Professional Documents

Culture Documents

ACC349 - Week 2 - WileyPlus

Uploaded by

Shelly ElamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC349 - Week 2 - WileyPlus

Uploaded by

Shelly ElamCopyright:

Available Formats

Running head: PROBLEM SET

1

Chapter 2 E2-6

A job cost sheet of Chamberlin Company is given below:

Job Cost Sheet

JOB NO. 469

Quantity 2,000

ITEM White Lion Cages

Date Requested 7/2

FOR Todd Company

DATE

Direct Materials

Date Completed 7/31

Direct Labor

Manufacturing Overhead

15

440

550

22

380

475

540

675

7/10

825

12

900

24

1,600

27

1500

31

Cost of completed job:

Direct Materials

4,825

Direct Labor

1,360

Manufacturing Overhead

1,700

Total Cost

7,885

Unit Cost

3.94

Chapter 2 E2-6 (A1) What are the source documents for direct materials, direct labor, and

manufacturing overhead costs assigned to this job?

Direct Materials: Requisition Slip

PROBLEM SET

Direct Labor: Time Tickets

The Manufacturing Overhead: predetermined overhead rate

Chapter 2 E2-6 (A2) What is the predetermined manufacturing overhead rate?

In this case the predetermined manufacturing overhead rate is:

125% of direct labor cost. $550 / $440 = 125%.

Chapter 2 E2-6 (A3) What are the total cost and the unit cost of the completed job? (Round unit

cost to nearest cent.)

Cost of completed job:

Direct Materials

4,825

Direct Labor

1360

Manufacturing Overhead

1700

Total Cost

Unit Cost = 3.94 (7,885/2,000)

7,885

PROBLEM SET

Chapter 2 E2-6 (B) Prepare the entry to record the completion of the job.

7/31

Finished goods Inventory

Work in progress inventory

7885

7885

(To record completion of job 469)

Chapter 2 E2-9

At May 31, 2011, the accounts of Stellar Manufacturing Company show the following.

1. May 1 inventoriesfinished goods $12,600, work in process $14,700, and raw

materials $8,200.

2. May 31 inventoriesfinished goods $9,500, work in process $17,900, and raw

materials $7,100.

3. Debit postings to work in process were: direct materials $62,400, direct labor $32,000,

and manufacturing overhead applied $40,000.

4. Sales totaled $200,000

PROBLEM SET

Chapter 2 E2-6 (A) Prepare a condensed cost of goods manufactured schedule.

Stellar Manufacturing Company

Cost of Goods Manufactured Schedule

For the Month Ending May 31, 2011

May 1

Work in progress

Direct Material Used

$62,400

Manufacturing Overhead Applied

$40,000

Direct Labor

$32,000

Total Manufacturing Cost

Total Cost of Work in Process

May 31

$14,700

Less: Work in process

Cost of Goods Manufactured

$134,400

$149,100

$14,900

$131,200

PROBLEM SET

Chapter 2 E2-9 (B) Prepare an income statement for May through gross profit.

Stellar Manufacturing Company

(Partial) Income Statement

For the Month Ending May 31, 2011

Sales

$200,000

Cost of Goods Sold

May 1

May 31

Finished Goods

$12,600

Cost of Goods Manufactured

$131,200

Cost of Goods Available for Sale

$143,800

Finished Goods

$9,500

Cost of Goods Sold

Gross Profit

$134,300

$65,700

PROBLEM SET

Chapter 2 E2-9 (C) Indicate the balance sheet presentation of the manufacturing inventories at

May 31, 2011.

May 31, 2011: Finished Goods

9,500

Work in Progress 17,900

Raw Materials

7,100

Chapter 3 E3-5

In Kagan Company, materials are entered at the beginning of each process. Work in

process inventories, with the percentage of work done on conversion costs, and production data

for its Sterilizing Department in selected months during 2011 are as follows.

PROBLEM SET

Beginning Work in Process

Month

Units

Conversion Cost %

Ending Work in Process

Units Transferred Out

Units

Conversion Cost %

January

0 -

7,000

2,000

60

March

0 -

12.000

3,000

30

May

0 -

16,000

5,000

80

July

0 -

10,000

1,500

40

Chapter 3 E3-5 (A) Compute the physical units for January and May.

January physical units: 9,000 units of production

May physical units: 21,000 units of production

Chapter 3 E3-5 (B) Compute the equivalent units of production for (1) materials and (2)

conversion costs for each month.

Month

Materials

Conversion Cost

January

9,000

8,200

PROBLEM SET

March

15,000

12,9000

May

21,000

20,000

July

11,500

10,600

Chapter 3 E3-9

Cederholm Company has gathered the following information.

Units in Beginning Work in process

Units started into production

Units in ending work in process

-036,000

6,000

Percent complete in ending work in process:

Conversion costs

Materials

40%

100%

Costs incurred:

Direct materials

$72,000

Direct labor

$81,000

PROBLEM SET

Overhead

$97,000

Chapter 3 E3-9 (A) Compute equivalent units of production for materials and for conversion

costs.

Materials: (30,000 + 6,000) = 36,000

Conversion costs: (30,000 + (6,000 X 40%)) = 32,400

Chapter 3 E3-9 (B) Determine the unit costs of production.

Materials: (72,000 / 36,000) = $2.00

Conversion costs: (81,000 + 97,200) / 32,400 = $5.50

PROBLEM SET

10

Chapter 3 E3-9 (C) Show the assignment of costs to units transferred out and in process.

Units transferred out (30,000 X 7.50) = 225,000

Units ending work in process (6,000 X 2.00 = 12000) + (2,400 X 5.50 = 13,200) = 25,200

You might also like

- ACC349 Week 2 Individual Assignments - E2-9Document2 pagesACC349 Week 2 Individual Assignments - E2-9lovebooks92No ratings yet

- Assignment Question AccDocument5 pagesAssignment Question AccruqayyahqaisaraNo ratings yet

- Seminar Practice 7 Solutions (Latest)Document54 pagesSeminar Practice 7 Solutions (Latest)Feeling_so_fly100% (1)

- Midterm Exam Solution Fall 2012Document13 pagesMidterm Exam Solution Fall 2012Daniel Lamarre100% (4)

- MGMT 027 Connect 04 HWDocument7 pagesMGMT 027 Connect 04 HWSidra Khan100% (1)

- Introduction To Managerial AccountingDocument8 pagesIntroduction To Managerial AccountingWam OwnNo ratings yet

- Managerial Acc AssignmentDocument3 pagesManagerial Acc AssignmentDũng PhanNo ratings yet

- Ch01 Managerial AccountingDocument7 pagesCh01 Managerial AccountingIrdo KwanNo ratings yet

- Job Costing Chapter 4 Key ConceptsDocument8 pagesJob Costing Chapter 4 Key Conceptsangelbear2577100% (1)

- Cost Draft 2Document13 pagesCost Draft 2wynellamae100% (1)

- rESEARCH QUESTIONS FbiDocument35 pagesrESEARCH QUESTIONS FbiBOOMERBADNo ratings yet

- Additional Examples With Solutions 17Document24 pagesAdditional Examples With Solutions 17Dachi ChaduneliNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- Cost Sheet ProblemsDocument7 pagesCost Sheet ProblemsApparao ChNo ratings yet

- Ch02 Job Order Costing1Document8 pagesCh02 Job Order Costing1Laika Mico MotasNo ratings yet

- ACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsDocument8 pagesACCT505 Week 2 Quiz 1 Job Order and Process Costing SystemsNatasha DeclanNo ratings yet

- Sanderson Company job order costing explainedDocument3 pagesSanderson Company job order costing explainedlinkin soyNo ratings yet

- Management Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsDocument9 pagesManagement Accounting 1 (Acc103) Assignment (15%) Sem 1, 2021 Due Date: 5 Apr 2021 General InstructionsRan CastiloNo ratings yet

- ACCT-611 COGM and COGS ProblemsDocument4 pagesACCT-611 COGM and COGS ProblemsElvan Mae Rita ReyesNo ratings yet

- Process CostingDocument68 pagesProcess Costingrandhawa_skaur100% (1)

- Comprehensive Exam A: Cost Accounting ProblemsDocument13 pagesComprehensive Exam A: Cost Accounting ProblemsKeith Joanne SantiagoNo ratings yet

- Tutorial 3 - Process CostingDocument5 pagesTutorial 3 - Process Costingsouayeh wejdenNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- A325 Chap 4 SolutionDocument5 pagesA325 Chap 4 SolutionAnita BroadusNo ratings yet

- Job Order QuestionsDocument6 pagesJob Order Questionsإبراهيم الشيخيNo ratings yet

- Exercise 1 - Cost Accumulation Procedure DeterminationDocument8 pagesExercise 1 - Cost Accumulation Procedure DeterminationstillwinmsNo ratings yet

- Process CostingDocument19 pagesProcess CostingmilleranNo ratings yet

- Principles of Cost Accounting 16th Edition Vanderbeck Test Bank 1Document36 pagesPrinciples of Cost Accounting 16th Edition Vanderbeck Test Bank 1brucesimstjmnsdcixz100% (19)

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Process Costing WorksheetDocument21 pagesProcess Costing WorksheetpchakkrapaniNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Sample PB CostDocument4 pagesSample PB CostMich Elle CabNo ratings yet

- Exam Review Unit I - Chapters 1-3Document24 pagesExam Review Unit I - Chapters 1-3Aaron DownsNo ratings yet

- 02 Aga Bagoes Ardiansyah 7fkhususDocument4 pages02 Aga Bagoes Ardiansyah 7fkhususAga Bagoes ArdiansyahNo ratings yet

- Comprehensive Exam A ReviewDocument28 pagesComprehensive Exam A ReviewKang JoonNo ratings yet

- 121 Mt2 Process Cost KeyDocument2 pages121 Mt2 Process Cost KeyMichelle LeeNo ratings yet

- Practice Set - A3Document6 pagesPractice Set - A3Dayanara VillanuevaNo ratings yet

- Tutorial 6Document4 pagesTutorial 6NurSyazwaniRosliNo ratings yet

- Midterm Quiz 2 - Problem and Answer KeyDocument6 pagesMidterm Quiz 2 - Problem and Answer KeyRynette Flores100% (1)

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Chapter 01 Test Bank Cost AccDocument5 pagesChapter 01 Test Bank Cost AccNada AlhenyNo ratings yet

- 6e Brewer Ch02 B EocDocument10 pages6e Brewer Ch02 B EocHa Minh0% (1)

- Cost Akun CHP 4 (Exer 3)Document2 pagesCost Akun CHP 4 (Exer 3)Vincent Suryajaya GuntoroNo ratings yet

- Midterm 1+ 2 (T NG H P)Document13 pagesMidterm 1+ 2 (T NG H P)Shen NPTDNo ratings yet

- KisikisiDocument7 pagesKisikisijalunasaNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- Managerial Accounting Problems on Product Costing and Cost FlowsDocument28 pagesManagerial Accounting Problems on Product Costing and Cost FlowsMaryAnnLasquiteNo ratings yet

- Process Costing System for Paint ManufacturerDocument4 pagesProcess Costing System for Paint ManufacturerCharlyn LapeñaNo ratings yet

- Prelims Reviewer For Cost AccountingDocument29 pagesPrelims Reviewer For Cost AccountingPamela Cruz100% (1)

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- Economic and Financial Modelling with EViews: A Guide for Students and ProfessionalsFrom EverandEconomic and Financial Modelling with EViews: A Guide for Students and ProfessionalsNo ratings yet

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Practical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsFrom EverandPractical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Engineering Applications: A Project Resource BookFrom EverandEngineering Applications: A Project Resource BookRating: 2.5 out of 5 stars2.5/5 (1)

- Beginning AutoCAD® 2021 Exercise WorkbookFrom EverandBeginning AutoCAD® 2021 Exercise WorkbookRating: 5 out of 5 stars5/5 (3)

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- ACC 349 - Week 5 - Final ExamDocument16 pagesACC 349 - Week 5 - Final ExamShelly ElamNo ratings yet

- ACC349 - Week 5 - DQ'sDocument4 pagesACC349 - Week 5 - DQ'sShelly ElamNo ratings yet

- ACC349 - Week 4 - DQ'sDocument3 pagesACC349 - Week 4 - DQ'sShelly ElamNo ratings yet

- ACC349 - Week 2 - DQ'sDocument6 pagesACC349 - Week 2 - DQ'sShelly ElamNo ratings yet

- ACC349 - Week 1 - DQ'sDocument6 pagesACC349 - Week 1 - DQ'sShelly ElamNo ratings yet

- ACC349 - Week 3 - DQ'sDocument9 pagesACC349 - Week 3 - DQ'sShelly ElamNo ratings yet

- ABC Analysis Reveals True Costs of Wine ProductsDocument11 pagesABC Analysis Reveals True Costs of Wine ProductsShelly ElamNo ratings yet

- ACC349 - Week 4 - Wiley PlusDocument5 pagesACC349 - Week 4 - Wiley PlusShelly ElamNo ratings yet

- ACC349 - Week 5 - WileyPlusDocument4 pagesACC349 - Week 5 - WileyPlusShelly ElamNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingDocument7 pagesMTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingJagannath RaoNo ratings yet

- Monetary and Fiscal Policy Review in Islamic Sharia Syahril ToonawuDocument20 pagesMonetary and Fiscal Policy Review in Islamic Sharia Syahril ToonawuSyahril XtreelNo ratings yet

- Chapter 4 ExerciseDocument7 pagesChapter 4 ExerciseJoe DicksonNo ratings yet

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviNo ratings yet

- Assignment Ishan SharmaDocument8 pagesAssignment Ishan SharmaIshan SharmaNo ratings yet

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaNo ratings yet

- Management Information System: (Canara Bank)Document13 pagesManagement Information System: (Canara Bank)Kukki SengarNo ratings yet

- AIS Prelim ExamDocument4 pagesAIS Prelim Examsharielles /No ratings yet

- The Airline IndustryDocument8 pagesThe Airline IndustryDan Hardy100% (1)

- Palm Heights Tower Web BrochureDocument19 pagesPalm Heights Tower Web BrochureGaurav RaghuvanshiNo ratings yet

- Central Bank of SudanDocument12 pagesCentral Bank of SudanYasmin AhmedNo ratings yet

- Appendix 11 Instructions ORSDocument1 pageAppendix 11 Instructions ORSAlee AbdulcalimNo ratings yet

- Marketing Plan of A New Product:: "ANGEL" Baby PerfumeDocument24 pagesMarketing Plan of A New Product:: "ANGEL" Baby PerfumeMehnaz Tabassum ShantaNo ratings yet

- Rethinking Single-Use Plastic Products in Travel & TourismDocument48 pagesRethinking Single-Use Plastic Products in Travel & TourismComunicarSe-ArchivoNo ratings yet

- Midterm EcommerceDocument6 pagesMidterm EcommerceUSMAN NAVEEDNo ratings yet

- Studio Accommodation Studio Accommodation Studio AccommodationDocument4 pagesStudio Accommodation Studio Accommodation Studio AccommodationNISHA BANSALNo ratings yet

- Solution Manual For Essentials of Corporate Finance by ParrinoDocument21 pagesSolution Manual For Essentials of Corporate Finance by Parrinoa8651304130% (1)

- Chapter 01 Introduction To OMDocument31 pagesChapter 01 Introduction To OMmehdiNo ratings yet

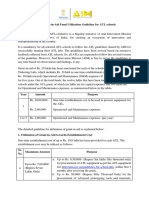

- Grant-In-Aid Fund Utilization GuidelineDocument5 pagesGrant-In-Aid Fund Utilization GuidelineBiswambharLayekNo ratings yet

- Executive Order No. 398: DteiacDocument2 pagesExecutive Order No. 398: DteiacDanNo ratings yet

- Customer Experience Department: Daily Incentive Program "Mcrewards"Document4 pagesCustomer Experience Department: Daily Incentive Program "Mcrewards"Cedie Gonzaga AlbaNo ratings yet

- The Green Register - Spring 2011Document11 pagesThe Green Register - Spring 2011EcoBudNo ratings yet

- A Dilg Joincircular 2015212 - cf2966c253Document12 pagesA Dilg Joincircular 2015212 - cf2966c253Erin CruzNo ratings yet

- Loan Functions of BanksDocument6 pagesLoan Functions of BanksMark AmistosoNo ratings yet

- Creating A BudgetDocument2 pagesCreating A BudgetLaci NunesNo ratings yet

- Apple Production Facilities ShiftDocument2 pagesApple Production Facilities ShiftSamarth GargNo ratings yet

- V. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesDocument3 pagesV. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesYuri Anne MasangkayNo ratings yet

- UNIT 1 - Introduction To Entepreneurship Part 1 (Compatibility Mode)Document71 pagesUNIT 1 - Introduction To Entepreneurship Part 1 (Compatibility Mode)kuddlykuddles100% (1)

- Topic 3 Long-Term Construction Contracts ModuleDocument20 pagesTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayNo ratings yet

- Market Failure Case StudyDocument2 pagesMarket Failure Case Studyshahriar sayeedNo ratings yet