Professional Documents

Culture Documents

Variable Costing vs. Absorption Costing

Uploaded by

GêmTürÏngånÖOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Variable Costing vs. Absorption Costing

Uploaded by

GêmTürÏngånÖCopyright:

Available Formats

Variable Costing vs.

Absorption Costing

Lets take a look at the overview of these costing approaches:

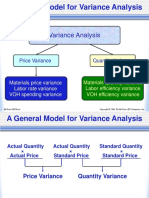

Garrison and Noreen, (2013)

The above power point presentation slide illustrates a manufacturing business cost

structure. Take note of the Fixed Manufacturing Overhead, there lies the difference

between the two methods.

From the Income Statement that you have learned in your previous major

subjects like Fundamentals of Accounting, Financial Accounting, and Cost

Accounting, the operating performance of an entity for a period ended on a certain

date can be a net profit or a net loss. Then, looking at the Cost of Goods Sold

section, there is this Finished Goods Inventory, End or Merchandise

Inventory, where End is deducted from the items available for sale. Thus, the

ending finished goods inventory contributes to an increase in net profit. Can you

still remember that these accounts are used under the periodic inventory costing

method? They remain unsold for a certain period that ended; therefore, they are

not classified costs of goods sold.

In this module, the cost classification will be product or period costs, and

variable or fixed costs. For a manufacturer, the valuation of inventories (or product

costs) and the cost of goods sold (or period costs), in total or on a per unit basis are

very important. Full absorption costing and variable costing are other cost

classifications that we will learn this time. For your information, the Income

Statement that you prepared in your previous accounting subjects (Fundamental

Accounting, Financial Accounting and Cost Accounting) is that of a full absorption

costing approach. Moreover, they are prepared to cater to the needs of external

information users. From the income statement of a manufacturer, you identified

that the inventories are product costs while the cost of goods sold is a period cost.

Supplementary to the income statement is the Cost of Goods Manufactured, which

Variable Costing vs. Absorption Costing

presents the total product or manufacturing costs: the direct materials, direct labor

and manufacturing overhead. Fixed and variable costs do not appear in the

statement, but take note that this manufacturing cost is composed of variable and

fixed costs.

Another costing approach used in the income statement report is variable

costing. This costing method specifically caters to the needs of managers, a basic

tool in their decision making agenda.

How do we differentiate absorption costing from variable costing? To distinguish

one from the other, presented below is a summary of variable costing against

absorption costing:

EXHIBIT 7-1 Variable Costing versus Absorption Costing (Garrison and

Noreen, 2010)

Variable Costing vs. Absorption Costing

Another issue to be considered in absorption and variable costing methods is the

income effect of the size of inventory at the end of a particular reporting period. The

matrix that follows shows (Exhibit 7-1) the Comparative Income Effects Absorption

and Variable Costing (Garrison and Noreen 13th Ed. 2010 page 286.

RELATION

BETWEEN

PRODUCTIO

EFFEC

T ON

INVEN

RELATION BETWEEN

ABSORPTION AND

VARIABLE COSTING NET

Variable Costing vs. Absorption Costing

N AND

SALES FOR

THE

PERIOD

Units

produced

Units

Produced

Units

Produced

TORIE

S

OPERATING INCOME

No

change

=in

invent

ories

Absorption

Costing

Net

operating

income

Invent

>ory

Increas

e

Absorptio

n Costing

Net

operating

Income

<

Invent

ories

Decrea

se

Absorptio

n

Costing

Net

Operating

Income

>

<

Variable

costing

Net operating

income

Variable

Costing

Net

Operating

Income*

Variable

Costing

Net Operating

Income**

*Net operating income is higher under absorption

costing because fixed manufacturing overhead cost

is deferred in inventory under absorption costing

as inventories increase.

** Net operating income is lower under absorption

costing because fixed manufacturing overhead

is released from inventory under absorption

costing as inventories decrease.

As mentioned earlier in the first part of this module, the two costing methods are

applied in the income statement report. Presented hereunder are two income

statements illustrating the absorption and variable costing methods. From the two

income statements, take note of the difference in net operating income brought by

the fixed manufacturing component of the ending inventory under the absorption

costing method.

Variable Costing vs. Absorption Costing

Absorption Costing Method:

Sales (15,000 units x Php20 per

unit.

Php 300,000

Less: Cost of Goods Sold

Beginning Inventory

Add: Cost of goods manufactured

(16,000 units x Php12 per unit)

Php

-0192,000

Goods available for sale.

Php 192,000

Less: Ending Inventory

(1,000 units x Php12* per unit)

12,000**

Cost of Goods Sold..

180,000

Gross Margin.

Php 120,000

Less: Selling and Administrative

Expenses

Variable: 15,000 units x Php3 =

Php45,000

( Php45,000 + Php30,000 fixed )

75,000

NET OPERATING INCOME

Php 45,000

=======

===

Variable Costing Method:

Sales (15,000 units x Php20 per unit)

.

Php300,000

Less: Variable Expenses

Variable Cost of Goods Sold:

Beginning Inventory.

Add: Variable Manufacturing Costs

(16,000 units x Php7 per Unit)

..

Php

112,000

-0-

Variable Costing vs. Absorption Costing

Goods available for sale..

Less: Ending Inventory

(1,000 units x Php7 per unit)

Variable Cost of Goods Sold.

Variable Selling and Administrative

Expenses

(15,000 units x Php3)

Php

112,000

7,000***

Php

105,000

45,000

Contribution Margin.

150,000

Php150,000

Less: Fixed Expenses

Fixed Manufacturing Overhead..

Php 90,000

Fixed Selling and Administrative Expenses

30,000

Php110,000

NET OPERATING INCOME

Php40,000

=======

===

The assumed ending inventories of Php12.00 per unit have a fixed

manufacturing overhead cost components of Php5.00 per unit.

**

Under the Absorption Costing approach the Php12 per unit includes the

fixed manufacturing cost component of ending inventories.

**

*

In the next income statement (variable costing approach), the ending

inventories deducted from the goods available for sale are purely variable

costs.

The fixed component of manufacturing overhead is included in the

Php90,000 Fixed Manufacturing Overhead. Thus, this explains the

difference in net operating income between the two approaches (which is

1,000 units x Php5.00 = Php5,000). Specifically, it is the fixed

manufacturing cost component of the ending inventories.

To help you understand the impact of variable costing and absorption costing in the

decision-making process of management likewise, to appreciate the role of

Management Accounting, read the following topics pages 288 - 291 of our textbook.

Variable Costing vs. Absorption Costing

You might also like

- Absorption & Variable CostingDocument40 pagesAbsorption & Variable CostingKaren Villafuerte100% (1)

- CVP AnalysisDocument51 pagesCVP AnalysisMonaliza MalapitNo ratings yet

- Standard Costing and Variance AnalysisDocument11 pagesStandard Costing and Variance AnalysisMd AzimNo ratings yet

- Variable Costing and Absorption CostingDocument15 pagesVariable Costing and Absorption CostingRomilCledoro100% (1)

- Cost Concepts, Cost Analysis, and Cost EstimationDocument2 pagesCost Concepts, Cost Analysis, and Cost EstimationGêmTürÏngånÖNo ratings yet

- Variable Costing and Absorption CostingDocument6 pagesVariable Costing and Absorption CostingSid Chaudhary100% (1)

- MAS.106 Variable Costing and Absorption CostingDocument3 pagesMAS.106 Variable Costing and Absorption CostingJerrizza RamirezNo ratings yet

- Job Order Costing Lecture NotesDocument6 pagesJob Order Costing Lecture NotesRenz LorenzNo ratings yet

- Module 9 SHAREHOLDERS' EQUITYDocument3 pagesModule 9 SHAREHOLDERS' EQUITYNiño Mendoza MabatoNo ratings yet

- Chapter # 06 - Cost of CapitalDocument36 pagesChapter # 06 - Cost of CapitalshakilhmNo ratings yet

- Standard Costs and Variance AnalysisDocument13 pagesStandard Costs and Variance AnalysisJanicaNoiraC.ZunigaNo ratings yet

- Ex2 Accounting For MaterialsDocument6 pagesEx2 Accounting For MaterialsCHACHACHA100% (1)

- Joint Cost and by Products PDFDocument20 pagesJoint Cost and by Products PDFJhoana HernandezNo ratings yet

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavNo ratings yet

- Job Costing and Process CostingDocument3 pagesJob Costing and Process CostingUmair Siyab100% (1)

- Ch16 (1) Managerial Accounting Concepts and PrinciplesDocument22 pagesCh16 (1) Managerial Accounting Concepts and PrinciplesCristian D. Baldoz100% (1)

- Segment ReportingDocument20 pagesSegment ReportingNick254No ratings yet

- Absorption and Variable CostingDocument2 pagesAbsorption and Variable CostingJenni Lorico67% (3)

- Cost Concept and Classification of CostDocument31 pagesCost Concept and Classification of CostRujean Salar AltejarNo ratings yet

- Variable & Absorption CostingDocument23 pagesVariable & Absorption CostingRobin DasNo ratings yet

- Cost Accumulation Comp PDFDocument29 pagesCost Accumulation Comp PDFGregorian JerahmeelNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- Chapter 1 Introduction To Cost AccountingDocument42 pagesChapter 1 Introduction To Cost AccountingPotato FriesNo ratings yet

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- Responsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesDocument3 pagesResponsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesAriel DicoreñaNo ratings yet

- Chap16-Standard Costing FOHDocument93 pagesChap16-Standard Costing FOHGeo Rublico ManilaNo ratings yet

- Handout 4 Strategy and Master BudgetDocument4 pagesHandout 4 Strategy and Master BudgetRemar22No ratings yet

- Responsibility Accounting & Transfer Pricing TextDocument13 pagesResponsibility Accounting & Transfer Pricing Textsaumyagargi19087850% (2)

- Responsibility AccountingDocument2 pagesResponsibility AccountingEugene Navarro100% (1)

- 04 x04 Cost-Volume-Profit RelationshipsDocument11 pages04 x04 Cost-Volume-Profit RelationshipscassandraNo ratings yet

- Relevant Costing - HandoutDocument10 pagesRelevant Costing - HandoutUsra Jamil SiddiquiNo ratings yet

- Factory Overhead Variances: Flexible Budget ApproachDocument4 pagesFactory Overhead Variances: Flexible Budget ApproachMeghan Kaye LiwenNo ratings yet

- CVP Analysis & Decision MakingDocument67 pagesCVP Analysis & Decision MakingcmukherjeeNo ratings yet

- AFAR Test BankDocument57 pagesAFAR Test BankandengNo ratings yet

- 04 Relevant CostingDocument5 pages04 Relevant CostingMarielle CastañedaNo ratings yet

- High Low MethodDocument4 pagesHigh Low MethodSamreen LodhiNo ratings yet

- Naqdown FinalsDocument6 pagesNaqdown FinalsMJ YaconNo ratings yet

- Relevant Costing TestbankDocument9 pagesRelevant Costing TestbankPrecious Vercaza Del RosarioNo ratings yet

- Process CostingDocument48 pagesProcess CostingIrfanNo ratings yet

- Ch13 Responsibility Accounting and Transfer PricingDocument39 pagesCh13 Responsibility Accounting and Transfer PricingChin-Chin Alvarez SabinianoNo ratings yet

- I Introduction To Cost AccountingDocument8 pagesI Introduction To Cost AccountingJoshuaGuerreroNo ratings yet

- Case 1. Landers CompanyDocument3 pagesCase 1. Landers CompanyMavel DesamparadoNo ratings yet

- Test Bank Cost Accounting 14e by Carter Ch01Document8 pagesTest Bank Cost Accounting 14e by Carter Ch01Beatrice TehNo ratings yet

- Variable Costing and Absorption CostingDocument2 pagesVariable Costing and Absorption CostingPauline Bogador Mayordomo0% (1)

- Manufacturing AccountDocument36 pagesManufacturing AccountSaksham RainaNo ratings yet

- MA2 04 Relevant Costing Problem 20Document4 pagesMA2 04 Relevant Costing Problem 20Joy Deocaris100% (1)

- Cost Accounting ReviewerDocument2 pagesCost Accounting ReviewerHenry Cadano HernandezNo ratings yet

- Cost Concepts and ClassificationsDocument15 pagesCost Concepts and ClassificationsMae Ann KongNo ratings yet

- Standard Costing and Variance Analysis !!!Document82 pagesStandard Costing and Variance Analysis !!!Kaya Duman100% (1)

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- Mas Test Bank QuestionDocument20 pagesMas Test Bank QuestionAsnor RandyNo ratings yet

- CVP Analysis Lecture Notes PDFDocument32 pagesCVP Analysis Lecture Notes PDFReverie Sevilla100% (1)

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Cost Segregation and Estimation (Final)Document3 pagesCost Segregation and Estimation (Final)Mica R.No ratings yet

- Responsibility AccountingDocument14 pagesResponsibility AccountingJignesh TogadiyaNo ratings yet

- Joint and by - Product CostingDocument22 pagesJoint and by - Product CostingTamanna ThomasNo ratings yet

- Chapter10.Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument41 pagesChapter10.Standard Costing, Operational Performance Measures, and The Balanced Scorecardjbsantos09100% (1)

- Chapter EightDocument38 pagesChapter EightLauren Campbell100% (4)

- Variable Costing: A Tool For ManagementDocument9 pagesVariable Costing: A Tool For ManagementNica JeonNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- POM 3.2 Marketing Management IIDocument37 pagesPOM 3.2 Marketing Management IIDhiraj SharmaNo ratings yet

- LISTA Nascar 2014Document42 pagesLISTA Nascar 2014osmarxsNo ratings yet

- The Website Design Partnership FranchiseDocument5 pagesThe Website Design Partnership FranchiseCheryl MountainclearNo ratings yet

- Sika Saudi Arabia: Safety Data SheetDocument4 pagesSika Saudi Arabia: Safety Data Sheetusman khalid100% (1)

- MDC PT ChartDocument2 pagesMDC PT ChartKailas NimbalkarNo ratings yet

- CORDLESS PLUNGE SAW PTS 20-Li A1 PDFDocument68 pagesCORDLESS PLUNGE SAW PTS 20-Li A1 PDFΑλεξης ΝεοφυτουNo ratings yet

- Technical Engineering PEEDocument3 pagesTechnical Engineering PEEMariano Acosta Landicho Jr.No ratings yet

- COVID Immunization Record Correction RequestDocument2 pagesCOVID Immunization Record Correction RequestNBC 10 WJARNo ratings yet

- LR Format 1.2Document1 pageLR Format 1.2Ch.Suresh SuryaNo ratings yet

- Ambient Lighting Vol 6 CompressedDocument156 pagesAmbient Lighting Vol 6 Compressedadvait_etcNo ratings yet

- Business Plan GROUP 10Document35 pagesBusiness Plan GROUP 10Sofia GarciaNo ratings yet

- Divider Block Accessory LTR HowdenDocument4 pagesDivider Block Accessory LTR HowdenjasonNo ratings yet

- Government of India Act 1858Document3 pagesGovernment of India Act 1858AlexitoNo ratings yet

- 1.6 Program AdministrationDocument56 pages1.6 Program Administration'JeoffreyLaycoNo ratings yet

- People V Superior Court (Baez)Document19 pagesPeople V Superior Court (Baez)Kate ChatfieldNo ratings yet

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianDocument3 pagesMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaNo ratings yet

- Verma Toys Leona Bebe PDFDocument28 pagesVerma Toys Leona Bebe PDFSILVIA ROMERO100% (3)

- Cencon Atm Security Lock Installation InstructionsDocument24 pagesCencon Atm Security Lock Installation InstructionsbiggusxNo ratings yet

- Lps - Config Doc of Fm-BcsDocument37 pagesLps - Config Doc of Fm-Bcsraj01072007No ratings yet

- Omae2008 57495Document6 pagesOmae2008 57495Vinicius Cantarino CurcinoNo ratings yet

- 0901b8038042b661 PDFDocument8 pages0901b8038042b661 PDFWaqasAhmedNo ratings yet

- SOP No. 6Document22 pagesSOP No. 6Eli CohenNo ratings yet

- Finaniial AsceptsDocument280 pagesFinaniial AsceptsKshipra PrakashNo ratings yet

- ADS Chapter 303 Grants and Cooperative Agreements Non USDocument81 pagesADS Chapter 303 Grants and Cooperative Agreements Non USMartin JcNo ratings yet

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsDocument3 pagesQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarNo ratings yet

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document28 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Monique Dianne Dela VegaNo ratings yet

- Central Banking and Monetary PolicyDocument13 pagesCentral Banking and Monetary PolicyLuisaNo ratings yet

- 16 Easy Steps To Start PCB Circuit DesignDocument10 pages16 Easy Steps To Start PCB Circuit DesignjackNo ratings yet

- Ahakuelo IndictmentDocument24 pagesAhakuelo IndictmentHNNNo ratings yet