Professional Documents

Culture Documents

Microsoft Vs Ford Data Case

Uploaded by

Fis MalesoriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microsoft Vs Ford Data Case

Uploaded by

Fis MalesoriCopyright:

Available Formats

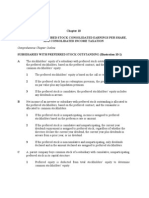

D ATA C ASE - C ASE 1

M I C R OS O F T C O R P O R A T I ON (MSFT) & F O R D M OT OR S (F)

FIN 7410

Fis Malsori

2/1/2016

Fis Malsori

2/1/2016

Introduction

The purpose of this study is to assess the financial health of two companies, that of Microsoft

Corporation (MSFT) and Ford Motors (F). These companies operate in different industries, and

the assessment will be conducted by analyzing trends and significant factors in their financial

indicators such as Liquidity Ratios, Profitability Margins, Capital Returns, Debt Managing Ratios,

and Valuation Ratios.

1)

a) Ford Motors (F)

Indicator/Year

2011

2012

2013

2014

$ 10.64

$ 12.95

$ 15.43

$ 15.50

4.11

4.02

4.09

4.05

Market Capitalization ($Billion)

$ 43.74

$ 51.99

$ 63.06

$ 62.70

Market Value Net Debt ($Billion)

$ 99.49

$ 105.06

$ 114.69

$ 119.17

Enterprise Value ($Billion)

$ 126.08

$ 141.39

$ 163.28

$ 171.11

Stock Price

Shares Outstanding (Billions)

Indicator/Year

2011

2012

2013

2014

Industry Average1

Liquidity Ratios

Current Ratio

Quick Ratio

Cash Ratio

1.82

1.74

0.67

1.94

1.83

0.71

2.04

1.94

0.76

2.01

1.91

0.70

N/A

Debt Management

Debt-to-Enterprise Ratio

Debt-to-Equity Ratio (Book Values)

0.79

6.62

0.74

6.59

0.70

4.35

0.70

4.80

N/A

0.76 (MRQ)

2.57

8.82

6.56

4.62

1.01 (TTM)

8.35%

14.83%

4.69%

4.22%

3.70%

4.87%

2.60%

2.21%

9.48%

10.71%

134.50%

35.52%

27.12%

12.85%

23.97%

6.46%

3.38%

2.51%

1.69%

18.67%

Interest Coverage Ratio

Profitability of Operations

EBIT Margin (%)

Net Profit Margin (%)

Return on Capital

Return on Equity (%)

ROIC (%)

1.31

1.09

Industry Average values represent the most recent quarter (MRQ), Trailing Twelve Months

(TTM) or a 5year average as found available on reuters.com

2

When calculating ROIC for the company a 35% tax rate on Taxable Profit is assumed.

1

Fis Malsori

2/1/2016

b) Microsoft Corporation (MSFT)

Indicator/Year

2011

Stock Price

2012

26.00

Shares Outstanding (Billions)

2013

30.59

34.54

2014

$

41.70

8.49

8.40

8.38

8.30

Market Capitalization ($Billion)

$ 220.74

$ 256.83

$ 289.27

$ 346.07

Market Value Net Debt ($Billion)

Enterprise Value ($Billion)

$ 223.05

Indicator/Year

2011

11.92

2012

11.94

$ 261.84

2013

2014

15.60

$ 301.07

22.65

$ 360.04

Industry Average3

Liquidity Ratios

Current Ratio

Quick Ratio

Cash Ratio

2.60

2.35

1.83

2.60

2.41

1.93

2.71

2.53

2.06

2.50

2.31

1.88

Debt-to-Enterprise Ratio

Debt-to-Equity Ratio (Book Values)

Interest Coverage Ratio

Profitability of Operations

EBIT Margin (%)

Net Profit Margin (%)

0.05

0.21

92.07

0.05

0.18

57.27

0.05

0.20

62.39

0.06

0.25

46.50

N/A

0.15(MRQ)

16.16(TTM)

38.8%

33.1%

29.5%

23.0%

34.4%

28.1%

32.0%

25.4%

23.6%

17.1%

Return on Capital

Return on Equity (%)

ROIC (%)4

40.6%

25.6%

25.6%

18.1%

27.7%

18.4%

24.6%

16.0%

17.4%

15.5%

2.83

1.57

N/A

Debt Management

Industry Average values represent the most recent quarter (MRQ), Trailing Twelve Months

(TTM) or a 5year average as found available on reuters.com

4

When calculating ROIC for the company a 35% tax rate on Taxable Profit is assumed.

Fis Malsori

2/1/2016

2) Enterprise Value

a) Ford Motors

When looking at the Enterprise Value Increase for Ford Motors (see Exhibit 1.0), we can see

that it has steadily increased throughout the four-year period, with a more significant increase in

the second year from $141.39 Billion to $163.28 Billion. The overall number of shares

outstanding for Ford Motors has not significantly changed and thus, cannot be the main driver of

the trend of its Enterprise Value Increase. Therefore, we can conclude that this increase can be

attributed to both Stock Price Increase as well as Net Debt Increase trends in the four-year

period. Fords Total Cash has also not had any substantial changes and, therefore, had no

significant impact on the Enterprise Value Increase.

b) Microsoft

On the other hand, when looking at Microsoft (see Exhibit 1.1) we can see a difference here in

what made its Enterprise Value Increase significantly over the course of 4 years. Considering a

number of factors such as the consistent number of shares outstanding, its Net Debt being

relatively low and any significant growth, combined with an increase in Total Cash from $52

Billion to $86 Billion (which would cause Enterprise Value to decrease), we can conclude that

the major driver of Microsofts Enterprise Value Growth is by far the substantial increases in

Stock Price over the four-year period.

Overall, when comparing the two firms, the composition of their enterprise values is quite

different with one thing in common being the substantial Stock Price increase. However, the

major difference is in the Net Debt of the companies, which is an indicator that the companies

finance their business in vastly different ways, which will be explained in the Ratio Analysis.

3) Liquidity Ratios

a) Ford

Fords Current Ratio shows a steady increase until last year (2014) when it dipped by only

0.03. Being above 2, the ratio indicates that Ford is able to meet its Current Liabilities with

enough Current Assets and still have some money left (Working Capital) for daily operations.

Similarly, when taking Inventory out of the equation, the Quick Ratio shows a similar trend, thus

indicating that Inventories are not Fords major component of Current Assets. On the other

hand, when looking at the companys Cash Ratio we can see that its Total Cash is not sufficient

to meet its current liabilities, yet, its trend is similar to the other two Liquidity Ratios. Comparing

3

Fis Malsori

2/1/2016

Fords Liquidity Ratios with the Industry Average tells us that Ford is better at meeting its current

liabilities than the average competitor is. An interesting observation to mention is the 0.1

decrease from the Current to the Quick Ratio of Ford after Inventories are taken out of the

equation, that is half the decrease when the same is done for the Industry Average Current and

Quick Ratios, thus, indicating that the average competitor has significantly more Inventory than

Ford does and that the average competitors Total Current Assets consist of a higher relative

dollar amount of Inventories than Fords Assets do.

b) Microsoft

Microsofts Liquidity Ratios showed an increase in 2013 and then a relatively significant

decrease in the following year. This can be explained by the big increase in Short-Term

Investments in 2013 and the slowing growth pace of these Investments in the last year

observed in the Balance sheet as opposed to the Total Current Liabilities that have kept their

growing pace without any slowing down in the last year. Similar to the Current Ratio, the Quick

and Cash Ratio have experienced the same trend overall. Interestingly, before taking out

Inventories, when comparing Microsofts Current Ratio we can see that the Industry Average is

Higher than the tech giants, and following the calculation and comparison of the Quick Ratio we

can then see that Microsofts Quick Ratio is higher than that of the Industry Average, and this

strongly suggests that the average competitor has substantial amounts of inventory on hand as

opposed to Microsoft.

4) Debt Management

a) Ford

The Car manufacturing giant has a very high Debt to Equity Ratio when compared to the

Industry Average. This indicates that Ford finances its business primarily with debt. Fords Debt

to Enterprise Ratio has continuously been decreasing mainly driven by inconsistent paces of

growth in Net Debt & Enterprise Value. The significant difference in comparing Ford with the

Industry is in its Debt to Equity Ratio being vastly higher than the industry average and,

therefore, indicating that its competitors finance themselves with less Debt than Ford does.

Its Interest Coverage Ratio, however, shows that Ford is better at managing its Debt than the

average Competitor in the car manufacturing industry.

b) Microsoft

Microsoft Corporation, on the other hand, is obviously less leveraged than Ford Motors. Its Debt

to Equity Ratio is as low as 0.25 in the most recent year (2014). When comparing this Ratio to

4

Fis Malsori

2/1/2016

its competitors, Microsoft is slightly more leveraged than the average competitor, however, its

Interest Coverage Ratio clearly shows that paying back debt and managing it is not a major

issue. It has the ability to pay 3 times the Interest expense that the average competitor can with

its Operating Income. Its Debt to Enterprise Ratio is also a positive indicator that the tech giant

is not highly leveraged. We can conclude that Microsoft manages its debt very well.

5) Profitability of Operations & Return on Capital

We have to be cautious when comparing the two companies for the fact that they operate in

different industries. However, looking at their Profit Margins, we can see that Microsoft is

notably more efficient in their daily operations than Ford is. Oddly, in 2011 and 2013, Ford

shows a lower EBIT Margin than its Net Margin which is explained by a so-called Tax

Provision for income taxes account in their Income Statement that has artificially grown

Fords bottom line. When comparing Ford with the industry average, we can conclude that the

average car manufacturing company is around four to five times more efficient in generating

taxable income.

Microsofts Profitability Margins and Returns on Capital, despite the decreasing trend, remain

significantly higher than the Industry Average. The notable plunge in Microsofts ROE & ROIC is

mainly due to a decrease in Operating profit which has been caused by a non-recurring other

operating expenses of roughly $6 Billion. A more suited measure of comparison between the

two companies would be the operating margins, since the equity related valuations will capture

debt financing risk.

6) Valuation Ratios

To compare Microsoft and Ford, a more suitable Valuation Ratio to use would be the EV/EBIT

Ratio, for the following reason:

If we would choose to compare them with the P/E Ratio, which takes into account EPS that is

comprised of Net Income that is derived after Income Expense and Taxes are taken out of

EBIT, we would have a financing component in our comparison for the simple fact that the two

companies finance themselves very differently.

On the other hand, the Enterprise Value/EBIT Ratio adds the Income and Tax expense back

into the equation to give a more isolated Operational perspective to the Valuation of the

company.

5

Fis Malsori

2/1/2016

Exhibits

Exhibit 1.0 Ford Motors

Ford Motors

180

160

140

120

100

80

60

40

20

0

Market Value Net Debt ($Billion)

2011

Enterprise Value ($Billion)

2012

2013

2014

Exhibit 1.1 Microsoft Corporation

Microsoft Corporation

400

350

300

250

200

150

100

50

0

Market Value Net Debt ($Billion)

2011

Enterprise Value ($Billion)

2012

2013

2014

You might also like

- 1Document36 pages1Soumyadeep BoseNo ratings yet

- Product Life CycleDocument5 pagesProduct Life CycleEkkala Naruttey0% (1)

- Appendix - 8A The Maturity ModelDocument10 pagesAppendix - 8A The Maturity ModelAndreea IoanaNo ratings yet

- Marketing Plan of PIADocument44 pagesMarketing Plan of PIAawais chishtyNo ratings yet

- AirAsia - Business StrategyDocument22 pagesAirAsia - Business StrategyAnhbonnieNo ratings yet

- Mobilink Management ReportDocument76 pagesMobilink Management Reportibrahim_ghaznaviNo ratings yet

- Differences Between Traditional Carriers and Low Cost Carriers StrategiesDocument5 pagesDifferences Between Traditional Carriers and Low Cost Carriers StrategiesRd Indra AdikaNo ratings yet

- Assignment 1 EXAMPLEDocument8 pagesAssignment 1 EXAMPLEhanhilah100% (1)

- Annual Report 2017: Honda Motor Co., LTDDocument42 pagesAnnual Report 2017: Honda Motor Co., LTDCarla OrozcoNo ratings yet

- E-Government in Finland: An AssessmentDocument1 pageE-Government in Finland: An AssessmentemakhuzNo ratings yet

- Ford Pinto Engineering DisasterDocument1 pageFord Pinto Engineering DisasterfettaneNo ratings yet

- RFP For Jet Airways v2Document17 pagesRFP For Jet Airways v2rahulalwayzzNo ratings yet

- Chapter 2 Competitiveness Strategy and ProductivityDocument55 pagesChapter 2 Competitiveness Strategy and ProductivityTabassum BushraNo ratings yet

- MAS Financial Ratio AnalysisDocument22 pagesMAS Financial Ratio AnalysisIfa Chan0% (1)

- Ford Motor Corp FinalDocument38 pagesFord Motor Corp FinalKumar Vikas0% (1)

- Assignment On Apple Inc.Document6 pagesAssignment On Apple Inc.Mohammad RakibNo ratings yet

- Ethical Problem of OutsourcingDocument2 pagesEthical Problem of OutsourcingVũ RainNo ratings yet

- A Template For Structural Analysis of IndustriesDocument5 pagesA Template For Structural Analysis of IndustriesSachin MenonNo ratings yet

- Finance Term PaperDocument29 pagesFinance Term PaperPlato KhisaNo ratings yet

- Emirates Telecommunications Corporation "Etisalat": By: Maha Kanz (CFA)Document11 pagesEmirates Telecommunications Corporation "Etisalat": By: Maha Kanz (CFA)memo ibNo ratings yet

- Financial Statement Analysis of HUL and Dabur India LtdDocument12 pagesFinancial Statement Analysis of HUL and Dabur India LtdEdwin D'SouzaNo ratings yet

- Corporate Strategy - Air IndiaDocument7 pagesCorporate Strategy - Air Indiapavananandmr0% (1)

- EVA Vs ROIDocument5 pagesEVA Vs ROINikhil KhobragadeNo ratings yet

- Goldstar Example of Ratio AnalysisDocument13 pagesGoldstar Example of Ratio AnalysisRoshan SomaruNo ratings yet

- CASE-STUDY ON INDIA'S GROWING AVIATION INDUSTRYDocument14 pagesCASE-STUDY ON INDIA'S GROWING AVIATION INDUSTRYSurabhi ParasharNo ratings yet

- Corporate Finance Assignment 1Document3 pagesCorporate Finance Assignment 1tientran91No ratings yet

- Case DELL Overtake HP Final - EdDocument20 pagesCase DELL Overtake HP Final - Edas1klh0No ratings yet

- Marketing Strategy: Presented By: 1. Kajal Pradhane 2. Bhakti Rane 3. Piyush TiwariDocument17 pagesMarketing Strategy: Presented By: 1. Kajal Pradhane 2. Bhakti Rane 3. Piyush TiwariBhakti RaneNo ratings yet

- CM 703 Change ManagementDocument9 pagesCM 703 Change Managementahsan1379No ratings yet

- Case Study PIADocument5 pagesCase Study PIAMystiquemashalNo ratings yet

- Sample Individual AssignmentDocument15 pagesSample Individual AssignmentZainuddin Abu Nasir100% (1)

- FSA Atlas Honda AnalysisDocument20 pagesFSA Atlas Honda AnalysisTaimoorNo ratings yet

- PESTLE ANALYSIS - GLOBAL FRAMEWORKDocument9 pagesPESTLE ANALYSIS - GLOBAL FRAMEWORKRahul MandalNo ratings yet

- Case Ans MKT 201Document9 pagesCase Ans MKT 201Shihab Uddin AhmedNo ratings yet

- Chap 017Document14 pagesChap 017siefbadawy1No ratings yet

- Analyzing Micro Environment Factors Impacting Airline BusinessDocument9 pagesAnalyzing Micro Environment Factors Impacting Airline BusinessUyen Huynh100% (3)

- Global Dimensions of Management and International BusinessDocument7 pagesGlobal Dimensions of Management and International Businesskakali kayal100% (1)

- Suzlon SolutionsDocument4 pagesSuzlon SolutionsMahendra NutakkiNo ratings yet

- Continental's EDS partnership under reviewDocument7 pagesContinental's EDS partnership under reviewtimduncan801044No ratings yet

- BPR in Pakistan RailwaysDocument25 pagesBPR in Pakistan Railwayssalman2605751100% (2)

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89No ratings yet

- Supply ChainDocument29 pagesSupply ChainArjun DasNo ratings yet

- Impact of Virtual Advertising in Sports EventsDocument19 pagesImpact of Virtual Advertising in Sports EventsRonak BhandariNo ratings yet

- Common Size Analys3esDocument5 pagesCommon Size Analys3esSaw Mee LowNo ratings yet

- Spice JetDocument4 pagesSpice JetPratik JagtapNo ratings yet

- Company Analysis SAPMDocument19 pagesCompany Analysis SAPMtincu_01No ratings yet

- Financial Derivatives: The Role in The Global Financial Crisis and Ensuing Financial ReformsDocument26 pagesFinancial Derivatives: The Role in The Global Financial Crisis and Ensuing Financial Reformsqazwsx4321No ratings yet

- Space Matrix MalindoDocument7 pagesSpace Matrix MalindomaliklduNo ratings yet

- British Airways: Submitted By, Meena Mohammed Hammem Mohammed Rahmethulla Mythiliswaran VaishnaviDocument49 pagesBritish Airways: Submitted By, Meena Mohammed Hammem Mohammed Rahmethulla Mythiliswaran VaishnaviSairam Aryan50% (2)

- PM T1Document4 pagesPM T1SiewChenSohNo ratings yet

- Shashank Yadvendra (19035322) MBA Sheffield Hallam UniversityDocument23 pagesShashank Yadvendra (19035322) MBA Sheffield Hallam Universityshashankyadav100% (2)

- The Boeing Company Financial Analysis - 3Document33 pagesThe Boeing Company Financial Analysis - 3Marina LubkinaNo ratings yet

- Good Food Served Quietly by Hearing Impaired StaffDocument3 pagesGood Food Served Quietly by Hearing Impaired StaffKishore KintaliNo ratings yet

- 2019-09-21T173710.854Document2 pages2019-09-21T173710.854Mikey MadRatNo ratings yet

- Lecture 19Document32 pagesLecture 19Riaz Baloch NotezaiNo ratings yet

- Not ADocument4 pagesNot AKasia PilecwzNo ratings yet

- 7100 Tarify Na Uslugi Aeroportov I Aeronavigatsionnyh Sluzhb Izdanie 2014Document612 pages7100 Tarify Na Uslugi Aeroportov I Aeronavigatsionnyh Sluzhb Izdanie 2014Doris AchengNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Private Sector Operations in 2020—Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2020—Report on Development EffectivenessNo ratings yet

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Us Evaluating Ma Through A Changing Utility Lens PDFDocument20 pagesUs Evaluating Ma Through A Changing Utility Lens PDFFis MalesoriNo ratings yet

- Wal-Mart Case Write-Up F.MDocument8 pagesWal-Mart Case Write-Up F.MFis Malesori0% (1)

- Case No. 5 - Midland EnergyDocument2 pagesCase No. 5 - Midland EnergyFis MalesoriNo ratings yet

- Analytical Decision Making vs. IntuitionDocument2 pagesAnalytical Decision Making vs. IntuitionFis MalesoriNo ratings yet

- Marketing 8680: Database Marketing Abc5 Fis Malësori 14254587Document7 pagesMarketing 8680: Database Marketing Abc5 Fis Malësori 14254587Fis MalesoriNo ratings yet

- Airline Simulation PresentationDocument20 pagesAirline Simulation PresentationFis Malesori33% (6)

- Financial Statement AnalysisDocument18 pagesFinancial Statement Analysis223001006No ratings yet

- Application QuestionsDocument8 pagesApplication QuestionsAbdelnasir HaiderNo ratings yet

- RAO and SAOB2021Document44 pagesRAO and SAOB2021Sha RonNo ratings yet

- Hybrid and Derivative SecuritiesDocument30 pagesHybrid and Derivative Securitiesmimi96100% (2)

- Target Corporation AnalysesDocument5 pagesTarget Corporation AnalysesAbdul HadiNo ratings yet

- Kogas Ar 2020Document11 pagesKogas Ar 2020Vinaya NaralasettyNo ratings yet

- Decentralized Venture Capital Research Paper by BullPerksDocument19 pagesDecentralized Venture Capital Research Paper by BullPerksSerhat ErmanNo ratings yet

- Midterm or Pre Final Exam in Bus Com Trimex Pup CampusesDocument8 pagesMidterm or Pre Final Exam in Bus Com Trimex Pup CampusesmahilomferNo ratings yet

- What is Proration in Mergers & AcquisitionsDocument2 pagesWhat is Proration in Mergers & AcquisitionsDanica BalinasNo ratings yet

- Capital Budgeting Techniques - pp13Document53 pagesCapital Budgeting Techniques - pp13Micheal WorthNo ratings yet

- PMS Reckoner SeptDocument7 pagesPMS Reckoner SeptsendtokrishmunNo ratings yet

- A Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Document12 pagesA Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Kshitij ThakurNo ratings yet

- IAS 14 - Segment ReportingDocument34 pagesIAS 14 - Segment Reportingwarsidi100% (2)

- NSE IFSC - Member DirectoryDocument1 pageNSE IFSC - Member DirectoryYash MangalNo ratings yet

- ACE Variable IC Online Mock Exam - 08182021Document11 pagesACE Variable IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- On July 1 2018 Truman Company Acquired A 70 PercentDocument1 pageOn July 1 2018 Truman Company Acquired A 70 PercentAmit PandeyNo ratings yet

- Avoiding Fraudulent TransfersDocument8 pagesAvoiding Fraudulent TransfersNamamm fnfmfdnNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Chapter 02-Acc 111-KuDocument5 pagesChapter 02-Acc 111-KushiieeNo ratings yet

- Business Valuation - DR Amit Bagga - Session Delivery Plan - M Oct 22 - T2 - SYDDocument3 pagesBusiness Valuation - DR Amit Bagga - Session Delivery Plan - M Oct 22 - T2 - SYDRadNo ratings yet

- Caplin Point LabDocument76 pagesCaplin Point Lab40 Sai VenkatNo ratings yet

- Modifying The Cash Conversion Cycle: Revealing Concealed Advance PaymentsDocument13 pagesModifying The Cash Conversion Cycle: Revealing Concealed Advance Paymentspriyankabatra.nicmNo ratings yet

- CFI5102201412 Advanced Corporate Financial StrategyDocument5 pagesCFI5102201412 Advanced Corporate Financial StrategyFungai MukundiwaNo ratings yet

- Capital Budgeting TechniquesDocument13 pagesCapital Budgeting TechniquesShashiprakash SainiNo ratings yet

- Finance Function - Managerial & Routine Finance FunctionsDocument8 pagesFinance Function - Managerial & Routine Finance FunctionsRavikumar GunakalaNo ratings yet

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocument16 pagesSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaNo ratings yet

- Lehman Brothers Examiners Report COMBINEDDocument2,292 pagesLehman Brothers Examiners Report COMBINEDTroy UhlmanNo ratings yet

- CO-MBAX9141-Term 3-MBAX9141 Mergers and Acquisitions - 2021Document8 pagesCO-MBAX9141-Term 3-MBAX9141 Mergers and Acquisitions - 2021naveed azeemNo ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet