Professional Documents

Culture Documents

Fixed Income Securities

Uploaded by

Raghuveer ChandraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Income Securities

Uploaded by

Raghuveer ChandraCopyright:

Available Formats

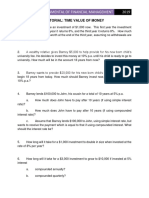

3.

A prospective homeowner wants to determine how much she can borrow in the form of a fixed-rate

20-year mortgage. Mortgages of that maturity carry a fixed interest rate of 9.00%. She estimates that she

can afford annual, pre-tax payments (interest plus principal) on her mortgage of $25,000 (for simplicity,

assume that mortgage payments are made once a year at the end of the year).

A. How large a mortgage can she afford, assuming she makes steady payments of $25,000 per year

for 20 years? How much total interest will be paid over the 20-year life of the mortgage?

How much interest will be paid during the first year of the mortgage? How much principal will

be repaid in the first year? How much of the final $25,000 payment at the end of 20 years will be

interest and how much will be principal?

B. Suppose the prospective home owner expects her income to grow such that she could afford

$25,000 per year of total debt service in the first five years of a 20-year mortgage, $30,000 per

year in the second five years, $35,000 in the third five years, and $40,000 in the last five years.

How large a mortgage at 9.00% could she afford under these circumstances?

4. To help ease a continuing need for financing, the Consolidated Chemical Company is considering

borrowing from insurance companies through a so-called private placement of bonds in addition to

issuing bonds in public debt markets. The company must choose between transactions suggested by two

different insurance companies. In both transactions, Consolidated Chemical would receive $10,000,000

up front in exchange for issuing a bond promising a single (larger) maturity payment from Consolidated

Chemical in 15 years at a promised interest rate. The two options open to Consolidated Chemical are as

follows:

A 15-year bond to Pru-Johntower Life Insurance Company, promising an annual rate of interest

of 10%;

A 15-year bond to Tom Paine Mutual Life Insurance Company, promising a rate of interest of

9.72% per year, compounded monthly.

A. What is the effective annual yield to maturity on each of the bonds?

B. What is the future required payment that Consolidated Chemical will make 15 years later on each

bond?

The Treasurer of Consolidated Chemical also explored with each insurance company the possibility of

selling an identical dollar amount of 15-year bonds that would make regular semi-annual coupon

payments each year and $10 million principal repayment at maturity rather than a single lump-sum

payment. It was discovered in each case that the insurance company would require an effective annual

yield on ordinary coupon bonds of equivalent default risk that was 50 basis points (i.e., 0.50%) higher

than the effective annual yields on the bonds with no coupons.

C. What might explain why the insurance companies would require a slightly higher effective annual

yield on the coupon bonds compared to the bonds with no coupons?

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Corporate Finance Practice ExamDocument11 pagesCorporate Finance Practice ExamPeng Jin100% (1)

- Final Exam Review-VrettaDocument4 pagesFinal Exam Review-VrettaAna Cláudia de Souza0% (2)

- Expert Witness DiscloseDocument4 pagesExpert Witness Discloseexpretwitness100% (1)

- AINS 23 - Commercial Insurance NotesDocument52 pagesAINS 23 - Commercial Insurance Notesvijaijohn100% (1)

- Problem Sets 15 - 401 08Document72 pagesProblem Sets 15 - 401 08Muhammad GhazzianNo ratings yet

- Too Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyDocument8 pagesToo Many Jobs - Linda Green, Tywanna Thomas, Korell Harp and Shelly ScheffeyForeclosure FraudNo ratings yet

- Problem SetsDocument69 pagesProblem SetsAnnagrazia ArgentieriNo ratings yet

- Verified Motion To Vacate Final Judgment of Foreclosure and Cancel Sep-19-2017 Foreclosure SaleDocument7 pagesVerified Motion To Vacate Final Judgment of Foreclosure and Cancel Sep-19-2017 Foreclosure SaleNeil GillespieNo ratings yet

- Stem-and-Leaf Plots & Histograms QuizDocument8 pagesStem-and-Leaf Plots & Histograms QuizRaghuveer ChandraNo ratings yet

- Format Sec 14 SarfaesiDocument11 pagesFormat Sec 14 SarfaesiHari100% (6)

- Sarfaesi Work Manual Book-ActualDocument43 pagesSarfaesi Work Manual Book-Actualamithasnani100% (3)

- Property - 493 Balite Vs LimDocument5 pagesProperty - 493 Balite Vs LimXing Keet LuNo ratings yet

- Ch5Probset Bonds+Interest 13ed. - MasterDocument8 pagesCh5Probset Bonds+Interest 13ed. - Masterpratiksha1091No ratings yet

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- JPMorgan Chase Mortgage Settlement DocumentsDocument291 pagesJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (2)

- Practice Set - TVMDocument2 pagesPractice Set - TVMVignesh KivickyNo ratings yet

- MathDocument42 pagesMathMamun RashidNo ratings yet

- 10-12 Assignment 1Document4 pages10-12 Assignment 1Pavan Kasireddy100% (1)

- Plaint BankingDocument6 pagesPlaint Bankingumaima ali100% (1)

- R06 The Time Value of Money Q BankDocument19 pagesR06 The Time Value of Money Q BankTeddy JainNo ratings yet

- Barreto V VillanuevaDocument18 pagesBarreto V VillanuevaSalma GurarNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- 2022-Sesi 8-Bond Valuation-Ed 12Document3 pages2022-Sesi 8-Bond Valuation-Ed 12Gabriela ClarenceNo ratings yet

- FM Tutorial TVM 2023.24Document5 pagesFM Tutorial TVM 2023.24Đức ThọNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- RE 410: Real Estate Finance: Spring 2017Document2 pagesRE 410: Real Estate Finance: Spring 2017Mohammed Al-YagoobNo ratings yet

- Problem Sets Present ValueDocument16 pagesProblem Sets Present ValueJoaquín Norambuena EscalonaNo ratings yet

- Mortgage Markets 2 1Document9 pagesMortgage Markets 2 1Janine Bad-angNo ratings yet

- Simple Compound Interest ProblemDocument2 pagesSimple Compound Interest ProblemKissy Jeirel SyNo ratings yet

- Work Sheet MBA CompiledDocument5 pagesWork Sheet MBA CompiledTeketel chemesaNo ratings yet

- 2017 Seminar4StudentsDocument2 pages2017 Seminar4StudentsLizzyNo ratings yet

- University of Pennsylvania The Wharton SchoolDocument18 pagesUniversity of Pennsylvania The Wharton SchoolBassel ZebibNo ratings yet

- EconomicsDocument11 pagesEconomicsJorosh Laurente DelosoNo ratings yet

- KIRTI1Document19 pagesKIRTI1Pallavi KokateNo ratings yet

- Debt ExerciseDocument5 pagesDebt ExerciseGiang Truong ThuyNo ratings yet

- Lecture 3 QuestionsDocument9 pagesLecture 3 QuestionsPubg KrNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Investments Exercise 3Document3 pagesInvestments Exercise 3Vilhelm CarlssonNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Assignment 1Document2 pagesAssignment 1Utsav PathakNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Bonds Valuation 2017 STUDocument4 pagesBonds Valuation 2017 STUAnissa GeddesNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Tutorial 1 Time Value of Money PDFDocument2 pagesTutorial 1 Time Value of Money PDFLâm TÚc NgânNo ratings yet

- Preguntas 5 y 6Document4 pagesPreguntas 5 y 6juan planas rivarolaNo ratings yet

- Chapter 5 - ExercisesDocument2 pagesChapter 5 - ExercisesVân Nhi PhạmNo ratings yet

- MNGT 604 Day1 Day2 Problem Set-2Document6 pagesMNGT 604 Day1 Day2 Problem Set-2harini muthuNo ratings yet

- Bonds and NotesDocument3 pagesBonds and Notesjano_art21No ratings yet

- Chapter 5 ExercisesDocument2 pagesChapter 5 ExercisesTranh Meow MeowNo ratings yet

- Introduction To Bonds PayableDocument2 pagesIntroduction To Bonds PayableMarko Zero FourNo ratings yet

- Midterm Test 1Document3 pagesMidterm Test 1Hùng Trường NguyễnNo ratings yet

- Exercise Economics Evaluation of StermoleDocument28 pagesExercise Economics Evaluation of StermoleHendro StrifeNo ratings yet

- Answer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Document3 pagesAnswer: (A) Payment of Beginning of Year 2 535.96, Year 3 576.16, Year 4 619.37, Year 5 665.82 (B) CPM 648.03 (C) Effective Yield 9.07%Irfan AzmanNo ratings yet

- W2 Fixed Income Valuation (Case 1)Document4 pagesW2 Fixed Income Valuation (Case 1)Grace IdreesNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMNguyễn Quốc HưngNo ratings yet

- Chapter 6Document27 pagesChapter 6Moin Uddin SiddiqueNo ratings yet

- Assignment 1Document7 pagesAssignment 1Camilo Andres MesaNo ratings yet

- Bonds PayableDocument42 pagesBonds PayableRukhsar Abbas Ali .No ratings yet

- Present Value: QuestionsDocument4 pagesPresent Value: QuestionsGajender SinghNo ratings yet

- TVM AssignmentDocument2 pagesTVM AssignmentCiarra CunananNo ratings yet

- FI Def Elements QBDocument13 pagesFI Def Elements QBheisenbergNo ratings yet

- Homework Assignment 1 KeyDocument6 pagesHomework Assignment 1 KeymetetezcanNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- 991財管題庫Document10 pages991財管題庫zzduble1No ratings yet

- How to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongFrom EverandHow to Reverse World Recession in Matter of Days: Win 10 Million Dollar to Prove It WrongNo ratings yet

- Word ListDocument63 pagesWord Listhari17101991No ratings yet

- A Sampling-and-Discarding Approach To Chance-Constrained Optimization: Feasibility and OptimalityDocument24 pagesA Sampling-and-Discarding Approach To Chance-Constrained Optimization: Feasibility and OptimalityRaghuveer ChandraNo ratings yet

- Dr. Subbarao - Corona Financial Crisis - Is This Time Different - 12 April2020Document12 pagesDr. Subbarao - Corona Financial Crisis - Is This Time Different - 12 April2020Raghuveer ChandraNo ratings yet

- PQ2 PDFDocument21 pagesPQ2 PDFBrew-sam ABNo ratings yet

- Life Is A Glorious GiftDocument5 pagesLife Is A Glorious GiftRaghuveer ChandraNo ratings yet

- Operations Research Applications and Algorithms, Wayne L. Winston, 4 Edition, 2004, Cengage Learning, ISBN-13: 9780534380588Document10 pagesOperations Research Applications and Algorithms, Wayne L. Winston, 4 Edition, 2004, Cengage Learning, ISBN-13: 9780534380588Raghuveer ChandraNo ratings yet

- DES627A SampleDocument3 pagesDES627A SampleRaghuveer ChandraNo ratings yet

- Aimcat 1202 PDFDocument19 pagesAimcat 1202 PDFRaghuveer ChandraNo ratings yet

- R&D, Innovation and Growth: Performance of The World's Leading Technology CorporationsDocument21 pagesR&D, Innovation and Growth: Performance of The World's Leading Technology CorporationsRaghuveer ChandraNo ratings yet

- Cac 40 20180329Document3 pagesCac 40 20180329Anirban BanerjeeNo ratings yet

- A Conic Section and A PointDocument1 pageA Conic Section and A PointRaghuveer ChandraNo ratings yet

- 2015 28 ReportDocument27 pages2015 28 ReportRaghuveer ChandraNo ratings yet

- IITGN Faculty AdvtDocument2 pagesIITGN Faculty AdvtSudipNo ratings yet

- SolutionsDocument11 pagesSolutionsRaghuveer ChandraNo ratings yet

- Ajor20110300002 44047984Document18 pagesAjor20110300002 44047984Raghuveer ChandraNo ratings yet

- CH Pres 01Document58 pagesCH Pres 01Adnan KamalNo ratings yet

- Uncapacitated and Capacitated Facility Location Problems: Vedat VerterDocument14 pagesUncapacitated and Capacitated Facility Location Problems: Vedat VerterRaghuveer ChandraNo ratings yet

- Chapter 07 PDFDocument20 pagesChapter 07 PDFRaghuveer ChandraNo ratings yet

- Expected Utility and Risk AversionDocument32 pagesExpected Utility and Risk AversionRaghuveer ChandraNo ratings yet

- Multiobjective OptimizationDocument6 pagesMultiobjective OptimizationRaghuveer ChandraNo ratings yet

- A Conic Section and A Straight LineDocument1 pageA Conic Section and A Straight LineRaghuveer ChandraNo ratings yet

- A Conic Section and A PointDocument1 pageA Conic Section and A PointRaghuveer ChandraNo ratings yet

- Expected Utility and Risk AversionDocument32 pagesExpected Utility and Risk AversionRaghuveer ChandraNo ratings yet

- Solutions Extra PDFDocument36 pagesSolutions Extra PDFRaghuveer ChandraNo ratings yet

- The Shortest Distance Between Skew LinesDocument5 pagesThe Shortest Distance Between Skew LinesRaghuveer ChandraNo ratings yet

- Steiner's Division by PlanesDocument4 pagesSteiner's Division by PlanesAshu1803No ratings yet

- Read Me FirstDocument1 pageRead Me FirstRaghuveer ChandraNo ratings yet

- The Sphere Circumscribing A TetrahedronDocument4 pagesThe Sphere Circumscribing A TetrahedronRaghuveer ChandraNo ratings yet

- Dorrie Heinrich ProblemsDocument3 pagesDorrie Heinrich ProblemsRaghuveer ChandraNo ratings yet

- Rwanda Financial System Stability Assessment FSSADocument45 pagesRwanda Financial System Stability Assessment FSSADagobert RugwiroNo ratings yet

- Real EstateDocument147 pagesReal Estatedcca calgaryNo ratings yet

- Navarro VS Solidum FullDocument7 pagesNavarro VS Solidum Fulljovani emaNo ratings yet

- Legal Notice Demand Against Bayana ForfeitDocument8 pagesLegal Notice Demand Against Bayana ForfeitVarinder DhimanNo ratings yet

- 10 04 2012 Alex Times LowResDocument28 pages10 04 2012 Alex Times LowResAlexandriaTimesNo ratings yet

- ECON - Ch. 1-4Document12 pagesECON - Ch. 1-4CheskaNo ratings yet

- Mortgages PQ Solving Property LawDocument4 pagesMortgages PQ Solving Property LawMahdi Bin MamunNo ratings yet

- In The Helen Galope Matter - Plaintiffs Revised Statement of Genuine IssuesDocument28 pagesIn The Helen Galope Matter - Plaintiffs Revised Statement of Genuine Issues83jjmack100% (1)

- Math 1050 Mortgage ProjectDocument7 pagesMath 1050 Mortgage Projectapi-253957931No ratings yet

- Submitted To: Sk. Alamgir Hossain Lecturer Department of Finance Jagannath University, Dhaka-1100Document35 pagesSubmitted To: Sk. Alamgir Hossain Lecturer Department of Finance Jagannath University, Dhaka-1100Kazi AsaduzzmanNo ratings yet

- Raiffeisen Bank International Q3 ReportDocument138 pagesRaiffeisen Bank International Q3 ReportCiocoiu Vlad AndreiNo ratings yet

- 10 Advance PDFDocument13 pages10 Advance PDFoperatingc watNo ratings yet

- DTCP DPMS, PDCR UserManual PDFDocument49 pagesDTCP DPMS, PDCR UserManual PDFvenkata satyaNo ratings yet

- A - Types of GIDocument27 pagesA - Types of GIPuneet NarulaNo ratings yet

- Bis 4Document4 pagesBis 4Koru KaoruNo ratings yet

- 4CM0 01 Que 20160512Document16 pages4CM0 01 Que 20160512Dhoni KhanNo ratings yet

- W07 Case Study Loan AssignmentDocument66 pagesW07 Case Study Loan AssignmentArmando Aroni BacaNo ratings yet

- Private Financing CanadaDocument2 pagesPrivate Financing CanadaAlpha MortgageNo ratings yet

- Mortgage and RRSPDocument2 pagesMortgage and RRSPmetaldwarfNo ratings yet

- Marketing of Financial Services AsignmentDocument11 pagesMarketing of Financial Services AsignmentMohit KumarNo ratings yet