Professional Documents

Culture Documents

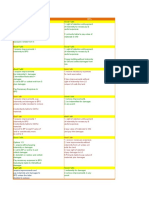

Interest Rate-New

Uploaded by

Anonymous bdm1KYJttOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest Rate-New

Uploaded by

Anonymous bdm1KYJttCopyright:

Available Formats

Interest; legal rate beginning July 1, 2013.

The

guidelines laid down in the case of Eastern

Shipping Lines are accordingly modified to

embody BSP-MB Circular No. 799, as follows:

I. When an obligation, regardless of its source, i.e.,

law, contracts, quasicontracts, delicts or quasidelicts is breached, the contravenor can be held

liable for damages. The provisions under Title

XVIII on Damages of the Civil Code govern in

determining the measure of recoverable

damages.

II. With regard particularly to an award of interest

in the concept of actual and compensatory

damages, the rate of interest, as well as the

accrual thereof, is imposed, as follows:

1. When the obligation is breached, and it consists

in the payment of a sum of money, i.e., a loan or

forbearance of money, the interest due should be

that which may have been stipulated in writing.

Furthermore, the interest due shall itself earn

legal interest from the time it is judicially

demanded. In the absence of stipulation, the rate

of interest shall be 6% per annum to be computed

from default, i.e., from judicial or extrajudicial

demand under and subject to the provisions of

Article 1169 of the Civil Code.

2. When an obligation, not constituting a loan or

forbearance of money, is breached, an interest on

the amount of damages awarded may be imposed

at the discretion of the court at the rate of 6% per

annum. No interest, however, shall be adjudged

on unliquidated claims or damages, except when

or until the demand can be established with

reasonable certainty.

Accordingly, where the demand is established

with reasonable certainty, the interest shall begin

to run from the time the claim is made judicially

or extrajudicially (Art. 1169, Civil Code), but when

such certainty cannot be so reasonably

established at the time the demand is made, the

interest shall begin to run only from the date the

judgment of the court is made (at which time the

quantification of damages may be deemed to

have been reasonably ascertained). The actual

base for the computation of legal interest shall, in

any case, be on the amount finally adjudged.

3. When the judgment of the court awarding a

sum of money becomes final and executory, the

rate of legal interest, whether the case falls under

paragraph 1 or paragraph 2, above, shall be 6%

per annum from such finality until its satisfaction,

this interim period being deemed to be by then an

equivalent to a forbearance of credit. And, in

addition to the above, judgments that have

become final and executory prior to July 1, 2013,

shall not be disturbed and shall continue to be

implemented applying the rate of interest fixed

therein

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Dominion Lawsuit Patrick ByrneDocument106 pagesDominion Lawsuit Patrick ByrneGMG EditorialNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Criminal Law Notes (CLU3M)Document36 pagesCriminal Law Notes (CLU3M)Steven WNo ratings yet

- Sample Declaration For CaliforniaDocument2 pagesSample Declaration For CaliforniaStan Burman88% (32)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Lawyer InfoDocument2 pagesLawyer InfoPraful BawejaNo ratings yet

- Draft Resolution No. 164-2020 - Adopting The PPAs For LCPC, Senior Citizens and PWDsDocument2 pagesDraft Resolution No. 164-2020 - Adopting The PPAs For LCPC, Senior Citizens and PWDsRica Carmel Lanzaderas100% (2)

- 1987-1991 Bar ExaminationDocument72 pages1987-1991 Bar ExaminationPantas DiwaNo ratings yet

- Humanitarian Negotiation Manual PDFDocument91 pagesHumanitarian Negotiation Manual PDFΑλεξαντερ ΤερσενιδηςNo ratings yet

- Nicaragua Vs United States (Summary) On Self Defence and Use of Force - Public International LawDocument14 pagesNicaragua Vs United States (Summary) On Self Defence and Use of Force - Public International LawGil Aragones III50% (2)

- LetterDocument3 pagesLetterBonjen BoniteNo ratings yet

- PRHC v. LCDCDocument3 pagesPRHC v. LCDCAiken Alagban LadinesNo ratings yet

- Week 1 Popular Culture PowerPointDocument12 pagesWeek 1 Popular Culture PowerPointAgung Prasetyo WibowoNo ratings yet

- Estate Tax AmendmentsDocument3 pagesEstate Tax AmendmentsPatrick TanNo ratings yet

- Organizing a Mathematics Club MeetingDocument1 pageOrganizing a Mathematics Club MeetingSonny Matias100% (2)

- Finman General Assurance Corp. vs. Court of AppealsDocument5 pagesFinman General Assurance Corp. vs. Court of AppealsNullus cumunisNo ratings yet

- VAT ProvisionsDocument9 pagesVAT ProvisionsAnonymous bdm1KYJttNo ratings yet

- Lo BPS OmDocument2 pagesLo BPS OmAnonymous bdm1KYJttNo ratings yet

- Trust Provisions CivrevDocument1 pageTrust Provisions CivrevAnonymous bdm1KYJttNo ratings yet

- Ease Ment Chart PropDocument2 pagesEase Ment Chart PropAnonymous bdm1KYJttNo ratings yet

- Wills Case DisinheritanceDocument22 pagesWills Case DisinheritanceAnonymous bdm1KYJttNo ratings yet

- Wills Intestate CaseDocument3 pagesWills Intestate CaseAnonymous bdm1KYJttNo ratings yet

- Credit Transactions CodalDocument8 pagesCredit Transactions CodalbarcelonnaNo ratings yet

- Wills LastbatchDocument15 pagesWills LastbatchAnonymous bdm1KYJttNo ratings yet

- Tax Codal ProvisionsDocument10 pagesTax Codal ProvisionsAnonymous bdm1KYJttNo ratings yet

- Wills LastbatchDocument15 pagesWills LastbatchAnonymous bdm1KYJttNo ratings yet

- Wills Fuentesvs - CanonDocument1 pageWills Fuentesvs - CanonAnonymous bdm1KYJttNo ratings yet

- Wills 10th CaseDocument26 pagesWills 10th CaseAnonymous bdm1KYJttNo ratings yet

- Wills 10th CaseDocument26 pagesWills 10th CaseAnonymous bdm1KYJttNo ratings yet

- Nera vs. Raymundo DigestDocument1 pageNera vs. Raymundo DigestAnonymous bdm1KYJttNo ratings yet

- 11miller Mardo CaseDocument2 pages11miller Mardo CaseAnonymous bdm1KYJttNo ratings yet

- Poli JudicialDocument4 pagesPoli JudicialAnonymous bdm1KYJttNo ratings yet

- Art 12 Exempting Circumstances: Madali Vs People 2009Document37 pagesArt 12 Exempting Circumstances: Madali Vs People 2009Anonymous bdm1KYJttNo ratings yet

- General Principles SEC. 23. General Principles of Income Taxation in The Philippines-Except When Otherwise Provided in ThisDocument22 pagesGeneral Principles SEC. 23. General Principles of Income Taxation in The Philippines-Except When Otherwise Provided in ThisAnonymous bdm1KYJttNo ratings yet

- Wills Digest Week 1Document4 pagesWills Digest Week 1Anonymous bdm1KYJttNo ratings yet

- Crimrev MidtermsDocument10 pagesCrimrev MidtermsAnonymous bdm1KYJttNo ratings yet

- Crimrev MidtermsDocument10 pagesCrimrev MidtermsAnonymous bdm1KYJttNo ratings yet

- Manotok Case For Legal FormsDocument6 pagesManotok Case For Legal FormsAnonymous bdm1KYJttNo ratings yet

- Art 12 Exempting Circumstances: Madali Vs People 2009Document37 pagesArt 12 Exempting Circumstances: Madali Vs People 2009Anonymous bdm1KYJttNo ratings yet

- TaxDocument3 pagesTaxAnonymous bdm1KYJttNo ratings yet

- TaxDocument3 pagesTaxAnonymous bdm1KYJttNo ratings yet

- Ge4 Quiz Answer KeyDocument2 pagesGe4 Quiz Answer KeyNechille BayanNo ratings yet

- Corporate Governance: Governance, Business Ethics, Risk Management, and Internal ControlDocument26 pagesCorporate Governance: Governance, Business Ethics, Risk Management, and Internal ControlPipz G. CastroNo ratings yet

- GVPT 200 Intro to IR TheoryDocument6 pagesGVPT 200 Intro to IR Theory123lorenzoNo ratings yet

- Concerned Citizens vs. MMDA (G.R. Nos. 171947-48, December 18, 2008)Document1 pageConcerned Citizens vs. MMDA (G.R. Nos. 171947-48, December 18, 2008)Tin CaddauanNo ratings yet

- Fortson v. Elbert County Detention Center and Administration Et Al - Document No. 8Document4 pagesFortson v. Elbert County Detention Center and Administration Et Al - Document No. 8Justia.comNo ratings yet

- Sarigumba V SandiganbayanDocument17 pagesSarigumba V SandiganbayanKTNo ratings yet

- The Reality of GlobalizationDocument3 pagesThe Reality of GlobalizationIrene Pines GarmaNo ratings yet

- Foundations of American Democracy (GoPo Unit 1)Document170 pagesFoundations of American Democracy (GoPo Unit 1)Yuvika ShendgeNo ratings yet

- 81Document2 pages81Trem GallenteNo ratings yet

- AKBAYAN Vs AQUINO DigestDocument2 pagesAKBAYAN Vs AQUINO DigestElla PerezNo ratings yet

- Short Summary of Prevention of Corruption ActDocument4 pagesShort Summary of Prevention of Corruption ActMandeep Singh WaliaNo ratings yet

- WillsDocument11 pagesWillsA Paula Cruz FranciscoNo ratings yet

- AFGE Local 3981 and Bureau of Prisons, 7-7-14, 9-5-14Document35 pagesAFGE Local 3981 and Bureau of Prisons, 7-7-14, 9-5-14E Frank CorneliusNo ratings yet

- St. John’s Class VIII Social Science Chapter 4 Judiciary AssignmentDocument3 pagesSt. John’s Class VIII Social Science Chapter 4 Judiciary AssignmentIndia Tech with Astitva0% (1)

- (Routledge Contemporary South Asia Series, 20) Mahendra Lawoti and Anup K. Pahari - The Maoist Insurgency in Nepal - Revolution in The Twenty-First Century-Routledge (2010)Document375 pages(Routledge Contemporary South Asia Series, 20) Mahendra Lawoti and Anup K. Pahari - The Maoist Insurgency in Nepal - Revolution in The Twenty-First Century-Routledge (2010)Aparajita RoyNo ratings yet

- Matter of Benjamin Acevedo, Vs New JerseyDocument11 pagesMatter of Benjamin Acevedo, Vs New JerseyAmmoLand Shooting Sports NewsNo ratings yet