Professional Documents

Culture Documents

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Uploaded by

Justia.com0 ratings0% found this document useful (0 votes)

25 views1 pageNotice: Agency information collection activities; proposals, submissions, and approvals, 33256 [05-11278] Department of Treasury

Original Title

Notice: Agency information collection activities; proposals, submissions, and approvals

Copyright

© Public Domain

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNotice: Agency information collection activities; proposals, submissions, and approvals, 33256 [05-11278] Department of Treasury

Copyright:

Public Domain

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Uploaded by

Justia.comNotice: Agency information collection activities; proposals, submissions, and approvals, 33256 [05-11278] Department of Treasury

Copyright:

Public Domain

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

33256 Federal Register / Vol. 70, No.

108 / Tuesday, June 7, 2005 / Notices

DEPARTMENT OF THE TREASURY establishing or governing the Frequency of response: On occasion.

organization. Estimated Total Reporting Burden:

Submission for OMB Review; Respondents: Business or other for- 6,203 hours.

Comment Request profit. Clearance Officer: Glenn P. Kirkland,

Estimated Number of Respondents: Internal Revenue Service, Room 6516,

June 1, 2005.

50. 1111 Constitution Avenue, NW.,

The Department of Treasury has Estimated Burden Hours Respondent: Washington, DC 20224. (202) 622–3428.

submitted the following public 3 hours. OMB Reviewer: Alexander T. Hunt,

information collection requirement(s) to Frequency of response: On occasion. Office of Management and Budget,

OMB for review and clearance under the Estimated Total Reporting Burden: Room 10235, New Executive Office

Paperwork Reduction Act of 1995, 150 hours. Building, Washington, DC 20503. (202)

Public Law 104–13. Copies of the OMB Number: 1545–1768. 395–7316.

submission(s) may be obtained by Revenue Procedure Number: Revenue

calling the Treasury Bureau Clearance Lois K. Holland,

Procedure 2002–16.

Officer listed. Comments regarding this Type of Review: Extension. Treasury PRA Clearance Officer.

information collection should be Title: Optional Election to Make [FR Doc. 05–11278 Filed 6–6–05; 8:45 am]

addressed to the OMB reviewer listed Monthly § 706 Allocations. BILLING CODE 4830–01–P

and to the Treasury Department Description: This revenue procedure

Clearance Officer, Department of the allows certain partnerships with money

Treasury, Room 11000, 1750 market fund partners to make an DEPARTMENT OF THE TREASURY

Pennsylvania Avenue, NW., optional election to close the

Washington, DC 20220. partnership’s books on a monthly basis Internal Revenue Service

DATES: Written comments should be with respect to the money market fund Open Meeting of the Area 7 Taxpayer

received on or before July 7, 2005, to be partners. Advocacy Panel (Including the States

assured of consideration. Respondents: Business or other for-

of Alaska, California, Hawaii, and

profit.

Internal Revenue Service (IRS) Nevada)

Estimated Number of Respondents/

OMB Number: 1545–0879. Recordkeepers: 1,000. AGENCY: Internal Revenue Service (IRS),

Regulation Project Number: IA–195– Estimated Burden Hours Respondent/ Treasury.

78 Final. Recordkeeper: 30 minutes. ACTION: Notice.

Type of Review: Extension. Frequency of response: Monthly,

Title: Certain Returned Magazines, Other. SUMMARY: An open meeting of the Area

Paperbacks or Records. Estimated Total Reporting/ 7 committee of the Taxpayer Advocacy

Description: The regulations provide Recordkeeping Burden: 500 hours. Panel will be conducted in San

rules relating to an exclusion from gross OMB Number: 1545–1918. Francisco, CA. The Taxpayer Advocacy

income for certain returned Form Number: IRS Form 12885. Panel (TAP) is soliciting public

merchandise. The regulations provide Type of Review: Extension. comments, ideas, and suggestions on

that in addition to physical return of the Title: Supplement to OF–612, improving customer service at the

merchandise, a written statement listing Optional Application for Federal Internal Revenue Service. The TAP will

certain information may constitute Employment. use citizen input to make

evidence of the return. Taxpayers who Description: Form 12885 is used as a recommendations to the Internal

receive physical evidence of the return supplement to the OF–612 to provide Revenue Service.

may, in lieu of retaining physical additional space for capturing work DATES: The meeting will be held

evidence, retain documentary evidence history. Thursday, June 30, 2005, and Friday,

of the return. Taxpayers in the trade or Respondents: Individuals or July 1, 2005.

business of selling magazines, households, Federal Government.

paperbacks, or records, who elect to use FOR FURTHER INFORMATION CONTACT:

Estimated Number of Respondents:

a certain methods of accounting are 24,823. Mary Peterson O’Brien at 1–888–912–

affected. Estimated Burden Hours Respondent: 1227, or 206–220–6096.

Respondents: Business or other for- 30 minutes. SUPPLEMENTARY INFORMATION: Notice is

profit. Frequency of response: On occasion. hereby given pursuant to Section

Estimated Number of Recordkeepers: Estimated Total Reporting Burden: 10(a)(2) of the Federal Advisory

19,500. 12,406 hours. Committee Act, 5 U.S.C. App. (1988)

Estimated Burden Hours OMB Number: 1545–1921. that an open meeting of the Area 7

Recordkeeper: 25 minutes. Form Number: IRS Form 12114. Taxpayer Advocacy Panel will be held

Estimated Total Reporting/ Type of Review: Extension. Thursday, June 30, 2005 from 8 am to

Recordkeeping Burden: 8,125 hours. Title: Continuation Sheet for Item #16 4:30 pm Pacific Time and Friday, July

OMB Number: 1545–1269. (Additional Information) OF–306, 1, 2005 from 8 am to noon Pacific Time

Regulation Project Number: PS–7–90 Declaration for Federal Employment at 333 O’Farrell Street, San Francisco,

Final. Description: Form 12114 is used as a CA 94102. The public is invited to make

Type of Review: Extension. continuation to the OF–306 to provide oral comments. Individual comments

Title: Nuclear Decommissioning Fund additional space for capturing will be limited to 5 minutes. If you

Qualification Requirements. additional information. would like to have the TAP consider a

Description: If a taxpayer requests, in Respondents: Individuals or written statement, please call 1–888–

connection with a request for a schedule households, Federal Government. 912–1227 or 206–220–6096, or write to

of ruling amounts, a ruling as to the Estimated Number of Respondents: Mary Peterson O’Brien, TAP Office, 915

classification of certain unincorporated 24,813. 2nd Avenue, MS W–406, Seattle, WA

organizations, the taxpayer is required Estimated Burden Hours Respondent: 98174 or you can contact us at

to submit a copy of the documents 15 minutes. www.improveirs.org. Due to limited

VerDate jul<14>2003 20:54 Jun 06, 2005 Jkt 205001 PO 00000 Frm 00202 Fmt 4703 Sfmt 4703 E:\FR\FM\07JNN1.SGM 07JNN1

You might also like

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- Federal Register-02-28062Document2 pagesFederal Register-02-28062POTUSNo ratings yet

- Federal Register-02-28545Document2 pagesFederal Register-02-28545POTUSNo ratings yet

- Federal Register-02-28464Document1 pageFederal Register-02-28464POTUSNo ratings yet

- Federal Register-02-28361Document2 pagesFederal Register-02-28361POTUSNo ratings yet

- Federal Register-02-28295Document1 pageFederal Register-02-28295POTUSNo ratings yet

- 258791Document26 pages258791jemybanez81No ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon Second DivisionDocument32 pagesRepublic of The Philippines Court of Tax Appeals Quezon Second DivisionIan InandanNo ratings yet

- Description: Tags: 120302eDocument2 pagesDescription: Tags: 120302eanon-247808No ratings yet

- Philippine gold refiner's VAT refund caseDocument20 pagesPhilippine gold refiner's VAT refund caseMarc Myer De AsisNo ratings yet

- CIR v. Wyeth Suaco & CTADocument12 pagesCIR v. Wyeth Suaco & CTADaLe AparejadoNo ratings yet

- Taxpayer Remedies and the Assessment CycleDocument22 pagesTaxpayer Remedies and the Assessment CycleRussell Stanley Que GeronimoNo ratings yet

- J.R.a. Philippines, Inc. vs. Commissioner of Internal RevenueDocument5 pagesJ.R.a. Philippines, Inc. vs. Commissioner of Internal Revenuevince005No ratings yet

- Treasury RFI SOFR FRN3Document3 pagesTreasury RFI SOFR FRN3LaLa BanksNo ratings yet

- Cta 1D CV 08854 D 2017aug04 Ass PDFDocument39 pagesCta 1D CV 08854 D 2017aug04 Ass PDFYna YnaNo ratings yet

- Description: Tags: 060600eDocument2 pagesDescription: Tags: 060600eanon-237556No ratings yet

- Republic of The Philippines Court of Appeals Quezon: TAX CityDocument27 pagesRepublic of The Philippines Court of Appeals Quezon: TAX CitydoookaNo ratings yet

- Cta 1D CV 08726 D 2017sep14 AssDocument115 pagesCta 1D CV 08726 D 2017sep14 AssdoookaNo ratings yet

- Revenue Memo Authorizes TVN for Additional Refund ClaimsDocument2 pagesRevenue Memo Authorizes TVN for Additional Refund ClaimsPAMELA KALAWNo ratings yet

- LANDCASTERDocument36 pagesLANDCASTERKathleneGabrielAzasHaoNo ratings yet

- ROHM Apollo Semiconductor Philippines vs. CIRDocument8 pagesROHM Apollo Semiconductor Philippines vs. CIRred gynNo ratings yet

- First Chicago NBD Corporation v. Commissioner of Internal Revenue, 135 F.3d 457, 1st Cir. (1998)Document7 pagesFirst Chicago NBD Corporation v. Commissioner of Internal Revenue, 135 F.3d 457, 1st Cir. (1998)Scribd Government DocsNo ratings yet

- Federal Register-02-28264Document1 pageFederal Register-02-28264POTUSNo ratings yet

- Federal Register-02-28265Document2 pagesFederal Register-02-28265POTUSNo ratings yet

- 1 Sitel Vs CIR Input VATDocument25 pages1 Sitel Vs CIR Input VATKris OrenseNo ratings yet

- Federal Register 02 27353Document2 pagesFederal Register 02 27353POTUSNo ratings yet

- Federal Register-02-28382Document1 pageFederal Register-02-28382POTUSNo ratings yet

- Federal Register-02-28477Document1 pageFederal Register-02-28477POTUSNo ratings yet

- Sitel Philippines Corporation vs. Commissioner of Internal Revenue, 817 SCRA 193, February 08, 2017Document21 pagesSitel Philippines Corporation vs. Commissioner of Internal Revenue, 817 SCRA 193, February 08, 2017Vida MarieNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument17 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityGeorge Mitchell S. GuerreroNo ratings yet

- $ Upreme Ql:ourt: 3aepublic Tbe BilippineDocument16 pages$ Upreme Ql:ourt: 3aepublic Tbe BilippineCesar ValeraNo ratings yet

- This Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboDocument2 pagesThis Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboChapter 11 DocketsNo ratings yet

- Direct Testimony and Exhibits: Before The Florida Public Service CommissionDocument374 pagesDirect Testimony and Exhibits: Before The Florida Public Service CommissionAsgrhNo ratings yet

- Petitioner vs. vs. Respondent: First DivisionDocument12 pagesPetitioner vs. vs. Respondent: First DivisionIrish Joi TapalesNo ratings yet

- CTA upholds tax assessments against Max Health & LivingDocument16 pagesCTA upholds tax assessments against Max Health & Livingメアリー フィオナNo ratings yet

- This ForDocument2 pagesThis ForChapter 11 DocketsNo ratings yet

- Cir VS TransitionsDocument17 pagesCir VS TransitionsChristopher ArellanoNo ratings yet

- Cta 2D CV 10216 D 2024mar07 RefDocument48 pagesCta 2D CV 10216 D 2024mar07 RefAnastasia BaliloNo ratings yet

- Cir VS SonyDocument31 pagesCir VS Sonyic corNo ratings yet

- Cta Eb CV 02476 D 2023apr04 RefDocument22 pagesCta Eb CV 02476 D 2023apr04 RefFirenze PHNo ratings yet

- $ - Upreme ( (Ourt: of Tbe Llbilippines FflanilnDocument2 pages$ - Upreme ( (Ourt: of Tbe Llbilippines FflanilnErika Mariz CunananNo ratings yet

- ADMINISTRATIVE TAX REMEDIESDocument80 pagesADMINISTRATIVE TAX REMEDIESGeline Joy D. SamillanoNo ratings yet

- Court of Tax Appeals: First DivisionDocument44 pagesCourt of Tax Appeals: First DivisionJomel ManaigNo ratings yet

- 49 - (G.R. No. 143672. April 24, 2003)Document6 pages49 - (G.R. No. 143672. April 24, 2003)alda hobisNo ratings yet

- CTA Case No 6426 Dated December 18, 2007Document14 pagesCTA Case No 6426 Dated December 18, 2007Jeffrey JosolNo ratings yet

- Special Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument24 pagesSpecial Second Division: Republic of The Philippines Court of Tax Appeals Quezon Cityjb13ruizNo ratings yet

- Commissioner of Internal Revenue vs. Deutsche Knowledge Services, Pte. LTD., 807 SCRA 90, November 07, 2016Document12 pagesCommissioner of Internal Revenue vs. Deutsche Knowledge Services, Pte. LTD., 807 SCRA 90, November 07, 2016Vida MarieNo ratings yet

- National Starch and Chemical Corporation v. Commissioner of Internal Revenue, 918 F.2d 426, 3rd Cir. (1990)Document14 pagesNational Starch and Chemical Corporation v. Commissioner of Internal Revenue, 918 F.2d 426, 3rd Cir. (1990)Scribd Government DocsNo ratings yet

- Federal Register-02-28273Document1 pageFederal Register-02-28273POTUSNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument19 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityMarcy BaklushNo ratings yet

- Federal Register-02-28261Document1 pageFederal Register-02-28261POTUSNo ratings yet

- Federal Register-02-28262Document2 pagesFederal Register-02-28262POTUSNo ratings yet

- Federal Register-02-28571Document1 pageFederal Register-02-28571POTUSNo ratings yet

- Dexsil Corporation v. Commissioner of Internal Revenue, 147 F.3d 96, 2d Cir. (1998)Document9 pagesDexsil Corporation v. Commissioner of Internal Revenue, 147 F.3d 96, 2d Cir. (1998)Scribd Government DocsNo ratings yet

- Cta 2D CV 06681 D 2006aug31 Ref PDFDocument17 pagesCta 2D CV 06681 D 2006aug31 Ref PDFKevin Ken Sison GancheroNo ratings yet

- Silicon Philippines, Inc. v. CIRDocument18 pagesSilicon Philippines, Inc. v. CIRAronJamesNo ratings yet

- Ii (.FR/) 1: Repmt To Be Oubni101D For All Basic Eceouma That Are Presenay Maintained Bythe Post CCR - FLRR Von DebtorDocument2 pagesIi (.FR/) 1: Repmt To Be Oubni101D For All Basic Eceouma That Are Presenay Maintained Bythe Post CCR - FLRR Von DebtorChapter 11 DocketsNo ratings yet

- Coggin v. Comr. of IRS, 71 F.3d 855, 11th Cir. (1996)Document14 pagesCoggin v. Comr. of IRS, 71 F.3d 855, 11th Cir. (1996)Scribd Government DocsNo ratings yet

- Accounting For Government and Non-Profit Organization 3Document11 pagesAccounting For Government and Non-Profit Organization 3accounting SolutionNo ratings yet

- Cta 3D CV 08372 D 2016mar31 Ass PDFDocument27 pagesCta 3D CV 08372 D 2016mar31 Ass PDFJsa GironellaNo ratings yet

- Arbabsiar ComplaintDocument21 pagesArbabsiar ComplaintUSA TODAYNo ratings yet

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDocument1 pageBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comNo ratings yet

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDocument12 pagesDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comNo ratings yet

- U.S. v. Rajat K. GuptaDocument22 pagesU.S. v. Rajat K. GuptaDealBook100% (1)

- Bank Robbery Suspects Allegedly Bragged On FacebookDocument16 pagesBank Robbery Suspects Allegedly Bragged On FacebookJustia.comNo ratings yet

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDocument22 pagesClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comNo ratings yet

- Signed Order On State's Motion For Investigative CostsDocument8 pagesSigned Order On State's Motion For Investigative CostsKevin ConnollyNo ratings yet

- USPTO Rejection of Casey Anthony Trademark ApplicationDocument29 pagesUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comNo ratings yet

- Amended Poker Civil ComplaintDocument103 pagesAmended Poker Civil ComplaintpokernewsNo ratings yet

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDocument1 pageGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comNo ratings yet

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDocument5 pagesU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comNo ratings yet

- Van Hollen Complaint For FilingDocument14 pagesVan Hollen Complaint For FilingHouseBudgetDemsNo ratings yet

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDocument7 pagesStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comNo ratings yet

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDocument22 pagesEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comNo ratings yet

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDocument4 pagesRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comNo ratings yet

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDocument3 pagesRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comNo ratings yet

- Wisconsin Union Busting LawsuitDocument48 pagesWisconsin Union Busting LawsuitJustia.comNo ratings yet

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDocument48 pagesDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDocument25 pagesDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comNo ratings yet

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDocument1 pageCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comNo ratings yet

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDocument15 pagesFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comNo ratings yet

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDocument52 pagesOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comNo ratings yet

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDocument1 pageSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comNo ratings yet

- Sweden V Assange JudgmentDocument28 pagesSweden V Assange Judgmentpadraig2389No ratings yet

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDocument6 pagesNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comNo ratings yet

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDocument6 pagesFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURNo ratings yet

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDocument24 pagesOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comNo ratings yet

- Lee v. Holinka Et Al - Document No. 4Document2 pagesLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- 60 Gadgets in 60 Seconds SLA 2008 June16Document69 pages60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Document2 pagesCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNo ratings yet

- I-Xxiv 001-328 r4nk - Indd IDocument352 pagesI-Xxiv 001-328 r4nk - Indd IadirenaldiNo ratings yet

- Islamic Education Movement: Recent History and Objectives Shah Abdul HannanDocument6 pagesIslamic Education Movement: Recent History and Objectives Shah Abdul Hannanروحايذول بن يونسNo ratings yet

- Lincoln and Guba CriteriaDocument2 pagesLincoln and Guba CriteriaKim SunooNo ratings yet

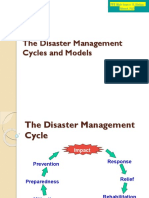

- 3 The Disaster Management Cycle and Models 1Document35 pages3 The Disaster Management Cycle and Models 1triratna100% (1)

- Business and Management HL Paper 2 MsDocument30 pagesBusiness and Management HL Paper 2 MsGray HomeNo ratings yet

- What's So Wonderful About BuddhismDocument86 pagesWhat's So Wonderful About BuddhismbhavangaNo ratings yet

- As ISO 14520.9-2009 Gaseous Fire-Extinguishing Systems - Physical Properties and System Design HFC 227ea ExtiDocument6 pagesAs ISO 14520.9-2009 Gaseous Fire-Extinguishing Systems - Physical Properties and System Design HFC 227ea ExtiSAI Global - APACNo ratings yet

- Law of Child Act TanzaniaDocument79 pagesLaw of Child Act TanzaniaMichael Mwambanga50% (2)

- Interview InstructionsDocument2 pagesInterview InstructionsmbramallNo ratings yet

- AOI 22 Winter Operations and Snow PlanDocument41 pagesAOI 22 Winter Operations and Snow PlanGrec MirceaNo ratings yet

- Father of Pakistan Quaide Azam Muhammad Ali Jinnah and Former Federally Administered Tribal Area of PakistanDocument7 pagesFather of Pakistan Quaide Azam Muhammad Ali Jinnah and Former Federally Administered Tribal Area of PakistanAfaq KhanNo ratings yet

- Clean Water for 5,000 in TanzaniaDocument16 pagesClean Water for 5,000 in TanzaniaAbdisamed AllaaleNo ratings yet

- Morphogenetic Field, Soul and Atmosphere: An Animation of Morphogenetic Fields Werner MerkerDocument8 pagesMorphogenetic Field, Soul and Atmosphere: An Animation of Morphogenetic Fields Werner MerkerErEledth100% (3)

- Inside the Supreme CourtDocument37 pagesInside the Supreme CourtEunice Kalaw VargasNo ratings yet

- Lesson 4 March 3 2021 Conceptualizing The Research Title and SOPDocument7 pagesLesson 4 March 3 2021 Conceptualizing The Research Title and SOPCharlton Benedict BernabeNo ratings yet

- Managing Maritime Infrastructure: Lessons From UAE and ChinaDocument18 pagesManaging Maritime Infrastructure: Lessons From UAE and ChinaKantaJupolaNo ratings yet

- Celta Assignment3Document6 pagesCelta Assignment3Madabushi Krishnan80% (5)

- Professional Education Drill 12 - Part 6Document1 pageProfessional Education Drill 12 - Part 6saglebal100% (1)

- Lesson Plan - Online Safety and SecurityDocument2 pagesLesson Plan - Online Safety and SecurityAnna Soriano71% (7)

- Weekly Home Learning Plan For Grade 6 Week6Document3 pagesWeekly Home Learning Plan For Grade 6 Week6john paul cabantacNo ratings yet

- MGT 301 Grand QuizDocument4 pagesMGT 301 Grand Quizعباس نانا100% (1)

- Bars Method of Performance AppraisalDocument6 pagesBars Method of Performance AppraisalAndrey MilerNo ratings yet

- GPS Study Guide and QuestionsDocument2 pagesGPS Study Guide and Questionsbelinda koyaiyeNo ratings yet

- Format Recenzie Studii În Domeniul Cdi: Date de Identificare StudiuDocument3 pagesFormat Recenzie Studii În Domeniul Cdi: Date de Identificare StudiuSusan MihaiNo ratings yet

- Future Aspirations Study and Work Knowlege Organiser EdexcelDocument24 pagesFuture Aspirations Study and Work Knowlege Organiser EdexcelCarmen EstebanNo ratings yet

- SPSPS 25th anniversary rulesDocument8 pagesSPSPS 25th anniversary rulesMac b IBANEZNo ratings yet

- Q2 DIASS Week 5 Module (Discipline of Communication, The Settings, Processes, Methods and Tools in Communication)Document23 pagesQ2 DIASS Week 5 Module (Discipline of Communication, The Settings, Processes, Methods and Tools in Communication)Ricardo Acosta Subad100% (1)

- Curriculum in English PDFDocument264 pagesCurriculum in English PDFandrew_ferrell_mageeNo ratings yet

- Grade Thresholds - June 2019: Cambridge International AS & A Level Computer Science (9608)Document2 pagesGrade Thresholds - June 2019: Cambridge International AS & A Level Computer Science (9608)zeeshan arifNo ratings yet

- Language PolicyDocument6 pagesLanguage PolicyfatmaNo ratings yet

- Legal Writing in Plain English, Third Edition: A Text with ExercisesFrom EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- Everybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeFrom EverandEverybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeNo ratings yet

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyFrom EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyRating: 5 out of 5 stars5/5 (2)

- Torts: QuickStudy Laminated Reference GuideFrom EverandTorts: QuickStudy Laminated Reference GuideRating: 5 out of 5 stars5/5 (1)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionFrom EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionRating: 5 out of 5 stars5/5 (1)

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsFrom EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsRating: 4 out of 5 stars4/5 (18)

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolFrom EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNo ratings yet

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersFrom EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNo ratings yet

- Nolo's Essential Guide to Buying Your First HomeFrom EverandNolo's Essential Guide to Buying Your First HomeRating: 4 out of 5 stars4/5 (43)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedFrom EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedNo ratings yet

- Form Your Own Limited Liability Company: Create An LLC in Any StateFrom EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNo ratings yet