Professional Documents

Culture Documents

Caltex vs CA - Elements of Negotiable Instruments and Estoppel

Uploaded by

Hiroshi Carlos0 ratings0% found this document useful (0 votes)

53 views6 pagesThe court held that:

1) The certificates of time deposit (CTDs) issued by the private respondent bank were negotiable instruments as they stated that the amount was repayable to the "bearer".

2) However, the petitioner could not rightfully recover the amounts of the CTDs as there was no valid negotiation through endorsement and delivery, even if the CTDs were bearer instruments.

3) The CTDs were admitted by the petitioner to have been provided by Cruz as security for fuel purchases in a letter to the private respondent, and this admission is conclusive under the doctrine of estoppel.

Original Description:

aw

Original Title

Caltex vs CA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe court held that:

1) The certificates of time deposit (CTDs) issued by the private respondent bank were negotiable instruments as they stated that the amount was repayable to the "bearer".

2) However, the petitioner could not rightfully recover the amounts of the CTDs as there was no valid negotiation through endorsement and delivery, even if the CTDs were bearer instruments.

3) The CTDs were admitted by the petitioner to have been provided by Cruz as security for fuel purchases in a letter to the private respondent, and this admission is conclusive under the doctrine of estoppel.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views6 pagesCaltex vs CA - Elements of Negotiable Instruments and Estoppel

Uploaded by

Hiroshi CarlosThe court held that:

1) The certificates of time deposit (CTDs) issued by the private respondent bank were negotiable instruments as they stated that the amount was repayable to the "bearer".

2) However, the petitioner could not rightfully recover the amounts of the CTDs as there was no valid negotiation through endorsement and delivery, even if the CTDs were bearer instruments.

3) The CTDs were admitted by the petitioner to have been provided by Cruz as security for fuel purchases in a letter to the private respondent, and this admission is conclusive under the doctrine of estoppel.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

Caltex vs CA

G.R. No. 97753

August 10, 1992

Petitioner: CALTEX (PHILIPPINES), INC.

Respondents: COURT OF APPEALS and SECURITY BANK

AND TRUST COMPANY

Topic: Elements of N.I; Indorsement; estoppel

Facts:

Private respondent Security Bank and Trust

Company, a commercial banking institution, issued

several certificates of time deposit in favor of Angel dela

Cruz, a depositor of Private Respondent.

Cruz delivered such CTDs to the Petitioner as proof

of payment for the formers purchase of fuel products

from the latter. However, Cruz informed Private

Respondent that the CTDs were lost and asked for the reissuance of copies of the CTDs which the latter did.

Thereafter, Cruz negotiated and obtained a loan from

Private Respondent. In order to satisfy the loan, Cruz

executed a notarized Deed of Assignment of Time Deposit

which authorizes the Private Respondent to apply the

CTDs to his loan upon maturity.

Subsequently, Petitioner went to the defendant for

the verification of the CTDs and asked the Private

Respondent to pre-terminate the same.

PR requested Petitioner to furnish the former a copy

of the document evidencing the guarantee agreement

with Cruz and the details of Cruzs obligations against the

Petitioner but the latter failed to do so, therefore,

Petitioners demand and claim for payment was rejected

by the PR.

The loan matured and fell due hence the PR set-off

and applied the CTDs to satisfy the loan.

Petitioner filed a complaint praying that PR pay the

former the sum of money covered by the CTDs. The

complaint was however dismissed by the trial court on

the ground that the CTDs were non-negotiable

considering that the word of the instrument indicates that

it is only repayable to the depositor and the word

bearer in the said instrument only refers to the

depositor itself.

Issue:

1)WON the CTDs in this case are negotiable.

2)WON Petitioner can rightfully recover on the CTDs.

3)WON the CTDs were intended as payment for the

purchase of the fuel products.

Held:

1)Yes. On this score, the accepted rule is that the

negotiability or non-negotiability of an instrument is

determined from the writing, that is, from the face of

the instrument itself. The duty of the court in such

case is to ascertain, not what the parties may have

secretly intended as contradistinguished from what

their words express, but what is the meaning of the

words they have used. What the parties meant must

be determined by what they said.

If it was really the intention of respondent bank to

pay the amount to Angel de la Cruz only, it could

have with facility so expressed that fact in clear and

categorical terms in the documents, instead of

having the word "BEARER" stamped on the space

provided for the name of the depositor in each CTD.

On the wordings of the documents, therefore, the

amounts deposited are repayable to whoever may be

the bearer thereof. Thus, petitioner's aforesaid

witness merely declared that Angel de la Cruz is the

depositor "insofar as the bank is concerned," but

obviously other parties not privy to the transaction

between them would not be in a position to know

that the depositor is not the bearer stated in the

CTDs.

2)No. Unfortunately for petitioner, although the CTDs

are bearer instruments, a valid negotiation thereof

for the true purpose and agreement between it and

De la Cruz, as ultimately ascertained, requires both

delivery and indorsement.

Under the Negotiable Instruments Law, an

instrument is negotiated when it is transferred from

one person to another in such a manner as to

constitute the transferee the holder thereof, and a

holder may be the payee or indorsee of a bill or note,

who is in possession of it, or the bearer thereof. In

the present case, however, there was no negotiation

in the sense of a transfer of the legal title to the

CTDs in favor of petitioner in which situation, for

obvious reasons, mere delivery of the bearer CTDs

would have sufficed.

3)No. In a letter addressed to PR, Petitioner wrote: ". . .

These certificates of deposit were negotiated to us by

Mr. Angel dela Cruz to guarantee his purchases of

fuel products".

This admission is conclusive upon petitioner, its

protestations notwithstanding. Under the doctrine of

estoppel, an admission or representation is rendered

conclusive upon the person making it, and cannot be

denied or disproved as against the person relying

thereon.

Doctrines:

1. This need for resort to extrinsic evidence is what is

sought to be avoided by the Negotiable

Instruments Law and calls for the application of the

elementary rule that the interpretation of obscure

words or stipulations in a contract shall not favor

the party who caused the obscurity.

- The person who made the obscurity in the

instrument is estopped from claiming the

otherwise he stated.

2. Under the doctrine of estoppel, an admission or

representation is rendered conclusive upon the

person making it, and cannot be denied or

disproved as against the person relying thereon.

3. Accordingly, a negotiation for such purpose cannot

be effected by mere delivery of the instrument

since, necessarily, the terms thereof and the

subsequent disposition of such security, in the

event of non-payment of the principal obligation,

must be contractually provided for.

- Indorsement and delivery are necessary for the

validity of the negotiable instrument.

4. Under the Negotiable Instruments Law, an

instrument is negotiated when it is transferred

from one person to another in such a manner as to

constitute the transferee the holder thereof, and a

holder may be the payee or indorsee of a bill or

note, who is in possession of it, or the bearer

thereof.

- How is an instrument negotiated?

5. The pertinent law on this point is that where the

holder has a lien on the instrument arising from

contract, he is deemed a holder for value to the

extent of his lien.

- Holder who has lien on the instrument is

considered as a holder for value to the extent of

his lien.

6. As such holder of collateral security, he would be a

pledgee but the requirements therefor and the

effects thereof, not being provided for by the

Negotiable Instruments Law, shall be governed by

the Civil Code provisions on pledge of incorporeal

rights.

- Pledge and security, not being covered by NIL, is

goverened by the CC.

You might also like

- Supreme Court upholds constitutionality of Retail Trade Liberalization Act (2010Document3 pagesSupreme Court upholds constitutionality of Retail Trade Liberalization Act (2010Hiroshi CarlosNo ratings yet

- Configure Windows 10 for Aloha POSDocument7 pagesConfigure Windows 10 for Aloha POSBobbyMocorroNo ratings yet

- The Way To Sell: Powered byDocument25 pagesThe Way To Sell: Powered bysagarsononiNo ratings yet

- 13 People V Hayag DigestedDocument1 page13 People V Hayag DigestedHiroshi CarlosNo ratings yet

- Case Digest ConsolidatedDocument16 pagesCase Digest ConsolidatedReycy Ruth TrivinoNo ratings yet

- Social Legislation Bar QuestionsDocument17 pagesSocial Legislation Bar QuestionsHiroshi Carlos100% (1)

- Ujpited ?tate of Americal: PresidentsDocument53 pagesUjpited ?tate of Americal: PresidentsTino Acebal100% (1)

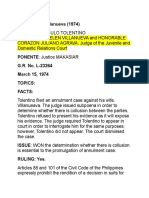

- 03 Tolentino Vs VillanuevaDocument2 pages03 Tolentino Vs VillanuevaHiroshi CarlosNo ratings yet

- Arquiza Vs CA and Equitable PCIDocument2 pagesArquiza Vs CA and Equitable PCIVince Reyes100% (1)

- Gonzales Vs ComelecDocument2 pagesGonzales Vs ComelecMaria Cherrylen Castor QuijadaNo ratings yet

- Civpro Case DigestsDocument21 pagesCivpro Case DigestsZiazel ThereseNo ratings yet

- ONG CHIA, Petitioner, vs. REPUBLIC OF THE Philippines and The Court of Appeals, RespondentsDocument10 pagesONG CHIA, Petitioner, vs. REPUBLIC OF THE Philippines and The Court of Appeals, RespondentsMaku PascualNo ratings yet

- Republic Vs CocofedDocument3 pagesRepublic Vs CocofedGlenn Juris BetguenNo ratings yet

- 07 Maloles II Vs PhillipsDocument5 pages07 Maloles II Vs PhillipsHiroshi CarlosNo ratings yet

- 03 Northwest Orient Airlines Vs CA 2Document3 pages03 Northwest Orient Airlines Vs CA 2Hiroshi CarlosNo ratings yet

- PNB vs. QuimpoDocument3 pagesPNB vs. QuimpoDonvidachiye Liwag Cena100% (1)

- Alliance of Quezon City Homeowners Association v. Quezon City Government, GR No. 230651 PDFDocument12 pagesAlliance of Quezon City Homeowners Association v. Quezon City Government, GR No. 230651 PDFJes CulajaraNo ratings yet

- Tacay Vs RTC of TagumDocument1 pageTacay Vs RTC of Tagumaish_08No ratings yet

- Medado V ConsingDocument3 pagesMedado V ConsingKatrina Ysobelle Aspi HernandezNo ratings yet

- Supreme Court Rules Trial Court Erred in Awarding Custody Based on Assumptions About Law School DemandsDocument2 pagesSupreme Court Rules Trial Court Erred in Awarding Custody Based on Assumptions About Law School DemandsBettina Rayos del SolNo ratings yet

- DNA Test Dispute in Illegitimate Child CaseDocument5 pagesDNA Test Dispute in Illegitimate Child CasepatrickNo ratings yet

- Pay v. Vda. de PalancaDocument3 pagesPay v. Vda. de PalancaMp CasNo ratings yet

- Ecumenical Prayer For The CourtsDocument1 pageEcumenical Prayer For The CourtsChristel Allena-Geronimo100% (3)

- The Bachelor of ArtsDocument6 pagesThe Bachelor of ArtsShubhajit Nayak100% (2)

- COMELEC ruling challenged in election caseDocument26 pagesCOMELEC ruling challenged in election caseMaybelle FajilaNo ratings yet

- Sixto Chu vs. Mach Asia Trading Corp. (GR 184333, April 1 2013)Document1 pageSixto Chu vs. Mach Asia Trading Corp. (GR 184333, April 1 2013)Earl LarroderNo ratings yet

- Ganzon Vs CADocument3 pagesGanzon Vs CARaymond RoqueNo ratings yet

- Legal opinion on quarry permit validity under revised zoning ordinanceDocument2 pagesLegal opinion on quarry permit validity under revised zoning ordinanceDianneNo ratings yet

- 4 - Alvero V Dela Rosa - Gen PrinDocument3 pages4 - Alvero V Dela Rosa - Gen PrinJosh PalomeraNo ratings yet

- RULE 13 Two ColumnsDocument17 pagesRULE 13 Two ColumnsAnonymous jUM6bMUuRNo ratings yet

- Banco Do Brasil Vs CADocument2 pagesBanco Do Brasil Vs CAHiroshi CarlosNo ratings yet

- The Discrimination ModelDocument16 pagesThe Discrimination ModelSiti MuslihaNo ratings yet

- Dy Vs CaDocument2 pagesDy Vs CajessapuerinNo ratings yet

- Supreme Court Rules LRTA Has Standing to Appeal Civil Service RulingDocument18 pagesSupreme Court Rules LRTA Has Standing to Appeal Civil Service RulingKristela AdraincemNo ratings yet

- Linux OS MyanmarDocument75 pagesLinux OS Myanmarweenyin100% (15)

- Service Manager Policy Investigation Confession UsedDocument1 pageService Manager Policy Investigation Confession UsedHiroshi CarlosNo ratings yet

- Fortunata Vs CADocument4 pagesFortunata Vs CAHiroshi CarlosNo ratings yet

- Fortunata Vs CADocument4 pagesFortunata Vs CAHiroshi CarlosNo ratings yet

- Zambales Chromite - Soriano Case DigestsDocument41 pagesZambales Chromite - Soriano Case DigestsJezenEstherB.PatiNo ratings yet

- Sps Buffe Vs Sec GonzalesDocument1 pageSps Buffe Vs Sec GonzalesHiroshi CarlosNo ratings yet

- 02 Sison Vs Board of AccountancyDocument3 pages02 Sison Vs Board of AccountancyHiroshi CarlosNo ratings yet

- Registration details of employees and business ownersDocument61 pagesRegistration details of employees and business ownersEMAMNNo ratings yet

- Guaranty Cases - Cred TransDocument28 pagesGuaranty Cases - Cred TransGela Bea BarriosNo ratings yet

- Negotiable Instruments Case ListDocument3 pagesNegotiable Instruments Case ListShariqah Hanimai Indol Macumbal-YusophNo ratings yet

- Abangan Will Probate RequirementsDocument1 pageAbangan Will Probate RequirementsHiroshi CarlosNo ratings yet

- Banares Vs BalisingDocument5 pagesBanares Vs BalisingHiroshi Carlos100% (1)

- Bandillon V LFUC - CorpinDocument3 pagesBandillon V LFUC - CorpinAndrew GallardoNo ratings yet

- Fua v. Yap PDFDocument8 pagesFua v. Yap PDFRJ RioNo ratings yet

- Chu v. Mach Asia Trading Corporation (2013)Document2 pagesChu v. Mach Asia Trading Corporation (2013)Hiroshi CarlosNo ratings yet

- Estoppel: University of The Philippines College of Law Evening 2021Document2 pagesEstoppel: University of The Philippines College of Law Evening 2021Judy Ann ShengNo ratings yet

- ElectionDocument3 pagesElectionJake AriñoNo ratings yet

- Baritua Vs MercaderDocument2 pagesBaritua Vs MercadermasterlegitNo ratings yet

- Jurisdiction by EstoppelDocument2 pagesJurisdiction by EstoppelKenn Ian De VeraNo ratings yet

- Fenequito Vs Vergara, Jr. G.R. No. 172829, July 8, 2012 FactsDocument4 pagesFenequito Vs Vergara, Jr. G.R. No. 172829, July 8, 2012 FactsLoveAnneNo ratings yet

- Guasch v. Dela CruzDocument9 pagesGuasch v. Dela CruzChristine Karen BumanlagNo ratings yet

- 196 Equitable Banking V IACDocument4 pages196 Equitable Banking V IACZoe VelascoNo ratings yet

- (Y) Yun Kwan Byung vs. PAGCORDocument1 page(Y) Yun Kwan Byung vs. PAGCORRobert Vencint NavalesNo ratings yet

- Immutability of final judgment upheldDocument4 pagesImmutability of final judgment upheldCaleb Josh PacanaNo ratings yet

- Dalen Vs MitsuiDocument5 pagesDalen Vs MitsuiirvincubsNo ratings yet

- Mariter Mendoza, G.R. No. 197987Document2 pagesMariter Mendoza, G.R. No. 197987Queenie Bee EsNo ratings yet

- DY v. BIBAT-PALAMOS: Exceptions to hierarchy of courtsDocument1 pageDY v. BIBAT-PALAMOS: Exceptions to hierarchy of courtsjenellNo ratings yet

- Yu Vs PaclebDocument2 pagesYu Vs PaclebFhel Jun D. MaghuyopNo ratings yet

- D-Syquia Vs AlmedaDocument3 pagesD-Syquia Vs AlmedanimfasfontaineNo ratings yet

- Calibre Traders Inc V Bayer PH IncDocument32 pagesCalibre Traders Inc V Bayer PH IncAngelo LopezNo ratings yet

- PH Bank Corp Vs TensuanDocument4 pagesPH Bank Corp Vs TensuanFrancis Kyle Cagalingan SubidoNo ratings yet

- Right to Speedy Trial FactorsDocument1 pageRight to Speedy Trial FactorskontributeNo ratings yet

- Quisay v. People (2016): Lack of Prior Written Authority Renders Information DefectiveDocument1 pageQuisay v. People (2016): Lack of Prior Written Authority Renders Information DefectiveAndrea RioNo ratings yet

- People v. Pangilinan (Arraignment)Document2 pagesPeople v. Pangilinan (Arraignment)adrianmdelacruzNo ratings yet

- UPPC vs AcropolisDocument13 pagesUPPC vs AcropolisTalina BinondoNo ratings yet

- Nisce Vs Equitable PCBDocument12 pagesNisce Vs Equitable PCBMarion Yves MosonesNo ratings yet

- Esuerte Vs CaDocument4 pagesEsuerte Vs CaKier Christian Montuerto InventoNo ratings yet

- R.A. 876Document6 pagesR.A. 876HaruNo ratings yet

- OUTLINE IN CREDIT TRANSACTIONS (Final)Document4 pagesOUTLINE IN CREDIT TRANSACTIONS (Final)Rey Almon Tolentino AlibuyogNo ratings yet

- RCBC Capital Vs BDO - G.R. No. 196171. January 15, 2014Document3 pagesRCBC Capital Vs BDO - G.R. No. 196171. January 15, 2014Ebbe DyNo ratings yet

- 091 Young V Keng SengDocument2 pages091 Young V Keng SengAnna Santos-LopezNo ratings yet

- 01 Gojo V GoyalaDocument1 page01 Gojo V GoyalaJustine GalandinesNo ratings yet

- Monge Vs PeopleDocument2 pagesMonge Vs PeoplejqdomingoNo ratings yet

- Motor Service v Yellow Taxi Summary Judgment RulingDocument2 pagesMotor Service v Yellow Taxi Summary Judgment RulingColee StiflerNo ratings yet

- Negotiable Instruments Law Bar QuestionsDocument3 pagesNegotiable Instruments Law Bar QuestionsLudica OjaNo ratings yet

- Philippine Supreme Court Decision on Labor Case AppealDocument14 pagesPhilippine Supreme Court Decision on Labor Case AppealManu SalaNo ratings yet

- Property Article 487-493 (Nos. 55-58)Document7 pagesProperty Article 487-493 (Nos. 55-58)Rodel Acson AguinaldoNo ratings yet

- Pleadings and verification requirementsDocument3 pagesPleadings and verification requirementsDavenry AtgabNo ratings yet

- Matilde Cantiveros Property DisputeDocument3 pagesMatilde Cantiveros Property DisputeLG Tirado-Organo100% (1)

- (Mahaba Ver) Caltex v. CA and Security Bank and Trust CompanyDocument4 pages(Mahaba Ver) Caltex v. CA and Security Bank and Trust CompanyYvonne MallariNo ratings yet

- BCCFI Vs CA and SIHI (1994) - Holder Who Presented Crossed Checks Payable To Another Person Is Not A Holder in Due Course. Holder Not in Due Course May Collect From The Named Payee.Document3 pagesBCCFI Vs CA and SIHI (1994) - Holder Who Presented Crossed Checks Payable To Another Person Is Not A Holder in Due Course. Holder Not in Due Course May Collect From The Named Payee.Hiroshi CarlosNo ratings yet

- 49 NAPOCOR Vs Province of QuezonDocument1 page49 NAPOCOR Vs Province of QuezonHiroshi CarlosNo ratings yet

- Material Master-Approval ProcessDocument7 pagesMaterial Master-Approval ProcessHiroshi CarlosNo ratings yet

- 11 The Holy See Vs Rosario Jr.Document2 pages11 The Holy See Vs Rosario Jr.Hiroshi CarlosNo ratings yet

- Dolores Natanuan Vs Atty TolentinoDocument1 pageDolores Natanuan Vs Atty TolentinoHiroshi CarlosNo ratings yet

- Case Digest 1 10Document23 pagesCase Digest 1 10louis jansenNo ratings yet

- 11 The Holy See Vs Rosario Jr.Document2 pages11 The Holy See Vs Rosario Jr.Hiroshi CarlosNo ratings yet

- Case Digest 1 10Document23 pagesCase Digest 1 10louis jansenNo ratings yet

- Sps Villuga Et Al Vs KellyDocument5 pagesSps Villuga Et Al Vs KellyHiroshi CarlosNo ratings yet

- 11 The Holy See Vs Rosario Jr.Document2 pages11 The Holy See Vs Rosario Jr.Hiroshi CarlosNo ratings yet

- 21 Fort Vs CIR DigestDocument3 pages21 Fort Vs CIR DigestHiroshi CarlosNo ratings yet

- 19 Mindanao Vs CIR DigestedDocument2 pages19 Mindanao Vs CIR DigestedHiroshi CarlosNo ratings yet

- Carcia Vs DrilonDocument36 pagesCarcia Vs DrilonHiroshi CarlosNo ratings yet

- Credit ReviewerDocument1 pageCredit ReviewerHiroshi CarlosNo ratings yet

- Developing The Marketing Mix: Notre Dame of Jaro IncDocument3 pagesDeveloping The Marketing Mix: Notre Dame of Jaro IncVia Terrado CañedaNo ratings yet

- Electrostatics Formulas and Numerical ProblemsDocument11 pagesElectrostatics Formulas and Numerical ProblemsManish kumar100% (2)

- Edwards 1999 Emotion DiscourseDocument22 pagesEdwards 1999 Emotion DiscourseRebeca CenaNo ratings yet

- Cambridge IGCSE™: Chinese As A Second Language 0523/03 May/June 2021Document6 pagesCambridge IGCSE™: Chinese As A Second Language 0523/03 May/June 2021For GamingNo ratings yet

- Shaft-Hub Couplings With Polygonal Profiles - Citarella-Gerbino2001Document8 pagesShaft-Hub Couplings With Polygonal Profiles - Citarella-Gerbino2001sosu_sorin3904No ratings yet

- Williams-In Excess of EpistemologyDocument19 pagesWilliams-In Excess of EpistemologyJesúsNo ratings yet

- Newton-Raphson MethodDocument32 pagesNewton-Raphson MethodnafisbadranNo ratings yet

- People v. De Joya dying declaration incompleteDocument1 pagePeople v. De Joya dying declaration incompletelividNo ratings yet

- Court Testimony-WpsDocument3 pagesCourt Testimony-WpsCrisanto HernandezNo ratings yet

- Assignment Brief Starting A Small BusinessDocument3 pagesAssignment Brief Starting A Small BusinessFaraz0% (1)

- Digoxin FABDocument6 pagesDigoxin FABqwer22No ratings yet

- Shortcut To Spanish Component #1 Cognates - How To Learn 1000s of Spanish Words InstantlyDocument2 pagesShortcut To Spanish Component #1 Cognates - How To Learn 1000s of Spanish Words InstantlyCaptain AmericaNo ratings yet

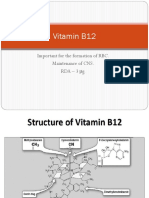

- Vitamin B12: Essential for RBC Formation and CNS MaintenanceDocument19 pagesVitamin B12: Essential for RBC Formation and CNS MaintenanceHari PrasathNo ratings yet

- SampleDocument4 pagesSampleParrallathanNo ratings yet

- Subarachnoid Cisterns & Cerebrospinal FluidDocument41 pagesSubarachnoid Cisterns & Cerebrospinal Fluidharjoth395No ratings yet

- ProbabilityDocument2 pagesProbabilityMickey WongNo ratings yet

- Second Periodic Test - 2018-2019Document21 pagesSecond Periodic Test - 2018-2019JUVELYN BELLITANo ratings yet

- B.A./B.Sc.: SyllabusDocument185 pagesB.A./B.Sc.: SyllabusKaran VeerNo ratings yet

- SMAW Product DevelopmentDocument9 pagesSMAW Product Developmenttibo bursioNo ratings yet

- Identifying States of Matter LessonDocument2 pagesIdentifying States of Matter LessonRaul OrcigaNo ratings yet

- Fs Casas FinalDocument55 pagesFs Casas FinalGwen Araña BalgomaNo ratings yet