Professional Documents

Culture Documents

Real Estate Project Final PDF

Uploaded by

Sheel NagdaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Estate Project Final PDF

Uploaded by

Sheel NagdaCopyright:

Available Formats

1

Investment Avenue: Real estate.

Executive Summary

This project aims to:

Provide layman explanations of Real Estate, types of investments and their

characteristics

Provide an in-depth independent and unbiased overview of the real estate scenario

based on inputs from Primary sources like developers, banks and financial institutions,

brokers and secondary sources like information and research available on the internet.

Provide vital information as to whether this boom in the real estate market is sustainable

or is it a bubble waiting to burst.

Provide validated consistent information across parameters that influence real estate

activity like Infrastructure developments in the city Residential area. Demand, supply.

Commercial Supply, prices, drivers and key characteristics Retail supply (malls)

proposed

A schematic locational dispersion on the map The research encompasses extensive

(personal & phone) interviews of Local developers Real estate agents Emails were sent

and phone calls were made to prominent Real Estate agents in Chennai, Kolkata,

Mumbai and New Delhi.

Case Study to understand real estate market better.

K.C COLLEGE

Investment Avenue: Real estate.

Introduction

INDIAS REAL ESTATE SECTOR

The real estate sector in India has come a long way by becoming one of the fastest

growing markets in the world. It is not only successfully attracting domestic real estate

developers, but foreign investors as well. The growth of the industry is attributed mainly to

a large population base, rising income level, and rapid urbanisation. The sector comprises

of four sub-sectors- housing, retail, hospitality, and commercial. While housing contributes

to five-six percent of the countrys gross domestic product (GDP), the remaining three subsectors are also growing at a rapid pace, meeting the increasing infrastructural needs. The

real estate sector has transformed from being unorganised to a dynamic and organised

sector over the past decade. Government policies have been instrumental in providing

support after recognising the need for infrastructure development in order to ensure better

standard of living for its citizens. In addition to this, adequate infrastructure forms a

prerequisite for sustaining the long-term growth momentum of the economy.

The Indian real estate sector is one of the most globally recognised sectors. In the country,

it is the second largest employer after agriculture and is slated to grow at 30 per cent over

the next decade. It comprises four sub sectors - housing, retail, hospitality, and

commercial. The growth of this sector is well complemented by the growth of the corporate

environment and the demand for office space as well as urban and semi-urban

accommodations. The construction industry ranks third among the 14 major sectors in

terms of direct, indirect and induced effects in all sectors of the economy. It is also

expected that this sector will incur more non-resident Indian investments in the near future,

as a survey by an industry body has revealed a 35 per cent surge in the number of

enquiries with property dealers. Bengaluru is expected to be the most favoured property

investment destination for NRIs, followed by Ahmedabad, Pune, Chennai, Goa, Delhi and

Dehradun. Private equity (PE) funding has picked up in the last one year due to attractive

valuations. Furthermore, with the Government of India introducing newer policies helpful to

real estate, this sector has garnered sufficient growth in recent times.

K.C COLLEGE

Investment Avenue: Real estate.

Types of Real Estate Investments

Income-Producing and Non-Income-Producing Investments

There are four broad types of income-producing real estate: offices, retail, industrial and

leased residential. There are many other less common types as well, such as hotels, ministorage, parking lots and seniors care housing.The key criteria in these investments that

we are focusing on is that they are income producing. Non-income-producing investments,

such as houses, vacation properties or vacant commercial buildings, are as sound as

income-producing investments. Just keep in mind that if you invest equity in a non-income

producing property you will not receive any rent, so all of your return must

be through capital appreciation If you invest in debt secured by non-income- producing

real estate, remember that the borrower's personal income must be sufficient to cover the

mortgage payments, because there is no tenant income to secure the payments.

Office Property

Offices are the "flagship" investment for many real estate owners. They tend to be, on

average, the largest and highest profile property type because of their typical location in

downtown cores and sprawling suburban office parks. At its most fundamental level, the

demand for office space is tied to companies' requirement for office workers, and the

average space per office worker. The typical office worker is involved in things like finance,

accounting, insurance, real estate, services, management and administration. As these

"white-collar" jobs grow, there is greater demand for office spaces. Returns from office

properties can be highly variable because the market tends to be sensitive to economic

performance. One downside is that office

buildings have high operating costs, so if you lose a tenant it can have a

substantial impact on the returns for the property. However, in times of

prosperity, offices tend to perform extremely well, because demand for

space causes rental rates to increase and an extended time period is

required to build an office tower to relieve the pressure on the market and rents.

Retail Property

There is a wide variety of Retail properties, ranging from large enclosed

shopping malls to single tenant buildings in pedestrian zones. At the present time, the

Power Centre format is in favour, with retailers occupying larger premises than in the

enclosed mall format, and having greater visibility and access from adjacent roadways.

Many retail properties have an anchor which is a large, well-known retailer that acts as a

draw to the centre. An example of a well-known anchor is Wal-Mart. If a retail property has

a food store as an anchor, it is said to be

food-anchored or grocery-anchored ; such anchors would typically enhance the

fundamentals of a property and make it more desirable for investment. Often, a retail

centre has one or more ancillary multi-bay buildings containing smaller tenants. One of

these small units is termed a commercial retail unit (CRU) The demand for retail space has

many drivers. Among them are: location, visibility, population density, population growth

and relative income levels.From an economic perspective, retails tend to perform best in

growing economies and when retail sales growth is high. Returns from Retails tend to be

more stable than Offices, in part because retail leases are generally longer and retailers

are less inclined to relocate as compared to office tenants.

K.C COLLEGE

Investment Avenue: Real estate.

Industrial Property

Industrials are often considered the "staple" of the average real estate

investor. Generally, they require smaller average investments, are less

management intensive and have lower operating costs than their office and retail

counterparts. There are varying types of industrials depending on the use of the building.

For example, buildings could be used for warehousing, manufacturing, research and

development, or distribution. Some industrials can even have partial or full office buildouts. Some important factors to consider in an industrial property would be

functionality (for example, ceiling height), location relative to major transport routes

(including rail or sea), building configuration, loading and the degree of specialization in

the space (such as whether it has cranes or freezers). For some uses, the presence of

outdoor or covered yard space is important.

Multi-family Residential Property

Multi-family residential property generally delivers the most stable returns, because no

matter what the economic cycle, people always need a place to live. The result is that in

normal markets, residential occupancy tends to stay reasonably high. Another factor

contributing to the stability of residential property is that the loss of a single tenant has a

minimal impact on the

bottom line whereas if you lose a tenant in any other type of property the negative effects

can be much more significant. For most commercial property types, tenant leases are

either net or partially net, meaning that most operating expenses can be passed along to

tenants.

However, residential properties typically do not have this attribute, meaning that the risk of

increases in building operating costs is borne by the property owner for the duration of the

lease. A positive aspect of residential properties is that in some countries,

government-insured financing is available. At the expense of a small

premium, insured financing lowers the interest rate on mortgages, thereby enhancing

potential returns from the investment.

K.C COLLEGE

Investment Avenue: Real estate.

Characteristics of real estate assets

No fixed maturity

Unlike a bond which has a fixed maturity date, an equity real estate

investment does not normally mature. In Europe, it is not uncommon

for investors to hold property for over 100 years. This attribute of real

estate allows an owner to buy a property, execute a business plan,

then dispose of the property whenever appropriate. An exception to

this characteristic is an investment in fixed-term debt; by definition a

mortgage would have a fixed maturity.

Tangible

Real estate is, well, real! You can visit your investment, speak with

your tenants, and show it off to your family and friends. You can see it

and touch it. A result of this attribute is that you have a certain degree

of physical control over the investment - if something is wrong with it,

you can try fixing it. You can't do that with a stock or bond.

Requires Management

Because real estate is tangible, it needs to be managed in a hands-on

manner. Tenant complaints must be addressed. Landscaping must be

handled. And, when the building starts to age, it needs to be

renovated.

Inefficient Markets

An inefficient market is not necessarily a bad thing. It just means that

information asymmetry exists among participants in the market,

allowing greater profits to be made by those with special information,

expertise or resources. In contrast, public stock markets are much

more efficient - information is efficiently disseminated among market

participants, and those with material non-public information are not

permitted to trade upon the information. In the real estate markets,

information is king, and can allow an investor to see profit

opportunities that might otherwise not have presented themselves.

High Transaction Costs

Private market real estate has high purchase costs and sale costs. On

purchases, there are real-estate-agent-related commissions, lawyers'

fees, engineers' fees and many other costs that can raise the effective

purchase price well beyond the price the seller will actually receive. On

sales, a substantial brokerage fee is usually required for the property

to be properly exposed to the market.

K.C COLLEGE

Investment Avenue: Real estate.

Lower Liquidity

With the exception of real estate securities, no public exchange exists

for the trading of real estate. This makes real estate more difficult to

sell because deals must be privately brokered. There can be a

substantial lag between the time you decide to sell a property and

when it actually is sold - usually a couple months at least.

Underlying Tenant Quality

When assessing an income-producing property, an important

consideration is the quality of the underlying tenancy. This is important

because when you purchase the property, you're buying two things:

the physical real estate, and the income stream from the tenants. If

the tenants are likely to default on their monthly obligation, the risk of the investment is

greater.

Variability among Regions

While it sounds clich, location is one of the important aspects of real

estate investments; a piece of real estate can perform very differently

among countries, regions, cities and even within the same city. These

regional differences need to be considered when making an

investment, because your selection of which market to invest in has as

large an impact on your eventual returns as your choice of property

within the market.

K.C COLLEGE

Investment Avenue: Real estate.

Advantages & Disadvantages of Real Estate

Benefits

Some of the benefits of having real estate in your portfolio are as follows

Cash flow

Cash flow is the difference between your income and your

expenses on a piece of property. You can have a positive or

negative cash flow. Obviously, you'll feel a lot better if the

cash flow is positive. My advice on cash flow is this: Never use

all of your positive cash flow for rapid debt reduction.You will be walking a thin line. By

keeping a strong positive cash flow,

you will have more options and space to manoeuvre.

Appreciation

Appreciation is the increase in value of a property. There are

two kinds of appreciation. The first is from economic

conditions beyond your control, such as inflation. But you

won't gain much from this type of appreciation since the gain

is offset by the higher cost of living.

The second kind is market appreciation, which you can control.

When you improve a property (through renovations); you force

its value higher. You can purchase a piece of property in need

of repairs and bring it back up to neighbourhood standards or

slightly higher; this will give you a property that is much

higher in value.

Leverage

Leverage is the ability to borrow a percentage of the value of a

piece of property. Real estate, in comparison to other

investments, offers a very high degree of leverage. In some

cases, a couple buying a single-family home can obtain 95%

financing. This allows individuals to purchase real estate with

little, if any, of their own money. What other investments offer

such a high degree of leverage?

Yield Enhancement

As part of a portfolio, real estate allows you to achieve higher returns

for a given level of portfolio risk. Similarly, by adding real estate to a

portfolio you could maintain your portfolio returns while decreasing

risk.

K.C COLLEGE

Investment Avenue: Real estate.

Amortization

With leverage, or the use of other people's money, comes a

repayment schedule. Your outstanding balance is reduced with

every payment you make. Part of each payment goes to

interest (applied first) and the rest goes to pay off the

principal. The principal reduction is called amortization -reducing debt. Hence, amortization can make you wealthy,

slowly and steadily.

Tax advantages

Owning real estate with the goal of making a profit allows you

to deduct interest payments and other expenses come tax

time. But don't be fooled into buying real estate for the tax

advantages; rather, purchase it because it makes economic

sense to do so.

Diversification

Value the positive aspects of diversifying your portfolio in terms of asset allocation are well

documented. Real estate returns have relatively low

correlations with other asset classes (traditional investment vehicles

such as stocks and bonds), which adds to the diversification of your

portfolio.)

Inflation Hedge

Real estate returns are directly linked to the rents that are received

from tenants. Some leases contain provisions for rent increases to be

indexed to inflation. In other cases, rental rates are increased

whenever a lease term expires and the tenant is renewed. Either way,

real estate income tends to increase faster in inflationary

environments, allowing an investor to maintain its real returns.

K.C COLLEGE

Investment Avenue: Real estate.

Shortcomings

Real estate also has some characteristics that require special consideration when making

an investment decision:

Costly to Buy, Sell and Operate

For transactions in the private real estate market, transaction costs

are significant when compared to other investment classes. It is

usually more efficient to purchase larger real estate assets because

you can spread the transaction costs over a larger asset base. Real

estate is also costly to operate because it is tangible and requires

ongoing maintenance.

Requires Management

With some exceptions, real estate requires ongoing management at

two levels. First, you require property management to deal with the

day-to-day operation of the property. Second, you need strategic

management of the property to consider the longer term market

position of the investment. Sometimes the management functions

are combined and handled by one group. Management comes at a

cost; even if it is handled by the owner, it will require time and

resources.

Difficult to Acquire

It can be a challenge to build a meaningful, diversified real estate

portfolio. Purchases need to be made in a variety of geographical

locations and across asset classes, which can be out of reach for

many investors. You can, however, purchase units in a private pool or a public security,

and these units are typically backed by a

diverse portfolio.

Cyclical (Leasing Market)

Not unlike other asset classes, real estate is cyclical. Real estate

has two cycles: the leasing market cycle and the investment market

cycle. The leasing market consists of the market for space in real

estate properties. As with most markets, conditions of the leasing

market are dictated by the supply side, which is the amount of

space available (or, vacancies), and the demand side, which is the

amount of space required by tenants. If demand for space

increases, then vacancies will decrease, and the resulting scarcity

of space will cause an increase in market rents. Once rents reach

economic levels, it becomes profitable for developers to construct

additional space so that supply can meet demand.

K.C COLLEGE

10

Investment Avenue: Real estate.

Cyclical (Investment Market)

The real estate investment market moves in a different cycle than

the leasing market. On the demand side of the investment market

are investors who have capital to invest in real estate. The supply

side consists of properties that are brought to market by their

owners. If the supply of capital seeking real estate investments is

plentiful, then property prices increase. As prices increase,

additional properties are brought to market to meet demand.

Although the leasing and investment market have independent

cycles, one does tend to influence the other. For instance, if the

leasing market is in decline, then growth in rents should decrease.

Faced with decreasing rental growth, real estate investors might

view real estate prices as being too high and might therefore stop

making additional purchases. If capital seeking real estate

decreases, then prices decrease to force equilibrium.

Performance Measurement

In the private market there is no high quality benchmark to which

you can compare your portfolio results. Similarly, it is difficult to

measure risk relative to the market. Risk and return are easy to

determine in the stock market but measuring real estate

performance is much more challenging

K.C COLLEGE

11

Investment Avenue: Real estate.

Introduction on real estate sector in India and unprecedented expansion

With property boom spreading in all directions, real estate in India is

touching new heights. Growing at a scorching 30 per cent, it has emerged as one of the

most appealing investment areas for domestic as well as foreign investors. However, the

growth also depends on the policies adopted by the government to facilitate investments

mainly in the economic and industrial sector. The new stand adopted by Indian

government regarding foreign direct investment (FDI) policies has encouraged an

increasing number of countries to invest in Indian Properties. India has displaced US as

the second-most favoured destination for FDI in the world. As the investment scenario in

India changes, India which has attracted more than three times foreign investment at US$

7.96 billion during the first half of 2005-06 fiscal, as against US$ 2.38 billion during the

corresponding period of 2004-05, making India amongst the "dominant host countries" for

FDI in Asia and the Pacific.The positive outlook of Indian government is the key factor

behind the sudden rise of the Indian Real Estate sector. The second largest employing

sector in India (including construction and facilities management), real estate is linked to

about 250 ancillary industries like cement, brick and steel through backward and forward

linkages. Consequently, a unit increase in expenditure in this sector has a multiplier effect

and the capacity to generate income as high as five times. This budding sector is today

witnessing development in all area such as residential, retail and commercial in metros of

India such as Mumbai, Delhi & NCR, Kolkata and Chennai.

Unprecedented Expansion

Rising income levels of a growing middle class along with increase in nuclear families, low

interest rates, modern attitudes to home ownership (the average age of a new homeowner

in 2006 was 32 years compared with 45 years a decade ago) and a change of attitude

amongst the young working population from that of 'save and buy' to 'buy and repay' have

all combined to boost housing demand. According to 'Housing Skyline of India 2007-08', a

study by research firm, Indicus Analytics, there will be demand for over 24.3 million new

dwellings for self-living in urban India alone by 2015. Consequently, this segment is likely

to throw huge investment opportunities. In fact, an estimated US$ billion investment will

be required over the next five years in urban housing, says a report by Merrill Lynch.

Simultaneously, the rapid growth of the Indian economy has had a cascading effect on

demand for commercial property to help meet the needs of business, such as modern

offices, warehouses, hotels and retail shopping centres. Growth in commercial office space

requirement is led by the burgeoning outsourcing and information technology (IT) industry

and organized retail. For example, IT and ITES alone are estimated to require 150 million

Sq.ft. across urban India by 2010. Similarly, the organized retail industry is likely to require

an additional 220 million Sq.ft by 2010. With the economy surging ahead, the demand for

all segments of the real estate sector is likely to continue to grow. The Indian real estate

industry is likely to grow from US$ 12 billion in 2005 to US$ 90 billion in by 2015. Given the

boom in residential housing, IT, ITeS, organized retail and hospitality industries, this

industry is likely to see increased investment activity.

K.C COLLEGE

Investment Avenue: Real estate.

12

Key trends in indian real estate sector

With growing economy and changing buyer expectations, real estate developers are

constantly being innovative with their business plans. Buyers in different cities have

reacted to the changes differently and the developers have had to adapt accordingly.

Pricing trends

According to the National Housing Bank (NHB), in the quarter ending June 2014, property

prices of residential units in Pune and Coimbatore registered growth of 3.9% and 3.5%,

respectively, over the previous quarter, representing the highest increase among all the 26

cities covered under the NHB Residex. At 0.5%, Bhubaneshwar registered the lowest

growth in property prices.

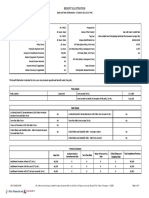

A comparative of the three main markets is as under:

% change - Major metropolitan cities

MUMBAI

BENGLURU

1.7%

DELHI

0.9%

-3.0%

Major increase in these 8 cities show positive growth quarter on quarter are as follows:

% INCREASE.

4

3

2

1

0

pune

mumbai ahemdabad patna

chennai

kochi

jaipur

bengluru

Major real estate destinations of the country and some other emerging towns can be

classified into three broad categories depending upon the stage of real estate

development that each one of them is undergoing.

K.C COLLEGE

13

Investment Avenue: Real estate.

Tier I Cities : Bangalore, Mumbai and NCR Characteristics: Fairly well

established real estate market. Demand drivers quite pronounced.

Tier II Cities : Hyderabad, Chennai, Pune and Kolkata Characteristics:

Growing real estate markets. Experiencing heightened demand and

investments.

Tier III Cities : Chandigarh, Ludhiana, Lucknow, Guwahati, Bhubaneswar,

Jaipur, Ahmedabad, Surat, Nagpur, Indore, Goa, Visakapatinam, Mysore,

Coimbatore, Kochi, Vijayawada, Mangalore, Trivandrum and Baroda

Characteristics: Real estate markets yet to establish. Perceived to have

substantial potential demand.

As the Indian real estate sector moves higher on the growth curve, a number of state

capitals and smaller cities which have relatively better infrastructure and are able to

support higher economic growth have come into limelight. These emerging growth centers

are characterized by low real estate costs, availability of land for development, untapped

manpower pool and rising quality of life. Many of these towns have industrial and tourism

driven economic base that can be leveraged for growth. Anticipating the latent demand in

these markets, a number of real estate developers and retailers have chalked out

expansive plans to harness the opportunity.City-wise housing price index major

metropolitan regions

K.C COLLEGE

Investment Avenue: Real estate.

14

City-wise housing price index Tier I cities

!

City-wise housing price index Tier II cities

K.C COLLEGE

Investment Avenue: Real estate.

15

City-wise housing price index Tier III cities

!

Investors expect to see significant uptick in real estate demand towards January to March

quarter of 2017, as a result of significant steps taken by the government towards

employment generation. NCR currently presents best investment opportunities, with most

of the currently available projects closer to the replacement cost, something which we

haven't seen over last two decades. Bangalore, Chennai and Pune continue to be top end

user driven markets propelled by significant job creation and infrastructure development.

Hyderabad is a market to watch out for over the next three years with possibility of annual

returns of over 30% to 40% across all locations.

K.C COLLEGE

16

Investment Avenue: Real estate.

Foreign Players

With the significant investment opportunities emerging in this industry, a

large number of international real estate players have entered the country. Currently,

foreign direct investment (FDI) inflows into the sector are estimated to be between US$ 5

billion and US$ 5.50 billion.

Jones Lang LaSalle (JLL), the world's leading integrated global real

estate services and money management firm, plans to invest around

US$ 1 billion in the country's burgeoning property market.

Dubai-based DAMAC Properties would invest up to US$ 4.5 billion to

develop properties in India.

Merrill Lynch & Co bought 49 per cent equity in seven mid-income

housing projects of India's largest real estate developer DLF in

Chennai, Bangalore, Kochi and Indore for US$ 375.98 million.

UAE-based real estate company Rakeen and Chennai-based mineral

firm Trimex Group have formed joint venture company - Rakindo

Developers - which would invest over US$ 5 billion over the next five

years.

Dubai-based Nakheel and Hines of the US have tied up with DLF to

develop properties in India. DLF has also formed a joint venture with

Limitless Holding, a part of Dubai World, to develop a US$ 15.23 billion

township project in Karnataka.

Gulf Finance House (GFH) has decided to invest over US$ 2 billion in a

Greenfield site close to Navi Mumbai. Global real estate majors such as Dubai World,

Trump Organization of US, Smart City of Dubai, Kishimoto Gordon Dalaya, Khuyool

Investments, Bonyan Holding, Plus Properties, ABG Group and Al Fara's Properties

among others have all firmed up their plans for the Indian real estate market with an

investment of around US$ 20-25 billion in the next 12-18 months.

K.C COLLEGE

17

Investment Avenue: Real estate.

Entry of Realty Funds

The boom in the real estate industry has attracted a large number of realty funds to tap

into this market. According to Cushman & Wakefield, foreign investors have raised nearly

US$ 30 billion since March 2005 for investing in Indian real estate.

Prominent global players like Carlyle, Blackstone, Morgan Stanley, Trikona, Warbus

Pincus, HSBC Financial Services, Americorp Ventures, Barclays and Citigroup among

others have all already checked into the Indian realty market.

In fact, real estate has been instrumental in India emerging as the top destination in Asia

(excluding Japan) in attracting private equity investments during the first ten months of this

year. Real estate accounted for 26 per cent of total value of private equity investments,

with 32 deals valued at US$ 2.6 billion. And according to industry estimates, another US$

10-20 billion would pour into the sector in the next three years.

Private equity in Indian real estate

There have been 150 overseas private equity funds who have lined up their chests to

invest in Indian real estate sector, report agency sources.

According to independent estimates, a total of USD 10 billion has already been raised

through this route and is expected to be invested in the next two years. On an average,

each of these funds has a minimum corpus of at least USD 150 million running up to a

billion Dollars, said property consultants.

Indian and multinational institutions such as J P Morgan, Falcon, 3i,

Blackstone, Carlyle, Kotak Real Estate, IL&FS, ICICI, and HDFC besides a host of others

are storming into this sector.

Private investors are starting to play an important role in the Indian real

estate investment market. At the end of 2005, the total Indian private equity volume was

roughly USD 1.6 billion, accounting for 40 per cent of the Indian real estate capital market.

This market is rapidly growing. In 2005, private property companies and individuals

holdings of real estate grew by 40 per cent year-on-year and are growing at double-digit

rates.

During the April-June 2006 quarter the PE firms launched funds targeting

over USD 8.7 billion for investing in India. A majority, over USD 5 billion, of the new fund

raising activity was aimed at real estate investments, said official of Venture Intelligence.

The funds are talking about their plans but real estate companies such as Mantri

Developers, GCorp, IDEB, and Sobha Developers who have received funds are upbeat on

these investments. Detailing a few recent investments and funds, an

industry analyst highlighted that Morgan Stanley invested Rs 3 billion in Mantri Developers

in Bangalore, Merrill Lynch invested around Rs 2.5 billion in Panchsheel Developers while

Siachen Capital, a New-York based fund reportedly invested close to Rs 5 billion in Nitesh

Estates. Tishman Speyer Properties has formed a joint venture with ICICI Ventures and

plans to invest about USD 1 billion in India within the next five years, the analyst

highlighted.

In 2005 nearly USD 850 million additional capital was invested into Indian real estate

sector. Strong growth in private equity was driven by unlisted property funds and

companies, which added around USD 82 million to the market, as well as by private

individuals. However, even more significant growth came from private debt (i.e. bank

K.C COLLEGE

18

Investment Avenue: Real estate.

Going Local

Indian real estate market permeates to smaller towns and cities. According to leading

global property consultancy firm Knight Frank, the real estate action is no longer limited to

the large metropolises of India but has now permeated to the burgeoning smaller towns

and cities. According to Knight Frank Research, the upswing of the Indian real estate

sector has been an outcome of a number of positive micro and macro factors. Consistent

and sustaining GDP growth, expanding service sector,rising purchasing power and

affluence, proactive and changing government policies have all lent momentum to this

rapidly growing sector. Accounting for almost 80% of the total office space absorption, the

Indian IT/ITES sector has been the primary demand driver. India's low cost-high

quality and productivity model has given it a leadership position in the

outsourcing arena. In a bid to scale up their operations and to remain

globally competitive, the Indian IT/ITES companies are exploring the smaller

towns and cities. Rising manpower and real estate costs, plaguing attrition

levels and very often risk mitigation have been the key reasons for this

movement.

Positive economic growth has also translated in rising disposable incomes

and growing aspiration levels across India. Rising consumerism has created a

demand for new retailing and entertainment avenues. Realizing that

consumers across cities have similar needs, albeit the scale may vary, new

age retailers are vying to cash in on the first mover advantage and are

expanding into hitherto unexplored smaller cities. Advent of organized

retailing has also translated into real estate growth in these emerging

locations.

Growth of the Indian 'Rich' (annual income>USD 4,700) and 'Consuming'

(annual income USD 1,000-4,700) class coupled with falling interest rates

and other fiscal incentives on home loans has increased the affordability and

the risk appetite of the average Indian consumer thereby leading to a

substantial rise in demand for housing. This has been further fueled by the

increase in the size of 25-55 age group of earning population and the

emergence of double income, nuclear families. Over the last decade the

average age of Indian home loan borrower has reduced by 10 years.

Another variable facilitating real estate growth in India is the growing

urbanization. According to United Nations Population Division, the urban

population in India will continue to grow at a rate of 2.5% per annum for the

next two and a half decade. As per the Census of India 2001, 41% of the

total population of India will be living in urban areas by 2011. The number of

cities with a population of one million or more is also is expected to double

from 35 recorded in 2001 to 70 by 2005. This increase in population will

generate incremental demand for housing and other real estate components.

All these factors together with increased liquidity in the real estate sector

through the international real estate funds and private equity funds will

K.C COLLEGE

19

Investment Avenue: Real estate.

result in radically transforming the real estate landscape over the next 3-5

years.

However, to support this growth and to make it more expansive, a lot needs

to be done. Foremost is the thrust on infrastructure. According to a World

Bank estimate, India needs to invest an additional 3-4% of its GDP on

infrastructure to sustain its current levels of growth and to spread the

benefits of growth more widely. Some positive steps have already been

taken in this direction. Huge investments in infrastructure to the tune of

$350 billion have been envisaged over the next five years. Connectivity may

get a boost with the completion of ~13,000 kms of roads under the Golden

Quadrilateral, North-South-East-West (NSEW) corridor and with 4-laning of all

the major national highways. This will further facilitate the economic

development of smaller towns and cities in the country.

Characteristics: Real estate markets yet to establish. Perceived to have

substantial potential demand. As the Indian real estate sector moves higher on the growth

curve, a number of state capitals and smaller cities which have relatively better

infrastructure and are able to support higher economic growth have come into limelight.

These emerging growth centers are characterized by low real estate costs,

availability of land for development, untapped manpower pool and rising

quality of life. Many of these towns have industrial and tourism driven

economic base that can be leveraged for growth. Anticipating the latent

demand in these markets, a number of real estate developers and retailers

have chalked out expansive plans to harness the opportunity.

K.C COLLEGE

20

Investment Avenue: Real estate.

Going Global

Simultaneously, many Indian realtors are making a name for themselves in

the international market through significant investments in foreign markets.

Prudential Real Estate Investors has acquired Round Hill Capital

Partners Kabushiki Kaisha, a Japanese asset management firm.

Embassy Group has inked a deal with the Serbian government to

construct a US$ 600 million IT park in Serbia.

Parsvnath Developers has tied up with the Al-Hasan Group in Oman.

Puravankara Group is doing a project in Sri Lanka - a high-end

residential complex, comprising 100 villas.

The Hiranandanis are constructing 5000 5-star hotel rooms, which will

come up between Abu Dhabi and Dubai.

Ansals API tied up with Malaysia's UEM Group to form a joint venture

company, Ansal API-UEM Contracts Pvt Ltd, which plans to bid for

government projects in Malaysia.

Kolkata's South City Projects is working on two projects in Dubai

K.C COLLEGE

21

Investment Avenue: Real estate.

Government Initiatives

POLICY INITIATIVES

Under the Sardar Patel Urban Housing Mission, 30 million houses will be built by 2022,

mostly for the economically weaker sections and low-income groups, through publicprivate- partnership, interest subsidy and increased flow of resources to housing sector.

The Government of India along with the governments of the respective states have taken

several initiatives to encourage the development in the sector. Some of them are as

follows:

The Securities and Exchange Board of India (SEBI) has notified final regulations that will

govern real estate investment trusts (REITs) and infrastructure investment trusts (InvITs).

This move will enable easier access to funds for cash-strapped developers and create a

new investment avenue for institutions and high net worth individuals, and eventually

ordinary investors.

The State Government of Kerala has decided to make the process of securing permits

from local bodies for construction of houses smoother, as it plans to make the process

online with the launch of a software called 'Sanketham'. This will ensure a more

standardised procedure, more transparency, and less corruption and bribery. The

Government of India has proposed to release the Real Estate (Development and

Regulation) Bill which aims to protect consumer interest and introduce standardisation in

business practices and transactions in the sector. The bill will also enable domestic and

foreign investment flow into the sector.

As the Indian economy grows, the real estate sector keeps benefiting. With the increase in

foreign tourist arrivals (FTA) every year, there is demand for real estate in the tourism and

hospitality sector. Also, with the entry of major private players in the education sector, the

major cities, that is Hyderabad, Bengaluru, Mumbai, Delhi, Pune, Chennai and Kolkata are

likely to account for 70 per cent of total demand for real estate in the education sector.

Demand for improved healthcare facilities is also expected to provide a boost to the

construction sector in the country.

K.C COLLEGE

22

Investment Avenue: Real estate.

Investments

The Indian real estate sector has witnessed high growth in recent times with the rise in

demand for office as well as residential spaces. Some of the major investments in this

sector are as follows:

Assotech Realty has tied up with Lemon Tree Hotels to manage and operate its serviced

residences. The first project, 210 apartments under the branding of Sandal Suites, will be

launched in Noida in 2015. The companies will launch 8-10 similar projects in a phased

manner over the next seven years with an investment of Rs 8000-9000 million (US$ 129145 million) approximately.

Blackstone Group LP is all set to become the largest owner of commercial office real

estate in India after a three-year acquisition drive in which it spent US$ 900 million to buy

prime assets. Blackstone has acquired 29 million sq ft of office space in cities such as

Bengaluru, Pune, Mumbai, and Noida on the outskirts of New Delhi.

L&T Infra Finance Private Equity (PE) plans to raise Rs 37,500 million (US$ 607 million) in

an overseas and a domestic fund, and launch a real estate fund.

IDFC Alternatives Ltd has sold two of its real estate investments to PE firm Blackstone

Group LP. The assets - a special economic zone (SEZ) in Pune and an information

technology (IT) park in Noida - were sold for a combined enterprise value of Rs 11,000

million (US$ 178 million).

Goldman Sachs plans to invest Rs 12,000 million (US$ 194 million) to build a new campus

in Bengaluru that can accommodate 9,000 people. The new campus is being developed in

collaboration with Kalyani Developers on the Sarjapur Outer Ring Road, Bengaluru.

Snapdeal has entered into a strategic partnership with Tata Value Homes to sell the latter's

apartments on its e-commerce platform, which marks the first time that an e- commerce

company has tied up with a real estate venture.

K.C COLLEGE

23

Investment Avenue: Real estate.

Factors driving the growth in the Real Estate Sector

One has to understand why the Indian real estate sector has presented itself as an asset

class for international and institutional investors. All the factors driving growth and

investment in this sector are driven by three key fundamentals.

Strong Economic Growth:

The worlds fourth largest economy,

growing at over 8% the last two years and forecast to grow at over 7%

over the next five; Growth measures supported across the political

spectrum; a boom in the services sector with a strong revival of

industry; powerful internal consumption and demand.

The Rise of the Middle-Class:

300 million and growing with

higher disposable incomes and even higher aspirations; educated,

professional workforce driving urbanization beyond the traditional

metro cities.

Enviable Demographics:

The worlds second most populous nation of 1.09 billion with 75% below the age of 50!

These fundamentals in turn have created a huge demand supply gap in all sectors of the

real estate market - commercial, residential, retail, healthcare, hospitality to name a few.

Drivers of profitability

Knowledge of the business

Though the principles of doing business are simple, over the many

years of unregulated development, dealing in real estate in India has

its own peculiarities, often at a local level and particularly in the area

of transparency and legal documentation, and a thorough knowledge

of these remains vital.

A wide network

There are developers and there are developers, and in a boom market

everybody has got into the act. It is important to quickly sift the wheat

from the chaff when forming JVs and SPVs for specific projects.

The longer-term approach

Real value to investors will accrue only on the sale of the end product

in terms of its multiplier effect. Also longer-term investments are more

likely to weather the hiccups of short term breaking news. Regulatory

efforts to keep out hedge funds and such short term profiteers will go

a long way in ensuring that this practice is sustained.

Focus on quality

This, more than anything, will derive the best value for investors, not

just in monetary terms but also lasting goodwill. This entails not just

the final product but also the totality of the environment where the

development is located. Governments efforts to ensure that

resettlement and social development of the displaced form part and

parcel of all large projects is the most encouraging news of all.

K.C COLLEGE

24

Investment Avenue: Real estate.

Why Invest In Indian Real Estate?

Flying high on the wings of booming real estate, property in India has

become a dream for every potential investor looking forward to dig profits.

All are eyeing Indian property market for a wide variety of reasons:

Its ever growing economy which is on a continuous rise with 8.1

percent increase witnessed in the last financial year. The boom in

economy increases purchasing power of its people and creates

demand for real estate sector.

India is going to produce an estimated 2 million new graduates from

various Indian universities during this year, creating demand for 100

million square feet of office and industrial space.

Presence of a large number of Fortune 500 and other reputed

companies will attract more companies to initiate their operational

bases in India thus creating more demand for corporate space.

Real estate investments in India

yield huge dividends. 70 percent of

foreign investors in India are making profits and another 12 percent

are breaking even.

Apart from IT, ITES and Business Process Outsourcing (BPO) India has

shown its expertise in sectors like auto-components, chemicals,

apparels, pharmaceuticals and jewellery where it can match the best in

the world. These positive attributes of India is definitely going to

attract more foreign investors in the near future. The relaxed FDI rules implemented by

India last year has invited more foreign investors and real estate in India is seemingly the

most lucrative ground at present. The revised investor friendly policies allowed foreigners

to own property, and dropped the minimum size for housing estates built with foreign

capital to 25 acres (10 hectares) from 100 acres (40 hectares). With

this sudden change in investment policies, the overseas firms can now put up commercial

buildings as long as the projects surpass 50,000 square meters (538,200 square feet) of

floor space.

Indian real estate sector is on boom and this is the right time to invest in

property in India to reap the highest rewards

K.C COLLEGE

25

Investment Avenue: Real estate.

Investment Opportunities

The real estate industry in India is yet in a promising stage. The sector happens to

be the second largest employer after agriculture and is expected to grow at the rate

of 30 per cent over the next decade. A growing migrant population due to

increasing job opportunities, together with healthy infrastructure development, is

underpinning demand in the regions residential real estate market.

It is believed that the Finance Ministry's motivation through softening of interest

rates and lending more to the real estate sector will have a positive impact on both

developers and consumers. The real estate market could start to perform better as

the easing of FDI norms will begin to show results during the second half of the

year. The economy will also recover in 2013 which in turn will perk up the real

estate sector in India. With the government trying to introduce developer and buyer

friendly policies, the outlook for real estate in 2013 does look promising.

Real estate contributed about 6.3 per cent to India's gross domestic product (GDP)

in 2013. The market size of the sector is expected to increase at a compound

annual growth rate (CAGR) of 11.2 per cent during FY 2008-2020 to touch US$ 180

billion by 2020.

The Government of India has allocated US$ 1.3B for Rural Housing Fund in the

Union Budget 2014-15. It also allocated US$ 0.7 billion for National Housing Bank

to increase the flow of cheaper credit for affordable housing for urban poor. The

government has allowed FDI of up to 100 per cent in development projects.

The entry of major private players in the education sector has created vast

opportunities for the real estate sector. Emergence of nuclear families and growing

urbanisation has given rise to several townships that are developed to take care of

the elderly. A number of senior citizen housing projects have been planned, and the

segment is expected to grow significantly in future. Growth in the number of tourists

has resulted in demand for service apartments. This demand is likely to be on the

uptrend and presents opportunities for the unorganised sector.

K.C COLLEGE

Investment Avenue: Real estate.

26

Niche sectors expected to provide growth opportunities:

Healthcare:

The healthcare sector is estimated to grow at the rate of 15 per cent per annum from

2011-16

India is expected to need additional 920,000 beds, entailing an investment between

USD32 billion and USD50 billion over the period 2010-20

Senior citizen housing:

Emergence of nuclear families and growing urbanisation has given rise to several

townships that are developed to take care of the elderly

A number of senior citizen housing projects have been planned; the segment is expected

to grow significantly in future.

Service apartments:

Growth in the number of tourists has resulted in demand for service apartments

This demand is likely to be on uptrend and presents opportunities for the unorganised

sector

Tourism market set for a surge; hotels to increase capacity

Foreign tourist arrivals in India are expected to rise at a CAGR of 10.5 per cent

during 2012-15

The number of foreign tourists arriving in the country is expected to be over 8.9

million by 2015

The number of hotel rooms in India as of 2011 stood at 121,000

The number of hotel beds in the country is expected to increase to 443,000 by 2015

from the current capacity of 262,000.

K.C COLLEGE

Investment Avenue: Real estate.

27

Number of Foreign tourist arriving in India

9

6.75

4.5

2.25

0

2012

2013

2014

2015

Capacity of the hotels in India

500

375

250

125

0

2009

2010

2011

2012

K.C COLLEGE

2013

2014

2015

28

Investment Avenue: Real estate.

The Other Side of the Coin

The Indian real estate market is still in its infancy, largely unorganized and dominated by

large number of small players, with very few corporate or large players having national

presence. The Indian real estate market, as compared to the other more developed Asian

and Western markets is characterized by smaller size, lower availability of good quality

space and higher prices. Supply of urban land is largely controlled by state-owned

development bodies like the Delhi Development Authority (DDA) and Housing Boards

leaving very limited developed space free, which is controlled by a few major players in

each city. Restrictive legislations and lack of transparency in transactions are other main

impediments to the growth of this sector. Limited investment from organized sector has

also hindered the growth of this sector. There is a thriving parallel economy in real estate,

involving large amounts of undeclared transactions, mainly due to high stamp duty rates.

The current legislative framework also leads to substantial losses to the Government.

Issues plaguing the real estate sector

Legislative Issues

Much of the over 100 laws governing various aspects of real estate date

back to the 19th century. Despite the plethora of laws, the situation appears to be far from

satisfactory and major amendments to existing laws are required to make them relevant to

modern day requirements. The Central laws governing real estate include:

Urban Land (Ceiling and Regulation) Act (ULCRA), 1976

This legislation fixed a ceiling on the vacant urban land that a person in

urban agglomerations can acquire and hold. A person is defined to include an individual, a

family, a firm, a company, or an association or body of individuals, whether incorporated or

not. This ceiling limit ranges from 500-2,000 square meters (sq. m). Excess vacant land is

either to be surrendered to the Competent Authority appointed under the Act for a small

compensation, or to be developed by its holder only for specified purposes. The Act

provides for appropriate documents to show that the provisions of this Act are not attracted

or should be produced to the Registering officer before registering instruments

compulsorily registrable under the Registration Act. The objective of acquiring the excess

vacant land could not be achieved because of intrinsic deficiencies in the legislation itself.

The provisions under Sections 19, 20 and 21 of the Act have together proved counterproductive to the objectives of the legislation. So far, only 19,020 hectares could be taken

possession of by State Governments and Union Territories and the remaining land was

locked up in various litigations.

Land Acquisition Act, 1894

This Act authorizes governments to acquire land for public purposes such as planned

development, provisions for town or rural planning, provision for residential purpose to the

poor or landless and for carrying out any education, housing or health scheme of the

Government.

In its present form, the Act hinders speedy acquisition of land at reasonable prices,

resulting in cost overruns.

K.C COLLEGE

29

Investment Avenue: Real estate.

Rent Control Act

Rent legislation in India has been in existence for a very long time. Rent

control by the government initially came as a temporary measure to protect the exploitation

of tenants by landlords after the Second World War. However these rent control acts

became almost a permanent feature. Rent legislation provides payment of fair rent to

landlords and protection of tenants against eviction. Besides, it effectively allows the

tenant to alienate rented property. Tenants occupying properties since 1947 continue to

pay rents fixed then, regardless of inflation and the realty boom.

Some of the adverse impacts of the Rent Control Act are:

Negative effect on investment in housing for rental purposes.

Withdrawal of existing housing stock from the rental market.

Accelerated deterioration of the physical condition of the

housing stock.

Stagnation of municipal property tax revenue, as it is based on

the rent.

Resultant deterioration in the provision of civic services.

Increase in litigation between landlords and tenants.

The Rent Control Act, in fact, is the single most important reason for the

proliferation of slums in India by creating a serious shortage of affordable housing for the

low income families. Low and middle-income families typically live in rented

accommodation all over the world and the need for such accommodation in our cities will

only increase as the economy modernizes, labour mobility increases and urbanization

takes place. It is, therefore, necessary to increase the stock of rental housing. Promotion

of rental housing can have a significant impact on the economy in many ways:

It reduces shortage of housing for a large section of the population who

cannot afford ownership.

Housing construction being a labour-intensive activity, investment in

housing generates employment for both skilled and unskilled labour.

Housing has backward and forward linkages with many other industries.

Other risk associated:

Liquidity risk:

The investment market is still in its infant stage. Investors face serious

challenges in finding appropriate investment product.

Regulatory risks:

In terms of property ownership, permission from the Reserve Bank of

India is required for foreign investors. For capital repatriation, investors

need to apply for approval from the RBI, and foreign direct investment

is limited to a limited set of opportunities (e.g. townships).

K.C COLLEGE

30

Investment Avenue: Real estate.

Property market transparency risk:

Jones Lang LaSalle rates the Indian property market transparency as

low in its international transparency survey from 2004. Although

market transparency has obviously improved, it is still hard to get

reliable and consistent information on the Indian property market.

There are also more professional due diligence and valuation

institutions needed. This holds even for the Tier I cities.

Overall market transparency risk:

Transparency International ranks India 88 out of 150 countries with

regard to the perceived corruption level.

Macroeconomic risks:

Interest rates, inflation and exchange rate risks remain important,

although volatility in these indicators has decreased significantly in

recent years. The provision of public goods is in many regions still

inadequate (education, transport infrastructure).

K.C COLLEGE

31

Investment Avenue: Real estate.

The Big Question.

Is the Real Estate Market a bubble waiting to burst???

Investing in real estate in India is becoming more expensive with each

passing day. A study conducted by Donald Trump Jr. shows that the Indian real estate

market is worth US $12 billion, with an average annual growth rate of 30%. Property prices

have appreciated by over 50% in cities like Bangalore, Pune, and Mumbai.

Why has real property become out of reach in India?

The Indian economy, especially the information technology and BPO

sectors, has been on a fast growth track. These industries offer high

paying jobs. Also, people are more aware of the luxurious lifestyle of

the West. With money in their hands, IT and call centre employees

can afford to buy these luxuries in India. All put together, this has

led to rise in property prices!

Real returns in real estate caught the NRIs attention! The inflow of

NRI funds in Indias real estate has also contributed to the price

hype. There is also a rise in the trend of NRIs returning to India for

good. This has put pressure on Indias real estate.

Indias commercial and retail real estate has also been on a rise.

There has been a mushrooming of shopping malls and

entertainment centres throughout the country. Multi-national

companies are also entering the Indian market regularly. Naturally,

there is an increase in demand for office space.

As the real estate investments gave high returns to investors,

foreign investors have also started taking interest in Indias real

estate. For example, Morgan Stanley invested US$ 68 million in

Mantri developers and Merrill Lynch has invested US$ 50 million in

Panchsheel Developers. Foreign companies like GE Commercial

Finance Real Estate has invested US$ 63 million in IT parks in India.

According to the Merrill Lynch forecast, the real estate business in

India will grow to $US 90 billion by 2015.

In a highly opinionated society where everybody has an opinion on

everything, it is generally the growth story that is targeted. No wonder, in the Indian context

today, the largest economic activity post agriculture, Real Estate seems to be under the

scanner of every prophet of doomsday. It is made to believe that a bubble is waiting to be

burst. In the absence of any sound logic, the critics have now got the Fitch Ratings'

outlook for the Indian real estate which suggests a price correction this year. The report

suggests property prices are likely to undergo a correction in 2008; partly as home buyers,

deterred by increasing property prices and high interest rates over

the last three years, may wait for the prices to moderate.

Therefore, debate rages today about whether or not a housing bubble exists in the country

in general and the NCR in particular.

K.C COLLEGE

32

Investment Avenue: Real estate.

The fact that there is even any controversy about the bubble's existence testifies to the

power of the forces of misinformation. This also proves that the long habit of wishful

thinking among the millions of victims of the so-called New Economy has yet to start to

dissipate. What the critics fail to see here is that even Fitch notes that price corrections

may not follow a uniform pattern geographically. I would like to add here that with the kind

of retail growth that is forecasted, it won't affect the commercial real estate, too.

There may be a price correction in the residential real estate, but it won't be a bubble burst

by any stretch of imagination. Growth in the country over the last three years has been

supported by sound economic fundamentals, with increased demand on the one hand and

increasing supply supported by equity raising on the other. Real estate

Companies here have produced strong topline growth in 2007, and even Fitch expects

revenue growth to continue in 2008, as Companies would continue to launch several new

projects. Moreover, real estate Companies have expanded to cities in a big way

outside their principal area of operation, and we all expect this geographical diversification

to continue through 2008. We live in a consumption Economy that is financed by debt,

which in turn largely rests upon our home foundations. Thus if there was a real shift

downward in housing demand, it would have a dramatic impact across the entire

Economy. This goes true for any Economy, and India is no exception.

K.C COLLEGE

Investment Avenue: Real estate.

33

Regulatory Developments

The year 2014 witnessed a change of guard at the Centre, which not only propelled the

positive sentiments of the market but also, as widely expected, led to the introduction of

several reforms. These, including the announcement of REITs, relaxation in the FDI norms

and affordable housing getting higher priority under the Land Acquisition Act, 2015 are

expected to give an impetus to the sector and offer players an opportunity to rewrite the

growth story.

The REIT Regime in India

On 26 September 2014, the SEBI notified the REITs regulations, thereby paving the way

for introduction of an internationally acclaimed investment structure in India. The Finance

Minister has also made necessary amendments to the Indian taxation regime to provide

the tax pass through status, which is one of the key requirements for feasibility of REITs.

The India REIT regime is aimed at providing:

an organised market for retail investors to invest and be part of the

growth story

Indian real estate

a professionally managed ecosystem that is risk averse and is aimed at protecting the

interest of public

an exit platform for the real estate sector to ease out liquidity burden REITs provide tax

transparency. This means that the REIT does not pay any corporate tax in exchange for

paying out strong, consistent dividends. Rather, taxes are paid by the individual

shareholder only.

Further, considering that the listed REITs will be registered and regulated by the SEBI and

adhere to the highest standards of corporate governance, financial reporting and

information disclosure, the REITs will provide operational transparency.

REITs assets/ investments:

All assets to be situated in India

REIT assets to include:

- land and any permanently attached improvements to it (whether leasehold or

freehold) including buildings, sheds, garages, fences, fittings, fixtures, warehouses,

car parks, etc.

- Transferable Development Rights (TDRs

Assets not forming part of REITs

- hospitals ,hotels, with project cost of more than Rs 200 crore each in any place in

India and of any star rating. 3-star or higher category classified hotels located

outside cities with population of more than 1 million

-common infrastructure for industrial parks, Special Economic Zones (SEZs),

tourism facilities and agriculture markets

- convention centres, with project cost of more than Rs 300 crore

K.C COLLEGE

Investment Avenue: Real estate.

34

- agricultural land or vacant land

- units of another REIT

mortgages not eligible to be REIT assets

at least 80% of value of the REIT assets to be invested incompleted and rent generating

properties. Specific conditions prescribed for investing the balance funds in other assets

REIT shall invest in at least two projects, and investment in one project should not

exceed 60% of the value of assets owned by REIT

REIT assets could be held directly by the REIT or via Special Purpose Vehicles (SPVs)

REIT to hold not less than 50% equity and controlling interest in SPVs

SPV to hold 80% equity in REIT assets

Tax regime:

Specific taxation regime has been in- troduced to deal with income earned via REITs. This

is summarised as follows:

Interest from the SPV will be exempt in the hand of the REIT but will be taxable as

income of the unit holders/ sponsor

Dividend will be exempt income for everyone

Capital gains earned by REITs on sale of share of SPV will be taxable

in the hands of the REIT at applicable rates but will be exempt in the hands of the unit

holders/ sponsor

Long-term capital gains earned by unit holders on sale of REIT units will be exempt

whereas short-term capital gains will be taxable @ 15%

Long-term capital gains earned by sponsor on sale of REIT units will be taxable @ 20%

whereas short- term capital gains will be taxable @ 30%

The REIT will be taxed for other income at the maximum marginal rate whereas the same

will be exempt for the unit holders/ sponsor

For the sponsor, transfer of shares of SPV to a REIT in exchange of units is not

considered a transfer. The tax payable is deferred to the date when the sponsor sells the

units of REIT

K.C COLLEGE

35

Investment Avenue: Real estate.

The Right to Fair Compensation and Transparency in Land Acquisition,

Rehabilitation and Resettlement Act, 2013

This legislation was introduced by the erstwhile UPA-II government and came into effect

from 1 January 2014, replacing the archaic Land Acquisition Act, 1894. This Act combines

both land acquisition, and rehabilitation and resettlement for the loss of land and

livelihoods of those even marginally affected by land acquisition. It focuses on increasing

transparency and involves prior consultation with local landowners and the local

Panchayati Raj institutions.

However, the current government brought in an ordinance to bring about significant

changes in the Act such as removing consent clause to acquire land for five different types

of projects - industrial corridors, PPP projects, rural infrastructure, affordable housing and

defence.

K.C COLLEGE

36

Investment Avenue: Real estate.

Case Study

This case study is about India's largest real estate company DLF Limited's (DLF) struggle

in the stressed market conditions due to the global financial crises which started in the

year 2007. The company which created India's biggest IPO in history, raising more than

US$ 2 billion, was counting on the continued growth of realty sector in the country.

However, the depressed economic situation coupled with credit crunch led to a significant

decline in the demand and property prices. While the company had ambitions plans to

launch several properties ranging from Special Economic Zones (SEZs), large townships,

hotels, and convocation centers, the market conditions took its toll on the business. These

factors disturbed the cash flow cycle of DLF, making it difficult for it to repay its debt on

time. The debt to equity ratio of the company increased to all time of high of 0.7 in June,

2010, with inadequate debt paying capacity.

In light of these factors, DLF had to exit from many of its projects either before, or even in

middle of starting the operations. The company devised several strategies overcome the

prevailing situation. By the mid-2010, DLF had a much leaner business structure, but it still

facing various challenges in bringing its business back into shape.

Issues:

Understand the real estate sector in India and issues and challenges faced by the

market leader in this sector. Which gives a clear view on investment in this sector as well.

Understand the impact of global financial crises on business dynamics.

To analyze how macro and micro economic factors influences the success of an

organization.

Determine the internal competencies of business though SWOT analysis.

Examine the role of external factors influencing business thorough PESTEL analysis.

Appreciate the importance of healthy cash flow cycle for a business.

Determine the best product mix, thorough analysis of demand, revenue streams, and

profitability from different verticals of business.

Understand the criticality of decision making process in business, especially during

stressed market conditions.

Scrutinize the impact of increasing debts on planning, execution, and evaluation of

business strategy.

Understand the importance of tailoring business tactics and strategy to fit specific

industry and company situations.

K.C COLLEGE

37

Investment Avenue: Real estate.

In Real Trouble?

As on June 12, 2010, DLF Limited (DLF), India's largest real estate company, had

accumulated an outstanding debt of more than US$3100million, marginally below the

record high of US$3635 million in the month of March 2009. The net profit of the company

also plunged by more than 60%, falling from US$993.25 million in financial year

2008-2009 to US$384.44 million in financial year 2009-2010. In addition to decreasing

profits, DLF was struggling with an enormous outstanding debt and a high debt to equity

ratio which stood at around 0.70 in the month of June 2010. To reduce its debt burden,

DLF was considering selling 97% of its stake in Aman Resorts, a hotel chain it had

acquired in November 2007 for about US$400 million, to Khazanah. If completed, this deal

was expected to release between US$300 million and US$350, helping DLF cut its heavy

debt pile. The company was also implementing many other strategies with an eye on

reducing its debt burden and managing its cash flow efficiently.

According to analysts, DLF had been doing well since liberalization and had witnessed

strong growth as a private company in the growing Indian economy. It went public in July

2007 with one of the biggest IPOs (Initial Public Offering) in India. DLF raised capital of

more than US$2 billion to further strengthen its growth. This made it the eighth most

valuable company in India and its promoters, KP Singh and his family, the fourth richest

Indians, just behind the two Ambani brothers and Lakshmi Mittal

It was expected that after this IPO, DLF would be able to grow much faster and change

growing Indian real estate sector, which was growing rapidly along with the Indian

economy. The funds raised from the IPO enabled DLF to reduce its prevailing debt and

acquire additional land to develop properties in the years to come. However, the global

financial crisis in 2008 created a grim situation, and hampered the anticipated growth of

DLF...

Problems Faced by DLF

Though DLF was able to book significant sales in the months before November 2009, the

sales started falling across segments from November 2009. In the housing segment, DLF

had launched some projects in the middle of the year in Kochi, Bangalore, and Gurgaon

which were witnessing marginal sales...

Credit Crunch & Increasing Debts

Analysts felt that under the duress of the prevailing market conditions, DLF was unable to

secure the required loans for implementing many of its projects. The overseas credit

markets had been shut since January 2008 giving DLF no access to FIIs...

The Struggle Continues

By the beginning of 2010, there was a slow revival in demand for both housing and

commercial properties within the country. This enabled DLF to increase the prices of some

of its residential properties by around 15%, which helped it to realize higher margins

K.C COLLEGE

38

Investment Avenue: Real estate.

Emerging trends

Smart cities

The challenges and opportunities that come with rising urbanisation across the world have

given birth to the concept of smart cities. Globally, urbanisation is on the rise and India is

not far behind. Growth in urban population is creating excessive pressure on demands for

water, transportation, waste management and power. For a city to cope with these

challenges and deliver a high-quality of urban living, it has to be energy-efficient and have

an efficient and sustainable transport infrastructure. Such cities are known

as smart cities, and are managed and monitored by cutting-edge information and

communications technology.

What is special about a smart city?

A smart city functions with increased efficiency. Be it in terms of deploying high-quality

street lights, smart grids, energy-efficient buildings, a smart traffic management system, or

an efficient water management system.

It solves issues of traffic jams, wasted energy, dark corners or crimes, and has a quick

emergency response system in place.

Smart cities in India

In India, although the smart city concept is still new, there have been initiatives by the

government and private developers to build smart cities. The government plans to develop

100 smart cities over the next 20 years for which an initial allocation of Rs 7,060 crore was

provided for in the 2014-15 Union Budget. These cities will include the construction of

satellite towns near existing mega cities, upgrading existing mid-sized cities and

construction of settlements along industrial corridors in addition to the construction of a few

new cities altogether.

Though the idea of a smart city seems appealing, it is full of challenges considering the

issues faced by our cities due to rapid urbanisation. Key challenges that the concept of

smart cities in India face are:

K.C COLLEGE