Professional Documents

Culture Documents

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

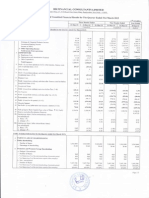

NCL Research & Financial Services Limited

Administrative Office : 79, Nagindas Master Road, 3rd Floor, Fort, Mumbai-400 023

CIN - L65921UP1985PLC007001, Email : ncl.research@gmail.com, Wesbite : www.nclfin.com

Statement of Standalone Unaudited Financial Results for the Quarter & Six months ended 30th September 2015

Particulars

Sr.

No.

1

Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

3 Months

ended

30.09.2015

Total Income from Operations (Net)

Expenses

149.35

-

149.35

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

Total Expenses

Profit/(Loss) from Operations before other Income, finance cost

and exceptional Expenses (1-2)

4

5

Other Income/(Loss)

6

7

Finance Costs

8

9

Exceptional Items

Profit/(Loss) from ordinary activities before finance costs and

exceptional items (3+4)

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

10 Tax Expense

11

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13

14 Paid-up Equity Share Capital (Face Value of Rs. 2/- each)

Net Profit (+)/Loss(-) from ordinary activites after tax (9-10)

Net Profit (+)/Loss(-) for the period (11-12)

116.41

-

116.41

125.46

-

265.76

-

257.92

-

321.84

-

125.46

265.76

257.92

321.84

183.32

41.31

79.95

41.31

79.95

14.31

1.72

10.26

(79.95)

67.60

14.35

1.72

10.29

26.36

23.17

28.66

3.44

20.55

93.96

(79.95)

26.55

4.16

18.83

81.75

90.05

102.29

171.80

81.75

90.05

81.75

90.05

81.75

90.05

(c) Changes in Inventories of Finished Goods, Work-in-Progress and

Stock-in-Trade

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

` in Lacs

Corresponding

Preceding 3

6 Months Corresponding 6 Year to date

3 Months

Months ended

ended

ended

Months ended figures as on

30.06.2015 30.09.2014 30.09.2015

31.03.2015

30.09.2014

Un-Audited

Un-Audited

Audited

13.16

2.77

7.24

102.29

171.80

102.29

171.80

102.29

171.80

(74.86)

55.22

6.82

71.05

49.54

241.55

208.38

80.29

208.38

80.29

208.38

80.29

208.38

-

80.29

25.40

81.75

81.75

90.05

90.05

102.29

102.29

171.80

171.80

208.38

208.38

54.89

54.89

2,908.50

2,908.50

581.70

581.70

581.70

2,908.50

15 Reserves excluding revaluation Reserves as per last Balance Sheet

3,246.62

Earning Per Share (before extra-ordinary items) of Rs. 2/- each

(not annualized)

16

(i) a) Basic

b) Diluted

0.28

0.28

0.31

0.31

1.76

1.76

2.95

2.95

3.58

3.58

0.19

0.19

17

(ii) a) Basic

b) Diluted

0.28

0.28

0.31

0.31

1.76

1.76

2.95

2.95

3.58

3.58

0.19

0.19

141,362,500

141,362,500

5,654,500

141,362,500

97.21

5,654,500

97.21

141,362,500

97.21

486.03

97.21

97.21

Earning Per Share (after extra-ordinary items) of Rs. 2/- each

(not annualized)

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding of

Promoter & Promoter Group)

- Percentage of Shares (as a % of the total Share Capital

of the Company)

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding of

Promoter & Promoter Group)

- Percentage of Shares (as a % of the total Share Capital

of the Company)

4,062,500

100.00

4,062,500

100.00

162,500

100.00

4,062,500

100.00

162,500

100.00

4,062,500

100.00

2.79

2.79

2.79

13.97

2.79

2.79

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

Nil

Nil

Notes :

1.

2.

3.

4.

5.

Segmental Report for the Quarter as per AS-17 is not applicable for the Quarter.

Above resultes were reviewed by Audit Committee and taken on record by Board of Directors in meeting held on 10th November 2015.

Figures for previous quarter / year have been re-grouped / re-casted wherever necessary.

The Provision for Taxation will be made at the end of the Year.

The Auditors of the Company have carried out "Limited Review" of the above financial Results.

For

Place : Mumbai

Date : 10th November 2015

NCL Research & Financial Services Limited

Sd/-

Vijay J. Poddar

Managing Director

NCL Research & Financial Services Limited

Statement of Assets & Liabilities

Particulars

A EQUITY & LIABILITIES

1 Shareholders' Fund

(a) Share Capital

(b) Reserves and Surplus

(c) Money Received against Share Warrants

Sub-Total - Share Holders Fund

2 Share Capital Money (Pending Allotment

3 Minority Interest*

4

Non Current Liabilities

(a) Long Term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long Term Liabilities

(d) Long Term Provisions

Sub-Total - Long Term Liabilities

5 Current Liabilities

(a) Short Term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short Term Provisions

Sub-Total - Current Liabilities

TOTAL EQUITY & LIABILITIES

B ASSETS

1 Non-Current Assets

(a) Fixed Assets

(b) Goodwill on Consolidation*

(c) Non-Current Investments

(d) Deferred Tax Assets (Net)

(e) Long Term Loans & Advances

(f) Other Non-Current Assets

Sub-Total - Non Current Assets

2 Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash & Cash Equivalents

(e) Short Term Loans & Advances

(f) Other Current Assets

Sub-Total - Current Assets

TOTAL - ASSETS

Rs. in Lacs

30th Sept 2015

Un-Audited

As At

31st March 2015

2,908.50

3,420.58

-

6,329.08

Audited

2,908.50

3,246.62

-

6,155.12

38.28

15.26

19.40

38.28

12.18

5.40

72.94

6,402.02

55.86

6,210.98

4.46

2.34

-

7.21

2.50

-

6.80

9.71

91.30

180.94

97.76

6,008.92

16.30

91.30

224.94

119.80

5,765.23

-

6,395.22

6,402.02

6,201.27

6,210.98

You might also like

- Money Laundering and Global Financial CrimesDocument178 pagesMoney Laundering and Global Financial CrimesenoshaugustineNo ratings yet

- Pre-Trial ReportDocument10 pagesPre-Trial ReportAldrin Aguas100% (1)

- Meralco Vs Jan Carlo Gala March 7Document3 pagesMeralco Vs Jan Carlo Gala March 7Chezca MargretNo ratings yet

- Badges of Dummy StatusDocument3 pagesBadges of Dummy StatusPamela DeniseNo ratings yet

- BRAZILIAN SOYABEANS FOB CONTRACTDocument5 pagesBRAZILIAN SOYABEANS FOB CONTRACTstevenverbeek100% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Counter-Affidavit Denies Charges of Coercion and ThreatsDocument3 pagesCounter-Affidavit Denies Charges of Coercion and ThreatsRio LorraineNo ratings yet

- Reyes vs. Lim, G.R. No. 134241, 11aug2003Document2 pagesReyes vs. Lim, G.R. No. 134241, 11aug2003Evangelyn EgusquizaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document1 pageStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document5 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document8 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDocument5 pagesParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 8.G.R. No. L-48368 GRAZA VS CA 163 Scra 41Document6 pages8.G.R. No. L-48368 GRAZA VS CA 163 Scra 41Lord AumarNo ratings yet

- Opinion Dahlgren 2010Document83 pagesOpinion Dahlgren 2010Dean MostofiNo ratings yet

- Investment Declaration Format FY 2022-23Document3 pagesInvestment Declaration Format FY 2022-23Divya WaghmareNo ratings yet

- OCA Circular No. 88 2022 - CompressedDocument52 pagesOCA Circular No. 88 2022 - CompressedSunny MooreNo ratings yet

- Matsyanyaya PDFDocument17 pagesMatsyanyaya PDFFrancisco Oneto Nunes100% (1)

- KAPPA SIGMA BETA Fraternity: Checking and Auditing The Financial StatementsDocument3 pagesKAPPA SIGMA BETA Fraternity: Checking and Auditing The Financial StatementsZean TanNo ratings yet

- Family Races: Activity TypeDocument3 pagesFamily Races: Activity TypeHanhnguyen2020No ratings yet

- Autodesk® Revit® Structure Benutzerhandbuch (PDFDrive)Document1,782 pagesAutodesk® Revit® Structure Benutzerhandbuch (PDFDrive)ercNo ratings yet

- PDF Deed of Apartment BakhaleDocument9 pagesPDF Deed of Apartment BakhaleK ShantanuNo ratings yet

- Form 1. Application For Travel and Accommodation Assistance - April 2019Document4 pagesForm 1. Application For Travel and Accommodation Assistance - April 2019chris tNo ratings yet

- CH08 PDFDocument25 pagesCH08 PDFpestaNo ratings yet

- Effective Advocacy For School Leaders: Ohio School Boards AssociationDocument14 pagesEffective Advocacy For School Leaders: Ohio School Boards AssociationJosua BeronganNo ratings yet

- Politics by Other Means, Conflicting Interests in Libya's Security SectorDocument102 pagesPolitics by Other Means, Conflicting Interests in Libya's Security SectorNaeem GherianyNo ratings yet

- Newton's Second Law - RevisitedDocument18 pagesNewton's Second Law - RevisitedRob DicksonNo ratings yet

- Avaya AuraDocument94 pagesAvaya AuraVladimir DikosavljevicNo ratings yet

- Barry Keen Micra InterviewDocument304 pagesBarry Keen Micra Interviewjuly1962No ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleDEXTER ARGONCILLONo ratings yet

- Court Martial of Capt Poonam KaurDocument4 pagesCourt Martial of Capt Poonam Kaurguardianfoundation100% (2)

- Bulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaDocument4 pagesBulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaSsd IndiaNo ratings yet

- Guntaiah Vs Hambamma Air 2005 SC 4013Document6 pagesGuntaiah Vs Hambamma Air 2005 SC 4013Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (2)

- SEC 6.01 - People V Garfin GR No.153176, 426 SCRA 393 PDFDocument25 pagesSEC 6.01 - People V Garfin GR No.153176, 426 SCRA 393 PDFabo8008No ratings yet

- Principles of Cost Accounting 16th Edition Vanderbeck Solution ManualDocument47 pagesPrinciples of Cost Accounting 16th Edition Vanderbeck Solution Manualcorey100% (30)

- Satire in Monty PythonDocument2 pagesSatire in Monty PythonJonathan Chen100% (4)