Professional Documents

Culture Documents

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

XPRO INDIA TIMITED

xfrrotncnd

L .::::33:'

Birla Building (2nd Floor),

9/1, R. N. Mukherjee Road

Kolkata - 700 001, India

Tel

Fax

:+91-33-3057370080410900

:+91-33-22420712

e-mail : xprocal@xproindia.com

January 28,2016

National Stock Exchange of India Ltd.

"Exchange Plaza",

Bandra-Kurla Complex, Bandra (E),

Mumbai400 051

Stock Svmbol XPROI NDIA(EQ)

lo

The Dy. General Manager

Bombay Stock Exchange Limited

Corporate Relationship Department

1" Floor, New Trading Ring

Rotunda Building, P J Towers

DalalStreet, Fort

Mumbai400 001

Stock Code No. 590013

Dear Sir,

Sub : Unaudited Stand-alone Financial Results for the Quarter & Nine Months Ended

December 31,2015 alongwith Limited Review Report from the Auditors thereon.

Further to our letter dated January 4, 2016, enclosed please find herewith Unaudited Stand-alone

Financial Results for the Quarter & Nine Months Ended December 31,2015, which were approved

by the Board at its meeting held on date which commenced at 11.45 a.m. and concluded

at .1.'.5.9.p.m, alongwith Limited Review Report from our Auditors, M/s Deloitte Haskins & Sells,

Chartered Accountants, for your kind information & records.

Thanking you,

Yours faithfully,

For XFRO INDIA LTD

s. c.

Company Secretary

Regisrcred Office : Barjora - Mejia Roa4 P.O. Ghutgori4 Tehsil : Barjora, Disn: Bankura West Bengal 722202;

Tel.;91-3241-257263 | 4:Fax:91-1241-257266; e-nail: cosec@xproindia.com;

CIN : L25209WB 1997PLC085972; www.xproindiacom

Deloitte

Deloitte Haskins & Sellt

Chartered Accountants

'Heritage', 3rd Floor,

Near 6ujarat Vidhyapith

Off Ashram Road,

Haskins & Sells

Ahmedabad -380 014.

Tel: +91 (079) 27582542

+91 (079) 275a25q3

+91 (079) 66073100

Fax: +91 (079) 27582551

INDEPENDENT AUDITOR'S REVIEW REPORT ON REVIEW OF INTERIM

FINANCIAL RESULTS

TO THE BOARD OF DIRECTORS OF

XPRO INDIA LIMITED

We have reviewed the accompanying Statement of Standalone Unaudited Financial

Results of XPRO INDIA LIMITED ('the Company") for the Quarter and Nine Months

ended December 31, 2015 ("the Statement"), being submitted by the Company pursuant

to the requirement of Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015. This Statement which is the responsibility of the

Company's Management and approved by the Board of Directors, has been prepared in

accordance with the recognition and measurement principles laid down in Accounting

Standard for Interim Financial Reporting (AS 25), prescribed under Section 133 of the

Companies Act, 2013 read with relevant rules issued thereunder and other accounting

principles generally accepted in India. Our responsibility is to issue a report on the

Statement based on our review.

2.

We conducted our review of the Statement in accordance with the Standard on Review

Engagements (SRE) 2410'Review of Interim Financial Information Performed by the

Independent Auditor of the Entity', issued by the Institute of Chartered Accountants of

India. This Standard requires that we plan and perform the review to obtain moderate

assurance as to whether the Statement is free of material misstatement. A review is

limited primarily to inquiries of Company personnel and analytical procedures applied to

financial data and thus provides less assurance than an audit. We have not performed an

audit and, accordingly, we do not express an audit opinion.

5.

Based on our review conducted as stated above, nothing has come to our attention that

causes us to believe that the accompanying Statement, prepared in accordance with the

aforesaid Accounting Standards and other accounting principles generally accepted in

India, has not disclosed the information required to be disclosed in terms of Regulation 33

of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015,

including the manner in which it is to be disclosed, or that it contains any material

misstatement.

FoTDELOITTE HASKINS & SELLS

Chartered Accountants

(Firm's Registration No. I 17365W)

ll

AHIVlEDARAD

r.r

J{,Afufer,.

A

't{,<r/v'c.L

Kartikeya Raval

Partner

(Membership No. l06l 89)

Kolkata, January 28, 20 | 6

XPRO INDIA LIMITED

t.

xDromcltA

r .:::::::.

Registered Office:

":::"

Barjora - Mejia Road, P.O. Ghutgoria,

Tehsil: Barjora, Distt.: Bankura, Vest Bengal 722 202

Tel: +91-3241-257263 / 4; e-mail: cosec@xproindia.com

CIN: L25209VB 1997 PLC08597

Vebsite: www.xproindia.com

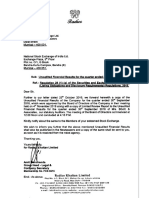

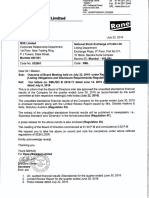

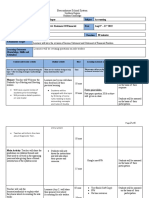

Statement of Standalone Unaudited Financial Results for the Quarter and Nine months ended December 31, 2015

({

December 31

2015

Unaudited

Particulars

st,

Net Sales/lncome from Operations (net of excise duty)

Exoenses

a) Cost of materials consumed

b) Changes in inventories of finished goods, workin-progress and stock-in-trade

c) Employee benefits expense

d) Depreciation and amortisation expense

e) Other Expenses

fl Total Exoenses

Loss from operations before other income,

flnance costs and exceptional items (1-2)

Other Income

Loss from Ordinary activities before finance

costs & exceptional items (3+4)

Finance costs

Loss from Ordinary activities after finance

costs but before Exceptional ltems (5-6)

Exceptional items

Loss from ordinary activities before tax (7+8)

Tax Exoense

Loss from ordinary activities afler tax (9-10)

Exhaordinary items (net of tax expenses)

Loss for the period (1 1+12)

Paid-up Equity Share Capital (Face value:

10 / share)

Reserves excluding Revaluation Reserve as per the

balance sheet of previous accounting year

Earnings per Share (of

1 0 each) (not annualised) (()

- Basic

before extraordinary items:

- Diluted

- Basic

after exhaordinary items:

- Diluted

6

7

8

9

10

11

13

14

15

3 months ended

September 3( uecemDer J1

2015

2014

Unaudited

Unaudited

Year to date for oeriod ended

uecemoer J1 uecemDer 31

2015

2014

Unaudited

Unaudited

codJ.oo

6292.86

5979.85

19 t2.95

zutiul.u9

3954.50

4531.49

(1 57.s5)

4417.92

74.66

14007.14

16.13

562.75

459,76

507.95

429.58

543.05

513.63

'1037.73

1096.81

11

6030.87

(347.21)

6408.28

(115.42\

6659.64

(67e.7e)

1625.29

339.36

3301.97

20275.61

(502 66)

50.90

(2e6.31)

61.39

(54.03)

(586.58)

10.38

93.21

1.85

208.99

(2e3.67)

5386.74

334.79

1586.26

in lacs)

Year ended

March 31

2015

Audited

zc

/vu.Jv

9253.39

230.98

1981.52

1465.22

1404.81

3343.77

22116.78

(1515.69)

4055.47

26926.17

(1127.78)

08e.53)

543.45

(584.33)

426.16

(1

(864.4e)

509.92

(563.e5)

(1

56.76)

(1

973.1 7)

1612.80

(2702.33)

(1892.50)

(864.49)

(563.95)

(1

56.76)

(1

973.1 7)

(2702.33\

(1

135.00

'135.00

(eee.4e)

(6e8.95)

(161.e8)

(860.e3)

1165.95

56.76)

270.00

(2243.17)

(161.e8)

(27023;_)

568.1

(eee.4e)

1

165.95

570,1 8

679.50

308.1 7

892,50)

(501 00)

(1391.50)

(1

(1

156.76)

165.95

(2405.1 5)

165.95

(2702.33\

1 165.95

(e e2)

(e e0)

(e.e2)

(s.s0r

(15.24)

(23.1 8)

(1

1.e3)

e.14)

(20.63)

(20 52\

(23.12),

(1

1.90)

(23. I 8)

(1

Q3.12\

(1 1

1.e3)

90)

(1

391 .50)

165.95

10498.42

1

16

(8.si)

(8.53)

(8.57)

t8 53)

(5.ee)

(5.e8)

(i

38)

(7 36)

(1

Notes:

1.

5.

6.

The above results have been reviewed by the Audit Committee and approved by the Board of Directors at their meetings held on January 28,2016

and reviewed by the Statutory Auditors.

The markets for consumer durables remains depressed with the resultant curtailed production at major 0EM customers impacting sales and results; it is

reasonably believed that these circumstances are transient and thal economic policies would dnve overall market confidence and demand.

The import-substitute products of the Company's highly sophisticated BOPP Dielechic (Capacitor) Film Unit located at Barjora, Distt. Bankura, (West

Bengal) have been well received with orders commencing from most major capacitor manufacturers. The unit however sufiers due to the prevailing

inverted duty structure. The results reflect the interest and depreciation burden during the stabilisation and volume build-up phase.

Extraordinary item represents the loss arising from damage attributable to flash floods, in the month of July, 201 5, at the Pithampur Unit of the Company.

Further, as already informed, production at the Unit has been temporarily suspended for overhauling and upgrading of the plant. The Company has

adequate capacity for production of Di-electric Films at other Units of the Company.

The Company's activities relate to "Polymer Processing" business which is the only reportable segment in accordance with requirement of Accounting

Standard 17 - "Segment Reporting".

Previous period's figures have been regroupedheananged where necessary,

Kolkata

January 28, 201 6

Managing Director & Chief Executive Officer

You might also like

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- CARTRADE 25012022123949 LetterDocument30 pagesCARTRADE 25012022123949 Lettermadhav kumarNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Latentview Analytics LimitedDocument12 pagesLatentview Analytics Limitedanish5337No ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Document7 pagesAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- FinancialResult Q4 201920 PDFDocument28 pagesFinancialResult Q4 201920 PDFRaj KNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document5 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Lessonn Plan Accounting Class 11 Week 2Document4 pagesLessonn Plan Accounting Class 11 Week 2SyedMaazAliNo ratings yet

- Literature Review On Personal Financial ManagementDocument8 pagesLiterature Review On Personal Financial Managementea4gaa0gNo ratings yet

- Financial Performance of NALCODocument68 pagesFinancial Performance of NALCOchandrasekhar100% (1)

- White PaperDocument22 pagesWhite PapersteffatoNo ratings yet

- Gleim EQE-Auditing Cross Reference-14eDocument2 pagesGleim EQE-Auditing Cross Reference-14eMbadilishaji DuniaNo ratings yet

- JDVP DO 33s 2018Document42 pagesJDVP DO 33s 2018Maychengchang Technical SchoolNo ratings yet

- Question No. 1 Is Compulsory Answer Any Four Questions From The Remaining Five QuestionsDocument9 pagesQuestion No. 1 Is Compulsory Answer Any Four Questions From The Remaining Five QuestionssiddhantNo ratings yet

- Black Money Act Tax on Undisclosed Foreign AssetsDocument16 pagesBlack Money Act Tax on Undisclosed Foreign AssetsDharshini AravamudhanNo ratings yet

- Assessment 2Document8 pagesAssessment 2katha gandhiNo ratings yet

- PAAB Public Notice 6 of 2023 Registered Firms As at 15 October 2023Document2 pagesPAAB Public Notice 6 of 2023 Registered Firms As at 15 October 2023knowledge musendekwaNo ratings yet

- CIA Exemptions For Other QualificationsDocument8 pagesCIA Exemptions For Other QualificationsAtiq RehmanNo ratings yet

- Budgetary Control: Part A: TheoryDocument9 pagesBudgetary Control: Part A: TheoryAditi TNo ratings yet

- Verotel Merchant Services B.V. v. Rizal Commercial Bank 2021Document90 pagesVerotel Merchant Services B.V. v. Rizal Commercial Bank 2021hyenadogNo ratings yet

- Guidance Note On GST Audit ICAI PDFDocument529 pagesGuidance Note On GST Audit ICAI PDFLitesh ChopraNo ratings yet

- MCI CommunicationsDocument8 pagesMCI CommunicationsShadow D'costaNo ratings yet

- 5S Implementation Plan at Work PlaceDocument18 pages5S Implementation Plan at Work PlacemanishlmehtaNo ratings yet

- Notes On Tax Remedies of The Government and TaxpayersDocument74 pagesNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- ITP Application & RulesDocument8 pagesITP Application & RulesShahaan Zulfiqar100% (2)

- First Test For The Third Quarter in Bf2 PeebsDocument4 pagesFirst Test For The Third Quarter in Bf2 PeebsFlorivee EreseNo ratings yet

- Baf Annual Report 2022Document558 pagesBaf Annual Report 2022Tahir Mustafa ChohanNo ratings yet

- Land Laws: Muhammad Ahmad Waheed F2017117063 Presentation Topic:-Record of RightsDocument9 pagesLand Laws: Muhammad Ahmad Waheed F2017117063 Presentation Topic:-Record of RightsMalik AhmadNo ratings yet

- Auditor's Report on Qualified Opinion of Municipality of TampakanDocument2 pagesAuditor's Report on Qualified Opinion of Municipality of TampakanGier Rizaldo BulaclacNo ratings yet

- Online Portfolio VersionDocument22 pagesOnline Portfolio Versionapi-282483815100% (1)

- NGAs New Barangay Accounting System OverviewDocument2 pagesNGAs New Barangay Accounting System OverviewHarPearl Lie100% (1)

- Audit of InventoryDocument5 pagesAudit of InventoryMa. Hazel Donita DiazNo ratings yet

- Transport RTIA Annual Report 2020-2021 V19 WebDocument188 pagesTransport RTIA Annual Report 2020-2021 V19 WebSundayTimesZANo ratings yet

- Quiz Bee WordDocument7 pagesQuiz Bee WordVince De GuzmanNo ratings yet

- Template 2 AMRUTDocument19 pagesTemplate 2 AMRUTSheshu KNo ratings yet

- Syllabus Auditing 2 ISA - PADocument4 pagesSyllabus Auditing 2 ISA - PAcarolinapurnomoNo ratings yet

- Manish Final Project PDFDocument52 pagesManish Final Project PDFManish BaviskarNo ratings yet