Professional Documents

Culture Documents

Fins 2624 Quiz 1

Uploaded by

sagarox7Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fins 2624 Quiz 1

Uploaded by

sagarox7Copyright:

Available Formats

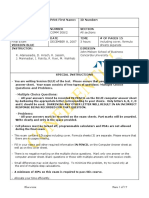

Take Test: Online quiz 1

1 of 3

https://lms-blackboard.telt.unsw.edu.au/webapps/assessment/take/launc...

FINS2624-Portfolio Mgmt - s1/2013

ey Status

OnlineTest/Surv

quizzes

Take Test: Online quiz 1

Description

Instructions

Multiple Attempts This Test allows 3 attempts. This is attempt number 1.

Force Completion This Test can be saved and resumed later.

Question 1

10 points

All else equal, the price and yield on a bond are

positively related.

negatively related.

sometimes positively and sometimes negatively related.

not related.

indefinitely related.

Question 2

10 points

A 10-year zero coupon bond with a face value of $100 is trading in the market. How much money would you

have to deposit in a bank to replicate its cash flows?

FV / (1+r

)

10

FV / (1+r )

1

FV * (1+r )

1

FV

FV / (1+r )

10

10

Question 3

10 points

A coupon bond is a bond that _________.

pays interest on a regular basis

does not pay interest on a regular basis but pays a lump sum at maturity

can always be converted into a specific number of shares of common stock in the issuing company

always sells at face value

none of the above

Question 4

10 points

21/03/2013 10:53 PM

Take Test: Online quiz 1

2 of 3

https://lms-blackboard.telt.unsw.edu.au/webapps/assessment/take/launc...

The yield to maturity on a bond is ________.

Test/Surv ey Status

below the coupon rate when the bond sells at a discount, and equal to the coupon rate when the bond sells

at a premium.

the discount rate that will set the present value of the payments equal to the bond price.

based on the assumption that any payments received are reinvested at the coupon rate.

none of the above.

A, B, and C.

Question 5

10 points

Consider an exotic bond that pays an annual coupon of $20 and matures in 15 years but has no face value.

Assume that the interest rate is 4% for all maturities. What would the bond trade for?

$222.37

$300.00

$166.58

$225.14

Question 6

10 points

Arbitrage traders rely on...

... superior earnings forecasts

... predictable relationships between the prices of two or more assets

... technical analysis

All of the above

Question 7

10 points

The yield to maturity of a bond is

... a hypothetical constant interest rate that would give the observed bond price

... the return an investor would earn if she bought the bond today and held it until maturity

... a convenient way to describe all the interest rates that are at work in the pricing of a particular bond

... a property of individual bonds (rather than of the market)

All of the above

Question 8

10 points

Of the assumptions below, the most likely to hold in practice is:

Complete markets

Arbitrage-free prices

Zero transaction costs

No default risk

Constant interest rates

Question 9

10 points

21/03/2013 10:53 PM

Take Test: Online quiz 1

3 of 3

https://lms-blackboard.telt.unsw.edu.au/webapps/assessment/take/launc...

Consider a bond with a face value of $100, paying an annual coupon of $20 and maturing in two years. The

Test/Surv ey Status

one-year interest rate is 10% (y = 10%) and the two-year interest rate is 7% (y = 7%). What is the yield1

2

to-maturity of the bond?

6.83%

7.24%

10.00%

10.91 %

Question 10

10 points

Suppose you are faced with the following interest rates:

y = 9%

1

y2 = 10%

y3 = 11%

Now consider a bond with a $100 face value maturing in three years. The bond pays annual coupon

payments at a 5% coupon rate. How much would it cost? Answer with one decimal point.

85.5

Save and Submit

21/03/2013 10:53 PM

You might also like

- Take Online Quiz 1 on Bond Pricing and YieldsDocument3 pagesTake Online Quiz 1 on Bond Pricing and YieldsMaxNo ratings yet

- Online Quiz 2 Test - Take TestDocument3 pagesOnline Quiz 2 Test - Take TestjonNo ratings yet

- Take Test: Online Quiz 2: Questi On 1Document3 pagesTake Test: Online Quiz 2: Questi On 1jonNo ratings yet

- Open Quick Links: Top Frame TabsDocument20 pagesOpen Quick Links: Top Frame TabsManthan ShahNo ratings yet

- Fins 2624 Quiz 2 Answers 1Document2 pagesFins 2624 Quiz 2 Answers 1sagarox70% (1)

- FINS 2624 Quiz 2 Attempt 2 PDFDocument3 pagesFINS 2624 Quiz 2 Attempt 2 PDFsagarox7No ratings yet

- Take Test: Online Quiz 10: Questi On 1Document3 pagesTake Test: Online Quiz 10: Questi On 1jonNo ratings yet

- FINS 2624 QUIZ 11 Answers On PDF by JonoDocument3 pagesFINS 2624 QUIZ 11 Answers On PDF by JonojonNo ratings yet

- Take Test: Online Quiz 9: Questi On 1Document4 pagesTake Test: Online Quiz 9: Questi On 1jonNo ratings yet

- Midterm Exam - Attempt ReviewDocument6 pagesMidterm Exam - Attempt ReviewMahmoud AliNo ratings yet

- Quiz Chapter 21Document3 pagesQuiz Chapter 21Vernon SzalachaNo ratings yet

- Online quiz 2 review submissionDocument2 pagesOnline quiz 2 review submissionsagarox7No ratings yet

- HKUST Canvas - Quiz 2 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionsDocument10 pagesHKUST Canvas - Quiz 2 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionslauyingsumNo ratings yet

- Review Online Quiz 10 Options Test ScoresDocument2 pagesReview Online Quiz 10 Options Test ScoresjonNo ratings yet

- Tutorial 3. Understanding Yield Spreads. AnswersDocument8 pagesTutorial 3. Understanding Yield Spreads. Answersizzatulloh50% (2)

- Tutorial FIN221 Chapter 3 - Part 2 (Q&A)Document13 pagesTutorial FIN221 Chapter 3 - Part 2 (Q&A)jojojoNo ratings yet

- Finaincial Assign 2Document20 pagesFinaincial Assign 2Vaishnav SinghNo ratings yet

- MBOF912D-Financial ManagementDocument20 pagesMBOF912D-Financial ManagementVaishnav SinghNo ratings yet

- AFIN 253 Quiz 2Document8 pagesAFIN 253 Quiz 2garytrollingtonNo ratings yet

- FG2233Document11 pagesFG2233Hassan Sheikh0% (1)

- Midsemester Test 2022 5 SeptemberDocument22 pagesMidsemester Test 2022 5 SeptemberTenebrae LuxNo ratings yet

- Tutorial FIN221 Chapter 3 - Part 1 (Q&A)Document17 pagesTutorial FIN221 Chapter 3 - Part 1 (Q&A)jojojoNo ratings yet

- Exam - Final - December 2021 - answersDocument14 pagesExam - Final - December 2021 - answerselodie Helme GuizonNo ratings yet

- VFM Final QuesDocument6 pagesVFM Final QuesPhạm Văn QuânNo ratings yet

- CM SampleExam 2Document10 pagesCM SampleExam 2sarahjohnsonNo ratings yet

- Managing Interest Rate RiskDocument10 pagesManaging Interest Rate RiskChuột Sâu KiuNo ratings yet

- Business Basics For Lawyers Practice Exam: PolskyDocument4 pagesBusiness Basics For Lawyers Practice Exam: PolskyKatherine McClintockNo ratings yet

- MCQ 4Document16 pagesMCQ 4Dương Hà LinhNo ratings yet

- Test 2Document6 pagesTest 2William FisherNo ratings yet

- ACC311 Mid FallDocument7 pagesACC311 Mid Fallfari kh100% (1)

- Review FinDocument19 pagesReview FinHuệ LinhNo ratings yet

- Open Quick Links: Top Frame TabsDocument19 pagesOpen Quick Links: Top Frame TabsManthan ShahNo ratings yet

- SERIES 3 FUTURES LICENSING EXAM REVIEW 2021+ TEST BANKFrom EverandSERIES 3 FUTURES LICENSING EXAM REVIEW 2021+ TEST BANKNo ratings yet

- IM6. Fixed IncomeDocument42 pagesIM6. Fixed IncomeZoon KiatNo ratings yet

- Cfa Level 1 Test QuestionsDocument9 pagesCfa Level 1 Test QuestionsVikram SuranaNo ratings yet

- Mgt201 Collection of Old PapersDocument133 pagesMgt201 Collection of Old Paperscs619finalproject.com100% (1)

- FRM Questions 2013 Actual by ForumDocument5 pagesFRM Questions 2013 Actual by ForumPrabhakar SharmaNo ratings yet

- Mtfall19soln SampleDocument7 pagesMtfall19soln SampleSupri awasthiNo ratings yet

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDocument14 pagesBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNo ratings yet

- Homework 4Document7 pagesHomework 4Liam100% (1)

- Acc501 Final Spring2007 S3Document7 pagesAcc501 Final Spring2007 S3Ab DulNo ratings yet

- Microsoft Word - Week 6 Bonds Version - 1 Solution 9th 04 2019Document6 pagesMicrosoft Word - Week 6 Bonds Version - 1 Solution 9th 04 2019Mark LiNo ratings yet

- Fins 2624 Quiz 9 Answers 1Document3 pagesFins 2624 Quiz 9 Answers 1jonNo ratings yet

- SERIES 3 FUTURES LICENSING EXAM REVIEW 2022+ TEST BANKFrom EverandSERIES 3 FUTURES LICENSING EXAM REVIEW 2022+ TEST BANKNo ratings yet

- FINA Exam1 - PracticeDocument6 pagesFINA Exam1 - Practicealison dreamNo ratings yet

- Question Paper Financial Risk Management - II (232) : April 2006Document16 pagesQuestion Paper Financial Risk Management - II (232) : April 2006api-27548664100% (2)

- MGT201 MCQs Solved Past PapersDocument1,140 pagesMGT201 MCQs Solved Past PapersRABIANo ratings yet

- Valuation of BondsDocument27 pagesValuation of BondsAbhinav Rajverma100% (1)

- MBA 670 Exam 1Document14 pagesMBA 670 Exam 1Lauren LoshNo ratings yet

- Expected Return Based On Its Current Market Price (P: Valuation of Shares & BondsDocument8 pagesExpected Return Based On Its Current Market Price (P: Valuation of Shares & Bondsv_viswaprakash3814No ratings yet

- Chapter 5: Answers To "Do You Understand" Text QuestionsDocument4 pagesChapter 5: Answers To "Do You Understand" Text QuestionsTan Kar BinNo ratings yet

- Midterm Exam 2 PracticeDocument6 pagesMidterm Exam 2 PracticebobtanlaNo ratings yet

- Financial Management 2Document9 pagesFinancial Management 2bajpairameshNo ratings yet

- 01 Comm 308 Final Exam (Fall 2007) SolutionsDocument17 pages01 Comm 308 Final Exam (Fall 2007) SolutionsAfafe ElNo ratings yet

- Midterm Exam Guide - Fall 2017 Investments TestDocument8 pagesMidterm Exam Guide - Fall 2017 Investments TestmiguelNo ratings yet

- Application of Corporate EventsDocument43 pagesApplication of Corporate EventsFrédé AmouNo ratings yet

- FP100T Everyday Economics and FinancesDocument25 pagesFP100T Everyday Economics and FinancesG JhaNo ratings yet

- Graded Quiz Unit 3 - Attempt Review - HomeDocument11 pagesGraded Quiz Unit 3 - Attempt Review - Homealonsofx18No ratings yet

- Sample Exam Paper With Answers PDFDocument6 pagesSample Exam Paper With Answers PDFabhimani5472No ratings yet

- Lasa Practice QuizDocument68 pagesLasa Practice QuizDinesh KumaraNo ratings yet

- FINS 2624 Quiz 2 Attempt 2 PDFDocument3 pagesFINS 2624 Quiz 2 Attempt 2 PDFsagarox7No ratings yet

- Online quiz 2 review submissionDocument2 pagesOnline quiz 2 review submissionsagarox7No ratings yet

- Mockterm FINS2624 S1 2013Document12 pagesMockterm FINS2624 S1 2013sagarox7No ratings yet

- Midterm Information SheetDocument1 pageMidterm Information Sheetsagarox7No ratings yet

- School of Mathematics and Statistics: Topic and Contents MatricesDocument5 pagesSchool of Mathematics and Statistics: Topic and Contents Matricessagarox7No ratings yet

- Formula SheetDocument1 pageFormula Sheetsagarox7No ratings yet

- MGMT 12 Concepts SummaryDocument3 pagesMGMT 12 Concepts Summarysagarox7No ratings yet

- Maths TestDocument15 pagesMaths Testsagarox7No ratings yet

- PEDFA $287M Bond Closing MemoDocument3 pagesPEDFA $287M Bond Closing MemoEmily Previti100% (1)

- Supramolecular Catalysis PDFDocument9 pagesSupramolecular Catalysis PDFmradu1No ratings yet

- Understanding the Properties of Oxalic AcidDocument18 pagesUnderstanding the Properties of Oxalic AcidJohnNo ratings yet

- Texas MVD Surety Bond Sample FormDocument2 pagesTexas MVD Surety Bond Sample FormBuySurety.com100% (2)

- Problem Set CouponDocument2 pagesProblem Set CouponClaudia ChoiNo ratings yet

- Prize Bond List DRAW OF Rs PDFDocument4 pagesPrize Bond List DRAW OF Rs PDFThomas FrenchNo ratings yet

- 1 Assignment-7Document8 pages1 Assignment-7Mar'atul IslamiyahNo ratings yet

- Chicago Offering DocumentsDocument280 pagesChicago Offering DocumentsThe Daily LineNo ratings yet

- Public Shariah MFR November 2017Document42 pagesPublic Shariah MFR November 2017Azrul AzimNo ratings yet

- BHARAT Bond FOF April 2023Document1 pageBHARAT Bond FOF April 2023Yogi173No ratings yet

- Stronghold Insurance V Republic-AsahiDocument3 pagesStronghold Insurance V Republic-AsahiGennard Michael Angelo AngelesNo ratings yet

- Ias 32Document24 pagesIas 32fadfadiNo ratings yet

- Sahara ScamDocument6 pagesSahara ScamdarshitakamaniNo ratings yet

- Caiib Questions Advanced Bank ManagementDocument3 pagesCaiib Questions Advanced Bank Managementpns988850% (2)

- Time Value of MoneyDocument59 pagesTime Value of MoneyjagrenuNo ratings yet

- Rajasthan Chemistry PET 1995 QuestionsDocument10 pagesRajasthan Chemistry PET 1995 QuestionsJai Kumar Kaushil100% (1)

- Silane Curing InsulationDocument26 pagesSilane Curing InsulationMandeep SinghNo ratings yet

- Periodic properties trendsDocument10 pagesPeriodic properties trendsS K MishraNo ratings yet

- Corporate Finance Workshop 1Document24 pagesCorporate Finance Workshop 1coffeedanceNo ratings yet

- False False: Selected Answer: Correct Answer: Response FeedbackDocument4 pagesFalse False: Selected Answer: Correct Answer: Response FeedbackCharles CaoNo ratings yet

- STPM Trials 2009 Chemistry Answer Scheme (SMJK Sam Tet Ipoh)Document14 pagesSTPM Trials 2009 Chemistry Answer Scheme (SMJK Sam Tet Ipoh)sherry_christyNo ratings yet

- 2 Thermodynamic Property Methods in Aspen PlusDocument10 pages2 Thermodynamic Property Methods in Aspen PlusNorman_Mpofu21100% (1)

- Supply AgreementDocument2 pagesSupply AgreementELENITA A DELA CRUZNo ratings yet

- S.V. Sysolyatin Et Al - Synthesis of Polycyclic Nitramines by Nitration of Condensation Products of Glyoxal and Formaldehyde With Sulfamic AcidsDocument11 pagesS.V. Sysolyatin Et Al - Synthesis of Polycyclic Nitramines by Nitration of Condensation Products of Glyoxal and Formaldehyde With Sulfamic AcidsKommissar1981No ratings yet

- InOrgChem LectureDocument13 pagesInOrgChem LectureRoger Jayson MercadoNo ratings yet

- 1 - Basic Chemistry Vocabulary ListDocument12 pages1 - Basic Chemistry Vocabulary ListJoshep Petrus CopperNo ratings yet

- Cred Transaction CaseDocument4 pagesCred Transaction CaseLouie SalladorNo ratings yet

- Instructions to Cash in Children's Bonus BondsDocument2 pagesInstructions to Cash in Children's Bonus BondsMattNo ratings yet

- Quiz 2 AnswersDocument6 pagesQuiz 2 Answerselliott.rillstoneNo ratings yet

- Condur SC 01Document2 pagesCondur SC 01visvisvisvisNo ratings yet