Professional Documents

Culture Documents

Weekly Trends February 26, 2016

Uploaded by

dpbasicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Trends February 26, 2016

Uploaded by

dpbasicCopyright:

Available Formats

Weekly Trends

Ryan Lewenza, CFA, CMT, Private Client Strategist

February 26, 2016

Youre Fired!

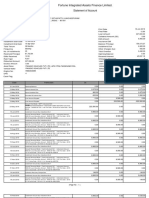

Equity Market YTD Returns (%)

The equity markets hate uncertainty, and thats exactly what we have in the

current US presidential primaries. But with Super Tuesday on March 1, we

should have a lot more clarity around the Republican and Democratic

Presidential candidate.

Historically, US equities have done ok during election years, with the S&P 500

Index (S&P 500) returning 6.1% on a price return basis. However, this is below

nd

the average of 8.7% for all years, and returns have been poor for 2 term

nd

Presidents. In US election years for 2 term Presidents, the S&P 500 has

returned -6%. However, its important to note that this average includes the

2000 and 2008 meltdowns. If we exclude 2008 (-38.5%) under George W Bush,

then the average return increases to 2.8%. Therefore, we believe the bears may

nd

be overplaying this market statistic of 2 term Presidents.

From a policy perspective we believe the key issues in the election will be the

economy, healthcare, environment and deficit. With the Republicans controlling

both the House and Senate, a Republican Presidential win would be huge for the

right, and likely result in dramatic policy changes following two terms of a

Democratic President.

There is a lot at stake for both the markets and policy in this election. We expect

market volatility to remain elevated until we get greater clarity on the party

leaders. However, as the frontrunner and possible winner of the US Presidential

election emerges, we expect the equity markets to stabilize and begin to move

higher.

Chart of the Week

Weekly count

1,200

"Donald Trump" Story Count (LHS)

VIX Index (RHS)

32

r = .70

26

800

23

600

20

400

17

S&P 500

-4.1

Russell 2000

-8.8

MSCI World

-6.5

MSCI Europe

-10.7

MSCI EAFE

-9.4

MSCI EM

-7.4

-15

Canadian Sectors

-10

-5

Weight

Recommendation

Consumer Discretionary

6.7

Market weight

Consumer Staples

4.7

Market weight

Energy

18.3

Market weight

Financials

38.1

Market weight

Health Care

3.0

Market weight

Industrials

8.0

Overweight

Technology

3.2

Overweight

Materials

9.5

Underweight

Communications

5.9

Overweight

Utilities

2.5

Underweight

Level

Reading

Technical Considerations

S&P/TSX Composite

12,817.5

50-DMA

12,622.7

Uptrend

200-DMA

13,694.7

Downtrend

53.9

Neutral

16,000

15,000

14,500

14,000

13,500

13,000

12,500

12,000

11,500

0

27-Feb

-0.5

15,500

29

1,000

200

-1.5

S&P/TSX Small Cap

RSI (14-day)

US Presidential Primaries Are Contributing To Market Volatility

1,400

S&P/TSX Comp

14

11,000

S&P/TSX

50-DMA

200-DMA

11

27-Apr

27-Jun

27-Aug

27-Oct

27-Dec

Source: Bloomberg, Raymond James Ltd.

Source: Bloomberg, Raymond James Ltd.

Sectors are based on Bloomberg classifications

Please read domestic and foreign disclosure/risk information beginning on page 4

Raymond James Ltd. 5300-40 King St W. | Toronto ON Canada M5H 3Y2.

2200-925 West Georgia Street | Vancouver BC Canada V6C 3L2.

Weekly Trends

February 26, 2016 | Page 2 of 4

Youre Fired!

Things are starting to heat up in the US presidential primaries. Donald Trump recently

won in South Carolina and Nevada, widening his lead in the Republican race.

Following the South Carolina primary, the field narrowed with Jeb Bush suspending

his campaign. Were this Donald Trumps reality show The Celebrity Apprentice, Trump

would surely have relished the opportunity to use his coined phrase, Youre fired to

Jeb Bush, given their clear disdain for each other. On the Democratic side, Hillary

Clinton gained momentum with a win over Barry Sanders in the Nevada caucus.

Currently, Hillary has 502 delegates (2,383 needed) to Sanders 70. While both Clinton

and Trump increased their respective leads, Tuesday March 1, or Super Tuesday will

likely be the defining moment for this election, with 11 states holding primaries. With

the run to the White House picking up, we thought it would be timely to discuss the

market implications of US Presidential elections and highlight the key issues at stake.

Let us be very clear at the outset that we are not endorsing any political party, and

are solely looking at the equity market implications from a quantitative or historical

context. With that said, we analyzed US equity returns during elections years, with

the key findings outlined below:

Since 1945, there have been 18 US Presidential elections. On average, the

S&P 500 has returned 6.1% on a price return basis during elections years,

which is below the average of 8.7% for all years.

The odds of a positive return are higher for election years at 76% versus

70% for all years.

nd

Equity returns for 2 term Presidents tend be poor during US election

nd

years. In US election years for 2 term Presidents, the S&P 500 has

returned -6%. However, its important to note that this average includes the

2000 and 2008 meltdowns. If we exclude 2008 (-38.5%) under George W

Bush, then the average return increases to 2.8%. Therefore, we believe the

nd

bears may be overplaying this market statistic of 2 term Presidents.

Finally, we examined equity returns under different combinations of

Republican/Democratic Presidents, House, and Senates. With the

Republicans controlling both the House and Senate, we can only have a DRR

(i.e. Democratic President, Republican House and Senate) or a RRR. Under

DRR combinations the S&P 500 has returned 13.3% versus RRR

combinations of -1.2% since 1929.

S&P 500 Returns During Presidential Elections

S&P 500 Returns Under The Different Combinations

10%

5%

0%

-5%

-10%

S&P 500 During 2nd Term Presidental Yrs ('52, '60, '88, '00, '08)

1

12

23

34

45

56

67

78

89

100

111

122

133

144

155

166

177

188

199

210

221

232

243

254

-15%

S&P 500 During Presidental Election Yrs (1945 to 2012)

Yearly Returns

Combination (Pres/House/Senate)

DDD

DRD

DRR

RDD

RDR

RRD

RRR

Trading Days

Source: Bloomberg, Raymond James Ltd. Note D represents Democrat and R represents Republican. Returns are since 1929.

Average %

9.3%

13.6%

13.3%

7.1%

3.7%

-18.2%

-1.2%

Count

34

4

9

20

8

2

10

Weekly Trends

February 26, 2016 | Page 3 of 4

Key Issues

Below we discuss the key political issues in this US presidential election. Again, our

aim is to be impartial and unbiased, as we attempt to summarize the salient

positions of the parties and leading candidates. They include:

Economy: The economy is the central issue among voters. Specifically,

stagnant wages, income inequality, high underemployment and lackluster

economic growth. Both parties are presenting policies aimed at addressing

middle class stagnation given median real household income of US$54,440

is at the same level as 1989. The Democrats are proposing to raise the

minimum wage, provide tax cuts to middle class and small business, and

increase infrastructure spending. While there is no clear consensus among

the remaining Republicans, tax reform, regulatory reform, and repealing

Obamacare are common views among the contenders. The frontrunner

Donald Trump is advocating for a rollback of recent trade agreements, and

getting tougher on trade with countries like China and Mexico.

Healthcare: Obamacare remains a very divisive and controversial policy. The

Democrats would keep the policy, with Senator Sanders taking it further by

offering universal health care, similar to Canada. The Republicans are united

in their continued repudiation of Obamacare, with leading contenders

supporting a repeal of the program.

Environment: This remains one of the more partisan issues in this race. The

Democrats believe in global warming and taking more aggressive action to

combat climate change. Increasing renewables, reducing subsidies to the

energy industry, and reducing emissions to meet UN targets are key

Democrat proposals. Broadly, Republican candidates question global

warming, or if it is occurring, the believe it is likely not manmade.

Deficit: With the total US outstanding debt recently breaching the US$19 tln

mark, this is a hot button issue, particularly for the Republican party. There

is a greater focus on addressing the deficits from the Republican party,

however little consensus on how to do it. On the Democrat side, Hillary

Clinton has put a greater emphasis on balancing budgets and addressing the

debt problem than Sanders. Sanders is proposing higher taxes on the

wealthiest Americans to help deal with the debt problem.

There is a lot at stake for both the markets and policy in this election. We expect

market volatility to remain elevated until we get greater clarity on the party leaders.

However, as the frontrunner and possible winner of the US Presidential election

emerges, we expect the equity markets to stabilize and begin to move higher.

US Household Income Is Stagnant

While US Debt Hit A New Record Of US$19 Tln

$60,000

(in billions)

$20,000

US Government Debt Outstanding

$18,000

$55,000

$16,000

$14,000

$50,000

$12,000

$10,000

$45,000

$8,000

$6,000

$40,000

$4,000

US Household Median Income Adjusted For Inflation

$35,000

$2,000

$0

'68

'71

'74

'77

'80

'83

'86

'89

Source: Bloomberg, Raymond James Ltd.

'92

'95

'98

'01

'04

'07

'10

'13

'50

'55

'60

'65

'70

'75

'80

'85

'90

'95

'00

'05

'10

'15

Weekly Trends

February 26, 2016 | Page 4 of 4

Important Investor Disclosures

Complete disclosures for companies covered by Raymond James can be viewed at: www.raymondjames.ca/researchdisclosures.

This newsletter is prepared by the Private Client Services team (PCS) of Raymond James Ltd. (RJL) for distribution to RJLs retail clients. It is not a

product of the Research Department of RJL.

All opinions and recommendations reflect the judgement of the author at this date and are subject to change. The authors recommendations may

be based on technical analysis and may or may not take into account information contained in fundamental research reports published by RJL or its

affiliates. Information is from sources believed to be reliable but accuracy cannot be guaranteed. It is for informational purposes only. It is not

meant to provide legal or tax advice; as each situation is different, individuals should seek advice based on their circumstances. Nor is it an offer to

sell or the solicitation of an offer to buy any securities. It is intended for distribution only in those jurisdictions where RJL is registered. RJL, its

officers, directors, agents, employees and families may from time to time hold long or short positions in the securities mentioned herein and may

engage in transactions contrary to the conclusions in this newsletter. RJL may perform investment banking or other services for, or solicit

investment banking business from, any company mentioned in this newsletter. Securities offered through Raymond James Ltd., Member-Canadian

Investor Protection Fund. Financial planning and insurance offered through Raymond James Financial Planning Ltd., not a Member-Canadian

Investor Protection Fund.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual funds. Please read the prospectus before

investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The results presented

should not and cannot be viewed as an indicator of future performance. Individual results will vary and transaction costs relating to investing in

these stocks will affect overall performance.

Information regarding High, Medium, and Low risk securities is available from your Financial Advisor.

RJL is a member of Canadian Investor Protection Fund. 2016 Raymond James Ltd.

You might also like

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Fidelity Multi-Sector Bond Fund - ENDocument3 pagesFidelity Multi-Sector Bond Fund - ENdpbasicNo ratings yet

- The Perfect StormDocument41 pagesThe Perfect StormNickKr100% (1)

- 2018 OutlookDocument18 pages2018 OutlookdpbasicNo ratings yet

- Shareholders Agreement (Two Shareholders)Document18 pagesShareholders Agreement (Two Shareholders)Legal Forms91% (11)

- Pay Attention To What The Market Is SayingDocument11 pagesPay Attention To What The Market Is SayingEmmy ChenNo ratings yet

- Understanding Natural Gas and LNG OptionsDocument248 pagesUnderstanding Natural Gas and LNG OptionsTivani MphiniNo ratings yet

- Clearance Procedures for ImportsDocument36 pagesClearance Procedures for ImportsNina Bianca Espino100% (1)

- BRIC EconomiesDocument12 pagesBRIC EconomiesLinh BùiNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash FlowsDocument5 pagesChapter 13 Capital Budgeting Estimating Cash FlowsStephen Ayala100% (1)

- Closing OperationsDocument88 pagesClosing OperationsNavyaKmNo ratings yet

- Hillary's 2016 Presidential Campaign Marketing PlanDocument19 pagesHillary's 2016 Presidential Campaign Marketing PlanMariia ShostakNo ratings yet

- State of The RaceDocument3 pagesState of The RaceTIMEThePageNo ratings yet

- Director Service Agreement Free SampleDocument3 pagesDirector Service Agreement Free Sampleapi-235666177No ratings yet

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- The Wall Street Journal November 14 2016Document44 pagesThe Wall Street Journal November 14 2016Hameleo1000No ratings yet

- Consumer Buying Behaviour For Ball PensDocument110 pagesConsumer Buying Behaviour For Ball PensSalahuddin Saiyed100% (1)

- 01 - Amaravati Project Report Edition No4 Status Feb 2019 PDFDocument180 pages01 - Amaravati Project Report Edition No4 Status Feb 2019 PDFNidz ReddyNo ratings yet

- Running Head: THE U.S ECONOMY1Document10 pagesRunning Head: THE U.S ECONOMY1Hillary Musembi KinyamasyoNo ratings yet

- Tax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Document2 pagesTax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Randy GusmanNo ratings yet

- Market Commentary 11-12-12Document4 pagesMarket Commentary 11-12-12CLORIS4No ratings yet

- US Economy: Election Watch 2012 - ImplicationsDocument16 pagesUS Economy: Election Watch 2012 - ImplicationsNotas De BolsaNo ratings yet

- The 2016 US Presidential ElectionDocument8 pagesThe 2016 US Presidential ElectionarancaNo ratings yet

- Winter 2017Document3 pagesWinter 2017Amin KhakianiNo ratings yet

- Terranova Calendar Nov 2012Document6 pagesTerranova Calendar Nov 2012B_U_C_KNo ratings yet

- Reuters BreakingViews Ebook - "Bridging The Divide: The Economic and Fiscal Challenges Facing The Next U.S. President"Document42 pagesReuters BreakingViews Ebook - "Bridging The Divide: The Economic and Fiscal Challenges Facing The Next U.S. President"Matthew Keys0% (1)

- Weekly Market Commentary 1-23-2012Document4 pagesWeekly Market Commentary 1-23-2012monarchadvisorygroupNo ratings yet

- Lane Asset Management Commentary For November 2016Document14 pagesLane Asset Management Commentary For November 2016Edward C LaneNo ratings yet

- Ulman Financial Newsletter - 2017-01Document8 pagesUlman Financial Newsletter - 2017-01Clay Ulman, CFP®No ratings yet

- No, The US Is Not Greece: June 27, 2011 630-517-7756Document1 pageNo, The US Is Not Greece: June 27, 2011 630-517-7756Roger LingleNo ratings yet

- Foxhall Capital Management, Inc.: The Foxhall Global OutlookDocument5 pagesFoxhall Capital Management, Inc.: The Foxhall Global OutlookRoger LingleNo ratings yet

- Bain Macro Trends Group Briefing Points: What The US Election Means For Business and The EconomyDocument2 pagesBain Macro Trends Group Briefing Points: What The US Election Means For Business and The EconomyvikrantNo ratings yet

- Weekly Market Commentary 9/4/2012Document4 pagesWeekly Market Commentary 9/4/2012monarchadvisorygroupNo ratings yet

- Running Head: The U.S Economy 1Document10 pagesRunning Head: The U.S Economy 1Hillary Musembi KinyamasyoNo ratings yet

- Running Head: ECONOMICS PAPERDocument7 pagesRunning Head: ECONOMICS PAPERVa SylNo ratings yet

- October Surprise?: The Special Program of Weekly Message Tracking Says, "Maybe"Document4 pagesOctober Surprise?: The Special Program of Weekly Message Tracking Says, "Maybe"TDGoddardNo ratings yet

- Democracy Corps Democrat Strategy October SurpriseDocument4 pagesDemocracy Corps Democrat Strategy October SurpriseKim HedumNo ratings yet

- Lane Asset Management Stock Market Commentary For January 2017Document9 pagesLane Asset Management Stock Market Commentary For January 2017Edward C LaneNo ratings yet

- The Macro Strategist: The Obama Factor in The Stock MarketDocument7 pagesThe Macro Strategist: The Obama Factor in The Stock MarketMario RossiNo ratings yet

- Ion and Paul RyanDocument2 pagesIon and Paul RyanannadeeaNo ratings yet

- Winning Easy; Governing HardDocument4 pagesWinning Easy; Governing HardMichael BenzingerNo ratings yet

- Weekly Trends October 9, 2015Document4 pagesWeekly Trends October 9, 2015dpbasicNo ratings yet

- Dave Rosenberg 2018 Economic OutlookDocument9 pagesDave Rosenberg 2018 Economic OutlooksandipktNo ratings yet

- Economic Warfare and Weaponization of Trade Impacts US EconomyDocument21 pagesEconomic Warfare and Weaponization of Trade Impacts US EconomysupriyaNo ratings yet

- HSIC January 13, 2018:: Holy Spirit Investment Club NotesDocument25 pagesHSIC January 13, 2018:: Holy Spirit Investment Club NotesElizabeth CullyNo ratings yet

- Financial Sense Bolin November 2016Document36 pagesFinancial Sense Bolin November 2016Financial SenseNo ratings yet

- Presidents Blinder Watson Nov2013Document57 pagesPresidents Blinder Watson Nov2013Ahmed YousufzaiNo ratings yet

- Not For UseDocument352 pagesNot For UseElizabeth CaseyNo ratings yet

- US PESTLE Insights 2021Document95 pagesUS PESTLE Insights 2021Rocky VNo ratings yet

- 2017-02 Counting On Trump To DeliverDocument4 pages2017-02 Counting On Trump To DeliverMichael BenzingerNo ratings yet

- Strategy ZIM 1120 CtaDocument57 pagesStrategy ZIM 1120 CtaaejNo ratings yet

- Weekly Market Commentary 10.29.2012Document3 pagesWeekly Market Commentary 10.29.2012monarchadvisorygroupNo ratings yet

- Trade Policy Transitions Three Eras of U.S. Trade PDFDocument49 pagesTrade Policy Transitions Three Eras of U.S. Trade PDFWilliam WulffNo ratings yet

- Green Span UsaDocument2 pagesGreen Span Usahpedrero9532No ratings yet

- UpdateDocument2 pagesUpdatedwernli1No ratings yet

- The Usa Presidential Elections 2016Document11 pagesThe Usa Presidential Elections 2016Wim VerjansNo ratings yet

- Weekly Market Commentary 7-3-2012Document3 pagesWeekly Market Commentary 7-3-2012monarchadvisorygroupNo ratings yet

- Journal of Multinational Financial Management: Robert N. Killins, Thanh Ngo, Hongxia WangDocument27 pagesJournal of Multinational Financial Management: Robert N. Killins, Thanh Ngo, Hongxia WanggustavoNo ratings yet

- Winter 2017 NSDocument2 pagesWinter 2017 NSAmin KhakianiNo ratings yet

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeDocument1,553 pagesEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassNo ratings yet

- Weekly Economic Commentary 11-5-2012Document5 pagesWeekly Economic Commentary 11-5-2012monarchadvisorygroupNo ratings yet

- March 4 Weekly Economic UpdateDocument2 pagesMarch 4 Weekly Economic UpdateDoug PotashNo ratings yet

- Is Volatility in Mean ReversionDocument3 pagesIs Volatility in Mean ReversionZay Min HtetNo ratings yet

- The Self-Doubting Superpower - Foreign AffairsDocument13 pagesThe Self-Doubting Superpower - Foreign AffairsArmenisn RossoneroNo ratings yet

- Facts: Truth or ConsequencesDocument7 pagesFacts: Truth or ConsequencesJames BradleyNo ratings yet

- Byron Wien - The Ten Surprises of 2014Document77 pagesByron Wien - The Ten Surprises of 2014SebastianNo ratings yet

- Monday's Market Minute - 5-9-16 PDFDocument4 pagesMonday's Market Minute - 5-9-16 PDFIncome Solutions Wealth ManagementNo ratings yet

- Financial Crisis Means: IntroductionDocument3 pagesFinancial Crisis Means: IntroductionKaushlya DagaNo ratings yet

- Trumponomics Early ResultsDocument24 pagesTrumponomics Early ResultsGuillermo GaleaNo ratings yet

- Mehlman Q3 2015 Washington Update (July 7)Document33 pagesMehlman Q3 2015 Washington Update (July 7)DavidKiharaNo ratings yet

- A Short History of Significant American Recessions, Depressions, and Panics: Why Conservative Economic Theory Does Not WorkFrom EverandA Short History of Significant American Recessions, Depressions, and Panics: Why Conservative Economic Theory Does Not WorkNo ratings yet

- Thackray Newsletter 2018 08 AugustDocument9 pagesThackray Newsletter 2018 08 AugustdpbasicNo ratings yet

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicNo ratings yet

- BMO ETF Portfolio Strategy Report: Playing Smart DefenseDocument7 pagesBMO ETF Portfolio Strategy Report: Playing Smart DefensedpbasicNo ratings yet

- The Race of Our Lives RevisitedDocument35 pagesThe Race of Our Lives RevisiteddpbasicNo ratings yet

- TL Secular Outlook For Global GrowthDocument12 pagesTL Secular Outlook For Global GrowthdpbasicNo ratings yet

- Credit Suisse Investment Outlook 2018Document64 pagesCredit Suisse Investment Outlook 2018dpbasic100% (1)

- SSRN Id3132563Document13 pagesSSRN Id3132563dpbasicNo ratings yet

- GMOMelt UpDocument13 pagesGMOMelt UpHeisenberg100% (2)

- Thackray Newsletter 2017 09 SeptemberDocument9 pagesThackray Newsletter 2017 09 SeptemberdpbasicNo ratings yet

- Thackray Seasonal Report Storm Warning 2017-May-05Document12 pagesThackray Seasonal Report Storm Warning 2017-May-05dpbasic100% (1)

- Otlk-Bklt-Ret-A4 1711Document48 pagesOtlk-Bklt-Ret-A4 1711dpbasicNo ratings yet

- Etf PSR q4 2017 eDocument7 pagesEtf PSR q4 2017 edpbasicNo ratings yet

- Thackray Newsletter 2017 09 SeptemberDocument4 pagesThackray Newsletter 2017 09 SeptemberdpbasicNo ratings yet

- Thackray Newsletter 2017 07 JulyDocument8 pagesThackray Newsletter 2017 07 JulydpbasicNo ratings yet

- Thackray Newsletter 2017 01 JanuaryDocument11 pagesThackray Newsletter 2017 01 JanuarydpbasicNo ratings yet

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocument12 pagesRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicNo ratings yet

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicNo ratings yet

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicNo ratings yet

- Hot Charts 9feb2017Document2 pagesHot Charts 9feb2017dpbasicNo ratings yet

- TL What It Would Take For U.S. Economy To GrowDocument8 pagesTL What It Would Take For U.S. Economy To GrowdpbasicNo ratings yet

- Special Report 30jan2017Document5 pagesSpecial Report 30jan2017dpbasicNo ratings yet

- Boc Policy MonitorDocument3 pagesBoc Policy MonitordpbasicNo ratings yet

- GeopoliticalBriefing 22nov2016Document6 pagesGeopoliticalBriefing 22nov2016dpbasicNo ratings yet

- INM 21993e DWolf Q4 2016 NewEra Retail SecuredDocument4 pagesINM 21993e DWolf Q4 2016 NewEra Retail SecureddpbasicNo ratings yet

- CMX Roadshow Final November 2016Document25 pagesCMX Roadshow Final November 2016dpbasicNo ratings yet

- Peloton Webinar September 26-2016Document26 pagesPeloton Webinar September 26-2016dpbasicNo ratings yet

- Hot Charts 17nov2016Document2 pagesHot Charts 17nov2016dpbasicNo ratings yet

- The Trumpquake - Special Report 10nov2016Document5 pagesThe Trumpquake - Special Report 10nov2016dpbasicNo ratings yet

- Project Report On Market Survey On Brand EquityDocument44 pagesProject Report On Market Survey On Brand EquityCh Shrikanth80% (5)

- Project IdentificationDocument89 pagesProject Identificationtadgash4920100% (3)

- SERPDocument2 pagesSERPBill BlackNo ratings yet

- Common Transaction SlipDocument1 pageCommon Transaction SlipAmrutaNo ratings yet

- Capital Budgeting Practices in PunjabDocument20 pagesCapital Budgeting Practices in PunjabChandna MaryNo ratings yet

- Jalandhar Amritsar PDFDocument120 pagesJalandhar Amritsar PDFBhagyashreeNo ratings yet

- P5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cDocument28 pagesP5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cAkshat ShahNo ratings yet

- ACCA104 - Notes ReceivableDocument7 pagesACCA104 - Notes ReceivableAnaluz Cristine B. CeaNo ratings yet

- N - Chandrasekhar Naidu (Pronote)Document3 pagesN - Chandrasekhar Naidu (Pronote)raju634No ratings yet

- Ifrs Framework PDFDocument23 pagesIfrs Framework PDFMohammad Delowar HossainNo ratings yet

- Program Management Office (Pgmo) : Keane White PaperDocument19 pagesProgram Management Office (Pgmo) : Keane White PaperOsama A. AliNo ratings yet

- Bharat Raj Punj Versus Central Goods and Service Tax Commissionerate, Alwar Its Inspector (Anti Evasion)Document2 pagesBharat Raj Punj Versus Central Goods and Service Tax Commissionerate, Alwar Its Inspector (Anti Evasion)Priyanshi DesaiNo ratings yet

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- 21 Asian Terminals vs. First LepantoDocument9 pages21 Asian Terminals vs. First LepantoMichelle Montenegro - AraujoNo ratings yet

- Waiver and Assignment of Pension RightsDocument2 pagesWaiver and Assignment of Pension RightsWendell MaunahanNo ratings yet

- Private Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Document6 pagesPrivate Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Esteban Enrique Posan BalcazarNo ratings yet

- Rudy Wong Case Analysis of Investment DecisionsDocument7 pagesRudy Wong Case Analysis of Investment DecisionsJuan Camilo Ninco CardenasNo ratings yet

- EH Agreement & Payment Plan Form PDFDocument2 pagesEH Agreement & Payment Plan Form PDFJonathan GavantNo ratings yet

- Topic 4 AnnuityDocument22 pagesTopic 4 AnnuityNanteni GanesanNo ratings yet