Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

'~_S_~_iv_a_m__A_u_to_t_e_C_h_L_i_m_it_e_d

~~

Shivam Autotech Limited

CIN: L34300DL2005PLC139163

Regd. Office: 303, 3rd Floor, Square One, District Centre, Saket, New Delhi-110017

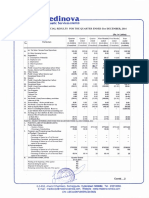

Un-Audited Financial Results for the Quarter and Nine Month ended 31-0ec-2014

(Figures

Sr.

No.

Particulars

PART-I

1

in Lacs except per share data & No. of shares)

QUARTER ENDED

NINE MONTH ENDED

Year Ended

31-Dec14

30Sep-14

31-Dec-13

31-Dec-14

31-Dec-13

31-Mar-14

(Reviewed)

(Reviewed)

(Reviewed)

(Reviewed)

(Reviewed)

(Audited)

(i)

(ii)

(iii)

(iv)

(v)

(vi)

Income from operations

(a) Net sales (Net of excise duty)

10,775.59

11,259.70

10,972.49

33,484.42

29,811.14

39,859.24

Total income from operations

10,775.59

11,259.70

10,972.49

33,484.42

29,811.14

39,859.24

(a) Cost of materials consumed

3,767.88

3,556.39

3,468.48

11,141.53

9,552.33

13,057.97

(b) Store Consumable

1,298.40

1,210.98

1,418.57

3,615.20

3,615.74

4,663.29

95.49

49.57

1,020.36

987.89

897.60

2,938.02

2,491.26

3,313.40

682.36

667.10

797.99

2,068.79

2,337.86

3,090.92

(net)

Exoenses

(c) Changes in inventories of finished goods,work-inprogress and stock-in-trade

(d) Employee benerts expense

(e) Depreciation and amortisation expense

(377.05)

(42.45)

188.46

(197.17)

838.16

1,007.78

1,057.01

2,792.42

2,620.35

3,593.56

(g) Other expenses

2,090.57

2,285.56

2,064.94

6,581.15

5,273.93

7,416.01

Total expenses

9,320.68

9,811.19

9,754.16

29,094.66

26,079.93

34,937.98

Profit / (Loss) from operations before other income,

finance costs and exceptional

(Item (1-2)

1,454.91

1,448.51

1,218.33

4,389.76

3,731.21

4,921.26

Other income

2.27

10.29

7.89

14.62

16.49

19.65

Profrt / (Loss) from ordinary activities before finance

costs and exceptional items (3 + 4 )

1,457.18

1,458.80

1,226.22

4,404.38

3,747.70

4,940.91

Finance costs

554.03

534.61

554.02

1,581.08

1,557.65

2,045.89

Profit / (Loss) from ordinary acfivities after finance

costs but before exceptional items

(5 - 6)

903.15

924.19

672.20

2,823.30

2,190.05

2,895.02

Exceptional items

903.15

924.19

672.20

2,823.30

2,190.05

2,895.02

300.69

129.06

(23.53

628.87

(84.81

51.78

602.46

795.13

695.73

2,194.43

2,274.86

2,843.24

1,000.00

1,000.00

1,000.00

1,000.00

1,000.00

(f) Job work Charges

9

10

Profit / (Loss) from ordinary activities before tax

7 + 8)

Tax Expenses (Net of MAT Credit Entitlement) if anv.

11

Net Profit / (Loss) from ordinary activities after tax

(9 - 10)

12

Paid-up equitv share ceoital (Face Value of Rs. 2/-

13

Reserve excluding Revaluation Reserves

14

Basic and diluted earnlnqs per share face value Rs.21

a) before exceptional items

b) after exceotional items

HARIDWAR WORKS

REGISTERED

OFFICE:

1,000.00

15,110.52

1.20

1.20

1.59

1.59

1.39

1.39

4.39

4.39

4.55

4.55

Plot No : 3, Industrial Park-ll, Phase-I, ViII. Salempur Mehdood,

Dist. Haridwar - 249402 Uttrakhand (India) E-mail: admn@shivamautotech.com

5.69

5.69

ISO I ITS 1694911_

ISO 14001

OHSAS 18001

303., 3rd Floor, Square One, Saket, New Delhi" 110017

TELFAX: +91 11 29564205, +91 11 29564202 E-mail :admn@shivamautotech.com

Website : www.shivamautotech.com

CERTIFIED FIRM

~.

_S_h_iv_a_m__ A_u_to_t_e_c_h_L_i_m_it_e_d

~~,

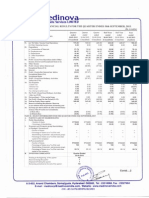

PART 11

PARTICULARS

Public shareholdinq

- Number of shares

- Percentage of shareholdina

OF SHAREHOLOING

Promoters and Promoter Group Shareholding

12602025

25.20%

12602025

25.20%

12602025

25.20%

12602025

25.20%

12602025

25.20%

12602025

25.20%

37397975

37397975

37397975

37397975

37397975

37397975

100%

100%

100%

100%

100%

100%

74.80%

74.80%

74.80%

74.80%

74.80%

74.80%

a) Pledqed 1 Encumbered

Number of shares

Percentage of shares (as a % of the total shareholding

of promoter and promoter group)

Percentage of shares (as a % of the total share capital

of the company)

b) Non - encumbered

Number of shares

Percentage of shares (as a % of the total shareholding

of the Promoter and Promoter group)

Percentage of shares (as a % of the total share capital

of the cornoanv)

B

INVESTOR COMPLAINTS

as on 31 Dec 2014

Pending at the beginning of the quarter Received

during the quarter

Received during the quarter

Disposed of during the quarter

5

.,

Remaining unresolved at the end of the quarter

Notes:The above unaudited results were reviewed by the Audit Committee and have been taken on record by the Board of Directors in there meeting held on 14th

February,2015

As the Company's business activity falls within a single primary business segment viz 'Two-wheelers, its pans and ancillary services' and is a single geographical

segment, the disclosure requirements of accounting Standard (AS-l 7) " Segment Reporting", specified in the Companies (Accounting Standard) Rules, 2006 are

not applicable.

Provision for tax includes current tax, deferred tax net off MAT credit entitlement. The Company has provided for Income tax libility after taking into account,

the deductions available under Section 801C of Income Tax Act' t 961 in respect of undertaking established.

4

As on 31.1 0.20 14 company has sub-Divided their existing Equity Shares of Rs. 101 each fully paid up into 5 (five) Equity shares of Rs. 2/ each fully paid-up.

The above results have been reviewed by statutory auditors as per clause 41 of the listing agreement

Previous quarter/year figures have been regrouped / reclassified whereever necessary, to make them comparable.

Foxand_~~half of board

Place: New Delhi

~I

Date: 14th February '2015

HARIDWAR WORKS

REGISTERED OFFICE:

Plot No : 3, Industrial Park-II, Phase-I, ViiI. Salempur Mehdood,

Dist. Haridwar - 249402 Uttrakhand (India) E-mail: admn@shivamautotech.com

Kant Munjal

Chairman

ISO IITS

ISO

1694'1~'"ID.

1400'

-

OHSAS 18001

.

~

303, 3rd Floor, Square One, Saket, New Delhi - 110017

TELFAX: +91 11 29564205, +91 11 29564202 E-mail :admn@shivamautotech.com

Web5ite : www.shivamautotech.com

CERTIFIED FIRM

S S HOTHARI MEHTA & CO

146-148 Tribhuvan Complex

lshwar t'\lagar.

Mathura Road

New Delhi-'II 0065

Phones: +91-11-4670 8888

Fax:

+91-11-66628889

E-rnail : delhi@ssi<nlin.com

LIMITED REVIEW REPORT

To

The Board of Directors

Shivam Autotech Limited

New Delhi.

1.

We have reviewed the accompanying statement of unaudited financial results of Shivam Autotech

Limited (the "Company") for the quarter ended December 31, 2014 (the "Statement") being

submitted by the company pursuant to the requirements of clause 41 of the Listing Agreement

with Stock Exchanges except for the disclosures regarding 'Public Shareholding' and "Promoter

and Promoter Group Shareholding" which have been traced from the disclosures made by the

management and have not been reviewed by us.. The statement of quarterly financial results

has been prepared in accordance with recognition & measurement prlnclples laid down in

Accounting Standard 25 "Interim Financial Reporting" [specified under Companies Act 1956

(which are deemed to be applicable as per the section 133 of the Companies Act 2013 Read with

Rule 7 of Companies (Accounts) Rules, 2014] & other recognized accounting practices and

policies in India, is the responsibility of the Company's Management and has been approved by

the Board of Directors. Our responsibility is to issue a report on the Statement based on our

review.

2.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2410,

'Review of Interim Financial Information performed by the Independent Auditor of the Entity'

issued by the Institute of Chartered Accountants of India. This standard requires that we plan

and perform the review to obtain moderate assurance as to whether the financial statements are

free of material misstatement. A review is limited primarily to inquiries of Company personnel

and analytical procedures applied to financial data and thus provides less assurance than an

aydit. We have not performed an audit and accordingly, we do not express an audit opinion.

3.

Based on our review conducted as above, nothing has come to our attention that causes us to

believ'e that the accompanying statement of unaudited financial results prepared in accordance

with recognition and measurement principles laid down in Accounting Standard AS - 25 'Interim

Financial Reporting' [specified under the Companies Act, 1956 (which are deemed to be

applicable as per section 133 of the Companies Act, 2013, read with Rule 7 of the Companies

(Accounts) Rules, 2014)] and other recognized accounting practices and policies has not

disclosed the information required to be disclosed in terms of Clause 41 of the Listing Agreement

including the manner in which it is to be disclosed, or that it contains any material misstatement.

Date: February 14, 2015

Place: New Delhi

You might also like

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Auditors Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Court rules on petition to dismiss criminal caseDocument1 pageCourt rules on petition to dismiss criminal caseBetson CajayonNo ratings yet

- Paramedical CouncilDocument2 pagesParamedical CouncilSachin kumarNo ratings yet

- 2016 Ballb (B)Document36 pages2016 Ballb (B)Vicky D0% (1)

- SC rules carrier liable for damages in sinking caseDocument1 pageSC rules carrier liable for damages in sinking caseKimberly RamosNo ratings yet

- Rules of Origin Are Used To Determine TheDocument4 pagesRules of Origin Are Used To Determine TheLeema AlasaadNo ratings yet

- The Lex Rei Sitae RulesDocument4 pagesThe Lex Rei Sitae RulesApple WormNo ratings yet

- St. George v. Shlesinger FACDocument27 pagesSt. George v. Shlesinger FACTHROnlineNo ratings yet

- Summary judgment on pleadingsDocument3 pagesSummary judgment on pleadingsVloudy Mia Serrano PangilinanNo ratings yet

- Territorial Jurisdiction in Online Defamation CasesDocument6 pagesTerritorial Jurisdiction in Online Defamation CasesJebin JamesNo ratings yet

- Cyber PdpaDocument30 pagesCyber PdpaSyafiq AffandyNo ratings yet

- Basic Types of Legal Documents: - Deeds, Wills, Mortgages, EtcDocument9 pagesBasic Types of Legal Documents: - Deeds, Wills, Mortgages, EtcvenkatNo ratings yet

- Presentation On GST: (Goods and Services Tax)Document11 pagesPresentation On GST: (Goods and Services Tax)tpplantNo ratings yet

- FRIA LawDocument15 pagesFRIA LawDonnNo ratings yet

- Don Victoriano Chiongbian (Don Mariano Marcos), Misamis OccidentalDocument2 pagesDon Victoriano Chiongbian (Don Mariano Marcos), Misamis OccidentalSunStar Philippine NewsNo ratings yet

- Screenshot 2021-12-10 at 5.33.04 PMDocument1 pageScreenshot 2021-12-10 at 5.33.04 PMtriloke pandeyNo ratings yet

- Consti Case List Secs 6-22Document26 pagesConsti Case List Secs 6-22Matthew WittNo ratings yet

- Heirs of Castillo Vs Lacuata-GabrielDocument2 pagesHeirs of Castillo Vs Lacuata-GabrielJo BudzNo ratings yet

- A Brief History of SingaporeDocument16 pagesA Brief History of SingaporestuutterrsNo ratings yet

- Implementation of EU-Georgia Association Agenda 2017-2020 Assessment by Civil SocietyDocument52 pagesImplementation of EU-Georgia Association Agenda 2017-2020 Assessment by Civil SocietyOSGF100% (4)

- Module 5 D Obligations With A Penal ClauseDocument3 pagesModule 5 D Obligations With A Penal Clauseairam cabadduNo ratings yet

- Appeal To High Court Under Code of Civil ProcedureDocument2 pagesAppeal To High Court Under Code of Civil ProcedureShelly SachdevNo ratings yet

- Harassment of Women at the WorkplaceDocument22 pagesHarassment of Women at the WorkplaceAbhinav PrakashNo ratings yet

- Enrico V Heirs of MedinaceliDocument2 pagesEnrico V Heirs of MedinaceliDylanNo ratings yet

- Comfort Women Seek Official Apology from JapanDocument4 pagesComfort Women Seek Official Apology from JapanCistron ExonNo ratings yet

- Code of Conduct For Court PersonnelDocument6 pagesCode of Conduct For Court PersonnelJenelyn Bacay LegaspiNo ratings yet

- Student Activity Permit Approval ProcessDocument1 pageStudent Activity Permit Approval ProcessJorge Erwin RadaNo ratings yet

- Hospitalii Vacancy - Part1Document2 pagesHospitalii Vacancy - Part1Bhavagna SaiNo ratings yet

- Part M Implementation PresentationDocument21 pagesPart M Implementation Presentationbudiaero100% (1)

- Labrel Module 3 DigestsDocument4 pagesLabrel Module 3 DigestsAdriannaNo ratings yet

- Income Tax Systems: A) Global Tax SystemDocument10 pagesIncome Tax Systems: A) Global Tax Systemmyka.No ratings yet