Professional Documents

Culture Documents

US Department of Justice Official Release - 02281-07 CRM 584

Uploaded by

legalmattersOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Department of Justice Official Release - 02281-07 CRM 584

Uploaded by

legalmattersCopyright:

Available Formats

FOR IMMEDIATE RELEASE CRM

MONDAY, AUGUST 6, 2007 (202) 514-2007

WWW.USDOJ.GOV TDD (202) 514-1888

American Express Bank International

Enters Into Deferred Prosecution

Agreement And Forfeits $55 Million To

Resolve Bank Secrecy Act Violations

WASHINGTON – Miami-based American Express Bank International has entered

into a deferred prosecution agreement on charges of failing to maintain an effective

anti-money laundering program and will forfeit $55 million to the U.S. government,

Assistant Attorney General Alice S. Fisher of the Criminal Division and U.S. Drug

Enforcement Administration Administrator Karen Tandy announced today.

A criminal information filed today at the U.S. District Court for the Southern

District of Florida in Miami charges American Express Bank International with one

count of failing to maintain an effective anti-money laundering program. American

Express Bank International waived indictment, agreed to the filing of the

information, and accepted and acknowledged responsibility for its behavior in a

factual statement accompanying the information. The company will pay $55 million

to the United States to settle forfeiture claims held by the government. In light of

the bank’s remedial actions to date and its willingness to acknowledge responsibility

for its actions, the government will recommend the dismissal of the charge in 12

months, provided the bank fully implements significant anti-money laundering

measures required by the agreement.

“Banks and other financial institutions must uphold their responsibility to safeguard

financial markets from the illegal activities of international drug cartels and

professional money launderers,” said Assistant Attorney General Alice S. Fisher of

the Criminal Division. “An effective anti-money laundering program is critical to

law enforcement efforts to detect and cut off the flow of drug money. The

Department of Justice will continue to work to stop financial institutions from

knowingly disregarding their obligations to have these vital programs in place.”

“Today an established and respected financial institution learned a valuable lesson

about its legal responsibilities. American Express and all legitimate banking

organizations must take every step possible to avoid becoming entangled in the web

of international drug money laundering,” said DEA Administrator Karen P. Tandy.

“Today the message is loud and clear: due diligence-don't take money without it.”

The Financial Crimes Enforcement Network (FinCEN) has also assessed a $25

million civil money penalty against the company for violations of the Bank Secrecy

Act, and the Board of Governors of the Federal Reserve has assessed a $20 million

civil money penalty. The $20 million Federal Reserve penalty and $15 million of

FinCEN’s $25 million penalty will be deemed satisfied by the payment of the $55

million forfeiture, resulting in total payments of $65 million by American Express

Bank International under these settlements.

Under the Bank Secrecy Act, banks are required to establish and maintain an anti-

money laundering compliance program that, at a minimum, provides for: (a) internal

policies, procedures and controls designed to guard against money laundering; (b)

the coordination and monitoring of day-to-day compliance with the Bank Secrecy

Act; (c) an ongoing employee training program; and (d) independent testing for

compliance conducted by bank personnel or an outside party. Banks are also

required to have comprehensive anti-money laundering programs that enable them

to identify and report suspicious financial transactions to the U.S. Treasury

Department’s Financial Crimes Enforcement Network.

The case was prosecuted by Trial Attorneys John W. Sellers and Thomas Pinder of

the Criminal Division’s Asset Forfeiture and Money Laundering Section, which is

headed by Chief Richard Weber. This case was investigated by the Drug

Enforcement Administration’s Miami Field Division, Fort Lauderdale District

Office.

###

07-584

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- PX2879Document37 pagesPX2879legalmattersNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Pentagon Comprehensive Review of Don't Ask, Don't Tell PolicyDocument267 pagesPentagon Comprehensive Review of Don't Ask, Don't Tell PolicyShane Vander HartNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- DoD "Don't Ask, Don't Tell" Repeal Support Plan For Implementation, 30 November 2010Document95 pagesDoD "Don't Ask, Don't Tell" Repeal Support Plan For Implementation, 30 November 2010legalmattersNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- San Bruno Fire: NTSB Preliminary ReportDocument3 pagesSan Bruno Fire: NTSB Preliminary Reportlegalmatters100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Phone Pbone: (Eastern IimejDocument6 pagesPhone Pbone: (Eastern IimejlegalmattersNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- PX2566Document8 pagesPX2566legalmattersNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- PX2853Document23 pagesPX2853legalmattersNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- PX2334Document7 pagesPX2334legalmattersNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- PX2096Document6 pagesPX2096legalmattersNo ratings yet

- Starting With 029:03: Trial DB - v2 Trial DB - v2Document6 pagesStarting With 029:03: Trial DB - v2 Trial DB - v2legalmattersNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- PX2403Document63 pagesPX2403legalmattersNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- PX2545Document7 pagesPX2545legalmattersNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Associação Americana de Psicologia - Orientação HomossexualDocument6 pagesAssociação Americana de Psicologia - Orientação HomossexualLorena FonsecaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- PX2335Document29 pagesPX2335legalmattersNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- PX2337Document31 pagesPX2337legalmattersNo ratings yet

- PX2310Document2 pagesPX2310legalmattersNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- PX2322Document11 pagesPX2322legalmattersNo ratings yet

- PX2153Document2 pagesPX2153legalmattersNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- PX2281Document21 pagesPX2281legalmattersNo ratings yet

- PX1867Document124 pagesPX1867legalmattersNo ratings yet

- PX2150Document3 pagesPX2150legalmattersNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PX2156Document3 pagesPX2156legalmattersNo ratings yet

- PX1868Document102 pagesPX1868legalmattersNo ratings yet

- PX1319Document36 pagesPX1319legalmattersNo ratings yet

- PX1308Document42 pagesPX1308legalmattersNo ratings yet

- PX1565Document3 pagesPX1565legalmattersNo ratings yet

- PX1763Document2 pagesPX1763legalmattersNo ratings yet

- Gao DomaDocument18 pagesGao Domadigitalflavours09No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- PX1328Document20 pagesPX1328legalmattersNo ratings yet

- P P E ? T I S - S M C ' B: Utting A Rice On Quality HE Mpact of AME EX Arriage On Alifornia S UdgetDocument37 pagesP P E ? T I S - S M C ' B: Utting A Rice On Quality HE Mpact of AME EX Arriage On Alifornia S UdgetlegalmattersNo ratings yet

- Acme Corporation: Strategic Plan 2014-2016: What Is Our Purpose? Financial How Will We Measure Success?Document1 pageAcme Corporation: Strategic Plan 2014-2016: What Is Our Purpose? Financial How Will We Measure Success?Peter Garga PanalanginNo ratings yet

- TNCDA Monthly Journal NovemberDocument36 pagesTNCDA Monthly Journal Novemberrammvr05No ratings yet

- KTQTE2Document172 pagesKTQTE2Ly Võ KhánhNo ratings yet

- Yasser ArafatDocument4 pagesYasser ArafatTanveer AhmadNo ratings yet

- Submission NichDocument5 pagesSubmission NichMankinka MartinNo ratings yet

- Assessment WPS OfficeDocument17 pagesAssessment WPS OfficeMary Ann Andes CaruruanNo ratings yet

- Essential Intrapartum and Newborn CareDocument25 pagesEssential Intrapartum and Newborn CareMaria Lovelyn LumaynoNo ratings yet

- Symantec Endpoint ProtectionDocument5 pagesSymantec Endpoint ProtectionreanveNo ratings yet

- 4 Peter Newmarks Approach To TranslationDocument9 pages4 Peter Newmarks Approach To TranslationhendrysaragiNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Exposure To Trading Market-TradejiniDocument5 pagesExposure To Trading Market-TradejiniJessica VarmaNo ratings yet

- Statutory Construction NotesDocument8 pagesStatutory Construction NotesBryan Carlo D. LicudanNo ratings yet

- Vampire - Habent Sua Fata Libelli - by Hanns Heinz EwersDocument2 pagesVampire - Habent Sua Fata Libelli - by Hanns Heinz EwersJoe E BandelNo ratings yet

- Sunrisers HyderabadDocument22 pagesSunrisers Hyderabadsagar pajankarNo ratings yet

- The Effect of Big-Data On The HEC of ChinaDocument9 pagesThe Effect of Big-Data On The HEC of ChinaAbdulGhaffarNo ratings yet

- Sita Devi KoiralaDocument18 pagesSita Devi KoiralaIndramaya RayaNo ratings yet

- DefaultDocument2 pagesDefaultBADER AlnassriNo ratings yet

- Shopping For A Surprise! - Barney Wiki - FandomDocument5 pagesShopping For A Surprise! - Barney Wiki - FandomchefchadsmithNo ratings yet

- Blockchain in ConstructionDocument4 pagesBlockchain in ConstructionHasibullah AhmadzaiNo ratings yet

- Unit Test 7A: 1 Choose The Correct Form of The VerbDocument4 pagesUnit Test 7A: 1 Choose The Correct Form of The VerbAmy PuenteNo ratings yet

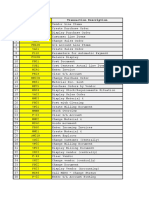

- # Transaction Code Transaction DescriptionDocument6 pages# Transaction Code Transaction DescriptionVivek Shashikant SonawaneNo ratings yet

- JustdiggitDocument21 pagesJustdiggityecith sanguinoNo ratings yet

- Launch Your Organization With WebGISDocument17 pagesLaunch Your Organization With WebGISkelembagaan telitiNo ratings yet

- Introduction To Marketing - KotlerDocument35 pagesIntroduction To Marketing - KotlerRajesh Patro0% (1)

- SynopsisDocument15 pagesSynopsisGodhuli BhattacharyyaNo ratings yet

- Basic Survival Student's BookDocument99 pagesBasic Survival Student's BookIgor Basquerotto de CarvalhoNo ratings yet

- John Zietlow, D.B.A., CTPDocument11 pagesJohn Zietlow, D.B.A., CTParfankafNo ratings yet

- Libanan, Et Al. v. GordonDocument33 pagesLibanan, Et Al. v. GordonAlvin ComilaNo ratings yet

- Skate Helena 02-06.01.2024Document1 pageSkate Helena 02-06.01.2024erkinongulNo ratings yet

- The Melodramatic ImaginationDocument254 pagesThe Melodramatic ImaginationMarcela MacedoNo ratings yet

- Nursing Law and JurisprudenceDocument9 pagesNursing Law and JurisprudenceKaren Mae Santiago AlcantaraNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Perversion of Justice: The Jeffrey Epstein StoryFrom EverandPerversion of Justice: The Jeffrey Epstein StoryRating: 4.5 out of 5 stars4.5/5 (10)

- Lady Killers: Deadly Women Throughout HistoryFrom EverandLady Killers: Deadly Women Throughout HistoryRating: 4 out of 5 stars4/5 (154)

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoFrom EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoRating: 4 out of 5 stars4/5 (97)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossFrom EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossRating: 3.5 out of 5 stars3.5/5 (6)

- Can't Forgive: My 20-Year Battle With O.J. SimpsonFrom EverandCan't Forgive: My 20-Year Battle With O.J. SimpsonRating: 3 out of 5 stars3/5 (3)

- The Protector's Handbook: A Comprehensive Guide to Close ProtectionFrom EverandThe Protector's Handbook: A Comprehensive Guide to Close ProtectionNo ratings yet