Professional Documents

Culture Documents

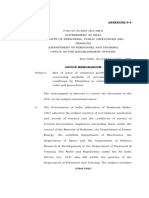

Service Tax Applicability on Work Contracts

Uploaded by

Animesh Saha0 ratings0% found this document useful (0 votes)

209 views2 pagesThe document discusses the applicability of service tax on work contracts for the Indian Ministry of Defence. It notes that the service tax rate was increased to 14% effective June 1, 2015. As contractors' quoted rates are deemed inclusive of all applicable taxes, the increased service tax liability will be borne by contractors. To avoid cost overruns, the appropriate percentage increase for service tax must be included in market variation calculations used for approving estimates and tenders. All zones are directed to revise their market variation percentages accordingly.

Original Description:

service tax detail in MES

Original Title

Service Tax Policy

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the applicability of service tax on work contracts for the Indian Ministry of Defence. It notes that the service tax rate was increased to 14% effective June 1, 2015. As contractors' quoted rates are deemed inclusive of all applicable taxes, the increased service tax liability will be borne by contractors. To avoid cost overruns, the appropriate percentage increase for service tax must be included in market variation calculations used for approving estimates and tenders. All zones are directed to revise their market variation percentages accordingly.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

209 views2 pagesService Tax Applicability on Work Contracts

Uploaded by

Animesh SahaThe document discusses the applicability of service tax on work contracts for the Indian Ministry of Defence. It notes that the service tax rate was increased to 14% effective June 1, 2015. As contractors' quoted rates are deemed inclusive of all applicable taxes, the increased service tax liability will be borne by contractors. To avoid cost overruns, the appropriate percentage increase for service tax must be included in market variation calculations used for approving estimates and tenders. All zones are directed to revise their market variation percentages accordingly.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Tele : 23019638

E2 Works (PPC) Sub Dte

Dte of Works, E-in-C's Branch

Integrated HQ of MoD (Army)

Kashmir House, Rajaji Marg .

New Delhi 110011.

A/95533/22-20/Pol/E2W (PPC)

' S Dec 15

List 'A' and 'B'

APPLICABILITY OF SERVICE TAX ON WORK CONTRACTS

1. Reference following E-in-C's Branch letters: -

(a)

No 66546/Manual/449/E8 dated 08 May 15.

(b)

No 66546/Manual/458/E8 dated 04 Jun 15.

2. Government of India : Ministry of Finance (Department of Revenue) vide

Notification No 14/ 2015 Service Tax dated 19 May 15 had increased the rate of

service tax to 14b/o wef 01 Jun 15.

3. As per the 'Manual on Contract' Appendix 8.1. Annexure XVI regarding Special

Conditions for Reimbursement/ Refund on Variation in "Taxes Directly related to

Contract Value". the rates quoted by the Contractor shall be deemed to be inclusive

of all taxes (including Sales tax/ VAT on materials, sales Tax/ VAT on Work Contracts,

turnover tax, Service tax, Labour welfare cess/ tax etc.), duties, Royalties, Octroi and

other levies payable under the respective statues. No reimbursement/ refund for

variation in rates of taxes, duties, Royalties, Octroi and other levies, and/ or imposition/

abolition of any/ existing taxes, duties, Royalties. Octroi and other levies shall be

made, except as provided in sub para (b) of Annexure XVI to Appndix 8.1.

4. In view of the above, the liability of payment of service tax shall be borne by the

contractor. This increased liability would result in higher quoting in tenders by the

contractors, which if not properly accounted for in the AEs and sanctioned will result

in increase in number of FC cases. Therefore, after due deliberation, it has been

decided that the appropriate percentage of applicable liability towards service tax are

to be included in Market Variation (MV) before being applied in the RIC/ AEs. All cases

under process should include updated MVs.

5. All zones are directed to revise the MV percentage accordingly and circulate

in their AOR for correct preparation of AEs and to avoid FC/ RAA cases. The revised

MV should take into account the actual rates and should not merely result in an

increase by a certain percentage.

ASaViiir Dube)

< Col

Dir (PPC)

For E-in-C

Copy to:QMG's Branch / DG LWE

HQ of MoD (Navy) / Dte of Wks

'A' Block New Delft

HQ of MoD (Air Force) / Dte of Wks

Vayu Bhawan. Rafi Mara

New Delhi - 110106.

HQ IDS / Works Dte

HQ SFC

C/o 56 APO

PIN - 908547

Coast Guard HQ

National Stadium Complex

New Delhi - 110001.

QMG's Branch / ADG TE

Dir (Works), HQ DGQA

Room No 153, 'H' Block

New ne!hi - 110011

HQ CME Pune

Pin - 908797

Cie 56 APO

CME / Faculty of Construction Management

Pin - 908797

neo 56 APO

Internal

E2W (Army) E2W (Navy'

E2W (Design) E2 (Est)

E4 (Utility'

gin 191911 E6 (Arch)

E8 (Contract)

Aomation Celi - For uploading on the MES website please

Col Rajat

Baijal

Digitally signed by Col Rajat Baijal

DN: c=IN, st=KASHMIR, o=E-IN-C

Branch Army MOD,Automation

Cell EINC, ou=nonnic-mail-admin,

cn=Col Rajat Baijal,

email=autocell-einc-army@nic.in

Date: 2015.12.14 15:41:09 +05'30'

You might also like

- WRPLVGMTS201213004 File2of2-UntochedDocument12 pagesWRPLVGMTS201213004 File2of2-UntochedNataraj Singh SardarNo ratings yet

- Report Accompanying The Revised GST & Embedded Tax: Palamoor - Ranga Reddy Lift Irrigation Scheme - Package - 5Document2 pagesReport Accompanying The Revised GST & Embedded Tax: Palamoor - Ranga Reddy Lift Irrigation Scheme - Package - 5Naveenkumar AdirintiNo ratings yet

- To Be Replied Within 24 HoursDocument24 pagesTo Be Replied Within 24 HoursIjaz AwanNo ratings yet

- Nation: MarketDocument9 pagesNation: MarketDebashis MitraNo ratings yet

- Architectural Consultancy RFQDocument10 pagesArchitectural Consultancy RFQGaurav PawarNo ratings yet

- Divi's Labs Ltd. vs. CCE SEZ ST ExmptnDocument6 pagesDivi's Labs Ltd. vs. CCE SEZ ST ExmptnChakravarthi B ANo ratings yet

- 8345 TenderDocument41 pages8345 Tendermvs srikarNo ratings yet

- Government Rate Contract for Desktop PC PeripheralsDocument19 pagesGovernment Rate Contract for Desktop PC Peripheralstops123No ratings yet

- Accounting Handbook For Regional Controllers PDFDocument66 pagesAccounting Handbook For Regional Controllers PDFAntara DeyNo ratings yet

- 2010 Mvuc Response To ArrDocument7 pages2010 Mvuc Response To ArrIan Mizzel A. DulfinaNo ratings yet

- GO Ms No 57Document2 pagesGO Ms No 57SEPR NlgNo ratings yet

- Request For Quotation: Collective RFQ Number/ Purchase GroupDocument27 pagesRequest For Quotation: Collective RFQ Number/ Purchase GroupQCTS FaridabadNo ratings yet

- NIT32 UpDocument209 pagesNIT32 Upprojects1No ratings yet

- RAU318HTDG-1.5 TonDocument13 pagesRAU318HTDG-1.5 Tonmukeshcet100% (1)

- CMPTR StyDocument11 pagesCMPTR StyWell WisherNo ratings yet

- TA BillDocument2 pagesTA BillParveen Kumar KalraNo ratings yet

- GlowDocument9 pagesGlowJasmeet SinghNo ratings yet

- BEML rate contract for servicing equipmentDocument6 pagesBEML rate contract for servicing equipmentanil peralaNo ratings yet

- ShollongDocument108 pagesShollongexecutive engineerNo ratings yet

- Refund of Tax Paid On Services Received by Special Economic Zones/DevelopersDocument4 pagesRefund of Tax Paid On Services Received by Special Economic Zones/Developersakira menonNo ratings yet

- Details of Service TaxDocument2 pagesDetails of Service Taxsanchu1981No ratings yet

- Schedule of Rates 2012-13 WRD KarnatakaDocument173 pagesSchedule of Rates 2012-13 WRD KarnatakaRiazahemad B Jagadal100% (1)

- Further Clarification and Supporting Documents For FinancialDocument4 pagesFurther Clarification and Supporting Documents For FinancialEngineeri TadiyosNo ratings yet

- Nitno 13Document3 pagesNitno 13Next Move HRNo ratings yet

- RVNL GST CircularDocument10 pagesRVNL GST CircularAmul GuptaNo ratings yet

- Printing & Supply Telephone Directories IOCL Mathura RefineryDocument23 pagesPrinting & Supply Telephone Directories IOCL Mathura RefineryHariNo ratings yet

- Practical Illustrations On Indirect TaxationDocument9 pagesPractical Illustrations On Indirect Taxationsridharan1969No ratings yet

- RwservletDocument18 pagesRwservletdhirajkumar_1No ratings yet

- DRC-07 AdvisoryDocument4 pagesDRC-07 AdvisoryGaurav KapriNo ratings yet

- Tender Doc Part 1Document97 pagesTender Doc Part 1vandana sahdevNo ratings yet

- P&M Nsic/Msme Open Domestic Tender (ODT) 1/12/M/L/033Document37 pagesP&M Nsic/Msme Open Domestic Tender (ODT) 1/12/M/L/033Ahmed KasamNo ratings yet

- Government crackdown on tax evasion by real estate firmDocument6 pagesGovernment crackdown on tax evasion by real estate firmSeemaNaikNo ratings yet

- 1534 - 2015 11 02 11 49 00 - 1446445141 PDFDocument134 pages1534 - 2015 11 02 11 49 00 - 1446445141 PDFFareha RiazNo ratings yet

- TapanDocument6 pagesTapanDebashis MitraNo ratings yet

- Compendium On: Office of CAO (C), Central RailwayDocument145 pagesCompendium On: Office of CAO (C), Central Railwayabhaskumar68No ratings yet

- Commercial Amendment No. A307/1022/Ca-01 TO BIDDING DOCUMENT NO.: SM/A307-IUE-PC-TN-8005/1022Document3 pagesCommercial Amendment No. A307/1022/Ca-01 TO BIDDING DOCUMENT NO.: SM/A307-IUE-PC-TN-8005/1022Vuong BuiNo ratings yet

- Claim ListDocument52 pagesClaim Listsui1981100% (2)

- Tendernotice 1Document116 pagesTendernotice 1Dileep ChintalapatiNo ratings yet

- Revised Philippine DPWH Guidelines for Calculating Project BudgetsDocument6 pagesRevised Philippine DPWH Guidelines for Calculating Project BudgetsJessica HerreraNo ratings yet

- Executive SummaryDocument12 pagesExecutive Summarynobi85804No ratings yet

- Works Contract Tax DeductionDocument2 pagesWorks Contract Tax Deductionviresh333No ratings yet

- PO - Upkeeping Mota Dahisara 236-2018Document17 pagesPO - Upkeeping Mota Dahisara 236-2018Vivek DekavadiyaNo ratings yet

- DRAFT INSPECTION REPORT FINDINGSDocument7 pagesDRAFT INSPECTION REPORT FINDINGSmahavir singhNo ratings yet

- Special Repair ESI Hospital Sec-8 FaridabadDocument269 pagesSpecial Repair ESI Hospital Sec-8 FaridabadsurjanshNo ratings yet

- Electric Bill Backup PDFDocument1 pageElectric Bill Backup PDFfahmad_cmsNo ratings yet

- Pune Metro Rail Project Bid Documents FORDocument34 pagesPune Metro Rail Project Bid Documents FORsantanu mukherjeeNo ratings yet

- Tender Vol-4 CivilDocument184 pagesTender Vol-4 CivillokenderchaturvediNo ratings yet

- Tender 2 PDFDocument243 pagesTender 2 PDFabid4845No ratings yet

- YogiDocument4 pagesYogiashok kuteNo ratings yet

- DPWH Department Order 72 Series of 2012 (ABC)Document6 pagesDPWH Department Order 72 Series of 2012 (ABC)Jayson Lupiba100% (3)

- ABC DO - 197 - s2016Document5 pagesABC DO - 197 - s2016Carol Santos63% (8)

- 2.3.5 Comparative StatementDocument6 pages2.3.5 Comparative StatementMir Yasir BajaraniNo ratings yet

- Quotation: Brandix Apparels Solutions LimitedDocument3 pagesQuotation: Brandix Apparels Solutions LimitedTharindu gangenathNo ratings yet

- Cenvat Credit and Tax Credit System ExplainedDocument44 pagesCenvat Credit and Tax Credit System Explainedశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Consolidated instructions on unauthorised absenceDocument3 pagesConsolidated instructions on unauthorised absenceRoy ANo ratings yet

- Government scheme disbursement detailsDocument8 pagesGovernment scheme disbursement detailsAnimesh SahaNo ratings yet

- Budgetary Offer - Solar All in One - Mes LansdowneDocument1 pageBudgetary Offer - Solar All in One - Mes LansdowneAnimesh SahaNo ratings yet

- Cgda Io - 06 - 08Document31 pagesCgda Io - 06 - 08Animesh SahaNo ratings yet

- Elmeasure Digital Meters Price ListDocument2 pagesElmeasure Digital Meters Price ListAnimesh SahaNo ratings yet

- Disclosure To Promote The Right To Information: IS 10500 (2012) : Drinking Water (FAD 25: Drinking Water)Document18 pagesDisclosure To Promote The Right To Information: IS 10500 (2012) : Drinking Water (FAD 25: Drinking Water)vngsasNo ratings yet

- Technical Drawings Part-I 28 Oct 2019Document128 pagesTechnical Drawings Part-I 28 Oct 2019Animesh SahaNo ratings yet

- Motors AC 8Pg PDFDocument8 pagesMotors AC 8Pg PDFAnimesh SahaNo ratings yet

- Technical Manual RKBDocument66 pagesTechnical Manual RKBRentu Philipose100% (3)

- Appd List of Contractros of CEEC - Aug 18Document173 pagesAppd List of Contractros of CEEC - Aug 18Animesh SahaNo ratings yet

- Castrol Price List Lubricants Pricelist 2018Document3 pagesCastrol Price List Lubricants Pricelist 2018Animesh SahaNo ratings yet

- 1180 1a2Document1 page1180 1a2Animesh SahaNo ratings yet

- Works Contract ServicesDocument13 pagesWorks Contract ServicesSreedhar EtrouthuNo ratings yet

- Electrical Centre Price List PDFDocument7 pagesElectrical Centre Price List PDFSrikanth Reddy Sangu67% (3)

- Maintenance & Operation On Contract BasisDocument2 pagesMaintenance & Operation On Contract BasisAnimesh SahaNo ratings yet

- Iafw 2249Document33 pagesIafw 2249Animesh Saha50% (2)

- Form 33Document2 pagesForm 33Rohit JainNo ratings yet

- Ban on unilateral guidelines for recruitment and service conditionsDocument83 pagesBan on unilateral guidelines for recruitment and service conditionsAnimesh SahaNo ratings yet

- K Series 100-160 KVA PDFDocument4 pagesK Series 100-160 KVA PDFAnimesh SahaNo ratings yet

- DEPRECIATION RATE FOR MES INSTALLATIONS AMENDMENT 20 Mar 17 PDFDocument4 pagesDEPRECIATION RATE FOR MES INSTALLATIONS AMENDMENT 20 Mar 17 PDFAnimesh SahaNo ratings yet

- Delhi Analysis of Rates 2014 Vol-1 PDFDocument696 pagesDelhi Analysis of Rates 2014 Vol-1 PDFJaisree Balu Pydi95% (22)

- Tender Documents 89529Document1 pageTender Documents 89529Animesh SahaNo ratings yet

- Permanent Ta DaDocument6 pagesPermanent Ta DaAnimesh SahaNo ratings yet

- Income Tax 2016-17Document4 pagesIncome Tax 2016-17Animesh SahaNo ratings yet

- PartyDocument1 pagePartyAnimesh SahaNo ratings yet

- ED 2007 (Amended) 2014Document4 pagesED 2007 (Amended) 2014Animesh SahaNo ratings yet

- Amendment Table B RMES 2015Document14 pagesAmendment Table B RMES 2015Animesh Saha100% (1)

- Finolex Cables Price ListDocument4 pagesFinolex Cables Price Listrjpatil19No ratings yet

- Reliable Power Distribution Solutions in Compact SpacesDocument8 pagesReliable Power Distribution Solutions in Compact SpacesAnimesh SahaNo ratings yet

- Credit Card Frauds RP PPT - NE218286Document25 pagesCredit Card Frauds RP PPT - NE218286NAGA100% (1)

- Concept Paper On The Causes of PovertyDocument6 pagesConcept Paper On The Causes of Povertygerald Ganotice100% (4)

- Research On AgingDocument5 pagesResearch On AgingAslam RehmanNo ratings yet

- Daksh Worksheet P5 AnnualDocument1 pageDaksh Worksheet P5 AnnualSandeep BhargavaNo ratings yet

- General Profile: CanadaDocument3 pagesGeneral Profile: CanadaDaniela CarauşNo ratings yet

- Sufficiency StrategyDocument17 pagesSufficiency StrategyRosita CaramanicoNo ratings yet

- Barro Sala-i-Martin - Convergence - 1992Document30 pagesBarro Sala-i-Martin - Convergence - 1992mgrotzNo ratings yet

- Lithium RecoveryDocument16 pagesLithium RecoverynikitaambeNo ratings yet

- 6a Prepare and Process Banking DocumentsDocument3 pages6a Prepare and Process Banking Documentsapi-27922856750% (2)

- Share Based Payments by Ca PS BeniwalDocument16 pagesShare Based Payments by Ca PS Beniwalhrudaya boys100% (1)

- ITB Chapter 1 (Part 2)Document9 pagesITB Chapter 1 (Part 2)Azim HamidNo ratings yet

- 1SDA100467R1 xt5s 630 Ekip Dip Ls I in 630 4p F FDocument4 pages1SDA100467R1 xt5s 630 Ekip Dip Ls I in 630 4p F Fccssaa123No ratings yet

- 5S Implementation PresentationDocument28 pages5S Implementation PresentationP K Senthil KumarNo ratings yet

- Victor PurwanaDocument31 pagesVictor PurwanaGanesh BonganeNo ratings yet

- TFL Spider Map For Barnet HospitalDocument1 pageTFL Spider Map For Barnet Hospitalhrpwmv83No ratings yet

- Chapter 2 EconomicsDocument8 pagesChapter 2 EconomicsVrinda TanejaNo ratings yet

- Mental Health Nursing R ShreevaniDocument3 pagesMental Health Nursing R ShreevaniBalwant SinghNo ratings yet

- Final ReportDocument16 pagesFinal ReportShahida HaqueNo ratings yet

- Financial Performance of Automobile Sector in IndiaDocument10 pagesFinancial Performance of Automobile Sector in IndiaInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Kiaer Christina Imagine No Possessions The Socialist Objects of Russian ConstructivismDocument363 pagesKiaer Christina Imagine No Possessions The Socialist Objects of Russian ConstructivismAnalía Capdevila100% (2)

- Indifference CurveDocument10 pagesIndifference Curveamit kumar dewanganNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- MulugetaaDocument4 pagesMulugetaaTesfaye Degefa100% (1)

- Technical Data: Ex-Control Switch Typ 292 Without and Typ 293 With Measuring InstrumentDocument5 pagesTechnical Data: Ex-Control Switch Typ 292 Without and Typ 293 With Measuring InstrumentAli RazaNo ratings yet

- PMS-FT21: Butt Weld Carbon Steel Fittings (Astm A234 GR - WPB)Document2 pagesPMS-FT21: Butt Weld Carbon Steel Fittings (Astm A234 GR - WPB)Deputy Chief Engineer TransgridNo ratings yet

- Bank Statement Template 3 - TemplateLabDocument1 pageBank Statement Template 3 - TemplateLabITNo ratings yet

- Hindi Book-BINA AUSHADHI KE KAYAKALP by Shri Ram Sharma PDFDocument48 pagesHindi Book-BINA AUSHADHI KE KAYAKALP by Shri Ram Sharma PDFAnil S ChaudharyNo ratings yet

- NSTP 1Document3 pagesNSTP 1Jocelyn Rafael Lamoste100% (2)

- (PDF) Unit - 1 - Information Technology NotesDocument51 pages(PDF) Unit - 1 - Information Technology NotesanilNo ratings yet

- Assignment 1Document2 pagesAssignment 1Babar Ali Roomi0% (1)