Professional Documents

Culture Documents

Financial Results, Limited Review Report For December 31, 2015 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results, Limited Review Report For December 31, 2015 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

BEOL/CS

/rs-761

10 FEB 2016

BSE Ltd.

Corporate Relationship Department

l.t Floor, New Trading Ring,

Rotunda Building

P.J.Towers, Dalal Street,

Fort,

MUMBAI.4OO OO1

The Manager,

Listing Department,

The National Stock Exchange of India Ltd,

Exchange Plaza, C-1, Block G,

Bandra Kurla Complex,

Bandra (E),

MUMBAI.4OO O51

Dear Sir,

Sub: unaudited Financiar Resurts for the

euarter

with

reference

to the above, we are enclosing herewith a

statement in the

g Unaudited Financiar Results of the company for

the

er, 2015 along with the Limited Review neport of the

This information is being submitted pursuant to Regulation

33 of SEBI ((Listing

obligations and Disclosure Requirements) Regulatiorr., 201s.

Please acknowledge the receipt.

Thanking you,

Yours faithfully,

for Birla Ericsson Optical Ltd.

.9"^'8ry

(Somesh Laddha)

Company Secretary

Encl: As above.

BIRLA ERICSSON OPTICAL LIMITED

Regd. Office: Udyog Vihar, p.O.Chorhata, Rewa - 496 006 (M.p.l

CtN: L3i300Mpi992pLC0o719O

Telephone No: 07662-400580, Fax No: 07662_40068O

Email : headoffice@birlaericsson.com; Website: M.birlaerlcsson.com

ANlS09001 :2008, lS0 14001 :2004&OHSAS 18001 : 2OO7 COMPANY

STATEMENT OF UNAUDITED FTNANCIAL RESULTS FOR THE QUARTER AND NINE

MONTHS ENDED 31ST DECEMBER. 2015

(t in lacsl

Quarter

st.

No

Particulars

Income from Operations

(a) Net Sales/lncome from Operations

ended

31.12.2015

(Unaudited)

Quarter

ended

30 09 201 5

Quarter

enoe0

31.12.2014

Nine Months

ended

31.12.2015

(Unaudited)

(Unaudited)

(Unauditsd)

ended

31 12.2014

(Unaudited)

6531 25

17168.27

18270.08

4826.02

6621 50

(Net of Excise Duty)

(b)

Other Operating Income (Net)

Total Income from ODerations (Nefl

84.84

77 85

491 0.86

6699 35

Expenses

132.28

oooJ c5

Nine Months

237.40

17405.67

Previous Year

en0e0

31 03 2015

(Audited)

zct I I Jc

479 28

612 30

8749 36

26389 65

(a)

(b)

Cost of Materials consumeo

3028.79

4915.72

Purchases of Stock-in-trade

0.94

(c)

496

Changes in Inventories of Finished Goods, Workin-progress and Stock-in-trade etc

399.29

(21 e5)

(483.21l,

Employee Benefits Expense

371.30

JlO YZ

31 1.98

Depreciation and Amonization Expense

177.47

175 58

t10.cz

506.34

420 87

av I .52

Other Expenses

61

2.93

628 62

694.49

2124.16

1810 47

2687 80

4590.72

6049 85

6043.48

16140 66

17158 45

24085 27

320.14

649 50

OZU UC

53.29

100 81

74 40

(d)

(e)

(f

Total Exoenses

.63

14731 07

16.00

114 00

1212.621

(831 30)

27 21

075.1 5

913 34

1220 88

263

66.25

9379 64

172 22

Profit from operations before Other Income, Financ

Costs and Exceptional ltems (1-2)

Other lncome

5

265.01

248.70

590

91

2304 38

zzz co

372 74

2677 12

Profit from ordinary activities before Finance

Costs and Exceptional ltems (3+4)

373.43

750

31

694 45

1513.71

1813 47

Finance Costs

100.94

ZJ

UO

191.24

529.02

599 92

Profit from ordinary activities after Finance

Costs but before Exceptional ltems (5-6)

272.49

s15 25

503 21

984.69

1213 55

tztocc

C,

Exceptional ltem (Refer Note

4.14

473 38

Profit from ordinary activities before Tax (Z-8)

268.35

41 87

503 21

507.17

10

Tax Expense

20.80

(35 00)

145 19

No

11

Net Profit for the period (9-10)

12

Paid-up Equity Share Capital

(Face value

3)

of {10/- per Share)

({)

(not annualised)

846.88

477.52

55.80

388 25

846 88

597 28

147.55

76 87

358 02

351.37

825 30

1249 60

3000.00

3000,00

3000.00

3000.00

3000.00

3000 00

0.49

vzo

.19

1.17

275

Reserves (excluding Revaluation Reserves)

14 Basic & Diluted EPS

830 24

568s 90

1

417

Notes:

The above Unaudited Financial Results duly reviewed by the Audit Committee have been approved by the Board

of Directors in its meeting

held on 1Oth February, 2016 and subjected to a Limited Review by the Statutory Auditors of the Company.

The Company has exercised option provided in Para - 464 of Accounting Standard - 1 1 on Effects of Changes in Foreign

Exchange Rates

with regard to the treatment of foreign exchange fluctuation.This has resulted in increase in profit by Rs.5431 lacs (net

of depreCiation of

Rs 3.87 lacs) for nine months ended 31st December, 2015

Exceptional ltem for the Quarter and Nine months ended 3'lst December, 2015, represents setflement of claim(s)

of an overseas supplier

through an out of court settlement of various long standing disputes/claims pending in different courts in India and nibitration

in Japan.

During the quarter ended 3'lst December, 2015, the Company has made long term investment of Rs.99.OO lacs in

equity share capital of Birla

Visabeira Private Limited and Rs.400.84 lacs towards acquisition of equity shares by way of subscription under the hignts

lssue of Universal

Cables Limited.

The tax expense comprises of current tax, deferred tax and is net of MAT credit entiflement.

o

The Company has only one reportable primary business segment. Hence, no separate segment wise information of revenue,

results and

capital employed is given.

Figures for the previous periods are re-classified/re-arranged/re-grouped,

classification/disclosure

fu Q""z- o'-lgst-:'.ng.,

Ev

l-$=fu

Place

Date

New Delhi

1oth February,2016

wherever necessary, to correspond with the current period,s

5v6i

For BIRLA ERICSSON OPTICAL LtMtTED

qft.uCHAIRMAN

DIN: 00394094

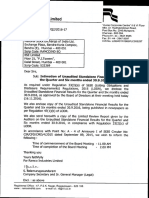

V. SANKAR AIYAR & CO.

CHARTERED ACCOUNTANTS

satyam cinema comprex, Ranjit Nagar community

centre, New Derhi-11ooo8

F

a' Nos {33?.I3l

[31.i1]38i33231,,33i3tS3t X3i333;3

E-mail : newdelhi@vsa.co.in & vsand@vsnl.com

Limited Review Report to the Board of Directors of

we have reviewed the accompanying statement of

Ericsson Optical Limited,

ll,B,!r

31s December,

un-audited

for tne quarter and nine mont

2015. This statement is ihe responrioiritv ot

Management and has been approved by the goaij of

responsibility is to issue a report on these financial statements

based on our

review.

2

we

conducted our review in accordance with the standard on Review

Engagements (SRE) 2410 'Review of Interim Financial information performed

by the Independent Auditor of the Entity', issued by the Institute of Chartered

Accountants of India. This standard requires that we plan and perform

the

review to obtain moderate assurance as to whether the financial statements

are free of material misstatement. A review is limited primarily to inquiries

of

company personnel and analytical procedures applied to financial data and

thus provides less assurance than an audit. we have not performed an audit

and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention

that causes us to believe that the accompanying statement of un-audited

flnancial results prepared in accordance'with i-he applicable Accountint

standards specified under section 133 of the companies Act, 2013, read wit[

Rule 7 of the companies (Accounts) Rules, zou and other recognised

accounting practices and policies, has not disclosed the information requlred to

be disclosed in terms of Regulation 33 of the sEBl (Listing obligations and

Disclosure Requirements) Regulations, 2015, including the rianner in which it

is to be disclosed, or that it contains any material misstitement.

For V. Sankar Aiyar & Co.

Chartered Accountants

lGAl Firm Regn. 109208W

R. Raghuraman

Place : New Delhi

Dated : 1Oth February,2016

Partner

Membership No. 0813S0

Mumbai : 2-c' court chambers, 35, New Marlne Lines Mumbai - 400 o2o. Tel (022)

22oo 4465 | 2206 7440E-mait : mumbai@vsa.co.in

chennai : 41, Circular Road, United India colony, Kodambakkam, chennai 600 024 Tet (044) 2972 5720 E-mail : chennai@vsa.co.in

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Industries Limited: BSE Limited Stock ExchangeDocument12 pagesIndustries Limited: BSE Limited Stock ExchangeBishal GuptaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- An Introduction To Cost Terms and PurposesDocument35 pagesAn Introduction To Cost Terms and Purposesoddi gigiihNo ratings yet

- Depreciation and The Disposal of Non-Current Assets: Date DetailsDocument11 pagesDepreciation and The Disposal of Non-Current Assets: Date DetailsSCRIBDerNo ratings yet

- 10 Key Accounting PrinciplesDocument3 pages10 Key Accounting PrinciplesAbdullahNo ratings yet

- Entreprenerial Finance Master DocumentDocument65 pagesEntreprenerial Finance Master DocumentemilspureNo ratings yet

- Financial Forecasting & Planning: Funds, Cash BudgetDocument18 pagesFinancial Forecasting & Planning: Funds, Cash BudgetzamriNo ratings yet

- Ch14 P13 ModelDocument6 pagesCh14 P13 ModelJusto Valverde0% (4)

- Cost of CapitalDocument26 pagesCost of CapitalShaza NaNo ratings yet

- ACCTG 215 Quiz 1 TitleDocument5 pagesACCTG 215 Quiz 1 TitleJenny HuynhNo ratings yet

- Lcif - Pages 1 To 5Document6 pagesLcif - Pages 1 To 5Daniel Malillin0% (1)

- Test BankDocument15 pagesTest BankBWB DONALDNo ratings yet

- Intermediate Accounting IFRS Edition Chapter 18 RevenueDocument92 pagesIntermediate Accounting IFRS Edition Chapter 18 RevenueMagdalena Nababan100% (9)

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Finance for Managers in 40 CharactersDocument311 pagesFinance for Managers in 40 CharacterssanjibkrjanaNo ratings yet

- Accounts Receivable Classification and MeasurementDocument12 pagesAccounts Receivable Classification and MeasurementPrincess Darlyn AlimagnoNo ratings yet

- ACCOUNTING/ACTG MISC Valix Chapter 1-6Document22 pagesACCOUNTING/ACTG MISC Valix Chapter 1-6Marjorie PalmaNo ratings yet

- Acc117-Chapter 2Document26 pagesAcc117-Chapter 2Fadilah JefriNo ratings yet

- Reliance IndustriesDocument32 pagesReliance IndustriesZia AhmadNo ratings yet

- Grand Manufacturing net profit calculationDocument10 pagesGrand Manufacturing net profit calculationRichfredlyn Moreno100% (1)

- Chapter 5 ECO01H HandoutDocument57 pagesChapter 5 ECO01H HandoutMạnh Nguyễn VănNo ratings yet

- 2020 FA L4 To L10 StudentsDocument40 pages2020 FA L4 To L10 Students徐恺民No ratings yet

- Balance Sheet of Everest Kanto CylinderDocument2 pagesBalance Sheet of Everest Kanto Cylindersatya936No ratings yet

- ICAB Advanced Level Suggested Answers November December 2019Document61 pagesICAB Advanced Level Suggested Answers November December 2019Sharif MahmudNo ratings yet

- Bos 28432 CP 14Document53 pagesBos 28432 CP 14Basant Ojha100% (1)

- Holding Notes 2Document16 pagesHolding Notes 2idealNo ratings yet

- Spiceland SM ch11 PDFDocument79 pagesSpiceland SM ch11 PDFmas aziz100% (3)

- Analysis OF Corporate Performance Using Ratios-A Study ON Kingfisher AirlinesDocument41 pagesAnalysis OF Corporate Performance Using Ratios-A Study ON Kingfisher AirlinesRuchira Nandi100% (1)

- A Cash Conversion Cycle Approach To Liquidity AnalysisDocument8 pagesA Cash Conversion Cycle Approach To Liquidity Analysissohail0779No ratings yet

- AFM 2021 BatchDocument4 pagesAFM 2021 BatchDhruv Shah0% (1)

- Depreciation Accounting: Key Concepts and MethodsDocument81 pagesDepreciation Accounting: Key Concepts and Methodsgoel76vishalNo ratings yet