Professional Documents

Culture Documents

Ratio Analysis Mini Case Model

Uploaded by

Sammir MalhotraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis Mini Case Model

Uploaded by

Sammir MalhotraCopyright:

Available Formats

A

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

274

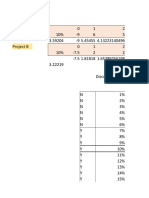

Chapter 13 Mini Case

The first part of the case, presented in Chapter 3, discussed the situation that Computron Industries was in after and

expansion program. Thus far, sales have not been up to the forecasted level, cost have been higher than were projected, and a

large loss occurred in 2004, rather than the expected profit. As a result, its managagers, directors, and investors are

concerned about the firm's survival.

Donna Jamison was brought in as an assistant to Fred Campo, Computron's chairman, who had the task of getting the

company back into a sound financial position. Computron's 2003 and 2004 balance sheets and income statements, together

with projections for 2005, are shown in the following tables. Also, the tables show the 2003 and 2004 financial ratios along

with industry average data. The 2005 projected financial statement data represent Jamison's and Campo's best guess for

2005 results, assuming that some new financing is arranged to get the company "over the hump."

Input Data:

2003

$8.50

100,000

40%

$40,000

2004

$6.00

100,000

40%

$40,000

2005

$12.17

250,000

40%

$40,000

Assets

Cash and equivalents

Short-term investments

Accounts receivable

Inventories

Total current assets

Gross Fixed Assets

Less Accumulated Dep.

Net Fixed Assets

Total Assets

2003

$9,000

$48,600

$351,200

$715,200

$1,124,000

$491,000

$146,200

$344,800

$1,468,800

2004

$7,282

$20,000

$632,160

$1,287,360

$1,946,802

$1,202,950

$263,160

$939,790

$2,886,592

2005

$14,000

$71,632

$878,000

$1,716,480

$2,680,112

$1,220,000

$383,160

$836,840

$3,516,952

Liabilities and equity

Accounts payable

Notes payable

Accruals

Total current liabilities

Long-term bonds

Total liabilities

Common stock (100,000 shares)

Retained earnings

Total common equity

Total liabilities and equity

$145,600

$200,000

$136,000

$481,600

$323,432

$805,032

$460,000

$203,768

$663,768

$1,468,800

$324,000

$720,000

$284,960

$1,328,960

$1,000,000

$2,328,960

$460,000

$97,632

$557,632

$2,886,592

$359,800

$300,000

$380,000

$1,039,800

$500,000

$1,539,800

$1,680,936

$296,216

$1,977,152

$3,516,952

2003

$3,432,000

$2,864,000

$340,000

$18,900

$3,222,900

$209,100

$62,500

$146,600

$58,640

$87,960

$0.880

$0.220

$6.638

2004

$5,834,400

$4,980,000

$720,000

$116,960

$5,816,960

$17,440

$176,000

-$158,560

-$63,424

-$95,136

($0.951)

$0.110

$5.576

2005

$7,035,600

$5,800,000

$612,960

$120,000

$6,532,960

$502,640

$80,000

$422,640

$169,056

$253,584

$1.014

$0.220

$7.909

Year-end common stock price

Year-end shares outstanding

Tax rate

Lease payments

Balance Sheets

Income Statements

Net sales

Costs of Goods Sold

Other Expenses

Depreciation

Total Operating Cost

Earnings before interest and taxes (EBIT)

Less interest

Earnings before taxes (EBT)

Taxes (40%)

Net Income before preferred dividends

EPS

DPS

Book Value Per Share

Jamison examined monthly data for 2004 (not given in the case), and she detected an improving pattern during the year.

Monthly sales were rising, costs were falling, and large losses in the early months had turned to a small profit by December.

Thus, the annual data look somewhat worse than final monthly data. Also, it appears to be taking longer for the advertising

program to get the message across, for the new sales offices to generate sales, and for the new manufacturing facilities to

operate efficiently. In other words, the lags between spending money and deriving benefits were longer than Computron's

managers had anticipated. For these reasons, Jamison and Campo see hope for the companyprovided it can survive in the

short run.

Jamison must prepare an analysis of where the company is now, what it must do to regain its financial health, and what

actions should be taken. Your assignment is to help her answer the following questions. Provide clear explanations, not yes

or no answers.

a. Why are ratios useful? What are the five major categories of ratios? Answer: See Chapter 13 Mini Case Show

b. (1.) Calculate the 2005 current and quick ratios based on the projected balance sheet and income statement data.

Calculated Data: Ratios

Liquidity ratios

Current Ratio

Quick Ratio

2003

2004

2005

Industry

Average

2.33

0.85

1.46

0.50

2.58

0.93

2.70

1.00

(2.) What can you say about the company's liquidity position in 2003, 2004, and as projected for 2005? We often think of

ratios as being useful (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for

stock valuation. Would these different types of analysts have an equal interest in the liquidity ratios? Answer: See Chapter

13 Mini Case Show

c. Calculate the 2005 inventory turnover, days sales outstanding (DSO), fixed assets turnover, operating capital requirement,

and total assets turnover. How does Computron's utilization of assets stack up against other firms in its industry?

Industry

Asset Management ratios

2003

2004

2005

Average

Inventory Turnover

4.80

4.53

4.10

6.10

Days Sales Outstanding

37.4

39.5

45.5

32.00

Fixed Asset Turnover

9.95

6.21

8.41

7.00

Total Asset Turnover

2.34

2.02

2.00

2.50

d. Calculate the 2005 debt, times-interest-earned, and EBITDA coverage ratios. How does Computron compare with the

industry with respect to financial leverage? What can you conclude from these ratios?

Industry

Debt Management ratios

2003

2004

2005

Average

Debt Ratio

54.8%

80.7%

43.8%

50.0%

Times Interest Earned

3.35

0.10

6.28

6.20

EBITDA Coverage Ratio

2.61

0.81

5.52

8.00

e. Calculate the 2005 profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What

can you say about these ratios?

Industry

Profitability ratios

2003

2004

2005

Average

Profit Margin

2.6%

-1.6%

3.6%

3.6%

Basic Earning Power

14.2%

0.6%

14.3%

17.8%

Return on Assets

6.0%

-3.3%

7.2%

9.0%

Return on Equity

13.3%

-17.1%

12.8%

18.0%

f. Calculate the 2005 price/earnings ratio, price/cash flow ratio, and market/book ratio. Do these ratios indicate that

investors are expected to have a high or low opinion of the company?

Industry

Market Value ratios

2003

2004

2005

Average

Price-to Earnings Ratio

9.66

-6.31

12.00

14.20

Price-to-Cash Flow Ratio

7.95

27.49

8.14

7.60

Market-to-Book Ratio

1.28

1.08

1.54

2.90

Book Value Per Share

6.64

5.58

7.91

na

g. Perform a common size analysis and percent change analysis. What do these analyses tell you about Computron?

See the worksheet with the TAB "Common Size and % Change"

h. Use the extended Du Pont equation to provide a summary and overview of Computron's financial condition as projected

for 2005. What are the firm's major strengths and weaknesses?

Du Pont Analysis

Computron

2003

Computron

2004

Computron

2005

Industry Average

ROE

13.3%

-17.1%

12.8%

18.00%

P.M.

2.6%

-1.6%

3.6%

3.6%

T.A.T.O.

Equity Multiplier

2.3

2.21

2.0

5.18

2.0

1.78

2.5

2.00

i. What are some potential problems and limitations of financial ratio analysis? Answer: See Chapter 13 Mini Case Show

j. What are some qualitative factors analysts should consider when evaluating a companys likely future financial

performance? Answer: See Chapter 13 Mini Case Show

Common Size Analysis and Percent Change Analysis

In

In common

common size

size analysis,

analysis, all

all income

income statement

statement items

items are

are divided

divided by

by sales,

sales, and

and all

all balance

balance sheet

sheet items

items are

are divided

divided by

by total

total

assets.

assets.

In

In percent

percent change

change analysis,

analysis, all

all items

items are

are expressed

expressed as

as aa percent

percent change

change from

from the

the first

first year,

year, called

called the

the base

base year,

year, of

of the

the analysis.

analysis.

Common Size Statements

Balance Sheets

2003

2004

2005

Industry

Assets

Cash and equivalents

Short-term investments

Accounts receivable

Inventories

Total Current Assets

Net Fixed Assets

Total Assets

0.6%

3.3%

23.9%

48.7%

76.5%

23.5%

100.0%

0.3%

0.7%

21.9%

44.6%

67.4%

32.6%

100.0%

0.4%

2.0%

25.0%

48.8%

76.2%

23.8%

100.0%

0.3%

0.3%

22.4%

41.2%

64.1%

35.9%

100.0%

Liabilities and equity

Accounts payable

Notes payable

Accruals

Total current liabilities

Long-term bonds

Total common equity

Total liabilities and equity

9.9%

13.6%

9.3%

32.8%

22.0%

45.2%

100.0%

11.2%

24.9%

9.9%

46.0%

34.6%

19.3%

100.0%

10.2%

8.5%

10.8%

29.6%

14.2%

56.2%

100.0%

11.9%

2.4%

9.5%

23.7%

26.3%

50.0%

100.0%

2003

2004

2005

Industry

100.0%

83.4%

9.9%

0.6%

6.1%

1.8%

4.3%

1.7%

2.6%

100.0%

85.4%

12.3%

2.0%

0.3%

3.0%

-2.7%

-1.1%

-1.6%

100.0%

82.4%

8.7%

1.7%

7.1%

1.1%

6.0%

2.4%

3.6%

100.0%

84.5%

4.4%

4.0%

7.1%

1.1%

5.9%

2.4%

3.6%

Income Statements

Net sales

Costs of Goods Sold

Other Expenses

Depreciation

EBIT

Less interest

Earnings before taxes (EBT)

Taxes (40%)

Net Income before preferred dividends

Percentage Change Analysis

Balance Sheets

2003

2004

2005

Assets

Cash and equivalents

Short-term investments

Accounts receivable

Inventories

Total Current Assets

Net Fixed Assets

Total Assets

0%

0%

0%

0%

0%

0%

0%

-19.1%

-58.8%

80.0%

80.0%

73.2%

172.6%

96.5%

55.6%

47.4%

150.0%

140.0%

138.4%

142.7%

139.4%

Liabilities and equity

Accounts payable

Notes payable

Accruals

Total current liabilities

Long-term bonds

Total common equity

Total liabilities and equity

0%

0%

0%

0%

0%

0%

0%

122.5%

260.0%

109.5%

175.9%

209.2%

-16.0%

96.5%

147.1%

50.0%

179.4%

115.9%

54.6%

197.9%

139.4%

2003

2004

2005

0%

0%

0%

0%

0%

0%

0%

0%

0%

70.0%

73.9%

111.8%

518.8%

-91.7%

181.6%

-208.2%

-208.2%

-208.2%

105.0%

102.5%

80.3%

534.9%

140.4%

28.0%

188.3%

188.3%

188.3%

Income Statements

Net sales

Costs of Goods Sold

Other Expenses

Depreciation

EBIT

Less interest

Earnings before taxes (EBT)

Taxes (40%)

Net Income before preferred dividends

You might also like

- Finance Chapter 13 Cost of Capital ProjectDocument8 pagesFinance Chapter 13 Cost of Capital Projectapi-382641983No ratings yet

- Statistics 1Document16 pagesStatistics 1Səbuhi Əbülhəsənli50% (2)

- Financial Model For A Potential M&A TransactionDocument206 pagesFinancial Model For A Potential M&A TransactionZheena OcampoNo ratings yet

- Ch.4 13ed TVM MiniC SolDocument36 pagesCh.4 13ed TVM MiniC SolChintan PatelNo ratings yet

- Chapter 06 - Risk & ReturnDocument42 pagesChapter 06 - Risk & Returnmnr81No ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- Group-01 Niche and Mainstream (PBME)Document15 pagesGroup-01 Niche and Mainstream (PBME)tejay356No ratings yet

- Ch.3 13ed Analysis of Fin Stmts MiniC SolsDocument7 pagesCh.3 13ed Analysis of Fin Stmts MiniC SolsAhmed SaeedNo ratings yet

- Class DiscussionDocument100 pagesClass DiscussionMadhav Chowdary Tumpati100% (1)

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross Incomericamae saladagaNo ratings yet

- Ross CH 13Document23 pagesRoss CH 13miftahulamalahNo ratings yet

- Cost of Capital Excel Temple-Free CH 10Document10 pagesCost of Capital Excel Temple-Free CH 10Mohiuddin AshrafiNo ratings yet

- Capital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalDocument2 pagesCapital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalMary Hazell Victori100% (1)

- Ch05 Mini CaseDocument8 pagesCh05 Mini CaseSehar Salman AdilNo ratings yet

- Bond ValuationDocument10 pagesBond ValuationVivek SuranaNo ratings yet

- Question #1: Jordan Enterprises Raw MaterialDocument35 pagesQuestion #1: Jordan Enterprises Raw MaterialAimen sakimdadNo ratings yet

- Irr, NPV, PiDocument49 pagesIrr, NPV, PiSuraj ChaudharyNo ratings yet

- CH 4 4-35 SpreadsheetDocument34 pagesCH 4 4-35 Spreadsheetcherishwisdom_997598No ratings yet

- Valuation of Bonds and Shares: Problem 1Document29 pagesValuation of Bonds and Shares: Problem 1Sourav Kumar DasNo ratings yet

- M 16 Forecasting Financial Statements in ExcelDocument12 pagesM 16 Forecasting Financial Statements in ExcelAnrag Tiwari100% (1)

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- FINANCE 3FA3 - Cost of CapitalDocument4 pagesFINANCE 3FA3 - Cost of CapitalAlbertNo ratings yet

- Afar Mock Board 2022Document16 pagesAfar Mock Board 2022Reynaldo corpuz0% (1)

- WACCDocument6 pagesWACCAbhishek P BenjaminNo ratings yet

- Change Analysis Balance SheetDocument6 pagesChange Analysis Balance SheetbimayogapcihNo ratings yet

- Presenting Financial InstrumentsDocument16 pagesPresenting Financial Instrumentsasachdeva17No ratings yet

- Final FIN 200 (All Chapters) FIXEDDocument65 pagesFinal FIN 200 (All Chapters) FIXEDMunNo ratings yet

- Data CollectionDocument9 pagesData CollectionSammir MalhotraNo ratings yet

- Foreign Marketing SelectionDocument9 pagesForeign Marketing SelectionSammir MalhotraNo ratings yet

- Hand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadDocument55 pagesHand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadHamad Bakar HamadNo ratings yet

- IFRS NotesDocument4 pagesIFRS Notes05550100% (2)

- AF 325 Homework # 1Document3 pagesAF 325 Homework # 1Kunhong ZhouNo ratings yet

- Notes (Chapter 1 - 3)Document15 pagesNotes (Chapter 1 - 3)Jeallaine Llena BautistaNo ratings yet

- Articulo - FINANCIAL ANALYSIS ON Fisher & Paykel Healthcare' - 2015 PDFDocument6 pagesArticulo - FINANCIAL ANALYSIS ON Fisher & Paykel Healthcare' - 2015 PDFFreddy VargasNo ratings yet

- XLSXDocument2 pagesXLSXchristiewijaya100% (1)

- Mgac CustomDocument123 pagesMgac CustomJoana TrinidadNo ratings yet

- Business Computing Exam NotesDocument24 pagesBusiness Computing Exam NotesAgnieszka Wesołowska100% (1)

- Statistics For Business Economics 14e Metric Version Chapter3Document73 pagesStatistics For Business Economics 14e Metric Version Chapter3Nguyễn Sĩ NhânNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- Capital StructureDocument25 pagesCapital StructureMihael Od SklavinijeNo ratings yet

- FINA Chapter 6 HWDocument7 pagesFINA Chapter 6 HWBrandonNo ratings yet

- Ch11 13ed CF Estimation MinicMasterDocument20 pagesCh11 13ed CF Estimation MinicMasterAnoop SlathiaNo ratings yet

- Chapter 2 - Hardware BasicsDocument5 pagesChapter 2 - Hardware BasicsJohn FrandoligNo ratings yet

- Regression Model Equation: Sample ProblemDocument10 pagesRegression Model Equation: Sample ProblemLeann Carla Santos Adan100% (1)

- Reference Sheet: Form - RS6 (Rev 11/11) F&I ToolsDocument1 pageReference Sheet: Form - RS6 (Rev 11/11) F&I ToolsLiamNo ratings yet

- Profitability Index Template: Strictly ConfidentialDocument4 pagesProfitability Index Template: Strictly ConfidentialLalit KheskwaniNo ratings yet

- Chapter 3 (14 Ed) Analysis of Financial StatementsDocument25 pagesChapter 3 (14 Ed) Analysis of Financial StatementsSOHAIL TARIQNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- Case 75 The Western Co DirectedDocument10 pagesCase 75 The Western Co DirectedHaidar IsmailNo ratings yet

- HW3 Managerial FinanceDocument13 pagesHW3 Managerial FinanceAndrew HawkinsNo ratings yet

- CVP FormulasDocument1 pageCVP FormulasabhanidharaNo ratings yet

- A Seminar Presentation On Balance Sheet & True and Fair View AnalysisDocument10 pagesA Seminar Presentation On Balance Sheet & True and Fair View AnalysisAshis karmakarNo ratings yet

- Fcffsimpleginzu ITCDocument62 pagesFcffsimpleginzu ITCPravin AwalkondeNo ratings yet

- Null Hypothesis: Hypothesis Testing For One MeanDocument3 pagesNull Hypothesis: Hypothesis Testing For One MeanLight HouseNo ratings yet

- ACC 230 Coca Cola Final PaperDocument9 pagesACC 230 Coca Cola Final PaperKrissi EbbensNo ratings yet

- Managerial Fin - Midterm Cheat - Copy2Document2 pagesManagerial Fin - Midterm Cheat - Copy2JoseNo ratings yet

- QMT 11 NotesDocument150 pagesQMT 11 NotesJustin LeeNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument7 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- Chapter 6. Interest RatesDocument33 pagesChapter 6. Interest RatesNaufal IhsanNo ratings yet

- Earnings Management and Creative AccountingDocument13 pagesEarnings Management and Creative Accountingjaclyn3kohNo ratings yet

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- Data Sciencefor BusinessDocument107 pagesData Sciencefor BusinessiltdfNo ratings yet

- Financial Management Assignment 1Document8 pagesFinancial Management Assignment 1Puspita RamadhaniaNo ratings yet

- Lakeside Company Case Studies in Auditing John M. Trussel J. Douglas Frazer Twelfth EditionDocument7 pagesLakeside Company Case Studies in Auditing John M. Trussel J. Douglas Frazer Twelfth EditionJoHn CarLoNo ratings yet

- Cost of Capital For Foreign InvestmentsDocument14 pagesCost of Capital For Foreign InvestmentsSammir MalhotraNo ratings yet

- Changing Trends in FMCG SectorDocument49 pagesChanging Trends in FMCG SectorSammir MalhotraNo ratings yet

- Vlookup From Closed WorkbookDocument1 pageVlookup From Closed WorkbookSammir MalhotraNo ratings yet

- Venture CapitalDocument150 pagesVenture CapitalSammir MalhotraNo ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsKapil DixitNo ratings yet

- West AsiaDocument7 pagesWest Asiasameer7986No ratings yet

- Corporate Strategy and Foreign Direct InvestmentDocument20 pagesCorporate Strategy and Foreign Direct InvestmentSammir MalhotraNo ratings yet

- Processing of An Export OrderDocument7 pagesProcessing of An Export OrderSammir MalhotraNo ratings yet

- Business Communication June 2008Document2 pagesBusiness Communication June 2008Sammir MalhotraNo ratings yet

- Export FinancingDocument7 pagesExport FinancingSammir MalhotraNo ratings yet

- Import FinanceDocument6 pagesImport FinanceSammir Malhotra0% (1)

- Export Import Trader Regulatory FrameworkDocument7 pagesExport Import Trader Regulatory FrameworkSammir MalhotraNo ratings yet

- Agricultural ProductsDocument7 pagesAgricultural Productssameer7986No ratings yet

- Preparing For ShipmentDocument8 pagesPreparing For ShipmentSammir MalhotraNo ratings yet

- Institutional Set Up For Export Promotion in IndiaDocument7 pagesInstitutional Set Up For Export Promotion in IndiaSammir MalhotraNo ratings yet

- Unit 6 (C)Document7 pagesUnit 6 (C)Ahmed SiddiquiNo ratings yet

- Shipment of Export CargoDocument5 pagesShipment of Export CargoSammir MalhotraNo ratings yet

- Imt-Distance and Open Learning Institute Ghazaibad End-Term Examination - June 2007Document2 pagesImt-Distance and Open Learning Institute Ghazaibad End-Term Examination - June 2007Sammir MalhotraNo ratings yet

- Computer Aided Management Dec 2007Document2 pagesComputer Aided Management Dec 2007Sammir MalhotraNo ratings yet

- Business Communication Dec 2008Document2 pagesBusiness Communication Dec 2008Sammir MalhotraNo ratings yet

- Imt 10 2008Document1 pageImt 10 2008Neha BhatiaNo ratings yet

- Computer Aided Managem Dec 2008Document1 pageComputer Aided Managem Dec 2008Sammir MalhotraNo ratings yet

- Business Communication June 2007Document1 pageBusiness Communication June 2007Sammir MalhotraNo ratings yet

- Emerging Trends and IssuesDocument6 pagesEmerging Trends and IssuesSammir MalhotraNo ratings yet

- International Branding, Packaging and Other DecisionDocument7 pagesInternational Branding, Packaging and Other DecisionSammir Malhotra100% (1)

- Business Communication Dec 2007Document1 pageBusiness Communication Dec 2007Sammir MalhotraNo ratings yet

- International AdvertisingDocument9 pagesInternational AdvertisingSammir MalhotraNo ratings yet

- Data Analysis and Report WritingDocument8 pagesData Analysis and Report WritingSammir MalhotraNo ratings yet

- (Demats) - Dematerialisation or "Demat" Is A Process Whereby Investors' Securities Like SharesDocument9 pages(Demats) - Dematerialisation or "Demat" Is A Process Whereby Investors' Securities Like Sharesferoz khanNo ratings yet

- CFV600 F2 Financial AnalysisDocument22 pagesCFV600 F2 Financial AnalysisJermaine hammondNo ratings yet

- 0 - GS Chapter 7 - Complex GroupsDocument10 pages0 - GS Chapter 7 - Complex GroupsJustyneNo ratings yet

- Cost Systems and Cost AccumulationDocument25 pagesCost Systems and Cost AccumulationPrima Warta SanthaliaNo ratings yet

- Company Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMDocument11 pagesCompany Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMAryan RajNo ratings yet

- Chapter 06Document41 pagesChapter 06nadeemNo ratings yet

- DDM 3 STDocument11 pagesDDM 3 STPro ResourcesNo ratings yet

- Liquidity Risk ToleranceDocument6 pagesLiquidity Risk ToleranceJawadNo ratings yet

- Delaware 20-2705720 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.)Document183 pagesDelaware 20-2705720 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.)Makuna NatsvlishviliNo ratings yet

- Troy Foster Jim Brenner: Formation & Early Stage FinancingDocument13 pagesTroy Foster Jim Brenner: Formation & Early Stage FinancingFounder InstituteNo ratings yet

- 09 Foreign Tax Credit Foreign LossesDocument7 pages09 Foreign Tax Credit Foreign LossesTayyaba YounasNo ratings yet

- Series A Term Sheet MarkupDocument16 pagesSeries A Term Sheet MarkupSURAJ SINGHNo ratings yet

- Case Project Financial AccountingDocument2 pagesCase Project Financial AccountingZargham ShiraziNo ratings yet

- Financial Accounting PDFDocument21 pagesFinancial Accounting PDFTangent PcsNo ratings yet

- Stock Valuation - Gilbert Enterprises CaseDocument2 pagesStock Valuation - Gilbert Enterprises Casesulaimani keedaNo ratings yet

- Mock Exam - Dec 2022.exampleDocument14 pagesMock Exam - Dec 2022.exampleVan AnhNo ratings yet

- Chapter 1 - TutorialDocument13 pagesChapter 1 - TutorialPro TenNo ratings yet

- What Kinds of Stocks Are There?Document4 pagesWhat Kinds of Stocks Are There?Gilner PomarNo ratings yet

- Taxation of Business Entities 2017 8th Edition Spilker Solutions ManualDocument11 pagesTaxation of Business Entities 2017 8th Edition Spilker Solutions Manualunknitbreedingbazmn100% (23)

- Chapter 08Document14 pagesChapter 08marieieiemNo ratings yet

- Multiple Choices - Computational Answer KeyDocument4 pagesMultiple Choices - Computational Answer KeyAleah kay BalontongNo ratings yet

- Valuation of SharesDocument51 pagesValuation of SharesSwati GoyalNo ratings yet

- COMMODITY EXCHANGE ChecklistDocument3 pagesCOMMODITY EXCHANGE ChecklistMuslih AbdikerNo ratings yet

- Question 3 Cash Flow StatementDocument2 pagesQuestion 3 Cash Flow StatementjbmggknbrxNo ratings yet

- Consolidated Financial Statements - Wholly OwnedDocument13 pagesConsolidated Financial Statements - Wholly OwnedJoseph SalidoNo ratings yet

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314No ratings yet

- Accounting Equation (Compatibility Mode)Document29 pagesAccounting Equation (Compatibility Mode)MahediNo ratings yet