Professional Documents

Culture Documents

Prac MT

Uploaded by

NguyênOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prac MT

Uploaded by

NguyênCopyright:

Available Formats

Accounting 311 Spring 2004 Midterm Exam.

Name _____________________________________

Unless specified otherwise, all questions are worth 4 points. For multiple-choice questions, circle

the best answer.

1. On April 15 a distraught employee, Bob Heavyfoot, backed his truck into your main plant and

destroyed the plant and all of its contents. Fortunately, certain accounting records were kept in

another building. Therefore, you know the following for the period January 1 to April 15, 2004:

Revenues

$500,000

GM (% of revenues)

25%

Direct materials purchased

$170,800

Direct Materials, 1/1/2004

$21,000

Work-in-Process, 1/1/2004

$17,000

Finished Goods, 1/1/2004

$7,000

Conversion Costs

$244,200

Cost of Goods Avail. for sale $386,000

Conversion costs equal 60% of total mfg. cost during the period.

What was the cost of Finished Goods inventory destroyed?

What was the cost of Work-in-Process inventory destroyed?

How much Direct Materials inventory was destroyed?

2. All of the following are true EXCEPT that indirect costs

A. may be included in prime costs.

B. are not easily traced to products or services.

C. vary with the selection of the cost object.

D. may be included in manufacturing overhead.

-1-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

3. At a breakeven point of 200 units, variable costs total $400 and fixed costs total $600. The 201st

unit sold will contribute how much to profits? (6 pts)

4. What is the correct journal entry if $57,000 of direct materials and $4,000 of indirect materials are

sent to the factory floor?

5. How many units would have to be sold to yield a target operating income of $22,000, assuming

variable costs are $15 per unit, total fixed costs are $2,000 and the unit selling price is $20?

6. The breakeven point decreases if

A. variable cost per unit increases.

B. total fixed costs decrease.

C. contribution margin per unit decreases.

D. selling price per unit decreases.

7. How is the margin of safety defined in the textbook?

-2-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

8. When a greater proportion of operating costs are fixed, then

A. a small increase in sales results in a small decrease in operating income.

B. when demand is low then risk of loss is high.

C. when demand is high the breakeven point is increased.

D. a decrease in sales reduces the cost per unit.

9. How does an increase in the income tax rate affect the breakeven point?

10. Wilson Company uses normal costing and direct labor hours to allocate mfg. overhead to jobs.

For 2003, Wilson budgeted 1,200 direct labor hours (actual was 1,100). Wilson also budgeted

$60,000 indirect mfg. costs. (10 pts.)

Ending $ balances in selected accounts are:

Materialscontrol $ 3,000

Work-in-process

10,000

Finished Goods

20,000

CoGS

170,000

MOHcontrol

45,000

Below provide the journal entry to write off the difference between allocated and actual overhead

using the proration approach based on ending total $ balances and close the overhead accounts.

-3-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

11. In class we discussed four ways to fix the under- over-allocated problem at the end of the period.

Which approach do most companies use? Why?

12. What can cause product-cost cross-subsidization?

13. Assuming that you are using a traditional cost system, what are two signs that you may need to

change/modify/refine your cost system?

14. The UNIQUE feature of an ABC system is the emphasis on

A. costing individual jobs.

B. department indirect cost rates.

C. multiple cost pools.

D. individual activities.

15. A well designed ABC cost system helps managers make better decisions because information

derived from an ABC analysis

A. can be used to eliminate nonvalue-added activities.

B. is easy to analyze and interpret.

C. takes the choices and judgment challenges away from the managers.

D. emphasizes how managers can achieve higher sales.

-4-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

16. Cocoa Pet Corporation manufactures two models of grooming stations, a standard and a deluxe

model. The following activity and cost information has been compiled. (12 pts)

Product

Standard

Deluxe

Overhead costs

Number of

Setups

3

7

Number of

Components

30

50

$20,000

$60,000

Number of

Direct Labor Hours

650

150

Assume a traditional costing system applies the $80,000 of overhead costs based on direct

labor hours.

a.

What is the total amount of overhead costs assigned to the standard model?

b.

What is the total amount of overhead costs assigned to the deluxe model?

Now assume that an activity-based costing system is used and that number of setups and

number of components are identified as the activity-cost drivers for overhead.

c.

What is the total amount of overhead costs assigned to the standard model?

d.

What is the total amount of overhead costs assigned to the deluxe model?

-5-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

17. ZVEREVA Beverage, Inc. uses the weighted-average method of process costing. Direct

materials in the Bottling department are added at the end of the process. Consider the

following data for the Bottling Department of ZVEREVA for the month of January:

WIP, Jan.1

Started or work

done in Jan.

CTO

Physical

Units

Direct

Materials

Conversion

Costs

57,000

$0

$64,125

600,000

Cost added in Jan.

WIP, Jan.31

$1,260,000

$915,300

27,000

Jan. 1 degree of completion: CC 90%

Jan. 31 degree of completion: CC 85%

Fill in the table below: (in $) [18 pts.]

DM

CC

No points

No points

TOTAL

CTO

E.WIP

TOTAL

18. How does the accounting treatment for Abnormal and Normal Spoilage differ?

-6-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

19. The Gangwere Company has assembled the following data pertaining to certain costs that cannot

be easily identified as either fixed or variable. Gangwere Company has heard about a method of

measuring cost functions called the high-low method and has decided to use it in this situation.

Month

January

February

March

April

May

June

Cost

$40,000

24,400

31,280

36,400

44,160

45,400

Hours

3,500

2,000

2,450

3,000

3,900

3,740

What is the estimated unit variable cost (slope coefficient)?

What is the estimated fixed cost (constant or intercept)?

What is the estimated total cost at an operating level of 2,850 hours?

20.

An inaccurate cost function with a slope coefficient that is estimated too low may MOST likely

result in

A. predicting total costs that are too high.

B. initiating cost cutting measures when they are unnecessary.

C. evaluating a weak manager as having strong performance.

D. promoting a product that is actually more profitable than budgeted.

-7-

Accounting 311 Spring 2004 Midterm Exam. Name _____________________________________

21. Schmidt Corporation produces a part that is used in the manufacture of one of its products. The

costs associated with the production of 10,000 units of this part are as follows:

Direct materials

Direct labor

Variable factory overhead

Fixed factory overhead

Total costs

$ 45,000

65,000

30,000

70,000

$210,000

Of the fixed factory overhead costs, $30,000 is avoidable.

Phil Company has offered to sell 10,000 units of the same part to Schmidt Corporation for $18

per unit. Assuming there is no other use for the facilities, should Schmidt make or buy from

Phil? Why?

Assuming no other use of their facilities, what is the highest price that Schmidt should be

willing to pay for 10,000 units of the part?

22.

Relevant costs in a make-or-buy decision of a part include

A. setup overhead for the manufacture of the product using the outsourced part.

B. currently used manufacturing capacity that has alternative uses.

C. annual plant insurance costs that will remain the same.

D. corporate office costs that will be allocated differently.

23. Define opportunity cost. (2 pts)

-8-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

1. On April 15 a distraught employee, Bob Heavyfoot, backed his truck into your main plant and

destroyed the plant and all of its contents. Fortunately, certain accounting records were kept in

another building. Therefore, you know the following for the period January 1 to April 15, 2004:

Revenues

$500,000

GM (% of revenues)

25%

Direct materials purchased

$170,800

Direct Materials, 1/1/2004

$21,000

Work-in-Process, 1/1/2004

$17,000

Finished Goods, 1/1/2004

$7,000

Conversion Costs

$244,200

Cost of Goods Avail. for sale $386,000

Conversion costs equal 60% of total mfg. cost during the period.

What was the cost of Finished Goods inventory destroyed?

CoGS = (1-.25) * $500,000 = $375,000

Ending FG Inv. = GAS COGS = $386,000 - $375,000 = $11,000

What was the cost of Work-in-Process inventory destroyed?

CoGM = GAS - Beg. FG Inv. = $386,000 - $7,000 = $379,000

Costs added to WIP this period = CC/0.6 = $244,200 / 0.6 = $407,000

End. WIP Inv. = $17,000 + $407,000 - $379,000 = $45,000

How much Direct Materials inventory was destroyed?

Direct materials used = Total mfg. cost CC = $407,000 - $244,200 = $162,800

Direct materials destroyed = $21,000 + 170,800 - $162,800 = $29,000

2. All of the following are true EXCEPT that indirect costs

A. may be included in prime costs.

B. are not easily traced to products or services.

C. vary with the selection of the cost object.

D. may be included in manufacturing overhead.

-9-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

3. At a breakeven point of 200 units, variable costs total $400 and fixed costs total $600. The 201st

unit sold will contribute how much to profits? (6 pts)

At 200 units, revenues = $1,000 and USP = $5. UVC = $400 / 200 = $2 / unit.

Therefore, UCM = $5 2 = $3.

4. What is the correct journal entry if $57,000 of direct materials and $4,000 of indirect materials are

sent to the factory floor?

Work-in-Process Control $57,000

Mfg. Overhead Control

4,000

Materials Control

$61,000

5. How many units would have to be sold to yield a target operating income of $22,000, assuming

variable costs are $15 per unit, total fixed costs are $2,000 and the unit selling price is $20?

(2,000 + 22,000) / 20 15 = 4,800 units

6. The breakeven point decreases if

A. variable cost per unit increases.

B. total fixed costs decrease.

C. contribution margin per unit decreases.

D. selling price per unit decreases.

7. How is the margin of safety defined in the textbook?

It is the difference between budgeted (or actual) revenues and breakeven revenues.

-10-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

8. When a greater proportion of operating costs are fixed, then

A. a small increase in sales results in a small decrease in operating income.

B. when demand is low then risk of loss is high.

C. when demand is high the breakeven point is increased.

D. a decrease in sales reduces the cost per unit.

9. How does an increase in the income tax rate affect the breakeven point?

It does not!

10. Wilson Company uses normal costing and direct labor hours to allocate mfg. overhead to jobs.

For 2003, Wilson budgeted 1,200 direct labor hours (actual was 1,100). Wilson also budgeted

$60,000 indirect mfg. costs. (10 pts.)

Ending $ balances in selected accounts are:

Materialscontrol $ 3,000

Work-in-process

10,000

Finished Goods

20,000

CoGS

170,000

MOHcontrol

45,000

Below provide the journal entry to write off the difference between allocated and actual overhead

using the proration approach based on ending total $ balances and close the overhead accounts.

Budgeted MOH rate = $60,000 / 1,200 = $50/DLH

Allocated MOH = $50 * 1,100 = $55,000

Therefore, OVERallocated $10,000

WIP = 10/200 = 5%

FG = 20/200 = 10%

CoGS = 170/200 = 85%

MOHallocated

$55,000

CoGS

FG

WIP

MOHcontrol

$ 8,500

1,000

500

45,000

-11-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

11. In class we discussed four ways to fix the under- over-allocated problem at the end of the period.

Which approach do most companies use? Why?

Direct w/o to CoGS; easy and does not make a material difference for them.

12. What can cause product-cost cross-subsidization?

Cost smoothing or peanut-butter costingusing broad averages assign cost.

13. Assuming that you are using a traditional cost system, what are two signs that you may need to

change/modify/refine your cost system?

Managers do not use/trust current systems output.

Get jobs you expect to not and visa versa.

Your process has changed but cost system has not.

You have increased (intense) competition.

14. The UNIQUE feature of an ABC system is the emphasis on

A. costing individual jobs.

B. department indirect cost rates.

C. multiple cost pools.

D. individual activities.

15. A well designed ABC cost system helps managers make better decisions because information

derived from an ABC analysis

A. can be used to eliminate nonvalue-added activities.

B. is easy to analyze and interpret.

C. takes the choices and judgment challenges away from the managers.

D. emphasizes how managers can achieve higher sales.

-12-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

16. Cocoa Pet Corporation manufactures two models of grooming stations, a standard and a deluxe

model. The following activity and cost information has been compiled. (12 pts)

Product

Standard

Deluxe

Overhead costs

Number of

Setups

3

7

Number of

Components

30

50

$20,000

$60,000

Number of

Direct Labor Hours

650

150

Assume a traditional costing system applies the $80,000 of overhead costs based on direct

labor hours.

a.

What is the total amount of overhead costs assigned to the standard model?

($80,000 / (650 + 150)) x 650 = $65,000

b.

What is the total amount of overhead costs assigned to the deluxe model?

($80,000 / (650 + 150)) x 150 = $15,000

Now assume that an activity-based costing system is used and that number of setups and

number of components are identified as the activity-cost drivers for overhead.

c.

What is the total amount of overhead costs assigned to the standard model?

Setups: $20,000 / (3 + 7) = $2,000

Components: $60,000 / (30 + 50) = $750

($2,000 x 3) + ($750 x 30) = $28,500

d.

What is the total amount of overhead costs assigned to the deluxe model?

($2,000 x 7) + ($750 x 50) = $51,500

-13-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

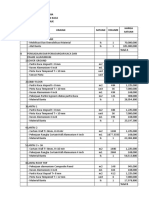

17. ZVEREVA Beverage, Inc. uses the weighted-average method of process costing. Direct

materials in the Bottling department are added at the end of the process. Consider the

following data for the Bottling Department of ZVEREVA for the month of January:

WIP, Jan.1

Started or work

done in Jan.

CTO

Physical

Units

Direct

Materials

57,000

$0

$64,125

51,300

600,000

630,000

601,650

630,000

630,000

630,000

Cost added in Jan.

WIP, Jan.31

Conversion

Costs

$1,260,000

27,000

$915,300

0

Total $ =

$1,260,000

22,950

$979,425

$2.00 /eu

$1.50 /eu

Jan. 1 degree of completion: CC 90%

Jan. 31 degree of completion: CC 85%

Fill in the table below: (in $) [18 pts.]

DM

CTO 630,000

E.WIP 0 : 22,950

TOTAL

$1,260,000

CC

630,000@$1.50 =

$945,000

TOTAL

$2,205,000

$0

22,950@$1.50 =

$ 34,425

$34,425

No points

No points

$2,239,425

18. How does the accounting treatment for Abnormal and Normal Spoilage differ?

Abnormal spoilage is expensed in the period detected while normal spoilage becomes part of the

cost of the product (CTO and TI cost) and is expensed in COGS when sold.

-14-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

19. The Gangwere Company has assembled the following data pertaining to certain costs that cannot

be easily identified as either fixed or variable. Gangwere Company has heard about a method of

measuring cost functions called the high-low method and has decided to use it in this situation.

Month

January

February

March

April

May

June

Cost

$40,000

24,400

31,280

36,400

44,160

45,400

Hours

3,500

2,000

2,450

3,000

3,900

3,740

What is the estimated unit variable cost (slope coefficient)?

b = ($44,160 - $24,400) / (3,900 2,000) = $10.40

What is the estimated constant (intercept)?

$44,160 = a + $10.40 (3,900)

a = $3,600

What is the estimated total cost at an operating level of 2,850 hours?

y = $3,600 + $10.40 (2,850) = $33,240

20.

An inaccurate cost function with a slope coefficient that is estimated too low may MOST likely

result in

A. predicting total costs that are too high.

B. initiating cost cutting measures when they are unnecessary.

C. evaluating a weak manager as having strong performance.

D. promoting a product that is actually more profitable than budgeted.

-15-

Accounting 311 Spring 2004 Midterm Exam.

****** KEY ******

21. Schmidt Corporation produces a part that is used in the manufacture of one of its products. The

costs associated with the production of 10,000 units of this part are as follows:

Direct materials

Direct labor

Variable factory overhead

Fixed factory overhead

Total costs

$ 45,000

65,000

30,000

70,000

$210,000

Of the fixed factory overhead costs, $30,000 is avoidable.

Phil Company has offered to sell 10,000 units of the same part to Schmidt Corporation for $18

per unit. Assuming there is no other use for the facilities, should Schmidt make or buy from

Phil? Why?

Make the part, as this would save $1 per unit.

Avoidable costs total $170,000 = $45,000 + $65,000 + $30,000 + $30,000.

$18 - $170,000/10,000 = $1

Assuming no other use of their facilities, what is the highest price that Schmidt should be

willing to pay for 10,000 units of the part ?

$45,000 + $65,000 + $30,000 + $30,000 = $170,000

22.

Relevant costs in a make-or-buy decision of a part include

A. setup overhead for the manufacture of the product using the outsourced part.

B. currently used manufacturing capacity that has alternative uses.

C. annual plant insurance costs that will remain the same.

D. corporate office costs that will be allocated differently.

23. Define opportunity cost. (2 pts)

The (net) benefit foregone by not choosing the next best alternative.

-16-

You might also like

- WARC 100 Summary of Results PDFDocument18 pagesWARC 100 Summary of Results PDFNguyênNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Mindset: If You Like This Summary, Buy The BookDocument16 pagesMindset: If You Like This Summary, Buy The BookRajeev K Nair100% (8)

- Academic Question Paper Test 9Document21 pagesAcademic Question Paper Test 9Berry BlueNo ratings yet

- Ielts Teachers GuideDocument32 pagesIelts Teachers Guidesuccess4everNo ratings yet

- Job CostingDocument10 pagesJob CostingGeejayFerrerPaculdoNo ratings yet

- Chap 004Document42 pagesChap 004NguyênNo ratings yet

- 1298 English ExercisesDocument126 pages1298 English ExercisesNguyênNo ratings yet

- Chap 020Document56 pagesChap 020NguyênNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RENCANA ANGGARAN BIAYA PEMASANGAN KACA PROYEK GEDUNG 21 AVENUEDocument5 pagesRENCANA ANGGARAN BIAYA PEMASANGAN KACA PROYEK GEDUNG 21 AVENUEAswal Al-fakirNo ratings yet

- Credit AppraisalDocument14 pagesCredit AppraisalRishabh Jain0% (1)

- A Project Report On Working Capital Management at Hero Honda PVT LTDDocument73 pagesA Project Report On Working Capital Management at Hero Honda PVT LTDNagireddy Kalluri75% (4)

- Cables Qutation-NationalDocument2 pagesCables Qutation-NationalMuhammad Abubakar QureshiNo ratings yet

- Fish Food SufficiencyDocument30 pagesFish Food SufficiencyDonaldDeLeonNo ratings yet

- Urbanism Si Mobila UrbanaDocument148 pagesUrbanism Si Mobila UrbanaLaura FinkelsteinNo ratings yet

- 170 - Help Points List PDFDocument6 pages170 - Help Points List PDFRaju PuttaswamyNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument8 pagesRequest For Taxpayer Identification Number and Certificationxintong liuNo ratings yet

- P2WORKDocument2 pagesP2WORKkhefnerNo ratings yet

- Dynamic BalancingDocument2 pagesDynamic BalancingChetan PrajapatiNo ratings yet

- Mental Health Nursing R ShreevaniDocument3 pagesMental Health Nursing R ShreevaniBalwant SinghNo ratings yet

- CH 6 Reverse Logistics PresentationDocument27 pagesCH 6 Reverse Logistics PresentationSiddhesh KolgaonkarNo ratings yet

- Lee Metcalf: The Homestead Act of 1862 National Wildlife RefugeDocument2 pagesLee Metcalf: The Homestead Act of 1862 National Wildlife RefugeChristian ComunityNo ratings yet

- Sectoral Snippets: India Industry InformationDocument18 pagesSectoral Snippets: India Industry Informationpg10shivi_gNo ratings yet

- CVP Considerations in Choosing Between High Fixed or Variable Cost StructuresDocument3 pagesCVP Considerations in Choosing Between High Fixed or Variable Cost StructuresJonna LynneNo ratings yet

- Brannigan Foods: Strategic Marketing PlanningDocument13 pagesBrannigan Foods: Strategic Marketing PlanningNand BhushanNo ratings yet

- User Guide Clearing Messages SWIFT ISO 15022: MT54x Version 1.6 (Release 2008)Document96 pagesUser Guide Clearing Messages SWIFT ISO 15022: MT54x Version 1.6 (Release 2008)Gordana PavlovaNo ratings yet

- DocxDocument2 pagesDocxWalt Chea100% (6)

- Debt Dispute LetterDocument2 pagesDebt Dispute LetterBenson ZhangNo ratings yet

- Travel PDFDocument1 pageTravel PDFtaliajanelleNo ratings yet

- Apparel Industry of Sri LankaDocument4 pagesApparel Industry of Sri LankaRanjan NishanthaNo ratings yet

- Stigler - Theory of Econ RegulationDocument20 pagesStigler - Theory of Econ Regulationheh92No ratings yet

- Industrialisation As A Process of Social Change in IndiaDocument4 pagesIndustrialisation As A Process of Social Change in IndiaBiren PachalNo ratings yet

- Board Resolution of Peace Riders Club Pascam II General Trias ChapterDocument2 pagesBoard Resolution of Peace Riders Club Pascam II General Trias ChapterCM Ronald Bautista100% (2)

- Nooyi Economic Club of Washington 51209Document34 pagesNooyi Economic Club of Washington 51209Prateek UpadhyayNo ratings yet

- TEF 1000 NAMES 2019 TEF Partners 1 .01Document7 pagesTEF 1000 NAMES 2019 TEF Partners 1 .01KAMPAMBA LUKWESANo ratings yet

- Strategic Management Project On Tata SteelDocument18 pagesStrategic Management Project On Tata SteelRonak GosaliaNo ratings yet

- PEST Example Analysis TemplateDocument1 pagePEST Example Analysis TemplateKarim AbdelazeemNo ratings yet

- Analysis of Vehicle Operating Costs (VOC) and Travel Time SavingsDocument10 pagesAnalysis of Vehicle Operating Costs (VOC) and Travel Time Savingsyitno507No ratings yet

- Research On AgingDocument5 pagesResearch On AgingAslam RehmanNo ratings yet