear to us that any offence under

Indian Penal Code, as alleged, would be attracted against

the applicants. Even if it is assumed that, the in-put form

is not correctly filled, that zone number is not mentioned

and that incorrect market value is mentioned of the

subject property, even then no offence can said to be

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

10

CRI.APPLICATION NO.4614/2012

rt

made out by the applicants of using false document or of

C

ou

forgery.

11.

To attract an offence under section 468 of

Indian Penal Code, the following are the requirements.

(i) That, the document in question is a forgery;

(ii)

That, the accused forged it;

(iii) That, in forging it he intend that it shall be used for

ig

h

the purpose of cheating.

12.

The assertion of a false claim in a document

Mere

does not constitute the document a false one.

inclusion of certain false recitals or particulars though may

amount to making a false statement, does not amount to

The mere fact that a document contains some

ba

y

forgery.

false recitals or untrue statement would not make it a false

document.

A suit plaint or a written statement may

om

contain certain averments which may be untrue, but such

untrue statements in pleading or application would not be

sufficient to make them forged documents. Similarly, the

affidavit though supposed to contain only true statements

may contain untrue statements.

The deponent in such

cases may perhaps be liable for other offences, but not the

offence of forgery.

Having regard to the definition of a

false document under section 464 of Indian Penal Code, a

document can be said to be forged only if it purports to be

signed or sealed by a person who in fact never signed or

sealed it.

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

11

In view of the above, we have no doubt in our

rt

13.

CRI.APPLICATION NO.4614/2012

mind that, even if the allegations made in the F.I.R. are

C

ou

accepted in their entirety, no offence can be said to be

made out against the applicants under section 468 of

Indian Penal Code.

14.

To attract an offence under section 471 of

Indian Penal Code, essential requirement is that, there

ig

h

should be a use of forged document. As discussed herein-above, none of the documents as alleged by the

prosecution can said to be a forged document. When the

preparation of a document does not amount to a forgery,

the use of such document does not constitute as offence

ba

y

under this section.

15.

As has been discussed here-in-above merely

because in the in-put form and the cover page of the Deed

om

of Sale the applicants have showed the market value of

the subject property derived at by the rate of Rs.3,500/per Sq. Mtr. which was the ready recknoer rate published

by the Government for the year 2007 for the zone under

which the property in question is situated when according

to prosecution the market value of the said property

should have been determined at the rate of Rs.4,100/- per

Sq. Mtr. which was ready recknoer rate for the year 2008

since the sale deed was being registered on 2 nd of

December, 2008, neither the in-put form, nor the deed of

sale or any other document related thereto can be termed

as a false or forged document.

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

12

Now, we will examine the correctness and the

rt

16.

CRI.APPLICATION NO.4614/2012

C

ou

legality of the allegation against the applicants that they

deliberately, showed the market value of the subject

property less with a view to make wrongful gain for them

and cause wrongful loss to the Government.

17.

Stamp duty requires to be paid at the rate as

ig

h

prescribed under Article 25 of the Stamp Duty Act on the

true Market Value of the property which is the subject

matter of the conveyance. As defined by Section 2(na) of

the Stamp Act Market Value in relation to any properly

which is the subject matter of any instrument means the

price which such property would have fetched if sold in

ba

y

open market on the date of execution of such instrument

or the consideration stated in the instrument whichever is

higher.

om

18.

In the instant case, it is the specific allegation

against the applicants that, they with fraudulent and

dishonest intention did not disclose the true market value

of the subject property while presenting the deed of sale of

the said property for its registration before the Sub

Registrar and thereby cheated the Government by causing

revenue loss of Rs.12,76,000/-.

The prosecution has

assessed the market value of the subject property to the

tune of Rs.7,05,20,000/-.

It is assessed by determining

the value of the said property at the rate of Rs.4,100/- per

Sq. Mtr. The rate of Rs.4,100 per Sq. Mtr. Is derived from

the ready recknoer rates published by the Government for

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

13

CRI.APPLICATION NO.4614/2012

rt

the year 2008 for the area / zone under which the subject

C

ou

property is situated.

19.

Having regard to the definition of Market Value

as provided under section 2(na) of the Stamp Act the

whole approach adopted as above by the prosecution in

determining the market value of the subject property

appears erroneous. As held by the Honble Apex Court in

case

of

Jawajee

Nagnatham

ig

h

the

V/s.

Revenue

Divisional Officer, Adilabad, A.P. and Others (1994)

4 S.C.C. 595, the Basic Valuation Register (for the instant

matter the Ready Recknoer) prepared and maintained for

the purpose of collecting stamp duty has no statutory base

or force and it cannot form a foundation to determine the

ba

y

market value mentioned thereunder in instrument brought

for registration.

om

20.

Similar view is taken by the Honble Apex Court

in the subsequent judgment in the matter of R. Sai

Bharathi V/s. J. Jaylalitha and other (2003 AIR

S.C.W. 6349). The Honble Apex Court has held that,

... the guideline value will only afford a

prima-facie base to ascertain the true or

correct market value. Guideline value is not

sacrosanct, but only a factor to be taken note

of if at all available in respect of an area in

which the property transferred lies. In any

event, for the purpose of Stamp Act guideline

value alone is not a factor to determine the

value of the property and the authorities

cannot regard the guideline valuation as the

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

14

CRI.APPLICATION NO.4614/2012

In view of the law laid down as above by the

C

ou

21.

rt

last word on the subject of market value.

Apex Court, the very foundation of the charge leveled

against the applicants that the market value of the subject

property was deliberately shown less by them with a view

to earn wrongful gain gets uprooted.

Secondly, even if it is assumed that the market

ig

h

value of the property in question was shown less by the

applicants, the registering officer i.e. the Sub Registrar,

Aurangabad could have very well referred the instrument

to the Collector for determination of the true market value

of the said property under section 32 A(2) of the Stamp

Act. Sub Registrar, Aurangabad admittedly did not adopt

ba

y

the said course and preferred to register the instrument by

accepting the stamp duty payable on the market value as

was shown of the property in question. The Sub Registrar,

om

thus, impliedly accepted the value as set-forth in the

instrument to be the true market value of the subject

property.

22.

In

fact,

the

consideration

paid

of

Rs.3,60,00,000/- of the property in question can be

accepted to be the true market value of the said property

since the applicants purchased the said property in public

auction.

The material on record reveal that the vendor

society had issued proclamation in Daily Lokmat and

invited tenders for purchase of the subject land.

The

averments in the Sale Deed executed of the subject land

reveal that, in response to the paper publication various

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

15

CRI.APPLICATION NO.4614/2012

rt

prospective purchasers approached to the vender society

and submitted their proposals and on 24.06.2008 in terms

C

ou

of negotiations and since the highest consideration to the

tune of Rs.3,60,00,000/- was offered by the present

applicants the vendor society resolved to sell the subject

land to the applicants.

As defined in Section 2(na) of the Stamp Act the

ig

h

price fetched by the property in an open market is to be

held as the market value of the said property on the day of

execution of the instrument in relation the said property.

There is reason to believe that on considering the recitals

in the sale deed reflecting that the property has been

purchased in an open auction for the consideration of

Rs.3,60,00,000/- and despite that the stamp duty was

ba

y

being paid on the value of Rs. 4,50,00,000/-,

the Sub

Registrar accepted the said document for registration and

allowed its registration without indulging in any further

om

enquiry whether the market value as shown is assessed as

per the 2008 ready recknoer rates published by the

Government or otherwise.

Further, as was submitted by

the learned Counsel for the applicants, the property in

question falls under the Green Zone and as such, whatever

price was offered by the applicants to the said property,

according to them, was the optimum, price.

This may

also be the reason that the Sub Registrar did not conduct

any further enquiry or objected to the market value as

shown of the property in question.

Prima-facie, we find

nothing to be blamed either on part of the applicants or

the concerned Sub Registrar and his staff.

::: Uploaded on - 03/10/2015

Further, even if

::: Downloaded on - 04/10/2015 15:31:46 :::

16

CRI.APPLICATION NO.4614/2012

rt

it is accepted that, the market value of the subject

property was shown less by the applicants and this aspect

C

ou

was overlooked by the Sub Registrar and his supporting

staff, resulting in causing loss of revenue to Government,

there exist the necessary provisions in the Stamp Act itself

to take care of such situation / contingency. Sub Section

(5) of Section 32 (A) of the Stamp Act provides that the

ig

h

Collector of the District may, suo-moto or on receipt of

information from any source, within ten years from the

date of registration of any instrument may examine it for

the purpose of satisfying himself as to the correctness of

the market value of the immovable property which is the

subject matter of such instrument and the duty payable

thereon, and if after such examination, he has reason to

ba

y

believe that the market value of such property has not

been truly and fully set-forth in the instrument, he shall

om

proceed as provided in Sub section (4) which reads thus:

(4) On receipt of the instrument of the true

copy of the instrument as the case may be,

under sub-section (2) or (3), the Collector of the

District shall, after giving the parties concerned a

reasonable opportunity of being heard and in

accordance with the rules made by the State

Government in that behalf, determine the true

market value of the immovable property which is

the subject matter of the instrument and the

proper duty payable thereon.

Upon such

determination, the Collector of the District shall

require the party liable to pay the duty, t make

the payment of the amount required to make up

the difference between the amount of duty

determined under this sub-section and the

amount of duty already paid by him and shall

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

17

CRI.APPLICATION NO.4614/2012

C

ou

rt

also require such party to pay in addition, ( a

penalty [of 2 per cent for every month or part

thereof] from the date of execution of the

instrument on differential amount of stamp

duty); and on such payment, the instrument

received under sub-section (2) or (3) shall be

returned to the officer or person referred to

therein.

It is significant to note that the aforesaid course of

ig

h

action has already been resorted to against the applicants.

The documents on record evince that a notice under

section 32(A)(2) of the Act has been issued to the

applicants on 16.06.2010. When such course was already

availed, we find no propriety in initiating the criminal

proceeding against the applicants under the provisions of

Indian Penal Code and more so when there does not seem

ba

y

any cogent, concrete and sufficient material available

om

against the applicants in that regard.

23.

Similar controversy was involved in the matter

of Sanjay Shivaji Dhapse V/s. State of Maharashtra

(2014 All M.R. (Cri.) 3617).

In the said Petition, an

offence was sought to be registered against the Insurance

Company alleging that, it did not affix the stamp of

sufficient amount and thereby caused loss of revenue to

the Government and thus cheated the Government.

The

Division Bench of this Court, however rejected the said

contention holding that not affixing stamp of adequate

amount would amount to irregularity and it is always

subject

to

verification

::: Uploaded on - 03/10/2015

check

by

the

concerned

::: Downloaded on - 04/10/2015 15:31:46 :::

18

CRI.APPLICATION NO.4614/2012

rt

Government Officer. The Division Bench also took note of

the fact that, in response to the notice received, the

24.

C

ou

Insurance Company has paid the deficit stamp duty.

After having considered the entire material on

record it appears to us that, on the basis of such record at

the most offences under section 59 and 62 may be

ig

h

attracted against the applicants, but, in no case any of the

offence under Indian Penal Code, as alleged, can said to be

made out against them.

If at all any guilt seems to be

showing

the

attributable on part of the applicants, it is that of not

market

value

of

the

subject

property

determined by applying the ready recknoer rates published

ba

y

by the Government for the year 2008; but then the offence

which may be made out would be under the penal

provision of the Stamp Act i.e. under sections 59 and 62 of

om

the said Act and not under the Indian Penal Code.

In view

of the specific provisions in the Stamp Act in regard to the

alleged intention of evading stamp duty and punishment

provided for the same, general provisions of Indian Penal

Code may not apply.

25.

In

so

far

as

the

prosecution

under

the

provisions of Stamp Act are concerned, it is the further

contention of the applicants that, in view of Section 59-A

of the Act no prosecution would lie since the subject

instrument was produced before the 3rd Joint Civil Judge,

Senior

Division,

Aurangabad

in

Special

Civil

Suit

No.514/2009, and the same has been admitted by the said

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

19

However, we do not wish to enter into the merits

of the said matter.

rt

Court.

CRI.APPLICATION NO.4614/2012

Suffice it to say that, the allegations

C

ou

made in the F.I.R. and the material placed on record in

support thereof even if taken at their face-value and

accepted as it is, do not constitute any of the offence as

alleged therein against the applicants under the provisions

of Indian Penal Code.

We have already noted that the

ig

h

offence as alleged under the Prevention of Corruption Act

would not be attracted against the applicants.

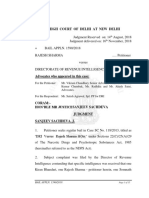

26.

In the circumstances, the continuation of the

criminal proceedings against the applicants in so far as it

relates to the offences under Indian Penal Code, and

Prevention of Corruption Act, would amount to the abuse

ba

y

of the process of the Court.

We, therefore, quash the F.I.R. and the further

criminal proceeding being Crime No. I-141/2012 to the

om

extent it relates to the offences under Indian Penal Code

and

the

Prevention

of

Corruption

Act

against

the

applicants.

Rule made absolute in above terms.

(P.R.BORA)

JUDGE

(R.M.BORDE)

JUDGE

...

AGP/crapln4614-2012

::: Uploaded on - 03/10/2015

::: Downloaded on - 04/10/2015 15:31:46 :::

You might also like

- Maheshbhai Ramnivas Bediya and Ors Vs State of GujGJ2019060519165118108COM657965Document6 pagesMaheshbhai Ramnivas Bediya and Ors Vs State of GujGJ2019060519165118108COM657965Karan KhannaNo ratings yet

- CRPC Case LawDocument7 pagesCRPC Case LawCROSS TREDERSNo ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- BailApplication For JamalLalchand ShaikhDocument24 pagesBailApplication For JamalLalchand ShaikhAdvocate Jasim ShaikhNo ratings yet

- SC Judgment-Forgery-civil Suit PendingDocument4 pagesSC Judgment-Forgery-civil Suit PendingNarapa Reddy YannamNo ratings yet

- CRL Appl Venkataramreddy Draft 15.03.2021Document12 pagesCRL Appl Venkataramreddy Draft 15.03.2021Kapil Dev C UllalNo ratings yet

- Judgment Database: I. Section 200, Indian Penal Code, 1860Document62 pagesJudgment Database: I. Section 200, Indian Penal Code, 1860kumar PritamNo ratings yet

- PDF Upload-362998 PDFDocument10 pagesPDF Upload-362998 PDFAnonymous yA2AXqCcFNo ratings yet

- Quashing Petition 8.01.2017 JigneshDocument5 pagesQuashing Petition 8.01.2017 JigneshAnnapooraniNo ratings yet

- Ajpplication for Discharge of SuretyDocument34 pagesAjpplication for Discharge of SuretyAdv Chanchal Kumar JhaNo ratings yet

- Narendra Singh Bhatia and Ors Vs Nilesh Patel and CG202108022216523148COM304699Document10 pagesNarendra Singh Bhatia and Ors Vs Nilesh Patel and CG202108022216523148COM304699Yashaswi KumarNo ratings yet

- XYZ Vs State of MaharashtraDocument20 pagesXYZ Vs State of MaharashtraGursimran KaurNo ratings yet

- Dipakbhai Jagdishchandra Patel Vs State of GujaratSC2019290419160819208COM575889Document19 pagesDipakbhai Jagdishchandra Patel Vs State of GujaratSC2019290419160819208COM575889Sharma AishwaryaNo ratings yet

- Reply - M M Khan - Jehangir MullaDocument10 pagesReply - M M Khan - Jehangir MullaRonnie SirsikarNo ratings yet

- Pankaj Singh Tomar Vs The State of MP and Ors 2707MP2021050821163032216COM835282Document8 pagesPankaj Singh Tomar Vs The State of MP and Ors 2707MP2021050821163032216COM835282Ashita VyasNo ratings yet

- CRL REV P 23 of 16+RDocument18 pagesCRL REV P 23 of 16+RLawbuzz CornerNo ratings yet

- Court Diary Internship ReportDocument15 pagesCourt Diary Internship ReportRagini SharmaNo ratings yet

- 489-F Latest JudgmentDocument15 pages489-F Latest JudgmentMoving StepNo ratings yet

- SivagamiDocument9 pagesSivagamiadvpreetipundirNo ratings yet

- In The High Court of Delhi at New DelhiDocument3 pagesIn The High Court of Delhi at New DelhisandeepNo ratings yet

- Biodiversity v2 482Document11 pagesBiodiversity v2 482Ankeeta SadekarNo ratings yet

- Rejoinder in Meenakshi Kalia Case CRM-M 11797 of 2016Document7 pagesRejoinder in Meenakshi Kalia Case CRM-M 11797 of 2016lslawfirmindiaNo ratings yet

- Judgment False Rape CaseDocument33 pagesJudgment False Rape Casesumit chhetriNo ratings yet

- Vaijnath Kondiba Khandke Vs State of Maharashtra aSC2018160919165952370COM257997Document3 pagesVaijnath Kondiba Khandke Vs State of Maharashtra aSC2018160919165952370COM257997Prayansh JainNo ratings yet

- P. Mallesh Vs The State of Telangana On 7 February, 2020Document5 pagesP. Mallesh Vs The State of Telangana On 7 February, 2020jamesarchard.cfmNo ratings yet

- AssignmentDocument39 pagesAssignmentKumar Ankit100% (1)

- Eshan Joshi V/s SumanDocument9 pagesEshan Joshi V/s Sumanradhi mehtaNo ratings yet

- National Herald Case RealityviewsDocument27 pagesNational Herald Case RealityviewsRealityviewsNo ratings yet

- Aanchal Cement Limited and Ors Vs Gimpex Limited 0TN201302061519170576COM379063Document18 pagesAanchal Cement Limited and Ors Vs Gimpex Limited 0TN201302061519170576COM379063tipsNo ratings yet

- Display PDFDocument7 pagesDisplay PDFPoonam NikhareNo ratings yet

- Gujarat High CourtDocument15 pagesGujarat High Courtmeghnasmittal24No ratings yet

- Rajesh Sharma Vs Directorate of Revenue On 16 November 2018Document15 pagesRajesh Sharma Vs Directorate of Revenue On 16 November 2018AkshitNo ratings yet

- Aba-1614-2021 With Appln - OdtDocument9 pagesAba-1614-2021 With Appln - Odtshivranjan9211No ratings yet

- criminal case observationDocument12 pagescriminal case observationmaru.hirva.123No ratings yet

- Gurjeet Singh Vs State of NCT of Delhi 07092022 DDE202216092216573772COM349715Document3 pagesGurjeet Singh Vs State of NCT of Delhi 07092022 DDE202216092216573772COM349715Geetansh AgarwalNo ratings yet

- Bank Dispute Hearing DecisionDocument13 pagesBank Dispute Hearing DecisionSaumya badigineniNo ratings yet

- Rohit Tandon Bail ApplicationDocument18 pagesRohit Tandon Bail ApplicationThe WireNo ratings yet

- MCRC 12330 2022 FinalOrder 10-Mar-2022Document3 pagesMCRC 12330 2022 FinalOrder 10-Mar-2022RAKESH NAIDUNo ratings yet

- Ni Act Compounding 507142Document26 pagesNi Act Compounding 507142Sreejith NairNo ratings yet

- Galgotias JudgementDocument16 pagesGalgotias JudgementnaveenNo ratings yet

- Judgment: ReportableDocument27 pagesJudgment: ReportableDazzler AshishNo ratings yet

- Ashutosh Ashok Parasrampuriya and Ors Vs Gharrkul SC202112102110211211COM948650 PDFDocument9 pagesAshutosh Ashok Parasrampuriya and Ors Vs Gharrkul SC202112102110211211COM948650 PDFSHERLOCKNo ratings yet

- Display PDFDocument8 pagesDisplay PDFg95jyt8hg2No ratings yet

- Nandakishore and Ors. vs. State by Ashoknagar Police, Bangalore and Anr PDFDocument5 pagesNandakishore and Ors. vs. State by Ashoknagar Police, Bangalore and Anr PDFSandeep Kumar VermaNo ratings yet

- In The High Court of Gujarat at Ahmedabad (District: Ahmedabad)Document13 pagesIn The High Court of Gujarat at Ahmedabad (District: Ahmedabad)Ronnie SirsikarNo ratings yet

- W.P. No. 1059 of 2022 637896764434677564Document3 pagesW.P. No. 1059 of 2022 637896764434677564Mashood KhanNo ratings yet

- High Court Quashes Look Out Circular Against PetitionersDocument10 pagesHigh Court Quashes Look Out Circular Against PetitionersANIRUDH A KULKARNI 1650104No ratings yet

- IOS2Document32 pagesIOS2Vijaya SriNo ratings yet

- In The Court of Shri Paramjeet Singh, Judge, Special Court, Chandigarh. (UID NO. PB0035)Document12 pagesIn The Court of Shri Paramjeet Singh, Judge, Special Court, Chandigarh. (UID NO. PB0035)NaitikNo ratings yet

- Disciplinary Committee No. IDocument5 pagesDisciplinary Committee No. IRahul AkellaNo ratings yet

- Gujarat HC upholds acquittal in dacoity caseDocument8 pagesGujarat HC upholds acquittal in dacoity caseLex ForiNo ratings yet

- Ramaswamy Nadar vs. The State of Madras PDFDocument5 pagesRamaswamy Nadar vs. The State of Madras PDFSandeep Kumar VermaNo ratings yet

- Teesta Setalvad Anticipatory Bail Gujarat HC JudgmentDocument63 pagesTeesta Setalvad Anticipatory Bail Gujarat HC JudgmentkartikeyatannaNo ratings yet

- Supreme Court quashes criminal case in West Bengal over commercial disputeDocument16 pagesSupreme Court quashes criminal case in West Bengal over commercial disputecharuNo ratings yet

- SC 10 Points For Quashing FIRsDocument15 pagesSC 10 Points For Quashing FIRsspsinghNo ratings yet

- Bail ApplicationDocument24 pagesBail ApplicationAdvocate Jasim ShaikhNo ratings yet

- Shakil Ahmad Jalaluddin Shaikh vs. Vahida Shakil ShaikhDocument11 pagesShakil Ahmad Jalaluddin Shaikh vs. Vahida Shakil ShaikhLive Law100% (1)

- Bombay HC Exonerates Two Senior Advocates From Allegations of Misrepresenting Facts Issues Contempt Notices Against Advocates Who Made The AllegationsDocument51 pagesBombay HC Exonerates Two Senior Advocates From Allegations of Misrepresenting Facts Issues Contempt Notices Against Advocates Who Made The AllegationsLive LawNo ratings yet

- Husband Filing Divorce Petition Is No Justification For Wife To Lodge False Criminal Cases Against Him and His Family - Bombay HCDocument81 pagesHusband Filing Divorce Petition Is No Justification For Wife To Lodge False Criminal Cases Against Him and His Family - Bombay HCLive Law100% (3)

- Arundhati Roy SLPDocument61 pagesArundhati Roy SLPLive Law0% (1)

- Strict Action Against Errant Docs, Tab On Diagnostic Centres Must To Curb Female Foeticide: Panel To SCDocument29 pagesStrict Action Against Errant Docs, Tab On Diagnostic Centres Must To Curb Female Foeticide: Panel To SCLive Law100% (1)

- Filing Vague and Irrelevant RTI QueriesDocument15 pagesFiling Vague and Irrelevant RTI QueriesLive LawNo ratings yet

- Delhi High Court Releases A Rape' Convict As He Married The VictimDocument5 pagesDelhi High Court Releases A Rape' Convict As He Married The VictimLive Law100% (1)

- SanctionDocument127 pagesSanctionLive LawNo ratings yet

- Bombay HC Asks Errant Police Officers To Pay Compensation To Doctors For Their Illegal Detention' in A Bailable CrimeDocument25 pagesBombay HC Asks Errant Police Officers To Pay Compensation To Doctors For Their Illegal Detention' in A Bailable CrimeLive Law100% (1)

- Defence EQuipmentDocument15 pagesDefence EQuipmentLive LawNo ratings yet

- IP ConfrenceDocument1 pageIP ConfrenceLive LawNo ratings yet

- Prosecute Litigants Who Indulge in Filing False Claims in Courts Invoking Section 209 IPC - Delhi HC PDFDocument99 pagesProsecute Litigants Who Indulge in Filing False Claims in Courts Invoking Section 209 IPC - Delhi HC PDFLive Law100% (1)

- Nankaunoo Vs State of UPDocument10 pagesNankaunoo Vs State of UPLive LawNo ratings yet

- Compassionate AppointmentDocument19 pagesCompassionate AppointmentLive LawNo ratings yet

- Surender at Kala vs. State of HaryanaDocument9 pagesSurender at Kala vs. State of HaryanaLive LawNo ratings yet

- Sarfaesi ActDocument40 pagesSarfaesi ActLive Law100% (2)

- Answersheets - RTIDocument21 pagesAnswersheets - RTILive LawNo ratings yet

- Lifting Corporate VeilDocument28 pagesLifting Corporate VeilLive LawNo ratings yet

- WWW - Livelaw.In: Bella Arakatsanis Agner Ascon and ÔTÉDocument13 pagesWWW - Livelaw.In: Bella Arakatsanis Agner Ascon and ÔTÉLive LawNo ratings yet

- DowryDocument11 pagesDowryLive Law50% (2)

- Comedy NightsDocument2 pagesComedy NightsLive LawNo ratings yet

- Allahabad HCDocument18 pagesAllahabad HCLive LawNo ratings yet

- Delhi High Court Act, 2015Document2 pagesDelhi High Court Act, 2015Live LawNo ratings yet

- CPIL Submissions On CJI's Remark Revised - 2Document16 pagesCPIL Submissions On CJI's Remark Revised - 2Live LawNo ratings yet

- CPIL Resolution 2013Document1 pageCPIL Resolution 2013Live LawNo ratings yet

- SabarimalaDocument4 pagesSabarimalaLive LawNo ratings yet

- GazetteDocument1 pageGazetteLive Law100% (1)

- Realistic Costs Should Be Imposed To Discourage Frivolous LitigationsDocument173 pagesRealistic Costs Should Be Imposed To Discourage Frivolous LitigationsLive LawNo ratings yet

- Condom Is Not A Medicine: Madras High CourtDocument8 pagesCondom Is Not A Medicine: Madras High CourtLive LawNo ratings yet

- Maths Lit 2014 ExamplarDocument17 pagesMaths Lit 2014 ExamplarAnymore Ndlovu0% (1)

- Risk Ology ManualDocument2 pagesRisk Ology ManualGregoryNo ratings yet

- Data SheetDocument14 pagesData SheetAnonymous R8ZXABkNo ratings yet

- Oscar Ortega Lopez - 1.2.3.a BinaryNumbersConversionDocument6 pagesOscar Ortega Lopez - 1.2.3.a BinaryNumbersConversionOscar Ortega LopezNo ratings yet

- Major Swine BreedsDocument1 pageMajor Swine BreedsDana Dunn100% (1)

- Brightline Guiding PrinciplesDocument16 pagesBrightline Guiding PrinciplesdjozinNo ratings yet

- Business Advantage Pers Study Book Intermediate PDFDocument98 pagesBusiness Advantage Pers Study Book Intermediate PDFCool Nigga100% (1)

- Duct Design ChartDocument7 pagesDuct Design ChartMohsen HassanNo ratings yet

- KL Wellness City LIvewell 360 2023Document32 pagesKL Wellness City LIvewell 360 2023tan sietingNo ratings yet

- FilesDocument12 pagesFilesRajesh TuticorinNo ratings yet

- Scenemaster3 ManualDocument79 pagesScenemaster3 ManualSeba Gomez LNo ratings yet

- Lead Magnet 43 Foolproof Strategies To Get More Leads, Win A Ton of New Customers and Double Your Profits in Record Time... (RDocument189 pagesLead Magnet 43 Foolproof Strategies To Get More Leads, Win A Ton of New Customers and Double Your Profits in Record Time... (RluizdasilvaazevedoNo ratings yet

- Characteristics: Wheels Alloy Aluminium Magnesium Heat ConductionDocument4 pagesCharacteristics: Wheels Alloy Aluminium Magnesium Heat ConductionJv CruzeNo ratings yet

- 01 NumberSystemsDocument49 pages01 NumberSystemsSasankNo ratings yet

- (NTA) SalaryDocument16 pages(NTA) SalaryHakim AndishmandNo ratings yet

- E200P Operation ManualDocument26 pagesE200P Operation ManualsharmasourabhNo ratings yet

- Financial ManagementDocument21 pagesFinancial ManagementsumanNo ratings yet

- 13 Daftar PustakaDocument2 pages13 Daftar PustakaDjauhari NoorNo ratings yet

- Norms and specifications for distribution transformer, DG set, street light poles, LED lights and high mast lightDocument4 pagesNorms and specifications for distribution transformer, DG set, street light poles, LED lights and high mast lightKumar AvinashNo ratings yet

- 702190-Free PowerPoint Template AmazonDocument1 page702190-Free PowerPoint Template AmazonnazNo ratings yet

- Etp ListDocument33 pagesEtp ListMohamed MostafaNo ratings yet

- Acceptance and Presentment For AcceptanceDocument27 pagesAcceptance and Presentment For AcceptanceAndrei ArkovNo ratings yet

- Tita-111 2Document1 pageTita-111 2Gheorghita DuracNo ratings yet

- Pike River Case StudyDocument7 pagesPike River Case StudyGale HawthorneNo ratings yet

- A K A G .: RUN Umar Shok UptaDocument2 pagesA K A G .: RUN Umar Shok UptaArun GuptaNo ratings yet

- Advanced Microcontrollers Grzegorz Budzyń Lecture 8 - ARM Based MCUs and APs PDFDocument103 pagesAdvanced Microcontrollers Grzegorz Budzyń Lecture 8 - ARM Based MCUs and APs PDFtudor11111No ratings yet

- M Series CylindersDocument61 pagesM Series CylindersAndres SantanaNo ratings yet

- Bajaj 100bDocument3 pagesBajaj 100brmlstoreNo ratings yet

- Organization Structure GuideDocument6 pagesOrganization Structure GuideJobeth BedayoNo ratings yet

- Air Cycle Refrigeration:-Bell - Coleman CycleDocument21 pagesAir Cycle Refrigeration:-Bell - Coleman CycleSuraj Kumar100% (1)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedRating: 5 out of 5 stars5/5 (78)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4 out of 5 stars4/5 (1)

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodFrom EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodRating: 4.5 out of 5 stars4.5/5 (1788)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryFrom EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryRating: 5 out of 5 stars5/5 (1)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterFrom EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterRating: 5 out of 5 stars5/5 (1)

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooFrom EverandBaby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooRating: 5 out of 5 stars5/5 (320)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- If I Did It: Confessions of the KillerFrom EverandIf I Did It: Confessions of the KillerRating: 3 out of 5 stars3/5 (132)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.From EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Rating: 5 out of 5 stars5/5 (43)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansFrom EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansRating: 4 out of 5 stars4/5 (17)

- Summary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisFrom EverandSummary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisRating: 4.5 out of 5 stars4.5/5 (23)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotFrom EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotNo ratings yet

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenFrom EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenRating: 3.5 out of 5 stars3.5/5 (36)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIFrom EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIRating: 4 out of 5 stars4/5 (19)

- A Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessFrom EverandA Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessRating: 5 out of 5 stars5/5 (158)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerFrom EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerRating: 4 out of 5 stars4/5 (52)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Perfect Murder, Perfect Town: The Uncensored Story of the JonBenet Murder and the Grand Jury's Search for the TruthFrom EverandPerfect Murder, Perfect Town: The Uncensored Story of the JonBenet Murder and the Grand Jury's Search for the TruthRating: 3.5 out of 5 stars3.5/5 (68)

- The 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!From EverandThe 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Rating: 5 out of 5 stars5/5 (388)

- Financial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You LoveFrom EverandFinancial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You LoveRating: 5 out of 5 stars5/5 (1)

- The Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalFrom EverandThe Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalRating: 4.5 out of 5 stars4.5/5 (45)

- The Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomFrom EverandThe Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomRating: 5 out of 5 stars5/5 (7)

- The Bigamist: The True Story of a Husband's Ultimate BetrayalFrom EverandThe Bigamist: The True Story of a Husband's Ultimate BetrayalRating: 4.5 out of 5 stars4.5/5 (103)