Professional Documents

Culture Documents

State Incentives

Uploaded by

Shabir TrambooCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Incentives

Uploaded by

Shabir TrambooCopyright:

Available Formats

Incentives available under J&K State Industrial Policy

Investment subsidy on Plant and N4achinery is available to nevr ssI, l4edium and Large units up to the {imit of

Rs.30.00 lakhs. for the Units not falling in Notified Locations/Backward Blocks

Units falling in prestigious ctegory having Capital investment more than Rs, 25.00 crores are eligible for 15olo Capital

Investment subsidy on plant and mahinery up to Rs. 60'00 lakhs.

Uniis falting in thrust areas, the upper limit of Capital Investment Subsidy @15olo is avaibble on plant and machinery upto

15olo Capitat

.

.

.

.

.

.

.

.

.

Rs.45.00 lakhs.

Units fatling jn preSrigious and thrust area category the Gpital lnvestrnent SLrbsidy @ 150/0 on Plant and machinery shall be

up to Rs. 75.00lakhs.

7!o/d subsidy on construction of a captive tube welLor building a captive water liftinq plant by Ptestigious units in any ofthe

Thrlst areas up to Rs. 22.50 lacs.

100% subsidy on Projed Repofts tlp to P"s. 2.00 lakhs

1oo./o subsidi on puahase/installation of D.G. sets from 10 Kw to 1000 K!v- maximum l:mit Rs. 2s.o0 lakhs.

3% interest:ubsidy on working capitat loan to exlsting and new industrial units for a period of 5 years from the date of

production to the units not falling within Notified locations/ Th rust areas.

100% capital subsidy of Testing Equipment's- maximunr limii Rs. 25.00 lakhs.

Assistance in the shape of subsidy on the expenses lncurred on Brand Promotion

500/0 uo to Fls. 20.00 lakhs first vear'

300/0 up to Rs. 15.00 lakhs for second year'

10o/o up to Rs. 10.00 lakhs for third year'

500/0 Air Freight Subsidy -l4aximum limit Rs. 5'00 lakhs per yeaf per unit.

30% subsidy on Pollution Control Equipment- maximum limil Rs. 20.00 lakhs

5olo intercst subsidy for Technocrats (which are Engineering Gnduate/l1BAs/Postgraduates) on Term loan i.e Land/Building

and Plant and l4achinery.

upto 15% price preference is available on the larided cos! of ihe product to the local ssl units in all Government purchases

a.

b.

c.

.

.

.

.

Earnest Monev Securiw Deposit.

D

iD

iii)

Stamp Duw

unit.t'all be required to pay only 500/0 ofthe amount of earnest money or Rs-5000/- whichever is lower'

Tender documents shatl als; be supptied to the SSI unic @ 50% ofthe price of documents or Rs.100/_ whichever be

SSI

lower.

SICOP shall be treated

Io'tg-iilGed.

at par with the SSI units for the purpose ofthe aforementioned provisions

in fauour of the financing institutions required to be signed by the promoter shall be exempted from payment of

stamD dutv,

Exemption of Court fee

units

Exemption from Court fee for registration of documents relatiag to lease of land will be granted to registered industrial

Research and Development (R&D)

Development (R&D) with maximum limit of Rs. 5'00 lakhs for

i) 50o/d subsidy on Expenditure incurred on Research and

each such Projed.

ii) 25olo sLrbsidy on Non- recurring items with a Maximum limit of Rs. 5.00 lakhs.

Human Resourc Develooment.

D

'

tt"^"S human Rsource Devlopmeni (R&D) subject to Rs. 5000/- per trainee and trs. 1.00 lakh

th" .".t

50./"

"f for any"funit for; "n

pe od of five years, ln case of women trainees the corresponding figures shall be 75olo, Rs. 7500

pei annum

and Rs.1.50 lakhs respedivelY,

ii)

-

employment of tlaines, 50o/o of the cost of training shall be borne by the

For progGmmes of ski development leading

programmes

maximum of Rs. 5 lakhs per unit, In case of women trainees, the

sublect

to

Government on approved

mrrespondinq figures would be 75olo and 7.5lakhs.

to

.

.

.

VAT Remission up to l4arch 2014.

AdditionalToll tax ExemotLon

jmported from outside State to

On import of raw materials, procurement of plant and machjnery and bulldinq mateials to be

prestigious

units ) and on Expolt of finished

existing or new tocat smalt iedium and Large Scale industrial r.rnits (including

provlsional

registration.

peiod

years

the

date

of

of five

frorn

goods to outside State for a

Exemption of Entry Tax on impot of plant and machinery.

You might also like

- Service Level Agreement TemplateDocument4 pagesService Level Agreement TemplateSUNIL PUJARI100% (1)

- Excel Construction Budget TemplateDocument4 pagesExcel Construction Budget TemplateMohamedNo ratings yet

- Real Estate Investing Resources at Mesa LibraryDocument4 pagesReal Estate Investing Resources at Mesa LibraryNgo Van Hieu0% (4)

- Cold-Storage ProjectDocument8 pagesCold-Storage ProjectHimansu MohapatraNo ratings yet

- European Bakery and Oven Market AnalysisDocument57 pagesEuropean Bakery and Oven Market AnalysisAli AlamNo ratings yet

- Bank GuaranteeDocument30 pagesBank GuaranteeKaruna ThatsitNo ratings yet

- MSME PresentationDocument37 pagesMSME PresentationMass Nelson100% (1)

- Legend:: Bonus Computation (Shortcut) ExampleDocument4 pagesLegend:: Bonus Computation (Shortcut) ExampleJeremyDream LimNo ratings yet

- 'Business Model and Project'viability' For A Technical Textile Project Based On 2 No Nonwoven Plant Lines'Document11 pages'Business Model and Project'viability' For A Technical Textile Project Based On 2 No Nonwoven Plant Lines'Krishna GadodiaNo ratings yet

- Nifty Doctor Simple SystemDocument5 pagesNifty Doctor Simple SystemPratik ChhedaNo ratings yet

- Plastic PolutionDocument147 pagesPlastic Polutionluis100% (1)

- Financial Accounting and Reporting EllioDocument181 pagesFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNo ratings yet

- Benefit of MsmeDocument6 pagesBenefit of MsmePIYUSH GOSAINNo ratings yet

- Annexure 4Document19 pagesAnnexure 4Sneha DhamijaNo ratings yet

- Industrialpolicy2005 10Document40 pagesIndustrialpolicy2005 10Madhukar ReddyNo ratings yet

- Tamil NaduDocument3 pagesTamil Naduanshulmishra713No ratings yet

- Msme Policy 2022 v-1Document13 pagesMsme Policy 2022 v-1Gupta MittalNo ratings yet

- Jammu & Kashmir Industrial Policy-2004Document6 pagesJammu & Kashmir Industrial Policy-2004Sourabh SapoliaNo ratings yet

- AP Textile, Apparel & Garments Policy 2018-2023 PDFDocument20 pagesAP Textile, Apparel & Garments Policy 2018-2023 PDFhymaNo ratings yet

- GO - Ms - No - 14Document192 pagesGO - Ms - No - 14Adhavan M AnnathuraiNo ratings yet

- NMFP Schemes HighlightsDocument2 pagesNMFP Schemes HighlightsBhuban MohantyNo ratings yet

- Bio Gas PlanDocument35 pagesBio Gas PlanVinod Bihal100% (1)

- Project Profile For Cold Storage Project: LocationDocument3 pagesProject Profile For Cold Storage Project: LocationHussain NazNo ratings yet

- AP Electric Vehicle PolicyDocument26 pagesAP Electric Vehicle Policy9052359751No ratings yet

- MNRE - Biogas Scheme PDFDocument40 pagesMNRE - Biogas Scheme PDFNeeraj ChhokarNo ratings yet

- FAQs MSE CDPDocument10 pagesFAQs MSE CDPRAMENDRA UPADHYAYNo ratings yet

- Revised NormsDocument17 pagesRevised NormsSunilsinh ThakurNo ratings yet

- AP State Finance Corporation Women Entrepreneur Scheme BenefitsDocument2 pagesAP State Finance Corporation Women Entrepreneur Scheme BenefitsamumiyaNo ratings yet

- Policy & Schemesf - MSE - 3 April 2013Document7 pagesPolicy & Schemesf - MSE - 3 April 2013arsh99No ratings yet

- Andhra PradeshDocument3 pagesAndhra PradeshsearchingselfNo ratings yet

- Incubation Scheme Guidelines FinalDocument7 pagesIncubation Scheme Guidelines Finalshreeshail_mp6009No ratings yet

- Prime Minister Employment Generation Programme (PMEGP) Funding and EligibilityDocument16 pagesPrime Minister Employment Generation Programme (PMEGP) Funding and EligibilityPandhari SanapNo ratings yet

- MSME Ministry, Govt. of India Defines Micro, Small and Medium EnterprisesDocument37 pagesMSME Ministry, Govt. of India Defines Micro, Small and Medium EnterprisesKannan GopalakrishnanNo ratings yet

- Pioneer Industrial Park: Bilaspur Chowk, Pathredi, Gurgaon (NH-08) W.E.F. 13/02/2008 Price List Payment PlansDocument3 pagesPioneer Industrial Park: Bilaspur Chowk, Pathredi, Gurgaon (NH-08) W.E.F. 13/02/2008 Price List Payment PlansTrue Crime ReviewNo ratings yet

- State Governments Incentives For InvestorsDocument6 pagesState Governments Incentives For InvestorsbalqueesNo ratings yet

- A Consent To Establish (Noc) : Industries Having Capital InvestmentDocument8 pagesA Consent To Establish (Noc) : Industries Having Capital InvestmentAnkit GuptaNo ratings yet

- Industrial Policy and Incentives in Andhra PradeshDocument17 pagesIndustrial Policy and Incentives in Andhra PradeshSai AnuthNo ratings yet

- How To Fund Your InnovationDocument4 pagesHow To Fund Your InnovationKshitij MalhotraNo ratings yet

- PPP Operational DetailsDocument14 pagesPPP Operational DetailsAnujit Shweta KulshresthaNo ratings yet

- Brochure - Edited V1Document20 pagesBrochure - Edited V1AmitomSudarshanNo ratings yet

- Nabard Rural Godown PDFDocument6 pagesNabard Rural Godown PDFVivek KhandelwalNo ratings yet

- Andhra Pradesh Fiscal Incentives, Exemptions & Subsidies: Units For Providing Cash SubsidyDocument2 pagesAndhra Pradesh Fiscal Incentives, Exemptions & Subsidies: Units For Providing Cash SubsidySree NivasNo ratings yet

- Incentives CategoriesDocument4 pagesIncentives CategoriesmilletfusionsNo ratings yet

- Categorization of Msmes, Ancillary IndustriesDocument3 pagesCategorization of Msmes, Ancillary IndustriesGaurav kumarNo ratings yet

- Karnataka Land Acquisition and Industrial Policy HighlightsDocument4 pagesKarnataka Land Acquisition and Industrial Policy HighlightsHarshit GuptaNo ratings yet

- Industrial Policy - 1980Document6 pagesIndustrial Policy - 1980cseprmNo ratings yet

- 20 Non 2013-Karnataka TX Policy To Generate Employment OpportunitiesDocument1 page20 Non 2013-Karnataka TX Policy To Generate Employment OpportunitiesKannan KrishnamurthyNo ratings yet

- Taxation Benefits To Ssi, Various IncentivesDocument31 pagesTaxation Benefits To Ssi, Various IncentivesThasni MK33% (3)

- Supporting MSME Growth in RajasthanDocument8 pagesSupporting MSME Growth in RajasthanKaushik PkaushikNo ratings yet

- Government Initiative WB Msme Policy 2013-18Document7 pagesGovernment Initiative WB Msme Policy 2013-18Vikash AgarwalNo ratings yet

- MSME Vendor Meet Highlights OpportunitiesDocument37 pagesMSME Vendor Meet Highlights OpportunitiesMass NelsonNo ratings yet

- Tata Innovation Fellowship 2012Document2 pagesTata Innovation Fellowship 2012vijaygovindarajNo ratings yet

- 6 Legal Framework For Investing in CambodiaDocument7 pages6 Legal Framework For Investing in CambodiaSeiha KhNo ratings yet

- Sez & STPDocument10 pagesSez & STPumashankar_kr100% (3)

- 2.6 or 5.1 - Subsidies - SN - July 2016Document17 pages2.6 or 5.1 - Subsidies - SN - July 2016Starlet PearlNo ratings yet

- 1 What Is A Special Economic Zone ?Document7 pages1 What Is A Special Economic Zone ?bhaskarraosatyaNo ratings yet

- Doing Business in RajasthanDocument4 pagesDoing Business in RajasthanCorporate ProfessionalsNo ratings yet

- PMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Document43 pagesPMEGP Revised Schemes For 5 Years From 2012-22 To 2025-26Naresh KadyanNo ratings yet

- Nimz and Manufacturing PolicyDocument7 pagesNimz and Manufacturing PolicyChandan Kumar RoyNo ratings yet

- TN Subsidies Medium Large Mega Industries ETP HWTSDFDocument1 pageTN Subsidies Medium Large Mega Industries ETP HWTSDFsivasamy ranjithNo ratings yet

- Technology Up-Gradation Fund Scheme For Handloom Sector 1Document11 pagesTechnology Up-Gradation Fund Scheme For Handloom Sector 1designerbob21No ratings yet

- MFPI Presentation on Food Processing Industries GoalsDocument20 pagesMFPI Presentation on Food Processing Industries GoalsSushil GhadgeNo ratings yet

- FDI For Make in IndiaDocument11 pagesFDI For Make in IndiaMohanrajNo ratings yet

- Tax Proposals in Financial Budget 2013-14: Ravi ChhatwaniDocument4 pagesTax Proposals in Financial Budget 2013-14: Ravi ChhatwanirockyrrNo ratings yet

- Blow Moulded Plastic Products Project ProfileDocument15 pagesBlow Moulded Plastic Products Project ProfileasdfdNo ratings yet

- Complete Guide To Setup A Software Export HouseDocument7 pagesComplete Guide To Setup A Software Export HouseSantosh KodereNo ratings yet

- Japanese Quail Protected Under The Wild Life Protection Act, 1972 But Govt. of India Provide Budget Provisions To Promote Its Breeding - Naresh KadyanDocument19 pagesJapanese Quail Protected Under The Wild Life Protection Act, 1972 But Govt. of India Provide Budget Provisions To Promote Its Breeding - Naresh KadyanNaresh KadyanNo ratings yet

- Aatmanirbhar Gujarat Scheme for MSMEsDocument2 pagesAatmanirbhar Gujarat Scheme for MSMEschaitanyaNo ratings yet

- Al Sunnah Jehlam 31 May 2011 PDFDocument48 pagesAl Sunnah Jehlam 31 May 2011 PDFShabir TrambooNo ratings yet

- Act of 1989Document70 pagesAct of 1989Shabir TrambooNo ratings yet

- Al Sunnah Jehlam 434445 MayJuneJuly 2012 PDFDocument263 pagesAl Sunnah Jehlam 434445 MayJuneJuly 2012 PDFShabir TrambooNo ratings yet

- Postpaid Plans Details Unique No. As Per Annexure X As Per Annexure X As Per Annexure X Sr. No. Particulars/ Services Postpaid Plan 1 Postpaid Plan 2 Postpaid Plan 3Document2 pagesPostpaid Plans Details Unique No. As Per Annexure X As Per Annexure X As Per Annexure X Sr. No. Particulars/ Services Postpaid Plan 1 Postpaid Plan 2 Postpaid Plan 3Shabir TrambooNo ratings yet

- Design of A Finite Capacity Scheduling System For Bakery Operations (Flow Shop Environment)Document10 pagesDesign of A Finite Capacity Scheduling System For Bakery Operations (Flow Shop Environment)AbbyNo ratings yet

- Entrepreneurship DevelopmentDocument18 pagesEntrepreneurship Developmentbalajisetty82No ratings yet

- EXP Student2 001 PDFDocument1 pageEXP Student2 001 PDFShabir TrambooNo ratings yet

- 1 PBDocument6 pages1 PBShabir TrambooNo ratings yet

- Cattle Feed Plant Poultry Feed PlantDocument3 pagesCattle Feed Plant Poultry Feed PlantShabir TrambooNo ratings yet

- 08 - Chapter 4 Analysis of Production Cost of BakeryDocument22 pages08 - Chapter 4 Analysis of Production Cost of BakeryShabir Tramboo75% (4)

- Powerpoint Presentation: Mahlatsi LeratoDocument43 pagesPowerpoint Presentation: Mahlatsi LeratoShabir TrambooNo ratings yet

- Feed Formulation Strategies and Methods: Submitted by Amit Kumar JanaDocument15 pagesFeed Formulation Strategies and Methods: Submitted by Amit Kumar JanaShabir TrambooNo ratings yet

- BARRETO-DILLON 2010 Budget Allocation and FinancingDocument19 pagesBARRETO-DILLON 2010 Budget Allocation and FinancingShabir TrambooNo ratings yet

- Intro To Market Research 2010Document448 pagesIntro To Market Research 2010Tim HeisNo ratings yet

- Lessons Learned: Top EntrepreneursDocument31 pagesLessons Learned: Top EntrepreneursShabir TrambooNo ratings yet

- Yeast Industry ReportDocument71 pagesYeast Industry ReportShabir TrambooNo ratings yet

- Powerpoint 141014220313 Conversion Gate02Document4 pagesPowerpoint 141014220313 Conversion Gate02Shabir TrambooNo ratings yet

- If You Can't Impress On The First SlideDocument30 pagesIf You Can't Impress On The First SlideShabir TrambooNo ratings yet

- <!DOCTYPE HTML PUBbakery LIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=bakery+feasibility.pdf HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 7645ece07280360c8fe9207bf0fc7d8342f8476e User-Agent: Mozilla/5.0 (Windows NT 6.1; WOW64) AppleWebKit/537.31 (KHTML, like Gecko) Chrome/26.0.1410.43 Safari/537.31 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=34200662Document69 pages<!DOCTYPE HTML PUBbakery LIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=bakery+feasibility.pdf HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 7645ece07280360c8fe9207bf0fc7d8342f8476e User-Agent: Mozilla/5.0 (Windows NT 6.1; WOW64) AppleWebKit/537.31 (KHTML, like Gecko) Chrome/26.0.1410.43 Safari/537.31 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=34200662Manoj JhambNo ratings yet

- Baking GlossaryDocument9 pagesBaking Glossarycaroline dulleteNo ratings yet

- The BakeryDocument40 pagesThe BakeryPrince MananNo ratings yet

- Quickbreads 100217155401 Phpapp01Document29 pagesQuickbreads 100217155401 Phpapp01Shabir TrambooNo ratings yet

- Chapter 32 Cakes and Icings: Gilber Noussitou 2010 G - l2-31-1Document21 pagesChapter 32 Cakes and Icings: Gilber Noussitou 2010 G - l2-31-1Shabir TrambooNo ratings yet

- Production scheduling templates and guidesDocument4 pagesProduction scheduling templates and guidesShabir TrambooNo ratings yet

- The Chemistry of Baking Bread: Susan Sherrouse, Tis Fairview/Miss Jewell ElementaryDocument16 pagesThe Chemistry of Baking Bread: Susan Sherrouse, Tis Fairview/Miss Jewell ElementaryShabir Tramboo100% (1)

- 2013 Food Code PDFDocument768 pages2013 Food Code PDFdiggerexeNo ratings yet

- Creativity3 121107194625 Phpapp01Document8 pagesCreativity3 121107194625 Phpapp01Shabir TrambooNo ratings yet

- Bakingtoolsandequipment 130306001142 Phpapp01Document53 pagesBakingtoolsandequipment 130306001142 Phpapp01Shabir TrambooNo ratings yet

- Uses of BreadsDocument7 pagesUses of BreadsShabir TrambooNo ratings yet

- OWNERISSUE110106IDocument16 pagesOWNERISSUE110106ISamNo ratings yet

- Price MechanismDocument10 pagesPrice MechanismRyan ThomasNo ratings yet

- Role of Company SecretaryDocument8 pagesRole of Company SecretaryILAKIYANo ratings yet

- Real Estate Sector Report BangladeshDocument41 pagesReal Estate Sector Report Bangladeshmars2580No ratings yet

- 3 Facts About Teachers in The Philippines AABDocument2 pages3 Facts About Teachers in The Philippines AABAndrewNo ratings yet

- Chap 13Document13 pagesChap 13Nick KopecNo ratings yet

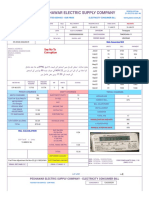

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- International Public Sector Accounting StandardsDocument4 pagesInternational Public Sector Accounting Standardsdiana perez100% (1)

- Chapter 2 The New Products ProcessDocument7 pagesChapter 2 The New Products ProcessmanoNo ratings yet

- Financial Statement Analysis of Lakshmigraha Worldwide IncDocument77 pagesFinancial Statement Analysis of Lakshmigraha Worldwide IncSurendra SkNo ratings yet

- Math 3 - EconomyDocument3 pagesMath 3 - EconomyJeana Rick GallanoNo ratings yet

- Law Review 5Document88 pagesLaw Review 5Bilguun Ganzorig75% (4)

- 8 13Document5 pages8 13Konrad Lorenz Madriaga UychocoNo ratings yet

- Chapter 3 Bonds PayableDocument2 pagesChapter 3 Bonds PayableEUNICE NATASHA CABARABAN LIMNo ratings yet

- 03 - Literature ReviewDocument7 pages03 - Literature ReviewVienna Corrine Q. AbucejoNo ratings yet

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- 空白信用证版本Document5 pages空白信用证版本ansontzengNo ratings yet

- SWOT Analysis of UKDocument4 pagesSWOT Analysis of UKlovely singhNo ratings yet

- Significance of Corporate Law in Nigeria by Sheriffdeen AmoduDocument7 pagesSignificance of Corporate Law in Nigeria by Sheriffdeen AmoduSheriffdeenNo ratings yet

- Executive Order From Governor Gretchen WhitmerDocument5 pagesExecutive Order From Governor Gretchen WhitmerWNDUNo ratings yet

- Tiểu luận đã chỉnhDocument28 pagesTiểu luận đã chỉnhĐức HoàngNo ratings yet

- Flash Memory Income Statements and Balance Sheets 2007-2009Document14 pagesFlash Memory Income Statements and Balance Sheets 2007-2009Pranav TatavarthiNo ratings yet