Professional Documents

Culture Documents

HW 9 Cost Accounting

Uploaded by

Thomas CarapaicaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW 9 Cost Accounting

Uploaded by

Thomas CarapaicaCopyright:

Available Formats

Thomas Carapaica

ID: 100832

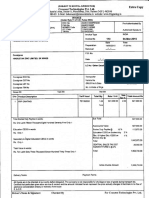

9-33

Materials inventory

WIP inventory (3,750 x $18)

Transfer to WIP inventory

Debit

Credit

$67,500

Balance

$67,500

$67,500

Wages Payable

WIP inventory (50% of the

material)

Transfer to WIP inventory

Debit

Credit

Balance

$33,750

$33,750

Work in Process Inventory

Materials handling activity

Inspection ($225 x 750) activity

Setups (40 x $2,700) activity

Running machines (15,000 hrs x

$22.50) activity

Debit

$67,500

$168,75

0

$108,00

0

$337,50

0

Credit

$33,750

Wages payable

Transfer to finished goods inventory

Finished goods inventory

WIP inventory

Debit

$715,50

0

Credit

Balance

$715,50

0

$715,50

0

Debit

Credit

Balance

$67,500

$67,500

$67,500

Credit

$168,75

0

Balance

$168,75

0

$168,75

0

Total cost

Materials handling

activity

WIP inventory

Actual cost

Quality inspection activity

WIP inventory

Actual cost

Debit

Balance

$67,500

$236,35

0

$344,25

0

$681,75

0

$715,50

0

$715,50

0

Thomas Carapaica

ID: 100832

Machine setups activity

Debit

Credit

$108,00

0

Balance

$108,00

0

$108,00

0

Debit

Credit

$337,50

0

Balance

$337,50

0

$337,50

0

WIP

Actual cost

Running machine activity

WIP inventory

Actual cost

9-36

a)

Accounts

receivable

departmen

t

Billing

Dispute

resolution

Allocation

base

Total

cost

Number of bills

prepared

Number of bills

prepared

$48,0

00

$36,0

00

$84,0

00

Total

Total

number of

bills

prepared/dis

putes

Personal

600

bills

600

bills

1,000

1,000

$28,8

00

$21,6

00

$50,4

00

Business

400

bills

400

bills

$19,2

00

$14,4

00

$33,6

00

b)

Activity

Billing

Dispute

resolution

Total

Cost driver

Number of bills

prepared

Number of

disputes

Total

cost

$48,00

0

$36,00

0

$84,00

0

9-37a

Chair Manufacturer

Volum

e of

cost

driver

s

Each

driver

1,000

48

72

500

Cost driver volume

Perso

nal

Busine

ss

$28,80

0

$30,00

0

$58,00

0

$19,20

0

$6,000

$25,00

0

Total

$48,0

00

$36,0

00

$84,0

00

Thomas Carapaica

ID: 100832

Income Statement

Rat

Standa

Activity

Ergo

e

rd

$2,925, $2,760,

Sales revenue

000

000

Direct

$550,0

$500,0

materials

00

00

$400,0

$200,0

Direct labor

00

00

Overhead

costs

Administrati

$312,0

$156,0

78%

on

00

00

Production

$7,2 $360,0

$720,0

setup

00

00

00

Quality

$1,8 $360,0

$360,0

control

00

00

00

$19

$288,0 $1,152,

Distribution

2

00

000

Total overhead

$1,320, $2,388,

costs

000

000

Operating

$655,0 ($328,

profit

00

000)

Total

$5,685,

000

$1,050,

000

$600,0

00

$468,0

00

$1,080,

000

$720,0

00

$1,440,

000

$3,708,

000

$327,0

00

$468,000 / $600,000 = 78%

$1,080,000 / 150 runs = $7,200 per run

$720,000 / 400 inspections = $1,800 per inspection

$1,440,000 / 7,500 units = $192 per unit

9-40

Activity

Processing orders

Setting up production

Handling materials

Using machines

Performing quality control

Packing

Total est. overhead

Cost

Driver

No. of

orders

No. of runs

Pounds

Machinehrs.

No. of insp.

No. of units

Est. Costs

Driver

Units

Rate

$54,000

200

$270

$216,000

$360,000

100

120,000

$2,160

$3

$288,000

12,000

$24

$72,000

$144,000

$1,134,00

0

45

480,000

$1,600

$0.30

Thomas Carapaica

ID: 100832

Predetermined rate for Direct labor-hour = Estimated activity / Estimated allocation base

Predetermined rate for Direct labor-hour = $1,134,000 / 7,500 hours = $151.20 per hour

Production costs using direct labor-hour

Account

Direct materials

Direct labor

Indirect costs

Total costs

Institutional

$39,000

$6,750

$68,040

$113,790

Standard

$24,000

$6,750

$68,040

$98,790

Silver

$15,000

$9,000

$90,720

$114,720

Total

$78,000

$22,500

$226,800

$327,300

Production costs using ABC

Account

Direct materials

Direct labor

Indirect costs

Processing orders

Setting up production

Handling materials

Using machines

Performing quality

control

Packing

Total cost

Institutio

nal

Standa

rd

$39,000

$24,000

$6,750

$6,750

$3,240

$2,430

$6,480

$6,480

$45,000

$13,920

$18,000

$3,360

$1,620

$12,96

0

$9,000

$1,920

$4,800

$4,800

$4,800

$14,400

$18,000

$7,200

$137,190

$73,020

$2,700

$57,00

0

$27,900

$267,21

0

Silver

$15,00

0

$9,000

Total

$78,000

$22,500

$7,290

$25,920

$72,000

$19,200

The discrepancy between our product costs using direct-labor hours as the allocation base versus

activity-based costing is because the way that overhead costs are allocated. The ABC method is

more precise than our existing direct labor cost method.

9-41

$36,000 / 100 runs = $360 per run

$60,000 / 200 orders = $300 per order

$24,000 / 8,000 pounds = $3.00 per pound

$72,000 / 10,000 machine hours = $7.20 per machine hour

$60,000 / 40 inspections = $1,500 per inspection

$48,000 / 20,000 units = $2.40 per unit

Thomas Carapaica

ID: 100832

$300,000 / 2,000 labor hours = $150 per labor hour

Direct materials

Direct labor

Overhead

Total costs

Short

$6,000

$3,000

$15,000

$24,00

0

Direct materials

Direct labor

Setting up production

Processing orders

Handling materials

Using machines

Providing quality

management

Packaging and

shipping

Total Costs

Medium

$3,750

$3,600

$18,000

$25,350

Shor

t

$6,00

0

$3,00

0

$720

$2,40

0

$1,20

0

$3,60

0

$3,00

0

$2,40

0

$22,

320

Medi

um

$3,75

0

$3,60

0

$1,44

0

$2,40

0

$2,40

0

$2,16

0

$3,00

0

$1,20

0

$19,9

50

Tall

$3,000

$3,300

$16,500

$22,80

0

Tall

$3,00

0

$3,30

0

$2,88

0

$1,20

0

$600

$2,16

0

$3,00

0

$720

$16,

860

Explanation

The discrepancy between our product costs using direct-labor hours as the allocation base versus

activity-based costing is because the way that overhead costs are allocated. The ABC method is

more precise than our existing direct labor cost method.

9-42

Activity

Sales

Direct costs

Income Statement

Main

Route 66

Alley Cat

Street

$7,600,00 $11,200,00 $9,500,00

0

0

0

Total

$28,300,00

0

Thomas Carapaica

ID: 100832

Direct

material

$3,000,00

0

$4,800,000

Direct labor

$288,000

$480,000

Variable OH

$939,600

$1,503,360

Contr. Margin

$3,372,40

0

$4,416,640

$4,000,00

0

$1,080,00

0

$2,255,04

0

$2,164,96

0

Fixed OH:

Plant admin.

Other

$11,800,00

0

$1,848,000

$4,698,000

$9,954,000

$1,760,000

$2,800,000

$5,394,00

0

Gross Profit

$4,698,000 / 50,000 machine hours = $93.96 per machine hour

Income Statement

Main

Route 66

Alley Cat

Street

$7,600,00 $11,200,00 $9,500,00

0

0

0

$28,300,00

0

Direct costs

Direct

material

$3,000,00

0

$4,800,000

$11,800,00

0

Direct labor

$288,000

$480,000

$4,000,00

0

$1,080,00

0

$102,960

$288,000

$418,500

$151,200

$43,200

$159,120

$432,000

$418,500

$241,920

$172,800

$205,920

$432,000

$837,000

$362,880

$432,000

$468,000

$1,152,000

$1,674,000

$756,000

$648,000

Activity

Sales

Variable OH

Mach. Setup

Order proc.

Warehousing

Energy

Shipping

Fixed OH:

Plant admin.

Other

Gross Profit

Total

$1,848,000

$1,760,000

$2,800,000

$5,394,00

0

The ABC method provides more accurate information than other methods. So, as

well as the CFO said, Products have to bear a fair share of all overhead or we wont

be covering all of our costs. By doing this, they would be able to take better

decision due to the accuracy of this method.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Month To Go Moving ChecklistDocument9 pagesMonth To Go Moving ChecklistTJ MehanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fundamentals of AccountingDocument5 pagesFundamentals of AccountingJayelleNo ratings yet

- Product Life CycleDocument19 pagesProduct Life CycleTamana Gupta100% (2)

- TRH 14 ManualDocument22 pagesTRH 14 ManualNelson KachaliNo ratings yet

- Thomas Carapaica - HW 1 Cost AccountingDocument8 pagesThomas Carapaica - HW 1 Cost AccountingThomas CarapaicaNo ratings yet

- Thomas Carapaica - HW 5 Cost AccountingDocument4 pagesThomas Carapaica - HW 5 Cost AccountingThomas CarapaicaNo ratings yet

- Thomas Carapaica - HW 2 Cost AccountingDocument6 pagesThomas Carapaica - HW 2 Cost AccountingThomas CarapaicaNo ratings yet

- Thomas Carapaica - HW 4 Cost AccountingDocument5 pagesThomas Carapaica - HW 4 Cost AccountingThomas CarapaicaNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNo ratings yet

- 3 Competitive EnvironmentDocument5 pages3 Competitive EnvironmentAlksgrtzNo ratings yet

- CH 12Document27 pagesCH 12DewiRatihYunusNo ratings yet

- ReshapeDocument4 pagesReshapearnab1988ghoshNo ratings yet

- R WaseemDocument3 pagesR WaseemWaseem RajaNo ratings yet

- FRBM Act: The Fiscal Responsibility and Budget Management ActDocument12 pagesFRBM Act: The Fiscal Responsibility and Budget Management ActNaveen DsouzaNo ratings yet

- FCE Letter SampleDocument3 pagesFCE Letter SampleLeezukaNo ratings yet

- 32N50C3 Mos PDFDocument11 pages32N50C3 Mos PDFHưng HQNo ratings yet

- 2016 04 1420161336unit3Document8 pages2016 04 1420161336unit3Matías E. PhilippNo ratings yet

- EconomicsDocument14 pagesEconomicscliffordsamuelNo ratings yet

- Reverse Pricing ProcedureDocument4 pagesReverse Pricing ProcedureAnonymous 13sDEcwShTNo ratings yet

- AEON SWOT Analysis & MatricDocument6 pagesAEON SWOT Analysis & MatricJanet1403No ratings yet

- Hunslet War DPT 3240Document3 pagesHunslet War DPT 3240pacolopez888No ratings yet

- AUD THEO BSA 51 Mr. LIMHEYADocument137 pagesAUD THEO BSA 51 Mr. LIMHEYAMarie AzaresNo ratings yet

- Ficci Ey M and e Report 2019 Era of Consumer Art PDFDocument309 pagesFicci Ey M and e Report 2019 Era of Consumer Art PDFAbhishek VyasNo ratings yet

- Annual Report of Bajaj Finance NBFC PDFDocument308 pagesAnnual Report of Bajaj Finance NBFC PDFAnand bhangariya100% (1)

- TFG Manuel Feito Dominguez 2015Document117 pagesTFG Manuel Feito Dominguez 2015Yenisel AguilarNo ratings yet

- DI and LRDocument23 pagesDI and LRVarsha SukhramaniNo ratings yet

- Sign ExtrusionDocument33 pagesSign Extrusionfirebird1972No ratings yet

- Groen BPP-40E Tilt SkilletDocument2 pagesGroen BPP-40E Tilt Skilletwsfc-ebayNo ratings yet

- Chp14 StudentDocument72 pagesChp14 StudentChan ChanNo ratings yet

- Ananda KrishnanDocument4 pagesAnanda KrishnanKheng How LimNo ratings yet

- Hazardous Consignment Note BlankDocument3 pagesHazardous Consignment Note BlankChristopher HenryNo ratings yet

- HZL 4100070676 Inv Pay Slip PDFDocument12 pagesHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNo ratings yet

- Ivy LeagueDocument2 pagesIvy LeagueDr Amit RangnekarNo ratings yet

- BCPC 204 Exams Questions and Submission InstructionsDocument5 pagesBCPC 204 Exams Questions and Submission InstructionsHorace IvanNo ratings yet