Professional Documents

Culture Documents

Term 2 Mid Sem Manac

Uploaded by

Ankur ShrimaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Term 2 Mid Sem Manac

Uploaded by

Ankur ShrimaliCopyright:

Available Formats

10/28/2015

CostandCostClassifications|Types|ManagerialAccounting

AccountingExplained

Home>ManagerialAccounting>CostClassifications

CostandCostClassifications

Costisasacrificeofresourcestoobtainabenefitoranyotherresource.Forexampleinproductionofa

car,wesacrificematerial,electricity,thevalueofmachine'slife(depreciation),andlaborwagesetc.Thus

theseareourcosts.

Costsareusuallyclassifiedasfollows:

ProductCostsVs.PeriodCosts

Productcostsarecostsassignedtothemanufactureofproductsandrecognizedforfinancialreporting

whensold.Theyincludedirectmaterials,directlabor,factorywages,factorydepreciation,etc.

Periodcostsareontheotherhandareallcostsotherthanproductcosts.Theyincludemarketingcosts

andadministrativecosts,etc.

BreakupofProductCosts

Theproductcostsarefurtherclassifiedinto:

Directmaterials:Representsthecostofthematerialsthatcanbeidentifieddirectlywiththe

productatreasonablecost.Forexample,costofpaperinnewspaperprinting,costof

Directlabor:Representsthecostofthelabortimespentonthatproduct,forexamplecostof

thetimespentbyapetroleumengineeronanoilrig,etc.

Manufacturingoverhead:Representsallproductioncostsexceptthosefordirectlaborand

directmaterials,forexamplethecostofanaccountant'stimeinanorganization,depreciationon

equipment,electricity,fuel,etc.

Theproductcoststhatcanbespecificallyidentifiedwitheachunitofaproductarecalleddirectproduct

costs.Whereasthosewhichcannotbetracedtoaspecificunitareindirectproductcosts.Thusdirect

materialcostanddirectlaborcostaredirectproductcostswhereasmanufacturingoverheadcostis

indirectproductcost.

PrimeCostsVs.ConversionCosts

Primecostsarethesumofalldirectcostssuchasdirectmaterials,directlaborandanyotherdirectcosts.

Conversioncostsareallcostsincurredtoconverttherawmaterialstofinishedproductsandtheyequal

thesumofdirectlabor,otherdirectcosts(otherthanmaterials)andmanufacturingoverheads.

CostClassificationDiagram

http://accountingexplained.com/managerial/costs/

1/3

10/28/2015

CostandCostClassifications|Types|ManagerialAccounting

FixedCostsVs.VariableCosts

Fixedcostsarecostswhichremainconstantwithinacertainlevelofoutputorsales.Thiscertainlimit

wherefixedcostsremainconstantregardlessofthelevelofactivityiscalledrelevantrange.Forexample,

depreciationonfixedassets,etc.

Variablecostsarecostswhichchangewithachangeinthelevelofactivity.Examplesincludedirect

materials,directlabor,etc.

SunkCostsVs.OpportunityCosts

Thecostsdiscussedsofararehistoricalcostswhichmeanstheyhavebeenincurredinpastandcannot

beavoidedbyourcurrentdecisions.Relevantinthisregardisanothercostclassification,calledsunk

costs.Sunkcostsarethosecoststhathavebeenirreversiblyincurredorcommittedtheymayalsobe

termedunrecoverablecosts.

Incontrasttosunkcostsareopportunitycostswhicharecostsofapotentialbenefitforegone.For

exampletheopportunitycostofgoingonapicnicisthemoneythatyouwouldhaveearnedinthattime.

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

ProductandPeriodCosts

DirectandIndirectCosts

PrimeandConversionCosts

RelevantvsIrrelevantCosts

CostAccountingSystems

CostAllocation

http://accountingexplained.com/managerial/costs/

2/3

10/28/2015

CostandCostClassifications|Types|ManagerialAccounting

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,918likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costs/

3/3

10/28/2015

CostAccountingSystems|ManagerialAccounting

AccountingExplained

Home>ManagerialAccounting>CostSystems

CostAccountingSystems

Acostaccountingsystem(alsocalledproductcostingsystemorcostingsystem)isaframeworkusedby

firmstoestimatethecostoftheirproductsforprofitabilityanalysis,inventoryvaluationandcostcontrol.

Estimatingtheaccuratecostofproductsiscriticalforprofitableoperations.Afirmmustknowwhich

productsareprofitableandwhichonesarenot,andthiscanbeascertainedonlywhenithasestimated

thecorrectcostoftheproduct.Further,aproductcostingsystemhelpsinestimatingtheclosingvalueof

materialsinventory,workinprogressandfinishedgoodsinventoryforthepurposeoffinancialstatement

preparation.

Therearetwomaincostaccountingsystems:thejobordercostingandtheprocesscosting.

Jobordercostingisacostaccountingsystemthataccumulatesmanufacturingcostsseparatelyfor

eachjob.Itisappropriateforfirmsthatareengagedinproductionofuniqueproductsandspecialorders.

Forexample,itisthecostingaccountingsystemmostappropriateforaneventmanagementcompany,a

nichefurnitureproducer,aproducerofveryhighcostairsurveillancesystem,etc.

Processcostingisacostaccountingsystemthataccumulatesmanufacturingcostsseparatelyforeach

process.Itisappropriateforproductswhoseproductionisaprocessinvolvingdifferentdepartmentsand

costsflowfromonedepartmenttoanother.Forexample,itisthecostaccountingsystemusedbyoil

refineries,chemicalproducers,etc.

Therearesituationswhenafirmusesacombinationoffeaturesofbothjobordercostingandprocess

costing,inwhatiscalledhybridcostaccountingsystem.

Inacostaccountingsystem,costallocationiscarriedoutbasedoneithertraditionalcostingsystemor

activitybasedcostingsystem.

Traditionalcostingsystemcalculatesasingleoverheadrateandappliesittoeachjoborineach

department.

Activitybasedcostingontheotherhand,involvescalculationofactivityrateandapplicationof

overheadcoststoproductsbasedontheirrespectiveactivityusage.

Basedonwhetherthefixedmanufacturingoverheadsarechargedtoproductsornot,costaccounting

systemshavetwovariations:variablecostingandabsorptioncosting.Variablecostingallocatesonly

variablemanufacturingoverheadstoinventories,whileabsorptioncostingallocatesbothvariableand

fixedmanufacturingoverheadstoproducts.Variablecostingcalculatescontributionmargin,while

absorptioncostingcalculatestherelevantgrossprofit.

StillfurtherrefinementtocostingaccountingsystemsincludeJITcosting,backflushcosting.

WrittenbyObaidullahJan,ACA,CFA

http://accountingexplained.com/managerial/costsystems/

1/2

10/28/2015

CostAccountingSystems|ManagerialAccounting

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,919likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/

2/2

10/28/2015

CostAllocation|Concepts|Examples

AccountingExplained

Home>ManagerialAccounting>CostAllocation

CostAllocation

Costallocation(alsocalledcostassignment)istheprocessoffindingcostofdifferentcostobjectssuchas

aproject,adepartment,abranch,acustomer,etc.Itinvolvesidentifyingthecostobject,identifyingand

accumulatingthecoststhatareincurredandassigningthemtothecostobjectonsomereasonablebasis.

Costallocationisimportantbecauseittheprocessthroughwhichcostsincurredinproducingacertain

productorrenderingacertainserviceiscalculated.Ifcostsarenotaccuratelycalculated,abusiness

mightneverknowwhichproductsaremakingmoneyandwhichonesarelosingmoney.Ifcostare

misallocated,abusinessmaybechargingwrongpricetoitscustomersand/oritmightbewasting

resourcesonproductsthatarewronglycategorizedasprofitable.

Mechanism

Typicalcostallocationmechanisminvolves:

Identifyingtheobjecttowhichthecostshavetobeassigned,

Accumulatingthecostsindifferentpools,

Identifyingthemostappropriatebasis/methodforallocatingthecost

Costobject

Costobjectisanitemforwhichabusinessneedtoseparatelyestimatecost.

Examplesofcostobjectincludeabranch,aproductline,aserviceline,acustomer,adepartment,a

brand,aproject,etc.

Costpool

Costpoolistheaccountheadinwhichcostsareaccumulatedforfurtherassignmenttocostobjects.

Examplesofcostpoolsincludefactoryrent,insurance,machinemaintenancecost,factoryfuel,etc.

Selectionofcostpooldependsonthecostallocationbaseused.Forexampleifacompanyusesjustone

allocationbasesaydirectlaborhours,itmightuseabroadcostpoolsuchasfixedmanufacturing

overheads.However,ifitusesmorespecificcostallocationbases,forexamplelaborhours,machine

hours,etc.itmightdefinenarrowercostpools.

Costdriver

Costdriverisanyvariablethatdrivessomecost.Ifincreaseordecreaseinavariablecausesanincrease

ordecreaseisacostthatvariableisacostdriverforthatcost.

Examplesofcostdriverinclude:

http://accountingexplained.com/managerial/costallocation/

1/4

10/28/2015

CostAllocation|Concepts|Examples

NumberofpaymentsprocessedcanbeagoodcostdriverforsalariesofAccountsPayablesection

ofaccountingdepartment,

Numberofpurchaseorderscanbeagoodcostdriverforcostofpurchasingdepartment,

Numberofinvoicessentcanbeagoodcostdriverforcostofbillingdepartment,

Numberofunitsshippedcanbeagoodcostdriverforcostofdistributiondepartment,etc.

Whiledirectcostsareeasilytracedtocostobjects,indirectcostsareallocatedusingsomesystematic

approach.

Costallocationbase

Costallocationbaseisthevariablethatisusedforallocating/assigningcostsindifferentcostpoolsto

differentcostobjects.Agoodcostallocationbaseissomethingwhichisanappropriatecostdriverfora

particularcostpool.

Example

T2Fisauniversitycafownedanoperatedbyastudent.Whileithasplansforexpansionitcurrently

offerstwoproducts:(a)tea&coffeeand(b)shakes.Itemploys2people:Mr.A,wholooksaftertea&

coffeeandMr.Bwhopreparesandservesshakes&desserts.

Itscostsforthefirstquarterareasfollows:

Mr.Asalary

16,000

Mr.Bsalary

12,000

Rent

10,000

Electricity

8,000

Directmaterialsconsumedinmakingtea&coffee

7,000

Directrawmaterialsforshakes

6,000

Musicrentalspaid

800

Internet&wifisubscription

500

Magazines

400

Totalteaandcoffeesalesandshakessaleswere$50,000&$60,000respectively.Numberofcustomers

whoorderedteaorcoffeewere10,000whilethoseorderingshakeswere8,000.

Theownerisinterestedinfindingoutwhichproductperformedbetter.

Solution

SalariesofMr.A&Banddirectmaterialsconsumedaredirectcostswhichdonotneedanyallocation.

Theyaretraceddirectlytotheproducts.Therestofthecostsareindirectcostsandneedsomebasisfor

allocation.

Costobjectsinthissituationaretheproducts:hotbeverages(i.e.tea&coffee)&shakes.Costpools

includerent,electricity,music,internetandwifisubscriptionandmagazines.

Appropriatecostdriversfortheindirectcostsareasfollows:

http://accountingexplained.com/managerial/costallocation/

2/4

10/28/2015

Rent

CostAllocation|Concepts|Examples

10,000

Electricity

8,000

Numberofcustomers

Unitedconsumedbyeachproduct

Musicrentalspaid

800

Numberofcustomers

Internet&wifisubscription

500

Numberofcustomers

Magazines

400

Numberofcustomers

19,700

Sincenumberofcustomersisagoodcostdriverforalmostallthecosts,thecostscanbeaccumulated

togethertoformonecostpoolcalledmanufacturingoverheads.Thiswouldsimplythecostallocation.

Totalmanufacturingoverheadsforthefirstquarterare$19,700.Totalnumberofcustomerswhoordered

eitherproductare18,000.Thisgivesusacostallocationbaseof$1.1percustomer($19,700/18,000).

Adetailedcostassignmentisasfollows:

Tea&Coffee

Shakes

50,000

60,000

16,000

12,000

7,000

6,000

Manufacturingoverheadsallocated

11,000

8,800

Totalcosts

34,000

26,800

Profitearned

16,000

33,200

Revenue

Costs:

Salaries

Directmaterials

ManufacturingoverheadsallocatedtoTea&Cofee=$1.110,000

ManufacturingoverheadsallocatedtoShakes=$1.18,000

WrittenbyIrfanullahJan

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

CostAllocation

ServiceDept.CostAllocation

RepeatedDistributionMethod

SimultaneousEquationMethod

SpecificOrderofClosingMethod

DirectAllocationMethod

JointCostAllocationMethods

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

http://accountingexplained.com/managerial/costallocation/

3/4

10/28/2015

CostAllocation|Concepts|Examples

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,919likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costallocation/

4/4

10/28/2015

JobOrderCosting|Steps|JournalEntries|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>JobOrderCosting

JobOrderCosting

Jobordercostingisacostaccountingsysteminwhichdirectcostsaretracedandindirectcostsare

allocatedtouniqueanddistinctjobsinsteadofdepartments.Itisappropriateforbusinessesthatprovide

nonuniformcustomizedproductsandservices.

Jobordercostingisoneofthetwomaincostaccountingsystems,theotherbeingtheprocesscostingin

whichcostsaretracedandallocatedfirsttodifferentprocessescarriedoutindifferentdepartmentsand

thentoproductsandservices.Manycompaniesusecostingsystemsthatareablendoffeaturesofboth

jobordercostingandprocesscostingsystems.

Companiesthatusejobordercosting

Someofthecompaniesthatusejobordercostinginclude:

Accounting,consultingandlegalfirms

Architects

Manufacturersofshipsandairplanes

Bookpublishers

Movieproducers

Thenatureoftheirworkissuchthattheyareinterestedinfindingprofitabilityofdifferentjobsandhence

theyaccumulatecostswithreferencetodifferentjobslikeauditengagement,consultingprojects,books,

movies,etc.

Stepsinjobordercostingprocess

Inajobordercostingsystem,jobsareaccountedforusingthejobordercostsheet.Theprocessinvolves

thefollowingsteps:

1. Identificationofthejob

2. Tracingdirectcoststothejob

3. Identifyingtheindirectcostsi.e.manufacturingoverheadsandfindingthecostallocationbasefor

eachcost.

4. Applyingtheindirectcoststothejobusingthepredeterminedallocationrate.

5. Findingtotalcostbysummingupallthecostcomponents.

6. Closingtheunder/overappliedmanufacturingoverheadstocostofgoodssold/incomestatement.

7. Calculatingrevenueandprofit.

http://accountingexplained.com/managerial/costsystems/jobordercosting

1/4

10/28/2015

JobOrderCosting|Steps|JournalEntries|Example

Journalentries:example

DynamicSystemsInc.(DS)receivedanordertomanufactureacustomizedairplanefortheofficialuseof

thepresidentofPakistan.DSwillchargeanamountequaltothecostoftheairplaneplusa30%profit

marginoncosttothegovernmentofPakistan.ThejobcodeisPK03.

Sincethemanufactureoftheairplaneisaoneoffproject,jobordercostingisthemostappropriatecost

accumulationsystem.LetusposttherequiredjournalentriesintheDScostingsystem.

1.DSpurchasedrawmaterials(suchasaluminum,fiber,etc.)atacostof$4million.

Materialinventory

$4,000,000

Accountspayable

$4,000,000

2.$2.8millionworthofrawmaterialswereusedintheprojectasdirectmaterials.

WorkinprocessPK03

$2,800,000

Inventories

$2,800,000

3.$0.4millionworthofrawmaterialswereusedasindirectmaterials.

Manufacturingoverheads

$400,000

Inventories

$400,000

4.Totaldirectlaborhoursconsumedonthejobcost$3million.Theamountisalreadypaid.

WorkinprocessPK03

$3,000,000

Cash

$3,000,000

5.Indirectlaborhoursrelevanttotheprojectcost$1million.

Manufacturingoverheads

$1,000,000

Cash

$1,000,000

6.Otherindirectcostsyettobepaidwere$2.5million.

Manufacturingoverheads

$2,500,000

Accountspayable

$2,500,000

7.Manufacturingoverheadsarechargedtojobsat100%ofdirectlaborcosti.e.$3,000,000.

WorkinprocessPK03

Manufacturingoverheads

$3,000,000

$3,000,000

8.ThecostofPK03istransferredfromworkinprogresstofinishedgoodsonitscompletionattotalcostof

$8,800,000(=directmaterialscostof$2,800,000plusdirectlaborcostof$3,000,000andapplied

manufacturingoverheadsof$3,000,000).

http://accountingexplained.com/managerial/costsystems/jobordercosting

2/4

10/28/2015

JobOrderCosting|Steps|JournalEntries|Example

Finishedgoods

$8,800,000

WorkinprocessPK03

$8,800,000

9.Revenueisrecordedat$11,440,000[=$8,800,0001.3].

Accountsreceivable

$11,440,000

Revenue

$11,440,000

10.Actualmanufacturingoverheadsare$3,900,000(=indirectmaterialsof$400,000plusindirectlabor

of$1,000,000andotheroverheadsof$2,500,000).Appliedmanufacturingoverheadsare$3,000,000.

The$900,000worthofmanufacturingoverheadsunderappliedistakentothecostofgoodssoldor

incomestatement.

Costofgoodssold

Manufacturingoverheads

$900,000

$900,000

ProfitonPK03is$1,700,000(=revenueof$11,440,000minusfinishedgoodsof$8,800,000andunder

appliedoverheadsadjustmentof$900,000).

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingExplained

http://accountingexplained.com/managerial/costsystems/jobordercosting

3/4

10/28/2015

JobOrderCosting|Steps|JournalEntries|Example

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/jobordercosting

4/4

10/28/2015

ProcessCosting|Steps|JournalEntries|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>ProcessCosting

ProcessCosting

Processcostingisacostaccountingsysteminwhichdirectcostsaretracedandindirectcostsare

allocatedtoprocessescarriedoutindifferentdepartments.Thecostoffinishedgoodsisthencomputed

basedonaveragecostaccumulatedattheendofthelastdepartment.

Unlikejobordercosting,whichisanotherwidelyusedcostingsystem,processcostingaveragesoutcosts

overalldepartmentsandvaluesthefinishedproductsandclosingworkinprocess,ifany,usingeitherthe

firstinfirstout(FIFO)orweightedaverageconvention.

Companiesthatuseprocesscosting

Processcostingisappropriateforcompaniesthatproducestandardizedproductsinlargequantities.Since

theproductsareverysimilarinnature,differentdepartmentsspecializeindifferentprocesses.Insuch

situation,itismoreefficienttoaccumulatecostsattheprocess/departmentlevelandhencethename.

Examplesincludeoilrefineries,paintandchemicalmanufacturers,fastmovingconsumergoods(FMCG)

producers,etc.

Stepsinprocesscosting

Processcostinginvolvespreparingaprocesscostsheetusingthefollowingsteps:

1. Preparingthequantityscheduletoaccountforthenumberofunits.

2. Findingthepercentageofcompletionofunitsinclosingworkinprocessandcalculatingequivalent

unitsusingFIFOorweightedaverageconvention,whicheverisrelevant.

3. Accumulatingcostsbroughtforwardfrompreviousdepartment,ifany,andcostsincurredincurrent

department,includingmanufacturingoverheads.

4. Findingcostperequivalentunit.

5. Valuingunitstransferredtofinishedgoodsandunitsinclosingworkinprocessatthecostper

equivalentunitandtheirrelevantpercentageofcompletion.

Journalentries

InternationalChemicals(IC)isengagedinpreparationofaffordablequalitypaintsbyexploitingeconomies

ofscale.Ithasfourdepartments:pigmentdispersing,letdown,testingandcanning.Letuspostsome

hypotheticaljournalentriesforIC'sprocesscosting.

1.Assume$10,000worthofpigmentsandresinsareintroducedinpigmentdispersingdepartmentas

directmaterials.

http://accountingexplained.com/managerial/costsystems/processcosting

1/3

10/28/2015

ProcessCosting|Steps|JournalEntries|Example

WorkinProcesspigmentdispersing

$10,000

Rawmaterials

$10,000

2.50hoursofdirectlabor@$25perhourareused.

WorkinProcesspigmentdispersing

$1,250

Payroll/wagespayable

$1,250

3.Manufacturingoverheadsareallocatedtoeachdepartmentat$500perdirectlaborhourworked.

WorkinProcesspigmentdispersing

$25,000

ManufacturingOverheads

$25,000

4.Actualmanufacturingoverheadsare$24,250.

ManufacturingOverheads

$24,250

Payables/Cash

$24,250

5.Totalcostofpigmentdispersingdepartmentwhichcomestobe$36,250($10,000+$1,250+

$25,000),istransferredtoletdowndepartment.

WorkinProcessletdown

WIPpigmentdispersing

$36,250

$36,250

6.Totalcostofpigmentdispersingdepartmentaredebitedtoworkinprocessaccountforletdown

departmentusingschemeofjournalentriesgivenfrom14andtheaccumulatedcostisthentransferred

totestingdepartmentandsoontillthefinishedgoodsaretransferredoutfromcanningdepartmentto

finishedgoodsaccount.

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

http://accountingexplained.com/managerial/costsystems/processcosting

2/3

10/28/2015

ProcessCosting|Steps|JournalEntries|Example

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,918likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/processcosting

3/3

10/28/2015

ProcessCostingFIFOMethod|Steps|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>ProcessCostingFIFOMethod

ProcessCostingFIFOMethod

UndertheFIFOmethodofprocesscosting,costsaretransferredtonextdepartmentandultimatelyto

finishedgoodsintheorderinwhichtheyenteredthecurrentdepartmenti.e.costsenteringfirstare

transferredfirstandhencethenameFIFOfirstinfirstout.

Unliketheweightedaveragemethod,theFIFOmethoddoesnotinvolveanyaveragingoutofthetotal

costsincurredduringaperiod.Itmovesthecostofbeginningworkinprocess(includingthecosts

incurredincurrentperiod)straighttocostofunitstransferredoutanddistributesthecostsaddedduring

theperiodfirsttothecostofunitstransferredoutandtheresttothecostofunitsintheendingworkin

process.

FIFOmethodinvolvesfollowingsteps,majorityofwhicharethesameasinweightedaveragemethod:

Preparingthequantityschedule:i.e.reconcilingunitsinthebeginningworkinprocess,units

added/startedduringtheperiod,unitstransferredoutandunitsinendingWIP.

BringingforwardthecostofendingWIPoflastperiodascostofbeginningworkinprocessofthe

currentperiod.

BringingforwardthepercentageofcompletionoftheendingWIPoflastperiod.

Findingthecostsbroughtforwardfrompreviousdepartmentandcostaddedinthecurrent

departmentunderdifferentheads:directmaterialsandconversioncosts.

Findingunitsstarted/addedandcompletedduringthecurrentperiod.

Findingtotalequivalentunits.

Findingcostperequivalentunitforeachcostcomponent.

AllocatingthecostbetweenunitstransferredoutandendingWIP.

Example

Letususethesameexampleasinthearticleonprocesscostingunderweightedaveragemethod.

PrepareacostofproductionreportforthepackagingdepartmentofCompanyABCforthemonthof

December2013underFIFOmethodofprocesscosting.Importantinformationisreproducedhere.

20,000unitsinworkinprocessasat1December:$20,000ofdirectmaterialsand$40,000of

conversioncosts(i.e.$10,000directlaborand$30,000manufacturingoverheads).100%ofthe

directmaterialscostand40%oftheconversioncosthavebeenincurredinlastperiodonthese

units.

200,000unitstransferredinfromproductiondepartmentduringthemonth:atatotalcostof

$555,000.

http://accountingexplained.com/managerial/costsystems/processcostingfifo

1/4

10/28/2015

ProcessCostingFIFOMethod|Steps|Example

Costsaddedincluded:directmaterialsof$22,000andconversioncostsof$20,000.

180,000unitstransferredtofinishedgoods.

40,000unitsinworkinprocessasat31December:100%completeastocoststransferredin,

80%completeastomaterialsand50%completeastoconversioncosts.

Solution

Thefirststepisthepreparationofquantityschedule.

Asat1December

20,000

Transferredin

200,000

Unitstobeaccountedfor

220,000

Transferredoutfromunitsfrom1December

20,000

Unitsbothstartedandcompletedduringthecurrentperiod

160,000

Unitstransferredout

180,000

Asat31December

40,000

Unitsaccountedfor

220,000

Now,calculatetheequivalentunits:

Transferred

Direct

Conversion

in

Materials

Costs

UnitsinbeginningWIP(A)

20,000

20,000

%ofcompletionofbeginningWIPinpreviousperiod(B)

0%

100%

40%

%ofbeginningWIPcompletedthisperiod[C=100%B]

100%

0%

60%

12,000

160,000

160,000

160,000

40,000

40,000

40,000

100%

80%

50%

40,000

32,000

20,000

200,000

192,000

192,000

EquivalentunitsinbeginningWIP[D=AC]

Unitsbothstartedandcompletedincurrentperiod(E)

UnitsofendingWIP(F)

PercentageofcompletionofendingWIP(G)

EquivalentunitsinendingWIP(H=FG)

Totalequivalentunits(D+E+H)

Next,findcostperequivalentunit.

Costs(I)

Totalequivalentunits(J)

Costperequivalentunit(I/J)

Transferred

Direct

Conversion

in

Materials

Costs

$555,000

$22,000

$20,000

200,000

192,000

192,000

$2.775

$0.1146

$0.1042

Total

$597,000

$2.993

Weneedtofindthecostofunitstransferredout.SinceweareusingFIFOmethod,wefirstincludethe

entirebeginningWIPinthecostofunitstransferredoutandthenincludeunitsstarted/addedduringthe

period.

http://accountingexplained.com/managerial/costsystems/processcostingfifo

2/4

10/28/2015

ProcessCostingFIFOMethod|Steps|Example

CostofbeginningWIPbroughtforwardfromlastperiod(K)

$60,000

Transferredincosts[(100%100%)*20,000*2.775](L)

Directmaterials[(100%100%)*20,000*0.1146](M)

Conversioncosts[(100%40%)*20,000*0.1042](N)

$1,250

CostincurredonbeginningWIPincurrentperiod(O=L+M+N)

$1,250

BeginningWIP(P=K+O)

$61,250

Costofunitsstartedandcompletedincurrentperiod(2.993*160,000)(Q) $479,000

Costofunitstransferredout(P+Q)

$540,250

Costofunitsinendingworkinprocesscomesfromunitsaddedduringtheperiod:

Transferred

Direct

Conversion

in

Materials

Costs

Total

Unitsasat31December(R)

40,000

40,000

40,000

40,000

Costperequivalentunit(S)

$2.775

$0.1146

$0.1042

$2.993

100%

80%

50%

$111,000

$3,667

$2,083

Percentageofcompletion(T)

Totalcost(RST)

$116,750

Itcanalsobecalculatedusingtheshortcutformulagivenbelow

CostofendingWIP=

CostofBeginningWIP+CostsTransferredin+CostsAddedinCurrentDepartmentCostsTransferred

out

ValueofendingWIPbasedonthisformulais:

CostofendingWIP=$60,000+$555,0000+$42,000$540,250=116,750

Wecansummarizethecostmovementusingthecostschedulegivenbelow:

Costtobeaccountedfor

Accountedforas

BeginningWIP

Costtransferredin

60000

555000

Transferredout

540,250

ClosingWIP

116,750

Total

657,000

Costadded

Materials

22000

Conversion

20000

42000

Total

657000

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

http://accountingexplained.com/managerial/costsystems/processcostingfifo

3/4

10/28/2015

ProcessCostingFIFOMethod|Steps|Example

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,919likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/processcostingfifo

4/4

10/28/2015

ProcessCostingWeightedAverageMethod|Steps|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>ProcessCostingWeightedAverageMethod

ProcessCostingWeightedAverageMethod

Processcostingsystemisusedforstandardizedproductionprocesses.Wheneveraprocesscostsheetis

preparedforadepartment,thedepartmentmostlikelyhassomeunfinishedunitseitherinitsbeginning

workinprocess,closingworkinprocessorboth.Insuchasituation,itisimportanttodetermineacost

flowassumption,i.e.toagreeontheorderinwhichcostsaretransferredouttothenextdepartment.

Therearetwocostflowassumptions:firstinfirstout(FIFO)andweightedaverage.

Intheweightedaveragemethodofprocesscosting,thecostsareaveragedoutandevenlyappliedtoboth

unitstransferredoutandunitsinclosingworkinprocess.UnlikeFIFOmethod,whichassumescosts

introducedfirstintoadepartmentaretransferredoutfirst,weightedaveragemethoddoesnotassume

anyspecificorder.

Processcostingunderweightedaveragemethodinvolvesthefollowingsteps:

1. Preparingthequantityschedule:i.e.findingunitsinthebeginningworkinprocessfortheperiod,

unitsstartedorunitstransferredinfrompriordepartments,unitstransferredouttonext

departmentorunitsoffinishedgoods,andunitsinclosingworkinprocess.

2. Bringingforwardthecostofunitsinthebeginningworkinprocessfromlastperiod.Thecostshould

bebrokenupintoallitscomponents:directmaterialsandconversioncosts(=directlaborand

manufacturingoverheads).

3. Findingthecostsaddedinthecurrentdepartmentunderdifferentheads:directmaterials,direct

laborandmanufacturingoverheads.

4. Findingtotalcosttobeaccountedforundereachheadi.e.directmaterials,directlaborand

manufacturingoverheads.Thiswouldinvolveaddingthecostincludedintheopeningworkin

processonaccountofdirectmaterials,directlaborandmanufacturingoverheadstothe

correspondingamountsaddedduringtheperiodonaccountoftherelevantcostcomponent.

5. Findingtotalequivalentunits.

6. Findingcostperequivalentunitforeachcostcomponentbydividingthetotalcostforthecost

componentbytotalequivalentunitsfortherelevantcostcomponent.

7. Allocatingthecostbetweentheunitstransferredoutandunitsincludedintheclosingworkin

process.

Example

Letusprepareaprocesscostsheetunderweightedaveragemethodusingthefollowingdatafor

CompanyABC'spackagingdepartmentforthemonthofDecember2013.

20,000unitsinworkinprocessasat1December:$20,000directmaterialsand$40,000for

conversioncosts(i.e.$10,000directlaborand$30,000manufacturingoverheads)

http://accountingexplained.com/managerial/costsystems/processcostingweightedaverage

1/4

10/28/2015

ProcessCostingWeightedAverageMethod|Steps|Example

200,000unitstransferredinfromproductiondepartmentduringthemonth:atatotalcostof

$555,000.

Costsaddedincluded:directmaterialsof$22,000andconversioncostsof$20,000.

180,000unitstransferredtofinishedgoods

40,000unitsinworkinprocessasat31December:100%completeastocoststransferredin,

80%completeastomaterialsand50%completeastoconversioncosts.

Solution

Letuspreparethequantityschedule.

Asat1December

20,000

Transferredin

200,000

Unitstobeaccountedfor

220,000

Transferredout

180,000

Asat31December

40,000

Unitsaccountedfor

220,000

Next,calculatetheequivalentunits.

Transferred

Direct

Conversion

in

Materials

Costs

180,000

180,000

180,000

Unitsasat31December(B)

40,000

40,000

40,000

Percentageofcompletion(C)

100%

80%

50%

40,000

32,000

20,000

220,000

212,000

200,000

Transferredout(A)

Equivalentunitsasat31Dec(D=BC)

Totalequivalentunits(A+D)

Next,calculatethecostperequivalentunit.

Transferred

Direct

Conversion

in

Materials

Costs

$0

$20,000

$40,000

$60,000

Addedduringthemonth

$555,000

$22,000

$20,000

$597,000

Coststobeaccountedfor

$555,000

$42,000

$60,000

$657,000

220,000

212,000

200,000

$2.52

$0.20

$0.30

Asat1December

Totalequivalentunits

Costperequivalentunit

Total

$3.02

Now,weneedtofindthecostofunitstransferredout.Itequals$543,600[=$3.02180,000].

Wealsoneedthefigureforcostofworkinprocessasat31December.Itcanbecalculatedasshownin

thetablebelow.

http://accountingexplained.com/managerial/costsystems/processcostingweightedaverage

2/4

10/28/2015

ProcessCostingWeightedAverageMethod|Steps|Example

Transferred

Direct

Conversion

in

Materials

Costs

Unitsasat31December(A)

Total

40,000

40,000

40,000

40,000

Costperequivalentunit(B)

$2.52

$0.20

$0.30

$3.02

Percentageofcompletion(C)

100%

80%

50%

100,909

6,340

6,000

Totalcost(ABC)

113,249

SincecostofopeningWIPpluscostaddedmustequalcosttransferredoutandcostinclosingWIP,the

costofclosingWIPcanbecalculatedusingasshortcutformulagivenbelow:

CostofclosingWIP=CoststobeAccountedforCostsTransferredOut

Inthisexample,itturnsoutafigureof$113,400(totalcosttobeaccountedforof$657,000minus

coststransferredoutof$543,600).Theminordifferenceisduetoroundingoff.

Thefinalprocesscostsheetshouldlooklikeasfollows:

CompanyABC

PackagingDepartment

CostofProductionReport

Dec13

QUANTITYSCHEDULE

Asat1December

20,000

Transferredin

200,000

Unitstobeaccountedfor

220,000

Transferredout

180,000

Asat31December

40,000

Unitsaccountedfor

220,000

COSTSCHEDULE

Directmaterials

20,000

Conversioncosts

40,000

Asat1December(A)

60,000

Coststransferredin(B)

555,000

Directmaterials

22,000

Conversioncosts

20,000

Costsadded(C)

42,000

Totalcoststobeaccountedfor(A+B+C)

657,000

Transferredtofinishedgoods(D)

543,751

Coststransferredin

100,909

Directmaterials

6,340

Conversioncosts

6,000

Asat31December(E)

113,249

Totalcostsaccountedfor(D+E)

657,000

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

http://accountingexplained.com/managerial/costsystems/processcostingweightedaverage

3/4

10/28/2015

ProcessCostingWeightedAverageMethod|Steps|Example

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,919likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/processcostingweightedaverage

4/4

10/28/2015

EquivalentUnitsFIFOMethod|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>EquivalentUnitsFIFOMethod

EquivalentUnitsFIFOMethod

EquivalentunitsunderFIFOmethodarethenumberoffinishedunitsthatcouldhavebeenpreparedina

processduringaperiodhadtherebeennounfinishedunits,eitherinopeningWIPorclosingWIP.

UndertheFIFOcostflowassumption,itisassumedthatthecoststhatenterfirstinthedepartmentexit

first.Theconsequenceofthisassumptionisthatthecostofunitstransferredoutfirstincludesthecostof

openingWIPandthenthecostofunitsaddedduringtheperiod.ThecostofopeningWIPiscarried

directlytotheunitstransferredout.Equivalentunitsarerelevantonlyforcostsincurredduringthe

period:whichincludescostsincurredoncompletingtheopeningWIP(i.e.theunfinishedpart),cost

incurredonunitsstarted/addedandtransferredoutandcostincurredonunitsinclosingworkinprocess.

Formula

EquivalentunitsunderFIFOmethodarecalculatedusingthefollowingformula:

Equivalentunitsforeachcostcomponent=(100%A)B+C+DE

Where,

A=percentageofcompletionattheendoflastperiod

B=unitsinopeningworkinprocess

C=unitsadded/startedandtransferredout

D=percentageofcompletionofunitsinclosingworkinprocess

E=unitsinclosingworkinprocess

Example

CalculateequivalentunitsunderFIFOmethodusingthedatagivenbelow:

Unitsinopeningworkinprocess

10,000

Unitsadded

190,000

Unitstransferredout

195,000

Unitsinclosingworkinprocess

5,000

PercentageofcompletionofopeningWIPdirectmaterials

80%

PercentageofcompletionofopeningWIPconversioncosts

40%

PercentageofcompletionofclosingWIPdirectmaterials

PercentageofcompletionofclosingWIPconversioncosts

100%

60%

Solution

http://accountingexplained.com/managerial/costsystems/equivalentunitsfifo

1/3

10/28/2015

EquivalentUnitsFIFOMethod|Example

DirectMaterials

ConversionCosts

10,000

10,000

%ofcompletionofbeginningWIPinpreviousperiod(B)

80%

40%

%ofbeginningWIPcompletedthisperiod[C=100%B]

20%

60%

2,000

6,000

185,000

185,000

UnitsclosingWIP(E)

5,000

5,000

%ofcompletionofclosingWIP(F)

100%

60%

EquivalentunitsinclosingWIP(G=EF)

5,000

3,000

192,000

194,000

UnitsinbeginningWIP(A)

EquivalentunitsinbeginningWIP[D=AC]

Unitsstartedandcompletedincurrentperiod

Totalequivalentunits

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

http://accountingexplained.com/managerial/costsystems/equivalentunitsfifo

2/3

10/28/2015

EquivalentUnitsFIFOMethod|Example

AccountingEx

21,919likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/equivalentunitsfifo

3/3

10/28/2015

EquivalentUnitsWeightedAverageMethod|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>EquivalentUnitsWeightedAverageMethod

EquivalentUnitsWeightedAverageMethod

Equivalentunitsarethenumberoffinishedunitsthatwouldhavebeenpreparedhadtherebeenno

partiallycompletedunitsinaprocess.

Theconceptofequivalentunitsisapplicabletoprocesscosting.Sinceprocessesarecontinuous,whena

costofproductionreportisprepared,theunfinishedunitsintheopeningworkinprocessorclosingwork

inprocessareassignedanestimatedpercentageofcompletion.Basedonthispercentageofcompletion,

numberofequivalentsunitsiscalculatedinordertofindcostpercompletedunit.

Formula

Thecalculationofequivalentunitsdependsonthecostflowassumptionusedi.e.thecalculationis

differentforfirstinfirstoutandweightedaverage.Intheweightedaveragemethod,totalequivalent

unitsfortheprocessforaperiodarecalculatedusingthefollowingformula.

Totalequivalentunitsforacostcomponent=A+BC

Where

A=unitstransferredouttothenextdepartment/finishedgoods

B=unitsinclosingworkinprocess

C=percentageofcompletionwithrespecttotherelevantcostcomponent

Example

Calculatetotalequivalentsunitsusingthefollowinginformation.

Unitsinopeningworkinprocess

10,000

Unitsadded

190,000

Unitstransferredout

195,000

Unitsinclosingworkinprocess

5,000

%ofcompletionofclosingWIPdirectmaterials

100%

%ofcompletionofclosingWIPconversioncosts

60%

Solution

Totalequivalentunitsdirectmaterials=190,000+5,000100%=195,000

Totalequivalentunitsconversioncosts=190,000+5,00060%=193,000

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

http://accountingexplained.com/managerial/costsystems/equivalentunitsweightedaverage

1/2

10/28/2015

EquivalentUnitsWeightedAverageMethod|Example

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

AccountingEx

21,919likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/equivalentunitsweightedaverage

2/2

10/28/2015

ActivityBasedCosting|Steps|Example

AccountingExplained

Home>ManagerialAccounting>CostSystems>ActivityBasedCosting

ActivityBasedCosting

Activitybasedcostingisamethodofassigningindirectcoststoproductsandserviceswhichinvolves

findingcostofeachactivityinvolvedintheproductionprocessandassigningcoststoeachproductbased

onitsconsumptionofeachactivity.

Activitybasedcostingismorerefinedapproachtocostingproductsandservicesthanthetraditional

costingmethod.Itinvolvesthefollowingsteps:

Identificationofactivitiesinvolvedintheproductionprocess

Classificationofeachactivityaccordingtothecosthierarchy(i.e.intounitlevel,batchlevel,

productlevelandfacilitylevel)

Identificationandaccumulationoftotalcostsofeachactivity

Identificationofthemostappropriatecostdriverforeachactivity

Calculationoftotalunitsofthecostdriverrelevanttoeachactivity

Calculationoftheactivityratei.e.thecostofeachactivityperunitofitsrelevantcostdriver

Applicationofthecostofeachactivitytoproductsbasedonitsactivityusagebytheproduct.

CostHierarchy

Thefirststepinactivitybasedcostinginvolvesidentifyingactivitiesandclassifyingthemaccordingtothe

costhierarchy.Costhierarchyisaframeworkthatclassifiesactivitiesbasedtheeaseatwhichtheyare

traceabletoaproduct.Thelevelsare(a)unitlevel,(b)batchlevel,(c)productlevel,and(d)facilitylevel.

Unitlevelactivitiesareactivitiesthatareperformedoneachunitofproduct.Batchlevelactivitiesare

activitiesthatareperformedwheneverabatchoftheproductisproduced.Productlevelactivitiesare

activitiesthatarecarriedoutseparatelyforeachproduct.Facilitylevelactivitiesareactivitiesthatare

carriedoutattheplantlevel.Theunitlevelactivitiesaremosteasilytraceabletoproductswhilefacility

levelactivitiesareleasttraceable.

Example

AlexErwinstartedInterwood,anichefurniturebrand,10yearsago.Heranthebusinessasasole

proprietorship.Whilehehas50skilledcarpentersand5salesmenonhispayroll,hehasbeentakingcare

oftheaccountingbyhimself.Now,heintendstooffer40%oftheownershiptopublicinnextcouple

years,andiswillingtomakechangesandhashiredyouasthemanagementaccountanttoorganizeand

improvetheaccountingsystems.

Interwood'stotalbudgetedmanufacturingoverheadscostforthecurrentyearis$5,404,639and

budgetedtotallaborhoursare20,000.Alexappliedtraditionalcostingmethodduringallofthe10years

http://accountingexplained.com/managerial/costsystems/activitybasedcosting

1/5

10/28/2015

ActivityBasedCosting|Steps|Example

period,andbasedthepredeterminedoverheadrateontotallaborhours.

Interwood'ssofarangeincludesthe2set,3setand6setoptions.PlatinumInteriorsrecentlyplacedan

orderfor150unitsofthe6settype.Theorderisexpectedtobedeliveredin1monthtime.Sinceitisa

customizedorder,Platinumwillbebilledatcostplus25%.

Youarenotafanoftraditionalproductcostingsystem.Youbelievethatthebenefitsofactivitybased

costingsystemexceedsitscosts,soyousatdownwithAaronMason,thechiefengineer,toidentifythe

activitieswhichthefirmundertakesinitssofadivision.Next,youcalculatedthetotalcostthatgoesinto

eachactivity,identifiedthecostdriverthatismostrelevanttoeachactivityandcalculatedtheactivity

rate.Theresultsaresummarizedbelow:

Activity

A(in$)

RelevantCostDriver

C=A/B(in$)

Productionofcomponents

2,313,132

Machinehours

25,000

93

Assemblyofcomponents

1,231,312

Numberoflaborhours

20,000

62

Packaging

213,123

Units

5,000

43

Shipping

231,230

Units

5,000

46

Setupcosts

34,243

Designing

123,132

Producttesting

24,234

Rent

Numberofsetups

Designerhours

Testinghours

1,234,233

Laborcost

240

143

1,000

123

500

$1,645,644

48

75%

Oncetheorderwasreadyforpackaging,Aarongaveyouasummaryoftotalcostincurredanda

statementofactivitiesperformed(alsocalledthebillofactivities)asshownbelow:

OrderNo:15X2013

Customer:PlatinumInteriors

Units:150

Type:6unit

Amountsin$

Costofdirectmaterials

25,000

Costofpurchasedcomponents

35,000

Laborcost

15,600

Activity

RelevantCostDriver

ActivityUsage

Productionofcomponents

Machinehours

320

Assemblyofcomponents

Numberoflaborhours

250

Packaging

Units

150

Shipping

Units

150

Numberofsetups

15

Designerhours

70

Setupcosts

Designing

TestingTestinghours

Rent

22

Laborcost

4500

PartA

Calculatethetotalcostoftheorderandtheinvoicevalueoftheorderbasedontraditionalcosting

system.

http://accountingexplained.com/managerial/costsystems/activitybasedcosting

2/5

10/28/2015

ActivityBasedCosting|Steps|Example

Solution

Inthetraditionalcostingsystem,costequalsmaterialscostpluslaborcostplusmanufacturingoverheads

chargedatthepredeterminedoverheadrate.

Thepredeterminedoverheadratebasedondirectlaborhours=$5,404,639/20,000=$270perlabor

hour

Theactualnumberoflaborhoursspentontheorderis250.Oncewehavethisdata,wecanestimatethe

manufacturingoverheadsandthetotalcostasfollows:

Directmaterials

25,000

Purchasedcomponents

35,000

Laborcost

15,600

Manufacturingoverheads($270250)

67,500

Totalcostundertraditionalproductcostingsystem

143,100

Platinumisbilledatcostplus25%,sotheamountofsalestobebookedwouldamountto$178,875(=

$143,1001.25).

PartB

Youknowactivitybasedcostingisamorerefinedapproach.Now,sinceyouhaveallthedataneeded,

calculatetheordercostusingactivitybasedcosting.

Solution

Inactivitybasedcosting,directmaterialscost,costofpurchasedcomponentsandlaborcostremainsthe

sameasintraditionalproductcosting.However,thevalueofmanufacturingoverheadsassignedismore

accuratelyestimated.Thefollowingworksheetestimatesthemanufacturingoverheadsthatshouldbe

assignedtotheorderofPlatinumInteriors:

(A)

(B)

(AB)

ActivityRate

ActivityUsage

ActivityCostAssigned

Productionofcomponents

93

320

29,760

Assemblyofcomponents

62

250

15,500

Packaging

43

150

6,450

Shipping

46

150

6,900

Setupcosts

143

15

2,145

Designing

123

70

8,610

48

22

1,056

75%

15,600

11,700

Activity

Producttesting

Rent

82,121

Totalcostoftheorderishence:

http://accountingexplained.com/managerial/costsystems/activitybasedcosting

3/5

10/28/2015

ActivityBasedCosting|Steps|Example

US$

Directmaterials

25,000

Purchasedcomponents

35,000

Laborcost

15,600

Manufacturingoverheads

82,121

Totalcostunderactivitybasedcosting

157,721

Basedonthemoreaccurateestimationoftheordercost,theinvoiceshouldberaisedat$197,150

(=$157,7211.25)insteadof$178,875calculatedundertraditionalproductcostingsystem.

Theexamplehighlightstheimportanceofcorrectestimationoftheproductcostandtheusefulnessof

activitybasedcostinginachievingthatgoal.

WrittenbyObaidullahJan,ACA,CFA

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

JobOrderCosting

JobCostSheet

ProcessCosting

ProcessCostingAVCO

EquivalentUnitsAVCO

ProcessCostingFIFO

EquivalentUnitsFIFO

ActivityBasedCosting

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

http://accountingexplained.com/managerial/costsystems/activitybasedcosting

4/5

10/28/2015

ActivityBasedCosting|Steps|Example

AccountingEx

21,918likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/costsystems/activitybasedcosting

5/5

10/28/2015

CostVolumeProfitAnalysis|BasicConcepts|ManagerialAccounting

AccountingExplained

Home>ManagerialAccounting>CVPAnalysis

CostVolumeProfitAnalysis

CostVolumeProfit(CVP)analysisisamanagerialaccountingtechniquethatisconcernedwiththeeffect

ofsalesvolumeandproductcostsonoperatingprofitofabusiness.Itdealswithhowoperatingprofitis

affectedbychangesinvariablecosts,fixedcosts,sellingpriceperunitandthesalesmixoftwoormore

differentproducts.

CVPanalysishasfollowingassumptions:

1. Allcostcanbecategorizedasvariableorfixed.

2. Salespriceperunit,variablecostperunitandtotalfixedcostareconstant.

3. Allunitsproducedaresold.

Wheretheprobleminvolvesmixedcosts,theymustbesplitintotheirfixedandvariablecomponentby

HighLowMethod,ScatterPlotMethodorRegressionMethod.

CVPAnalysisFormula

ThebasicformulausedinCVPAnalysisisderivedfromprofitequation:

px=vx+FC+Profit

Intheaboveformula,

pispriceperunit

visvariablecostperunit

xaretotalnumberofunitsproducedandsoldand

FCistotalfixedcost

Besidestheaboveformula,CVPanalysisalsomakesuseoffollowingconcepts:

ContributionMargin(CM)

ContributionMargin(CM)isequaltothedifferencebetweentotalsales(S)andtotalvariablecostor,in

otherwords,itistheamountbywhichsalesexceedtotalvariablecosts(VC).Inordertomakeprofitthe

contributionmarginofabusinessmustexceeditstotalfixedcosts.Inshort:

CM=SVC

UnitContributionMargin(UnitCM)

ContributionMargincanalsobecalculatedperunitwhichiscalledUnitContributionMargin.Itisthe

excessofsalespriceperunit(p)overvariablecostperunit(v).Thus:

http://accountingexplained.com/managerial/cvpanalysis/

1/3

10/28/2015

CostVolumeProfitAnalysis|BasicConcepts|ManagerialAccounting

UnitCM=pv

ContributionMarginRatio(CMRatio)

ContributionMarginRatioiscalculatedbydividingcontributionmarginbytotalsalesorunitCMbyprice

perunit.

WrittenbyIrfanullahJan

ManagerialAccounting

ManagerialAccountingIntro

CostClassifications

CostAccountingSystems

CostAllocation

CostBehaviorAnalysis

CostVolumeProfitAnalysis

BEPEquationMethod

BEPContributionMethod

SalesMixBreakevenPoint

ContributionMargin

TargetIncomeSales

MarginofSafety

DegreeofOperatingLeverage

AbsorptionCosting

TargetCosting

CostplusPricing

VariableCosting

RelevantCosting

CapitalBudgeting

MasterBudget

InventoryManagement

StandardCosting

PerformanceMeasurement

http://accountingexplained.com/managerial/cvpanalysis/

2/3

10/28/2015

CostVolumeProfitAnalysis|BasicConcepts|ManagerialAccounting

AccountingEx

21,918likes

LikePage

Share

Bethefirstofyourfriendstolike

this

Copyright20112013AccountingExplained.com|AllRightsReserved

Nopartofthiswebsitemaybereproducedwithoutapriorwrittenpermission.

ContactUs|PrivacyPolicy|Disclaimer

http://accountingexplained.com/managerial/cvpanalysis/

3/3

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Uber - Changing The Way The World MovesDocument12 pagesUber - Changing The Way The World MovesAnkur Shrimali100% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Reminiscence of TimeDocument2 pagesReminiscence of TimeAnkur ShrimaliNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- What'sBest!® 9.0.0.0 Status ReportDocument12 pagesWhat'sBest!® 9.0.0.0 Status ReportRikrdo ParedesNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Marico Glory Hunters National FinalistDocument4 pagesMarico Glory Hunters National FinalistAnkur ShrimaliNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Mid-Term Datesheet PGPM 2015-17 - Term-IIIDocument1 pageMid-Term Datesheet PGPM 2015-17 - Term-IIIAnkur ShrimaliNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- IndiaNow Digital IndiaDocument72 pagesIndiaNow Digital IndiaAnkur ShrimaliNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Smart IronDocument9 pagesSmart IronAnkur ShrimaliNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Tewnty First Century FoxDocument16 pagesTewnty First Century FoxAnkur ShrimaliNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Apple Environmental Responsibility Report 2015Document36 pagesApple Environmental Responsibility Report 2015BiancaNo ratings yet

- Candidate Details for Orientation SessionsDocument6 pagesCandidate Details for Orientation SessionsAnkur ShrimaliNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Euro Trip Guide by Manav Gupta-1Document5 pagesEuro Trip Guide by Manav Gupta-1Ankur ShrimaliNo ratings yet

- Term 2 Mid Sem HRMDocument127 pagesTerm 2 Mid Sem HRMAnkur ShrimaliNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Blue Ocean StrategyDocument21 pagesBlue Ocean StrategyAnkur ShrimaliNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Whole Hotels For Marriott Corp Hilton Holiday La QuintaDocument3 pagesWhole Hotels For Marriott Corp Hilton Holiday La QuintaAnkur ShrimaliNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Fact Sheet Aarhus BSS 2016Document3 pagesFact Sheet Aarhus BSS 2016Ankur ShrimaliNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Term 2 Mid Sem HRMDocument127 pagesTerm 2 Mid Sem HRMAnkur ShrimaliNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Excel ModelsDocument433 pagesExcel ModelsVipul Singh100% (11)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- T2 PGPM 2015-17Document2 pagesT2 PGPM 2015-17Ankur ShrimaliNo ratings yet

- BA382T MayDocument21 pagesBA382T MayAnkur ShrimaliNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument18 pagesManagement Accounting - I: - Dr. Sandeep GoelAnkur ShrimaliNo ratings yet

- Indian Economy OverviewDocument3 pagesIndian Economy OverviewAnkur ShrimaliNo ratings yet

- Fact Inference JudgementDocument8 pagesFact Inference JudgementAnkur ShrimaliNo ratings yet

- Quiz 2 - Answer and ExplanationDocument3 pagesQuiz 2 - Answer and Explanationabcx397No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 20 - Backflush Costing System - Activity-Based CostingDocument33 pages20 - Backflush Costing System - Activity-Based CostingCarla MarieNo ratings yet

- A Study of The USDX Based On ARIMA ModelDocument5 pagesA Study of The USDX Based On ARIMA Modelkamran raiysatNo ratings yet

- DECAL, WIRING SCHEMATIC (Xe), FULLMED VOLT, REMOTE STR HAZ DUTYDocument4 pagesDECAL, WIRING SCHEMATIC (Xe), FULLMED VOLT, REMOTE STR HAZ DUTYMarcos LunaNo ratings yet

- Assessment C - Budgets - V2-3Document2 pagesAssessment C - Budgets - V2-3LuN LoNo ratings yet

- Public Works Bill FormDocument4 pagesPublic Works Bill FormvoccubdNo ratings yet

- UPVC Windows Quotation ProjectDocument3 pagesUPVC Windows Quotation ProjectsathishNo ratings yet

- McKinsey Case Study AnalysisDocument2 pagesMcKinsey Case Study AnalysisSrinivas Kannan100% (1)

- A4-Equity ValuationDocument3 pagesA4-Equity ValuationMariya PatelNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Mathematics of Finance Canadian 8th Edition Brown Solutions Manual 1Document56 pagesMathematics of Finance Canadian 8th Edition Brown Solutions Manual 1amanda100% (56)

- Bright Ideas Catalogue INDIADocument130 pagesBright Ideas Catalogue INDIAKiran KumarNo ratings yet

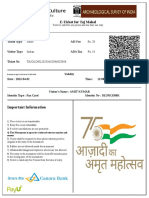

- E-Ticket details for Taj Mahal visitDocument5 pagesE-Ticket details for Taj Mahal visitAmit KushwahaNo ratings yet

- Delhi Public School Jodhpur Monday Test Economics Class XIDocument1 pageDelhi Public School Jodhpur Monday Test Economics Class XIParth AroraNo ratings yet

- Cabos Tração NexansDocument99 pagesCabos Tração NexansfabianohyaNo ratings yet

- Happy Hours Apparels Aug 20, 2021Document2 pagesHappy Hours Apparels Aug 20, 2021Noman AwanNo ratings yet

- CH 10Document26 pagesCH 10EmadNo ratings yet

- MDS CatalogueDocument56 pagesMDS Cataloguedgovender31No ratings yet

- Cambridge International AS & A Level: Economics 9708/11Document12 pagesCambridge International AS & A Level: Economics 9708/11李立No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Seminar QuestionsDocument2 pagesSeminar QuestionsjekaterinaNo ratings yet

- Titanium Plus-One Pager - OBCDocument1 pageTitanium Plus-One Pager - OBCSiaNo ratings yet

- 2CBCOWPROJECTREPORTDocument8 pages2CBCOWPROJECTREPORTVenkata Rao NaiduNo ratings yet

- Masters in Business Administration International Business (MPIB7103) Individual AssignmentDocument12 pagesMasters in Business Administration International Business (MPIB7103) Individual AssignmentQhairun NathiaNo ratings yet

- Macro L5Document16 pagesMacro L5naspgNo ratings yet

- Financial Speculation and Fictitious Profits: A Marxist AnalysisDocument230 pagesFinancial Speculation and Fictitious Profits: A Marxist AnalysisAll KNo ratings yet

- Member Data Record: Philippine Health Insurance CorporationDocument1 pageMember Data Record: Philippine Health Insurance CorporationKyle HernandezNo ratings yet

- Sumif, Sumifs, Countif, AverageifDocument9 pagesSumif, Sumifs, Countif, AverageifRaghavendraNo ratings yet

- Account Statement 040823 030923Document9 pagesAccount Statement 040823 030923Ashwani PanditNo ratings yet

- Ejercicios Módulo 9Document24 pagesEjercicios Módulo 9Jorjelys SerranoNo ratings yet

- Af ManifestDocument23 pagesAf ManifestCwasi Musicman100% (1)

- தனி வட்டிDocument41 pagesதனி வட்டிAnbuNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingFrom EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingRating: 5 out of 5 stars5/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)