Professional Documents

Culture Documents

Bom

Uploaded by

Anonymous wAJzw07tXKOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bom

Uploaded by

Anonymous wAJzw07tXKCopyright:

Available Formats

A line there states that, Regarding independence, Wiles mentioned that her

daughter is a staff accountant for Harer and Jones

A professional accountant has an obligation to evaluate threats to compliance to

fundamental principles. He is expected to know the circumstances that may

compromise compliance with the fundamental principles.

Independence is an important factor that must be considered by the firm before

accepting an audit engagement. Independence of mind and in appearance is

necessary to enable the professional accountant in public practice to express a

conclusion and be seen to express a conclusion without bias, conflict of interest or

undue influence of others. They should consider whether there are any threats to

the audit teams independence.

Once the threat has been identified a professional accountant may be required to

resolve the a conflict inin the application of Fundamental standards. We say

depending on the circumstances because as what Ive read we dont just comply

with a set of specific rules because there can be different circumstances or

combination of circumstances so it is impossible to define every situation and

specify the appropriate action that should be taken.

that is why the Code of Ethics provides a framework to assist professional

accountant to identify, evaluate, and address threats to compliance with the

fundamental standards taking into consideration as part of the resolution process:

Relevant facts

Ethical issues involved

Fundamental principles related

Alternative courses of action

PROBLEM:

Jones.

Donna Wiles daughter is working as a staff accountant in Harer and

RELEVANT FACTS:

Donna Wiles is working as a controller of Lone Star

A company's controller is the chief accounting officer and heads the

accounting department. The controller is responsible for the company's

financial statements, general ledger, cost accounting, payroll, accounts

payable, accounts receivable, budgeting, tax compliance, and various special

analyses

Her daughter is working as a staff accountant in Harer and Jones.

The controller has no ownership interest in Lone Star at the present time

It can be said that Wiles is an employee of the client who is in position to exert

significant influence over the subject matter of the engagement. And she is an

immediate family of the staff accountant.with that having said the

FUNDAMENTAL PRINCIPLE RELATED:

Objectivity and there isfamiliarity threat to objectivity.

ACTIONS TAKEN :

Discuss the issue with higher levels of management within the firm

As it is stated, at your meeting with the managing partner of the office, you

are able to resolve potential independence proble

Prohibitions of assigning to an audit client firm professionals whose family

members are employed in certain positions at the client.

the staff accountant may not be ssigned in the engagement with Lone Star.

As it was said earlier it we shouldnt just have independence in mind but also in

appearance that is why it is best for the proff. Accountant to document the

details of any discussions held or decisions taken concerning th`e issue.

Self-interest. The threat that arises when an auditor acts in his or her own

emotional, financial or other personal self-interest.

Self-review. The threat of bias arising when an auditor audits his or her own

work or the work of a colleague.

Advocacy. The threat that arises when an auditor acts as an advocate for or

against an audit clients position or opinion rather than as an unbiased attestor.

Familiarity (or trust). The threat that arises when an auditor is being influenced

by a close relationship with an audit client.

Intimidation. The threat that arises when an auditor is being, or believes that he

or she is being, overtly or covertly coerced by an audit client or by another

interested party.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New AcademicDocument263 pagesNew AcademicshakNo ratings yet

- Example of Preschool Observation: Documentation and AnalysisDocument1 pageExample of Preschool Observation: Documentation and Analysisarra resuelloNo ratings yet

- DLL Format LandscapeDocument2 pagesDLL Format Landscapewilflor romeroNo ratings yet

- Q3 WEEK 1 and 2 (MARCH 1-12. 2021) Grade 2Document10 pagesQ3 WEEK 1 and 2 (MARCH 1-12. 2021) Grade 2Michelle EsplanaNo ratings yet

- June 2013 (v1) QP - Paper 1 CIE Maths IGCSE PDFDocument8 pagesJune 2013 (v1) QP - Paper 1 CIE Maths IGCSE PDFDhiyana ANo ratings yet

- DLP HGP Quarter 2 Week 1 2Document3 pagesDLP HGP Quarter 2 Week 1 2Arman Fariñas100% (1)

- Jinyu Wei Lesson Plan 2Document13 pagesJinyu Wei Lesson Plan 2api-713491982No ratings yet

- Intellectual WellnessDocument9 pagesIntellectual WellnessHania DollNo ratings yet

- Advertising 9 Managing Creativity in Advertising and IBPDocument13 pagesAdvertising 9 Managing Creativity in Advertising and IBPOphelia Sapphire DagdagNo ratings yet

- Main Idea and Supporting DetailsDocument4 pagesMain Idea and Supporting DetailsZoe ZuoNo ratings yet

- MODULE 2 e LearningDocument70 pagesMODULE 2 e Learningseena15No ratings yet

- Daily Lesson Plan: Learning Objectives: by The End of The Lesson Learners Will Be Able ToDocument3 pagesDaily Lesson Plan: Learning Objectives: by The End of The Lesson Learners Will Be Able ToDaima HussainNo ratings yet

- Ar Altaf Shaikh VitaeDocument3 pagesAr Altaf Shaikh VitaearchioNo ratings yet

- National Standards For Foreign Language EducationDocument2 pagesNational Standards For Foreign Language EducationJimmy MedinaNo ratings yet

- Aiming For Integrity Answer GuideDocument4 pagesAiming For Integrity Answer GuidenagasmsNo ratings yet

- The University: AccreditationDocument9 pagesThe University: Accreditationbob cellNo ratings yet

- Media Information Literacy: Final ExaminationDocument3 pagesMedia Information Literacy: Final ExaminationRodessa Marie Canillas LptNo ratings yet

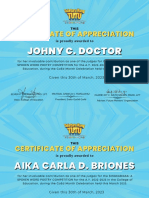

- Certificate of AppreciationDocument114 pagesCertificate of AppreciationSyrus Dwyane RamosNo ratings yet

- Parenting Style Assessment PDFDocument4 pagesParenting Style Assessment PDFAbyssman ManNo ratings yet

- Unit 1: The Nature of The Learner: Embodied SpiritDocument3 pagesUnit 1: The Nature of The Learner: Embodied SpiritMeet Me100% (1)

- Davison 2012Document14 pagesDavison 2012Angie Marcela Marulanda MenesesNo ratings yet

- MentoringDocument20 pagesMentoringShruthi Raghavendra100% (1)

- End-of-Course Reflection Paper/Questionnaire: Guide Questions Response/sDocument3 pagesEnd-of-Course Reflection Paper/Questionnaire: Guide Questions Response/sNitaflor Ganio100% (1)

- Editorial Board 2023 International Journal of PharmaceuticsDocument1 pageEditorial Board 2023 International Journal of PharmaceuticsAndrade GuiNo ratings yet

- JLS JLPT N1-N5Document2 pagesJLS JLPT N1-N5Shienthahayoyohayoha100% (1)

- Kindergarten HandbookDocument281 pagesKindergarten Handbookrharaksi100% (10)

- 2006-2007 CUNY Law Admin GoalsDocument7 pages2006-2007 CUNY Law Admin GoalscunylawblogNo ratings yet

- Story15 HouseDocument29 pagesStory15 HousePAKK(SK,SJKT)-0619 Irene Wong Yen LingNo ratings yet

- Modular/Block Teaching: Practices and Challenges at Higher Education Institutions of EthiopiaDocument16 pagesModular/Block Teaching: Practices and Challenges at Higher Education Institutions of EthiopiaMichelle RubioNo ratings yet

- Recent Trends in CompensationDocument2 pagesRecent Trends in Compensationhasanshs12100% (1)