Professional Documents

Culture Documents

Ryanair

Uploaded by

Zefi KtsiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ryanair

Uploaded by

Zefi KtsiCopyright:

Available Formats

Ryanairs large cash position is weighing on asset turns and CFROI

CLARITY IS CONFIDENCE

HOLT

Removing excess cash significantly improves CFROI to unrivalled levels

2011 asset turns im prove

by +30% com pared to the

default scenario

CLARITY IS CONFIDENCE

HOLT

New plane order and cash redistribution scenario

As per com pany disclosure:

Order of 175 new Boeing 737-800 placed in March 2013

Of the total order, 75 planes will serve as replacements with the remaining 100 planes representing

incremental capex

Delivery of planes to commence in FY13 with the total delivery being spread out over 6 years to

FY2018

Assum ptions:

Price of 30m/plane (~50% of current estimated list price) for a total estimated order value of 5.3bn

(in line with previous large order)

20% of order value paid upfront in cash

Capex post March 2019 FY is assumed to be primarily maintenance capex, ignoring the potential for

additional orders of the new Boeing 737MAX

Additional cash sitting on the balance sheet is assumed to be redistributed to shareholders over the

next 10 year, gradually reducing the large cash balance

CLARITY IS CONFIDENCE

HOLT

New plane order and cash redistribution scenario more growth needed for significant upside*

Value creation through improved

CFROI and strong growth

Lower cash balance and low costs for

new planes driving asset turns higher

CLARITY IS CONFIDENCE

Growth from current order

and reduced cash balance

not enough to warrant

significant upside

4

*NOTE: Cash assumed to be redistributed to shareholders does not form part of the companys valuation.

HOLT

Global Market Com m entary Disclaim er *

References to Credit Suisse include all of the subsidiaries and affiliates of Credit Suisse AG operating under its investment banking division. For more information on our structure, please follow the attached link: https://www.creditsuisse.com/who_we_are/en/what_we_do.jsp

This material has been prepared by individual traders or sales personnel of Credit Suisse and not by Credit Suisse's research department. It is intended only to provide observations and views of these traders or sales personnel,

which may be different from, or inconsistent with, the observations and views of Credit Suisse research department analysts, other Credit Suisse traders or sales personnel, or the proprietary positions of Credit Suisse. Observations

and views expressed herein may be changed by the trader or sales personnel at any time without notice. Credit Suisse accepts no liability for loss arising from the use of this material.

This material does not purport to contain all of the information that an interested party may desire and, in fact, provides only a limited view of a particular market. It is not investment research, or a research recommendation, as it does

not constitute substantive research or analysis. The information provided is not intended to provide a sufficient basis on which to make an investment decision and is not a personal recommendation. While it has been obtained from or

based upon sources believed by the trader or sales personnel to be reliable, each of the trader or sales personnel and Credit Suisse does not represent or warrant its accuracy or completeness and is not responsible for losses or

damages arising out of errors, omissions or changes in market factors.

This material is provided for informational purposes and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. It is directed exclusively at Credit Suisse's market professional

and institutional investor clients as defined by the rules of the relevant regulatory authority. It is not intended for private customers and such persons should not rely on this material. Moreover, any investment or service to which this

material may relate will not be made available by Credit Suisse to such private customers.

This material may have previously been communicated to the Credit Suisse trading desk or other Credit Suisse clients. You should assume that the trading desk makes markets and/or currently maintains positions in any of the

securities mentioned above. Credit Suisse may, from time to time, participate or invest in transactions with issuers of securities that participate in the markets referred to herein, perform services for or solicit business from such

issuers, and/or have a position or effect transactions in the securities or derivatives thereof. Information provided on any trades executed with Credit Suisse will not constitute an official confirmation of the trade details, and all

preliminary trade report information is subject to our formal written confirmation.

FOR IMPORTANT DISCLOSURES on companies covered in Credit Suisse Investment Banking Division research reports, please see www.credit-suisse.com/researchdisclosures. To obtain a copy of the most recent Credit Suisse

research on any company mentioned please contact your sales representative or go to http://www.credit-suisse.com/researchandanalytics.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. Backtested, hypothetical or simulated

performance results have inherent limitations. Simulated results are achieved by the retroactive application of a backtested model itself designed with the benefit of hindsight. The backtesting of performance differs from the actual

account performance because the investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved. Alternative modeling techniques or

assumptions might produce significantly different results and prove to be more appropriate. Past hypothetical backtest results are neither an indicator nor a guarantee of future returns. Actual results will vary from the analysis.

Investment principal on securities can be eroded depending on sale price or market price. In addition, there are securities on which investment principal may be eroded due to changes in redemption amounts. Care is required when

investing in such instruments.

HOLT Disclaim er

The HOLT methodology does not assign ratings or a target price to a security. It is an analytical tool that involves use of a set of proprietary quantitative algorithms and warranted value calculations, collectively called the HOLT

valuation model, that are consistently applied to all the companies included in its database. Third-party data (including consensus earnings estimates) are systematically translated into a number of default variables and incorporated into

the algorithms available in the HOLT valuation model. The source financial statement, pricing, and earnings data provided by outside data vendors are subject to quality control and may also be adjusted to more closely measure the

underlying economics of firm performance. These adjustments provide consistency when analyzing a single company across time, or analyzing multiple companies across industries or national borders. The default scenario that is

produced by the HOLT valuation model establishes a warranted price for a security, and as the third-party data are updated, the warranted price may also change. The default variables may also be adjusted to produce alternative

warranted prices, any of which could occur. Additional information about the HOLT methodology is available on request

CFROI, CFROE, HOLT, HOLT Lens, HOLTfolio, HOLTSelect, HS60, HS40, ValueSearch, AggreGator, Signal Flag, Forecaster, Clarity is Confidence and Powered by HOLT are trademarks or registered trademarks of Credit

Suisse Group AG or its affiliates in the United States and other countries.

HOLT is a corporate performance and valuation advisory service of Credit Suisse.

2012 Credit Suisse Group AG and its subsidiaries and affiliates. All rights reserved.

* For region specific disclosures, including information about applicable registrations and certain regulatory disclosures, please follow the links below:

Americas: https://www.credit-suisse.com/legal/en/ib/market_commentary.jsp

Europe: https://www.credit-suisse.com/legal/en/ib/europe.jsp (Credit Suisse Securities (Europe) Limited is authorized and regulated by the Financial Services Authority.)

Asia: https://www.credit-suisse.com/legal/en/ib/market_commentary_disclaimer_asia.jsp

General investors in Japan should open the following link and read it:

https://www.credit-suisse.com/jp/investment_banking/ja/disclaimer/

CLARITY IS CONFIDENCE

HOLT

You might also like

- Holt Ov 0402Document15 pagesHolt Ov 0402Zefi KtsiNo ratings yet

- Healthcare 11-8-12Document17 pagesHealthcare 11-8-12Zefi KtsiNo ratings yet

- F5 NetworksDocument10 pagesF5 NetworksZefi KtsiNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookZefi KtsiNo ratings yet

- Top PowerPoint Keyboard Shortcuts for FinanceDocument2 pagesTop PowerPoint Keyboard Shortcuts for FinanceSachin JainNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BIT 4107 Mobile Application DevelopmentDocument136 pagesBIT 4107 Mobile Application DevelopmentVictor NyanumbaNo ratings yet

- British Universal Steel Columns and Beams PropertiesDocument6 pagesBritish Universal Steel Columns and Beams PropertiesjagvishaNo ratings yet

- Philippine Army BDU BidDocument2 pagesPhilippine Army BDU BidMaria TeresaNo ratings yet

- eHMI tool download and install guideDocument19 pageseHMI tool download and install guideNam Vũ0% (1)

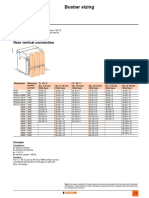

- Busbar sizing recommendations for Masterpact circuit breakersDocument1 pageBusbar sizing recommendations for Masterpact circuit breakersVikram SinghNo ratings yet

- AA ActivitiesDocument4 pagesAA ActivitiesSalim Amazir100% (1)

- Combined Set12Document159 pagesCombined Set12Nguyễn Sơn LâmNo ratings yet

- Mil STD 2154Document44 pagesMil STD 2154Muh SubhanNo ratings yet

- Cableado de TermocuplasDocument3 pagesCableado de TermocuplasRUBEN DARIO BUCHELLYNo ratings yet

- Factors of Active Citizenship EducationDocument2 pagesFactors of Active Citizenship EducationmauïNo ratings yet

- Consumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaDocument16 pagesConsumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaSundaravel ElangovanNo ratings yet

- Technical Specification of Heat Pumps ElectroluxDocument9 pagesTechnical Specification of Heat Pumps ElectroluxAnonymous LDJnXeNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlhajarawNo ratings yet

- 100 Training Games - Kroehnert, GaryDocument180 pages100 Training Games - Kroehnert, GarywindsorccNo ratings yet

- Gapped SentencesDocument8 pagesGapped SentencesKianujillaNo ratings yet

- Assembly ModelingDocument222 pagesAssembly ModelingjdfdfererNo ratings yet

- 2010 HD Part Cat. LBBDocument466 pages2010 HD Part Cat. LBBBuddy ButlerNo ratings yet

- Propoxur PMRADocument2 pagesPropoxur PMRAuncleadolphNo ratings yet

- Joining Instruction 4 Years 22 23Document11 pagesJoining Instruction 4 Years 22 23Salmini ShamteNo ratings yet

- A Database of Chromatographic Properties and Mass Spectra of Fatty Acid Methyl Esters From Omega-3 ProductsDocument9 pagesA Database of Chromatographic Properties and Mass Spectra of Fatty Acid Methyl Esters From Omega-3 ProductsmisaelNo ratings yet

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDocument8 pagesCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiNo ratings yet

- Masteringphys 14Document20 pagesMasteringphys 14CarlosGomez0% (3)

- Dance Appreciation and CompositionDocument1 pageDance Appreciation and CompositionFretz Ael100% (1)

- Applied Statics and Strength of Materials 6th Edition Ebook PDFDocument61 pagesApplied Statics and Strength of Materials 6th Edition Ebook PDFteri.sanborn87695% (44)

- Paradigms of ManagementDocument2 pagesParadigms of ManagementLaura TicoiuNo ratings yet

- Arta Kelmendi's resume highlighting education and work experienceDocument2 pagesArta Kelmendi's resume highlighting education and work experienceArta KelmendiNo ratings yet

- BenchmarkDocument4 pagesBenchmarkKiran KumarNo ratings yet

- MA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Document10 pagesMA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Sit LucasNo ratings yet

- Longman ESOL Skills For Life - ShoppingDocument4 pagesLongman ESOL Skills For Life - ShoppingAstri Natalia Permatasari83% (6)

- Jesd8 15aDocument22 pagesJesd8 15aSridhar PonnurangamNo ratings yet