Professional Documents

Culture Documents

A141 Tutorial 4 Bkal1013

Uploaded by

CyrilraincreamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A141 Tutorial 4 Bkal1013

Uploaded by

CyrilraincreamCopyright:

Available Formats

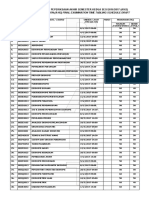

BKAL1013 A141

TUTORIAL # 4

1.

RM6,860.00

RM6,982.50

RM7,000.00

RM6,985.00

Cost of merchandise sold would be classified as a (an):

A.

B.

C.

D.

6.

RM11,662

RM11,672

RM12,250

RM11,172

Merchandise with an invoice price of RM7,000 is purchased with terms of 2/10, n/30, FOB shipping

point. Transportation costs paid by the buyer were RM125. What is the cost of the merchandise

purchased if payment is made during the discount period?

A.

B.

C.

D.

5.

shows gross profit but not income from operations.

shows both gross profit and income from operations.

shows neither gross profit nor income from operations.

shows income from operations but not gross profit.

A sales invoice included the following information: merchandise price, RM12,000; transportation,

RM500; terms 2/10, n/eom, FOB shipping point. Assuming that a credit for merchandise returned of

RM600 is granted prior to payment, that the transportation is prepaid by the seller, and that the

invoice is paid within the discount period, what is the amount of cash received by the seller?

A.

B.

C.

D.

4.

debit Cash, credit Accounts Receivable.

debit Accounts Receivable, credit Sales.

debit Accounts Receivable, credit Cash.

debit Merchandise Inventory, credit Accounts Payable.

Multiple-step Statement of Profit or Loss and Others Comprehensive Incomes:

A.

B.

C.

D.

3.

DUE DATE: 13 November 2014

When a corporation sells merchandise and the terms are FOB shipping point and pays the shipping

costs, the seller would record the transportation costs with the following entry:

A.

B.

C.

D.

2.

th

asset.

expense.

liability.

revenue.

The discount period for credit terms of 1/10, n/30 is:

A.

B.

C.

D.

1 day.

10 days.

20 days.

30 days.

BKAL1013 A141

7.

Freight costs incurred by the seller are recorded in the:

A.

B.

C.

D.

8.

The sales discount is based on:

A.

B.

C.

D.

9.

statement of changes in owners equity.

statement of retained earnings.

statement of financial position.

statement of cash flows.

Information about the accounting policies adopted in preparing the financial statements are explained

in the:

A.

B.

C.

D.

13.

Reflect prospective cash receipts to investors and creditors.

Reflect the companys resources and claim to its resources.

Reflect future investment earnings.

Reflect prospective cash flows to the company.

If you were analyzing a corporations shareholders equity, and you wanted to determine how many

units of common share were issued during the current year, the best financial statement to review

would be the:

A.

B.

C.

D.

12.

Sales Returns and Allowances and Accounts Receivable

Accounts Receivable and Cost of Merchandise Sold

Merchandise Inventory and Cost of Merchandise Sold

Sales Returns and Allowances and Merchandise Inventory

Which of the following is NOT an objective of financial reporting?

A.

B.

C.

D.

11.

invoice price plus transportation costs.

invoice price less discount.

invoice price plus transportation costs less returns and allowances.

invoice price less returns and allowances.

In a perpetual inventory system, what accounts are credited when a customer returns merchandise to

the seller?

A.

B.

C.

D.

10.

sales account.

cost of merchandise sold account.

transportation in account.

transportation out account.

statement of changes in owners equity.

notes to the financial statements.

statement of cash flow.

corporate governance statement.

How often is the annual report being issued?

A.

B.

C.

D.

Every six month

Every month

Once a year

None of the above is correct

BKAL1013 A141

14. Credit terms are 3/12, n/30 indicates that the buyer is:

a.

b.

c.

d.

Allowed a 30% discount if payment is made within 12 days

Allowed a 12% discount if payment is made within 30 days

Allowed a 3% discount if payment is made within 12 days

Allowed a 3% discount if payment is made within 30 days

15. A merchandiser purchases inventory on account under a perpetual inventory system with terms of

3/15, n/45. The merchandiser would :

A.

B.

C.

D.

Debit Purchase Discounts on date of purchase if the discount is not taken

Debit Purchase Discounts on date of purchase if the discount is taken

Credit Inventory on date of payment if discount is not taken

Credit Inventory on date of payment if discount is taken

16. Merchandise subject terms 2/10, n/ 30, FOB destination, is sold on account to a customer for

RM15,000. The purchaser returns RM2,000 of merchandise within the discount period. Assuming

payment is made within the discount period, what is the amount of cash discount allowable?

A.

B.

C.

D.

RM300

RM260

RM400

RM150

17. A purchase return or allowance under a perpetual inventory system is credited to:

A.

B.

C.

D.

Inventory

Account Receivable

Account Payable

Purchases

18. The major revenue of merchandiser is _________ while the major expense(s) is (are) ____________.

A.

B.

C.

D.

sales revenue, cost of goods sold

gross profit, operating expenses

sales revenue, operating expenses

income from operation, cost of goods sold

19. The buyer is responsible for the shipping costs when the shipping is:

A.

B.

C.

D.

FOB shipping point

COD shopping point

FOB destination

COD destination

20. Which of the following account would the seller debit when the purchaser takes advantage of credit

terms within the discount period?

A. Purchase Discount

B. Purchase Returns and Allowances

C. Sales Returns and Allowances

BKAL1013 A141

D. Sales Discount

21. Under a perpetual inventory system, the entry to record the cost of goods sold would include a debit

to:

A.

B.

C.

D.

Cost of Goods Sold and credit to Inventory for the cost of the inventory

Inventory and credit to Sales Revenue for the retail price of the inventory

Cost of Goods Sold and credit to Inventory for the retail price of the inventory

Inventory and credit to Sales Revenue for the cost of the inventory

Use the following data for Questions 22 to 27.

MyGoodfellas Trading has the following information:

Net sales

Gross purchases

Gross profit

Ending inventory

Sales return

Purchases returns

22.

What is the gross sales amount?

A.

B.

C.

D.

23.

RM600,000

RM690,000

RM693,000

RM707,000

What is the cost of goods sold?

A.

B.

C.

D.

25.

RM1,007,000

RM1,010,000

RM1,100,000

RM1,400,000

What is the net purchases amount?

A.

B.

C.

D.

24.

RM

1,000,000

700,000

400,000

100,000

10,000

7,000

RM300,000

RM400,000

RM600,000

RM900,000

Herry Pottery Maker Enterprise purchased goods having a list price of RM36,000, a trade discount of

30%, and a cash discount of 5%. The cash payment to settle the account within the discount period

is:

A. RM23,400

B. RM23,940

BKAL1013 A141

C. RM25,200

D. RM34,200

26.

If merchandised sold on account is returned, the seller may inform the buyer of the

on the item by issuing:

A.

B.

C.

D.

27.

an invoice

a receipt

a credit note

a debit note

Which of the following is a FALSE statement about a multiple-step income statement?

A.

B.

C.

D.

Operating expenses are often classified as selling and administrative expenses

There may be a section for operating assets

There may be a section for non-operating activities

There is a section for cost of goods sold

reduction

BKAL1013 A141

TUTORIAL # 4

DUE DATE: 13th November 2014

MATRIC NO: _____________

NAME:

GROUP: _____

POSITION NO: ______

______________________________________

ANSWER:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Tutorial PerakaunanDocument5 pagesTutorial PerakaunanNureenKamalNo ratings yet

- A172 Tutorial 3 QuestionDocument7 pagesA172 Tutorial 3 Questionmpnaidu13111998100% (3)

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Merchandising Quiz 1Document5 pagesMerchandising Quiz 1Sheldon Bazinga100% (1)

- Accounting For Merchandising BusinessDocument6 pagesAccounting For Merchandising BusinessElla Acosta100% (1)

- ĐỀ nklt chương 6Document8 pagesĐỀ nklt chương 6Mai NgọcNo ratings yet

- A172 Tutorial 3 QuestionDocument10 pagesA172 Tutorial 3 Questionlaurenyap100% (1)

- Tutorial (Merchandising Without Answers)Document18 pagesTutorial (Merchandising Without Answers)Luize Nathaniele SantosNo ratings yet

- Bài-luyện-tập-NLKT-chương-6-Ms-Trang (1)Document8 pagesBài-luyện-tập-NLKT-chương-6-Ms-Trang (1)Phuong Anh HoangNo ratings yet

- Final Exam Fundamentals of AccountingDocument7 pagesFinal Exam Fundamentals of AccountingdumpanonymouslyNo ratings yet

- Periodic PerpetualDocument25 pagesPeriodic PerpetualNunung Nurul100% (1)

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessDocument13 pagesACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessJerric CristobalNo ratings yet

- Financial Accounting Chapter 5 QuizDocument6 pagesFinancial Accounting Chapter 5 QuizZenni T XinNo ratings yet

- Assignment 14 Ok TDocument10 pagesAssignment 14 Ok TJu RaizahNo ratings yet

- REVIEWER - Basic MERCHANDISING Accounting2023Document9 pagesREVIEWER - Basic MERCHANDISING Accounting2023hello hayaNo ratings yet

- Exercise For Chapter 5 6Document16 pagesExercise For Chapter 5 6Ngọc Ánh VũNo ratings yet

- C1 Financial ReportingDocument23 pagesC1 Financial ReportingSteeeeeeeephNo ratings yet

- Handouts Acctg 1 - MerchandisingDocument13 pagesHandouts Acctg 1 - MerchandisingJoannah Marie OliverosNo ratings yet

- Tutorial 3 Merchandising-1Document5 pagesTutorial 3 Merchandising-1minzheNo ratings yet

- A122 Exercises QDocument30 pagesA122 Exercises QBryan Jackson100% (1)

- Tutorial 3Document3 pagesTutorial 3uyieeNo ratings yet

- ACCT. Cycle Reviewer 2Document7 pagesACCT. Cycle Reviewer 2Rosemarie GoNo ratings yet

- FDNACCT Quiz-2 Answer-Key Set-ADocument4 pagesFDNACCT Quiz-2 Answer-Key Set-APia DigaNo ratings yet

- Revenue IAS 18Document7 pagesRevenue IAS 18Chota H MpukuNo ratings yet

- Chapter 6Document43 pagesChapter 6Awrangzeb AwrangNo ratings yet

- Accounting 201 Chapter 5 True-False and Multiple Choice QuestionsDocument4 pagesAccounting 201 Chapter 5 True-False and Multiple Choice QuestionsBig WillyNo ratings yet

- Cost RecoveryDocument3 pagesCost RecoveryObe AbsinNo ratings yet

- B ACTG111 4 Practice Problems MerchandisingDocument16 pagesB ACTG111 4 Practice Problems Merchandisinghotdog kaNo ratings yet

- 4 Exam Part 2Document4 pages4 Exam Part 2RJ DAVE DURUHANo ratings yet

- CH 8 - Merchandising OperationsDocument70 pagesCH 8 - Merchandising OperationsJem BobilesNo ratings yet

- Financial Ratios TutorialDocument8 pagesFinancial Ratios TutorialCyrilraincream0% (1)

- Set A Merchandising Vat QuizDocument6 pagesSet A Merchandising Vat QuizJan Allyson BiagNo ratings yet

- Chapter 6: Accounting For Merchandising Activities: PART1: The Following Statement Is True or False?Document24 pagesChapter 6: Accounting For Merchandising Activities: PART1: The Following Statement Is True or False?Lưu HoaNo ratings yet

- SF Comprehensive Quiz 1Document10 pagesSF Comprehensive Quiz 1Francis Raagas40% (5)

- Self Study Chapter 18 2Document18 pagesSelf Study Chapter 18 2Scott ShearerNo ratings yet

- A141 Tutorial 2 Bkal1013Document7 pagesA141 Tutorial 2 Bkal1013CyrilraincreamNo ratings yet

- ACC124 Accounts ReceivableDocument29 pagesACC124 Accounts Receivableジェロスミ プエブラスNo ratings yet

- Acctg 11 2nd Term Final ExamDocument13 pagesAcctg 11 2nd Term Final ExamJanet AnotdeNo ratings yet

- Polytechnic University of the Philippines COLLEGE of ACCOUNTANCY and FINANCE Department of Accountancy – Basic Accounting Sta. Mesa, City of Manila SIMULATED FINAL EXAMINATION ACCO 2016Document10 pagesPolytechnic University of the Philippines COLLEGE of ACCOUNTANCY and FINANCE Department of Accountancy – Basic Accounting Sta. Mesa, City of Manila SIMULATED FINAL EXAMINATION ACCO 2016Zek DannugNo ratings yet

- Basic Acctg MCQDocument8 pagesBasic Acctg MCQJohn AceNo ratings yet

- MCQs Problems For Merchandising Business - For UploadDocument8 pagesMCQs Problems For Merchandising Business - For UploadIrish Trisha PerezNo ratings yet

- 0 Accounting For Merchandising BusinessDocument114 pages0 Accounting For Merchandising BusinessIan RanilopaNo ratings yet

- Merchandising OperationsDocument39 pagesMerchandising OperationsRyan Jeffrey Padua Curbano50% (2)

- 5.4 Merchandising Answer Key PDFDocument7 pages5.4 Merchandising Answer Key PDFamichuNo ratings yet

- Module 9 - Merchandising Accounting CycleDocument62 pagesModule 9 - Merchandising Accounting CycleRandolph Collado100% (1)

- IFA Chapter 3Document17 pagesIFA Chapter 3Suleyman TesfayeNo ratings yet

- Cash Discounts & Trade Discounts I. DrillDocument3 pagesCash Discounts & Trade Discounts I. DrillArny MaynigoNo ratings yet

- If, Cost of Machine Rs.400, 000 Useful Life 5 Years Rate of Depreciation 40%Document13 pagesIf, Cost of Machine Rs.400, 000 Useful Life 5 Years Rate of Depreciation 40%Narang NewsNo ratings yet

- Financial Accounting Canadian 5Th Edition Harrison Test Bank Full Chapter PDFDocument54 pagesFinancial Accounting Canadian 5Th Edition Harrison Test Bank Full Chapter PDFlucnathanvuz6hq100% (11)

- Accouting Test V2.1finalDocument5 pagesAccouting Test V2.1finalShamel LaylaNo ratings yet

- PBM Accounting Quiz on Merchandising BusinessesDocument4 pagesPBM Accounting Quiz on Merchandising BusinessesAli Shaharyar ShigriNo ratings yet

- A141 Tutorial 1 BkalDocument7 pagesA141 Tutorial 1 BkalCyrilraincreamNo ratings yet

- ACC 211 - Review 2 (Chapters 5, 6, & 7)Document4 pagesACC 211 - Review 2 (Chapters 5, 6, & 7)Brennan Patrick WynnNo ratings yet

- Financial Accounting Midterm ExamDocument4 pagesFinancial Accounting Midterm ExamMary Joy SumapidNo ratings yet

- Acct Lesson 9Document9 pagesAcct Lesson 9Gracielle EspirituNo ratings yet

- Quiz - Merchandising BSA 101 2015-2016 With SolutionDocument7 pagesQuiz - Merchandising BSA 101 2015-2016 With SolutionNia BranzuelaNo ratings yet

- Chapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document40 pagesChapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- OSX FinancialAccounting ISM Ch06Document65 pagesOSX FinancialAccounting ISM Ch06Kash AlveroNo ratings yet

- Effect of Sickness On WorkplaceDocument6 pagesEffect of Sickness On WorkplaceCyrilraincreamNo ratings yet

- Resistance To ChangeDocument8 pagesResistance To ChangeCyrilraincreamNo ratings yet

- A Knowledge Base Representing Porter's Five Forces ModelDocument6 pagesA Knowledge Base Representing Porter's Five Forces ModelhinirobNo ratings yet

- How To Increase Learning TransferDocument2 pagesHow To Increase Learning TransferCyrilraincreamNo ratings yet

- Open Systems TheoryDocument10 pagesOpen Systems TheoryCyrilraincream100% (1)

- Chapter 5 Diagnosis of ChangeDocument5 pagesChapter 5 Diagnosis of ChangeCyrilraincreamNo ratings yet

- Strategic Management and Strategic Competitiveness: Student VersionDocument16 pagesStrategic Management and Strategic Competitiveness: Student VersionCyrilraincreamNo ratings yet

- Appreciative InquiryDocument19 pagesAppreciative InquiryCyrilraincreamNo ratings yet

- HR IN PUBLIC SECTOR Past YearDocument4 pagesHR IN PUBLIC SECTOR Past YearCyrilraincreamNo ratings yet

- 1 PB PDFDocument12 pages1 PB PDFAknaf Ismed GanieNo ratings yet

- A Peek Into Goodyears Ergonomic SandboxDocument3 pagesA Peek Into Goodyears Ergonomic SandboxCyrilraincreamNo ratings yet

- Analyzing Open Source Business With Porter's FiveDocument4 pagesAnalyzing Open Source Business With Porter's FiveCyrilraincreamNo ratings yet

- BSMH 3103 - PPT 3Document24 pagesBSMH 3103 - PPT 3Cyrilraincream0% (1)

- Boeings High-Flying Approach To HR Planning RecruitmentDocument1 pageBoeings High-Flying Approach To HR Planning RecruitmentCyrilraincream50% (2)

- How To Create An Effective Training Program 8 Steps To SuccessDocument32 pagesHow To Create An Effective Training Program 8 Steps To SuccessCyrilraincreamNo ratings yet

- The Sims 4 CheatDocument1 pageThe Sims 4 CheatCyrilraincreamNo ratings yet

- JWP Draf A162 UumDocument18 pagesJWP Draf A162 UumCyrilraincreamNo ratings yet

- Factors Influencing Consumer Ethical Decision MakingDocument11 pagesFactors Influencing Consumer Ethical Decision MakingCyrilraincreamNo ratings yet

- Influence of Business Ethics Judgments of Malaysiaa AccountantsDocument16 pagesInfluence of Business Ethics Judgments of Malaysiaa AccountantsCyrilraincreamNo ratings yet

- Ethics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFDocument13 pagesEthics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFCyrilraincreamNo ratings yet

- BWRR3043 2015/2016 A152Document7 pagesBWRR3043 2015/2016 A152CyrilraincreamNo ratings yet

- Review Article Guidelines for Students on RotationDocument16 pagesReview Article Guidelines for Students on RotationZama MakhathiniNo ratings yet

- Topic 5 BEEB1013Document20 pagesTopic 5 BEEB1013CyrilraincreamNo ratings yet

- Ethics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFDocument13 pagesEthics Practices of Malaysian Public Listed Companies - Empirical Evidence PDFCyrilraincreamNo ratings yet

- Impact of Reward On Job Satisfaction and Employee RetentionDocument8 pagesImpact of Reward On Job Satisfaction and Employee RetentionCyrilraincreamNo ratings yet

- SQQS1013 Chapter 5Document23 pagesSQQS1013 Chapter 5Cyrilraincream100% (1)

- CorruptionDocument3 pagesCorruptionCyrilraincreamNo ratings yet

- Citing Secondary Sources (Using APA 6TH Edition)Document1 pageCiting Secondary Sources (Using APA 6TH Edition)CyrilraincreamNo ratings yet

- Labour Law LegislationDocument12 pagesLabour Law LegislationCyrilraincreamNo ratings yet

- CalendarDocument2 pagesCalendarSaya FarezNo ratings yet

- 1532407706ceb Long Term Generation Expansion Plan 2018-2037 PDFDocument230 pages1532407706ceb Long Term Generation Expansion Plan 2018-2037 PDFTirantha BandaraNo ratings yet

- MCQ Banking, Finance and Economy TestDocument7 pagesMCQ Banking, Finance and Economy Testarun xornorNo ratings yet

- Law No 28 Year 2007 (UU KUP English)Document85 pagesLaw No 28 Year 2007 (UU KUP English)cariiklan100% (1)

- Simple Annuity Activity (Math of Investment)Document1 pageSimple Annuity Activity (Math of Investment)RCNo ratings yet

- Policy On Emergency LoanDocument3 pagesPolicy On Emergency LoanLancemachang EugenioNo ratings yet

- 2122 s3 Bafs Notes STDocument3 pages2122 s3 Bafs Notes STKiu YipNo ratings yet

- Fin 580 WK 2 Paper - Team CDocument5 pagesFin 580 WK 2 Paper - Team Cchad salcidoNo ratings yet

- Assignment 1Document2 pagesAssignment 1Babar Ali Roomi0% (1)

- Opinion - Mary Mcculley V US Bank Homeowner WinsDocument28 pagesOpinion - Mary Mcculley V US Bank Homeowner WinsmcculleymaryNo ratings yet

- SGCA Rules On Moneys Held in Customers' Segregated Accounts: Speed ReadDocument5 pagesSGCA Rules On Moneys Held in Customers' Segregated Accounts: Speed ReadBernard ChungNo ratings yet

- RCBC vs Alfa RTW Manufacturing Corp Bank Loan Dispute DecisionDocument6 pagesRCBC vs Alfa RTW Manufacturing Corp Bank Loan Dispute DecisionAlecsandra ChuNo ratings yet

- 2nd Sem PDM SyllabusDocument11 pages2nd Sem PDM SyllabusVinay AlagundiNo ratings yet

- Real Estate - Understanding U.S. Real Estate DebtDocument16 pagesReal Estate - Understanding U.S. Real Estate DebtgarchevNo ratings yet

- Project Report On "Role of Banks in International Trade": Page - 1Document50 pagesProject Report On "Role of Banks in International Trade": Page - 1Adarsh Rasal100% (1)

- Book Review The TCS Story ... and BeyondDocument4 pagesBook Review The TCS Story ... and BeyondIshanNo ratings yet

- Sebi Grade A Exam: Paper 2 Questions With SolutionsDocument34 pagesSebi Grade A Exam: Paper 2 Questions With SolutionsnitinNo ratings yet

- Bikash 4Document16 pagesBikash 4Bikash Kumar NayakNo ratings yet

- Strategic Plan of Indian Tobacco Company (ItcDocument27 pagesStrategic Plan of Indian Tobacco Company (ItcJennifer Smith100% (1)

- Leadership in Change Management Group WorkDocument11 pagesLeadership in Change Management Group WorkRakinduNo ratings yet

- Chamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesDocument30 pagesChamika's Style: Hairstylist: Braids, Twist, Cornrows, Those Type of Hair StylesUmarNo ratings yet

- 216 - JSAW Annual Report 2013 14Document137 pages216 - JSAW Annual Report 2013 14utalentNo ratings yet

- IDirect Zomato IPOReviewDocument13 pagesIDirect Zomato IPOReviewSnehashree SahooNo ratings yet

- SS 2 SlidesDocument31 pagesSS 2 SlidesDart BaneNo ratings yet

- Steven - Perkins DRUNK TRADERDocument19 pagesSteven - Perkins DRUNK TRADERjigarchhatrolaNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- ACST101 Final Exam S1 2015 QuestionsDocument20 pagesACST101 Final Exam S1 2015 Questionssamathuva12No ratings yet

- Eco 411 Problem Set 1: InstructionsDocument4 pagesEco 411 Problem Set 1: InstructionsUtkarsh BarsaiyanNo ratings yet

- Common Law Distress On Third PartiesDocument7 pagesCommon Law Distress On Third Partiesnorris1234No ratings yet

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDocument6 pagesCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaNo ratings yet

- Xisaab XidhDocument1 pageXisaab XidhAbdiNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Dot Complicated: Untangling Our Wired LivesFrom EverandDot Complicated: Untangling Our Wired LivesRating: 3 out of 5 stars3/5 (2)

- Blood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeFrom EverandBlood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeRating: 4.5 out of 5 stars4.5/5 (335)

- Women's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesFrom EverandWomen's Work: The First 20,000 Years: Women, Cloth, and Society in Early TimesRating: 4.5 out of 5 stars4.5/5 (190)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- So You Want to Start a Podcast: Finding Your Voice, Telling Your Story, and Building a Community that Will ListenFrom EverandSo You Want to Start a Podcast: Finding Your Voice, Telling Your Story, and Building a Community that Will ListenRating: 4.5 out of 5 stars4.5/5 (35)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Becoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysFrom EverandBecoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysRating: 4.5 out of 5 stars4.5/5 (18)

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewFrom EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewRating: 4.5 out of 5 stars4.5/5 (25)

- Copywriting Secrets: How Everyone Can Use the Power of Words to Get More Clicks, Sales, and Profits...No Matter What You Sell or Who You Sell It To!From EverandCopywriting Secrets: How Everyone Can Use the Power of Words to Get More Clicks, Sales, and Profits...No Matter What You Sell or Who You Sell It To!Rating: 4.5 out of 5 stars4.5/5 (20)

- The Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryFrom EverandThe Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryRating: 4.5 out of 5 stars4.5/5 (40)

- Build: An Unorthodox Guide to Making Things Worth MakingFrom EverandBuild: An Unorthodox Guide to Making Things Worth MakingRating: 5 out of 5 stars5/5 (121)

- How to Make a Killing: Blood, Death and Dollars in American MedicineFrom EverandHow to Make a Killing: Blood, Death and Dollars in American MedicineNo ratings yet

- Bottle of Lies: The Inside Story of the Generic Drug BoomFrom EverandBottle of Lies: The Inside Story of the Generic Drug BoomRating: 4 out of 5 stars4/5 (44)

- Competing Against Luck: The Story of Innovation and Customer ChoiceFrom EverandCompeting Against Luck: The Story of Innovation and Customer ChoiceRating: 4.5 out of 5 stars4.5/5 (143)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)