Professional Documents

Culture Documents

Mba I Accounting For Management (14mba13) Solution

Uploaded by

chaitanya23Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mba I Accounting For Management (14mba13) Solution

Uploaded by

chaitanya23Copyright:

Available Formats

ACCOUNTING FOR MANAGERS

14MBA13

Solved VTU-Question Paper

Module-1

1.

a)

b)

c)

d)

What are the functions of accounting? June/July 2015 (3Marks)

Record Keeping Function

Managerial Function

Legal Requirement function

Language of Business

2. Explain any 3 uses of financial statements in brief. Give examples of decisions that

are based on accounting information. Dec.14/Jan15 (3 Marks)

Facilitate to replace memory: Accounting facilitates replace human memory by

maintaining complete record of financial transactions.

Facilitates to comply with legal requirements: Accounting facilitates to comply with legal

requirements which require an Enterprise to maintain books of accounts. For e.g. Sec 209

of the Companies Act 1956, requires a company to maintain proper books of accounts on

accrual basis.

Facilitate to ascertain net results of operations: Accounting facilitates to ascertain net result

of operations by preparing Income Statement or P&L A/c.

Facilitates to ascertain financial position: Accounting facilitates to ascertain financial

position by preparing Balance Sheet.

Facilitates the users to take decisions: Accounting facilitates the users to take decisions by

communicating accounting information to them.

3. What is GAAP? Explain the need for accounting standard. June/July 2015 (7Marks)

Accounting standard is a selected set of accounting policies or broad guidelines regarding the

principles and methods to be chosen out of several alternatives. Standards conform to applicable

laws, customs, and usage and business environment.

Objective

The main objective of accounting standards is to harmonize the diverse accounting policies and

practices at present in use in India.

Importance or Advantages of setting Accounting standards

Reduction in variations:

Standards reduce to a reasonable extent or eliminate altogether confusing variances in the

accounting treatment used to prepare financial statements.

Disclosure beyond that required by law;

There are certain areas where important information is not statutorily required to be disclosed.

Standards may call for disclosure beyond that required by law.

Facilitates comparison:

The application of accounting standards would to a limited extent, facilitate comparison of

financial statements of companies situated in different parts of the world and also of different

companies situated in the same industry.

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

4. What are the concepts and conventions of accounting? Explain them in brief.

June/July 2015, Dec.14/Jan15 (10Marks)

Accounting Concepts

Accounting Entity Concept

According to this assumption, a business is treated as a separate entity that is distinct from its

owner(s), and all other economic proprietors. This concept requires that for accounting purposes a

distinction should be made between (i) personal transactions and business transactions, and (ii)

transactions of one business entity and those of another business entity.

Money measurement Concept

According to this concept, only those transactions which are capable of being expressed in term of

money are included in the accounting records. Non-monetary transactions should be ignored. E.g.

Guarantee given by bank, Strikes, Lockouts, Layoff etc

Accounting Period Concept

According to this concept, the economic life of an enterprise is artificially split into periodic

intervals which are known as accounting periods at the end of which an income statement and

position statement are prepared to show the performance and financial position.

Going Concern Concept

According to this concept, the enterprise is normally viewed as a going concern that is, continuing

in operation for the foreseeable future. Generally Accepted Accounting Principles (GAAPs)

GAAPs may be defined as those rules of action or conduct which are derived from experience and

practice and when they prove useful, they become accepted as principles of accounting.

Conventions of accounting:

Duality Principle

The duality aspects of transaction is the basis of double entry records. The entry made for each

transaction is composed of two parts-one for debit and another for credit. Every debit has equal

amount of credit.

Revenue Recognition Principle

This principle is mainly concerned with the revenue being recognized in the Income Statement

(P&L A/c) of an enterprise. Revenue is the gross inflow of cash. It includes receivable from sale

of goods, rendering of services and use of enterprise resources, interests, royalties and dividends.

Revenue is recognized in the period in which it is earned irrespective of the fact whether it is

received or not during that period.

Historical Cost Principle

According to this principle, an asset is ordinarily recorded in the accounting records at the price

paid to acquire it at the time of its acquisition and the cost becomes the basis for the accounts

during the period of acquisition and subsequent accounting periods. The cost of an asset is

systematically reduced from year to year by charging depreciation and the asset is shown in the

balance sheet at book value.

Matching Principle

According to this principle, the expenses incurred in an accounting period should be matched with

the revenues recognized on all goods sold during a period, cost of those goods sold should also be

charged to that period. In Trial balance all debits should be matched with all credits. In B/S, assets

side should be matched with liabilities side.

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

Full Disclosure Principle

According to this principle, the financial statements should act as means of conveying and not

concealing. The financial statements must disclosure all the relevant and reliable information. It

should be full, fair and adequate so that the users can take correct assessment about the financial

performance and position of the enterprise.

Objectivity Principle

According to this principle, the accounting data should be definite, verifiable and free from bias

of the accountant. This principle requires that each recorded transaction in the books of accounts

should have an adequate evidence to support it. (E.g. vouchers, receipts, invoices etc.)

Module-2

1. What is purchase book? Explain purchase book with imaginary transaction.

Dec.14/Jan15 (3Marks)

This book is kept with the object of recording credit purchases of goods for resale. Each inward

invoice after it has been entered as to calculations and also to the quantity, quality and price of the

goods received is numbered consecutively and then entered in the purchase books.

Postings: Each personal a/c is credited with its respective amount and the monthly total of this

book is debited to purchases a/c in the Ledger.

2. What is journal? How is it different from ledger? (7Marks)

A daily record of events or business; a private journal is usually referred to as a

Below each journal entry a brief explanation of the transaction is given within the brackets is called

narration

Ledger is a secondary book of entry. The journal entries are posted to the ledger at the end of each

period. Ledger is a book containing various account. In this book, separate account is opened for

each and every transactions of different nature.

Module-3

1. Define depreciation June/July 2015 (3Marks)

Depreciation is a non-cash expense that reduces the value of an asset over time. When it's stated

that depreciation is "non-cash," it means that depreciation is taken as an accounting entry, and that

the amount of cash held by the business is not affected. Business assets that can be depreciated

include equipment, machinery, technology and computers, office furniture, buildings and

improvements to buildings, leasehold improvements, and business vehicles. Land cannot be

depreciated because it appreciates instead of depreciating.

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

2. Differentiate between Trial balance and balance sheet (7Marks)

Trial Balance is a statement of ledger balances. In this statement four columns are provided for

recording the serial number, name of accounts, debit balances and a credit balances. The total of

such balances must be equal.

Rules Debit : All assets, expenses & losses

Credit : All liabilities, incomes & gains

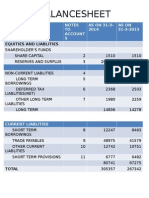

A Balance Sheet is a statement depicting the financial position of the business on a specific date.

Balance sheet is defined as a still-photograph of the state of affairs of

the business at a particular date. The financial position of a business is revealed by its assets and

liabilities on a particular date.

Module-4

1. What is Leverage ratio? June/July 2015 (3Marks)

Leverage refers to the use of debt finance. While debt capital is a cheaper source of finance, it is

also riskier source of finance. Leverage ratios help in assessing the risk arising from the use of

debt capital.

2. What is marshalling of balance sheet? Dec.14/Jan15 (3Marks)

Marshalling of balance sheet is to show assets and liabilities in specific order or arrangement. We

can either show assets and liabilities in liquidity order or permanence order.

3. What is common size statement? Dec.14/Jan15 (3Marks)

In vertical analysis of financial statements, an item is used as a base value and all other accounts

in the financial statement are compared to this base value. On the balance sheet, total assets equal

100% and each asset is stated as a percentage of total assets. Similarly, total liabilities and

stockholder's equity are assigned 100%, with a given liability or equity account stated as a

percentage of total liabilities and stockholder's equity. On the income statement, 100% is assigned

to net sales, with all revenue and expense accounts then related to it. Figure is assumed to be 100

and all figures are expressed as a percentage of sales. Similarly, in the Balance Sheet, the total of

assets or liabilities is taken as 100 and all figures are expressed as a percentage of this total.

4. Write a short note on comparative, common size, trend analysis and ratio analysis

(10Marks)

COMPARATIVE FINANCIAL STATEMENTS

A simple method for financial analysis is Comparative Financial Statements. Comparative

financial statements will contain items at least for two periods. Changes increases and decreases

in income statement and balance sheet over period are shown. Comparative Financial Statements

can be prepared for more than two periods or on more than two dates.

Common size financial statements are those in which figures reported are converted into

percentages to some common base. In the income statement, the sale figure is assumed to be 100

and all figures are expressed as a percentage of sales. Similarly, in the Balance Sheet, the total of

assets or liabilities is taken as 100 and all figures are expressed as a percentage of this total.

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

TREND ANALYSIS

Trend percentages are immensely useful in making a comparative study of financial statements

for several years.

The method of calculating trend percentages involves the calculation of percentage relationship

that each item bears to the same item in the base year.

Any year may be taken as the base year. It is usually the earliest year. Any intervening year

may also be taken as the base year.

Each item of base year is taken as 100 and on that basis the percentage for each item of the

years is calculated.

These percentages can also be taken as Index Numbers showing relative changes in the

financial data resulting with the passage of time.

Ratios for Financial Statement Analysis

A ratio gives the mathematical relationship between one variable and another. Ratios are

well known and most widely used tools for financial analysis.

The various types of ratios have been classified into the following categories:

1.

2.

3.

4.

Liquidity ratios

Turnover ratios

Profitability ratios

Ownership ratios

Module-5

1. What is Forensic Accounting? June/July 2015, Dec.14/Jan15 (3Marks)

Forensic Accounting, A branch of accounting that uses investigative skills to determine the

accuracy of a company's financial statements in a legal dispute. The word forensic means "suitable

for a court of law." Thus, forensic accountants are used in fraud investigations, breach of contract

disputes, and other disagreements that require court action. Forensic accountants are often retained

by one or both parties in such dispute to bolster their cases

2. What do you mean by IFRS? State the objectives. June/July 2015, Dec.14/Jan15

(7Marks)

The International Financial Reporting Standards refer to the reporting standards of finance as set

by the international accounting standards. Both IFRS and Indian Accounting Standards have

different accounting standards. However, with the growing market trend, the need of a common

set of accounting standards was felt by all. Hence, IFRS is to be followed. However, with the

differences in the standards existing between both the bodies, a careful handling is to be carried

out. Following are few changes that will be made in case IFRS is issued and made compulsory:

AS-1: Disclosure of accounting principles

IFRS-/IAS-1: Adoption of international financial reporting standards/presentation of financial

statements.

AS-3: cash flow statements

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

IAS-7: cash flow statements

AS-4: events after the balance sheet date

IAS-10: events recorded after the balance sheet date

AS-5: changes in accounting policies and accounting errors

IAS-8: prior period changes and accounting policies and errors changes

3. What is window dressing? Explain any 5 techniques of window dressing June/July

2015, Dec.14/Jan15 (10 Marks)

It is the act or instance of making something appear deceptively attractive or favorable; something

used to create a deceptively attractive or favorable impression. The act or practice of giving

something superficial appeal by skilful presentation.

Nature of Window Dressing

1. Inflate the sales from the current year by advancing the sales from the following year.

2. Alter the other income figure by playing with non-operational figures like sale of fixed

assets.

3. Fiddle with the method and rate of depreciation. (A switch may be effected from the written

down value method to the straight line method or vice versa.)

4. Change the method of stock valuation from, say, direct costing to absorption, to minimize

the cost of goods sold.

5. Capitalise certain expenses like research and development costs and product promotion

cost that are ordinarily written off in the profit and loss account.

Module-6

1. What do you understand by the term Corporate Governance? June/July 2015

(3Marks)

Corporate governance is the set of processes, customs, policies, laws and institutions affecting the

way in which a corporation is directed, administered or controlled. Corporate governance also

includes the relationships among the many players involved (the stakeholders) and the goals for

which the corporation is governed. The principal players are the shareholders, management and

the board of directors. Other stakeholders include employees, suppliers, customers, banks and

other lenders, regulators, the environment and the community at large.

Corporate governance is a multi-faceted subject. An important theme of corporate governance

deals with issues of accountability and fiduciary duty, essentially advocating the implementation

of guidelines and mechanisms to ensure good behaviour and protect shareholders. Another key

focus is the economic efficiency view, through which the corporate governance system should aim

to optimize economic results, with a strong emphasis on shareholders welfare. There are yet other

aspects to the corporate governance subject, such as the stakeholder view, which calls for more

attention and accountability to players other than the shareholders (e.g.: the employees or the

environment).

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

2. What is Human Resource Accounting? Is it essential? June/July 2015, Dec.14/Jan15

(7Marks)

Human Resource Accounting is the process of identifying and measuring data about Human

Resources and communicating this information to the interested parties. It is an attempt to identify

and report the Investments made in Human Resources of an organisation that are currently not

accounted for in the Conventional Accounting Practices.

Methods of Human Resource Accounting

Quite a few Models have been suggested in the past for the Human Resource Accounting and these

can be classified into 2 parts each having various Models. Some of the Important ones are:A. Cost Based Models

I. Capitalization of Historical Costs Model

II. Replacement Costs Model

III. Opportunity Cost Model

B. Value Based Models

I. Present Value of Future Earnings Model/ Lev and Schwartz Model

II. Reward Valuation Model/ Flamholtz Model

III. Valuation on Group Basis

3. What is meant by Accounting Standard? Explain any 6 AS in brief. Dec.14/Jan15 (10

Marks)

The Accounting standards bring uniformity in the preparation and presentation of financial

statements and aids in comparison of different financial statements of companies in the same or

different industries.

Procedure for framing Accounting Standards

received by ICAI assigned to ASB

AS-1

AS-2(Revised)

AS-3(Revised)

AS-4(Revised)

AS-5(Revised)

AS-6(Revised)

DEPT.OF MBA-SJBIT

Disclosure of Accounting

Policies

Valuation of inventories

Cash Flow Statements

Contingencies and Events

occurring after Balance

Sheet Date

Net Profit or Loss, prior

period items and changes in

Accounting policies

Depreciation Accounting

ACCOUNTING FOR MANAGERS

14MBA13

Module-7

1. What do you understand by the previous year and Assessment year? June/July 2015

(3Marks)

Previous Year {Sec 3} : It means the Financial year immediately preceding Assessment Year {Sec

2 (9)}

Assessment Year {Sec 2 (9)} : It is the period of 12 months commencing from 1st April of every

year and ends with 31st March of next year

2. What is deduction? Explain the deduction available to individual under 80C.

June/July 2015, Dec.14/Jan15 (7 Marks)

Further the Government Policy of attracting investment and activity in the desired direction and to

provide stimulus to growth or to meet social objectives, concession in the form of deduction from

Taxable Income is allowed. Chapter VI-A of the Income-tax Act, 1961 contains such deduction

provisions. In computing Total Income of an assesse deductions under sections 80C to 80U are

permissible from Gross Total Income.

Gross Total Income means the aggregate of income computed under each head as per

provisions of the Act, and but before making any deductions under this chapter.

1.

2.

3.

4.

5.

6.

Life insurance premium on the life of self, spouse and child

Contribution to PPF on the life of self, spouse and child

Contribution to SPF & RPF for self only

Housing loan repayment to the extent of principle amount

Subscription to notified NABARD bonds

Tuition fees paid to the university, school, college or education institution located in India

for full time education of children other than donation

7. Five years time deposit under post office savings scheme

8. Subscription to NSC

9. Term deposit of at least 5 years with a scheduled bank

3. Define the term Income. Explain any 4 heads of income in brief. Dec.14/Jan15

(7Marks)

Total Income {Sec 2 (45)}: T.I means the amount of income referred to in Sec 5

The Incomes earned by an assesse have been classified in to five major heads. They are

1. Income from salary

2. Income from house property

3. Profits and Gains of Business or Profession

4. Capital Gain

5. Income from Other Source

DEPT.OF MBA-SJBIT

ACCOUNTING FOR MANAGERS

14MBA13

4. Describe the Income tax sales rates applicable for individual for the annual year 201415. June/July 2015, Dec.14/Jan15. (10 Marks)

Rates of income-tax for assessment year 2014-15

1. Rates of Income Tax

(A) I. In the case of every Individual (other than those covered in part (II) or (III) below) or

Hindu Undivided Family or AOP/BOI (other than a co-operative society) whether incorporated

or not, or every artificial judicial person

Up to `2,00,000

`2,00,001 to `5,00,000

`5,00,001 to `10,00,000

Above `10,00,000

Nil

10%

20%

30%

II. In the case of every individual, being a resident in India, who is of the age of 60 years or

more but less than 80 years at any time during the previous year.

Up to `2,50,000

`2,50,001 to `5,00,000

`5,00,001 to `10,00,000

Above `10,00,000

Nil

10%

20%

30%

III. In the case of every individual, being a resident in India, who is of the age of 80 years or

more at any time during the previous year.

Up to `5,00,000

`5,00,001 to `10,00,000

Above `10,00,000

Nil

20%

30%

Surcharge: The amount of income-tax computed in accordance with the above rates shall be

increased by a surcharge at the rate of 10% of such income-tax in case of a person having a

total income exceeding `1 crore.

Cess: Education Cess @ 2% and SHEC @ 1% on income tax (inclusive of surcharge, if

applicable) shall be chargeable.

DEPT.OF MBA-SJBIT

You might also like

- Business Accounting - BBA-IT 2Document8 pagesBusiness Accounting - BBA-IT 2Ishika SrivastavaNo ratings yet

- Essentials of Financial Accounting - 1st SEMDocument10 pagesEssentials of Financial Accounting - 1st SEMParichay PalNo ratings yet

- Accounting For Manager Complete NotesDocument105 pagesAccounting For Manager Complete NotesAARTI100% (2)

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- Introduction To AccountingDocument19 pagesIntroduction To Accountingkarn.sakshi05No ratings yet

- Accounting For ManagersDocument10 pagesAccounting For ManagersThandapani PalaniNo ratings yet

- Accounts TheoryDocument6 pagesAccounts TheorySubhankar BhattacharjeeNo ratings yet

- Acc Assign1Document24 pagesAcc Assign1chandresh_johnsonNo ratings yet

- Entrepreneurship: Quarter 2: Module 7 & 8Document15 pagesEntrepreneurship: Quarter 2: Module 7 & 8Winston MurphyNo ratings yet

- Part 1 - Acc - 2016Document10 pagesPart 1 - Acc - 2016Sheikh Mass JahNo ratings yet

- Financial AccoountingDocument5 pagesFinancial AccoountingASR07No ratings yet

- Summary 1 60Document73 pagesSummary 1 60Karen Joy Jacinto Ello100% (1)

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Financial Accounting Managers GuideDocument13 pagesFinancial Accounting Managers GuideMohit TripathiNo ratings yet

- Business AcDocument6 pagesBusiness AcShelton GiftNo ratings yet

- Name: Abdul Gani Roll No: 201DDE1184 Course: MCA Year/Sem: 2 / 3 Paper Code: MCA 304 Paper Name: (Principles of Accounting)Document7 pagesName: Abdul Gani Roll No: 201DDE1184 Course: MCA Year/Sem: 2 / 3 Paper Code: MCA 304 Paper Name: (Principles of Accounting)logicballiaNo ratings yet

- Accounting Concepts and Principles - 2020 Online ClassDocument40 pagesAccounting Concepts and Principles - 2020 Online ClassGhillian Mae GuiangNo ratings yet

- Chapter 5Document8 pagesChapter 5Janah MirandaNo ratings yet

- ACCTG CONCEPTS AND CONVENTIONSDocument26 pagesACCTG CONCEPTS AND CONVENTIONSIshaan PaliwalNo ratings yet

- Amaara Sky HotelDocument12 pagesAmaara Sky HotelBorn 99No ratings yet

- September 4, 2021 - Accounting - 01 (Passed)Document5 pagesSeptember 4, 2021 - Accounting - 01 (Passed)wandeerNo ratings yet

- GAAP and accounting concepts explainedDocument13 pagesGAAP and accounting concepts explainedPreciousCapizNo ratings yet

- Question Answer EMBA505Document9 pagesQuestion Answer EMBA505Md. AsaduzzamanNo ratings yet

- 2مصطلحات تجارية محاسبة 1Document14 pages2مصطلحات تجارية محاسبة 1Mohamedmostafa MostafaNo ratings yet

- 2مصطلحات تجارية محاسبة 1Document14 pages2مصطلحات تجارية محاسبة 1Mohamedmostafa MostafaNo ratings yet

- The Purpose and Use of The Accounting Records Which Used in MontehodgeDocument15 pagesThe Purpose and Use of The Accounting Records Which Used in MontehodgeNime AhmedNo ratings yet

- Introduction To Financial Accountin1Document27 pagesIntroduction To Financial Accountin1yug.rokadia100% (1)

- Fundamentals of AccountingDocument7 pagesFundamentals of AccountingDengdit Akol100% (1)

- Accountancy and ManagementDocument19 pagesAccountancy and ManagementLiwash SaikiaNo ratings yet

- Unit 2 Tutrorial NotesDocument7 pagesUnit 2 Tutrorial NotesDavdi HansonNo ratings yet

- Financial statements components and relationshipsDocument2 pagesFinancial statements components and relationshipsAlexsiah De VeraNo ratings yet

- Chapter 1 Introduction To AccountingDocument17 pagesChapter 1 Introduction To Accountingpriyam.200409No ratings yet

- Accounting & Financial ManagementDocument92 pagesAccounting & Financial ManagementRajni Sinha VermaNo ratings yet

- Accounting 1st SessionDocument25 pagesAccounting 1st SessionDelfa CastillaNo ratings yet

- Accounting Policies Can Be Used To Legally Manipulate EarningsDocument7 pagesAccounting Policies Can Be Used To Legally Manipulate EarningsKisitu MosesNo ratings yet

- Subject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesDocument16 pagesSubject Financial Accounting and Reporting Chapter/Unit Chapter 2/part 1 Lesson Title Accounting and Business Lesson ObjectivesAzuma JunichiNo ratings yet

- Theory Base of AccountingDocument10 pagesTheory Base of Accountingkshitijraja18No ratings yet

- Bba 1sem Financial Accounting Important NotesDocument38 pagesBba 1sem Financial Accounting Important Notestyagiujjwal59No ratings yet

- Accounting Concepts and Recording of Financial TransactionsDocument8 pagesAccounting Concepts and Recording of Financial Transactionsjunita bwaliNo ratings yet

- Course: Financial Accounting & AnalysisDocument16 pagesCourse: Financial Accounting & Analysiskarunakar vNo ratings yet

- BBA-101 (Fundamentals of Accounting)Document10 pagesBBA-101 (Fundamentals of Accounting)Muniba BatoolNo ratings yet

- Financial Accounting 123Document46 pagesFinancial Accounting 123shekhar87100% (1)

- Understand Double Entry AccountingDocument11 pagesUnderstand Double Entry AccountingEsha ZakiNo ratings yet

- Fundamentels of Accounting Lect 1Document9 pagesFundamentels of Accounting Lect 1Jahanzaib ButtNo ratings yet

- Financial Accounting Basics: Statements, Principles & StandardsDocument18 pagesFinancial Accounting Basics: Statements, Principles & StandardsramakrishnanNo ratings yet

- Mefa Unit 5Document32 pagesMefa Unit 5Saalif RahmanNo ratings yet

- FABM 2 Key Elements and Financial StatementsDocument5 pagesFABM 2 Key Elements and Financial StatementsLenard TaberdoNo ratings yet

- Accounting NoteDocument96 pagesAccounting NoteFahomeda Rahman SumoniNo ratings yet

- The Management of The Finances of A Business / Organisation in Order To Achieve Financial ObjectivesDocument12 pagesThe Management of The Finances of A Business / Organisation in Order To Achieve Financial ObjectivesPrince GoyalNo ratings yet

- Accounting Fundamentals for ManagersDocument12 pagesAccounting Fundamentals for ManagersarifNo ratings yet

- What Is AccountingDocument6 pagesWhat Is AccountingOtaku girlNo ratings yet

- Accounts SuggestionsDocument18 pagesAccounts SuggestionsDipon GhoshNo ratings yet

- ACCT 1005 Summary Notes 1.2 Accounting Concepts and PrinciplesDocument3 pagesACCT 1005 Summary Notes 1.2 Accounting Concepts and PrinciplesShamark EdwardsNo ratings yet

- Accounting Concepts AssingmentDocument13 pagesAccounting Concepts AssingmentKapilNo ratings yet

- Notes - Unit-1Document13 pagesNotes - Unit-1happy lifeNo ratings yet

- General Ledger Reconciliations Guide Business Owners (39Document11 pagesGeneral Ledger Reconciliations Guide Business Owners (39Sherin ThomasNo ratings yet

- Econ 303Document5 pagesEcon 303ali abou aliNo ratings yet

- Chp14 ConceptsDocument9 pagesChp14 ConceptsMohd Hafiz AhmadNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Projectreport 141008015527 Conversion Gate01Document78 pagesProjectreport 141008015527 Conversion Gate01chaitanya23No ratings yet

- Mba III Services Management (14mbamm303) NotesDocument113 pagesMba III Services Management (14mbamm303) NotesZoheb Ali K100% (14)

- BM Module 7Document24 pagesBM Module 7chaitanya23No ratings yet

- Tecnia Journal Vol 6 No1Document85 pagesTecnia Journal Vol 6 No1chaitanya23No ratings yet

- Management Lessons On An Aircraft Carrier at SeaDocument5 pagesManagement Lessons On An Aircraft Carrier at Seachaitanya23No ratings yet

- Mba-i-Accounting For Management (14mba13) - Question PaperDocument2 pagesMba-i-Accounting For Management (14mba13) - Question Paperchaitanya23No ratings yet

- Basics of ExcelDocument79 pagesBasics of Excelchaitanya23No ratings yet

- Question Paper Services Management (14mbamm303)Document2 pagesQuestion Paper Services Management (14mbamm303)chaitanya23No ratings yet

- PartexDocument11 pagesPartexMirza Mehedi AlamNo ratings yet

- YuanDocument18 pagesYuanchaitanya23No ratings yet

- Consumer Learning Schiffman07Document55 pagesConsumer Learning Schiffman07chaitanya23No ratings yet

- Mba I Accounting For Management (14mba13) AssignmentDocument1 pageMba I Accounting For Management (14mba13) Assignmentchaitanya23No ratings yet

- ABCDocument5 pagesABCchaitanya23No ratings yet

- Practical ComponentDocument10 pagesPractical Componentchaitanya23No ratings yet

- Solution-Services Management (14mbamm303)Document22 pagesSolution-Services Management (14mbamm303)chaitanya23No ratings yet

- YuanDocument18 pagesYuanchaitanya23No ratings yet

- Toyota ProjectDocument12 pagesToyota Projectchaitanya23No ratings yet

- Solution-Services Management (14mbamm303)Document22 pagesSolution-Services Management (14mbamm303)chaitanya23No ratings yet

- Question Paper Services Management (14mbamm303)Document2 pagesQuestion Paper Services Management (14mbamm303)chaitanya23No ratings yet

- Personality Test ResultDocument8 pagesPersonality Test Resultchaitanya23No ratings yet

- Marginal Costing ResearchDocument5 pagesMarginal Costing Researchchaitanya23No ratings yet

- QuestionaireDocument4 pagesQuestionairechaitanya23No ratings yet

- Factoral DesignsDocument24 pagesFactoral Designschaitanya23No ratings yet

- Marginal Costing ResearchDocument5 pagesMarginal Costing Researchchaitanya23No ratings yet

- Balance SheetDocument4 pagesBalance Sheetchaitanya23No ratings yet

- Maruti Suzuki Bal Sheet AnalysisDocument13 pagesMaruti Suzuki Bal Sheet Analysischaitanya23No ratings yet

- BRM (M-4)Document33 pagesBRM (M-4)chaitanya23No ratings yet

- The Recent Gang Rape of A 23Document4 pagesThe Recent Gang Rape of A 23chaitanya23No ratings yet

- Pillar 1Document43 pagesPillar 1Ioana DragneNo ratings yet

- Code of Conduct and Ethical Standards For Public Officials and EmployeesDocument42 pagesCode of Conduct and Ethical Standards For Public Officials and EmployeesNahanni Ellama50% (2)

- Case S02 01Document5 pagesCase S02 01jnfzNo ratings yet

- Rubfila International LimitedDocument7 pagesRubfila International LimiteddeepaksreshtaNo ratings yet

- ThreeHorizons 1Document2 pagesThreeHorizons 1sreen2rNo ratings yet

- Partnership Practice Manual PDFDocument47 pagesPartnership Practice Manual PDFanupNo ratings yet

- Thornton - Ethical Investments - A Case of Disjointed ThinkingDocument7 pagesThornton - Ethical Investments - A Case of Disjointed ThinkingmanavmelwaniNo ratings yet

- IMF and World BankDocument100 pagesIMF and World BankMohsen SirajNo ratings yet

- The Impact of Corporate Governance Characteristics On The of Financial DistressDocument15 pagesThe Impact of Corporate Governance Characteristics On The of Financial DistressFuad Achsan AlviaroNo ratings yet

- Contractor Enlistment ProspectusDocument17 pagesContractor Enlistment Prospectusnit111No ratings yet

- Working Capital Management of Nepal Telecom PDFDocument135 pagesWorking Capital Management of Nepal Telecom PDFGyalmu Lama100% (2)

- Company SC XXX SrlexDocument10 pagesCompany SC XXX SrlexGavrila AlexandruNo ratings yet

- Zanaco Capital Raising DocumentDocument10 pagesZanaco Capital Raising DocumentKristi DuranNo ratings yet

- Dental Services MarketDocument35 pagesDental Services MarketIndia Business ReportsNo ratings yet

- Group 4 Basic Long-Term Financial ConceptsDocument28 pagesGroup 4 Basic Long-Term Financial ConceptsHazel Becbec Labadia89% (9)

- Capítulo 15 - Mankiw MacroeconomiaDocument34 pagesCapítulo 15 - Mankiw MacroeconomiaAnonymous wJ8jxANo ratings yet

- AnnualReport2008 09Document242 pagesAnnualReport2008 09Ninad PaiNo ratings yet

- Lao VS lAODocument2 pagesLao VS lAOJuris Renier MendozaNo ratings yet

- Master Budget ASISTENSI 3 AKUNTANSI MANAJEMENDocument4 pagesMaster Budget ASISTENSI 3 AKUNTANSI MANAJEMENLupita WidyaningrumNo ratings yet

- Npos vs. PoDocument4 pagesNpos vs. Pocindycanlas_07No ratings yet

- The Blackstone Group Annual Report 2008Document87 pagesThe Blackstone Group Annual Report 2008AsiaBuyouts100% (4)

- Accenture Basel III and Its ConsequencesDocument16 pagesAccenture Basel III and Its Consequencesalicefriends_27No ratings yet

- Kompella July 2011Document76 pagesKompella July 2011reachanujNo ratings yet

- Lecture 6 Part II (Multivariate GARCH Only) 20130527002724Document35 pagesLecture 6 Part II (Multivariate GARCH Only) 20130527002724georgiana 0912No ratings yet

- IFRS 6 - Exploration For and Evaluation of Mineral ResourcesDocument2 pagesIFRS 6 - Exploration For and Evaluation of Mineral ResourcesLoui BayauaNo ratings yet

- BNP Paribas Dupire Arbitrage Pricing With Stochastic VolatilityDocument18 pagesBNP Paribas Dupire Arbitrage Pricing With Stochastic Volatilityvictormatos90949No ratings yet

- Sps. Abejo v. Dela CruzDocument3 pagesSps. Abejo v. Dela CruzBananaNo ratings yet

- Auditor's Report (TVS Motor Company)Document12 pagesAuditor's Report (TVS Motor Company)Viraj WadkarNo ratings yet

- CIR Versus CA (Trust Fund Doctrine)Document1 pageCIR Versus CA (Trust Fund Doctrine)Boysie Ceth GarvezNo ratings yet

- Managing the Cash Conversion CycleDocument20 pagesManaging the Cash Conversion CycleMangoStarr Aibelle VegasNo ratings yet